Key Insights

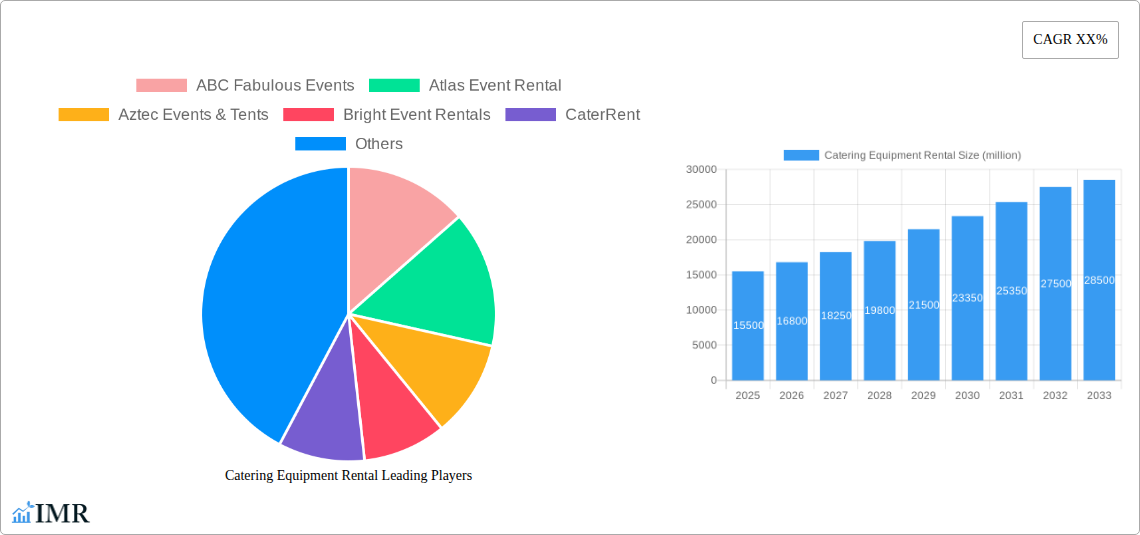

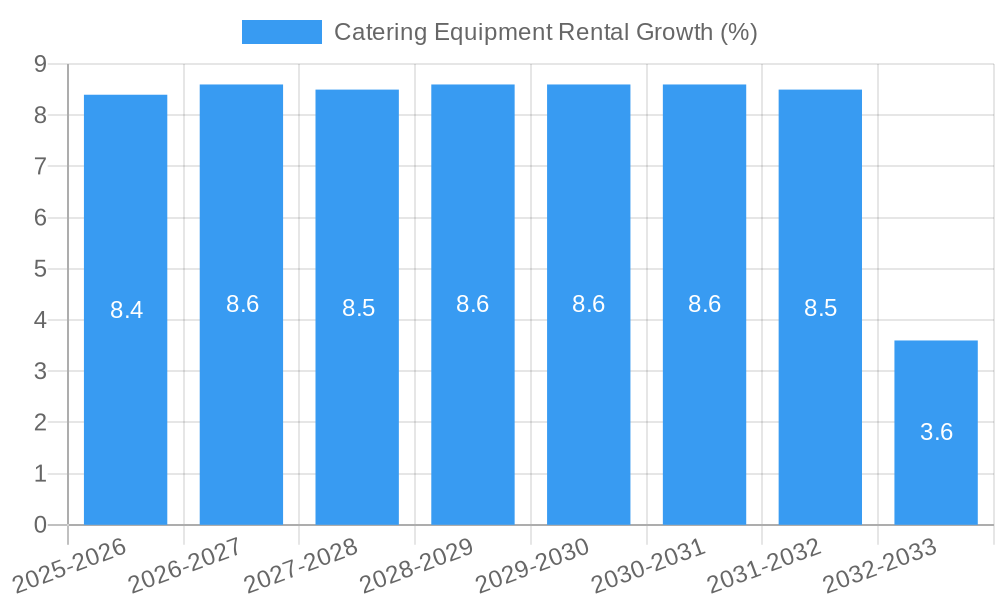

The global Catering Equipment Rental market is poised for robust expansion, with an estimated market size of approximately USD 15,500 million in 2025. This growth is projected to continue at a Compound Annual Growth Rate (CAGR) of around 8.5% over the forecast period from 2025 to 2033, reaching an estimated USD 28,500 million by 2033. This upward trajectory is primarily fueled by the increasing demand for specialized event services and the growing trend of outsourcing catering equipment for both commercial and household events. The dynamic nature of the event industry, encompassing everything from large-scale corporate functions and weddings to smaller private gatherings, necessitates flexible and cost-effective solutions for equipment sourcing. Businesses and individuals are increasingly opting for rentals to avoid the significant capital expenditure and logistical challenges associated with purchasing and maintaining a diverse inventory of catering equipment. This market is further propelled by the convenience and variety offered by rental companies, which provide a wide array of food display, heating, and refrigeration equipment, catering to diverse culinary needs and event scales.

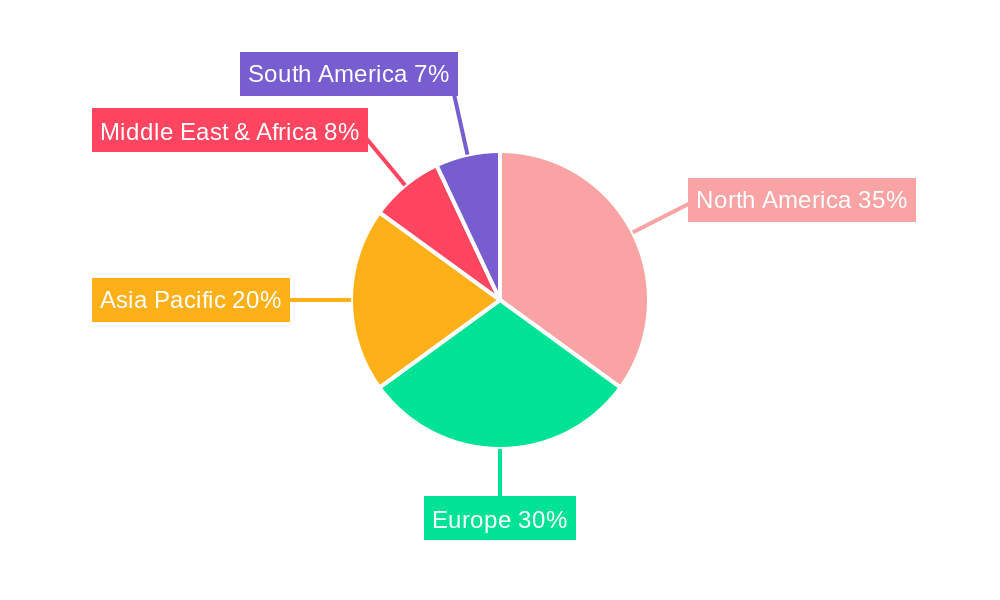

Key drivers shaping the Catering Equipment Rental market include the burgeoning events industry, the rise of food trucks and pop-up restaurants requiring temporary equipment, and a general shift towards experiential consumption. Furthermore, technological advancements in catering equipment are also influencing rental demands, with a growing interest in energy-efficient and smart appliances. However, certain factors may pose restraints, such as the operational complexities of managing rental logistics and the potential for damage or wear and tear on equipment. Geographically, North America and Europe are expected to dominate the market due to well-established event infrastructures and higher disposable incomes. The Asia Pacific region, with its rapidly expanding middle class and increasing frequency of social and corporate events, presents a significant growth opportunity. The market is segmented into various applications, including household and commercial, and further categorized by equipment types such as food display, heating, and refrigeration, all contributing to the multifaceted nature and expanding reach of the catering equipment rental sector.

Catering Equipment Rental Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report offers a detailed analysis of the global catering equipment rental market, providing crucial insights for industry stakeholders. Covering the historical period from 2019 to 2024 and projecting growth through 2033, this report is your definitive guide to understanding market dynamics, growth drivers, competitive landscape, and future opportunities. With a base year of 2025, our projections are based on robust data and advanced analytical models.

Catering Equipment Rental Market Dynamics & Structure

The global catering equipment rental market exhibits a moderately concentrated structure, with a few key players holding significant market share, while a substantial number of regional and specialized providers cater to niche demands. Technological innovation is a primary driver, with advancements in energy-efficient refrigeration units and smart food display systems enhancing operational efficiency and sustainability for caterers. Regulatory frameworks, particularly concerning food safety and hygiene standards, play a crucial role in shaping equipment rental practices and investment decisions. Competitive product substitutes, such as outright equipment purchase, are present but often outweighed by the flexibility and cost-effectiveness of rentals, especially for events and seasonal demands. End-user demographics are shifting, with an increasing demand from the commercial segment, encompassing corporate events, hospitality businesses, and large-scale public gatherings. Mergers and acquisitions (M&A) are a notable trend, driven by companies seeking to expand their service portfolios, geographical reach, and economies of scale.

- Market Concentration: Dominated by a blend of large national rental companies and numerous regional operators.

- Technological Innovation: Focus on energy efficiency, smart features, and modular designs for diverse applications.

- Regulatory Frameworks: Stringent food safety and hygiene regulations influencing equipment standards and maintenance protocols.

- Competitive Substitutes: Outright purchase versus rental for varying business models and event scales.

- End-User Demographics: Significant growth in demand from the commercial sector, including event venues, hotels, and corporate catering.

- M&A Trends: Strategic acquisitions aimed at consolidating market share and enhancing service offerings.

Catering Equipment Rental Growth Trends & Insights

The catering equipment rental market is poised for robust growth, driven by a confluence of economic factors, evolving consumer preferences, and industry-specific demands. The market size is projected to witness a significant expansion from an estimated $6.5 billion in 2025 to approximately $10.2 billion by 2033, reflecting a Compound Annual Growth Rate (CAGR) of 5.8%. Adoption rates for rental services are steadily increasing across both established and emerging markets, as businesses recognize the financial advantages and operational flexibility associated with leasing rather than owning expensive catering equipment. Technological disruptions are continuously reshaping the landscape; for instance, the integration of IoT in food heating and refrigeration units allows for remote monitoring and predictive maintenance, thereby minimizing downtime and ensuring optimal food quality.

Consumer behavior shifts are also playing a pivotal role. The rise of the experience economy and the increasing frequency of large-scale events, from weddings and festivals to corporate conferences, are fueling the demand for a wide array of specialized catering equipment. Caterers are increasingly opting for rental solutions to manage fluctuating demands and to access the latest equipment without significant capital outlay. This trend is further amplified by the growing emphasis on sustainability, with rental companies often investing in and maintaining energy-efficient and eco-friendly equipment, aligning with the environmental consciousness of many end-users. Furthermore, the burgeoning gig economy and the proliferation of small-scale catering businesses also contribute to the demand for flexible and affordable equipment rental options, making it easier for new entrepreneurs to enter the market. The commercial segment is expected to remain the dominant application, driven by consistent demand from hotels, restaurants, event management companies, and corporate cafeterias.

Dominant Regions, Countries, or Segments in Catering Equipment Rental

The Commercial segment is projected to be the dominant force driving growth within the global catering equipment rental market. This dominance is attributed to the sheer volume of events and operational demands within various commercial verticals. The North America region, particularly the United States and Canada, is anticipated to be a leading geographical market, owing to its mature event industry, robust hospitality sector, and significant corporate spending on events.

Commercial Segment Dominance:

- Key Drivers: High frequency of corporate events, conferences, weddings, festivals, and hospitality operations requiring flexible equipment solutions.

- Market Share: Expected to account for over 75% of the total market value by 2033.

- Growth Potential: Continuous expansion of the event management industry and a sustained need for specialized catering infrastructure in hotels and restaurants.

- Application Breakdown: Encompasses demand from hotels, restaurants, event venues, catering companies, corporate offices, and exhibition centers.

Leading Regions & Countries:

- North America:

- Key Drivers: Well-established event infrastructure, high disposable incomes, and a strong corporate culture driving event participation. Significant M&A activities by major players like Atlas Event Rental and Party Rent Group further solidify its position.

- Market Share: Estimated to hold over 35% of the global market by 2033.

- Countries: United States and Canada are key contributors.

- Europe:

- Key Drivers: Thriving tourism and hospitality sectors, coupled with a strong tradition of large-scale events and festivals.

- Market Share: Projected to account for approximately 28% of the global market.

- Countries: United Kingdom, Germany, France, and Italy are significant markets.

- North America:

Dominant Equipment Types within the Commercial Segment:

- Food Heating Equipment: Essential for maintaining food temperature at events and in commercial kitchens, including chafing dishes, heated display cabinets, and warming trays.

- Food Refrigeration Equipment: Crucial for food safety and preservation, encompassing reach-in refrigerators, walk-in coolers, and specialized refrigerated display units.

- Food Display Equipment: Critical for presentation, including buffet stations, display shelves, and refrigerated counters.

Catering Equipment Rental Product Landscape

The catering equipment rental market is characterized by a diverse and evolving product landscape, emphasizing functionality, safety, and aesthetics. Innovations focus on enhancing energy efficiency, such as advanced refrigeration compressors and insulated heating elements, reducing operational costs for users. Smart technology integration is on the rise, with some food display equipment offering digital temperature readouts and connectivity for remote monitoring. Food heating equipment is seeing advancements in rapid heating capabilities and uniform temperature distribution. The market also offers a wide array of food refrigeration equipment, from standard reach-in units to specialized blast chillers and mobile cold storage solutions, all designed to meet stringent food safety regulations. The "Other" category includes essential items like service carts, beverage dispensers, and specialized cooking appliances.

Key Drivers, Barriers & Challenges in Catering Equipment Rental

Key Drivers:

- Event Industry Growth: The expanding global event industry, including corporate functions, weddings, and festivals, directly fuels demand for temporary catering equipment.

- Cost-Effectiveness & Flexibility: Rental services offer a cost-effective solution for businesses with fluctuating needs, avoiding high capital expenditure and ongoing maintenance costs.

- Technological Advancements: Innovations in energy efficiency and smart features make rental equipment more attractive and compliant with evolving standards.

- Scalability: The ability to scale equipment needs up or down for different event sizes provides unparalleled flexibility.

Barriers & Challenges:

- Supply Chain Disruptions: Global supply chain issues can impact the availability of new equipment for rental companies and lead to extended lead times.

- Maintenance & Upkeep Costs: Ensuring equipment is in optimal working condition requires significant investment in maintenance and repairs, impacting profitability.

- Competition: Intense competition from both large national players and smaller local providers can lead to price wars and margin erosion.

- Regulatory Compliance: Adhering to evolving health, safety, and environmental regulations requires continuous investment and adaptation.

- Seasonality: Demand can be highly seasonal, leading to underutilization of assets during off-peak periods.

Emerging Opportunities in Catering Equipment Rental

Emerging opportunities in the catering equipment rental sector lie in the growing demand for sustainable and eco-friendly equipment solutions. As environmental consciousness rises, rental companies that invest in energy-efficient refrigerators, induction heating units, and reusable serving ware will gain a competitive edge. The expansion of the food truck and pop-up restaurant scene presents a significant opportunity for specialized, modular, and easily transportable catering equipment rentals. Furthermore, the integration of digital platforms for inventory management, booking, and logistics is creating opportunities for enhanced customer experience and operational efficiency. Tapping into niche markets, such as gluten-free or vegan event catering, by offering specialized equipment like dedicated cooking and display units, also presents an untapped market.

Growth Accelerators in the Catering Equipment Rental Industry

Several factors are poised to accelerate the growth of the catering equipment rental industry. The increasing globalization of events and the trend towards destination weddings and international corporate gatherings are expanding the geographical reach and demand for rental services. Strategic partnerships between equipment rental companies and event management firms, venue owners, and food manufacturers can create synergistic opportunities, offering comprehensive packages and streamlined services. The ongoing digital transformation, including the adoption of AI-powered inventory management and predictive analytics for demand forecasting, will optimize operational efficiency and customer service. Investment in a diverse and modern fleet, incorporating the latest technological innovations, will be a key differentiator and growth catalyst.

Key Players Shaping the Catering Equipment Rental Market

- ABC Fabulous Events

- Atlas Event Rental

- Aztec Events & Tents

- Bright Event Rentals

- CaterRent

- Diamond Event

- Jongor Hire

- Lowe Rental

- Party Rent Group

- Port City Rentals

- Redi Rental

- Reventals

- Signature Event Rental

- Tremont Rentals

Notable Milestones in Catering Equipment Rental Sector

- 2019: Increased adoption of online booking platforms for event equipment rentals.

- 2020: Impact of COVID-19 pandemic leading to a temporary slowdown, followed by a surge in demand for outdoor and smaller-scale event rentals as restrictions eased.

- 2021: Growing emphasis on hygiene and sanitization protocols for rental equipment, leading to investments in specialized cleaning services.

- 2022: Significant investment in energy-efficient refrigeration and heating equipment to meet sustainability demands.

- 2023: Expansion of rental fleets to include a wider variety of specialized equipment for diverse culinary needs, such as ethnic food preparation.

- 2024: Increased integration of IoT and smart technology in rental equipment for remote monitoring and predictive maintenance.

In-Depth Catering Equipment Rental Market Outlook

The catering equipment rental market is set for sustained and robust growth, driven by the dynamic nature of the events and hospitality sectors. The increasing demand for flexible, cost-effective, and technologically advanced solutions will continue to propel market expansion. Key growth accelerators include the ongoing digitalization of rental processes, offering seamless booking and management experiences, and a growing preference for sustainable and eco-friendly equipment. Strategic acquisitions and partnerships among key players are expected to consolidate the market and enhance service offerings. The projected market size of approximately $10.2 billion by 2033, with a CAGR of 5.8%, underscores significant opportunities for innovation and strategic investment in this vital industry.

Catering Equipment Rental Segmentation

-

1. Application

- 1.1. Household

- 1.2. Commercial

-

2. Types

- 2.1. Food Display Equipment

- 2.2. Food Heating Equipment

- 2.3. Food Refrigeration Equipment

- 2.4. Other

Catering Equipment Rental Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Catering Equipment Rental REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Catering Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Household

- 5.1.2. Commercial

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Food Display Equipment

- 5.2.2. Food Heating Equipment

- 5.2.3. Food Refrigeration Equipment

- 5.2.4. Other

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Catering Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Household

- 6.1.2. Commercial

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Food Display Equipment

- 6.2.2. Food Heating Equipment

- 6.2.3. Food Refrigeration Equipment

- 6.2.4. Other

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Catering Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Household

- 7.1.2. Commercial

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Food Display Equipment

- 7.2.2. Food Heating Equipment

- 7.2.3. Food Refrigeration Equipment

- 7.2.4. Other

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Catering Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Household

- 8.1.2. Commercial

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Food Display Equipment

- 8.2.2. Food Heating Equipment

- 8.2.3. Food Refrigeration Equipment

- 8.2.4. Other

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Catering Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Household

- 9.1.2. Commercial

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Food Display Equipment

- 9.2.2. Food Heating Equipment

- 9.2.3. Food Refrigeration Equipment

- 9.2.4. Other

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Catering Equipment Rental Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Household

- 10.1.2. Commercial

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Food Display Equipment

- 10.2.2. Food Heating Equipment

- 10.2.3. Food Refrigeration Equipment

- 10.2.4. Other

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 ABC Fabulous Events

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Atlas Event Rental

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aztec Events & Tents

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bright Event Rentals

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 CaterRent

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Diamond Event

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Jongor Hire

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Lowe Rental

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Party Rent Group

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Port City Rentals

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Redi Rental

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Reventals

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Signature Event Rental

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Tremont Rentals

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 ABC Fabulous Events

List of Figures

- Figure 1: Global Catering Equipment Rental Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Catering Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 3: North America Catering Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Catering Equipment Rental Revenue (million), by Types 2024 & 2032

- Figure 5: North America Catering Equipment Rental Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Catering Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 7: North America Catering Equipment Rental Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Catering Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 9: South America Catering Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Catering Equipment Rental Revenue (million), by Types 2024 & 2032

- Figure 11: South America Catering Equipment Rental Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Catering Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 13: South America Catering Equipment Rental Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Catering Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Catering Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Catering Equipment Rental Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Catering Equipment Rental Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Catering Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Catering Equipment Rental Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Catering Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Catering Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Catering Equipment Rental Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Catering Equipment Rental Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Catering Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Catering Equipment Rental Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Catering Equipment Rental Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Catering Equipment Rental Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Catering Equipment Rental Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Catering Equipment Rental Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Catering Equipment Rental Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Catering Equipment Rental Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Catering Equipment Rental Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Catering Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Catering Equipment Rental Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Catering Equipment Rental Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Catering Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Catering Equipment Rental Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Catering Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Catering Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Catering Equipment Rental Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Catering Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Catering Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Catering Equipment Rental Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Catering Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Catering Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Catering Equipment Rental Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Catering Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Catering Equipment Rental Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Catering Equipment Rental Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Catering Equipment Rental Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Catering Equipment Rental Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Catering Equipment Rental?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Catering Equipment Rental?

Key companies in the market include ABC Fabulous Events, Atlas Event Rental, Aztec Events & Tents, Bright Event Rentals, CaterRent, Diamond Event, Jongor Hire, Lowe Rental, Party Rent Group, Port City Rentals, Redi Rental, Reventals, Signature Event Rental, Tremont Rentals.

3. What are the main segments of the Catering Equipment Rental?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3350.00, USD 5025.00, and USD 6700.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Catering Equipment Rental," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Catering Equipment Rental report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Catering Equipment Rental?

To stay informed about further developments, trends, and reports in the Catering Equipment Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence