Key Insights

The global cannabis packaging market is experiencing significant expansion, propelled by increasing cannabis product legalization and consumption worldwide. The market, projected to reach $50.05 billion by 2025, is expected to grow at a Compound Annual Growth Rate (CAGR) of 7.1% from 2025 to 2033. Key growth drivers include stringent regulatory mandates for child-resistant, tamper-evident, and secure packaging. Additionally, rising consumer preference for premium, aesthetically appealing, and sustainable packaging materials such as recycled cardboard and biodegradable plastics is fostering innovation. Technological advancements are also contributing, with the integration of smart packaging solutions offering enhanced traceability and security features.

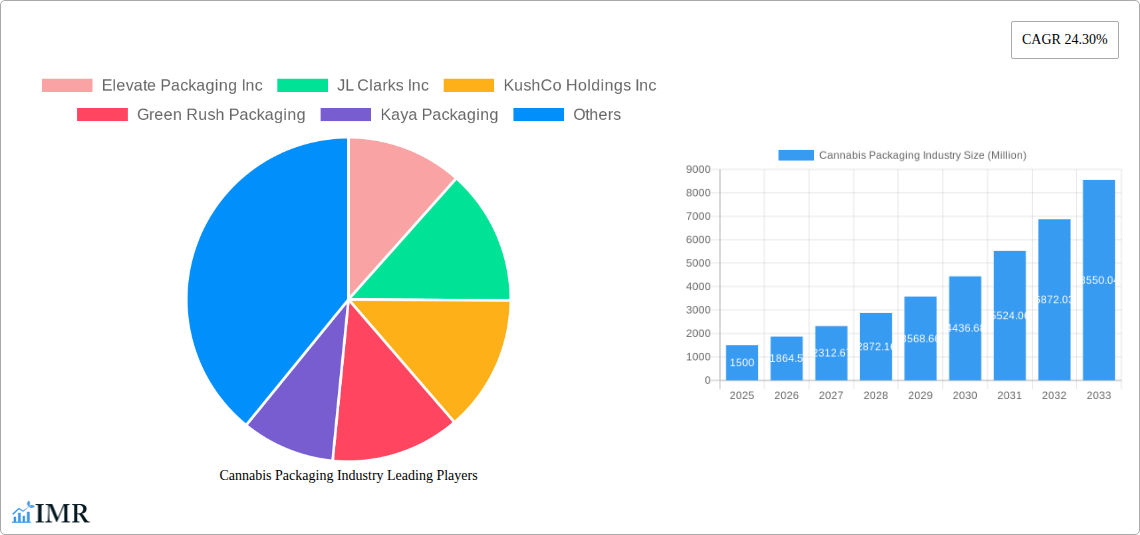

Cannabis Packaging Industry Market Size (In Billion)

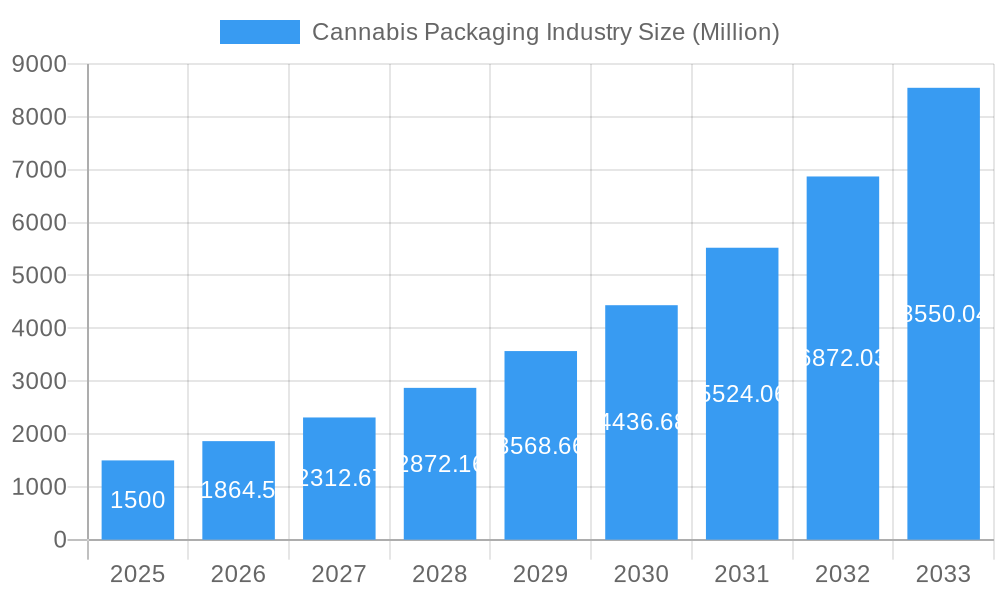

Market challenges include navigating evolving regional regulations, which can impact compliance and market access. The higher cost of specialized cannabis packaging materials and the necessity of advanced manufacturing technologies also pose financial considerations. The market is segmented by packaging type (rigid and flexible) and materials (glass, metal, plastics, and cardboard). Leading companies like Elevate Packaging Inc., JL Clarks Inc., and KushCo Holdings Inc. are actively shaping the market with their innovative and compliant solutions. North America currently leads the market, with Europe and other emerging regions showing substantial growth potential as global cannabis legalization continues to advance. The forecast period of 2025-2033 anticipates sustained growth driven by consumer demand and ongoing industry innovation.

Cannabis Packaging Industry Company Market Share

This report offers a comprehensive analysis of the Cannabis Packaging market, detailing market dynamics, growth trajectories, regional leadership, product offerings, key industry participants, and future projections. The analysis covers the period from 2019 to 2033, with 2025 designated as the base and estimated year. Utilizing extensive market research data, this report delivers actionable intelligence for industry stakeholders. The study provides a granular understanding of both the parent (Cannabis Packaging) and sub-segments (e.g., Rigid Packaging, Flexible Packaging, Glass Containers) within this dynamic sector.

Cannabis Packaging Industry Market Dynamics & Structure

The cannabis packaging market is characterized by moderate concentration, with several key players vying for market share. Technological innovation, driven by increasing demand for child-resistant and tamper-evident packaging, is a key driver. Stringent regulatory frameworks governing cannabis packaging vary significantly across jurisdictions, influencing material selection and design. Competitive product substitutes, like biodegradable options, are gaining traction. End-user demographics are diverse, encompassing both recreational and medical users. The market has witnessed several M&A activities in recent years, reflecting consolidation trends.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on child-resistant, tamper-evident, and sustainable packaging solutions.

- Regulatory Landscape: Highly fragmented and varies significantly across regions, posing challenges for standardization.

- M&A Activity: xx deals closed between 2019 and 2024, with a predicted xx deals in the forecast period.

- Competitive Substitutes: Biodegradable and compostable packaging materials pose a competitive threat.

- Innovation Barriers: High regulatory hurdles and the need for specialized certifications are major barriers.

Cannabis Packaging Industry Growth Trends & Insights

The global cannabis packaging market is experiencing significant growth, driven by the legalization and expansion of the cannabis industry worldwide. Market size is projected to reach xx Million units by 2025, with a CAGR of xx% during the forecast period (2025-2033). Adoption rates are increasing in line with cannabis market expansion, with particular growth in regions with recently legalized recreational or medicinal cannabis. Technological disruptions, such as the introduction of innovative materials and designs, are accelerating market evolution. Consumer behavior is shifting towards more sustainable and environmentally friendly packaging options.

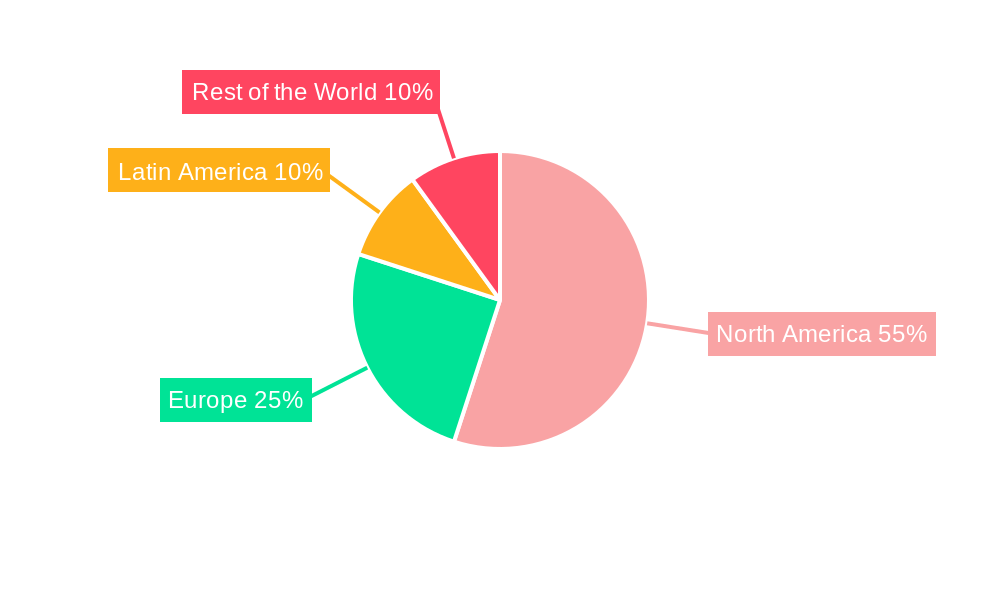

Dominant Regions, Countries, or Segments in Cannabis Packaging Industry

North America (primarily the US and Canada) currently dominates the cannabis packaging market, driven by early adoption of cannabis legalization and a robust cannabis industry. Within North America, states like California, Colorado, and Oregon are leading the charge. The rigid packaging segment holds a larger market share than flexible packaging due to its suitability for various cannabis products. Glass remains a preferred packaging material due to its barrier properties and consumer perception of quality and safety.

- Leading Region: North America (xx% market share in 2025).

- Key Countries: USA, Canada, Germany, and xx.

- Dominant Segment (By Type): Rigid Packaging (xx Million units in 2025).

- Dominant Segment (By Material): Glass (xx Million units in 2025)

- Growth Drivers: Legalization of cannabis in new jurisdictions, rising consumer demand, and preference for premium packaging.

Cannabis Packaging Industry Product Landscape

The cannabis packaging industry offers a diverse range of products, including rigid containers (jars, bottles), flexible pouches, and specialized packaging for various cannabis products (flowers, pre-rolls, edibles, concentrates). Innovations focus on enhancing child-resistance, tamper-evidence, and sustainability. Key performance indicators include barrier properties, shelf life extension, and cost-effectiveness. Unique selling propositions often center around eco-friendly materials, innovative designs, and customizability.

Key Drivers, Barriers & Challenges in Cannabis Packaging Industry

Key Drivers: Increasing legalization of cannabis in various countries, rising consumer demand for premium and sustainable packaging, technological advancements in packaging materials and designs.

Key Challenges: Stringent regulatory requirements vary across jurisdictions, creating complexities for manufacturers, supply chain disruptions leading to material shortages and price volatility, intense competition from established packaging companies and new entrants.

Emerging Opportunities in Cannabis Packaging Industry

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging options (e.g., biodegradable materials), customized and branded packaging solutions to enhance product appeal, and expansion into new markets with emerging cannabis regulations.

Growth Accelerators in the Cannabis Packaging Industry

Technological breakthroughs in sustainable packaging materials and printing technologies, strategic partnerships between packaging companies and cannabis producers, expansion into international markets with developing cannabis industries are key catalysts for long-term growth.

Key Players Shaping the Cannabis Packaging Industry Market

- Elevate Packaging Inc

- JL Clarks Inc

- KushCo Holdings Inc

- Green Rush Packaging

- Kaya Packaging

- N2 Packaging Systems LLC

- Berry Global Inc

- Cannaline Cannabis Packaging Solutions

- Greenlane Holdings Inc

- Dymapak

- Diamond Packaging

Notable Milestones in Cannabis Packaging Industry Sector

- November 2021: The Niagara Herbalist launches a cannabis packaging buyback program, promoting sustainability.

- January 2022: Origin Pharma Packaging launches a child-resistant jar for medicinal cannabis flower, addressing safety concerns.

In-Depth Cannabis Packaging Industry Market Outlook

The cannabis packaging market is poised for continued growth, driven by expanding legalization efforts globally and increasing consumer preference for high-quality, sustainable packaging. Strategic partnerships, technological innovations, and expansion into new markets will play crucial roles in shaping the market's future. The market presents significant opportunities for companies that can adapt to evolving regulations and meet the demands of a diverse and expanding consumer base.

Cannabis Packaging Industry Segmentation

-

1. Type

- 1.1. Rigid Packaging

- 1.2. Flexible Packaging

-

2. Packaging Materials

- 2.1. Glass

- 2.2. Metal

- 2.3. Plastics

- 2.4. Cardboard Containers

Cannabis Packaging Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Latin America

- 4. Rest of the World

Cannabis Packaging Industry Regional Market Share

Geographic Coverage of Cannabis Packaging Industry

Cannabis Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Medical and Recreational Cannabis Products; Legalization of Cannabis in Various North American Countries

- 3.3. Market Restrains

- 3.3.1. Stringent Regulation Related to Cannabis Packaging

- 3.4. Market Trends

- 3.4.1. Plastic Packaging Holds a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Rigid Packaging

- 5.1.2. Flexible Packaging

- 5.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 5.2.1. Glass

- 5.2.2. Metal

- 5.2.3. Plastics

- 5.2.4. Cardboard Containers

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Latin America

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Rigid Packaging

- 6.1.2. Flexible Packaging

- 6.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 6.2.1. Glass

- 6.2.2. Metal

- 6.2.3. Plastics

- 6.2.4. Cardboard Containers

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Rigid Packaging

- 7.1.2. Flexible Packaging

- 7.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 7.2.1. Glass

- 7.2.2. Metal

- 7.2.3. Plastics

- 7.2.4. Cardboard Containers

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Latin America Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Rigid Packaging

- 8.1.2. Flexible Packaging

- 8.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 8.2.1. Glass

- 8.2.2. Metal

- 8.2.3. Plastics

- 8.2.4. Cardboard Containers

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Rest of the World Cannabis Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Rigid Packaging

- 9.1.2. Flexible Packaging

- 9.2. Market Analysis, Insights and Forecast - by Packaging Materials

- 9.2.1. Glass

- 9.2.2. Metal

- 9.2.3. Plastics

- 9.2.4. Cardboard Containers

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Elevate Packaging Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 JL Clarks Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 KushCo Holdings Inc

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Green Rush Packaging

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kaya Packaging

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 N2 Packaging Systems LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Berry Global Inc *List Not Exhaustive

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Cannaline Cannabis Packaging Solutions

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Greenlane Holdings Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Dymapak

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Diamond Packaging

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.1 Elevate Packaging Inc

List of Figures

- Figure 1: Global Cannabis Packaging Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Cannabis Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Cannabis Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Cannabis Packaging Industry Revenue (billion), by Packaging Materials 2025 & 2033

- Figure 5: North America Cannabis Packaging Industry Revenue Share (%), by Packaging Materials 2025 & 2033

- Figure 6: North America Cannabis Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Cannabis Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Cannabis Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Cannabis Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Cannabis Packaging Industry Revenue (billion), by Packaging Materials 2025 & 2033

- Figure 11: Europe Cannabis Packaging Industry Revenue Share (%), by Packaging Materials 2025 & 2033

- Figure 12: Europe Cannabis Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Cannabis Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Latin America Cannabis Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 15: Latin America Cannabis Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 16: Latin America Cannabis Packaging Industry Revenue (billion), by Packaging Materials 2025 & 2033

- Figure 17: Latin America Cannabis Packaging Industry Revenue Share (%), by Packaging Materials 2025 & 2033

- Figure 18: Latin America Cannabis Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Latin America Cannabis Packaging Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Cannabis Packaging Industry Revenue (billion), by Type 2025 & 2033

- Figure 21: Rest of the World Cannabis Packaging Industry Revenue Share (%), by Type 2025 & 2033

- Figure 22: Rest of the World Cannabis Packaging Industry Revenue (billion), by Packaging Materials 2025 & 2033

- Figure 23: Rest of the World Cannabis Packaging Industry Revenue Share (%), by Packaging Materials 2025 & 2033

- Figure 24: Rest of the World Cannabis Packaging Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Rest of the World Cannabis Packaging Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 3: Global Cannabis Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 6: Global Cannabis Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 8: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 9: Global Cannabis Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 11: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 12: Global Cannabis Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Cannabis Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 14: Global Cannabis Packaging Industry Revenue billion Forecast, by Packaging Materials 2020 & 2033

- Table 15: Global Cannabis Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cannabis Packaging Industry?

The projected CAGR is approximately 7.1%.

2. Which companies are prominent players in the Cannabis Packaging Industry?

Key companies in the market include Elevate Packaging Inc, JL Clarks Inc, KushCo Holdings Inc, Green Rush Packaging, Kaya Packaging, N2 Packaging Systems LLC, Berry Global Inc *List Not Exhaustive, Cannaline Cannabis Packaging Solutions, Greenlane Holdings Inc, Dymapak, Diamond Packaging.

3. What are the main segments of the Cannabis Packaging Industry?

The market segments include Type, Packaging Materials.

4. Can you provide details about the market size?

The market size is estimated to be USD 50.05 billion as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Medical and Recreational Cannabis Products; Legalization of Cannabis in Various North American Countries.

6. What are the notable trends driving market growth?

Plastic Packaging Holds a Significant Market Share.

7. Are there any restraints impacting market growth?

Stringent Regulation Related to Cannabis Packaging.

8. Can you provide examples of recent developments in the market?

January 2022: Origin Pharma Packaging launched a piece of packaging dedicated to the medicinal cannabis industry, a child-resistant Jar to support the 'flower# product, which is often prescribed in certain European countries.,

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cannabis Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cannabis Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cannabis Packaging Industry?

To stay informed about further developments, trends, and reports in the Cannabis Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence