Key Insights

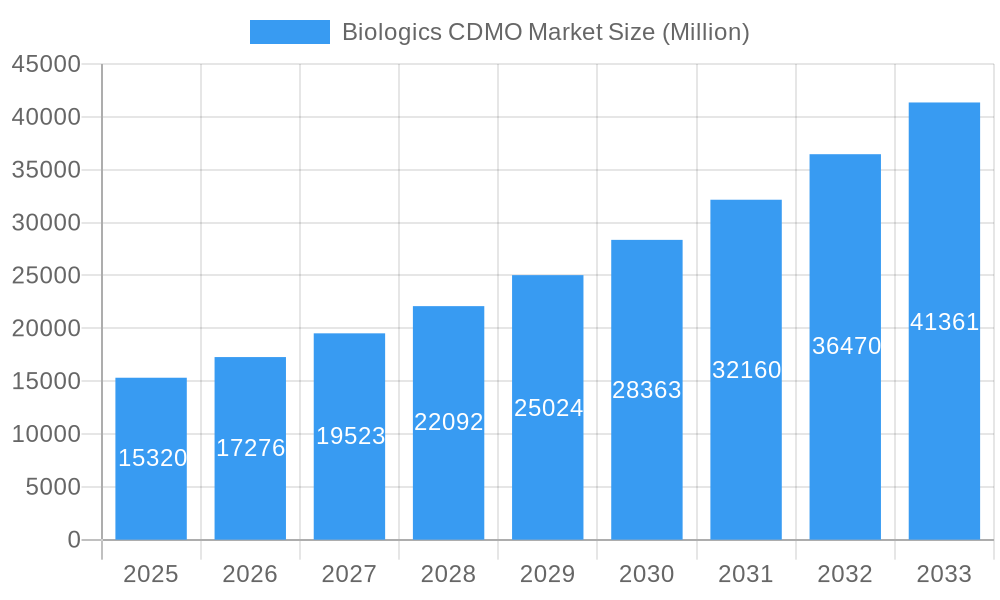

The Biologics Contract Development and Manufacturing Organization (CDMO) market is experiencing robust growth, projected to reach \$15.32 billion in 2025 and exhibiting a Compound Annual Growth Rate (CAGR) of 12.78% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing prevalence of chronic diseases globally is driving demand for biologics, including monoclonal antibodies, vaccines, and recombinant proteins. Secondly, the rising adoption of advanced technologies like cell line development, process optimization, and analytical testing within CDMOs is enhancing efficiency and reducing drug development timelines. Thirdly, the outsourcing trend by pharmaceutical and biotechnology companies is accelerating, as CDMOs offer specialized expertise and scalable manufacturing capabilities, enabling companies to focus on research and development. Finally, the growing regulatory approvals for biosimilars are contributing significantly to market expansion. Market segmentation reveals significant contribution from mammalian-based biologics production, reflecting the dominance of this technology in producing high-quality therapeutic proteins.

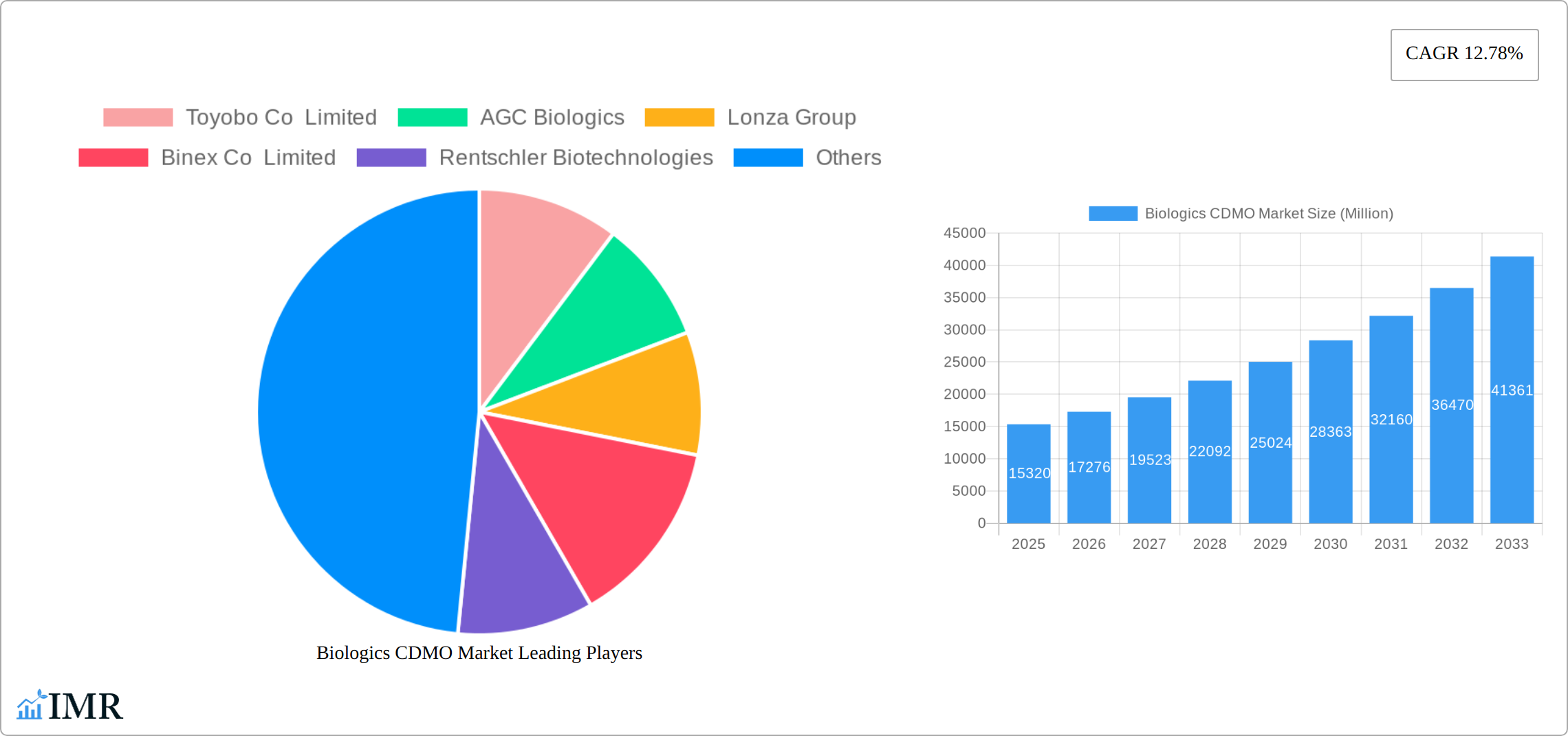

Biologics CDMO Market Market Size (In Billion)

Despite this positive outlook, the market faces certain challenges. Competition among established and emerging CDMO players is intense, requiring continuous innovation and strategic partnerships. Regulatory hurdles and stringent quality control requirements necessitate significant investment in infrastructure and compliance. Furthermore, supply chain complexities and fluctuations in raw material costs can impact profitability. However, given the overall robust growth trajectory of the biologics industry, the Biologics CDMO market is well-positioned for continued expansion over the forecast period, with significant opportunities for companies offering specialized services and advanced technologies. Regional variations are expected, with North America and Europe maintaining leading market shares initially, although the Asia-Pacific region is predicted to experience strong growth driven by increasing investments in pharmaceutical infrastructure and rising healthcare expenditure.

Biologics CDMO Market Company Market Share

Biologics CDMO Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Biologics CDMO Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report utilizes data from the historical period (2019-2024) and forecasts market trends from 2025 to 2033. This report is crucial for industry professionals, investors, and stakeholders seeking a thorough understanding of this rapidly evolving market segment. The total market value in 2025 is estimated at xx Million.

Biologics CDMO Market Dynamics & Structure

The Biologics CDMO market is characterized by a moderately concentrated landscape, with a few large players holding significant market share. However, the market also sees participation from numerous smaller, specialized CDMOs. Technological innovation, particularly in areas like single-use technologies and continuous manufacturing, is a key driver. Stringent regulatory frameworks, especially concerning Good Manufacturing Practices (GMP), significantly influence operational costs and market entry. Biosimilars represent a significant segment, presenting both opportunities and challenges due to price competition. Mergers and acquisitions (M&A) are frequent, reflecting industry consolidation and expansion into new therapeutic areas. The parent market is the broader pharmaceutical contract manufacturing market, while the child market includes segments like cell and gene therapy CDMOs.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% of market share in 2025.

- Technological Innovation: Driven by single-use technologies, continuous manufacturing, and process analytical technology (PAT).

- Regulatory Framework: Stringent GMP regulations increase operational complexity and costs.

- Competitive Product Substitutes: Limited direct substitutes, but competition exists from in-house manufacturing capabilities of large pharmaceutical companies.

- End-User Demographics: Primarily pharmaceutical and biotechnology companies, spanning large multinational corporations to smaller biotech startups.

- M&A Trends: High frequency of M&A activity, driven by expansion, technology acquisition, and market consolidation. xx major M&A deals were observed between 2019 and 2024.

Biologics CDMO Market Growth Trends & Insights

The Biologics Contract Development and Manufacturing Organization (CDMO) market is experiencing a period of significant and sustained growth. This expansion is primarily propelled by the escalating global demand for advanced biologic therapeutics, the burgeoning market for biosimilars, and the rapid development and commercialization of innovative cell and gene therapies. Industry analysts project the market size to reach [Insert Projected Market Size Here, e.g., $XX Billion] by 2033, with a projected Compound Annual Growth Rate (CAGR) of [Insert Projected CAGR Here, e.g., XX%] during the forecast period. This robust growth trajectory is underpinned by several critical factors. Technological advancements are continuously enhancing manufacturing efficiency, optimizing yields, and significantly reducing production costs, making complex biologics more accessible. Concurrently, an increasing number of pharmaceutical and biotechnology companies are strategically opting for outsourcing to specialized CDMOs to leverage their expertise, scale, and innovative capabilities, thereby streamlining their operations and focusing on core competencies like drug discovery and clinical development. The market penetration of biologics within the overall pharmaceutical landscape continues to expand, driven by their efficacy in treating complex diseases, which in turn provides a solid foundation for CDMO growth. Furthermore, evolving consumer behaviors, with a growing emphasis on personalized medicine and targeted therapies, are creating new avenues and demands that CDMOs are well-positioned to address.

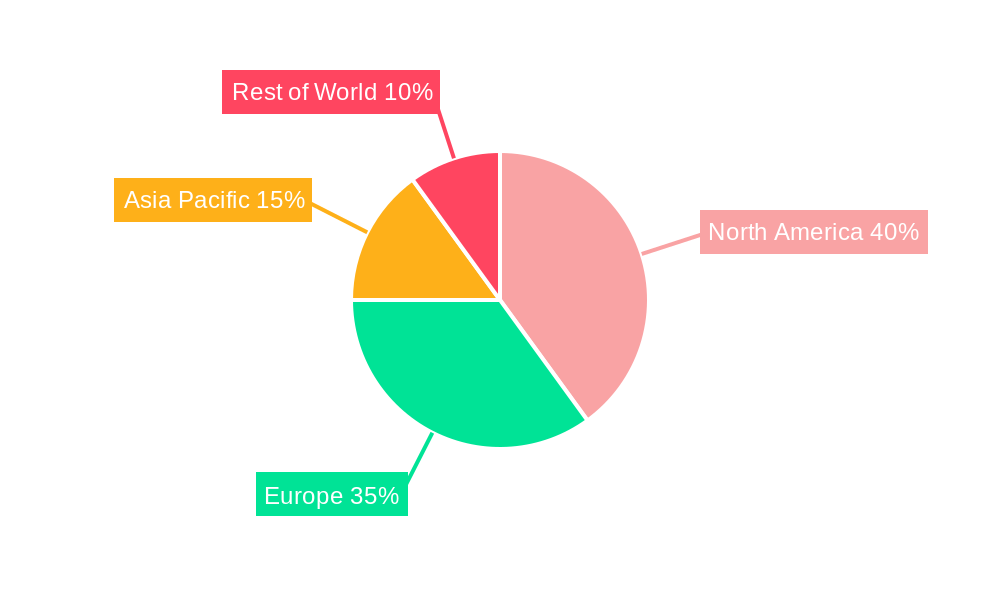

Dominant Regions, Countries, or Segments in Biologics CDMO Market

North America currently commands the largest share of the Biologics CDMO market. This dominance is attributed to its highly developed biopharmaceutical industry, substantial investments in research and development, a well-established regulatory framework that fosters innovation, and a strong presence of leading biopharmaceutical companies. Europe represents another substantial and dynamic market. It boasts a high concentration of established CDMOs with advanced capabilities and a rapidly expanding biosimilars market, fueled by healthcare system pressures to provide more affordable treatment options. The Asia-Pacific region is witnessing the most rapid growth. This surge is propelled by increasing domestic pharmaceutical production capabilities, supportive government policies aimed at fostering the biopharmaceutical sector, a growing pool of skilled talent, and cost advantages for manufacturing.

By Segment: Within the service offerings, the Mammalian cell culture segment continues to be the dominant force. This is due to its proven efficacy and scalability in producing complex recombinant proteins, monoclonal antibodies, and other glycoproteins, which constitute a significant portion of the biologics pipeline. The Biosimilars segment, often categorized under "Other Biologics," is a particularly high-growth area. The expiry of patents for blockbuster biologic drugs, coupled with the pressing need for more cost-effective treatment alternatives, is driving significant investment and demand for biosimilar development and manufacturing services from CDMOs.

- North America: Characterized by a vibrant biopharmaceutical ecosystem, substantial R&D expenditure, and a predictable regulatory environment.

- Europe: Features a dense network of experienced CDMOs, a mature biosimilars market, and a robust regulatory and healthcare infrastructure.

- Asia-Pacific: Exhibits accelerated growth driven by expanding local manufacturing capacities, government initiatives, and competitive pricing.

- Mammalian Segment: Remains the market leader due to its established reliability and suitability for producing a wide array of complex protein-based therapeutics.

- Biosimilars Segment: Stands out as a key growth driver, spurred by patent cliffs and the global demand for accessible biologic treatments.

Biologics CDMO Market Product Landscape

The Biologics CDMO market offers a comprehensive and integrated suite of services that span the entire lifecycle of biologic drug development and manufacturing. This extensive portfolio includes critical stages such as upstream and downstream process development, state-of-the-art analytical testing and characterization, pilot-scale production, and large-scale commercial manufacturing. Furthermore, specialized services like aseptic filling and finishing, formulation development, and lyophilization are increasingly in demand. Key advancements defining the modern CDMO landscape include the adoption of continuous manufacturing processes, sophisticated analytical technologies for enhanced quality control, and the widespread integration of single-use technologies (SUTs) that offer flexibility, scalability, and reduced contamination risks. The primary value propositions offered by leading CDMOs revolve around their ability to significantly reduce manufacturing costs, accelerate development timelines from bench to market, and provide access to highly specialized expertise and cutting-edge technologies that clients may not possess in-house. Ongoing innovation within the sector focuses on continuous improvements in process efficiency, yield optimization, enhanced quality assurance systems, and the development of novel manufacturing platforms to meet the evolving needs of the biopharmaceutical industry.

Key Drivers, Barriers & Challenges in Biologics CDMO Market

Key Drivers:

- Surging Demand for Biologics: The increasing prevalence of chronic and complex diseases, coupled with the demonstrated efficacy of biologic drugs, continues to drive substantial demand across a wide spectrum of therapeutic areas, from oncology and immunology to rare diseases.

- Growth of Biosimilars and Generics: The expiration of patents for many innovator biologics is fueling a significant expansion in the biosimilars market. CDMOs play a crucial role in developing and manufacturing these cost-effective alternatives, increasing accessibility for patients and healthcare systems.

- Strategic Outsourcing by Biopharma Companies: Pharmaceutical and biotechnology firms, both large and small, are increasingly recognizing the strategic advantage of outsourcing their development and manufacturing activities. This allows them to focus on R&D, clinical trials, and commercialization, while leveraging the specialized expertise and infrastructure of CDMOs.

- Technological Advancements in Bioprocessing: Continuous innovations in areas such as cell line development, bioreactor technology, downstream purification, and analytical techniques are leading to enhanced manufacturing efficiency, higher yields, improved product quality, and ultimately, reduced production costs.

- Rise of Advanced Therapies: The rapid progress and increasing clinical success of cell and gene therapies present a significant new wave of demand for specialized CDMO services, requiring unique manufacturing capabilities and expertise.

Key Barriers & Challenges:

- Stringent Regulatory Requirements: The highly regulated nature of pharmaceutical manufacturing, particularly for biologics, necessitates strict adherence to Good Manufacturing Practices (GMP) and other regulatory guidelines. Meeting these evolving and complex requirements, along with the associated compliance costs, can be a significant hurdle.

- Capacity Constraints and Lead Times: In certain high-demand segments or regions, there can be limitations in manufacturing capacity, leading to extended lead times for projects and potential bottlenecks in bringing products to market.

- Intense Competition and Pricing Pressures: The Biologics CDMO market is highly competitive, with a growing number of players vying for contracts. This can lead to intense pricing pressures, impacting profit margins, especially for standard manufacturing services.

- Supply Chain Volatility and Raw Material Costs: The global supply chain for specialized raw materials, critical components, and consumables used in biologics manufacturing can be susceptible to disruptions. This was vividly demonstrated in recent years, where supply chain issues and increased demand led to significant price hikes, with reports indicating a [Insert Specific Percentage Here, e.g., 15-25%] increase in raw material costs in 2022 for certain critical inputs.

- Intellectual Property Protection and Data Security: CDMOs handle highly sensitive proprietary information and intellectual property. Ensuring robust data security protocols and maintaining client confidentiality is paramount and requires continuous investment and vigilance.

Emerging Opportunities in Biologics CDMO Market

- Expansion into emerging markets, particularly in Asia-Pacific and Latin America.

- Growth in cell and gene therapy CDMO services.

- Development of innovative manufacturing technologies like continuous processing.

- Increased focus on personalized medicine and customized manufacturing solutions.

Growth Accelerators in the Biologics CDMO Market Industry

The long-term growth of the Biologics CDMO market will be significantly influenced by continued technological advancements in manufacturing processes, strategic partnerships between CDMOs and pharmaceutical companies, and the expansion into new therapeutic areas, such as cell and gene therapy. The increasing demand for biologics across therapeutic areas, coupled with the ongoing trend towards outsourcing, will propel the market’s continued expansion.

Key Players Shaping the Biologics CDMO Market Market

- Toyobo Co Limited

- AGC Biologics

- Lonza Group

- Binex Co Limited

- Rentschler Biotechnologies

- Wuxi Biologics

- AbbVie Contract Manufacturing

- Parexel International Corporation

- Sandoz Biopharmaceuticals (Novartis AG)

- Catalent Inc

- JRS Pharma

- Fujifilm Diosynth Biotechnologies USA Inc

- Samsung Biologics

- Boehringer Ingelheim Group

- Icon PLC

Notable Milestones in Biologics CDMO Market Sector

- December 2021: AstraZeneca and Samsung Biologics formed a strategic biopharmaceutical manufacturing partnership, expanding on previous agreements and including manufacturing of a cancer immunotherapy product worth approximately USD 380 million.

- March 2022: Oasmia Pharmaceutical AB and Lonza signed a large-scale manufacturing agreement for a drug intermediate for Cantrixil.

- April 2022: FUJIFILM Corporation acquired a cell therapy manufacturing facility from Atara Biotherapeutics Inc., expanding FUJIFILM Diosynth Biotechnologies' global network.

In-Depth Biologics CDMO Market Market Outlook

The Biologics CDMO market is poised for sustained growth, driven by factors such as increasing demand for biologics, the rise of biosimilars, and advancements in manufacturing technologies. Strategic partnerships and M&A activities will further consolidate the market and drive innovation. The expansion into emerging markets and the development of new therapeutic modalities will present substantial opportunities for CDMOs in the coming years. The market is expected to witness continued high demand for customized solutions, particularly in cell and gene therapy.

Biologics CDMO Market Segmentation

-

1. Type

- 1.1. Mammalian

- 1.2. Non-mammalian (Microbial)

-

2. Product Type

-

2.1. Biologics

- 2.1.1. Monoclon

- 2.1.2. Recombinant Proteins

- 2.1.3. Antisense and Molecular Therapy

- 2.1.4. Vaccines

- 2.1.5. Other Biologics

- 2.2. Biosimilars

-

2.1. Biologics

Biologics CDMO Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Biologics CDMO Market Regional Market Share

Geographic Coverage of Biologics CDMO Market

Biologics CDMO Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.78% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Access to New Technologies and Higher Speed of Execution Realized by CDMOs; Need for High Capital Investments to Develop Capabilities Has Led to Firms Choosing the Outsourcing Model; Lack of In-house Capacity among Emerging Drug Development Companies

- 3.3. Market Restrains

- 3.3.1. Presence of Alternative Printing Technology

- 3.4. Market Trends

- 3.4.1. CDMOs’ Access to New Technologies and Higher Speed of Execution Driving Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Mammalian

- 5.1.2. Non-mammalian (Microbial)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Biologics

- 5.2.1.1. Monoclon

- 5.2.1.2. Recombinant Proteins

- 5.2.1.3. Antisense and Molecular Therapy

- 5.2.1.4. Vaccines

- 5.2.1.5. Other Biologics

- 5.2.2. Biosimilars

- 5.2.1. Biologics

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Mammalian

- 6.1.2. Non-mammalian (Microbial)

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Biologics

- 6.2.1.1. Monoclon

- 6.2.1.2. Recombinant Proteins

- 6.2.1.3. Antisense and Molecular Therapy

- 6.2.1.4. Vaccines

- 6.2.1.5. Other Biologics

- 6.2.2. Biosimilars

- 6.2.1. Biologics

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Mammalian

- 7.1.2. Non-mammalian (Microbial)

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Biologics

- 7.2.1.1. Monoclon

- 7.2.1.2. Recombinant Proteins

- 7.2.1.3. Antisense and Molecular Therapy

- 7.2.1.4. Vaccines

- 7.2.1.5. Other Biologics

- 7.2.2. Biosimilars

- 7.2.1. Biologics

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Mammalian

- 8.1.2. Non-mammalian (Microbial)

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Biologics

- 8.2.1.1. Monoclon

- 8.2.1.2. Recombinant Proteins

- 8.2.1.3. Antisense and Molecular Therapy

- 8.2.1.4. Vaccines

- 8.2.1.5. Other Biologics

- 8.2.2. Biosimilars

- 8.2.1. Biologics

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Australia and New Zealand Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Mammalian

- 9.1.2. Non-mammalian (Microbial)

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Biologics

- 9.2.1.1. Monoclon

- 9.2.1.2. Recombinant Proteins

- 9.2.1.3. Antisense and Molecular Therapy

- 9.2.1.4. Vaccines

- 9.2.1.5. Other Biologics

- 9.2.2. Biosimilars

- 9.2.1. Biologics

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Latin America Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Mammalian

- 10.1.2. Non-mammalian (Microbial)

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Biologics

- 10.2.1.1. Monoclon

- 10.2.1.2. Recombinant Proteins

- 10.2.1.3. Antisense and Molecular Therapy

- 10.2.1.4. Vaccines

- 10.2.1.5. Other Biologics

- 10.2.2. Biosimilars

- 10.2.1. Biologics

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Middle East and Africa Biologics CDMO Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Mammalian

- 11.1.2. Non-mammalian (Microbial)

- 11.2. Market Analysis, Insights and Forecast - by Product Type

- 11.2.1. Biologics

- 11.2.1.1. Monoclon

- 11.2.1.2. Recombinant Proteins

- 11.2.1.3. Antisense and Molecular Therapy

- 11.2.1.4. Vaccines

- 11.2.1.5. Other Biologics

- 11.2.2. Biosimilars

- 11.2.1. Biologics

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Toyobo Co Limited

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 AGC Biologics

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Lonza Group

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Binex Co Limited

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Rentschler Biotechnologies

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Wuxi Biologics

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 AbbVie Contract Manufacturing*List Not Exhaustive

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Parexel International Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Sandoz Biopharmaceuticals (Novartis AG)

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Catalent Inc

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.11 JRS Pharma

- 12.2.11.1. Overview

- 12.2.11.2. Products

- 12.2.11.3. SWOT Analysis

- 12.2.11.4. Recent Developments

- 12.2.11.5. Financials (Based on Availability)

- 12.2.12 Fujifilm Diosynth Biotechnologies USA Inc

- 12.2.12.1. Overview

- 12.2.12.2. Products

- 12.2.12.3. SWOT Analysis

- 12.2.12.4. Recent Developments

- 12.2.12.5. Financials (Based on Availability)

- 12.2.13 Samsung Biologics

- 12.2.13.1. Overview

- 12.2.13.2. Products

- 12.2.13.3. SWOT Analysis

- 12.2.13.4. Recent Developments

- 12.2.13.5. Financials (Based on Availability)

- 12.2.14 Boehringer Ingelheim Group

- 12.2.14.1. Overview

- 12.2.14.2. Products

- 12.2.14.3. SWOT Analysis

- 12.2.14.4. Recent Developments

- 12.2.14.5. Financials (Based on Availability)

- 12.2.15 Icon PLC

- 12.2.15.1. Overview

- 12.2.15.2. Products

- 12.2.15.3. SWOT Analysis

- 12.2.15.4. Recent Developments

- 12.2.15.5. Financials (Based on Availability)

- 12.2.1 Toyobo Co Limited

List of Figures

- Figure 1: Global Biologics CDMO Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 3: North America Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 9: Europe Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 15: Asia Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Asia Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Asia Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 21: Australia and New Zealand Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: Australia and New Zealand Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 23: Australia and New Zealand Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Australia and New Zealand Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 27: Latin America Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Latin America Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Latin America Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Latin America Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Biologics CDMO Market Revenue (Million), by Type 2025 & 2033

- Figure 33: Middle East and Africa Biologics CDMO Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Middle East and Africa Biologics CDMO Market Revenue (Million), by Product Type 2025 & 2033

- Figure 35: Middle East and Africa Biologics CDMO Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 36: Middle East and Africa Biologics CDMO Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Biologics CDMO Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Biologics CDMO Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 5: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 8: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 9: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 11: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 12: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 14: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 15: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 17: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 18: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Biologics CDMO Market Revenue Million Forecast, by Type 2020 & 2033

- Table 20: Global Biologics CDMO Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 21: Global Biologics CDMO Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Biologics CDMO Market?

The projected CAGR is approximately 12.78%.

2. Which companies are prominent players in the Biologics CDMO Market?

Key companies in the market include Toyobo Co Limited, AGC Biologics, Lonza Group, Binex Co Limited, Rentschler Biotechnologies, Wuxi Biologics, AbbVie Contract Manufacturing*List Not Exhaustive, Parexel International Corporation, Sandoz Biopharmaceuticals (Novartis AG), Catalent Inc, JRS Pharma, Fujifilm Diosynth Biotechnologies USA Inc, Samsung Biologics, Boehringer Ingelheim Group, Icon PLC.

3. What are the main segments of the Biologics CDMO Market?

The market segments include Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.32 Million as of 2022.

5. What are some drivers contributing to market growth?

Access to New Technologies and Higher Speed of Execution Realized by CDMOs; Need for High Capital Investments to Develop Capabilities Has Led to Firms Choosing the Outsourcing Model; Lack of In-house Capacity among Emerging Drug Development Companies.

6. What are the notable trends driving market growth?

CDMOs’ Access to New Technologies and Higher Speed of Execution Driving Market Growth.

7. Are there any restraints impacting market growth?

Presence of Alternative Printing Technology.

8. Can you provide examples of recent developments in the market?

April 2022 - FUJIFILM Corporation announced that it had completed the acquisition of a dedicated cell therapy manufacturing facility from Atara Biotherapeutics Inc. The facility, located in Thousand Oaks, California, will be operated as part of FUJIFILM DiosynthBiotechnologies' global network, a subsidiary of FUJIFILM Corporation and a world-leading contract development and manufacturing organization (CDMO).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Biologics CDMO Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Biologics CDMO Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Biologics CDMO Market?

To stay informed about further developments, trends, and reports in the Biologics CDMO Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence