Key Insights

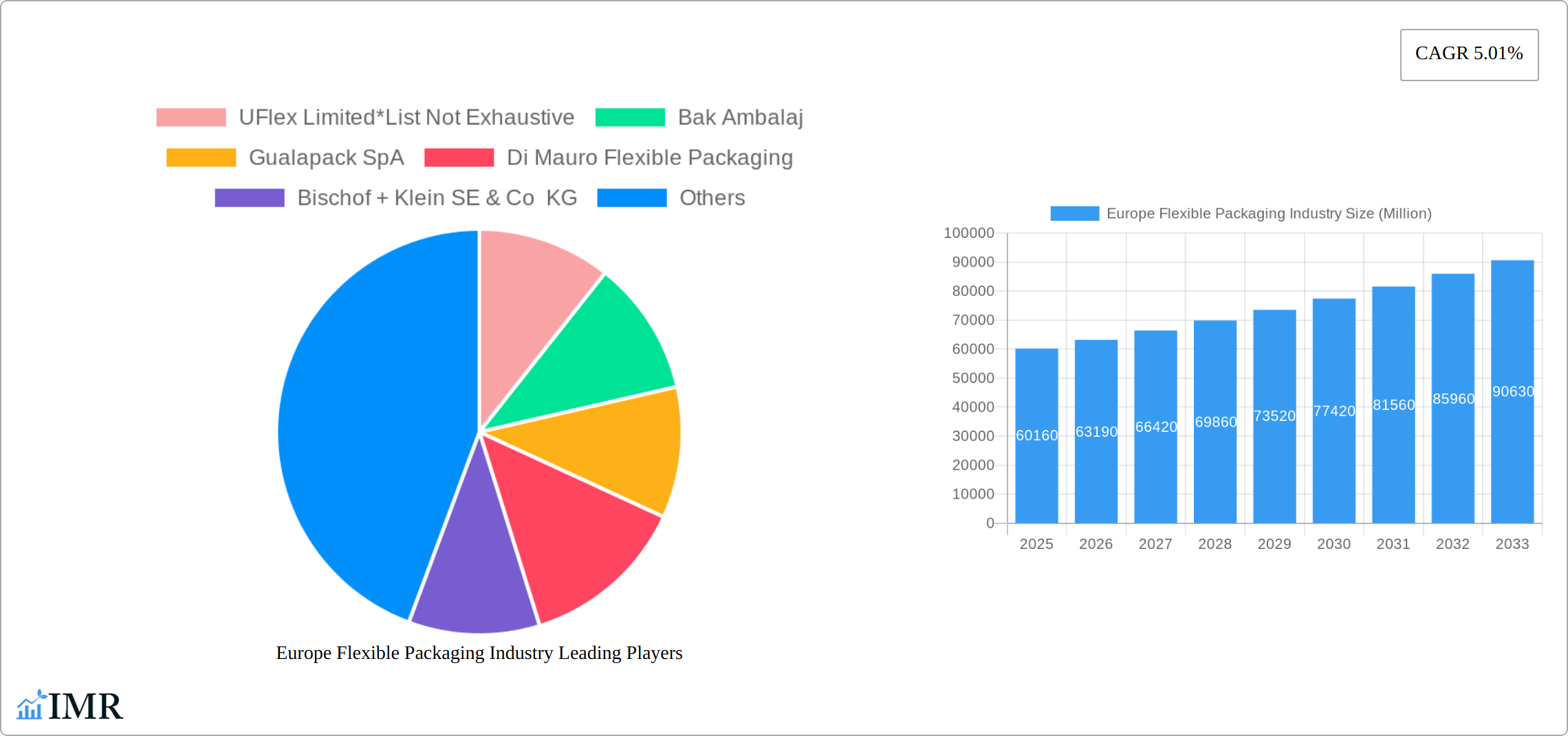

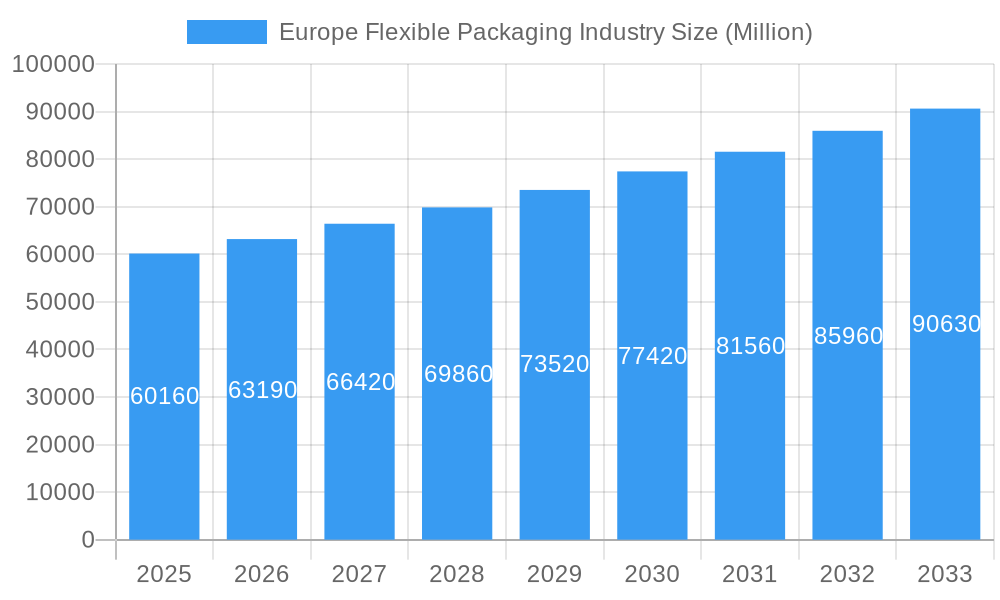

The European flexible packaging market, valued at €60.16 billion in 2025, is projected to experience robust growth, exhibiting a Compound Annual Growth Rate (CAGR) of 5.01% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning food and beverage sector, particularly within Western Europe, fuels significant demand for flexible packaging solutions offering extended shelf life, improved product protection, and enhanced convenience. The rise of e-commerce and the increasing popularity of ready-to-eat meals further contribute to market growth. Furthermore, the healthcare and pharmaceuticals sector's adoption of flexible packaging for improved product safety and tamper evidence enhances market prospects. Sustainability concerns are also shaping the market, with a growing preference for recyclable and biodegradable materials like bio-based polymers gaining traction. While material cost fluctuations and stringent regulatory compliance pose some challenges, the overall market trajectory remains positive.

Europe Flexible Packaging Industry Market Size (In Billion)

Growth is expected to be particularly strong in countries like Germany, France, and the UK, reflecting their robust economies and advanced packaging infrastructure. The segment breakdown reveals a diverse market. Pouches (retort, stand-up, and flat) and bags (gusseted and wicketed) dominate the product landscape, followed by packaging films. Polyethylene (PE) and Biaxially Oriented Polypropylene (BOPP) remain leading material types due to their cost-effectiveness and versatility. However, the increasing demand for sustainable alternatives will likely drive increased market share for other materials in the coming years, such as more sustainable options and materials with improved barrier properties. Competitive dynamics are intense, with a mix of established multinational corporations and specialized regional players vying for market share. The ongoing consolidation and strategic partnerships within the industry further contribute to the dynamic nature of the European flexible packaging market.

Europe Flexible Packaging Industry Company Market Share

Europe Flexible Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe flexible packaging industry, covering market dynamics, growth trends, dominant segments, and key players. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report leverages extensive data and qualitative insights to offer a 360-degree view of this dynamic market, invaluable for industry professionals, investors, and strategic decision-makers. The report covers a market size of xx Million units.

Keywords: Europe flexible packaging, flexible packaging market, packaging industry Europe, food packaging, healthcare packaging, sustainable packaging, Polyethene (PE), Biaxially Oriented Polypropylene (BOPP), pouches, bags, packaging films, Amcor, Mondi, Berry Global, UFlex.

Europe Flexible Packaging Industry Market Dynamics & Structure

The European flexible packaging market is characterized by a dynamic interplay between established multinational corporations and agile, specialized local players. This competitive landscape is significantly shaped by a relentless drive for technological innovation, primarily fueled by a growing imperative for sustainability and evolving consumer demands for convenience, functionality, and environmental responsibility. Stringent and evolving regulatory frameworks, particularly concerning material recyclability, food safety, and carbon footprint reduction, are not merely compliance hurdles but are increasingly becoming catalysts for innovation and strategic differentiation. The industry continuously navigates challenges such as competition from alternative packaging formats and the volatility of raw material prices, necessitating strategic sourcing and operational efficiencies. This dynamic environment fosters robust Mergers & Acquisitions (M&A) activity, as key players strategically consolidate to expand market reach, enhance product portfolios, and gain a competitive edge.

- Market Concentration: Moderately concentrated, with a few major players holding significant market share (approx. xx-xx%). The presence of numerous small to medium-sized enterprises (SMEs) fosters niche specialization and innovation.

- Technological Innovation: A strong emphasis on developing and implementing sustainable material solutions, including advanced biodegradable polymers, mono-material structures designed for enhanced recyclability, and the incorporation of significant percentages of post-consumer recycled (PCR) content. Innovations also extend to advanced barrier technologies that extend shelf life and reduce food waste.

- Regulatory Landscape: The regulatory environment is becoming increasingly stringent, with a focus on the Extended Producer Responsibility (EPR) schemes, single-use plastic directives, and evolving food contact material regulations. These regulations are driving the transition towards a circular economy model within the flexible packaging sector.

- Competitive Substitutes: Ongoing competition from rigid packaging solutions (e.g., glass, metal cans, rigid plastic containers) and emerging material alternatives. The industry's response involves highlighting the inherent advantages of flexible packaging, such as reduced material usage, lower transportation emissions, and superior product protection.

- End-User Demographics: Shifting consumer preferences are a critical driver, with a growing demand for packaging that is not only convenient and preserves product freshness but also aligns with ethical and environmental values. This includes a desire for reduced plastic waste and the use of natural or recycled materials.

- M&A Trends: Consolidation through strategic mergers and acquisitions continues to be a significant trend, leading to the formation of larger, more diversified entities capable of offering integrated solutions and achieving economies of scale. Over the past five years, approximately xx-xx strategic M&A deals have been recorded, indicating a high level of industry dynamism and a pursuit of market leadership.

Europe Flexible Packaging Industry Growth Trends & Insights

The European flexible packaging market exhibited a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033), reaching a market value of xx Million units by 2033. Growth is fueled by increasing demand across various end-user sectors, particularly food and beverage, driven by factors such as population growth, changing consumption patterns, and the rise of e-commerce. Technological advancements in materials science and packaging machinery contribute to enhanced performance and sustainability features. Consumer preference shifts toward convenient, sustainable, and tamper-evident packaging solutions also contribute to market expansion. Market penetration of sustainable packaging options is steadily increasing. The adoption rate for eco-friendly flexible packaging is projected to grow at xx% annually during the forecast period.

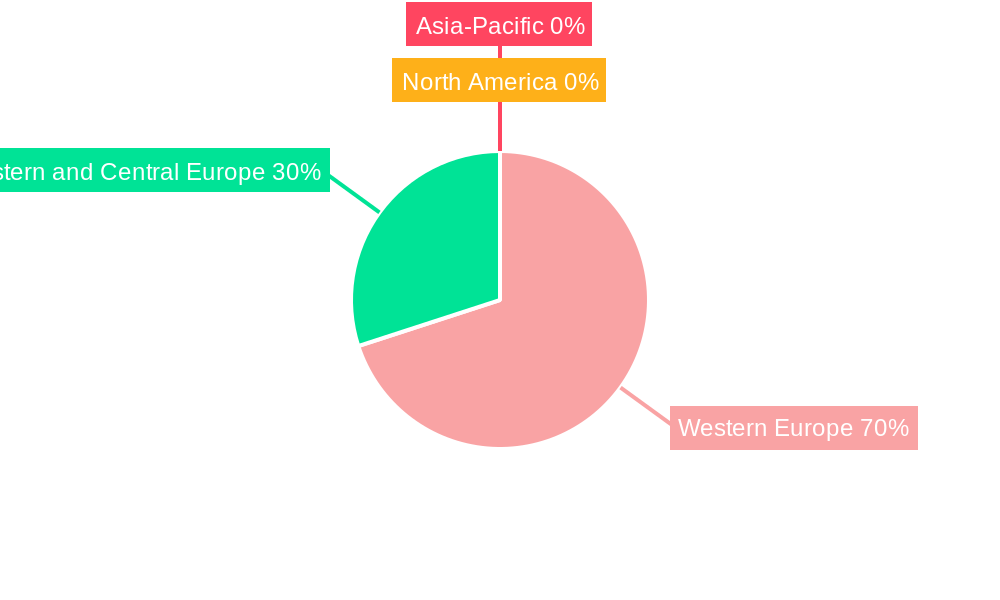

Dominant Regions, Countries, or Segments in Europe Flexible Packaging Industry

Western Europe dominates the European flexible packaging market, driven by high consumption levels and advanced packaging technologies. Within Western Europe, Germany and the UK are key markets due to their robust manufacturing sectors and well-established supply chains. Spain, as part of Western Europe, represents a crucial regional market for flexible packaging, particularly due to a strong food and beverage industry. The Food segment, specifically within the Beverage sub-segment, currently leads market growth, holding an estimated xx% market share. The strong growth in the beverage sector is attributed to factors such as the rising demand for ready-to-drink beverages, increasing adoption of flexible pouches for convenience and portability, and the sustainability focus of many beverage companies.

- Key Growth Drivers in Western Europe: Established industrial infrastructure, high disposable income, and strong demand from food and beverage sectors.

- Key Growth Drivers in Spain: Growing tourism sector, robust food and beverage production, and increasing adoption of sustainable packaging.

- Market Share of the Food Segment: Significant market share within the flexible packaging industry (estimated xx%), due to the widespread use of flexible packaging in food and beverage products.

- Growth Potential of the Food Segment: Continued expansion driven by innovation in sustainable packaging and increasing demand for convenient food packaging.

Europe Flexible Packaging Industry Product Landscape

The European flexible packaging product landscape is exceptionally diverse, catering to a vast array of consumer and industrial needs. Dominant product categories include high-performance pouches (e.g., stand-up pouches with resealable features, retort pouches for extended shelf life, and flat pouches for efficient storage), versatile bags (including gusseted bags for bulk products and wicketed bags for high-speed filling operations), and a wide spectrum of specialized films. The current wave of innovation is intensely focused on enhancing functionality and sustainability. This includes the development of advanced barrier films that significantly extend product shelf life and reduce spoilage, materials engineered for improved recyclability through mono-material designs or enhanced separation technologies, and the integration of user-centric features such as tamper-evident seals for enhanced security and easy-open mechanisms for improved consumer convenience. Cutting-edge advancements in material science are at the forefront, with a notable surge in the development and application of biodegradable and compostable films derived from renewable resources. Key selling propositions in this evolving market revolve around superior barrier protection against moisture, oxygen, and light, demonstrably improved product shelf life, tangible sustainability benefits, and optimized cost-effectiveness throughout the value chain.

Key Drivers, Barriers & Challenges in Europe Flexible Packaging Industry

Key Drivers: Growing demand from the food and beverage sectors, increasing adoption of sustainable packaging, advancements in materials and manufacturing technologies, and stringent regulations driving innovation.

Challenges: Fluctuations in raw material prices, intense competition, stringent environmental regulations requiring increased investment in sustainable solutions, and maintaining supply chain stability amid geopolitical uncertainty. These challenges create pressure on profit margins and require companies to invest in research and development for innovative, sustainable solutions.

Emerging Opportunities in Europe Flexible Packaging Industry

The European flexible packaging industry is poised for significant growth, with numerous emerging opportunities driven by evolving market demands and technological advancements. A primary area of opportunity lies within the rapidly expanding market for sustainable and recyclable flexible packaging, particularly in the development and widespread adoption of biodegradable and compostable films that offer environmentally responsible end-of-life solutions. Growth is also anticipated in highly specialized applications, such as the integration of active and intelligent packaging solutions. These cutting-edge technologies incorporate sensors, indicators, and other smart features to monitor product freshness, track supply chain conditions, and enhance consumer engagement. The burgeoning growth of e-commerce presents substantial opportunities for the development of specialized packaging solutions that are robust, lightweight, and optimized for direct-to-consumer shipping, alongside a growing demand for personalized packaging solutions that cater to specific consumer preferences and branding needs. Furthermore, untapped market potential exists within the emerging economies of Eastern Europe, where demand for modern packaging solutions is on the rise. Significant expansion potential is also identified within crucial sectors like healthcare and pharmaceuticals, where stringent requirements for sterility, protection, and traceability are driving innovation in specialized flexible packaging formats.

Growth Accelerators in the Europe Flexible Packaging Industry

Technological breakthroughs in barrier materials and sustainable solutions will be key drivers of long-term growth. Strategic partnerships between packaging manufacturers, material suppliers, and brand owners will foster innovation and enhance sustainability efforts. Expansion into new geographical markets, particularly in Eastern Europe, combined with the development of innovative packaging designs and improved sustainability profiles will accelerate market growth.

Key Players Shaping the Europe Flexible Packaging Industry Market

- UFlex Limited

- Bak Ambalaj

- Gualapack SpA

- Di Mauro Flexible Packaging

- Bischof + Klein SE & Co KG

- CDM Packaging

- Schur Flexible

- Wipak Oy

- Mondi Group

- Danaflex Group

- Amcor PLC

- BERRY GLOBAL INC

- Aluflexpack Group

- Treofan group (Bc Jindal)

- Coveris Holdings

- Cellografica Gerosa SpA

- Constantia Flexibles

- ProAmpac LLC

- Sipospack

- Huhtamaki Oyj

- ePac Holdings LLC

- AL INVEST BA

Notable Milestones in Europe Flexible Packaging Industry Sector

- April 2023: Berry Global announces the development of its International Center of Excellence and Circular Innovation Hub in Barcelona, Spain, focusing on sustainable packaging solutions. This signifies a significant investment in sustainable packaging research and development in Europe.

- April 2022: Mondi launches new recyclable packaging solutions for the food industry, highlighting the growing importance of sustainable packaging in reducing food waste. This product launch reflects the industry's response to the increasing consumer demand for environmentally friendly packaging.

In-Depth Europe Flexible Packaging Industry Market Outlook

The outlook for the European flexible packaging industry is exceptionally robust and promising, underpinned by a confluence of powerful market forces. The relentless pursuit of innovation, particularly in the realm of sustainable materials and circular economy principles, is a primary engine for future growth. The escalating demand for convenient, protective, and aesthetically pleasing packaging solutions across a diverse range of sectors – from food and beverage to healthcare and personal care – continues to fuel market expansion. Furthermore, ongoing advancements in manufacturing processes, including digitalization and automation, are leading to increased efficiency, reduced waste, and enhanced product quality. Strategic investments in cutting-edge research and development, coupled with strategic partnerships and targeted market expansions, will be instrumental in shaping the industry's landscape in the coming years. The unwavering commitment to sustainability and the principles of the circular economy will continue to act as a potent catalyst for further innovation, driving the development of novel materials and packaging designs. This dynamic and forward-looking environment positions the European flexible packaging market as a particularly attractive and high-growth sector for both investors and industry participants seeking to capitalize on evolving consumer needs and environmental imperatives.

Europe Flexible Packaging Industry Segmentation

-

1. Material Type

- 1.1. Polyethene (PE)

- 1.2. Biaxially Oriented Polypropylene (BOPP)

- 1.3. Cast Polypropylene (CPP)

- 1.4. Polyvinyl Chloride (PVC)

- 1.5. PET

- 1.6. Other Material Types (EVOH, EVA, PA, etc.)

-

2. Product Type

- 2.1. Pouches

- 2.2. Bags (Gusseted and Wicketed)

-

2.3. Packaging Films

- 2.3.1. PE-based

- 2.3.2. BOPET

- 2.3.3. CPP and BOPP

- 2.3.4. PVC

- 2.3.5. Other Film Types

- 2.4. Other Product Types

-

3. End-user Verticals

-

3.1. Food

- 3.1.1. Frozen Food

- 3.1.2. Dairy Products

- 3.1.3. Fruits and Vegetables

- 3.1.4. Other Food Products

- 3.2. Beverage

- 3.3. Healthcare and Pharmaceuticals

- 3.4. Cosmetics and Personal Care

- 3.5. Other End-user verticals

-

3.1. Food

Europe Flexible Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Flexible Packaging Industry Regional Market Share

Geographic Coverage of Europe Flexible Packaging Industry

Europe Flexible Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.01% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Steady Rise in Demand for Processed Food; Move Toward Light Weighting Expected to Spur Volume Demand

- 3.3. Market Restrains

- 3.3.1. Dynamic Nature of Regulations in the Region

- 3.4. Market Trends

- 3.4.1. Food Segment is Expected to Drive the Flexible Packaging Market in the Region

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Flexible Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 5.1.1. Polyethene (PE)

- 5.1.2. Biaxially Oriented Polypropylene (BOPP)

- 5.1.3. Cast Polypropylene (CPP)

- 5.1.4. Polyvinyl Chloride (PVC)

- 5.1.5. PET

- 5.1.6. Other Material Types (EVOH, EVA, PA, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Pouches

- 5.2.2. Bags (Gusseted and Wicketed)

- 5.2.3. Packaging Films

- 5.2.3.1. PE-based

- 5.2.3.2. BOPET

- 5.2.3.3. CPP and BOPP

- 5.2.3.4. PVC

- 5.2.3.5. Other Film Types

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.3.1. Food

- 5.3.1.1. Frozen Food

- 5.3.1.2. Dairy Products

- 5.3.1.3. Fruits and Vegetables

- 5.3.1.4. Other Food Products

- 5.3.2. Beverage

- 5.3.3. Healthcare and Pharmaceuticals

- 5.3.4. Cosmetics and Personal Care

- 5.3.5. Other End-user verticals

- 5.3.1. Food

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 UFlex Limited*List Not Exhaustive

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Bak Ambalaj

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Gualapack SpA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Di Mauro Flexible Packaging

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bischof + Klein SE & Co KG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 CDM Packaging

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Schur Flexible

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Wipak Oy

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mondi Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Danaflex Group

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Amcor PLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 BERRY GLOBAL INC

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Aluflexpack Group

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Treofan group (Bc Jindal)

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Coveris Holdings

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Cellografica Gerosa SpA

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Constantia Flexibles

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 ProAmpac LLC

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 Sipospack

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Huhtamaki Oyj

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.21 ePac Holdings LLC

- 6.2.21.1. Overview

- 6.2.21.2. Products

- 6.2.21.3. SWOT Analysis

- 6.2.21.4. Recent Developments

- 6.2.21.5. Financials (Based on Availability)

- 6.2.22 AL INVEST BA

- 6.2.22.1. Overview

- 6.2.22.2. Products

- 6.2.22.3. SWOT Analysis

- 6.2.22.4. Recent Developments

- 6.2.22.5. Financials (Based on Availability)

- 6.2.1 UFlex Limited*List Not Exhaustive

List of Figures

- Figure 1: Europe Flexible Packaging Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Europe Flexible Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 2: Europe Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Europe Flexible Packaging Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 4: Europe Flexible Packaging Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Europe Flexible Packaging Industry Revenue Million Forecast, by Material Type 2020 & 2033

- Table 6: Europe Flexible Packaging Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 7: Europe Flexible Packaging Industry Revenue Million Forecast, by End-user Verticals 2020 & 2033

- Table 8: Europe Flexible Packaging Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: France Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Flexible Packaging Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Flexible Packaging Industry?

The projected CAGR is approximately 5.01%.

2. Which companies are prominent players in the Europe Flexible Packaging Industry?

Key companies in the market include UFlex Limited*List Not Exhaustive, Bak Ambalaj, Gualapack SpA, Di Mauro Flexible Packaging, Bischof + Klein SE & Co KG, CDM Packaging, Schur Flexible, Wipak Oy, Mondi Group, Danaflex Group, Amcor PLC, BERRY GLOBAL INC, Aluflexpack Group, Treofan group (Bc Jindal), Coveris Holdings, Cellografica Gerosa SpA, Constantia Flexibles, ProAmpac LLC, Sipospack, Huhtamaki Oyj, ePac Holdings LLC, AL INVEST BA.

3. What are the main segments of the Europe Flexible Packaging Industry?

The market segments include Material Type, Product Type, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 60.16 Million as of 2022.

5. What are some drivers contributing to market growth?

Steady Rise in Demand for Processed Food; Move Toward Light Weighting Expected to Spur Volume Demand.

6. What are the notable trends driving market growth?

Food Segment is Expected to Drive the Flexible Packaging Market in the Region.

7. Are there any restraints impacting market growth?

Dynamic Nature of Regulations in the Region.

8. Can you provide examples of recent developments in the market?

April 2023 - The ability to access innovative, sustainable packaging solutions is more important than ever as customers worldwide strive to shift to a circular, net-zero economy. Berry Global, which designs and produces innovative, sustainable packaging solutions, will begin developing its International Center of Excellence and Circular Innovation Hub in Barcelona, Spain, as early as the third quarter of 2023.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Flexible Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Flexible Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Flexible Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Flexible Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence