Key Insights

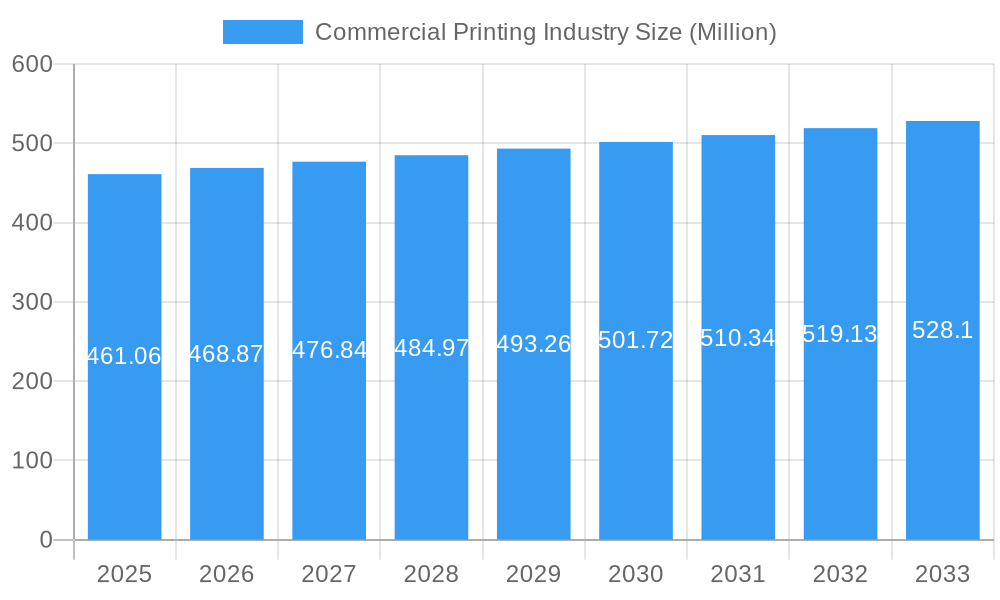

The global commercial printing market, valued at $461.06 million in 2025, is projected to experience steady growth, driven primarily by the ongoing demand for packaging solutions across various industries. The increasing reliance on e-commerce and personalized marketing campaigns fuels the demand for high-quality printed materials, particularly in the advertising and publishing sectors. Offset lithography remains a dominant printing technique due to its cost-effectiveness for large-volume printing, although inkjet and other digital printing methods are gaining traction, particularly for shorter print runs and customized products. The market is segmented by printing type (offset lithography, inkjet, flexographic, screen, gravure, and others) and application (packaging, advertising, and publishing). While the market faces restraints from the rise of digital media and shifting consumer preferences towards electronic communication, the continued need for tangible marketing materials and the evolving sophistication of packaging design are expected to mitigate these challenges. Growth is anticipated to be driven by innovation in printing technologies, sustainability initiatives within the printing industry, and the expanding demand for high-quality printed products in emerging economies. The competitive landscape comprises a mix of large multinational corporations and smaller, specialized printers, suggesting opportunities for both consolidation and niche market specialization.

Commercial Printing Industry Market Size (In Million)

The projected CAGR of 1.67% suggests a moderate, consistent growth trajectory over the forecast period (2025-2033). This growth is likely influenced by regional variations. While North America and Europe might show more mature growth rates, the Asia-Pacific region is expected to contribute significantly to overall market expansion due to its rapid economic development and expanding consumer base. The continued focus on sustainable printing practices and the integration of advanced technologies will likely shape future market developments, influencing pricing strategies, production efficiency, and the overall competitiveness of industry players. Further research into specific regional market shares and detailed company performance data would allow for a more precise analysis of market segmentation and competitive dynamics.

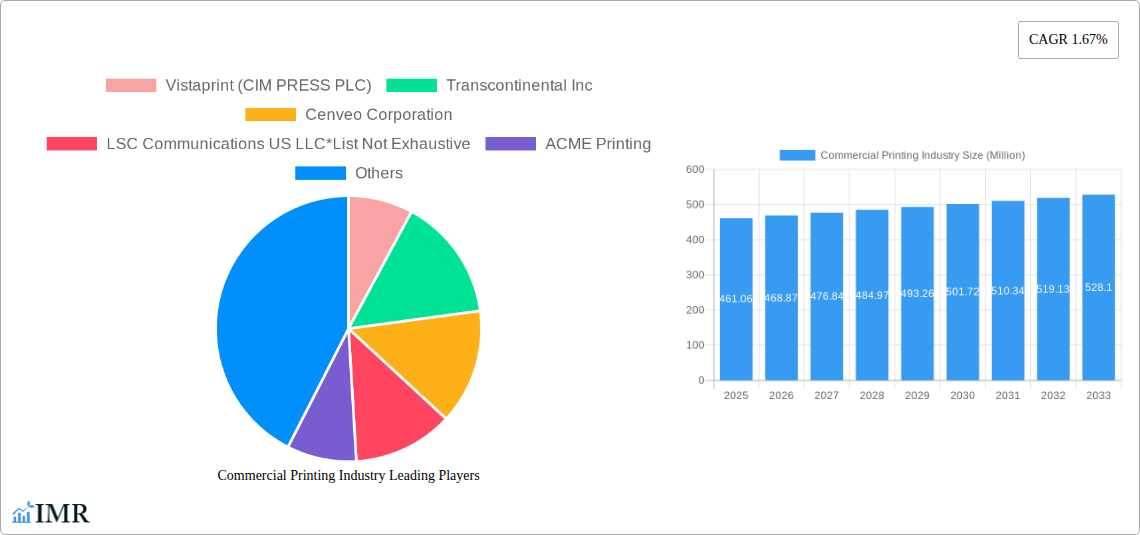

Commercial Printing Industry Company Market Share

Commercial Printing Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Commercial Printing Industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report is essential for industry professionals, investors, and strategists seeking a deep understanding of this evolving market. Parent markets include the broader printing industry and packaging industry while child markets include specific print applications like advertising and publishing.

Market Size (USD Million):

- 2019: xx

- 2024: xx

- 2025 (Estimated): xx

- 2033 (Forecast): xx

Commercial Printing Industry Market Dynamics & Structure

The commercial printing market is characterized by moderate concentration, with several large players and numerous smaller, specialized firms. Technological innovation, particularly in digital printing and sustainable materials, is a key driver. Regulatory frameworks concerning environmental compliance and data privacy significantly impact operations. The market faces competition from digital alternatives like email marketing and online publishing. End-user demographics, including the growing demand for personalized marketing materials, influence market trends. M&A activity has been moderate, driven by consolidation and expansion strategies.

- Market Concentration: Moderately concentrated, with a few large players holding significant market share (estimated at xx% for the top 5 players in 2025).

- Technological Innovation: Digital printing, 3D printing, and sustainable ink technologies are key drivers.

- Regulatory Framework: Environmental regulations and data privacy laws impact operations and costs.

- Competitive Substitutes: Digital marketing, e-books, and online publishing pose significant competition.

- End-User Demographics: Growing demand for personalized marketing and packaging materials.

- M&A Activity: Moderate level of mergers and acquisitions, driven by consolidation and expansion. Estimated xx M&A deals in the period 2019-2024.

Commercial Printing Industry Growth Trends & Insights

The commercial printing market experienced fluctuating growth during the historical period (2019-2024), impacted by economic conditions and the shift towards digital media. However, the market is projected to witness a steady growth during the forecast period (2025-2033), driven by factors like increasing demand from the packaging and personalized marketing segments, coupled with innovations in printing technologies. The adoption rate of sustainable printing practices is also increasing, driven by environmental concerns. Consumer behavior shifts towards personalized experiences are creating new opportunities in the market.

- CAGR (2025-2033): xx%

- Market Penetration: xx% in 2025, projected to reach xx% by 2033.

- Key Growth Drivers: Packaging, personalized marketing, and growing demand for high-quality printed materials.

- Technological Disruptions: Digital printing, 3D printing, and sustainable printing technologies are reshaping the market.

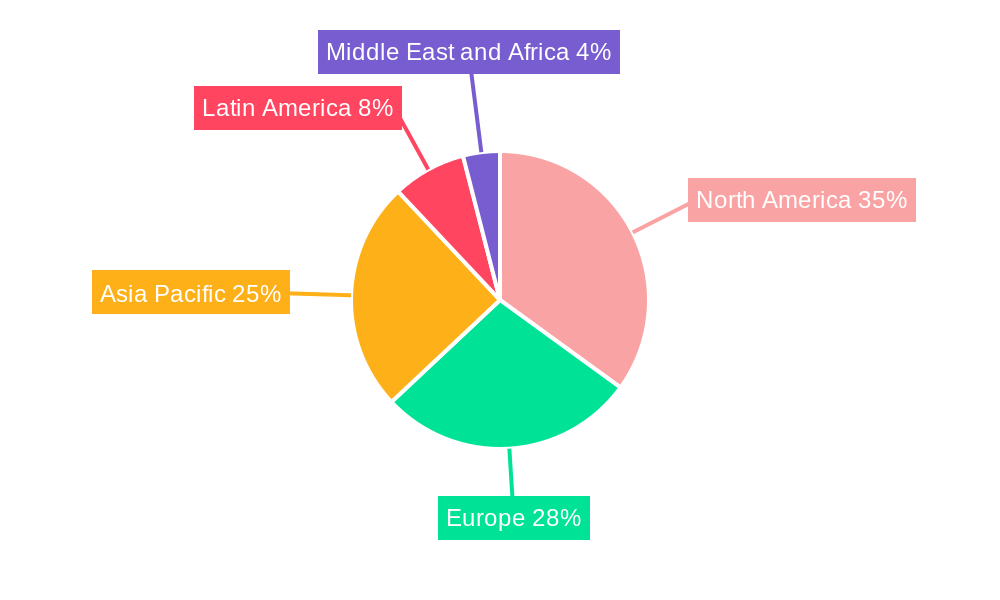

Dominant Regions, Countries, or Segments in Commercial Printing Industry

While North America and Europe have historically held significant market share, the Asia-Pacific region is emerging as a powerhouse for growth in the commercial printing industry. This surge is primarily attributed to rapid economic development, a burgeoning middle class with increasing disposable income, and a strong expansion of the e-commerce sector, driving demand for diverse printed materials. Among the key segments, packaging stands out as the largest application, propelled by the escalating consumer desire for visually appealing, high-quality, and often sustainably produced printed packaging. In terms of printing technology, offset lithography remains a stalwart, but its dominance is increasingly challenged by the rapid adoption and innovation in inkjet and digital printing, which offer greater flexibility, personalization, and faster turnaround times.

- Leading Region: North America (retaining substantial market share, with projections indicating approximately xx% in 2025).

- Fastest-Growing Region: Asia-Pacific, driven by economic expansion and increasing consumer spending.

- Dominant Application: Packaging (expected to command a significant market share of around xx% in 2025), encompassing both primary and secondary packaging needs.

- Dominant Printing Type: Offset Lithography continues to be a major player (holding an estimated xx% market share in 2025), but inkjet printing is experiencing unparalleled growth due to its versatility.

- Key Growth Drivers (Asia-Pacific): Robust economic growth, rising disposable incomes, expanding e-commerce penetration, and an increasing demand for sophisticated printed products across various sectors.

Commercial Printing Industry Product Landscape

Commercial printing offers a broad range of products, including brochures, flyers, packaging materials, books, magazines, and labels. Innovations focus on high-quality output, faster turnaround times, and sustainable materials. Advanced printing techniques like digital printing allow for personalization and cost-effective production of small batches. Unique selling propositions often center on speed, quality, customization, and sustainable options. Technological advancements include improved ink formulations, faster printing speeds, and more efficient pre-press processes.

Key Drivers, Barriers & Challenges in Commercial Printing Industry

Key Drivers:

- Growing demand from e-commerce for packaging and promotional materials.

- Increasing demand for personalized marketing campaigns.

- Technological advancements in printing techniques and materials.

Challenges and Restraints:

- Competition from digital marketing channels.

- Rising raw material costs.

- Environmental regulations and sustainability concerns.

- Fluctuations in economic conditions impacting demand.

Emerging Opportunities in Commercial Printing Industry

- Growth in personalized marketing and customized packaging.

- Increasing demand for sustainable and eco-friendly printing solutions.

- Expansion into niche markets with specialized printing requirements.

- Adoption of advanced printing technologies such as 3D printing.

Growth Accelerators in the Commercial Printing Industry Industry

The commercial printing industry is experiencing significant momentum driven by several key accelerators. The widespread adoption of advanced digital printing technologies is revolutionizing production, enabling shorter runs, variable data printing, and on-demand capabilities. Strategic collaborations and partnerships are crucial for expanding market reach, accessing new customer bases, and offering integrated solutions. Furthermore, the exploration and development of new market segments, particularly personalized products, are opening up lucrative avenues for growth. Substantial investments in Research and Development (R&D) are focused on creating more sustainable printing solutions, including eco-friendly inks and materials, as well as implementing automation technologies to enhance operational efficiency, reduce costs, and improve overall competitiveness. These advancements are collectively paving the way for substantial and sustained growth in the coming years.

Key Players Shaping the Commercial Printing Industry Market

A dynamic landscape of key players is actively shaping the commercial printing industry, driving innovation and market trends:

- Vistaprint (CIM PRESS PLC) - A global leader in online printing services, known for its extensive range of products and customer-centric approach.

- Transcontinental Inc - A diversified packaging and printing company with a strong presence in North America, offering integrated solutions.

- Cenveo Corporation - A significant player in the North American printing and communication services market, with a broad portfolio of offerings.

- LSC Communications US LLC - A prominent provider of print and related solutions, serving various industries including publishing and marketing.

- ACME Printing - A notable contributor to the market, recognized for its quality printing services.

- R R Donnelley & Sons - A global provider of integrated communications, with a strong legacy in commercial printing.

- Toppan Co Limited - A major Japanese printing company with a global reach, excelling in areas like packaging, decor, and security printing.

Notable Milestones in Commercial Printing Industry Sector

The commercial printing industry continues to witness significant advancements and innovative developments:

- June 2022: Toppan unveiled a pioneering light-responsive hologram, significantly enhancing security features for printed materials and combating counterfeiting.

- May 2022: Siegwerk introduced SICURA Litho Pack ECO, a groundbreaking UV offset ink formulation that boasts over 40% renewable components, underscoring the industry's commitment to sustainability.

In-Depth Commercial Printing Industry Market Outlook

The commercial printing industry is on a trajectory of steady and robust growth, underpinned by the persistent and evolving demand for high-quality printed materials across critical sectors such as packaging, marketing collateral, and publishing. To maintain and enhance a competitive edge in this dynamic market, strategic investments in innovative technologies, a strong commitment to sustainable practices, and proactive expansion into emerging and niche market segments will be paramount. The industry is anticipated to experience a continued trend of consolidation, where larger, well-established entities will strategically acquire smaller firms to expand their market share, broaden their service portfolios, and achieve economies of scale. Ultimately, the future landscape of the commercial printing industry will be profoundly shaped by the ongoing emphasis on personalization, sustainability, and operational efficiency.

Commercial Printing Industry Segmentation

-

1. Printing Type

- 1.1. Offset Lithography

- 1.2. Inkjet

- 1.3. Flexographic

- 1.4. Screen

- 1.5. Gravure

- 1.6. Other Printing Types

-

2. Application

- 2.1. Packaging

- 2.2. Advertising

-

2.3. Publishing

- 2.3.1. Books

- 2.3.2. Magazines

- 2.3.3. Newspapers

- 2.3.4. Other Publishing

- 2.4. Other Applications

Commercial Printing Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Commercial Printing Industry Regional Market Share

Geographic Coverage of Commercial Printing Industry

Commercial Printing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Demand for Promotional Materials from the Retail

- 3.2.2 Food

- 3.2.3 and Beverage Industries; Introduction of Eco-friendly Practices

- 3.3. Market Restrains

- 3.3.1. Increase in Digitization and Rising Dependence on Feedstock Prices

- 3.4. Market Trends

- 3.4.1. Packaging Segment Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Type

- 5.1.1. Offset Lithography

- 5.1.2. Inkjet

- 5.1.3. Flexographic

- 5.1.4. Screen

- 5.1.5. Gravure

- 5.1.6. Other Printing Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Packaging

- 5.2.2. Advertising

- 5.2.3. Publishing

- 5.2.3.1. Books

- 5.2.3.2. Magazines

- 5.2.3.3. Newspapers

- 5.2.3.4. Other Publishing

- 5.2.4. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Printing Type

- 6. North America Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Printing Type

- 6.1.1. Offset Lithography

- 6.1.2. Inkjet

- 6.1.3. Flexographic

- 6.1.4. Screen

- 6.1.5. Gravure

- 6.1.6. Other Printing Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Packaging

- 6.2.2. Advertising

- 6.2.3. Publishing

- 6.2.3.1. Books

- 6.2.3.2. Magazines

- 6.2.3.3. Newspapers

- 6.2.3.4. Other Publishing

- 6.2.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Printing Type

- 7. Europe Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Printing Type

- 7.1.1. Offset Lithography

- 7.1.2. Inkjet

- 7.1.3. Flexographic

- 7.1.4. Screen

- 7.1.5. Gravure

- 7.1.6. Other Printing Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Packaging

- 7.2.2. Advertising

- 7.2.3. Publishing

- 7.2.3.1. Books

- 7.2.3.2. Magazines

- 7.2.3.3. Newspapers

- 7.2.3.4. Other Publishing

- 7.2.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Printing Type

- 8. Asia Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Printing Type

- 8.1.1. Offset Lithography

- 8.1.2. Inkjet

- 8.1.3. Flexographic

- 8.1.4. Screen

- 8.1.5. Gravure

- 8.1.6. Other Printing Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Packaging

- 8.2.2. Advertising

- 8.2.3. Publishing

- 8.2.3.1. Books

- 8.2.3.2. Magazines

- 8.2.3.3. Newspapers

- 8.2.3.4. Other Publishing

- 8.2.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Printing Type

- 9. Australia and New Zealand Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Printing Type

- 9.1.1. Offset Lithography

- 9.1.2. Inkjet

- 9.1.3. Flexographic

- 9.1.4. Screen

- 9.1.5. Gravure

- 9.1.6. Other Printing Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Packaging

- 9.2.2. Advertising

- 9.2.3. Publishing

- 9.2.3.1. Books

- 9.2.3.2. Magazines

- 9.2.3.3. Newspapers

- 9.2.3.4. Other Publishing

- 9.2.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Printing Type

- 10. Latin America Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Printing Type

- 10.1.1. Offset Lithography

- 10.1.2. Inkjet

- 10.1.3. Flexographic

- 10.1.4. Screen

- 10.1.5. Gravure

- 10.1.6. Other Printing Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Packaging

- 10.2.2. Advertising

- 10.2.3. Publishing

- 10.2.3.1. Books

- 10.2.3.2. Magazines

- 10.2.3.3. Newspapers

- 10.2.3.4. Other Publishing

- 10.2.4. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Printing Type

- 11. Middle East and Africa Commercial Printing Industry Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Printing Type

- 11.1.1. Offset Lithography

- 11.1.2. Inkjet

- 11.1.3. Flexographic

- 11.1.4. Screen

- 11.1.5. Gravure

- 11.1.6. Other Printing Types

- 11.2. Market Analysis, Insights and Forecast - by Application

- 11.2.1. Packaging

- 11.2.2. Advertising

- 11.2.3. Publishing

- 11.2.3.1. Books

- 11.2.3.2. Magazines

- 11.2.3.3. Newspapers

- 11.2.3.4. Other Publishing

- 11.2.4. Other Applications

- 11.1. Market Analysis, Insights and Forecast - by Printing Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Vistaprint (CIM PRESS PLC)

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Transcontinental Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Cenveo Corporation

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 LSC Communications US LLC*List Not Exhaustive

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 ACME Printing

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 R R Donnelley & Sons

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Toppan Co Limited

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.1 Vistaprint (CIM PRESS PLC)

List of Figures

- Figure 1: Global Commercial Printing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 3: North America Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 4: North America Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 5: North America Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 9: Europe Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 10: Europe Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 11: Europe Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 15: Asia Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 16: Asia Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 17: Asia Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 21: Australia and New Zealand Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 22: Australia and New Zealand Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 23: Australia and New Zealand Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: Australia and New Zealand Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 27: Latin America Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 28: Latin America Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 29: Latin America Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Latin America Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East and Africa Commercial Printing Industry Revenue (Million), by Printing Type 2025 & 2033

- Figure 33: Middle East and Africa Commercial Printing Industry Revenue Share (%), by Printing Type 2025 & 2033

- Figure 34: Middle East and Africa Commercial Printing Industry Revenue (Million), by Application 2025 & 2033

- Figure 35: Middle East and Africa Commercial Printing Industry Revenue Share (%), by Application 2025 & 2033

- Figure 36: Middle East and Africa Commercial Printing Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East and Africa Commercial Printing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 2: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 3: Global Commercial Printing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 5: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 6: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 8: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 9: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 11: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 12: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 14: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 15: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 17: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 18: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Commercial Printing Industry Revenue Million Forecast, by Printing Type 2020 & 2033

- Table 20: Global Commercial Printing Industry Revenue Million Forecast, by Application 2020 & 2033

- Table 21: Global Commercial Printing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Commercial Printing Industry?

The projected CAGR is approximately 1.67%.

2. Which companies are prominent players in the Commercial Printing Industry?

Key companies in the market include Vistaprint (CIM PRESS PLC), Transcontinental Inc, Cenveo Corporation, LSC Communications US LLC*List Not Exhaustive, ACME Printing, R R Donnelley & Sons, Toppan Co Limited.

3. What are the main segments of the Commercial Printing Industry?

The market segments include Printing Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 461.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Demand for Promotional Materials from the Retail. Food. and Beverage Industries; Introduction of Eco-friendly Practices.

6. What are the notable trends driving market growth?

Packaging Segment Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Increase in Digitization and Rising Dependence on Feedstock Prices.

8. Can you provide examples of recent developments in the market?

June 2022: Toppan created a hologram that could respond to bright light by displaying text and images. This made verification easier for those who do not have specialized hardware or a QR code.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Commercial Printing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Commercial Printing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Commercial Printing Industry?

To stay informed about further developments, trends, and reports in the Commercial Printing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence