Key Insights

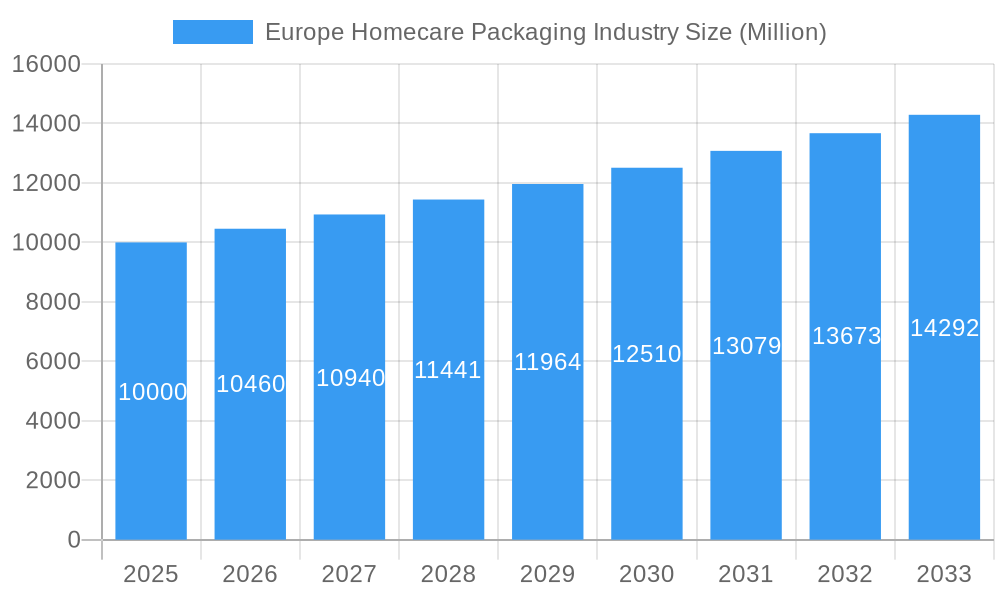

The European homecare packaging market, valued at approximately $20.3 billion in the 2025 base year, is poised for robust expansion. Driven by escalating demand for convenient and sustainable packaging, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 0.4%, reaching an estimated value by 2033. Key growth drivers include the increasing adoption of eco-friendly materials such as recycled plastics and paper, a consumer shift towards smaller, concentrated product formats for enhanced convenience and reduced logistics costs, and heightened awareness of hygiene and sanitation, significantly influenced by recent global health events. Market segmentation indicates plastics and paper as leading material types, with bottles, containers, and cartons dominating packaging formats across diverse homecare categories including dishwashing, laundry care, and personal care. Germany, France, and the United Kingdom represent the largest national markets, attributed to their developed economies and higher per capita consumption. Emerging European economies present notable growth opportunities as consumer preferences and purchasing behaviors evolve. The competitive arena features a blend of multinational corporations and regional specialists, offering prospects for established entities and new entrants prioritizing innovation and sustainability.

Europe Homecare Packaging Industry Market Size (In Billion)

Market growth faces impediments from volatile raw material pricing, particularly for plastics, evolving regulatory frameworks governing packaging waste and recyclability, and persistent pressure to minimize the environmental impact of packaging throughout its lifecycle. The industry is proactively addressing these challenges through investments in advanced recycling technologies, packaging lightweighting initiatives, and the development of innovative, highly recyclable, and compostable materials. Furthermore, companies are intensifying their focus on sustainable material sourcing and embracing circular economy principles to bolster their environmental and social responsibility credentials. The future trajectory of the European homecare packaging market will be shaped by the imperative to balance consumer demands for convenience and affordability with critical environmental considerations and increasingly stringent regulatory compliance.

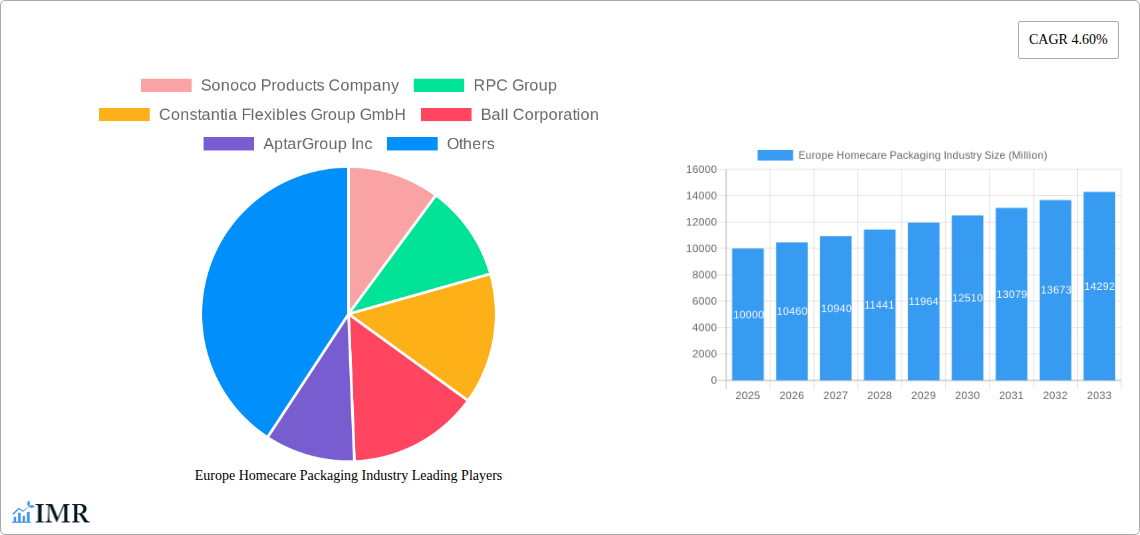

Europe Homecare Packaging Industry Company Market Share

Europe Homecare Packaging Industry: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Europe homecare packaging market, encompassing market dynamics, growth trends, leading segments, and key players. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on opportunities within this dynamic sector. The market is segmented by material (plastic, paper, metal, glass), type (bottles & containers, metal cans, cartons, pouches, other), product (dishwashing, insecticides, laundry care, toiletries, polishes, air care, other), and country (United Kingdom, France, Germany, Italy, Spain, Rest of Europe). Key players include Sonoco Products Company, RPC Group, Constantia Flexibles Group GmbH, Ball Corporation, AptarGroup Inc, DS Smith PLC, Winpak Ltd, Amcor PLC, Can-Pack SA, Silgan Holdings, and ProAmpac, among others. The total market size is estimated at xx Million units in 2025.

Europe Homecare Packaging Industry Market Dynamics & Structure

The European homecare packaging market is characterized by a moderately concentrated landscape, with several large multinational companies holding significant market share. Technological innovation, particularly in sustainable and recyclable packaging solutions, is a key driver. Stringent environmental regulations across Europe are shaping packaging choices, pushing manufacturers towards eco-friendly materials and designs. The market experiences competition from substitute materials, particularly in the shift towards biodegradable and compostable alternatives. End-user demographics, with increasing demand for convenient and sustainable products, are also influencing the market. Mergers and acquisitions (M&A) activity in the sector is relatively frequent, reflecting consolidation and a focus on expanding product portfolios and geographical reach.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on sustainable packaging (recyclable, biodegradable materials) and improved barrier properties.

- Regulatory Framework: Stringent regulations regarding recyclability, material composition, and labeling are driving innovation.

- Competitive Substitutes: Biodegradable plastics, compostable materials, and alternative packaging formats pose a competitive threat.

- End-User Demographics: Growing consumer preference for convenience and sustainability is influencing packaging choices.

- M&A Trends: xx M&A deals recorded in the past 5 years (2020-2025), indicating consolidation and expansion strategies.

Europe Homecare Packaging Industry Growth Trends & Insights

The European homecare packaging market exhibits steady growth, driven by increasing demand for homecare products and ongoing innovation within the packaging sector. The market experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a CAGR of xx% during the forecast period (2025-2033). The adoption of sustainable packaging solutions is accelerating, with a market penetration rate of xx% for recyclable materials in 2025, expected to increase to xx% by 2033. Technological disruptions, such as advancements in material science and printing technologies, are creating opportunities for new and improved packaging formats. Consumer behavior shifts towards e-commerce are influencing packaging designs to improve product protection during shipping. The market size is projected to reach xx Million units by 2033.

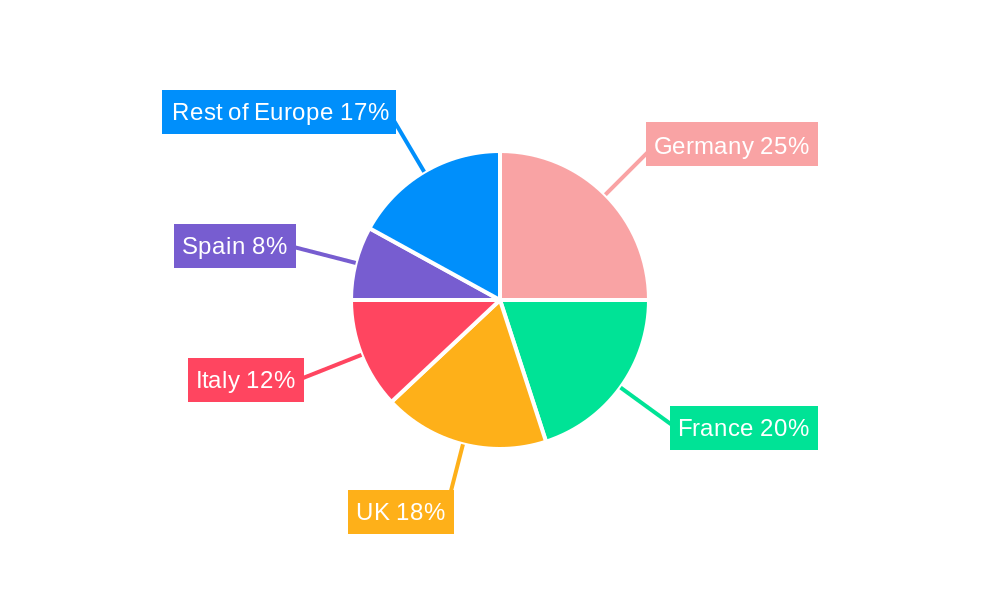

Dominant Regions, Countries, or Segments in Europe Homecare Packaging Industry

The United Kingdom, Germany, and France are the leading countries in the European homecare packaging market, driven by high per capita consumption of homecare products and established manufacturing infrastructure. Within material segments, plastic dominates due to its versatility and cost-effectiveness, while paper and recyclable materials are gaining traction due to environmental concerns. In terms of product segments, the toiletries sector showcases the highest demand, followed by laundry care and dishwashing products. This dominance reflects consumer preferences, regulatory pressures, and established supply chains.

- Key Drivers in Leading Regions:

- UK: Strong consumer spending, advanced logistics, and a significant presence of major homecare brands.

- Germany: Robust manufacturing sector, technological expertise, and stringent environmental regulations driving innovation.

- France: Large population base, established homecare industry, and increasing focus on sustainable packaging.

- Dominant Material Segment: Plastic (xx% market share in 2025), driven by versatility, cost-effectiveness, and established infrastructure.

- Dominant Product Segment: Toiletries (xx% market share in 2025), reflecting high per capita consumption and diverse product offerings.

Europe Homecare Packaging Industry Product Landscape

The homecare packaging landscape is characterized by a diverse range of products, including bottles, containers, metal cans, cartons, pouches, and other specialized formats. Innovation focuses on improved barrier properties to enhance product shelf life and sustainability through the use of recycled materials and lightweight designs. Unique selling propositions include tamper-evident closures, child-resistant packaging, and easy-to-open mechanisms. Technological advancements include improved printing techniques for enhanced branding and information conveyance, and the development of active packaging with enhanced functionalities.

Key Drivers, Barriers & Challenges in Europe Homecare Packaging Industry

Key Drivers: Growing demand for homecare products, rising consumer preference for convenient and sustainable packaging, technological advancements in material science and printing technologies, and supportive government policies promoting sustainability.

Key Challenges: Fluctuating raw material prices, stringent environmental regulations increasing production costs, intense competition among packaging manufacturers, and maintaining a sustainable supply chain amid geopolitical uncertainty. For example, the impact of the increased cost of polypropylene is estimated to have reduced overall industry profitability by approximately xx% in 2024.

Emerging Opportunities in Europe Homecare Packaging Industry

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging solutions, including biodegradable plastics and compostable materials. The increasing adoption of e-commerce is driving demand for packaging suitable for shipping and home delivery. There is also potential in the development of smart packaging incorporating features like sensors and connected technology for improved product traceability and consumer engagement. Untapped market segments include niche homecare products with specialized packaging requirements.

Growth Accelerators in the Europe Homecare Packaging Industry

Technological advancements, particularly in sustainable materials and packaging designs, will be a major growth driver. Strategic partnerships between packaging manufacturers and homecare brands to develop innovative packaging solutions will also accelerate market growth. Expansion into new markets and product segments will continue to fuel growth, along with the increasing adoption of e-commerce and home delivery services.

Key Players Shaping the Europe Homecare Packaging Market

- Sonoco Products Company

- RPC Group

- Constantia Flexibles Group GmbH

- Ball Corporation

- AptarGroup Inc

- DS Smith PLC

- Winpak Ltd

- Amcor PLC

- Can-Pack SA

- Silgan Holdings

- ProAmpac

Notable Milestones in Europe Homecare Packaging Industry Sector

- March 2021: Dettol (Reckitt) partnered with CleanedUp to launch a hygiene program for businesses, boosting demand for sanitizing solution packaging.

- May 2021: Unilever committed to recyclable toothpaste tubes by 2025, driving collaboration with packaging manufacturers like Amcor and EPL.

In-Depth Europe Homecare Packaging Industry Market Outlook

The future of the European homecare packaging market is bright, driven by sustainability trends, technological innovation, and increasing consumer demand. Strategic opportunities lie in developing sustainable packaging solutions, leveraging digital technologies for improved traceability, and expanding into new market segments. The market's continued growth is expected to be fueled by the increasing focus on convenience, hygiene, and eco-conscious consumption.

Europe Homecare Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper

- 1.3. Metal

- 1.4. Glass

-

2. Type

- 2.1. Bottles and Containers

- 2.2. Metal Cans

- 2.3. Cartons

- 2.4. Pouches

- 2.5. Other Types

-

3. Products

- 3.1. Dishwashing

- 3.2. Insecticides

- 3.3. Laundry Care

- 3.4. Toiletries

- 3.5. Polishes

- 3.6. Air Care

- 3.7. Other Products

Europe Homecare Packaging Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Homecare Packaging Industry Regional Market Share

Geographic Coverage of Europe Homecare Packaging Industry

Europe Homecare Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 0.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Product Innovation

- 3.2.2 Differentiation

- 3.2.3 and Branding; Rising Per Capita Income Positively Impacting the Purchase Power

- 3.3. Market Restrains

- 3.3.1. Fluctuations in Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Plastic Material is Expected to Hold a Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Homecare Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Bottles and Containers

- 5.2.2. Metal Cans

- 5.2.3. Cartons

- 5.2.4. Pouches

- 5.2.5. Other Types

- 5.3. Market Analysis, Insights and Forecast - by Products

- 5.3.1. Dishwashing

- 5.3.2. Insecticides

- 5.3.3. Laundry Care

- 5.3.4. Toiletries

- 5.3.5. Polishes

- 5.3.6. Air Care

- 5.3.7. Other Products

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Sonoco Products Company

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RPC Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Constantia Flexibles Group GmbH

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Ball Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 AptarGroup Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 DS Smith PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Winpak Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Amcor PLC

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Can-Pack SA

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Silgan Holdings

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ProAmpac*List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Sonoco Products Company

List of Figures

- Figure 1: Europe Homecare Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Homecare Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: Europe Homecare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Europe Homecare Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 3: Europe Homecare Packaging Industry Revenue billion Forecast, by Products 2020 & 2033

- Table 4: Europe Homecare Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Europe Homecare Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 6: Europe Homecare Packaging Industry Revenue billion Forecast, by Type 2020 & 2033

- Table 7: Europe Homecare Packaging Industry Revenue billion Forecast, by Products 2020 & 2033

- Table 8: Europe Homecare Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: United Kingdom Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Germany Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: France Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Italy Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Spain Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Netherlands Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Belgium Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Sweden Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Norway Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Poland Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Denmark Europe Homecare Packaging Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Homecare Packaging Industry?

The projected CAGR is approximately 0.4%.

2. Which companies are prominent players in the Europe Homecare Packaging Industry?

Key companies in the market include Sonoco Products Company, RPC Group, Constantia Flexibles Group GmbH, Ball Corporation, AptarGroup Inc, DS Smith PLC, Winpak Ltd, Amcor PLC, Can-Pack SA, Silgan Holdings, ProAmpac*List Not Exhaustive.

3. What are the main segments of the Europe Homecare Packaging Industry?

The market segments include Material, Type, Products.

4. Can you provide details about the market size?

The market size is estimated to be USD 20.3 billion as of 2022.

5. What are some drivers contributing to market growth?

Product Innovation. Differentiation. and Branding; Rising Per Capita Income Positively Impacting the Purchase Power.

6. What are the notable trends driving market growth?

Plastic Material is Expected to Hold a Significant Market Share.

7. Are there any restraints impacting market growth?

Fluctuations in Raw Material Prices.

8. Can you provide examples of recent developments in the market?

March 2021 - Dettol (Reckitt) announced the launch of a new program to help businesses raise hygiene standards when they reopen in partnership with CleanedUp, which is known to supply simple and easy to install sanitizing solutions. The new partnership will offer businesses access to hygiene products, freehand sanitizer or wipe dispensers, and enhanced cleaning training materials.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Homecare Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Homecare Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Homecare Packaging Industry?

To stay informed about further developments, trends, and reports in the Europe Homecare Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence