Key Insights

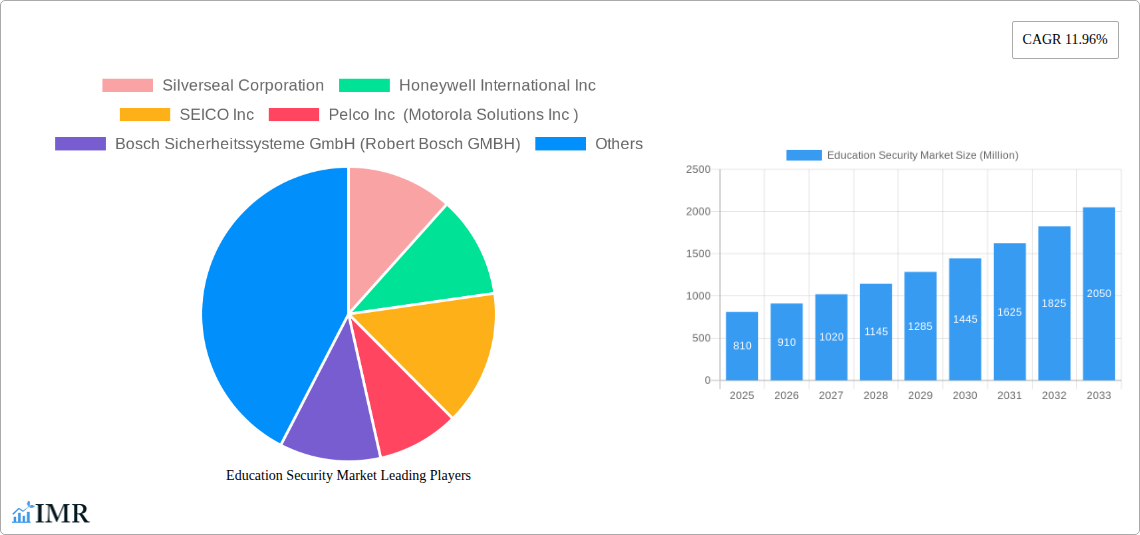

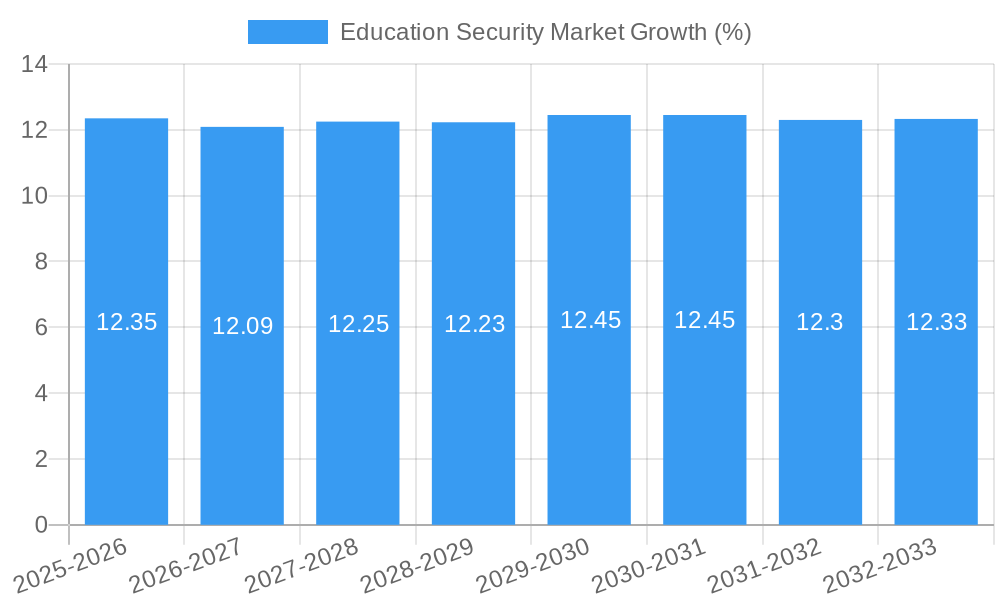

The global Education Security Market is experiencing robust expansion, projected to reach $0.81 billion in the base year of 2025. This growth is fueled by an impressive Compound Annual Growth Rate (CAGR) of 11.96%, indicating a dynamic and expanding sector over the forecast period of 2025-2033. The increasing emphasis on safeguarding students, faculty, and educational assets from a spectrum of threats, including physical violence, unauthorized access, and data breaches, serves as a primary driver. Educational institutions, from K-12 schools to higher education campuses, are investing heavily in advanced security solutions to create safer learning environments. This includes sophisticated surveillance systems, access control technologies, alarm monitoring, and comprehensive pre-employment screening for staff, all contributing to a more secure campus ecosystem.

Key trends shaping this market include the integration of artificial intelligence (AI) and machine learning (ML) into security systems for predictive threat analysis and automated response. The adoption of cloud-based security solutions is also on the rise, offering greater scalability, accessibility, and cost-efficiency for educational institutions. Furthermore, the convergence of physical and cybersecurity is becoming paramount, addressing the dual risks faced by modern educational facilities. While the market is poised for significant growth, challenges such as budget constraints in some educational sectors and the need for continuous technological updates to combat evolving threats present ongoing considerations. The market is segmented across various services, including guarding, pre-employment screening, security consulting, systems integration, and alarm monitoring, catering to the diverse security needs of primary, secondary, and higher education facilities.

Education Security Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the global Education Security Market, encompassing primary and secondary education facilities, higher education facilities, and other educational facilities. With a focus on critical segments like Guarding, Pre-Employment Screening, Security Consulting, Systems Integration & Management, Alarm Monitoring Services, and Other Private Security Services, this study delves into market dynamics, growth trends, regional dominance, and the evolving product landscape. Covering the period from 2019 to 2033, with a base year of 2025, this report offers actionable insights for stakeholders seeking to navigate the rapidly expanding school security market, campus security solutions, and educational institution safety. We analyze the impact of key players such as Silverseal Corporation, Honeywell International Inc, SEICO Inc, Pelco Inc (Motorola Solutions Inc), Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH), Cisco Systems Inc, Genetec Inc, Verkada Inc, Securitas Technology (Securitas AB), Hangzhou Hikvision Digital Technology Co Ltd, Kisi Incorporated, AV Costar, Axis Communications AB, and Siemens A.

Education Security Market Market Dynamics & Structure

The Education Security Market exhibits a moderately concentrated structure, driven by a blend of established global security providers and innovative niche players. Technological innovation remains a pivotal driver, with advancements in AI-powered surveillance, access control systems, and integrated safety platforms significantly shaping market offerings. Robust regulatory frameworks, aimed at enhancing student safety, staff security, and campus protection, are continuously evolving, mandating higher security standards for educational institutions. Competitive product substitutes are emerging, ranging from advanced cybersecurity solutions for protecting sensitive student data to sophisticated physical security measures. End-user demographics are increasingly diverse, with a growing demand for tailored security solutions catering to the unique needs of K-12 schools, universities, and vocational training centers. Mergers and acquisitions (M&A) trends indicate a strategic consolidation within the market, with larger entities acquiring specialized technology providers to expand their service portfolios and market reach.

- Market Concentration: Dominated by a few key players, but with a rising number of specialized solution providers.

- Technological Innovation Drivers: AI-driven analytics for threat detection, IoT-enabled security devices, cloud-based security management platforms.

- Regulatory Frameworks: Increasing government mandates for enhanced school safety measures, data privacy regulations (e.g., FERPA), and building codes impacting security infrastructure.

- Competitive Product Substitutes: Advanced communication systems for emergency response, mental health support technologies, and cybersecurity solutions for digital assets.

- End-User Demographics: Growing demand for integrated, user-friendly, and cost-effective security solutions across all educational levels.

- M&A Trends: Strategic acquisitions by major security firms to gain access to cutting-edge technologies and expand service offerings.

Education Security Market Growth Trends & Insights

The Education Security Market is projected for substantial growth, fueled by an escalating awareness of safety concerns within educational environments. The market size is expected to witness a significant expansion from approximately USD 18,500 Million in the historical period to an estimated USD 32,000 Million by 2033, exhibiting a robust Compound Annual Growth Rate (CAGR) of xx%. Adoption rates for advanced security technologies are on an upward trajectory, driven by an increasing number of incidents and a proactive approach by educational institutions to invest in preventative measures. Technological disruptions, such as the integration of biometric identification systems for secure access and the deployment of drone surveillance for large campuses, are transforming the security landscape. Consumer behavior shifts are also playing a crucial role, with parents, educators, and administrators prioritizing security as a non-negotiable aspect of the educational experience. This evolving demand necessitates comprehensive solutions encompassing physical security, cybersecurity, and emergency preparedness. The market penetration of smart security systems, designed for real-time monitoring and rapid response, is steadily increasing, indicating a strong market receptiveness to integrated campus security systems and school safety technology.

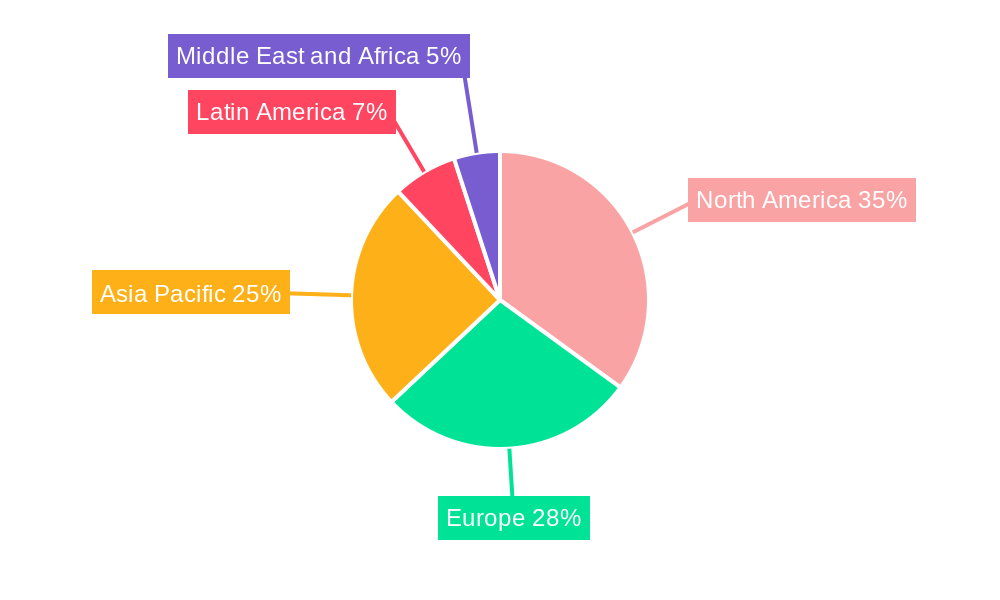

Dominant Regions, Countries, or Segments in Education Security Market

The North America region is anticipated to emerge as a dominant force in the Education Security Market, largely driven by the United States and Canada. This regional dominance is propelled by stringent government regulations mandating enhanced school safety and security, coupled with a proactive stance by educational institutions in adopting advanced security technologies. The Primary & Secondary Facilities segment, in particular, is a significant growth engine within this region, reflecting the high priority placed on safeguarding younger students.

- Key Drivers in North America:

- Economic Policies: Substantial government grants and funding initiatives specifically allocated for improving school safety and security, such as the USD 8,25,522 in School and Safety grants announced in May 2024, directly contribute to market expansion.

- Infrastructure Investment: Continuous investment in modernizing school infrastructure to incorporate advanced security systems, including surveillance cameras, access control, and alarm systems.

- Public Awareness: High public and media attention on school safety incidents, fostering a strong demand for comprehensive security solutions.

- Technological Adoption: A readily available market for innovative security technologies, from AI-powered analytics to integrated emergency communication platforms.

The Systems Integration & Management service segment is also witnessing robust growth across North America. This is attributed to the increasing complexity of modern security needs, requiring a holistic approach to managing various security layers. Educational institutions are increasingly opting for integrated systems that provide centralized control, real-time monitoring, and streamlined response protocols. The market share for these integrated solutions is expected to grow as institutions seek to optimize their security investments and enhance operational efficiency. Furthermore, the growing adoption of vape detectors and smoke detectors in educational facilities, as seen in the March 2024 announcement of USD 30 million investment in Ontario for school safety, including such devices, highlights a specific and growing niche within the broader education security market. This demonstrates a trend towards addressing emerging safety concerns beyond traditional security threats.

Education Security Market Product Landscape

The Education Security Market is characterized by continuous product innovation, with a strong emphasis on intelligent and integrated solutions. Advanced video surveillance systems now incorporate AI analytics for anomaly detection, facial recognition, and behavioral analysis, enhancing proactive threat identification. Access control solutions are evolving beyond traditional key cards to include biometric authentication and mobile credentialing, offering secure and convenient entry management. Integrated security platforms are becoming the norm, unifying video, access control, intrusion detection, and emergency communication systems into a single, user-friendly interface. These products are designed for diverse applications, from monitoring school corridors and identifying unauthorized access to managing large-scale events and facilitating rapid emergency response. Performance metrics focus on reliability, scalability, ease of deployment, and cost-effectiveness. Unique selling propositions often lie in the ability to provide real-time situational awareness, predictive analytics for risk mitigation, and seamless integration with existing IT infrastructure, thereby enhancing overall school safety and campus security.

Key Drivers, Barriers & Challenges in Education Security Market

Key Drivers:

- Escalating Safety Concerns: Increasing incidents of violence, bullying, and security breaches in educational institutions are the primary drivers.

- Technological Advancements: The availability of sophisticated AI-powered surveillance, access control, and communication systems makes robust security solutions more accessible and effective.

- Government Mandates and Funding: Proactive government initiatives and grant programs, such as those for school safety grants, are accelerating the adoption of security measures.

- Parental and Public Demand: Growing expectations from parents and the public for secure learning environments.

Barriers & Challenges:

- Budgetary Constraints: Many educational institutions, especially public schools, face significant financial limitations, making substantial security investments challenging.

- Privacy Concerns: The implementation of advanced surveillance technologies often raises privacy concerns among students, staff, and parents, requiring careful ethical considerations and transparent policies.

- Integration Complexity: Integrating new security systems with existing legacy infrastructure can be complex and costly.

- Rapid Technological Obsolescence: The fast pace of technological development necessitates continuous upgrades, adding to long-term operational costs. Supply chain disruptions for critical security hardware can also impact deployment timelines.

Emerging Opportunities in Education Security Market

Emerging opportunities in the Education Security Market lie in the development and deployment of AI-driven predictive analytics for early threat detection and intervention. The growing demand for comprehensive cybersecurity solutions to protect sensitive student data from cyber threats presents a significant untapped market. Furthermore, the integration of mental health support technologies with security systems, enabling faster response to student welfare concerns, is an evolving area. The expansion of services into remote learning environments and the development of flexible, scalable security solutions for diverse educational models also represent promising avenues for growth.

Growth Accelerators in the Education Security Market Industry

Growth in the Education Security Market is significantly accelerated by technological breakthroughs, particularly in areas like artificial intelligence for threat detection and video analytics. Strategic partnerships between security technology providers and educational technology companies are fostering the development of holistic safety solutions. Market expansion strategies, including offering subscription-based security-as-a-service models, are making advanced security more accessible to a wider range of educational institutions. The increasing focus on creating secure and inclusive learning environments, coupled with a global commitment to enhancing student safety, continues to be a powerful catalyst for sustained market growth.

Key Players Shaping the Education Security Market Market

- Silverseal Corporation

- Honeywell International Inc

- SEICO Inc

- Pelco Inc (Motorola Solutions Inc )

- Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH)

- Cisco Systems Inc

- Genetec Inc

- Verkada Inc

- Securitas Technology (Securitas AB)

- Hangzhou Hikvision Digital Technology Co Ltd

- Kisi Incorporated

- AV Costar

- Axis Communications AB

- Siemens A

Notable Milestones in Education Security Market Sector

- May 2024: Senator Wayne Fontana, D-District 42, announced USD 8,25,522 in School and Safety grants to enhance student and staff safety, security, and mental health support, directly boosting investment in education security solutions.

- March 2024: Schools in Ontario could soon be equipped with more security cameras and more vape detectors. Premier Kathleen Wynne announced that USD 30 million would be spent on school safety in the province’s budget. Installing vape detectors and smoke detectors that detect vapor in places like washrooms will help keep students healthy and safe, highlighting a growing demand for specialized school safety technology.

In-Depth Education Security Market Market Outlook

The Education Security Market is poised for continued robust growth, driven by a persistent emphasis on creating secure educational environments. Future market potential will be shaped by the increasing integration of AI and machine learning in security systems, enabling predictive threat analysis and automated response protocols. Strategic opportunities abound for providers offering comprehensive campus security solutions that encompass physical security, cybersecurity, and emergency management. The evolving landscape of education, including hybrid and remote learning models, will necessitate adaptive and scalable security frameworks, creating a demand for innovative, cloud-based platforms and specialized student safety services.

Education Security Market Segmentation

-

1. Services

- 1.1. Guarding

- 1.2. Pre-Employment Screening

- 1.3. Security Consulting

- 1.4. Systems Integration & Management

- 1.5. Alarm Monitoring Services

- 1.6. Other Private Security Services

-

2. Facilities

- 2.1. Primary & Secondary Facilities

- 2.2. Higher Education Facilities

- 2.3. Other Educational Facilities

Education Security Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Education Security Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 11.96% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Real-time Surveillance; Growing Demand for Cost-effective security solutions and significant Infrastructure Developments

- 3.3. Market Restrains

- 3.3.1. The Security Solutions Procurement Costs and Privacy Concerns Related to Public Surveillance Impact the Growth of the Market

- 3.4. Market Trends

- 3.4.1. Higher Education Facilities are Expected to Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Education Security Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Services

- 5.1.1. Guarding

- 5.1.2. Pre-Employment Screening

- 5.1.3. Security Consulting

- 5.1.4. Systems Integration & Management

- 5.1.5. Alarm Monitoring Services

- 5.1.6. Other Private Security Services

- 5.2. Market Analysis, Insights and Forecast - by Facilities

- 5.2.1. Primary & Secondary Facilities

- 5.2.2. Higher Education Facilities

- 5.2.3. Other Educational Facilities

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Services

- 6. North America Education Security Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Services

- 6.1.1. Guarding

- 6.1.2. Pre-Employment Screening

- 6.1.3. Security Consulting

- 6.1.4. Systems Integration & Management

- 6.1.5. Alarm Monitoring Services

- 6.1.6. Other Private Security Services

- 6.2. Market Analysis, Insights and Forecast - by Facilities

- 6.2.1. Primary & Secondary Facilities

- 6.2.2. Higher Education Facilities

- 6.2.3. Other Educational Facilities

- 6.1. Market Analysis, Insights and Forecast - by Services

- 7. Europe Education Security Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Services

- 7.1.1. Guarding

- 7.1.2. Pre-Employment Screening

- 7.1.3. Security Consulting

- 7.1.4. Systems Integration & Management

- 7.1.5. Alarm Monitoring Services

- 7.1.6. Other Private Security Services

- 7.2. Market Analysis, Insights and Forecast - by Facilities

- 7.2.1. Primary & Secondary Facilities

- 7.2.2. Higher Education Facilities

- 7.2.3. Other Educational Facilities

- 7.1. Market Analysis, Insights and Forecast - by Services

- 8. Asia Pacific Education Security Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Services

- 8.1.1. Guarding

- 8.1.2. Pre-Employment Screening

- 8.1.3. Security Consulting

- 8.1.4. Systems Integration & Management

- 8.1.5. Alarm Monitoring Services

- 8.1.6. Other Private Security Services

- 8.2. Market Analysis, Insights and Forecast - by Facilities

- 8.2.1. Primary & Secondary Facilities

- 8.2.2. Higher Education Facilities

- 8.2.3. Other Educational Facilities

- 8.1. Market Analysis, Insights and Forecast - by Services

- 9. Latin America Education Security Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Services

- 9.1.1. Guarding

- 9.1.2. Pre-Employment Screening

- 9.1.3. Security Consulting

- 9.1.4. Systems Integration & Management

- 9.1.5. Alarm Monitoring Services

- 9.1.6. Other Private Security Services

- 9.2. Market Analysis, Insights and Forecast - by Facilities

- 9.2.1. Primary & Secondary Facilities

- 9.2.2. Higher Education Facilities

- 9.2.3. Other Educational Facilities

- 9.1. Market Analysis, Insights and Forecast - by Services

- 10. Middle East and Africa Education Security Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Services

- 10.1.1. Guarding

- 10.1.2. Pre-Employment Screening

- 10.1.3. Security Consulting

- 10.1.4. Systems Integration & Management

- 10.1.5. Alarm Monitoring Services

- 10.1.6. Other Private Security Services

- 10.2. Market Analysis, Insights and Forecast - by Facilities

- 10.2.1. Primary & Secondary Facilities

- 10.2.2. Higher Education Facilities

- 10.2.3. Other Educational Facilities

- 10.1. Market Analysis, Insights and Forecast - by Services

- 11. North America Education Security Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Education Security Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Spain

- 12.1.5 Italy

- 12.1.6 Spain

- 12.1.7 Belgium

- 12.1.8 Netherland

- 12.1.9 Nordics

- 12.1.10 Rest of Europe

- 13. Asia Pacific Education Security Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 South Korea

- 13.1.5 Southeast Asia

- 13.1.6 Australia

- 13.1.7 Indonesia

- 13.1.8 Phillipes

- 13.1.9 Singapore

- 13.1.10 Thailandc

- 13.1.11 Rest of Asia Pacific

- 14. South America Education Security Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 Brazil

- 14.1.2 Argentina

- 14.1.3 Peru

- 14.1.4 Chile

- 14.1.5 Colombia

- 14.1.6 Ecuador

- 14.1.7 Venezuela

- 14.1.8 Rest of South America

- 15. North America Education Security Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 United States

- 15.1.2 Canada

- 15.1.3 Mexico

- 16. MEA Education Security Market Analysis, Insights and Forecast, 2019-2031

- 16.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 16.1.1 United Arab Emirates

- 16.1.2 Saudi Arabia

- 16.1.3 South Africa

- 16.1.4 Rest of Middle East and Africa

- 17. Competitive Analysis

- 17.1. Global Market Share Analysis 2024

- 17.2. Company Profiles

- 17.2.1 Silverseal Corporation

- 17.2.1.1. Overview

- 17.2.1.2. Products

- 17.2.1.3. SWOT Analysis

- 17.2.1.4. Recent Developments

- 17.2.1.5. Financials (Based on Availability)

- 17.2.2 Honeywell International Inc

- 17.2.2.1. Overview

- 17.2.2.2. Products

- 17.2.2.3. SWOT Analysis

- 17.2.2.4. Recent Developments

- 17.2.2.5. Financials (Based on Availability)

- 17.2.3 SEICO Inc

- 17.2.3.1. Overview

- 17.2.3.2. Products

- 17.2.3.3. SWOT Analysis

- 17.2.3.4. Recent Developments

- 17.2.3.5. Financials (Based on Availability)

- 17.2.4 Pelco Inc (Motorola Solutions Inc )

- 17.2.4.1. Overview

- 17.2.4.2. Products

- 17.2.4.3. SWOT Analysis

- 17.2.4.4. Recent Developments

- 17.2.4.5. Financials (Based on Availability)

- 17.2.5 Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH)

- 17.2.5.1. Overview

- 17.2.5.2. Products

- 17.2.5.3. SWOT Analysis

- 17.2.5.4. Recent Developments

- 17.2.5.5. Financials (Based on Availability)

- 17.2.6 Cisco Systems Inc

- 17.2.6.1. Overview

- 17.2.6.2. Products

- 17.2.6.3. SWOT Analysis

- 17.2.6.4. Recent Developments

- 17.2.6.5. Financials (Based on Availability)

- 17.2.7 Genetec Inc

- 17.2.7.1. Overview

- 17.2.7.2. Products

- 17.2.7.3. SWOT Analysis

- 17.2.7.4. Recent Developments

- 17.2.7.5. Financials (Based on Availability)

- 17.2.8 Verkada Inc

- 17.2.8.1. Overview

- 17.2.8.2. Products

- 17.2.8.3. SWOT Analysis

- 17.2.8.4. Recent Developments

- 17.2.8.5. Financials (Based on Availability)

- 17.2.9 Securitas Technology (Securitas AB)

- 17.2.9.1. Overview

- 17.2.9.2. Products

- 17.2.9.3. SWOT Analysis

- 17.2.9.4. Recent Developments

- 17.2.9.5. Financials (Based on Availability)

- 17.2.10 Hangzhou Hikvision Digital Technology Co Ltd

- 17.2.10.1. Overview

- 17.2.10.2. Products

- 17.2.10.3. SWOT Analysis

- 17.2.10.4. Recent Developments

- 17.2.10.5. Financials (Based on Availability)

- 17.2.11 Kisi Incorporated

- 17.2.11.1. Overview

- 17.2.11.2. Products

- 17.2.11.3. SWOT Analysis

- 17.2.11.4. Recent Developments

- 17.2.11.5. Financials (Based on Availability)

- 17.2.12 AV Costar

- 17.2.12.1. Overview

- 17.2.12.2. Products

- 17.2.12.3. SWOT Analysis

- 17.2.12.4. Recent Developments

- 17.2.12.5. Financials (Based on Availability)

- 17.2.13 Axis Communications AB

- 17.2.13.1. Overview

- 17.2.13.2. Products

- 17.2.13.3. SWOT Analysis

- 17.2.13.4. Recent Developments

- 17.2.13.5. Financials (Based on Availability)

- 17.2.14 Siemens A

- 17.2.14.1. Overview

- 17.2.14.2. Products

- 17.2.14.3. SWOT Analysis

- 17.2.14.4. Recent Developments

- 17.2.14.5. Financials (Based on Availability)

- 17.2.1 Silverseal Corporation

List of Figures

- Figure 1: Global Education Security Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 9: South America Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: North America Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 11: North America Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: MEA Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 13: MEA Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: North America Education Security Market Revenue (Million), by Services 2024 & 2032

- Figure 15: North America Education Security Market Revenue Share (%), by Services 2024 & 2032

- Figure 16: North America Education Security Market Revenue (Million), by Facilities 2024 & 2032

- Figure 17: North America Education Security Market Revenue Share (%), by Facilities 2024 & 2032

- Figure 18: North America Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 19: North America Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Europe Education Security Market Revenue (Million), by Services 2024 & 2032

- Figure 21: Europe Education Security Market Revenue Share (%), by Services 2024 & 2032

- Figure 22: Europe Education Security Market Revenue (Million), by Facilities 2024 & 2032

- Figure 23: Europe Education Security Market Revenue Share (%), by Facilities 2024 & 2032

- Figure 24: Europe Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 25: Europe Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Education Security Market Revenue (Million), by Services 2024 & 2032

- Figure 27: Asia Pacific Education Security Market Revenue Share (%), by Services 2024 & 2032

- Figure 28: Asia Pacific Education Security Market Revenue (Million), by Facilities 2024 & 2032

- Figure 29: Asia Pacific Education Security Market Revenue Share (%), by Facilities 2024 & 2032

- Figure 30: Asia Pacific Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 31: Asia Pacific Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 32: Latin America Education Security Market Revenue (Million), by Services 2024 & 2032

- Figure 33: Latin America Education Security Market Revenue Share (%), by Services 2024 & 2032

- Figure 34: Latin America Education Security Market Revenue (Million), by Facilities 2024 & 2032

- Figure 35: Latin America Education Security Market Revenue Share (%), by Facilities 2024 & 2032

- Figure 36: Latin America Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 37: Latin America Education Security Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: Middle East and Africa Education Security Market Revenue (Million), by Services 2024 & 2032

- Figure 39: Middle East and Africa Education Security Market Revenue Share (%), by Services 2024 & 2032

- Figure 40: Middle East and Africa Education Security Market Revenue (Million), by Facilities 2024 & 2032

- Figure 41: Middle East and Africa Education Security Market Revenue Share (%), by Facilities 2024 & 2032

- Figure 42: Middle East and Africa Education Security Market Revenue (Million), by Country 2024 & 2032

- Figure 43: Middle East and Africa Education Security Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Education Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Education Security Market Revenue Million Forecast, by Services 2019 & 2032

- Table 3: Global Education Security Market Revenue Million Forecast, by Facilities 2019 & 2032

- Table 4: Global Education Security Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Canada Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Mexico Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Germany Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: France Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Italy Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Spain Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Belgium Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Netherland Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Nordics Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Rest of Europe Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 21: China Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Japan Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: India Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Korea Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Southeast Asia Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Australia Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Indonesia Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Phillipes Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Singapore Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Thailandc Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 31: Rest of Asia Pacific Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 33: Brazil Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Argentina Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Peru Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Chile Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 37: Colombia Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Ecuador Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: Venezuela Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Rest of South America Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: United States Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Canada Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Mexico Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 45: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 46: United Arab Emirates Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: Saudi Arabia Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: South Africa Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: Rest of Middle East and Africa Education Security Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Global Education Security Market Revenue Million Forecast, by Services 2019 & 2032

- Table 51: Global Education Security Market Revenue Million Forecast, by Facilities 2019 & 2032

- Table 52: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: Global Education Security Market Revenue Million Forecast, by Services 2019 & 2032

- Table 54: Global Education Security Market Revenue Million Forecast, by Facilities 2019 & 2032

- Table 55: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 56: Global Education Security Market Revenue Million Forecast, by Services 2019 & 2032

- Table 57: Global Education Security Market Revenue Million Forecast, by Facilities 2019 & 2032

- Table 58: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 59: Global Education Security Market Revenue Million Forecast, by Services 2019 & 2032

- Table 60: Global Education Security Market Revenue Million Forecast, by Facilities 2019 & 2032

- Table 61: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Education Security Market Revenue Million Forecast, by Services 2019 & 2032

- Table 63: Global Education Security Market Revenue Million Forecast, by Facilities 2019 & 2032

- Table 64: Global Education Security Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Education Security Market?

The projected CAGR is approximately 11.96%.

2. Which companies are prominent players in the Education Security Market?

Key companies in the market include Silverseal Corporation, Honeywell International Inc, SEICO Inc, Pelco Inc (Motorola Solutions Inc ), Bosch Sicherheitssysteme GmbH (Robert Bosch GMBH), Cisco Systems Inc, Genetec Inc, Verkada Inc, Securitas Technology (Securitas AB), Hangzhou Hikvision Digital Technology Co Ltd, Kisi Incorporated, AV Costar, Axis Communications AB, Siemens A.

3. What are the main segments of the Education Security Market?

The market segments include Services, Facilities.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Real-time Surveillance; Growing Demand for Cost-effective security solutions and significant Infrastructure Developments.

6. What are the notable trends driving market growth?

Higher Education Facilities are Expected to Witness Major Growth.

7. Are there any restraints impacting market growth?

The Security Solutions Procurement Costs and Privacy Concerns Related to Public Surveillance Impact the Growth of the Market.

8. Can you provide examples of recent developments in the market?

May 2024: Senator Wayne Fontana, D-District 42, announced USD 8,25,522 in School and Safety grants to enhance student and staff safety, security, and mental health support.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Education Security Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Education Security Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Education Security Market?

To stay informed about further developments, trends, and reports in the Education Security Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence