Key Insights

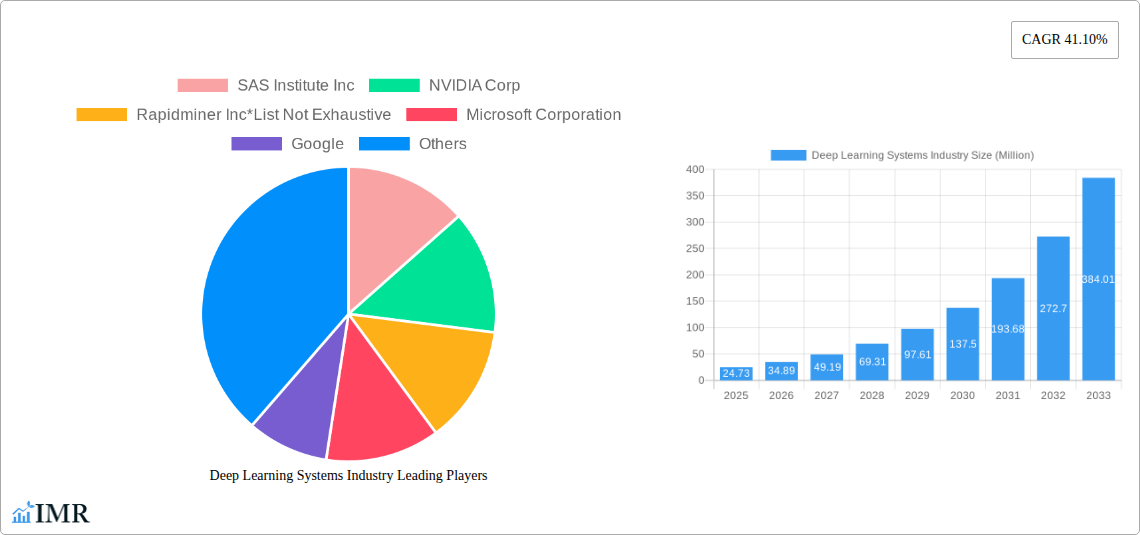

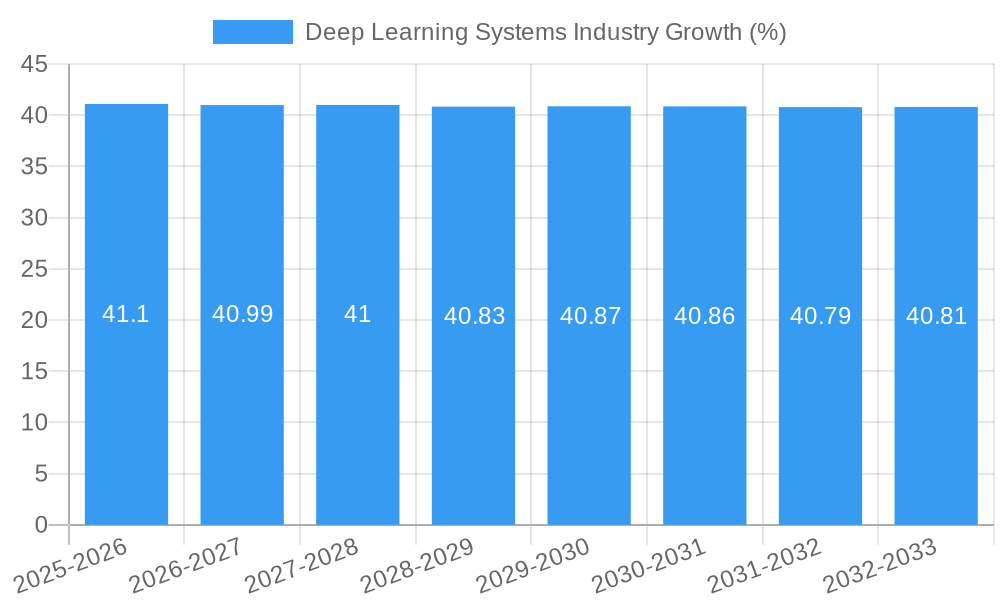

The Deep Learning Systems market is poised for explosive growth, projected to reach a substantial \$24.73 million in 2025 with an astounding CAGR of 41.10%. This rapid expansion is fueled by a confluence of powerful drivers, most notably the escalating demand for advanced data processing capabilities across virtually all sectors. The insatiable need to extract actionable insights from vast datasets, coupled with the inherent complexity of modern business challenges, positions deep learning as an indispensable tool. Furthermore, significant advancements in computing power, algorithm development, and the increasing availability of high-quality training data have democratized access to these sophisticated technologies, accelerating their adoption. The market's trajectory is further bolstered by the widespread integration of deep learning into core functionalities, moving beyond niche applications to become a foundational element of innovation.

The dynamic landscape of the Deep Learning Systems market is characterized by diverse and evolving trends. Key among these is the burgeoning dominance of AI-driven image recognition, transforming industries from retail with enhanced customer analytics to healthcare with sophisticated diagnostic tools. Signal recognition is also gaining significant traction, with applications ranging from autonomous vehicles to predictive maintenance in manufacturing. The continuous evolution of software and services, offering more accessible and powerful deep learning platforms, is a crucial trend, alongside the increasing demand for specialized hardware like GPUs and TPUs designed to accelerate these complex computations. While the market presents immense opportunities, potential restraints include the high cost of initial implementation for smaller enterprises, the ongoing need for skilled AI professionals, and data privacy concerns, particularly in sensitive sectors like BFSI and healthcare. Nevertheless, the overwhelming growth potential, driven by innovation and broad industry adoption, is set to redefine the technological frontier.

This comprehensive report delivers an in-depth analysis of the global Deep Learning Systems market, examining its dynamic landscape from 2019 to 2033, with a base and estimated year of 2025. We meticulously explore market drivers, growth trends, regional dominance, and the key players shaping this transformative industry. This report is designed for industry professionals, investors, and strategists seeking actionable insights into the burgeoning AI revolution.

Deep Learning Systems Industry Market Dynamics & Structure

The Deep Learning Systems market is characterized by a moderate to high concentration, with major technology giants like NVIDIA Corp, Microsoft Corporation, and Google leading innovation and adoption. The market's dynamism is primarily driven by relentless technological innovation, fueled by advancements in neural network architectures, specialized hardware (GPUs, TPUs), and vast datasets. Regulatory frameworks are evolving, particularly concerning data privacy and AI ethics, influencing development and deployment strategies. Competitive product substitutes, while emerging, often fall short of the sophisticated capabilities offered by dedicated deep learning solutions. End-user demographics span a wide spectrum, from large enterprises to specialized research institutions, all seeking to leverage AI for competitive advantage. Mergers and acquisitions (M&A) activity remains a key strategy for market consolidation and talent acquisition, with several significant deals anticipated during the forecast period, potentially increasing market share for acquiring entities.

- Market Concentration: Dominated by a few key players, with opportunities for specialized niche providers.

- Technological Innovation Drivers: Advancements in AI algorithms, GPU performance, and cloud computing infrastructure.

- Regulatory Frameworks: Evolving data privacy laws (e.g., GDPR, CCPA) and ethical AI guidelines.

- Competitive Product Substitutes: Traditional ML algorithms, expert systems, and rule-based AI.

- End-User Demographics: Enterprises across various sectors, research institutions, and government bodies.

- M&A Trends: Strategic acquisitions for technology integration, talent acquisition, and market expansion.

Deep Learning Systems Industry Growth Trends & Insights

The Deep Learning Systems market is experiencing robust growth, propelled by widespread adoption across diverse industries. The market size evolution is projected to be significant, driven by increasing demand for automation, predictive analytics, and intelligent decision-making. Adoption rates for deep learning solutions are accelerating as organizations recognize their potential to enhance efficiency, personalize customer experiences, and drive innovation. Technological disruptions, such as the development of more efficient deep learning frameworks and specialized AI accelerators, are continuously pushing the boundaries of what is possible. Consumer behavior shifts towards more personalized and intelligent digital interactions are further fueling the demand for deep learning-powered applications. This comprehensive report, leveraging [Insert Predictive Model/Data Source Name Here], will provide detailed market size projections, CAGR estimates, and market penetration figures across key segments, offering a nuanced understanding of the market's trajectory.

The market is poised for substantial expansion, with [Insert Market Size in Million Units] Million Units in the base year 2025, projected to reach [Insert Market Size in Million Units] Million Units by 2033, exhibiting a compound annual growth rate (CAGR) of [Insert CAGR Percentage] % during the forecast period. This growth is underpinned by the increasing integration of deep learning into core business processes across sectors like BFSI, retail, and manufacturing. The proliferation of AI-enabled devices and the exponential growth of data are creating fertile ground for deep learning applications, ranging from advanced image and signal recognition to sophisticated data processing and natural language understanding. The report will delve into the specific adoption rates within each end-user industry, highlighting how businesses are leveraging deep learning to gain a competitive edge. Furthermore, emerging trends like federated learning and explainable AI are expected to address existing adoption barriers and unlock new market opportunities.

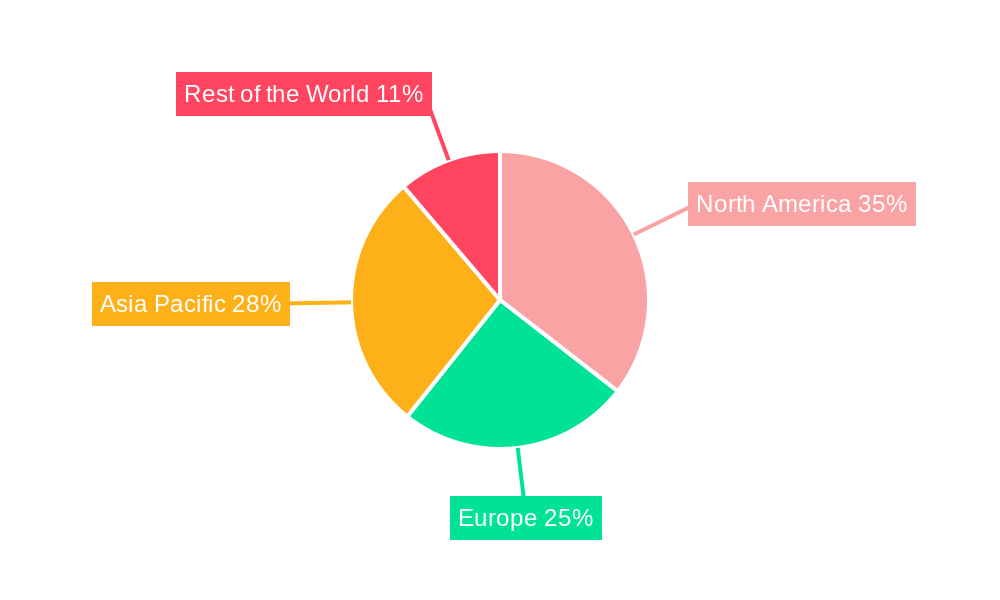

Dominant Regions, Countries, or Segments in Deep Learning Systems Industry

North America, led by the United States, currently dominates the Deep Learning Systems market, driven by extensive R&D investments, a mature technological ecosystem, and early adoption of AI across key industries. The region's dominance is further bolstered by the presence of leading technology companies and a highly skilled workforce. In terms of Offering, the Software segment, encompassing deep learning frameworks, libraries, and platforms, holds the largest market share, reflecting the foundational role of software in developing and deploying AI models. Hardware, including specialized processors like GPUs and TPUs, is a critical enabler and is experiencing rapid growth.

The End-User Industry landscape sees BFSI and Healthcare emerging as significant growth drivers. BFSI leverages deep learning for fraud detection, risk assessment, and personalized financial services, while Healthcare utilizes it for drug discovery, medical imaging analysis, and predictive diagnostics. The Automotive sector's adoption for autonomous driving systems and advanced driver-assistance systems (ADAS) is also a major contributor. Among Applications, Data Processing and Image Recognition are the most mature and widely deployed, powering everything from recommendation engines to surveillance systems.

- North America's Dominance: Fueled by R&D, tech giants, and early adoption.

- Software Segment Leadership: Foundation for AI development and deployment.

- Hardware as a Critical Enabler: Driven by demand for specialized AI chips.

- BFSI & Healthcare Growth: Driven by fraud detection, personalized services, and medical advancements.

- Automotive's Transformative Role: For autonomous driving and ADAS.

- Mature Applications: Data Processing and Image Recognition lead widespread adoption.

Deep Learning Systems Industry Product Landscape

The deep learning systems product landscape is characterized by rapid innovation, with offerings ranging from specialized AI hardware accelerators like NVIDIA's GPUs and AMD's Instinct accelerators to sophisticated software platforms from Microsoft Azure AI, Google Cloud AI, and IBM Watson. Key product advancements focus on improving model training efficiency, inference speed, and energy consumption. Companies are developing more powerful, yet energy-efficient, processors, alongside user-friendly software tools that democratize AI development. Applications are expanding beyond traditional image and signal recognition to encompass complex data processing, natural language understanding, and generative AI, enabling novel use cases in content creation and scientific research.

Key Drivers, Barriers & Challenges in Deep Learning Systems Industry

Key Drivers:

- Technological Advancements: Continuous improvements in algorithms, processing power, and data availability.

- Increasing Data Volume: The exponential growth of digital data fuels the need for advanced analytics.

- Demand for Automation: Industries seeking to enhance efficiency and reduce operational costs.

- Personalization Needs: Consumers expecting tailored experiences across digital platforms.

- Government Initiatives: Investments in AI research and development globally.

Barriers & Challenges:

- High Implementation Costs: Significant investment required for hardware, software, and skilled personnel.

- Data Privacy and Security Concerns: Strict regulations and public apprehension surrounding data usage.

- Talent Shortage: A scarcity of skilled AI engineers and data scientists.

- Ethical Considerations and Bias: Ensuring fairness, transparency, and accountability in AI systems.

- Integration Complexity: Challenges in seamlessly integrating deep learning solutions with existing IT infrastructure.

Emerging Opportunities in Deep Learning Systems Industry

Emerging opportunities in the Deep Learning Systems market lie in the development of more accessible and interpretable AI solutions, catering to small and medium-sized enterprises (SMEs). The burgeoning field of edge AI presents a significant avenue for growth, enabling real-time data processing and decision-making on devices without relying on cloud connectivity. Furthermore, the application of deep learning in sustainability initiatives, such as optimizing energy consumption and predicting environmental changes, offers a compelling and socially impactful growth area. The continued evolution of generative AI promises to unlock novel creative applications and personalized content generation, creating entirely new market segments.

Growth Accelerators in the Deep Learning Systems Industry Industry

Several catalysts are accelerating the growth of the Deep Learning Systems industry. The increasing availability of high-quality, labeled datasets, coupled with the development of more powerful and energy-efficient AI hardware, significantly reduces barriers to entry and enhances performance. Strategic partnerships between hardware manufacturers, software providers, and cloud service providers are fostering an integrated ecosystem, enabling seamless deployment and scalability. Market expansion into emerging economies, driven by digital transformation initiatives and government support for AI adoption, further amplifies growth potential.

Key Players Shaping the Deep Learning Systems Industry Market

- SAS Institute Inc

- NVIDIA Corp

- Rapidminer Inc

- Microsoft Corporation

- Google

- IBM Corp

- Advanced Micro Devices Inc

- Amazon Web Services Inc

- Intel Corp

- Facebook Inc

Notable Milestones in Deep Learning Systems Industry Sector

- September 2023: Amazon and Anthropic announced a strategic partnership to accelerate the development of safer generative AI and make it widely accessible to AWS consumers.

- August 2022: Amazon launched new Machine Learning (ML) software to analyze patient medical records for improved treatment and reduced expenses in healthcare.

- May 2022: Intel launched its second-generation Habana AI deep learning processors, offering high efficiency and performance to support diverse AI workloads from cloud to edge.

In-Depth Deep Learning Systems Industry Market Outlook

- September 2023: Amazon and Anthropic announced a strategic partnership to accelerate the development of safer generative AI and make it widely accessible to AWS consumers.

- August 2022: Amazon launched new Machine Learning (ML) software to analyze patient medical records for improved treatment and reduced expenses in healthcare.

- May 2022: Intel launched its second-generation Habana AI deep learning processors, offering high efficiency and performance to support diverse AI workloads from cloud to edge.

In-Depth Deep Learning Systems Industry Market Outlook

The future outlook for the Deep Learning Systems market is exceptionally bright, driven by continued innovation and expanding applications. The integration of AI into everyday life and business operations will only deepen, creating sustained demand for advanced deep learning solutions. Future growth accelerators will include breakthroughs in areas like reinforcement learning, explainable AI, and federated learning, addressing current limitations and opening up new frontiers. Strategic collaborations, particularly in developing responsible AI frameworks and ensuring data privacy, will be crucial for long-term market health and broad adoption. The market's trajectory points towards a future where deep learning is an indispensable component of technological progress and economic development.

Deep Learning Systems Industry Segmentation

-

1. Offering

- 1.1. Hardware

- 1.2. Software and Services

-

2. End-User Industry

- 2.1. BFSI

- 2.2. Retail

- 2.3. Manufacturing

- 2.4. Healthcare

- 2.5. Automotive

- 2.6. Telecom and Media

- 2.7. Other End-user Industries

-

3. Application

- 3.1. Image Recognition

- 3.2. Signal Recognition

- 3.3. Data Processing

- 3.4. Other Applications

Deep Learning Systems Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Deep Learning Systems Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 41.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Computing Power

- 3.2.2 coupled with the Presence of Large Unstructured Data; Ongoing Efforts toward the Integration of DL in Consumer-based Solutions; Growing Use of Deep Learning in Retail Sector is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Data Privacy and Security Concerns; Requirement for High Initial Investments

- 3.4. Market Trends

- 3.4.1. Growing Use of Deep Learning in Retail Sector is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Deep Learning Systems Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Hardware

- 5.1.2. Software and Services

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. BFSI

- 5.2.2. Retail

- 5.2.3. Manufacturing

- 5.2.4. Healthcare

- 5.2.5. Automotive

- 5.2.6. Telecom and Media

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Application

- 5.3.1. Image Recognition

- 5.3.2. Signal Recognition

- 5.3.3. Data Processing

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Deep Learning Systems Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Hardware

- 6.1.2. Software and Services

- 6.2. Market Analysis, Insights and Forecast - by End-User Industry

- 6.2.1. BFSI

- 6.2.2. Retail

- 6.2.3. Manufacturing

- 6.2.4. Healthcare

- 6.2.5. Automotive

- 6.2.6. Telecom and Media

- 6.2.7. Other End-user Industries

- 6.3. Market Analysis, Insights and Forecast - by Application

- 6.3.1. Image Recognition

- 6.3.2. Signal Recognition

- 6.3.3. Data Processing

- 6.3.4. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Deep Learning Systems Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Hardware

- 7.1.2. Software and Services

- 7.2. Market Analysis, Insights and Forecast - by End-User Industry

- 7.2.1. BFSI

- 7.2.2. Retail

- 7.2.3. Manufacturing

- 7.2.4. Healthcare

- 7.2.5. Automotive

- 7.2.6. Telecom and Media

- 7.2.7. Other End-user Industries

- 7.3. Market Analysis, Insights and Forecast - by Application

- 7.3.1. Image Recognition

- 7.3.2. Signal Recognition

- 7.3.3. Data Processing

- 7.3.4. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Deep Learning Systems Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Hardware

- 8.1.2. Software and Services

- 8.2. Market Analysis, Insights and Forecast - by End-User Industry

- 8.2.1. BFSI

- 8.2.2. Retail

- 8.2.3. Manufacturing

- 8.2.4. Healthcare

- 8.2.5. Automotive

- 8.2.6. Telecom and Media

- 8.2.7. Other End-user Industries

- 8.3. Market Analysis, Insights and Forecast - by Application

- 8.3.1. Image Recognition

- 8.3.2. Signal Recognition

- 8.3.3. Data Processing

- 8.3.4. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Rest of the World Deep Learning Systems Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Hardware

- 9.1.2. Software and Services

- 9.2. Market Analysis, Insights and Forecast - by End-User Industry

- 9.2.1. BFSI

- 9.2.2. Retail

- 9.2.3. Manufacturing

- 9.2.4. Healthcare

- 9.2.5. Automotive

- 9.2.6. Telecom and Media

- 9.2.7. Other End-user Industries

- 9.3. Market Analysis, Insights and Forecast - by Application

- 9.3.1. Image Recognition

- 9.3.2. Signal Recognition

- 9.3.3. Data Processing

- 9.3.4. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. North America Deep Learning Systems Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Europe Deep Learning Systems Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Asia Pacific Deep Learning Systems Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Rest of the World Deep Learning Systems Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Competitive Analysis

- 14.1. Global Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 SAS Institute Inc

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 NVIDIA Corp

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Rapidminer Inc*List Not Exhaustive

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Microsoft Corporation

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Google

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 IBM Corp

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 Advanced Micro Devices Inc

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Amazon Web Services Inc

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Intel Corp

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Facebook Inc

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.1 SAS Institute Inc

List of Figures

- Figure 1: Global Deep Learning Systems Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Deep Learning Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Deep Learning Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Deep Learning Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Deep Learning Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Deep Learning Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Deep Learning Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Rest of the World Deep Learning Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Rest of the World Deep Learning Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Deep Learning Systems Industry Revenue (Million), by Offering 2024 & 2032

- Figure 11: North America Deep Learning Systems Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 12: North America Deep Learning Systems Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 13: North America Deep Learning Systems Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 14: North America Deep Learning Systems Industry Revenue (Million), by Application 2024 & 2032

- Figure 15: North America Deep Learning Systems Industry Revenue Share (%), by Application 2024 & 2032

- Figure 16: North America Deep Learning Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Deep Learning Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Deep Learning Systems Industry Revenue (Million), by Offering 2024 & 2032

- Figure 19: Europe Deep Learning Systems Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 20: Europe Deep Learning Systems Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 21: Europe Deep Learning Systems Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 22: Europe Deep Learning Systems Industry Revenue (Million), by Application 2024 & 2032

- Figure 23: Europe Deep Learning Systems Industry Revenue Share (%), by Application 2024 & 2032

- Figure 24: Europe Deep Learning Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Deep Learning Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Deep Learning Systems Industry Revenue (Million), by Offering 2024 & 2032

- Figure 27: Asia Pacific Deep Learning Systems Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 28: Asia Pacific Deep Learning Systems Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 29: Asia Pacific Deep Learning Systems Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 30: Asia Pacific Deep Learning Systems Industry Revenue (Million), by Application 2024 & 2032

- Figure 31: Asia Pacific Deep Learning Systems Industry Revenue Share (%), by Application 2024 & 2032

- Figure 32: Asia Pacific Deep Learning Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 33: Asia Pacific Deep Learning Systems Industry Revenue Share (%), by Country 2024 & 2032

- Figure 34: Rest of the World Deep Learning Systems Industry Revenue (Million), by Offering 2024 & 2032

- Figure 35: Rest of the World Deep Learning Systems Industry Revenue Share (%), by Offering 2024 & 2032

- Figure 36: Rest of the World Deep Learning Systems Industry Revenue (Million), by End-User Industry 2024 & 2032

- Figure 37: Rest of the World Deep Learning Systems Industry Revenue Share (%), by End-User Industry 2024 & 2032

- Figure 38: Rest of the World Deep Learning Systems Industry Revenue (Million), by Application 2024 & 2032

- Figure 39: Rest of the World Deep Learning Systems Industry Revenue Share (%), by Application 2024 & 2032

- Figure 40: Rest of the World Deep Learning Systems Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Rest of the World Deep Learning Systems Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Deep Learning Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Deep Learning Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 3: Global Deep Learning Systems Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Global Deep Learning Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 5: Global Deep Learning Systems Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Global Deep Learning Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Deep Learning Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Deep Learning Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Deep Learning Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Global Deep Learning Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 11: Deep Learning Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Global Deep Learning Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 13: Deep Learning Systems Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Global Deep Learning Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 15: Global Deep Learning Systems Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 16: Global Deep Learning Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 17: Global Deep Learning Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Deep Learning Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 19: Global Deep Learning Systems Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 20: Global Deep Learning Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 21: Global Deep Learning Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 22: Global Deep Learning Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 23: Global Deep Learning Systems Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 24: Global Deep Learning Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 25: Global Deep Learning Systems Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Deep Learning Systems Industry Revenue Million Forecast, by Offering 2019 & 2032

- Table 27: Global Deep Learning Systems Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 28: Global Deep Learning Systems Industry Revenue Million Forecast, by Application 2019 & 2032

- Table 29: Global Deep Learning Systems Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Deep Learning Systems Industry?

The projected CAGR is approximately 41.10%.

2. Which companies are prominent players in the Deep Learning Systems Industry?

Key companies in the market include SAS Institute Inc, NVIDIA Corp, Rapidminer Inc*List Not Exhaustive, Microsoft Corporation, Google, IBM Corp, Advanced Micro Devices Inc, Amazon Web Services Inc, Intel Corp, Facebook Inc.

3. What are the main segments of the Deep Learning Systems Industry?

The market segments include Offering, End-User Industry, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 24.73 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Computing Power. coupled with the Presence of Large Unstructured Data; Ongoing Efforts toward the Integration of DL in Consumer-based Solutions; Growing Use of Deep Learning in Retail Sector is Driving the Market.

6. What are the notable trends driving market growth?

Growing Use of Deep Learning in Retail Sector is Driving the Market.

7. Are there any restraints impacting market growth?

Data Privacy and Security Concerns; Requirement for High Initial Investments.

8. Can you provide examples of recent developments in the market?

September 2023: Amazon and Anthropic announced a strategic partnership that would bring together their respective technology and expertise in safer generative artificial intelligence (AI) to accelerate the development of Anthropic’s future foundation models and make them widely accessible to AWS consumers.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Deep Learning Systems Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Deep Learning Systems Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Deep Learning Systems Industry?

To stay informed about further developments, trends, and reports in the Deep Learning Systems Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence