Key Insights

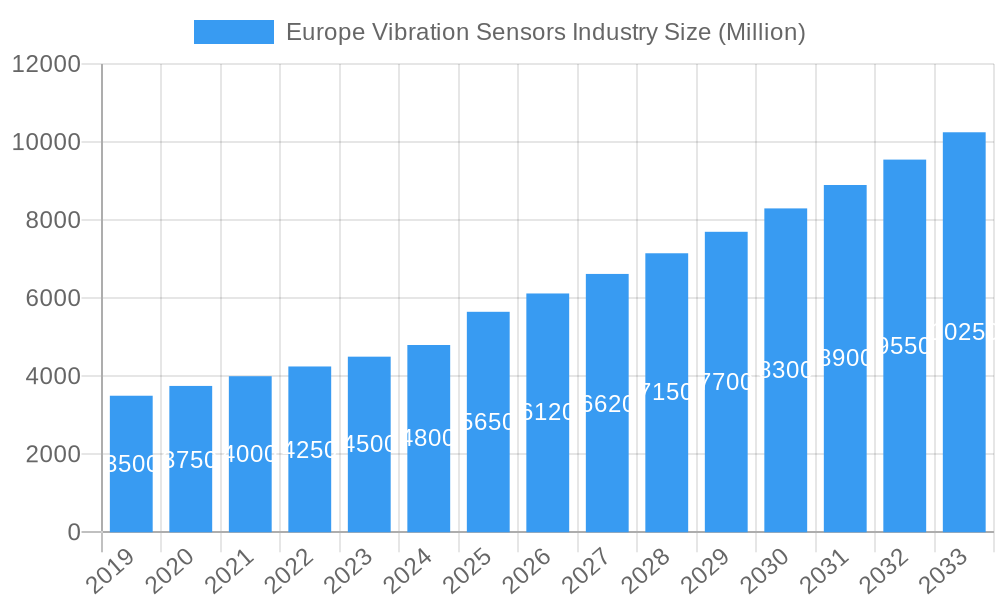

The Europe Vibration Sensors market is projected for significant expansion, expected to reach a valuation of $4.51 billion by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 6.49% throughout the forecast period of 2025-2033. Key growth drivers include the escalating adoption of advanced monitoring systems across industries. The automotive sector is a primary contributor, with manufacturers integrating vibration sensors for enhanced vehicle diagnostics, safety, and predictive maintenance. The healthcare industry's utilization of these sensors for precise medical equipment monitoring and advanced diagnostics further fuels market growth. Additionally, the aerospace and defense sector's demand for reliable vibration sensing in aircraft health monitoring and sophisticated defense systems significantly bolsters expansion.

Europe Vibration Sensors Industry Market Size (In Billion)

Operational efficiency and asset longevity are increasingly prioritized across industrial applications, further propelling market growth. Sectors like oil and gas, metals and mining, and general manufacturing are deploying vibration sensors to detect early equipment failures, thereby reducing downtime, maintenance costs, and optimizing production. Technological advancements, including sensor miniaturization, improved accuracy, and IoT integration, enhance accessibility and effectiveness. While market growth is strong, potential challenges such as initial installation costs and the requirement for skilled personnel for deployment and data interpretation warrant strategic consideration. Nevertheless, the clear benefits of enhanced safety, improved performance, and cost savings are anticipated to drive sustained market expansion.

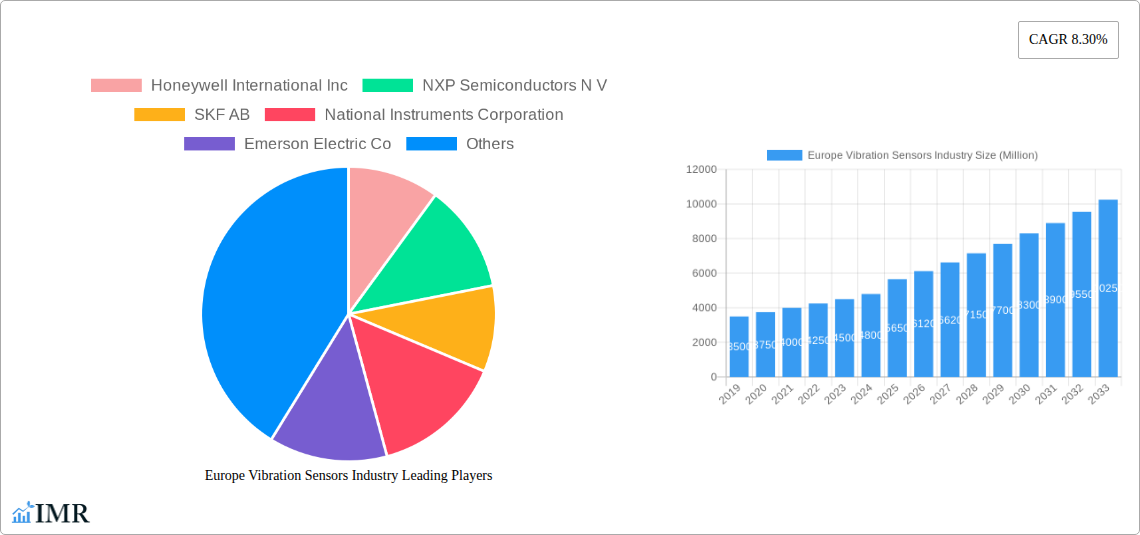

Europe Vibration Sensors Industry Company Market Share

Europe Vibration Sensors Industry Report: Market Analysis, Trends, and Forecast (2019-2033)

This comprehensive report offers an in-depth analysis of the Europe vibration sensors market, providing critical insights into its dynamics, growth trajectory, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this report is an essential resource for stakeholders seeking to understand and capitalize on opportunities within this vital sector. We delve into market segmentation by product and industry, analyze key players and their strategies, and highlight significant industry developments. The report provides quantitative data in Million units, where available, to support its findings, and uses "xx" for any unspecified values.

Europe Vibration Sensors Industry Market Dynamics & Structure

The Europe vibration sensors market is characterized by a moderately concentrated landscape, with major players like Honeywell International Inc., NXP Semiconductors N.V., and SKF AB holding significant market share. Technological innovation serves as a primary driver, with continuous advancements in sensor miniaturization, wireless connectivity, and data analytics enhancing performance and expanding applications. Stringent regulatory frameworks in industries such as automotive and aerospace mandate the use of reliable vibration monitoring for safety and compliance, further fueling market demand.

- Market Concentration: Dominated by a few key players, with increasing competition from specialized manufacturers.

- Technological Innovation: Driven by IoT integration, AI-powered analytics for predictive maintenance, and enhanced sensor accuracy.

- Regulatory Frameworks: Essential for safety-critical applications, including automotive (ISO 26262) and industrial machinery standards.

- Competitive Product Substitutes: While direct substitutes are limited, advancements in alternative monitoring techniques could pose a future challenge.

- End-User Demographics: A strong demand from established industrial sectors like oil and gas, metals and mining, and automotive, with growing adoption in healthcare and consumer electronics.

- M&A Trends: Strategic acquisitions and partnerships are evident as companies aim to broaden product portfolios and expand market reach. For instance, TE Connectivity's acquisition of First Sensor AG demonstrates this trend.

Europe Vibration Sensors Industry Growth Trends & Insights

The Europe vibration sensors market is poised for robust expansion, driven by an increasing emphasis on predictive maintenance and the Industrial Internet of Things (IIoT). The market size is projected to evolve significantly, propelled by escalating adoption rates across diverse industries seeking to optimize operational efficiency and minimize downtime. Technological disruptions, such as the integration of advanced signal processing and machine learning algorithms within sensor systems, are transforming capabilities, enabling more accurate fault detection and prognostics. Consumer behavior shifts, particularly in industrial sectors, are leaning towards proactive asset management, where vibration sensors play a pivotal role in monitoring equipment health.

The CAGR for the Europe vibration sensors market is estimated to be xx% between 2025 and 2033. Market penetration is deepening, especially in sectors requiring high reliability and safety. The transition from reactive to proactive maintenance strategies across manufacturing, energy, and transportation industries is a significant contributor. Furthermore, the increasing adoption of smart factories and connected devices is creating new avenues for growth. The development of smaller, more energy-efficient, and cost-effective vibration sensors is also expanding their applicability into previously niche segments. The growing awareness of the economic benefits derived from early fault detection, such as reduced repair costs and extended equipment lifespan, is a key factor influencing market dynamics. The increasing complexity of machinery and the demand for higher operational precision further necessitate the use of sophisticated vibration monitoring solutions. The trend towards wireless sensor networks and cloud-based data platforms is also accelerating adoption, simplifying deployment and data analysis.

Dominant Regions, Countries, or Segments in Europe Vibration Sensors Industry

The Automotive industry stands out as a dominant segment driving growth within the Europe vibration sensors market. This is primarily attributed to the stringent safety regulations and the increasing complexity of vehicle systems, which necessitate comprehensive vibration monitoring for components such as engines, transmissions, and chassis. The ongoing development of electric vehicles (EVs) further amplifies this trend, requiring specialized sensors to monitor the unique vibrational characteristics of electric powertrains and battery systems.

Automotive Industry Dominance:

- Market Share: The automotive segment is projected to account for approximately xx% of the total Europe vibration sensors market revenue by 2025.

- Key Drivers:

- ADAS & Autonomous Driving: Advanced Driver-Assistance Systems (ADAS) and the development of autonomous vehicles rely heavily on accurate vibration data for system calibration and performance monitoring.

- EV Growth: The surge in electric vehicle production demands novel vibration sensing solutions for battery packs, motors, and power electronics.

- NVH Reduction: Continuous efforts in Noise, Vibration, and Harshness (NVH) reduction to enhance passenger comfort and vehicle quality drive the demand for sophisticated accelerometers and other vibration sensors.

- Regulatory Compliance: Mandates for vehicle safety and diagnostics necessitate robust vibration monitoring systems.

- Growth Potential: Significant untapped potential exists in the aftermarket for retrofitting older vehicles with advanced vibration sensing capabilities.

Product Segment Dominance: Accelerometers:

- Market Share: Accelerometers are expected to represent the largest product segment, holding around xx% of the market by 2025.

- Key Drivers:

- Versatility: Their wide range of applications across all major industries, from industrial machinery to consumer electronics, makes them indispensable.

- Technological Advancements: Miniaturization, MEMS technology, and enhanced sensitivity continue to drive demand.

- Cost-Effectiveness: Increasingly affordable manufacturing processes are making accelerometers accessible for a broader range of applications.

Leading Countries: Germany, France, and the United Kingdom are anticipated to be the leading countries in terms of vibration sensor consumption within Europe, owing to their robust automotive manufacturing bases, strong industrial sectors, and significant investments in R&D.

Europe Vibration Sensors Industry Product Landscape

The Europe vibration sensors market showcases a dynamic product landscape characterized by continuous innovation and application expansion. Accelerometers, including MEMS and piezoelectric variants, remain the cornerstone, offering unparalleled versatility for condition monitoring, structural health assessment, and motion sensing across diverse industries. Proximity probes are crucial for safeguarding large rotating machinery in demanding environments like oil and gas, while tachometers provide essential speed and rotational data for precise control and safety. Emerging product innovations focus on miniaturization, wireless connectivity, and integrated intelligence, enabling seamless integration into IIoT ecosystems.

Key Drivers, Barriers & Challenges in Europe Vibration Sensors Industry

Key Drivers: The Europe vibration sensors market is propelled by a confluence of factors, most notably the increasing adoption of predictive maintenance strategies across industrial sectors. The drive for enhanced operational efficiency, reduced downtime, and lower maintenance costs is a primary motivator. Furthermore, the proliferation of the Industrial Internet of Things (IIoT) and smart manufacturing initiatives are creating a fertile ground for advanced sensor solutions that enable real-time data collection and analysis. Regulatory mandates for safety and compliance in industries like automotive and aerospace also serve as significant growth accelerators.

Barriers & Challenges: Despite the promising outlook, the market faces certain challenges. The initial cost of implementing comprehensive vibration monitoring systems can be a barrier, particularly for small and medium-sized enterprises (SMEs). Cybersecurity concerns related to connected sensor networks also present a hurdle, requiring robust security protocols. The availability of skilled personnel to interpret complex sensor data and implement effective maintenance strategies can also be a limiting factor. Additionally, the intense competition among a growing number of manufacturers, coupled with the need for continuous innovation, places pressure on profit margins.

Emerging Opportunities in Europe Vibration Sensors Industry

Emerging opportunities in the Europe vibration sensors industry are largely centered around the burgeoning demand for condition monitoring in renewable energy infrastructure, such as wind turbines and solar farms, where early detection of mechanical anomalies can prevent costly failures. The growing integration of vibration sensors in consumer electronics, particularly in smart home devices and wearables for health monitoring, presents a rapidly expanding market. Furthermore, the development of highly sensitive, miniaturized, and low-power consumption sensors is opening doors for applications in medical devices and advanced robotics. The increasing focus on predictive maintenance in the railway sector and the expanding use of vibration analysis in structural health monitoring for bridges and buildings also represent significant growth avenues.

Growth Accelerators in the Europe Vibration Sensors Industry Industry

The long-term growth of the Europe vibration sensors industry is being significantly accelerated by advancements in artificial intelligence (AI) and machine learning (ML) algorithms, which are enhancing the analytical capabilities of vibration data, leading to more accurate fault prediction and diagnostics. Strategic partnerships between sensor manufacturers and IIoT platform providers are fostering integrated solutions, making it easier for businesses to deploy and manage sensor networks. Market expansion into emerging economies and underserved industrial segments, coupled with continuous product miniaturization and cost reduction efforts, are also key catalysts. The increasing demand for high-performance sensors in specialized applications like aerospace and defense further fuels innovation and market growth.

Key Players Shaping the Europe Vibration Sensors Industry Market

- Honeywell International Inc

- NXP Semiconductors N V

- SKF AB

- National Instruments Corporation

- Emerson Electric Co

- TE Connectivity Ltd

- Bosch Sensortec GmbH (Robert Bosch GmbH)

- Hansford Sensors Ltd

- Texas Instruments Incorporated

- Rockwell Automation Inc

- Analog Devices Inc

Notable Milestones in Europe Vibration Sensors Industry Sector

- Mar 2020: TE Connectivity Ltd completed its public takeover of First Sensor AG, acquiring 71.87% of its shares. This strategic move enabled TE Connectivity to offer a broader product base, enhancing its sensors business and overall growth strategy.

- Aug 2020: Hansford Sensors Ltd launched the HS-173I Accelerometers, a premium intrinsically safe triaxial range featuring PUR cable and conduit for exceptional durability. These accelerometers are certified for hazardous environments across Europe, the US, and Australia, offering IP68 sealing and a range of sensitivities.

In-Depth Europe Vibration Sensors Industry Market Outlook

The future outlook for the Europe vibration sensors industry is exceptionally bright, driven by the sustained demand for intelligent condition monitoring and the ongoing digital transformation of industries. Key growth accelerators include the ubiquitous integration of AI and machine learning for predictive analytics, enabling unprecedented levels of operational foresight. Strategic collaborations between sensor manufacturers and IIoT solution providers are creating synergistic ecosystems, simplifying data management and deployment. The continuous miniaturization and cost optimization of sensors are unlocking new application frontiers in healthcare, consumer electronics, and advanced robotics. As industries increasingly prioritize asset longevity and operational resilience, the role of sophisticated vibration sensing technologies will only expand, promising significant future market potential and strategic opportunities for innovative players.

Europe Vibration Sensors Industry Segmentation

-

1. product

- 1.1. Accelerometers

- 1.2. Proximity Probes

- 1.3. Tachometers

- 1.4. Others

-

2. Industry

- 2.1. Automotive

- 2.2. Helathcare

- 2.3. Aerospace & Defence

- 2.4. Consumer Electronics

- 2.5. Oil And Gas

- 2.6. Metals and Mining

- 2.7. others

Europe Vibration Sensors Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

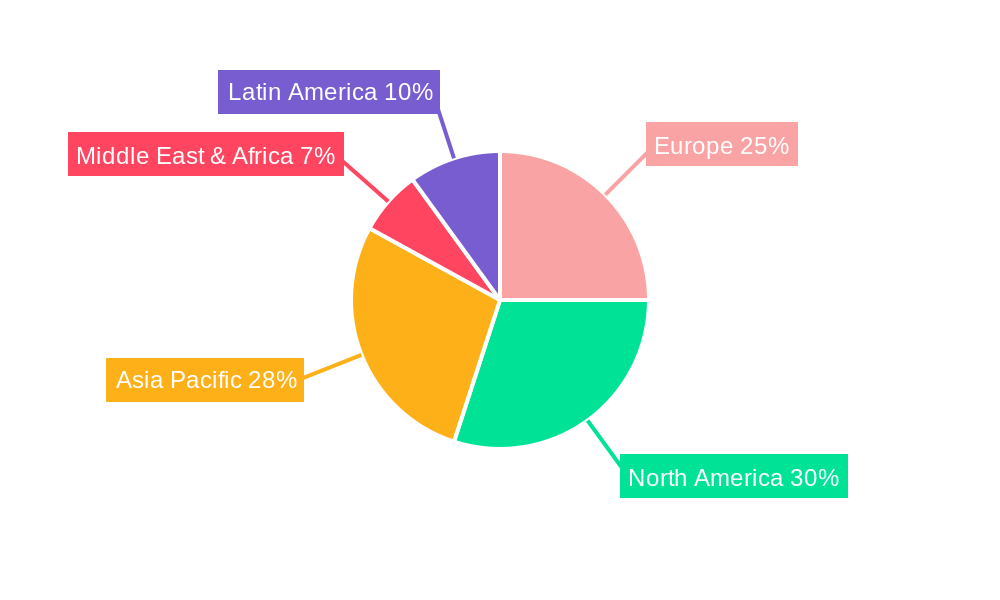

Europe Vibration Sensors Industry Regional Market Share

Geographic Coverage of Europe Vibration Sensors Industry

Europe Vibration Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Need for Machine Monitoring and Maintenance; Longer Service Life

- 3.2.2 Self Generating Capability and Wide Range of Frequency of Vibration Sensors

- 3.3. Market Restrains

- 3.3.1. Compatibility With Old Machinery; Critical and Hazardous Implication on the Environment

- 3.4. Market Trends

- 3.4.1. Aerospace & Defense End User to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Vibration Sensors Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by product

- 5.1.1. Accelerometers

- 5.1.2. Proximity Probes

- 5.1.3. Tachometers

- 5.1.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Industry

- 5.2.1. Automotive

- 5.2.2. Helathcare

- 5.2.3. Aerospace & Defence

- 5.2.4. Consumer Electronics

- 5.2.5. Oil And Gas

- 5.2.6. Metals and Mining

- 5.2.7. others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Honeywell International Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 NXP Semiconductors N V

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 SKF AB

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 National Instruments Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Emerson Electric Co

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 TE Connectivity Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch Sensortec GmbH (Robert Bosch GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Hansford Sensors Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Texas Instruments Incorporated

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rockwell Automation Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Analog Devices Inc

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Honeywell International Inc

List of Figures

- Figure 1: Europe Vibration Sensors Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Vibration Sensors Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Vibration Sensors Industry Revenue billion Forecast, by product 2020 & 2033

- Table 2: Europe Vibration Sensors Industry Revenue billion Forecast, by Industry 2020 & 2033

- Table 3: Europe Vibration Sensors Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Vibration Sensors Industry Revenue billion Forecast, by product 2020 & 2033

- Table 5: Europe Vibration Sensors Industry Revenue billion Forecast, by Industry 2020 & 2033

- Table 6: Europe Vibration Sensors Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Vibration Sensors Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Vibration Sensors Industry?

The projected CAGR is approximately 6.49%.

2. Which companies are prominent players in the Europe Vibration Sensors Industry?

Key companies in the market include Honeywell International Inc, NXP Semiconductors N V, SKF AB, National Instruments Corporation, Emerson Electric Co, TE Connectivity Ltd, Bosch Sensortec GmbH (Robert Bosch GmbH, Hansford Sensors Ltd, Texas Instruments Incorporated, Rockwell Automation Inc, Analog Devices Inc.

3. What are the main segments of the Europe Vibration Sensors Industry?

The market segments include product, Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.51 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Need for Machine Monitoring and Maintenance; Longer Service Life. Self Generating Capability and Wide Range of Frequency of Vibration Sensors.

6. What are the notable trends driving market growth?

Aerospace & Defense End User to Hold Significant Share.

7. Are there any restraints impacting market growth?

Compatibility With Old Machinery; Critical and Hazardous Implication on the Environment.

8. Can you provide examples of recent developments in the market?

Mar 2020: TE Connectivity Ltd has completed its public takeover of First Sensor AG. TE now holds 71.87% shares of First Sensor. In combination with First Sensor and TE portfolios, TE will be able to offer a broader product base, including innovative sensors, connectors, and systems, that supports the growth strategy of TE's sensors business and TE Connectivity as a whole.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Vibration Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Vibration Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Vibration Sensors Industry?

To stay informed about further developments, trends, and reports in the Europe Vibration Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence