Key Insights

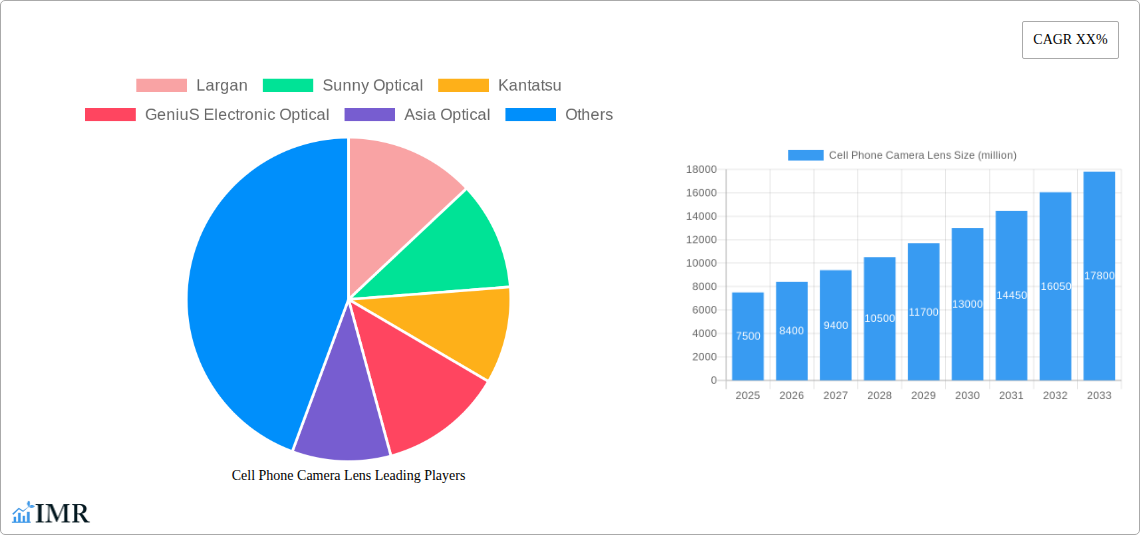

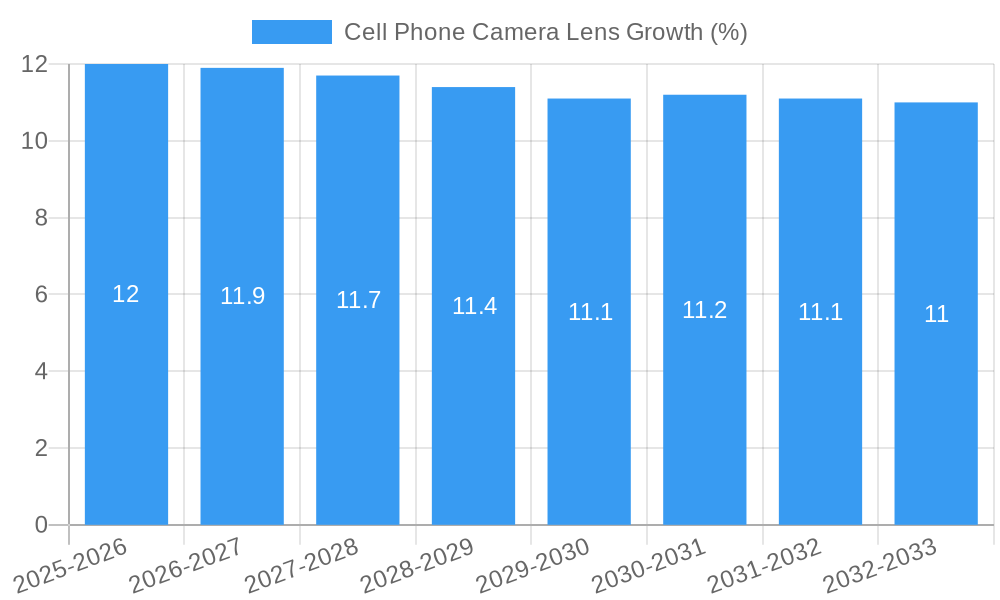

The global cell phone camera lens market is poised for significant expansion, projected to reach an estimated market size of approximately $7,500 million by 2025. This growth is underpinned by a robust Compound Annual Growth Rate (CAGR) of roughly 12% anticipated over the forecast period from 2025 to 2033. This upward trajectory is primarily driven by the relentless demand for enhanced mobile photography experiences, fueled by the increasing integration of sophisticated camera systems in smartphones across all price segments. The continuous evolution of smartphone camera technology, including higher megapixel counts, advanced optical image stabilization, and miniaturization of components, is a key catalyst. Furthermore, the proliferation of dual and triple-lens setups, catering to diverse photographic needs like wide-angle, telephoto, and macro shots, is a substantial growth driver. The rising adoption of smartphones in emerging economies and the growing trend of content creation and social media engagement also contribute significantly to this market's vitality.

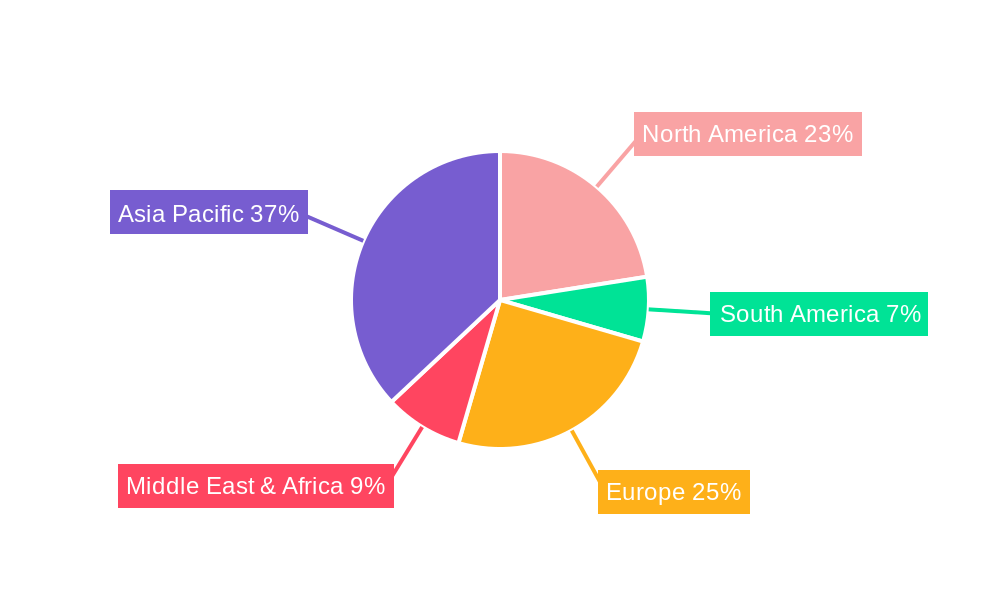

However, the market faces certain restraints that could temper its growth. Intense price competition among manufacturers and the high cost associated with research and development for cutting-edge lens technologies can present challenges. Supply chain disruptions and the reliance on specific raw materials can also pose risks. Despite these hurdles, the market's segmentation reveals a strong emphasis on higher megapixel lenses, with the 13 MEGA and 16+ MEGA segments expected to dominate. The application segment is predominantly driven by the smartphone rear camera, though front camera innovation also plays a crucial role. Geographically, Asia Pacific, led by China and India, is anticipated to be the largest and fastest-growing region due to its massive smartphone user base and significant manufacturing capabilities. North America and Europe remain substantial markets, driven by early adoption of premium smartphone features.

Cell Phone Camera Lens Market Dynamics & Structure

The global cell phone camera lens market is characterized by a highly concentrated competitive landscape, with a few dominant players controlling a significant share. Key innovators such as Largan, Sunny Optical, and Kantatsu lead the charge, leveraging advanced manufacturing capabilities and relentless technological advancements. Market concentration is further influenced by the stringent R&D investments required for miniaturization, optical performance enhancement, and multi-lens system integration.

Technological innovation serves as the primary growth driver, fueled by the escalating demand for superior mobile photography and videography. Industry professionals are keenly observing advancements in aspheric lenses, freeform optics, and integrated sensor-lens modules. The proliferation of dual, triple, and quad-camera setups in smartphones necessitates complex lens designs and increased production volumes, creating substantial opportunities.

Regulatory frameworks, though less prominent than in other tech sectors, primarily focus on material safety and manufacturing standards. However, the growing emphasis on sustainable manufacturing practices is starting to influence production processes and material sourcing. Competitive product substitutes, such as improved image processing software and computational photography, are continuously evolving but have yet to fully replace the fundamental need for high-quality optical lenses.

End-user demographics are increasingly sophisticated, with a growing segment of consumers prioritizing camera quality as a key purchasing decision for smartphones. This demographic shift is pushing manufacturers to integrate more advanced lens technologies. Mergers & Acquisitions (M&A) have played a role in market consolidation, though the core innovation remains largely driven by organic R&D. For instance, a recent M&A deal in the parent market for optical components saw a valuation of over $1.5 billion units, indicating the strategic importance of this sector. The child market, specifically for smartphone camera modules, is estimated to be worth $25 billion units in 2025.

- Market Concentration: Dominated by a few key players, with a strong emphasis on vertical integration.

- Technological Innovation Drivers: Miniaturization, enhanced optical performance, multi-lens systems, AI integration.

- Regulatory Frameworks: Primarily focused on material safety and manufacturing standards, with a nascent shift towards sustainability.

- Competitive Product Substitutes: Advanced image processing and computational photography, but not a full replacement for optics.

- End-User Demographics: Growing consumer preference for high-quality mobile photography driving demand for advanced lenses.

- M&A Trends: Limited recent large-scale M&A activity in the lens manufacturing segment itself, but significant investment in the broader optical components and module market.

Cell Phone Camera Lens Growth Trends & Insights

The global cell phone camera lens market is poised for substantial growth, projected to expand from an estimated $15.2 billion units in 2025 to $38.7 billion units by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 12.5% during the forecast period. This upward trajectory is primarily propelled by the insatiable consumer demand for enhanced mobile photography and videography experiences, directly influencing smartphone design and functionality. The market has witnessed a significant evolution from basic single-lens systems to sophisticated multi-lens arrays, reflecting advancements in optical engineering and manufacturing precision.

Adoption rates for advanced lens technologies, such as periscope lenses for optical zoom and ultra-wide-angle lenses, are accelerating across all smartphone segments, from entry-level to premium. This widespread adoption is driven by smartphone manufacturers' continuous efforts to differentiate their products and capture a larger market share in an increasingly competitive environment. The increasing integration of artificial intelligence (AI) in smartphone cameras further amplifies the need for specialized lenses that can complement computational photography algorithms, enabling features like improved low-light performance, enhanced depth sensing, and advanced image stabilization.

Technological disruptions are constantly reshaping the landscape. The shift towards higher megapixel counts, from 13 MEGA to 16+ MEGA sensors, necessitates lenses with improved resolution and reduced optical aberrations. Furthermore, the burgeoning foldable smartphone market presents unique challenges and opportunities for lens manufacturers, requiring flexible and durable optical solutions. Consumer behavior is also a critical factor. As smartphones become the primary imaging devices for a vast majority of the global population, the perceived quality of the camera system, heavily influenced by the lens, directly impacts purchasing decisions. This has led to a greater emphasis on factors like aperture size, lens coatings for reduced glare, and the overall clarity and sharpness of images.

The market penetration of smartphones equipped with advanced camera lens systems is expected to continue its upward trend, driven by both innovation and affordability. The increasing output of mid-range and budget smartphones featuring multi-lens configurations, once exclusive to flagship devices, further broadens the market's reach. The estimated market size for cell phone camera lenses in 2019 was $8.5 billion units, demonstrating significant growth over the historical period. By 2025, this figure is projected to reach $15.2 billion units, highlighting a strong historical growth trend that is expected to continue. The parent market for optical lenses, encompassing all applications, is projected to reach $75 billion units by 2033, with the cell phone camera lens segment representing a substantial and rapidly growing portion of this broader market. The child market for complete camera modules is estimated to be worth $25 billion units in 2025.

Dominant Regions, Countries, or Segments in Cell Phone Camera Lens

The Smartphone Rear Camera segment is currently the undisputed leader in the cell phone camera lens market, driving significant growth and innovation. This dominance is directly attributable to the escalating consumer demand for sophisticated mobile photography and videography capabilities, making rear camera systems a primary determinant of smartphone appeal. In 2025, this segment is projected to account for an estimated 70% of the total cell phone camera lens market revenue, translating to approximately $10.6 billion units. The increasing prevalence of multi-lens setups, including ultra-wide, telephoto, and macro lenses, further solidifies the rear camera's supremacy, necessitating a diverse array of specialized lenses.

Leading this segment's growth are East Asian countries, particularly China, South Korea, and Japan. These nations are not only major manufacturing hubs for smartphones and their components but also represent some of the largest consumer markets for high-end mobile devices. China's immense smartphone user base and its robust domestic supply chain for camera components, spearheaded by giants like Largan and Sunny Optical, are pivotal. South Korea, home to global smartphone leaders like Samsung, consistently pushes the boundaries of camera technology, influencing global trends. Japan, with its long-standing expertise in optical engineering, contributes significantly through companies like Kantatsu.

The 16+ MEGA category within the "Types" segment is experiencing the most dynamic growth, mirroring the trend towards higher resolution sensors. In 2025, this category is expected to represent over 45% of the total lens volume, estimated at 690 million units, and is projected to grow at a CAGR of 13.8% through 2033. This surge is driven by consumer perception that higher megapixels equate to better image quality, prompting manufacturers to equip their devices with lenses capable of supporting these advanced sensors.

- Dominant Segment: Smartphone Rear Camera, accounting for an estimated $10.6 billion units in 2025.

- Key Regional Drivers: East Asia (China, South Korea, Japan) due to manufacturing prowess and large consumer bases.

- Dominant Type Segment: 16+ MEGA lenses, projected to reach 690 million units in 2025 and experiencing rapid growth.

- Growth Drivers within Dominant Segments:

- Smartphone Rear Camera: Multi-lens systems (ultra-wide, telephoto, macro), advanced optical zoom technologies, improved low-light performance.

- 16+ MEGA Lenses: Consumer demand for higher resolution, advancements in sensor technology requiring higher optical performance, integration with computational photography.

- Market Share in Dominant Segments: The Smartphone Rear Camera segment is estimated to hold approximately 70% of the total market in 2025. The 16+ MEGA lens category is projected to capture over 45% of the lens volume in 2025.

- Growth Potential: High growth potential for both the Smartphone Rear Camera segment and the 16+ MEGA lens type, driven by continuous innovation and evolving consumer preferences. The parent market is projected to reach $75 billion units by 2033, with these segments being key contributors.

Cell Phone Camera Lens Product Landscape

The cell phone camera lens product landscape is defined by increasing complexity, miniaturization, and enhanced optical performance. Innovations are centered around multi-element lens designs, utilizing materials like high-refractive index plastics and advanced coatings to minimize aberrations and maximize light transmission. Products range from the foundational VGA lenses, still present in some low-cost devices, to sophisticated 16+ MEGA lenses that enable high-resolution imaging. Key advancements include the widespread adoption of aspheric lens elements to correct optical distortions in compact designs, and the development of hybrid lens elements combining plastic and glass for improved performance and cost-effectiveness. The integration of lenses into complete camera modules, often incorporating image sensors and actuators, represents a significant trend, streamlining manufacturing and enhancing overall camera system capabilities.

Key Drivers, Barriers & Challenges in Cell Phone Camera Lens

Key Drivers:

- Demand for Enhanced Mobile Photography: Consumers increasingly expect flagship-level camera performance, driving demand for sophisticated lens systems.

- Technological Advancements: Miniaturization, improved optical designs (e.g., periscope lenses, larger apertures), and new materials are enabling better image quality in smaller form factors.

- Multi-Camera Adoption: The proliferation of dual, triple, and quad-camera setups on smartphones necessitates a higher volume of diverse lens types.

- Growth of Emerging Markets: Increasing smartphone penetration in developing regions creates a broader consumer base for devices with improved cameras.

- Innovation in Computational Photography: Lenses are being designed to better complement AI-driven image processing, enabling features like superior low-light and zoom capabilities.

Barriers & Challenges:

- High R&D Costs: Developing cutting-edge lens technology requires substantial investment in research and development.

- Manufacturing Complexity & Precision: Producing high-quality, miniaturized lenses demands extremely precise manufacturing processes and stringent quality control.

- Supply Chain Volatility: Geopolitical factors, material shortages, and global logistics can disrupt the supply of specialized optical components.

- Price Sensitivity: While consumers desire better cameras, the overall smartphone price remains a significant factor, creating pressure on component costs.

- Competition from Image Processing: Advanced software algorithms can sometimes compensate for optical limitations, posing a challenge to the perceived value of purely optical improvements.

- Environmental Regulations: Increasing scrutiny on manufacturing processes and material sourcing can add compliance costs and complexities.

Emerging Opportunities in Cell Phone Camera Lens

Emerging opportunities lie in the continued development of specialized lenses for emerging smartphone form factors, such as foldable and rollable devices, which require flexible and durable optical solutions. The growing demand for augmented reality (AR) and virtual reality (VR) applications on smartphones presents a significant opportunity for lenses designed for depth sensing, 3D imaging, and wider field-of-view capture. Furthermore, advancements in meta-lenses and liquid lenses offer the potential for unprecedented miniaturization and dynamic optical adjustment, opening doors for entirely new camera functionalities. The increasing focus on sustainability also presents an opportunity for manufacturers to innovate in eco-friendly materials and production methods.

Growth Accelerators in the Cell Phone Camera Lens Industry

The long-term growth of the cell phone camera lens industry is being propelled by several key accelerators. First, the relentless pursuit of the "perfect" smartphone camera experience by manufacturers is driving continuous investment in R&D for higher resolution, improved low-light performance, and advanced zoom capabilities. Strategic partnerships between lens manufacturers and leading smartphone brands are crucial for co-development and rapid integration of new technologies. The expansion of 5G networks, enabling richer multimedia content and AR/VR experiences, will further fuel the demand for higher-quality imaging hardware, including advanced camera lenses. Market expansion into underserved regions, coupled with the increasing affordability of smartphones with good camera systems, also acts as a significant growth accelerator.

Key Players Shaping the Cell Phone Camera Lens Market

- Largan Precision Co., Ltd.

- Sunny Optical Technology (Group) Company Limited

- Kantatsu Co., Ltd.

- GeniuS Electronic Optical Co., Ltd.

- Asia Optical Co., Inc.

- Kolen Co., Ltd.

- Sekonix Co., Ltd.

- Cha Diostech Co., Ltd.

- Newmax Co., Ltd.

- Ability Opto-Electronics Technology Co., Ltd.

- Kinko Optical Co., Ltd.

Notable Milestones in Cell Phone Camera Lens Sector

- 2019: Introduction of 5x and 10x optical zoom periscope lenses by multiple manufacturers, significantly enhancing smartphone telephoto capabilities.

- 2020: Increased adoption of 48MP and 64MP camera sensors, demanding more sophisticated lenses to capture their full resolution.

- 2021: Widespread integration of ultra-wide-angle lenses as a standard rear camera feature across mid-range and high-end smartphones.

- 2022: Advancements in lens coatings leading to further reductions in glare and improved color accuracy in challenging lighting conditions.

- 2023: Emergence of dual-telephoto lens systems in some flagship devices, offering greater flexibility in zoom photography.

- 2024: Significant progress in the development and early adoption of freeform optics for more compact and powerful lens designs.

In-Depth Cell Phone Camera Lens Market Outlook

- 2019: Introduction of 5x and 10x optical zoom periscope lenses by multiple manufacturers, significantly enhancing smartphone telephoto capabilities.

- 2020: Increased adoption of 48MP and 64MP camera sensors, demanding more sophisticated lenses to capture their full resolution.

- 2021: Widespread integration of ultra-wide-angle lenses as a standard rear camera feature across mid-range and high-end smartphones.

- 2022: Advancements in lens coatings leading to further reductions in glare and improved color accuracy in challenging lighting conditions.

- 2023: Emergence of dual-telephoto lens systems in some flagship devices, offering greater flexibility in zoom photography.

- 2024: Significant progress in the development and early adoption of freeform optics for more compact and powerful lens designs.

In-Depth Cell Phone Camera Lens Market Outlook

The outlook for the cell phone camera lens market remains exceptionally bright, driven by an ongoing demand for superior mobile imaging. Growth accelerators such as the relentless pursuit of enhanced photographic capabilities by smartphone manufacturers, coupled with strategic collaborations between component suppliers and device makers, will continue to fuel innovation. The burgeoning adoption of multi-lens systems and higher megapixel counts ensures a sustained demand for diverse and advanced optical solutions. Furthermore, the expansion of 5G networks and the growing potential of AR/VR applications on mobile devices will necessitate even more sophisticated lens technologies, creating new avenues for market growth and solidifying the cell phone camera lens as a critical differentiator in the competitive smartphone landscape.

Cell Phone Camera Lens Segmentation

-

1. Application

- 1.1. Front Camera for Smartphone

- 1.2. Smartphone Rear Camera

-

2. Types

- 2.1. VGA

- 2.2. 1.3 MEGA

- 2.3. 2 MEGA

- 2.4. 3 MEGA

- 2.5. 5 MEGA

- 2.6. 8 MEGA

- 2.7. 13 MEGA

- 2.8. 16+ MEGA

- 2.9. Others

Cell Phone Camera Lens Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Cell Phone Camera Lens REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Cell Phone Camera Lens Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Front Camera for Smartphone

- 5.1.2. Smartphone Rear Camera

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. VGA

- 5.2.2. 1.3 MEGA

- 5.2.3. 2 MEGA

- 5.2.4. 3 MEGA

- 5.2.5. 5 MEGA

- 5.2.6. 8 MEGA

- 5.2.7. 13 MEGA

- 5.2.8. 16+ MEGA

- 5.2.9. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Cell Phone Camera Lens Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Front Camera for Smartphone

- 6.1.2. Smartphone Rear Camera

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. VGA

- 6.2.2. 1.3 MEGA

- 6.2.3. 2 MEGA

- 6.2.4. 3 MEGA

- 6.2.5. 5 MEGA

- 6.2.6. 8 MEGA

- 6.2.7. 13 MEGA

- 6.2.8. 16+ MEGA

- 6.2.9. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Cell Phone Camera Lens Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Front Camera for Smartphone

- 7.1.2. Smartphone Rear Camera

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. VGA

- 7.2.2. 1.3 MEGA

- 7.2.3. 2 MEGA

- 7.2.4. 3 MEGA

- 7.2.5. 5 MEGA

- 7.2.6. 8 MEGA

- 7.2.7. 13 MEGA

- 7.2.8. 16+ MEGA

- 7.2.9. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Cell Phone Camera Lens Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Front Camera for Smartphone

- 8.1.2. Smartphone Rear Camera

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. VGA

- 8.2.2. 1.3 MEGA

- 8.2.3. 2 MEGA

- 8.2.4. 3 MEGA

- 8.2.5. 5 MEGA

- 8.2.6. 8 MEGA

- 8.2.7. 13 MEGA

- 8.2.8. 16+ MEGA

- 8.2.9. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Cell Phone Camera Lens Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Front Camera for Smartphone

- 9.1.2. Smartphone Rear Camera

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. VGA

- 9.2.2. 1.3 MEGA

- 9.2.3. 2 MEGA

- 9.2.4. 3 MEGA

- 9.2.5. 5 MEGA

- 9.2.6. 8 MEGA

- 9.2.7. 13 MEGA

- 9.2.8. 16+ MEGA

- 9.2.9. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Cell Phone Camera Lens Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Front Camera for Smartphone

- 10.1.2. Smartphone Rear Camera

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. VGA

- 10.2.2. 1.3 MEGA

- 10.2.3. 2 MEGA

- 10.2.4. 3 MEGA

- 10.2.5. 5 MEGA

- 10.2.6. 8 MEGA

- 10.2.7. 13 MEGA

- 10.2.8. 16+ MEGA

- 10.2.9. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Largan

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sunny Optical

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Kantatsu

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 GeniuS Electronic Optical

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Asia Optical

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Kolen

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sekonix

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Cha Diostech

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Newmax

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ability Opto-Electronics

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Kinko

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 Largan

List of Figures

- Figure 1: Global Cell Phone Camera Lens Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Cell Phone Camera Lens Revenue (million), by Application 2024 & 2032

- Figure 3: North America Cell Phone Camera Lens Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Cell Phone Camera Lens Revenue (million), by Types 2024 & 2032

- Figure 5: North America Cell Phone Camera Lens Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Cell Phone Camera Lens Revenue (million), by Country 2024 & 2032

- Figure 7: North America Cell Phone Camera Lens Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Cell Phone Camera Lens Revenue (million), by Application 2024 & 2032

- Figure 9: South America Cell Phone Camera Lens Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Cell Phone Camera Lens Revenue (million), by Types 2024 & 2032

- Figure 11: South America Cell Phone Camera Lens Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Cell Phone Camera Lens Revenue (million), by Country 2024 & 2032

- Figure 13: South America Cell Phone Camera Lens Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Cell Phone Camera Lens Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Cell Phone Camera Lens Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Cell Phone Camera Lens Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Cell Phone Camera Lens Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Cell Phone Camera Lens Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Cell Phone Camera Lens Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Cell Phone Camera Lens Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Cell Phone Camera Lens Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Cell Phone Camera Lens Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Cell Phone Camera Lens Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Cell Phone Camera Lens Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Cell Phone Camera Lens Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Cell Phone Camera Lens Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Cell Phone Camera Lens Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Cell Phone Camera Lens Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Cell Phone Camera Lens Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Cell Phone Camera Lens Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Cell Phone Camera Lens Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Cell Phone Camera Lens Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Cell Phone Camera Lens Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Cell Phone Camera Lens Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Cell Phone Camera Lens Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Cell Phone Camera Lens Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Cell Phone Camera Lens Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Cell Phone Camera Lens Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Cell Phone Camera Lens Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Cell Phone Camera Lens Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Cell Phone Camera Lens Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Cell Phone Camera Lens Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Cell Phone Camera Lens Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Cell Phone Camera Lens Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Cell Phone Camera Lens Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Cell Phone Camera Lens Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Cell Phone Camera Lens Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Cell Phone Camera Lens Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Cell Phone Camera Lens Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Cell Phone Camera Lens Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Cell Phone Camera Lens Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cell Phone Camera Lens?

The projected CAGR is approximately XX%.

2. Which companies are prominent players in the Cell Phone Camera Lens?

Key companies in the market include Largan, Sunny Optical, Kantatsu, GeniuS Electronic Optical, Asia Optical, Kolen, Sekonix, Cha Diostech, Newmax, Ability Opto-Electronics, Kinko.

3. What are the main segments of the Cell Phone Camera Lens?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cell Phone Camera Lens," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cell Phone Camera Lens report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cell Phone Camera Lens?

To stay informed about further developments, trends, and reports in the Cell Phone Camera Lens, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence