Key Insights

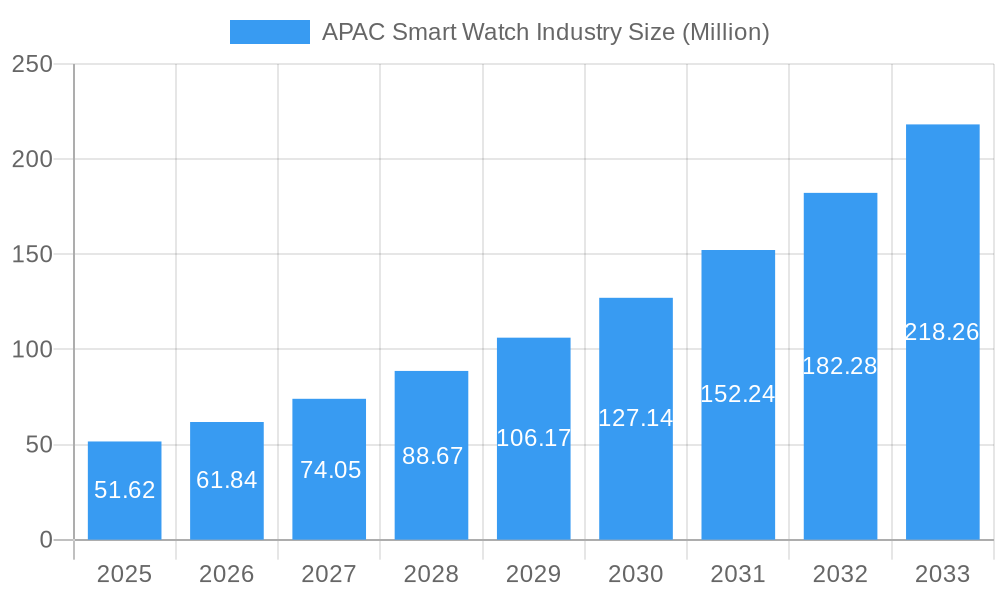

The APAC Smart Watch Industry is poised for remarkable expansion, with a current market size of approximately $51.62 billion in 2025, projected to ascend at a robust Compound Annual Growth Rate (CAGR) of 19.69% through 2033. This impressive growth trajectory is fueled by a confluence of factors, including the increasing adoption of wearable technology for personal health monitoring, fitness tracking, and enhanced connectivity. The rising disposable incomes across key Asian Pacific nations, coupled with a growing tech-savvy population keen on embracing smart devices, are significant demand drivers. Furthermore, strategic investments by leading tech giants in research and development for innovative smartwatch features, such as advanced health sensors, seamless integration with smartphones, and longer battery life, are pushing the market forward. The demand for smartwatches catering to diverse applications, from sophisticated medical monitoring and personal assistance to advanced sports tracking, is broadening the market appeal and penetration across various consumer segments.

APAC Smart Watch Industry Market Size (In Million)

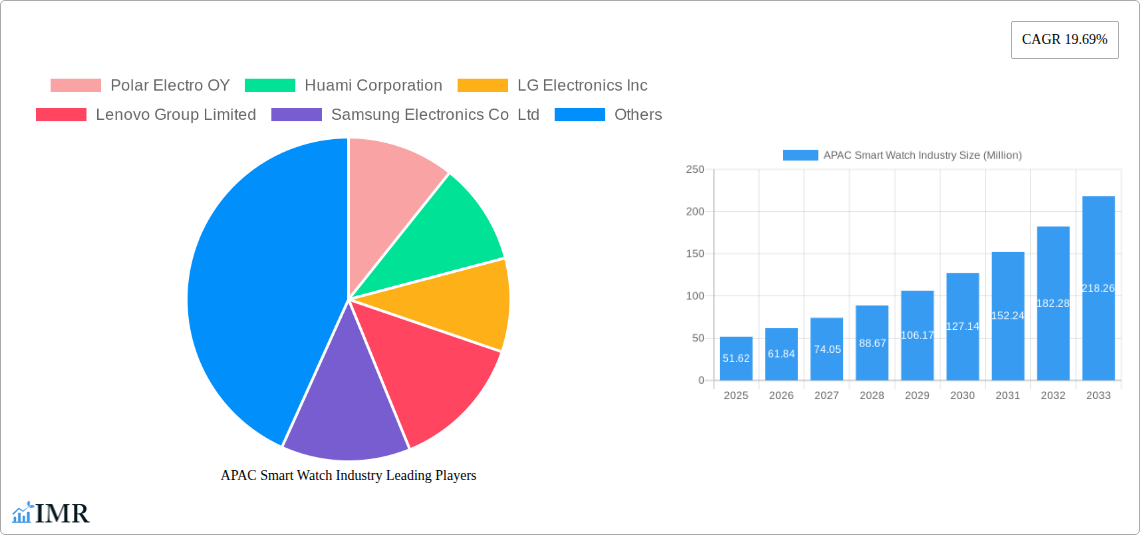

The competitive landscape is characterized by intense innovation and strategic collaborations among established global players and emerging regional contenders. Companies like Apple, Samsung, Huawei, and Xiaomi are at the forefront, continually introducing devices with enhanced functionalities and appealing designs. The market is segmenting dynamically, with AMOLED displays gaining prominence due to their superior visual quality and energy efficiency, while Android/Wear OS and Watch OS dominate the operating system segment, offering rich app ecosystems. Geographically, China and India represent significant growth engines within the APAC region, driven by their massive consumer bases and rapidly evolving digital infrastructure. While the market exhibits immense potential, challenges such as the high cost of advanced smartwatches, data privacy concerns, and the need for greater interoperability between different ecosystems could moderate growth in certain niches. However, the overwhelming trend towards personalized health management and the integration of smartwatches into daily life are expected to drive sustained and substantial market expansion in the foreseeable future.

APAC Smart Watch Industry Company Market Share

APAC Smartwatch Industry Report: Market Dynamics, Growth Trends, and Key Players (2019-2033)

This comprehensive report offers an in-depth analysis of the APAC Smartwatch Industry, meticulously examining market dynamics, growth trajectories, and the competitive landscape. With a study period spanning from 2019 to 2033, and a base year of 2025, this report leverages extensive data and expert insights to provide actionable intelligence for industry stakeholders. Explore parent and child market segmentation, discover high-traffic keywords for optimal SEO visibility, and gain critical insights into consumer adoption, technological advancements, and future market potential. All quantitative values are presented in Million Units.

APAC Smart Watch Industry Market Dynamics & Structure

The APAC Smartwatch Industry is characterized by a dynamic and evolving market structure, driven by relentless technological innovation and shifting consumer preferences. Market concentration is notably high, with a few dominant players like Apple Inc., Samsung Electronics Co Ltd., and Xiaomi Corporation commanding significant market share. However, the rise of agile manufacturers and emerging brands continues to foster healthy competition. Technological innovation is a paramount driver, with continuous advancements in sensor technology, battery life, and operating system integration pushing the boundaries of what smartwatches can offer. Regulatory frameworks, while generally supportive of technological adoption, vary across the region, influencing market entry and product compliance. Competitive product substitutes, including advanced fitness trackers and specialized wearables, present a constant challenge, necessitating differentiation through feature sets and ecosystem integration. End-user demographics are broadening, encompassing tech-savvy youth, health-conscious adults, and the increasingly significant elderly population seeking health monitoring solutions. Mergers and acquisitions (M&A) trends are indicative of market consolidation and strategic expansion, as established players seek to acquire innovative technologies or expand their geographical reach.

- Market Concentration: High, with key players dominating significant market share.

- Technological Innovation: Rapid advancements in sensors, battery, and AI capabilities are central to growth.

- Regulatory Landscape: Varied across APAC, impacting product development and market access.

- Competitive Substitutes: Advanced fitness trackers and niche wearables challenge market share.

- End-User Demographics: Expanding beyond early adopters to include health-conscious individuals and seniors.

- M&A Trends: Active, with companies seeking strategic acquisitions for technology and market access.

APAC Smart Watch Industry Growth Trends & Insights

The APAC Smartwatch Industry is poised for remarkable growth, fueled by escalating consumer demand for connected devices and advanced health monitoring. The market size is projected to witness a substantial evolution, driven by increasing disposable incomes and a growing awareness of health and wellness among the populace. Adoption rates for smartwatches are steadily climbing across the Asia-Pacific region, as these devices transition from luxury gadgets to essential lifestyle tools. Technological disruptions are a constant feature, with advancements in AI-powered features, contactless payment integration, and miniaturization of sophisticated sensors significantly enhancing user experience and functionality. Consumer behavior shifts are evident, with a growing emphasis on personalized health insights, seamless connectivity with other smart devices, and the desire for devices that seamlessly blend style with utility. The market penetration of smartwatches is expected to surge as prices become more accessible and the perceived value proposition strengthens. Emerging markets within APAC are demonstrating particularly robust growth potential as they leapfrog traditional mobile technology adoption curves. The integration of smartwatches into broader digital health ecosystems is also a significant trend, further embedding these devices into daily life.

The forecast period of 2025–2033 is expected to witness a Compound Annual Growth Rate (CAGR) of approximately 15-20%, propelled by a combination of hardware innovation and software ecosystem development. The historical period from 2019–2024 laid the groundwork for this expansion, marked by early adoption and the establishment of key product categories. The estimated year of 2025 represents a pivotal point, with the market already demonstrating strong momentum and the potential for accelerated expansion in the coming years. The increasing focus on preventative healthcare and remote patient monitoring will also contribute significantly to market growth, particularly for devices equipped with advanced medical-grade sensors.

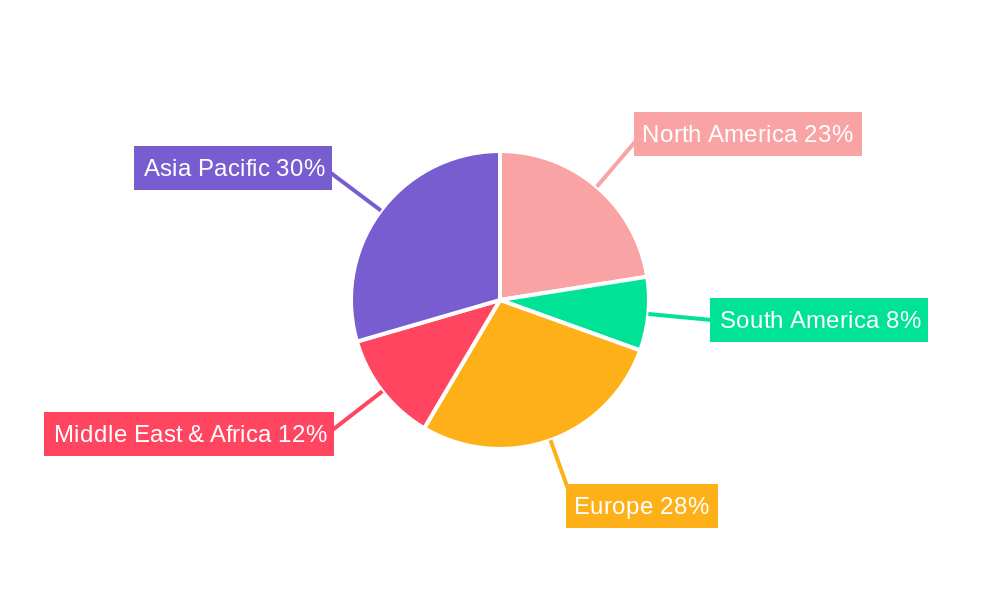

Dominant Regions, Countries, or Segments in APAC Smart Watch Industry

Within the APAC Smartwatch Industry, East Asia, particularly China and South Korea, stands out as a dominant region and country, respectively, driving significant market growth. This dominance is attributable to several key factors, including advanced technological infrastructure, a large and tech-savvy consumer base, and supportive government policies that encourage innovation and digital adoption.

Operating Systems: Android/Wear OS commands a substantial share due to its widespread adoption by multiple device manufacturers and its open-source nature, allowing for greater customization and app development. However, Watch OS continues to hold a strong position, particularly within its ecosystem, demonstrating high user loyalty and robust app support.

- Key Drivers in East Asia: High disposable incomes, rapid urbanization, strong R&D investments, and a culture of early technology adoption.

- Market Share: East Asia accounts for over 55% of the total APAC smartwatch market revenue.

- Growth Potential: Continued expansion driven by a young, affluent population and increasing demand for smart devices.

Display Type: AMOLED displays are increasingly dominating the market, offering superior brightness, contrast ratios, and power efficiency compared to other display technologies. This contributes significantly to the premium user experience expected from modern smartwatches.

- Dominance Factors: Superior visual quality, energy efficiency, and aesthetic appeal.

- Market Share: AMOLED displays are estimated to hold over 70% of the market share in premium and mid-range smartwatches.

Application: Personal Assistance and Sports applications are the primary growth engines for the APAC smartwatch market. Consumers are increasingly leveraging smartwatches for daily task management, communication, and to track their fitness routines and athletic performance. The rising popularity of wearable technology for health and wellness is also boosting the Medical application segment, with an increasing number of devices offering advanced health monitoring features.

- Key Drivers for Personal Assistance: Seamless integration with smartphones, voice assistant capabilities, and contactless payments.

- Key Drivers for Sports: Advanced fitness tracking, GPS functionality, and performance analytics for a wide range of activities.

- Growth Potential for Medical: Early detection of health anomalies, remote patient monitoring, and personalized health insights.

The combination of a technologically advanced region, a dominant operating system and display type, and widespread adoption for personal assistance and sports applications solidifies the leadership position of East Asia in the APAC Smartwatch Industry.

APAC Smart Watch Industry Product Landscape

The APAC Smartwatch Industry product landscape is defined by continuous innovation, catering to diverse consumer needs. Leading brands are pushing the boundaries with advanced features such as multi-path optical heart rate sensors, body response monitoring cEDA sensors, and multi-purpose ECG/EDA sensors, exemplified by Fitbit's recent launches. Products boast high-resolution AMOLED displays for vibrant visuals and energy efficiency. Applications range from sophisticated personal assistants and seamless payment solutions to advanced sports tracking with GPS and performance analytics, and increasingly, integrated medical monitoring capabilities for heart health and stress management. Unique selling propositions often lie in extended battery life, ruggedized designs for outdoor enthusiasts, and integration within comprehensive smart home and health ecosystems. Technological advancements are focused on miniaturization of sensors, improved AI-powered insights, and enhanced connectivity.

Key Drivers, Barriers & Challenges in APAC Smart Watch Industry

Key Drivers:

- Technological Advancements: Continuous improvements in sensor accuracy, battery life, processor speed, and AI capabilities are key motivators for consumers.

- Growing Health and Wellness Consciousness: Increasing awareness of the benefits of wearable technology for fitness tracking, disease prevention, and health monitoring is a significant driver.

- Smartphone Penetration: High smartphone adoption rates create a strong ecosystem for smartwatch integration and functionality.

- Declining Device Costs: As manufacturing scales, prices become more accessible, widening the consumer base.

- Government Initiatives: Supportive policies promoting digital transformation and wearable technology adoption in certain APAC nations.

Barriers & Challenges:

- Battery Life Limitations: Despite improvements, battery life remains a concern for some users, especially with extensive feature usage.

- Privacy and Data Security Concerns: The collection of sensitive health and personal data raises privacy issues that need to be addressed effectively.

- High Cost of Premium Models: While prices are declining, high-end smartwatches can still be a barrier for price-sensitive consumers.

- Interoperability Issues: Lack of seamless integration between different operating systems and ecosystems can limit user choice and experience.

- Intense Competition: A crowded market with numerous players necessitates constant innovation and competitive pricing.

- Supply Chain Disruptions: Global supply chain issues can impact production and availability of components, potentially affecting pricing and delivery.

Emerging Opportunities in APAC Smart Watch Industry

Emerging opportunities in the APAC Smartwatch Industry lie in the untapped potential of the elderly demographic for health monitoring, the development of specialized smartwatches for specific sports and professions, and the integration of augmented reality (AR) functionalities. The growing demand for personalized health insights and preventative care solutions presents a significant opportunity for devices that can offer more advanced diagnostic capabilities. Furthermore, the expansion of the "smart health" ecosystem, where smartwatches play a central role in managing chronic conditions and facilitating remote patient monitoring, is a rapidly growing area. The increasing adoption of foldable and flexible display technologies also opens avenues for innovative form factors.

Growth Accelerators in the APAC Smart Watch Industry Industry

Several catalysts are accelerating the long-term growth of the APAC Smartwatch Industry. Continued technological breakthroughs in miniaturized sensors, ultra-low-power processors, and advanced battery technologies will enable more sophisticated and longer-lasting devices. Strategic partnerships between smartwatch manufacturers, healthcare providers, and app developers are crucial for building comprehensive health and wellness ecosystems. Market expansion into tier-2 and tier-3 cities within APAC, coupled with the development of more affordable and feature-rich models, will unlock new consumer segments. The increasing demand for seamless connectivity and integration with other IoT devices will also fuel growth as smartwatches become the central hub for personal technology.

Key Players Shaping the APAC Smart Watch Industry Market

- Apple Inc.

- Samsung Electronics Co Ltd.

- Xiaomi Corporation

- Huami Corporation

- Huawei Technologies Co Ltd.

- Garmin Ltd.

- Fitbit Inc.

- Fossil Group Inc.

- Sony Corporation

- Polar Electro OY

- Lenovo Group Limited

- LG Electronics Inc.

Notable Milestones in APAC Smart Watch Industry Sector

- November 2022: Xiaomi announced the launch of its new watch S2 in China alongside the flagship Xiaomi 13 series, Buds 4, and a couple of new products. After the launch in China, the company could also aim to launch the watch in the global market.

- August 2022: Fitbit launched its Sense 2 and Versa 4 smartwatches. The Sense 2 offers extra heart monitoring and stress management capabilities in design and features. Fitbit Sense 2 features offer a Multi-path optical heart rate sensor; body response monitoring cEDA sensor; multipurpose ECG/EDA sensors; red and IR SpO2 sensors; gyroscope; altimeter; 3-axis accelerometer; skin temperature sensor; and ambient light sensor.

In-Depth APAC Smart Watch Industry Market Outlook

The APAC Smartwatch Industry is on a robust upward trajectory, driven by an confluence of factors that promise sustained growth. The increasing demand for connected health and wellness solutions, coupled with relentless technological innovation, is creating a fertile ground for market expansion. Strategic partnerships, aimed at building integrated ecosystems and expanding service offerings, will be critical growth accelerators. Furthermore, the penetration into emerging markets within the APAC region, coupled with the development of more accessible and feature-rich devices, will significantly broaden the consumer base. The industry's future is intrinsically linked to its ability to deliver personalized, actionable insights and seamless user experiences, positioning smartwatches as indispensable tools for modern living.

APAC Smart Watch Industry Segmentation

-

1. Operating Systems

- 1.1. Watch OS

- 1.2. Android/Wear OS

- 1.3. Other Operating Systems

-

2. Display Type

- 2.1. AMOLED

- 2.2. PMOLED

- 2.3. TFT LCD

-

3. Application

- 3.1. Personal Assistance

- 3.2. Medical

- 3.3. Sports

- 3.4. Other Applications

APAC Smart Watch Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

APAC Smart Watch Industry Regional Market Share

Geographic Coverage of APAC Smart Watch Industry

APAC Smart Watch Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 19.69% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer

- 3.3. Market Restrains

- 3.3.1 Growing Complexity of Wearable Devices and Limited Use of Features

- 3.3.2 Augmented With Security Risks

- 3.4. Market Trends

- 3.4.1. Increasing Internet Penetration in the Asia Pacific is Expected to Drive the Studied Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 5.1.1. Watch OS

- 5.1.2. Android/Wear OS

- 5.1.3. Other Operating Systems

- 5.2. Market Analysis, Insights and Forecast - by Display Type

- 5.2.1. AMOLED

- 5.2.2. PMOLED

- 5.2.3. TFT LCD

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Personal Assistance

- 5.3.2. Medical

- 5.3.3. Sports

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6. North America APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Operating Systems

- 6.1.1. Watch OS

- 6.1.2. Android/Wear OS

- 6.1.3. Other Operating Systems

- 6.2. Market Analysis, Insights and Forecast - by Display Type

- 6.2.1. AMOLED

- 6.2.2. PMOLED

- 6.2.3. TFT LCD

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Personal Assistance

- 6.3.2. Medical

- 6.3.3. Sports

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Operating Systems

- 7. South America APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Operating Systems

- 7.1.1. Watch OS

- 7.1.2. Android/Wear OS

- 7.1.3. Other Operating Systems

- 7.2. Market Analysis, Insights and Forecast - by Display Type

- 7.2.1. AMOLED

- 7.2.2. PMOLED

- 7.2.3. TFT LCD

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Personal Assistance

- 7.3.2. Medical

- 7.3.3. Sports

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Operating Systems

- 8. Europe APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Operating Systems

- 8.1.1. Watch OS

- 8.1.2. Android/Wear OS

- 8.1.3. Other Operating Systems

- 8.2. Market Analysis, Insights and Forecast - by Display Type

- 8.2.1. AMOLED

- 8.2.2. PMOLED

- 8.2.3. TFT LCD

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Personal Assistance

- 8.3.2. Medical

- 8.3.3. Sports

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Operating Systems

- 9. Middle East & Africa APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Operating Systems

- 9.1.1. Watch OS

- 9.1.2. Android/Wear OS

- 9.1.3. Other Operating Systems

- 9.2. Market Analysis, Insights and Forecast - by Display Type

- 9.2.1. AMOLED

- 9.2.2. PMOLED

- 9.2.3. TFT LCD

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Personal Assistance

- 9.3.2. Medical

- 9.3.3. Sports

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Operating Systems

- 10. Asia Pacific APAC Smart Watch Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Operating Systems

- 10.1.1. Watch OS

- 10.1.2. Android/Wear OS

- 10.1.3. Other Operating Systems

- 10.2. Market Analysis, Insights and Forecast - by Display Type

- 10.2.1. AMOLED

- 10.2.2. PMOLED

- 10.2.3. TFT LCD

- 10.3. Market Analysis, Insights and Forecast - by Application

- 10.3.1. Personal Assistance

- 10.3.2. Medical

- 10.3.3. Sports

- 10.3.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Operating Systems

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Polar Electro OY

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Huami Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 LG Electronics Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lenovo Group Limited

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Samsung Electronics Co Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Garmin Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fitbit Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Huawei Technologies Co Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Xiaomi Corporatio

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Fossil Group Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Sony Corporation

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Polar Electro OY

List of Figures

- Figure 1: Global APAC Smart Watch Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 3: North America APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 4: North America APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 5: North America APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 6: North America APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 7: North America APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 8: North America APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 9: North America APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 11: South America APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 12: South America APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 13: South America APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 14: South America APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 15: South America APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 16: South America APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 17: South America APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 19: Europe APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 20: Europe APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 21: Europe APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 22: Europe APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Europe APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Europe APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 27: Middle East & Africa APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 28: Middle East & Africa APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 29: Middle East & Africa APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 30: Middle East & Africa APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 31: Middle East & Africa APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 32: Middle East & Africa APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 33: Middle East & Africa APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific APAC Smart Watch Industry Revenue (Million), by Operating Systems 2025 & 2033

- Figure 35: Asia Pacific APAC Smart Watch Industry Revenue Share (%), by Operating Systems 2025 & 2033

- Figure 36: Asia Pacific APAC Smart Watch Industry Revenue (Million), by Display Type 2025 & 2033

- Figure 37: Asia Pacific APAC Smart Watch Industry Revenue Share (%), by Display Type 2025 & 2033

- Figure 38: Asia Pacific APAC Smart Watch Industry Revenue (Million), by Application 2025 & 2033

- Figure 39: Asia Pacific APAC Smart Watch Industry Revenue Share (%), by Application 2025 & 2033

- Figure 40: Asia Pacific APAC Smart Watch Industry Revenue (Million), by Country 2025 & 2033

- Figure 41: Asia Pacific APAC Smart Watch Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 2: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 3: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 4: Global APAC Smart Watch Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 6: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 7: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 8: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 13: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 14: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Brazil APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Argentina APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 20: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 21: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 22: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Germany APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: France APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Italy APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Spain APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Russia APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: Benelux APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Nordics APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 33: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 34: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 35: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Turkey APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Israel APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: GCC APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: North Africa APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: South Africa APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Global APAC Smart Watch Industry Revenue Million Forecast, by Operating Systems 2020 & 2033

- Table 43: Global APAC Smart Watch Industry Revenue Million Forecast, by Display Type 2020 & 2033

- Table 44: Global APAC Smart Watch Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 45: Global APAC Smart Watch Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: China APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: India APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Japan APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: South Korea APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Oceania APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific APAC Smart Watch Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Smart Watch Industry?

The projected CAGR is approximately 19.69%.

2. Which companies are prominent players in the APAC Smart Watch Industry?

Key companies in the market include Polar Electro OY, Huami Corporation, LG Electronics Inc, Lenovo Group Limited, Samsung Electronics Co Ltd, Garmin Ltd, Fitbit Inc, Huawei Technologies Co Ltd, Xiaomi Corporatio, Fossil Group Inc, Apple Inc, Sony Corporation.

3. What are the main segments of the APAC Smart Watch Industry?

The market segments include Operating Systems, Display Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.62 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Technological Advancements in the Wearables Market; Increase in Health Awareness among the Consumer.

6. What are the notable trends driving market growth?

Increasing Internet Penetration in the Asia Pacific is Expected to Drive the Studied Market.

7. Are there any restraints impacting market growth?

Growing Complexity of Wearable Devices and Limited Use of Features. Augmented With Security Risks.

8. Can you provide examples of recent developments in the market?

November 2022 - Xiaomi announced the launch of its new watch S2 in China alongside the flagship Xiaomi 13 series, Buds 4, and a couple of new products. After the launch in China, the company could also aim to launch the watch in the global market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Smart Watch Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Smart Watch Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Smart Watch Industry?

To stay informed about further developments, trends, and reports in the APAC Smart Watch Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence