Key Insights

The Cypriot e-commerce market is poised for significant expansion, projected at a Compound Annual Growth Rate (CAGR) of 9.33%. The market size is estimated at $1.07 billion in the base year 2025. This upward trajectory is propelled by a confluence of factors, including rising internet and smartphone adoption, a digitally native and young demographic, and an expanding middle class with increasing discretionary spending power. The inherent convenience and broad product selection offered by online platforms, coupled with advancements in logistics and payment systems, are key growth enablers. Despite existing hurdles such as online security concerns, data privacy apprehensions, and a relatively niche market, the sector's growth prospects remain robust. Key segments like fashion, electronics, and home goods are experiencing notable traction, evidenced by the presence of global giants like Amazon and ASOS, alongside domestic players such as Bazaraki, indicating a competitive and dynamic marketplace.

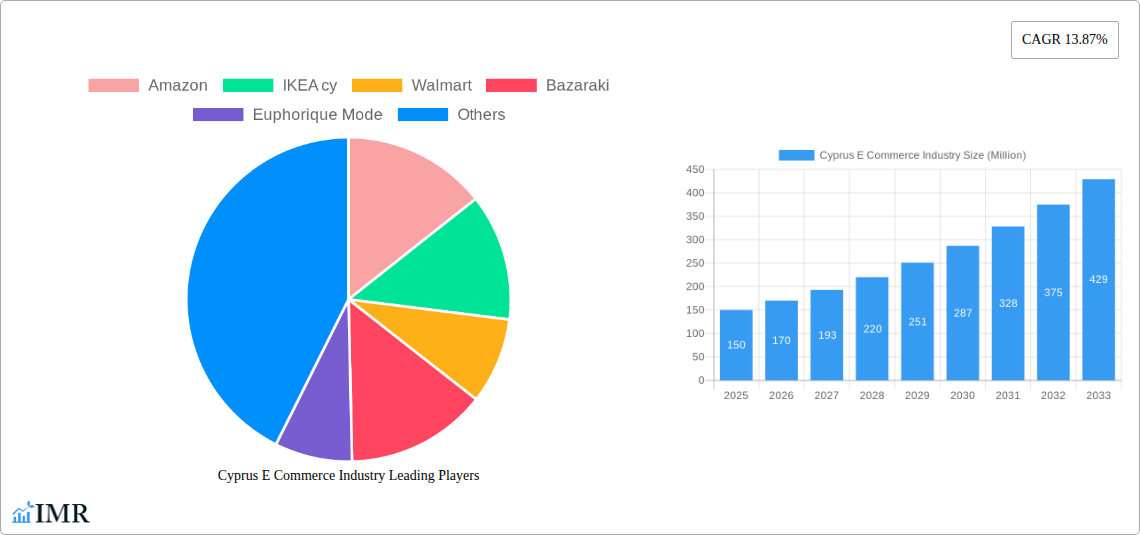

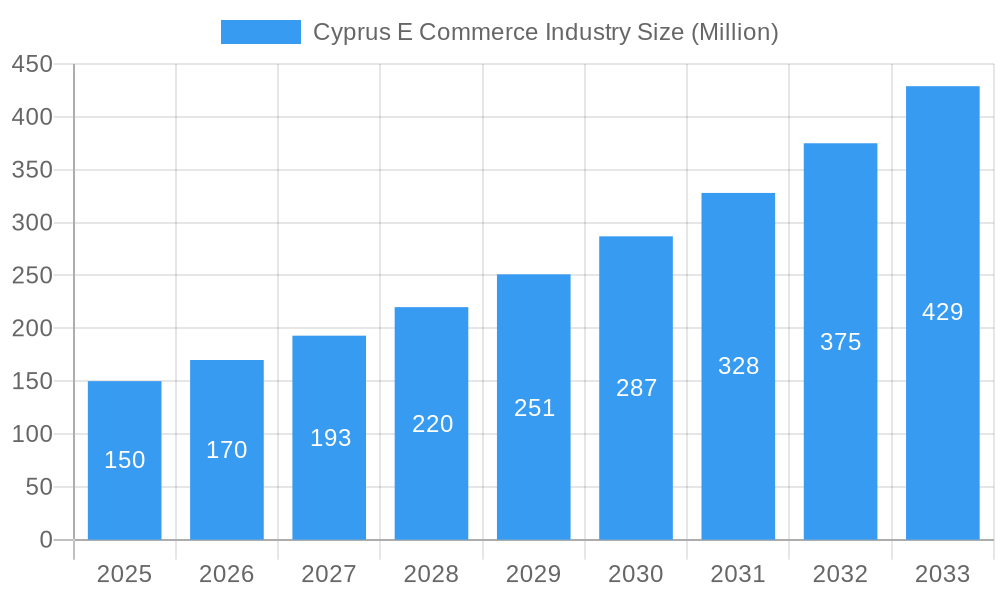

Cyprus E Commerce Industry Market Size (In Billion)

Sustained e-commerce growth in Cyprus hinges on continued infrastructure development, enhanced digital literacy, and strengthened consumer protection frameworks to mitigate security concerns. Strategic investments in logistics, payment gateways, and secure online platforms are vital. Future segmentation analysis will delineate specific high-growth application areas. By proactively addressing market limitations and capitalizing on existing drivers, Cyprus can optimize its e-commerce potential and emerge as a regional online retail hub. Growth is anticipated throughout the forecast period (2025-2033), albeit potentially moderating slightly as market maturity increases.

Cyprus E Commerce Industry Company Market Share

Cyprus E-Commerce Industry: Market Report 2019-2033

This comprehensive report provides a detailed analysis of the Cyprus e-commerce industry, covering market dynamics, growth trends, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. This report is invaluable for businesses, investors, and policymakers seeking to understand and navigate this rapidly evolving market.

Keywords: Cyprus e-commerce, online retail Cyprus, Cyprus digital market, e-commerce Cyprus market size, Cyprus online shopping, Bazaraki, Amazon Cyprus, IKEA Cyprus, e-commerce market analysis Cyprus, Cyprus e-commerce trends, Cyprus e-commerce growth, Cyprus online marketplace.

Cyprus E-Commerce Industry Market Dynamics & Structure

The Cyprus e-commerce market exhibits a moderately concentrated structure, with a mix of international giants like Amazon and eBay alongside established local players such as Bazaraki. Market concentration is approximately 45% in 2025, with the top 5 players holding the majority share. Technological innovation, particularly in mobile commerce and logistics, is a significant driver. Regulatory frameworks, while generally supportive, are continuously evolving to address issues like data privacy and consumer protection. Competitive product substitutes, primarily traditional brick-and-mortar retail, are gradually losing market share. End-user demographics show a growing preference for online shopping among younger generations, with increasing adoption across various socioeconomic groups. M&A activity has been moderate, with an estimated xx deals in the historical period (2019-2024), primarily focused on enhancing logistics and expanding product offerings.

- Market Concentration: 45% (2025) held by top 5 players

- Technological Innovation: Mobile commerce, improved logistics

- Regulatory Framework: Evolving data privacy and consumer protection laws

- Competitive Substitutes: Traditional retail stores facing decreasing market share

- End-User Demographics: High adoption among younger demographics

- M&A Activity: xx deals (2019-2024), focusing on logistics and expansion

Cyprus E-Commerce Industry Growth Trends & Insights

The Cypriot e-commerce market experienced robust growth during the historical period (2019-2024), driven by increased internet penetration, smartphone adoption, and a shift in consumer preferences. The market size, valued at xx million in 2024, is projected to reach xx million in 2025 and xx million by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is fueled by technological disruptions like improved payment gateways, mobile-first e-commerce platforms, and enhanced delivery services. Consumer behavior shifts towards convenience and a wider product selection are key drivers. Market penetration increased from xx% in 2019 to xx% in 2024 and is expected to surpass xx% by 2033.

Dominant Regions, Countries, or Segments in Cyprus E-Commerce Industry

The Limassol and Nicosia regions are the dominant drivers of e-commerce growth in Cyprus, primarily due to higher population density, better internet infrastructure, and a more affluent consumer base. These regions contribute to approximately 70% of total e-commerce revenue in 2025. The fashion segment (Apparel and Accessories) demonstrates the highest growth potential in this period followed by the Electronics segment. Key growth drivers include:

- Economic Policies: Government initiatives promoting digital economy

- Infrastructure: Improved internet access and logistics networks

- Consumer Preferences: Increasing preference for online shopping

- Market Share: Limassol and Nicosia regions hold ~70% of market share (2025)

Cyprus E-Commerce Industry Product Landscape

The Cypriot e-commerce market offers a diverse range of products and services across various categories, from fashion and electronics to groceries and home goods. Technological advancements in areas like personalized recommendations, augmented reality, and artificial intelligence are enhancing the overall customer experience. Unique selling propositions often focus on localization, providing services tailored to the Cypriot market and offering efficient and reliable delivery. Key innovations include user-friendly mobile apps, secure payment gateways, and personalized shopping experiences.

Key Drivers, Barriers & Challenges in Cyprus E-Commerce Industry

Key Drivers:

- Increasing internet and smartphone penetration

- Growing consumer preference for online shopping

- Government initiatives to promote digital economy

- Investments in e-commerce infrastructure

Challenges:

- High logistics costs and delivery times

- Limited payment gateway options for certain online stores

- Competition from international e-commerce giants

- Trust issues related to online transactions. These challenges have resulted in an estimated xx million loss in revenue in 2024.

Emerging Opportunities in Cyprus E-Commerce Industry

Untapped market segments include niche products, personalized services, and sustainable e-commerce. Opportunities lie in utilizing emerging technologies like AR/VR for enhanced product visualization and leveraging social commerce platforms for targeted marketing. Evolving consumer preferences towards personalized experiences and environmentally friendly practices present significant opportunities for growth.

Growth Accelerators in the Cyprus E-Commerce Industry

Long-term growth will be propelled by technological breakthroughs in areas such as AI-driven personalization, blockchain for secure transactions, and improved logistics solutions. Strategic partnerships between e-commerce platforms and traditional retailers will further accelerate market expansion. Expansion into rural areas and focusing on untapped consumer segments will unlock significant growth potential.

Notable Milestones in Cyprus E-Commerce Industry Sector

- October 2021: Massimo Dutti launches its online store in Cyprus.

- March 2022: Alphamega Hypermarkets' e-shop gains 25,000 new customers, achieving sales almost equal to its offline store.

In-Depth Cyprus E-Commerce Industry Market Outlook

The Cyprus e-commerce market holds immense future potential, fueled by continuous technological advancements, evolving consumer preferences, and supportive government policies. Strategic opportunities lie in focusing on niche markets, leveraging emerging technologies, and forging strong partnerships to enhance logistics and customer experience. The market is poised for sustained growth, with the potential to become a significant contributor to the Cypriot economy in the coming years.

Cyprus E Commerce Industry Segmentation

-

1. B2C E-Commerce

- 1.1. Beauty & Personal Care

- 1.2. Consumer Electronics

- 1.3. Fashion & Apparel

- 1.4. Food & Beverage

- 1.5. Furniture & Home

- 1.6. Others (Toys, DIY, Media, etc.)

- 2. B2B E-Commerce

Cyprus E Commerce Industry Segmentation By Geography

- 1. Cyprus

Cyprus E Commerce Industry Regional Market Share

Geographic Coverage of Cyprus E Commerce Industry

Cyprus E Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.33% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage

- 3.3. Market Restrains

- 3.3.1. Privacy and security concerns

- 3.4. Market Trends

- 3.4.1. Significant Growth in E-Commerce is Expected due to digital transformation

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Cyprus E Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 5.1.1. Beauty & Personal Care

- 5.1.2. Consumer Electronics

- 5.1.3. Fashion & Apparel

- 5.1.4. Food & Beverage

- 5.1.5. Furniture & Home

- 5.1.6. Others (Toys, DIY, Media, etc.)

- 5.2. Market Analysis, Insights and Forecast - by B2B E-Commerce

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Cyprus

- 5.1. Market Analysis, Insights and Forecast - by B2C E-Commerce

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amazon

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 IKEA cy

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Walmart

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bazaraki

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Euphorique Mode

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ramon Flip

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Epic

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 eBay

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Asos

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Vision Scalper

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Amazon

List of Figures

- Figure 1: Cyprus E Commerce Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Cyprus E Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: Cyprus E Commerce Industry Revenue billion Forecast, by B2C E-Commerce 2020 & 2033

- Table 2: Cyprus E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 3: Cyprus E Commerce Industry Revenue billion Forecast, by B2B E-Commerce 2020 & 2033

- Table 4: Cyprus E Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 5: Cyprus E Commerce Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 6: Cyprus E Commerce Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Cyprus E Commerce Industry Revenue billion Forecast, by B2C E-Commerce 2020 & 2033

- Table 8: Cyprus E Commerce Industry Volume K Unit Forecast, by B2C E-Commerce 2020 & 2033

- Table 9: Cyprus E Commerce Industry Revenue billion Forecast, by B2B E-Commerce 2020 & 2033

- Table 10: Cyprus E Commerce Industry Volume K Unit Forecast, by B2B E-Commerce 2020 & 2033

- Table 11: Cyprus E Commerce Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 12: Cyprus E Commerce Industry Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Cyprus E Commerce Industry?

The projected CAGR is approximately 9.33%.

2. Which companies are prominent players in the Cyprus E Commerce Industry?

Key companies in the market include Amazon, IKEA cy, Walmart, Bazaraki, Euphorique Mode, Ramon Flip, Epic, eBay, Asos, Vision Scalper.

3. What are the main segments of the Cyprus E Commerce Industry?

The market segments include B2C E-Commerce , B2B E-Commerce.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.07 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from Fashion Industry; Penetration of Internet and Smartphone Usage.

6. What are the notable trends driving market growth?

Significant Growth in E-Commerce is Expected due to digital transformation.

7. Are there any restraints impacting market growth?

Privacy and security concerns.

8. Can you provide examples of recent developments in the market?

In March 2022, Alphamega Hypermarkets' e-shop, which was launched in 2021 has seen significant growth gaining 25000 new customers and recording a huge sale which was almost equal to its offline store.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Cyprus E Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Cyprus E Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Cyprus E Commerce Industry?

To stay informed about further developments, trends, and reports in the Cyprus E Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence