Key Insights

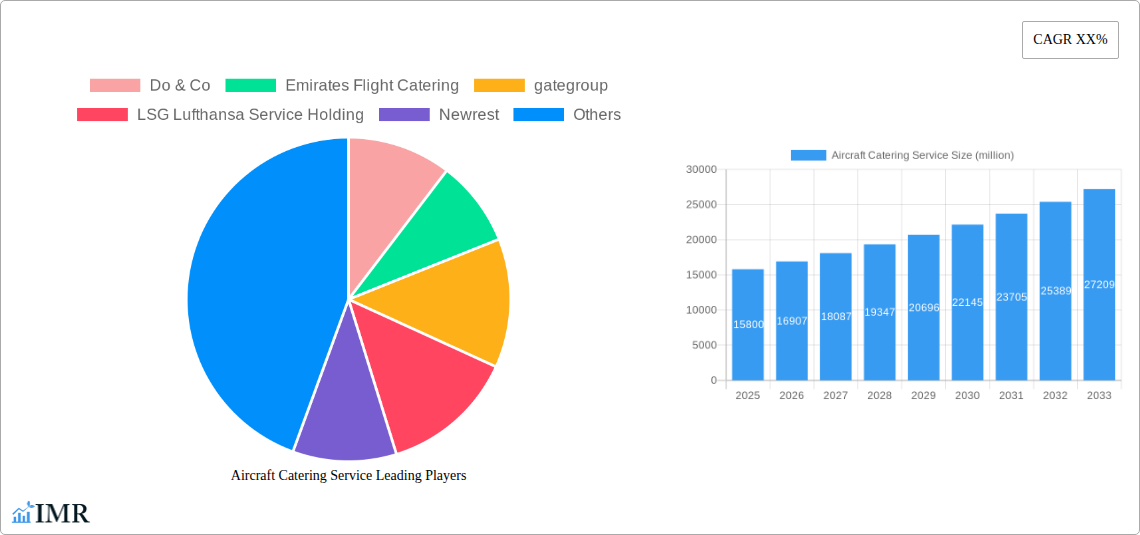

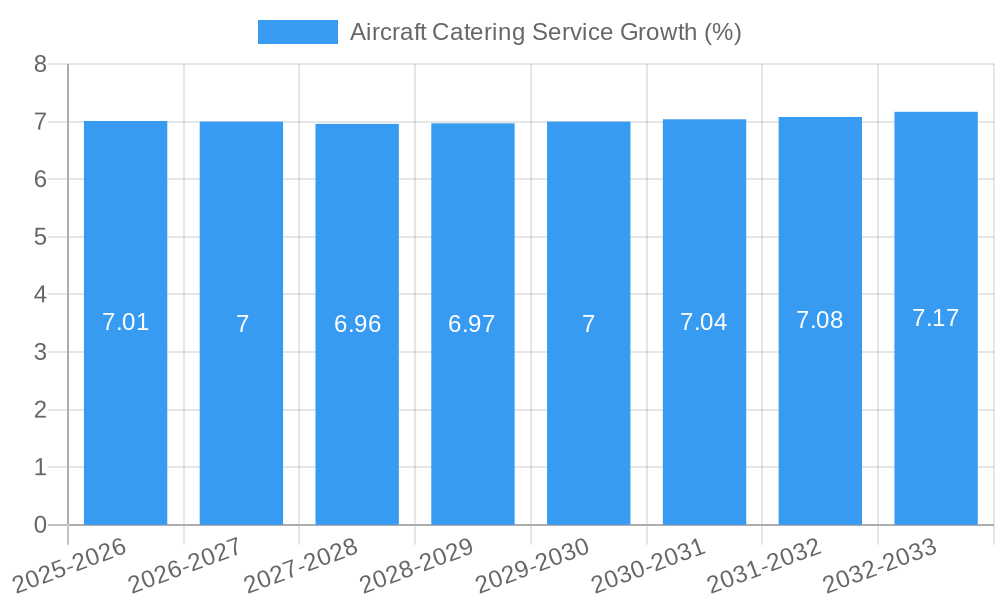

The global Aircraft Catering Service market is poised for significant expansion, projected to reach an estimated market size of approximately $15,800 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of roughly 7.5% during the study period of 2019-2033. Key drivers propelling this upward trajectory include the sustained recovery and expansion of the global aviation industry post-pandemic, a discernible increase in air passenger traffic across all cabin classes, and the growing emphasis by airlines on enhancing the passenger experience as a crucial differentiator. This focus translates into greater investment in premium meal and beverage offerings, particularly in Business and First Class segments, which command higher service expectations and thus contribute disproportionately to market value. Furthermore, the burgeoning low-cost carrier (LCC) segment, while typically offering a more basic service, is also seeing growth in ancillary revenue streams from paid food and beverage options, further bolstering overall market demand.

Despite the strong growth outlook, certain restraints warrant consideration. These include the escalating operational costs for catering service providers, encompassing raw material prices, labor expenses, and the complexities of in-flight logistics. Supply chain disruptions, though easing, can still impact timely delivery and product availability. Additionally, stringent regulatory requirements related to food safety and hygiene demand continuous investment in compliance and quality control. Nevertheless, the market is witnessing several transformative trends. A significant shift towards healthier, sustainably sourced, and plant-based meal options is gaining traction, driven by evolving consumer preferences and environmental consciousness. Technological advancements in food preparation and logistics are also playing a role, aiming to optimize efficiency and reduce waste. The competitive landscape features established global players and regional specialists, all vying for lucrative contracts with airlines, driving innovation and service diversification.

Aircraft Catering Service Market Dynamics & Structure

The global aircraft catering service market is characterized by a moderately concentrated structure, with key players like Do & Co, Emirates Flight Catering, gategroup, LSG Lufthansa Service Holding, Newrest, and SATS dominating market share. Technological innovation is a significant driver, focusing on enhancing efficiency, sustainability, and passenger experience through advanced food preparation, delivery systems, and digital ordering platforms. Regulatory frameworks, primarily concerning food safety, hygiene standards, and international aviation regulations, play a crucial role in shaping operational practices and market entry. Competitive product substitutes, while limited in direct replacement for in-flight meals, include the growing trend of passengers bringing their own food or airlines offering reduced catering options to cut costs. End-user demographics, including the evolving preferences of economy, business, and first-class passengers, significantly influence service offerings. Mergers and acquisitions (M&A) trends indicate a strategic consolidation aimed at expanding geographical reach, diversifying service portfolios, and achieving economies of scale. For instance, recent M&A activity in the broader travel and hospitality sector has seen catering providers integrating with airline groups or other service providers to offer a more holistic passenger journey.

- Market Concentration: Top 6 players hold an estimated 60% of the global market.

- Technological Innovation Drivers: Smart kitchen technologies, AI-powered inventory management, and sustainable packaging solutions.

- Regulatory Frameworks: IATA standards, HACCP compliance, and national food safety regulations.

- Competitive Product Substitutes: Pre-packaged snacks, passenger-provided food, and buy-on-board options.

- End-User Demographics: Growing demand for premium, healthy, and culturally diverse meal options across all classes.

- M&A Trends: Focus on vertical integration and strategic partnerships for service expansion.

Aircraft Catering Service Growth Trends & Insights

The aircraft catering service market is poised for significant expansion, driven by the projected rebound in air travel post-pandemic and the increasing demand for enhanced passenger experiences. The market size is estimated to grow from approximately $22.5 billion in 2024 to $38.7 billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth trajectory is underpinned by a rising global middle class, leading to increased leisure and business travel. Adoption rates for premium catering services are particularly high in the business and first-class segments, where passengers expect personalized and high-quality dining experiences. Technological disruptions are playing a pivotal role, with advancements in food technology, such as plant-based alternatives and lab-grown protein, starting to influence menu offerings. Furthermore, the integration of digital platforms for pre-ordering meals and providing dietary preferences is becoming a standard expectation. Consumer behavior shifts are evident in the growing emphasis on health and wellness, driving demand for nutritious, organic, and allergen-free options. Airlines are responding by partnering with renowned chefs and introducing bespoke menus that cater to diverse palates and dietary requirements, including a substantial increase in vegetarian, vegan, and gluten-free options. The convenience and perceived value of onboard catering remain crucial factors for passenger satisfaction. The post-pandemic recovery in the aviation industry is directly translating into increased demand for catering services as flight frequencies rise and passenger numbers surge. The desire for a seamless and enjoyable travel experience, which includes high-quality onboard dining, is a key differentiator for airlines, thus fueling the growth of this sector. The increasing focus on sustainability within the aviation industry is also influencing catering services, with a push towards reducing food waste, utilizing eco-friendly packaging, and sourcing local ingredients. This not only aligns with environmental consciousness but also resonates with a growing segment of travelers who prioritize sustainable brands. The competitive landscape is also evolving, with catering companies investing heavily in research and development to offer innovative solutions that meet the changing needs of airlines and passengers. This includes developing specialized catering for different flight durations and destinations, as well as offering flexible service models that can be adapted to varying passenger loads and economic conditions. The overarching trend points towards a more sophisticated and personalized approach to aircraft catering, moving beyond basic sustenance to become an integral part of the overall travel experience, thus propelling sustained growth in this dynamic market.

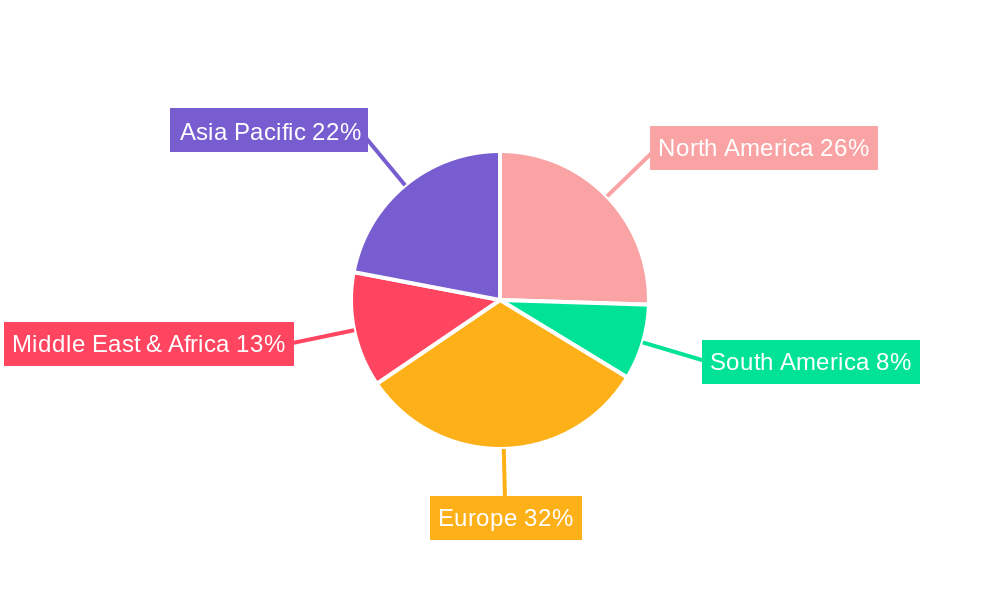

Dominant Regions, Countries, or Segments in Aircraft Catering Service

The North America region is currently the dominant force in the global aircraft catering service market, driven by a robust aviation infrastructure, high passenger traffic, and a strong emphasis on premium travel experiences. The United States, in particular, plays a pivotal role, boasting the world's largest airline industry and a significant number of major international airports, which naturally translate into substantial demand for aircraft catering services. The dominance of North America is further amplified by the high disposable incomes of its population, leading to a greater propensity for premium travel, thereby boosting the market for business and first-class catering. The region's leading airlines consistently invest in enhancing their onboard product, with catering being a key component of this strategy. This includes the development of innovative menus by renowned chefs and the adoption of advanced food preparation and delivery technologies. Economically, North America's stable economic policies and strong consumer spending power provide a fertile ground for the growth of the aviation and associated catering sectors.

Within the Application segment, Economy Class holds the largest market share due to the sheer volume of passengers. However, Business Class and First Class segments are exhibiting higher growth rates, driven by the increasing demand for premium and personalized experiences. Airlines are differentiating themselves by offering superior culinary offerings in these premium cabins, leading to increased per-passenger revenue for catering services.

In terms of Types, Foos constitute the larger segment, owing to the fundamental necessity of meal provision on flights. However, the Beverage segment is experiencing significant growth, driven by the rising popularity of premium alcoholic and non-alcoholic beverages, specialty coffees, and artisanal teas, often curated to complement the meal offerings and enhance the overall passenger experience.

Key drivers for North America's dominance include:

- High Passenger Traffic: The region consistently handles a large volume of both domestic and international air travel.

- Economic Prosperity: High disposable incomes support premium travel and enhanced onboard services.

- Technological Adoption: Early and widespread adoption of advanced catering technologies.

- Airline Competition: Intense competition among airlines necessitates superior onboard product offerings, including catering.

- Infrastructure: Well-developed airport facilities and efficient logistics networks.

The market share for North America is estimated to be around 35% of the global market, with an anticipated CAGR of xx% during the forecast period. The growth potential within the premium segments (Business and First Class) in this region is particularly strong, reflecting a global trend towards experiential travel. The continuous evolution of dietary preferences and the demand for healthier, sustainable, and culturally diverse food options are also shaping the catering landscape, with North American providers actively responding to these trends.

Aircraft Catering Service Product Landscape

The aircraft catering service product landscape is characterized by a continuous evolution towards enhanced quality, variety, and convenience. Product innovations are centered on delivering a premium dining experience that rivals high-end restaurants, with a focus on fresh, high-quality ingredients, and aesthetically pleasing presentation. Airlines are increasingly partnering with celebrity chefs to design bespoke menus for premium cabins, offering a diverse range of international cuisines and catering to specific dietary needs such as vegan, gluten-free, and allergen-free options. Technological advancements are driving efficiency in food preparation and service, including advanced chilling and reheating technologies that preserve food quality and flavor. Unique selling propositions often lie in the customization of menus, the sourcing of local and sustainable ingredients, and the ability to cater to highly specific passenger requests. Performance metrics are evaluated based on passenger satisfaction scores, food waste reduction, and operational efficiency.

Key Drivers, Barriers & Challenges in Aircraft Catering Service

Key Drivers:

- Resumption of Air Travel: The strong rebound in global air passenger traffic post-pandemic is the primary growth catalyst.

- Demand for Premium Experiences: Passengers, especially in business and first class, increasingly seek high-quality, personalized dining as part of their travel.

- Technological Advancements: Innovations in food preparation, logistics, and digital ordering enhance efficiency and passenger satisfaction.

- Airline Competition: Catering is a key differentiator for airlines aiming to attract and retain passengers.

- Growing Middle Class: An expanding global middle class fuels demand for air travel and associated services.

Key Barriers & Challenges:

- Supply Chain Volatility: Disruptions in the global supply chain for ingredients and packaging materials can impact costs and availability.

- Regulatory Hurdles: Stringent food safety and hygiene regulations require continuous investment and compliance.

- Cost Pressures: Airlines often seek to optimize costs, which can put pressure on catering service providers' margins.

- Skilled Labor Shortages: Finding and retaining skilled chefs and service staff can be challenging.

- Sustainability Demands: Balancing cost-effectiveness with the growing demand for sustainable practices and reduced waste.

- Geopolitical Instability: Conflicts and economic downturns can negatively impact travel demand and operational stability.

Emerging Opportunities in Aircraft Catering Service

Emerging opportunities in the aircraft catering service sector lie in the expanding demand for specialized dietary options, including plant-based, organic, and locally sourced menus, catering to the growing health-conscious and environmentally aware traveler. The integration of advanced technology for personalized ordering and feedback mechanisms presents a significant opportunity to enhance passenger engagement and loyalty. Furthermore, the growth of low-cost carriers and their evolving ancillary revenue strategies opens avenues for innovative, value-added catering packages and snack options. Exploring untapped markets in developing regions with burgeoning aviation sectors also presents considerable potential for expansion. The increasing trend of "experiential travel" is creating demand for unique culinary offerings that reflect local cuisines and onboard dining as a distinct part of the travel journey.

Growth Accelerators in the Aircraft Catering Service Industry

Several catalysts are accelerating growth in the aircraft catering industry. Technological breakthroughs in areas like smart kitchen equipment, AI-driven inventory management, and advanced food preservation are enhancing operational efficiency and product quality. Strategic partnerships between catering providers, airlines, and food technology companies are fostering innovation and expanding service capabilities. Market expansion strategies, including catering for private jets and cargo flights, offer new revenue streams. Furthermore, the increasing focus on sustainability by airlines and passengers alike is driving investment in eco-friendly packaging and waste reduction initiatives, creating a competitive advantage for providers who embrace these practices. The development of specialized menus tailored to specific routes and passenger demographics is also a key growth driver.

Key Players Shaping the Aircraft Catering Service Market

Notable Milestones in Aircraft Catering Service Sector

- 2019: Launch of AI-powered menu planning tools by major catering providers to optimize ingredient sourcing and reduce waste.

- 2020: Significant industry-wide focus on enhanced hygiene protocols and contactless service delivery due to the global pandemic.

- 2021: Increased investment in plant-based and sustainable food options across airline menus.

- 2022: Introduction of personalized pre-ordering platforms for in-flight meals via airline mobile applications.

- 2023: Expansion of partnerships between catering companies and renowned culinary institutions to develop premium dining experiences.

- 2024: Development and pilot testing of advanced food preservation technologies to extend shelf life and maintain nutritional value.

- 2025: Anticipated wider adoption of smart kitchen technologies for improved efficiency and quality control in catering operations.

In-Depth Aircraft Catering Service Market Outlook

The aircraft catering service market is poised for robust and sustained growth, fueled by the continued recovery of air travel and an escalating passenger appetite for premium and personalized onboard experiences. Key growth accelerators include ongoing technological integration, leading to greater operational efficiency and innovation in food preparation and delivery. Strategic collaborations between airlines, catering providers, and food technology firms will unlock new service possibilities and market segments. The industry is also set to benefit from the increasing demand for sustainable and health-conscious food options, presenting opportunities for providers who can effectively meet these evolving consumer preferences. The market outlook suggests a dynamic landscape where innovation, customization, and a commitment to passenger satisfaction will be paramount for success.

Aircraft Catering Service Segmentation

-

1. Application

- 1.1. Economy Class

- 1.2. Business Class

- 1.3. First Class

-

2. Types

- 2.1. Foos

- 2.2. Beverage

Aircraft Catering Service Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Aircraft Catering Service REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aircraft Catering Service Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Economy Class

- 5.1.2. Business Class

- 5.1.3. First Class

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Foos

- 5.2.2. Beverage

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Aircraft Catering Service Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Economy Class

- 6.1.2. Business Class

- 6.1.3. First Class

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Foos

- 6.2.2. Beverage

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Aircraft Catering Service Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Economy Class

- 7.1.2. Business Class

- 7.1.3. First Class

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Foos

- 7.2.2. Beverage

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Aircraft Catering Service Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Economy Class

- 8.1.2. Business Class

- 8.1.3. First Class

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Foos

- 8.2.2. Beverage

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Aircraft Catering Service Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Economy Class

- 9.1.2. Business Class

- 9.1.3. First Class

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Foos

- 9.2.2. Beverage

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Aircraft Catering Service Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Economy Class

- 10.1.2. Business Class

- 10.1.3. First Class

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Foos

- 10.2.2. Beverage

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Do & Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Emirates Flight Catering

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 gategroup

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 LSG Lufthansa Service Holding

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Newrest

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 SATS

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Do & Co

List of Figures

- Figure 1: Global Aircraft Catering Service Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Aircraft Catering Service Revenue (million), by Application 2024 & 2032

- Figure 3: North America Aircraft Catering Service Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Aircraft Catering Service Revenue (million), by Types 2024 & 2032

- Figure 5: North America Aircraft Catering Service Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Aircraft Catering Service Revenue (million), by Country 2024 & 2032

- Figure 7: North America Aircraft Catering Service Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Aircraft Catering Service Revenue (million), by Application 2024 & 2032

- Figure 9: South America Aircraft Catering Service Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Aircraft Catering Service Revenue (million), by Types 2024 & 2032

- Figure 11: South America Aircraft Catering Service Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Aircraft Catering Service Revenue (million), by Country 2024 & 2032

- Figure 13: South America Aircraft Catering Service Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Aircraft Catering Service Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Aircraft Catering Service Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Aircraft Catering Service Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Aircraft Catering Service Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Aircraft Catering Service Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Aircraft Catering Service Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Aircraft Catering Service Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Aircraft Catering Service Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Aircraft Catering Service Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Aircraft Catering Service Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Aircraft Catering Service Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Aircraft Catering Service Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Aircraft Catering Service Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Aircraft Catering Service Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Aircraft Catering Service Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Aircraft Catering Service Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Aircraft Catering Service Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Aircraft Catering Service Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Aircraft Catering Service Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Aircraft Catering Service Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Aircraft Catering Service Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Aircraft Catering Service Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Aircraft Catering Service Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Aircraft Catering Service Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Aircraft Catering Service Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Aircraft Catering Service Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Aircraft Catering Service Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Aircraft Catering Service Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Aircraft Catering Service Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Aircraft Catering Service Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Aircraft Catering Service Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Aircraft Catering Service Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Aircraft Catering Service Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Aircraft Catering Service Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Aircraft Catering Service Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Aircraft Catering Service Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Aircraft Catering Service Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Aircraft Catering Service Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aircraft Catering Service?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Aircraft Catering Service?

Key companies in the market include Do & Co, Emirates Flight Catering, gategroup, LSG Lufthansa Service Holding, Newrest, SATS.

3. What are the main segments of the Aircraft Catering Service?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4900.00, USD 7350.00, and USD 9800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aircraft Catering Service," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aircraft Catering Service report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aircraft Catering Service?

To stay informed about further developments, trends, and reports in the Aircraft Catering Service, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence