Key Insights

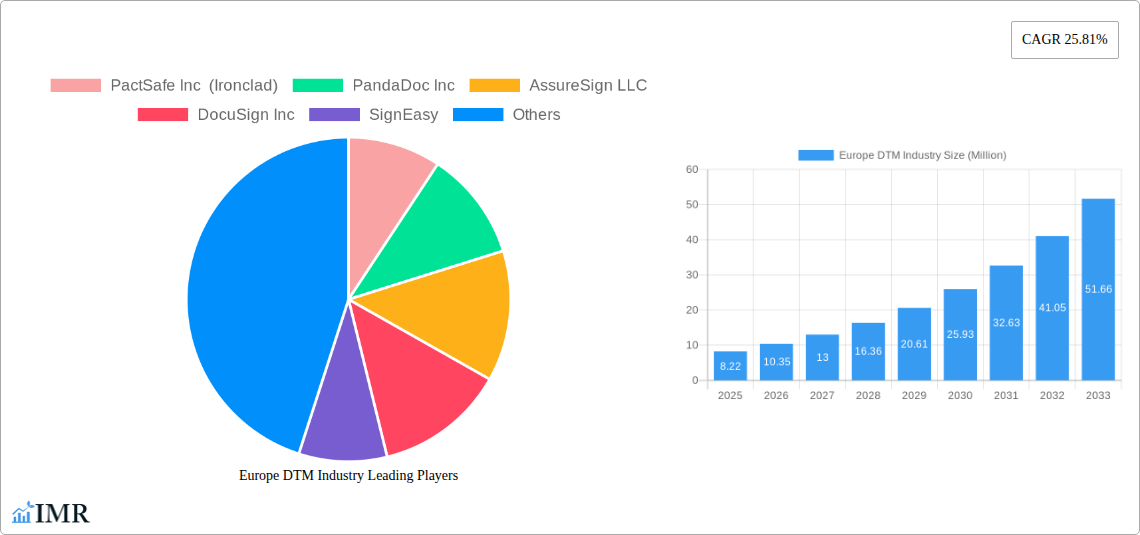

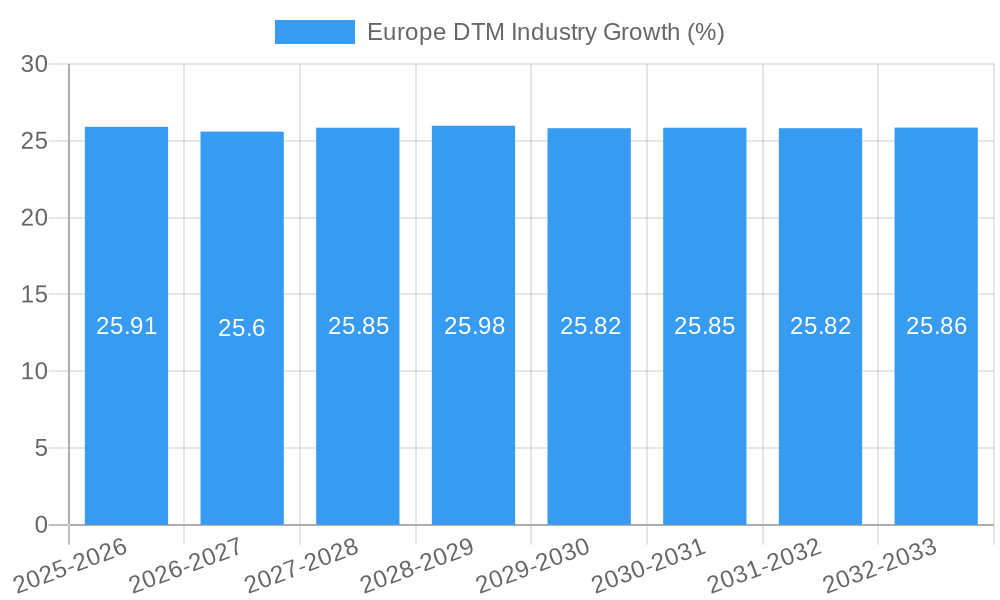

The European Digital Transaction Management (DTM) market is experiencing robust expansion, projected to reach approximately USD 8.22 million in 2025, with an impressive Compound Annual Growth Rate (CAGR) of 25.81% expected throughout the forecast period of 2025-2033. This significant growth is propelled by a confluence of factors, notably the increasing demand for enhanced workflow automation, heightened security in digital agreements, and the imperative for regulatory compliance across various industries. The adoption of DTM solutions is no longer confined to large enterprises; Small and Medium Enterprises (SMEs) are increasingly recognizing the benefits of digitalizing their transaction processes, leading to wider market penetration. Key drivers include the shift towards remote work, which necessitates secure and efficient remote signing capabilities, and the growing digital transformation initiatives across sectors like BFSI, healthcare, and retail. Furthermore, the inherent advantages of DTM, such as reduced operational costs, faster transaction cycles, and improved customer experience, are compelling businesses to invest in these advanced technologies.

The European DTM landscape is characterized by dynamic trends and strategic initiatives aimed at expanding its reach and enhancing its capabilities. Innovations in areas such as electronic signatures, identity verification, and document workflow automation are shaping the market. Solution providers are focusing on developing integrated platforms that offer end-to-end document lifecycle management, from creation to archiving. The emphasis on data security and privacy, particularly in light of stringent regulations like GDPR, is a critical trend, driving the demand for DTM solutions that offer robust compliance features. While the market is on an upward trajectory, certain restraints, such as the initial cost of implementation and the need for significant organizational change management, can pose challenges. However, the long-term benefits and the increasing digital imperative are expected to outweigh these hurdles, ensuring sustained growth. Emerging markets within Europe, including the United Kingdom, Germany, and France, are leading the adoption, with other nations like Spain, Italy, and the Netherlands also demonstrating significant potential.

This comprehensive report delivers an in-depth analysis of the Europe Digital Transaction Management (DTM) industry, exploring its dynamic market structure, key growth drivers, and evolving landscape. With a forecast period extending to 2033, this report provides actionable insights for stakeholders seeking to capitalize on the burgeoning demand for digital signatures, electronic agreements, and automated workflow solutions. The analysis covers DTM solutions, DTM services, and examines market penetration across Small and Medium Enterprises (SME) and Large Enterprises. Delve into the critical end-user industries including BFSI, Healthcare, Retail, IT and Telecommunication, and Other End-user Industries. All quantitative values are presented in Million units.

Europe DTM Industry Market Dynamics & Structure

The European Digital Transaction Management (DTM) market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and increasing end-user adoption. Market concentration is moderate, with several prominent players vying for market share, driven by a competitive landscape that includes established giants and agile disruptors. Technological innovation is a primary growth driver, fueled by advancements in Artificial Intelligence (AI) for contract analysis and automation, blockchain for enhanced security, and cloud-based platforms for seamless accessibility. The regulatory landscape, particularly the eIDAS regulation in Europe, provides a robust framework that fosters trust and encourages the widespread adoption of electronic signatures and digital transactions.

- Market Concentration: Moderate, with key players like DocuSign Inc., Adobe Inc., and PactSafe Inc. (Ironclad) holding significant market presence.

- Technological Innovation Drivers: AI-powered contract analysis, blockchain security, cloud infrastructure, mobile accessibility.

- Regulatory Frameworks: eIDAS regulation significantly bolsters trust and legal validity of electronic transactions.

- Competitive Product Substitutes: While DTM offers clear advantages, traditional paper-based processes and manual document handling still represent a substitute in some segments.

- End-User Demographics: Increasing digital literacy and a growing preference for convenience across all age groups.

- M&A Trends: Consolidation is expected as larger players acquire innovative startups to expand their product portfolios and market reach. Recent M&A activities in the parent market indicate a strong trend towards integrated solutions. The child market is also witnessing strategic partnerships to enhance service offerings.

Europe DTM Industry Growth Trends & Insights

The Europe DTM industry is on a trajectory of robust expansion, driven by a confluence of factors that are fundamentally reshaping how businesses manage transactions and agreements. The market size is projected to witness a significant compound annual growth rate (CAGR) from 2025 to 2033, reflecting an accelerating adoption of digital processes across all sectors. This growth is underpinned by increasing adoption rates of electronic signature solutions, driven by the inherent efficiency gains and cost reductions they offer. Technological disruptions, particularly the integration of AI and machine learning into DTM platforms, are revolutionizing contract lifecycle management, moving beyond simple signing to intelligent analysis and automation.

The shift in consumer behavior towards digital-first interactions and the growing expectation of seamless, on-demand services are compelling businesses to invest in DTM solutions. This is particularly evident in sectors like BFSI and IT, where the volume of transactions and the need for rapid, secure processing are paramount. The parent market is experiencing sustained growth, with the child market mirroring this expansion through specialized offerings. Insights from the historical period (2019-2024) indicate a steady climb in market penetration, with the base year 2025 showcasing a solid foundation for future growth. The forecast period (2025-2033) anticipates this momentum to continue, propelled by digital transformation initiatives and the ongoing need for secure and efficient transaction management.

Dominant Regions, Countries, or Segments in Europe DTM Industry

The European DTM industry's dominance is multi-faceted, with key regions, countries, and segments exhibiting significant growth potential and market penetration. Among the Component segments, DTM Solutions are currently the primary growth driver, encompassing electronic signature platforms, workflow automation tools, and secure document management systems. The demand for these integrated solutions is outpacing standalone services as businesses seek end-to-end digital transaction capabilities. Within Organization Size, Large Enterprises represent a dominant segment, driven by their higher transaction volumes, more complex compliance requirements, and greater capacity for investment in advanced DTM technologies. However, the Small and Medium Enterprise (SME) segment is rapidly growing, fueled by the availability of scalable and affordable DTM solutions that address their unique business needs.

In terms of End-user Industries, the BFSI sector consistently demonstrates strong adoption, owing to the critical need for secure, compliant, and efficient handling of financial agreements, loan applications, and account openings. The IT and Telecommunication sector also plays a pivotal role, with its high volume of service agreements, customer onboarding processes, and software licensing contracts. The Healthcare industry is increasingly embracing DTM for patient consent forms, medical record management, and administrative processes, driven by privacy regulations and the need for streamlined operations. Retail is also a significant contributor, utilizing DTM for sales contracts, warranties, and employee onboarding. "Other End-user Industries" collectively represent a growing market, including government, legal services, and real estate, all benefiting from the efficiency and security offered by DTM. Economic policies promoting digitalization and robust IT infrastructure within countries like Germany, the UK, and France are key drivers of regional dominance, with a significant market share and promising growth potential.

Europe DTM Industry Product Landscape

The Europe DTM industry is witnessing a surge of innovative product offerings that are enhancing efficiency, security, and user experience. Key product innovations include AI-powered features for intelligent document analysis, such as key terms extraction and summarization, simplifying complex contract reviews. Advanced security measures, including blockchain integration, are providing immutable audit trails and enhanced data integrity. Mobile-first design principles are enabling seamless transaction management on the go. Performance metrics are increasingly focused on speed of document turnaround, reduction in manual errors, and improved compliance rates. Unique selling propositions often revolve around the ease of integration with existing business systems, robust API capabilities, and comprehensive customer support. Technological advancements are continuously pushing the boundaries of what DTM can achieve, moving towards fully automated and intelligent transaction workflows.

Key Drivers, Barriers & Challenges in Europe DTM Industry

Key Drivers:

- Digital Transformation Initiatives: Widespread adoption of digital technologies across European businesses.

- Efficiency and Cost Savings: Reduction in paper, printing, mailing, and manual processing costs.

- Enhanced Security and Compliance: Robust regulatory frameworks like eIDAS and increasing data privacy concerns.

- Improved Customer Experience: Faster transaction times and convenient, accessible digital processes.

- Technological Advancements: AI, blockchain, and cloud computing enhancing DTM capabilities.

- Remote Work Trends: Increased reliance on digital tools for seamless collaboration and transaction management.

Key Barriers & Challenges:

- Legacy Systems Integration: Difficulties in integrating DTM solutions with outdated IT infrastructure.

- Resistance to Change: Inertia and user reluctance to adopt new digital workflows.

- Varying Digital Maturity: Uneven adoption rates and digital literacy across different regions and business sizes.

- Perceived Complexity: Some organizations may find initial implementation and setup complex.

- Cybersecurity Concerns: Although DTM enhances security, ongoing vigilance against evolving cyber threats is crucial.

- Competitive Pressures: Intense competition among DTM providers necessitates continuous innovation and competitive pricing.

Emerging Opportunities in Europe DTM Industry

Emerging opportunities in the Europe DTM industry lie in the further integration of AI for predictive contract analytics and risk assessment, moving beyond mere automation. The untapped potential within the Other End-user Industries, particularly in public sector digitalization and the growing gig economy, presents significant growth avenues. Evolving consumer preferences for hyper-personalized and instantaneous digital interactions will drive demand for more sophisticated and intuitive DTM experiences. The expansion of DTM solutions into new geographical markets within Europe, especially in regions with developing digital infrastructure, offers considerable scope for market penetration. Furthermore, the development of specialized DTM solutions tailored for niche industries, such as the creative arts or non-profit sector, could unlock new customer segments.

Growth Accelerators in the Europe DTM Industry Industry

The long-term growth of the Europe DTM industry is being significantly accelerated by continuous technological breakthroughs, particularly in the realm of AI and machine learning, which are enabling more intelligent contract analysis and workflow automation. Strategic partnerships between DTM providers and complementary technology companies, such as CRM or ERP providers, are facilitating seamless integration and expanding market reach. Aggressive market expansion strategies by leading players, targeting underserved segments and regions, are also playing a crucial role. The increasing emphasis on sustainability and paperless operations, driven by both corporate social responsibility and regulatory pressures, further acts as a powerful catalyst for DTM adoption.

Key Players Shaping the Europe DTM Industry Market

- PactSafe Inc (Ironclad)

- PandaDoc Inc

- AssureSign LLC

- DocuSign Inc

- SignEasy

- ZorroSign Inc

- Adobe Inc

- Nintex Group Pty Ltd

- Mitratech Holdings Inc

- InfoCert SpA (Tinexta SpA)

- Topaz Systems Inc

- Namirial SpA

- Scrive A

- eOriginal Inc

Notable Milestones in Europe DTM Industry Sector

- April 2024: Signeasy launched public beta of its AI-powered features, including key terms extraction, AI summary, and smart Q&A, significantly streamlining the contract review process.

- November 2023: ZorroSign Inc. released its next-generation Android mobile application, enhancing user experience, security, and compliance for digital transactions across various industries.

In-Depth Europe DTM Industry Market Outlook

- April 2024: Signeasy launched public beta of its AI-powered features, including key terms extraction, AI summary, and smart Q&A, significantly streamlining the contract review process.

- November 2023: ZorroSign Inc. released its next-generation Android mobile application, enhancing user experience, security, and compliance for digital transactions across various industries.

In-Depth Europe DTM Industry Market Outlook

The future market potential for the Europe DTM industry is exceptionally bright, driven by sustained digitalization trends and an ever-increasing demand for secure, efficient, and compliant transaction management. Growth accelerators such as AI-driven automation, seamless integration capabilities, and a growing focus on user experience will continue to propel market expansion. Strategic opportunities include further penetration into underserved SME markets, developing specialized DTM solutions for emerging industries, and capitalizing on the ongoing need for robust data security and privacy compliance. The market is poised for significant growth, offering substantial value to businesses across the European continent.

Europe DTM Industry Segmentation

-

1. Component

- 1.1. Solutions

- 1.2. Services

-

2. Organization Size

- 2.1. Small and Medium Enterprise

- 2.2. Large Enterprise

-

3. End-user Industry

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Retail

- 3.4. IT and Telecommunication

- 3.5. Other End-user Industries

Europe DTM Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe DTM Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 25.81% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in E-signatures and Adoption of Cloud Services; Ongoing Focus on Automation of Businesses

- 3.3. Market Restrains

- 3.3.1. Geopolitical Situation and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. IT and Telecommunication Industry to be the Largest End User

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Component

- 5.1.1. Solutions

- 5.1.2. Services

- 5.2. Market Analysis, Insights and Forecast - by Organization Size

- 5.2.1. Small and Medium Enterprise

- 5.2.2. Large Enterprise

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Retail

- 5.3.4. IT and Telecommunication

- 5.3.5. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Component

- 6. Germany Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe DTM Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 PactSafe Inc (Ironclad)

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 PandaDoc Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 AssureSign LLC

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 DocuSign Inc

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 SignEasy

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 ZorroSign Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Adobe Inc

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Nintex Group Pty Ltd

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Mitratech Holdings Inc

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 InfoCert SpA (Tinexta SpA)

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.11 Topaz Systems Inc

- 13.2.11.1. Overview

- 13.2.11.2. Products

- 13.2.11.3. SWOT Analysis

- 13.2.11.4. Recent Developments

- 13.2.11.5. Financials (Based on Availability)

- 13.2.12 Namirial SpA

- 13.2.12.1. Overview

- 13.2.12.2. Products

- 13.2.12.3. SWOT Analysis

- 13.2.12.4. Recent Developments

- 13.2.12.5. Financials (Based on Availability)

- 13.2.13 Scrive A

- 13.2.13.1. Overview

- 13.2.13.2. Products

- 13.2.13.3. SWOT Analysis

- 13.2.13.4. Recent Developments

- 13.2.13.5. Financials (Based on Availability)

- 13.2.14 eOriginal Inc

- 13.2.14.1. Overview

- 13.2.14.2. Products

- 13.2.14.3. SWOT Analysis

- 13.2.14.4. Recent Developments

- 13.2.14.5. Financials (Based on Availability)

- 13.2.1 PactSafe Inc (Ironclad)

List of Figures

- Figure 1: Europe DTM Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe DTM Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe DTM Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe DTM Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 3: Europe DTM Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 4: Europe DTM Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 5: Europe DTM Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Europe DTM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Germany Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: France Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Italy Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Netherlands Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Sweden Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Rest of Europe Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Europe DTM Industry Revenue Million Forecast, by Component 2019 & 2032

- Table 15: Europe DTM Industry Revenue Million Forecast, by Organization Size 2019 & 2032

- Table 16: Europe DTM Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Europe DTM Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United Kingdom Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Germany Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: France Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Italy Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Spain Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Netherlands Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Belgium Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Sweden Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Norway Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 27: Poland Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Denmark Europe DTM Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe DTM Industry?

The projected CAGR is approximately 25.81%.

2. Which companies are prominent players in the Europe DTM Industry?

Key companies in the market include PactSafe Inc (Ironclad), PandaDoc Inc, AssureSign LLC, DocuSign Inc, SignEasy, ZorroSign Inc, Adobe Inc, Nintex Group Pty Ltd, Mitratech Holdings Inc, InfoCert SpA (Tinexta SpA), Topaz Systems Inc, Namirial SpA, Scrive A, eOriginal Inc.

3. What are the main segments of the Europe DTM Industry?

The market segments include Component, Organization Size, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.22 Million as of 2022.

5. What are some drivers contributing to market growth?

Rise in E-signatures and Adoption of Cloud Services; Ongoing Focus on Automation of Businesses.

6. What are the notable trends driving market growth?

IT and Telecommunication Industry to be the Largest End User.

7. Are there any restraints impacting market growth?

Geopolitical Situation and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

April 2024: Signeasy, one of the leading e-signature and contract management platforms, announced an exciting leap forward with the public beta release of its AI-powered features. With capabilities like key terms extraction, AI summary, and smart Q&A, this launch transforms the traditionally tedious contract review process into a swift, seamless experience, saving businesses significant time and resources.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe DTM Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe DTM Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe DTM Industry?

To stay informed about further developments, trends, and reports in the Europe DTM Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence