Key Insights

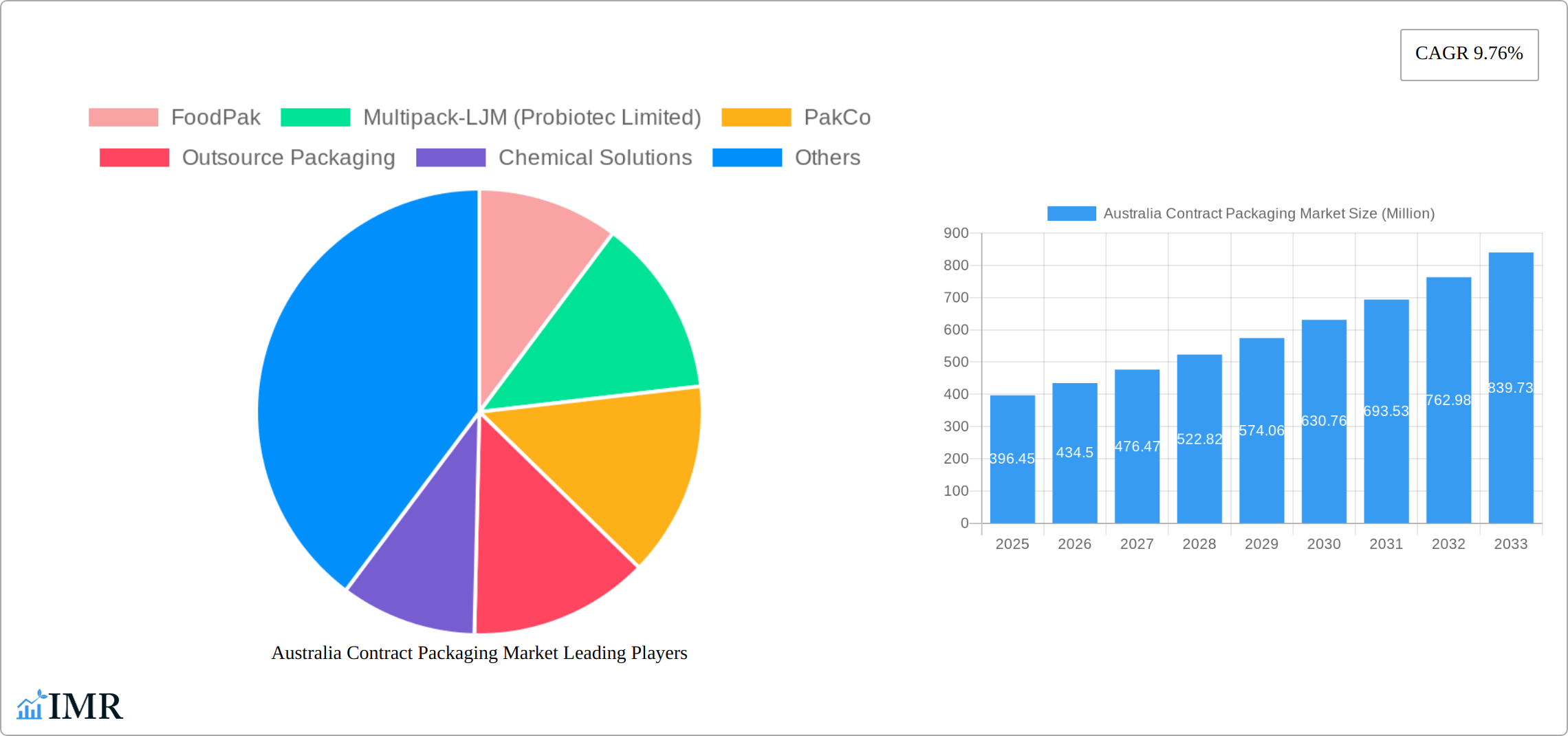

The Australian contract packaging market, valued at $396.45 million in 2025, is experiencing robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) of 9.76% from 2025 to 2033. This expansion is driven by several key factors. The increasing demand for outsourced packaging solutions from food and beverage companies, seeking to optimize efficiency and reduce costs, significantly fuels market growth. Furthermore, the pharmaceutical and personal care sectors are contributing substantially, driven by the need for specialized packaging and stringent quality control measures that contract packaging providers readily offer. Growth is also fueled by the rising adoption of sustainable and innovative packaging materials, aligning with consumer preferences for eco-friendly products. While potential restraints such as fluctuating raw material prices and labor costs exist, the overall market outlook remains positive, particularly considering the strong emphasis on product differentiation and supply chain optimization within the Australian market.

Australia Contract Packaging Market Market Size (In Million)

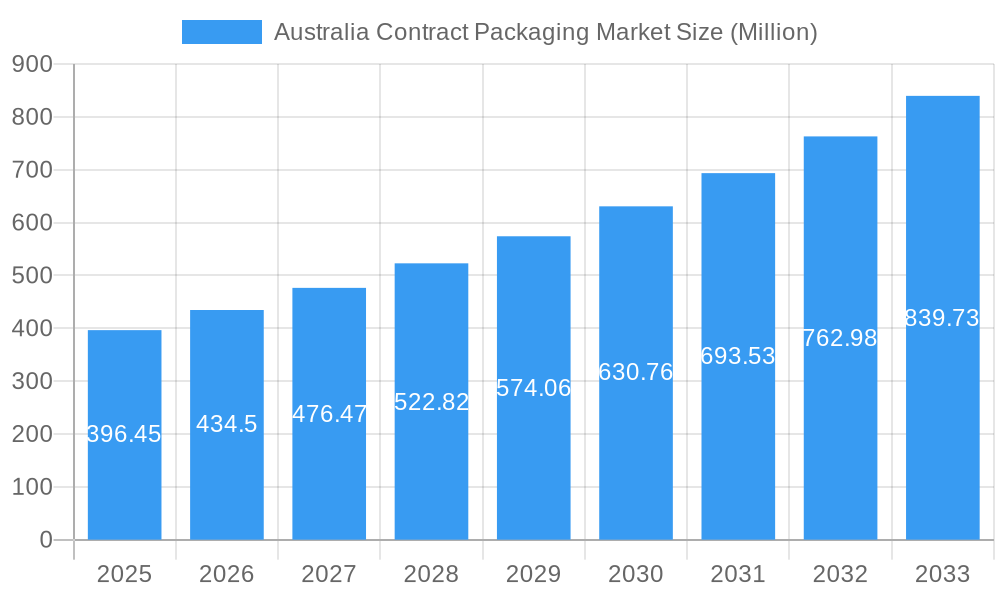

The competitive landscape is characterized by a mix of established players like FoodPak, Multipack-LJM, and PakCo, alongside smaller specialized firms catering to niche segments. The market exhibits a diversified end-user base, with the food and beverage sector currently dominating, followed by pharmaceutical and personal care. However, future growth is anticipated to be driven by increased demand from the home care and personal care sectors, as businesses increasingly outsource non-core activities to focus on their core competencies. The primary, secondary, and tertiary packaging segments are all contributing to market growth, reflecting the diverse packaging needs of various industries. Strategic partnerships, technological advancements in packaging automation, and a focus on delivering customized packaging solutions will shape the future of the Australian contract packaging market.

Australia Contract Packaging Market Company Market Share

Australia Contract Packaging Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Australia contract packaging market, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an invaluable resource for industry professionals, investors, and strategic decision-makers. The report segments the market by type (Primary, Secondary, Tertiary) and end-user (Food, Beverage, Pharmaceutical, Home Care & Personal Care, Other) providing granular insights into market size and growth potential in Million units.

Australia Contract Packaging Market Market Dynamics & Structure

The Australian contract packaging market is characterized by a moderately concentrated landscape with several established players and emerging businesses. Technological innovation, driven by advancements in automation and sustainable packaging solutions, significantly influences market dynamics. Stringent regulatory frameworks regarding food safety and environmental compliance shape operational practices. Competitive substitutes, such as in-house packaging solutions, present challenges, while the growing demand from diverse end-user segments, particularly in food and pharmaceuticals, fuels market expansion. M&A activity remains moderate, with a xx number of deals recorded between 2019 and 2024, representing a xx% market share consolidation.

- Market Concentration: Moderately concentrated, with top 5 players holding an estimated xx% market share in 2024.

- Technological Innovation: Automation, flexible packaging, sustainable materials (e.g., biodegradable plastics) are key drivers. Barriers include high initial investment costs and integration complexities.

- Regulatory Framework: Strict food safety and environmental regulations influence packaging choices and operational procedures.

- Competitive Landscape: Intense competition from both established and emerging players, with pressure from in-house packaging options.

- End-User Demographics: Growing demand from food, pharmaceutical, and personal care sectors drives market expansion. Shifting consumer preferences towards sustainable packaging also influence the market.

- M&A Trends: Moderate M&A activity observed, primarily driven by expansion strategies and technological acquisition. Future consolidation expected.

Australia Contract Packaging Market Growth Trends & Insights

The Australian contract packaging market experienced a steady growth trajectory during the historical period (2019-2024), fueled by increasing outsourcing trends, rising demand for customized packaging solutions, and a focus on operational efficiency. The market is projected to maintain a robust CAGR of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. Technological disruptions, such as the adoption of advanced automation and data analytics, are accelerating efficiency and streamlining processes. Consumer behavior shifts towards sustainable and convenient packaging further drive market expansion. Market penetration remains relatively high in established sectors, while opportunities for growth exist in emerging areas.

Dominant Regions, Countries, or Segments in Australia Contract Packaging Market

The major cities in Australia, including Sydney, Melbourne, and Brisbane, lead the contract packaging market due to their high concentration of manufacturing and distribution facilities, supporting large end-user industries. The pharmaceutical segment holds a significant market share, driven by stringent regulations and specialized packaging requirements. The food and beverage sector also exhibits substantial growth, driven by increasing demand for ready-to-eat meals and convenient packaging formats.

- Key Drivers: Strong manufacturing base, thriving food and pharmaceutical industries, favorable government policies supporting domestic manufacturing, efficient logistics and infrastructure.

- Dominance Factors: High concentration of end-users, well-established supply chains, strong regulatory support.

- Growth Potential: Significant expansion potential exists in the personal care and home care segments due to increasing consumer demand and the rising popularity of e-commerce.

Australia Contract Packaging Market Product Landscape

The Australian contract packaging market is characterized by its extensive and evolving product offerings, catering to a diverse array of consumer and industrial goods. This landscape includes a comprehensive spectrum of packaging formats, from primary (product-contact) and secondary (grouping or display) to tertiary (transport and distribution) solutions. Key innovations driving this market forward include a strong emphasis on sustainable and eco-friendly materials, such as recycled plastics, biodegradable films, and compostable options, aligning with Australia's growing environmental consciousness. Furthermore, the integration of smart packaging technologies is gaining traction, incorporating elements like QR codes for traceability, NFC tags for enhanced consumer engagement, and temperature sensors for sensitive products, thereby improving product integrity and transparency. Customized designs are also paramount, with contract packagers offering bespoke solutions tailored to specific brand aesthetics, product protection requirements, and shelf-life extension needs. In a highly competitive arena, performance metrics such as speed, efficiency, precision, and cost-effectiveness are critical differentiators. Unique selling propositions for market players often revolve around specialized expertise in niche packaging requirements (e.g., pharmaceuticals, hazardous materials, or fragile items), a robust commitment to sustainable practices, and highly streamlined logistics and supply chain management capabilities, ensuring timely and secure delivery.

Key Drivers, Barriers & Challenges in Australia Contract Packaging Market

Key Drivers: The Australian contract packaging market is propelled by several robust factors. A primary driver is the growing demand from a multitude of end-user sectors, including food and beverage, pharmaceuticals, personal care, and industrial goods, each with its unique packaging needs. The increasing prevalence of outsourcing trends by manufacturers and brand owners seeking to reduce capital expenditure, operational costs, and focus on core competencies is a significant growth catalyst. Technological advancements, particularly in automation, high-speed filling and sealing, and sophisticated printing capabilities, are continuously improving efficiency and enabling new packaging solutions. Furthermore, supportive government initiatives promoting domestic manufacturing, innovation, and sustainability in the packaging sector provide a favorable environment for market expansion.

Challenges and Restraints: Despite strong growth drivers, the market faces several significant hurdles. Fluctuations in raw material prices, particularly for plastics and paper, can impact profitability and pricing strategies. Stringent regulatory compliance, encompassing food safety standards, environmental regulations, and labeling requirements, necessitates continuous investment and adaptation. Intense competition from both established, large-scale contract packaging providers and agile new entrants puts pressure on margins and drives the need for differentiation. Potential supply chain disruptions, stemming from global events, logistical complexities, or unforeseen natural disasters, can impact the timely availability of materials and finished goods. Additionally, labor shortages in skilled operational and technical roles can hinder production capacity and efficiency. These collective challenges could collectively impact market growth by an estimated X-Y% annually during the forecast period if not effectively mitigated through strategic planning and operational resilience.

Emerging Opportunities in Australia Contract Packaging Market

The Australian contract packaging market is ripe with emerging opportunities driven by evolving consumer behaviors and technological advancements. A paramount trend is the increasing demand for sustainable and eco-friendly packaging materials, presenting a substantial opportunity for contract packagers who can offer innovative, recyclable, biodegradable, or compostable solutions. The widespread adoption of smart packaging technologies, such as those enabling traceability, authentication, and enhanced consumer interaction through digital platforms, is creating new service offerings and value propositions. The exponential growth of e-commerce continues to fuel the need for specialized, protective, and aesthetically pleasing packaging solutions optimized for direct-to-consumer delivery and unboxing experiences. Untapped markets include niche product segments with highly specialized packaging needs, such as artisanal food products, unique cosmetic formulations, or specialized medical devices, where tailored solutions are highly valued. Furthermore, evolving consumer preferences towards personalized, convenient, and aesthetically appealing packaging represent a key opportunity for contract packagers to offer customized branding, unique formats, and on-demand packaging services.

Growth Accelerators in the Australia Contract Packaging Market Industry

Several factors are poised to significantly accelerate growth within the Australian contract packaging market. Technological breakthroughs, particularly in advanced automation for high-volume production, robotics for intricate handling, and the development of novel sustainable packaging materials with enhanced barrier properties, will be major growth engines. The forging of strategic partnerships and collaborations between contract packaging companies and brand owners is crucial. These alliances foster co-innovation, streamline supply chains, improve product development cycles, and ensure alignment on sustainability goals. Market expansion strategies targeting emerging and high-growth end-user sectors, such as the rapidly expanding health and wellness segment (including supplements and functional foods), the burgeoning plant-based food industry, and the continued expansion of the pet care market, present substantial opportunities for specialized packaging solutions. Investment in R&D for flexible and adaptable packaging lines that can quickly switch between product SKUs also acts as a key accelerator, enabling contract packagers to serve a wider range of clients and demands.

Key Players Shaping the Australia Contract Packaging Market Market

- FoodPak

- Multipack-LJM (Probiotec Limited)

- PakCo

- Outsource Packaging

- Chemical Solutions

- UltraPak (Australia) Pty Ltd

- Finishing Services Pty Ltd

- HH Packaging (Probiotec Limited)

- Probiotec Pharma (Probiotec Limited)

- Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited)

- Tripak Pharmaceuticals

- Rapid Pak

Notable Milestones in Australia Contract Packaging Market Sector

- August 2023: The Boxed Beverage Company partners with Tetra Pak to launch sustainably packaged alkaline water, Waterbox, highlighting the growing focus on sustainable packaging solutions.

- January 2023: CEVA Logistics implements Nulogy's cloud-based contract packaging software, signifying the adoption of advanced technology in the industry to enhance efficiency and traceability.

In-Depth Australia Contract Packaging Market Market Outlook

The Australian contract packaging market is projected to experience robust and sustained growth in the coming years. This positive outlook is underpinned by a confluence of factors, including the aforementioned technological advancements driving efficiency and innovation, the increasing demand from diverse and expanding end-user sectors, and a steadfast and growing focus on sustainability as a core market differentiator. The imperative for businesses to optimize their supply chains and reduce operational overheads will continue to fuel outsourcing trends. Strategic partnerships between contract packagers and brand owners, coupled with focused efforts on expansion into untapped market segments and the development of specialized service offerings, will be crucial for companies aiming to capitalize on these opportunities and gain a competitive edge. The market is poised for continued organic growth and potential consolidation, with innovative, agile, and sustainability-focused companies that can offer advanced technological capabilities and customized solutions likely to capture significant market share and lead the industry's evolution in the coming years.

Australia Contract Packaging Market Segmentation

-

1. Type

- 1.1. Primary

- 1.2. Secondary

- 1.3. Tertiary

-

2. End User

- 2.1. Food

- 2.2. Beverage

- 2.3. Pharmaceutical

- 2.4. Home Care and Personal Care

- 2.5. Other End Users

Australia Contract Packaging Market Segmentation By Geography

- 1. Australia

Australia Contract Packaging Market Regional Market Share

Geographic Coverage of Australia Contract Packaging Market

Australia Contract Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.76% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. FMCG Domain Remains a Key Driver for the Growth of Co-packing Services; Growing Emphasis on Outsourcing Non-core Operations By Product Manufacturers in Australia to Drive Demand

- 3.3. Market Restrains

- 3.3.1. ; Performance Issues with Bio-based Materials; High Cost of Bio-packaging Materials

- 3.4. Market Trends

- 3.4.1. FMCG Domain Remains a Key Driver for Growth of Co-Packing Services

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia Contract Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Primary

- 5.1.2. Secondary

- 5.1.3. Tertiary

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Pharmaceutical

- 5.2.4. Home Care and Personal Care

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FoodPak

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Multipack-LJM (Probiotec Limited)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PakCo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Outsource Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Chemical Solutions

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 UltraPak (Australia) Pty Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Finishing Services Pty Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 HH Packaging (Probiotec Limited)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Probiotec Pharma (Probiotec Limited)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited)*List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tripak Pharmaceuticals

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Rapid Pak

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 FoodPak

List of Figures

- Figure 1: Australia Contract Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Australia Contract Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Australia Contract Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Australia Contract Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 3: Australia Contract Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Australia Contract Packaging Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Australia Contract Packaging Market Revenue Million Forecast, by End User 2020 & 2033

- Table 6: Australia Contract Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia Contract Packaging Market?

The projected CAGR is approximately 9.76%.

2. Which companies are prominent players in the Australia Contract Packaging Market?

Key companies in the market include FoodPak, Multipack-LJM (Probiotec Limited), PakCo, Outsource Packaging, Chemical Solutions, UltraPak (Australia) Pty Ltd, Finishing Services Pty Ltd, HH Packaging (Probiotec Limited), Probiotec Pharma (Probiotec Limited), Australian Blister Sealing Incorporated Pty Ltd (Probiotec Limited)*List Not Exhaustive, Tripak Pharmaceuticals, Rapid Pak.

3. What are the main segments of the Australia Contract Packaging Market?

The market segments include Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 396.45 Million as of 2022.

5. What are some drivers contributing to market growth?

FMCG Domain Remains a Key Driver for the Growth of Co-packing Services; Growing Emphasis on Outsourcing Non-core Operations By Product Manufacturers in Australia to Drive Demand.

6. What are the notable trends driving market growth?

FMCG Domain Remains a Key Driver for Growth of Co-Packing Services.

7. Are there any restraints impacting market growth?

; Performance Issues with Bio-based Materials; High Cost of Bio-packaging Materials.

8. Can you provide examples of recent developments in the market?

August 2023 - The Australian Start-up company, the Boxed Beverage Company, came into collaboration with the key packaging company Tetra-Pack to launch sustainably packaged alkaline water, Waterbox.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia Contract Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia Contract Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia Contract Packaging Market?

To stay informed about further developments, trends, and reports in the Australia Contract Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence