Key Insights

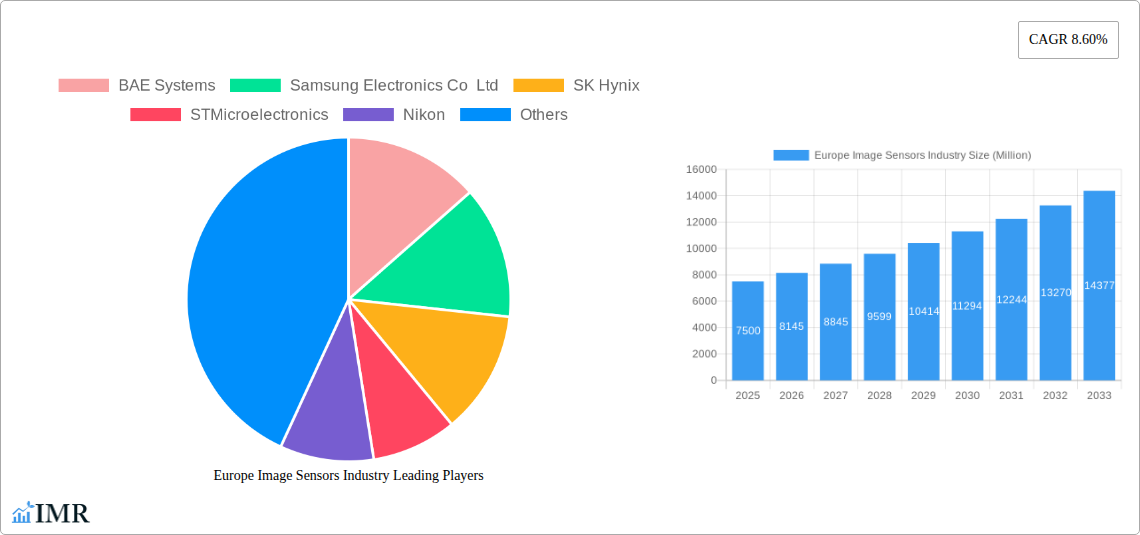

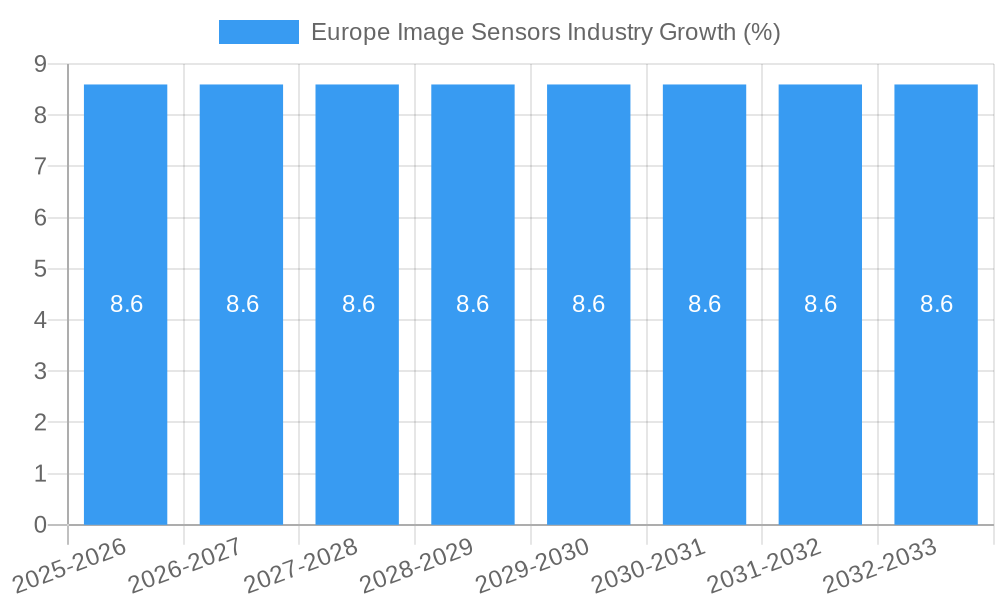

The European Image Sensors Market is poised for substantial growth, projected to reach approximately $7,500 million by 2025 and expand at a robust Compound Annual Growth Rate (CAGR) of 8.60% through 2033. This expansion is fueled by a confluence of factors, most notably the escalating demand for advanced imaging capabilities across a multitude of end-user industries. Consumer electronics, including smartphones and digital cameras, continue to be a primary growth engine, driven by consumers' desire for higher resolution, faster frame rates, and enhanced low-light performance. Simultaneously, the healthcare sector is witnessing a significant uptake of image sensors for medical imaging devices such as endoscopes, diagnostic scanners, and surgical robots, where precision and detail are paramount. The automotive industry's rapid embrace of advanced driver-assistance systems (ADAS) and autonomous driving technologies, which rely heavily on sophisticated camera systems, is another critical driver. Furthermore, the burgeoning security and surveillance sector, propelled by increasing global security concerns and smart city initiatives, further amplifies the demand for reliable and high-performance image sensors.

The market's trajectory is also shaped by evolving technological trends, with CMOS sensors increasingly dominating the landscape due to their superior performance, lower power consumption, and cost-effectiveness compared to CCD sensors. Innovations in sensor technology, such as backside-illuminated (BSI) sensors, stacked CMOS, and advancements in resolution and pixel size, are continually pushing the boundaries of imaging capabilities, enabling new applications and enhancing existing ones. While the market presents immense opportunities, certain restraints may influence its pace. These include the high research and development costs associated with cutting-edge sensor technology and potential supply chain disruptions that could impact production and pricing. However, the strong underlying demand and continuous innovation are expected to outweigh these challenges, positioning the European image sensors market for a dynamic and prosperous future.

Europe Image Sensors Industry Report: Market Size, Growth, Trends, Key Players & Forecast (2019-2033)

This comprehensive report delivers an in-depth analysis of the Europe Image Sensors Industry, a pivotal sector driving innovation across consumer electronics, automotive, healthcare, and industrial applications. We provide critical insights into market dynamics, growth trends, regional dominance, product landscapes, key players, and future outlook, leveraging high-traffic keywords like "Europe image sensors market," "CMOS sensors," "CCD sensors," "automotive image sensors," "industrial image sensors," and "consumer electronics imaging." The report encompasses the study period of 2019–2033, with a base year of 2025, an estimated year of 2025, and a forecast period of 2025–2033, including historical data from 2019–2024. All unit values are presented in Million units.

Europe Image Sensors Industry Market Dynamics & Structure

The Europe image sensors market is characterized by a dynamic interplay of technological advancements, stringent regulatory frameworks, and evolving end-user demands. Market concentration is influenced by the presence of global giants and specialized European players. Technological innovation is a primary driver, fueled by the relentless pursuit of higher resolution, improved low-light performance, and enhanced processing capabilities in image sensors. Regulatory landscapes, particularly concerning data privacy and product safety in automotive and healthcare, significantly shape product development and market access. Competitive product substitutes, while evolving, are often incremental improvements rather than disruptive alternatives. End-user demographics are increasingly sophisticated, demanding higher performance and specialized functionalities from image sensors. Mergers and acquisitions (M&A) activity, though not as high as in some other tech sectors, plays a role in consolidating market share and acquiring innovative technologies.

- Market Concentration: Dominated by a few key global manufacturers with a significant presence in Europe, alongside emerging niche players.

- Technological Innovation Drivers: Miniaturization, AI integration, advanced pixel architectures, and energy efficiency are paramount.

- Regulatory Frameworks: Compliance with EU regulations for automotive safety (e.g., ADAS), medical devices, and industrial automation.

- Competitive Product Substitutes: While CMOS and CCD remain dominant, advancements in sensor fusion and alternative imaging techniques present potential challenges.

- End-User Demographics: Growing demand from the automotive sector for ADAS and autonomous driving, coupled with increased adoption in industrial automation and smart cities.

- M&A Trends: Strategic acquisitions aimed at gaining access to new technologies or expanding market reach in specialized segments.

Europe Image Sensors Industry Growth Trends & Insights

The Europe Image Sensors Industry is poised for significant expansion, driven by escalating demand across diverse sectors and continuous technological innovation. The market size evolution is projected to witness robust growth, with adoption rates for advanced image sensors accelerating, particularly in the automotive and industrial segments. Technological disruptions, such as the integration of AI directly into image sensors and the development of novel sensing technologies like event-based cameras, are reshaping the competitive landscape. Consumer behavior shifts, favoring smarter, more connected devices, are indirectly fueling the demand for higher-performance imaging capabilities. The forecast period is expected to see a Compound Annual Growth Rate (CAGR) of approximately XX% for the Europe image sensors market. This growth is underpinned by increasing penetration of advanced driver-assistance systems (ADAS) in vehicles, the proliferation of smart security and surveillance networks, and the burgeoning use of machine vision in industrial automation and robotics. Furthermore, the healthcare sector's increasing reliance on advanced imaging for diagnostics and monitoring, alongside the relentless innovation in consumer electronics, from smartphones to augmented reality devices, will continue to be major catalysts. The integration of these sensors into the Internet of Things (IoT) ecosystem further amplifies their market potential, creating a sustained upward trajectory for the industry.

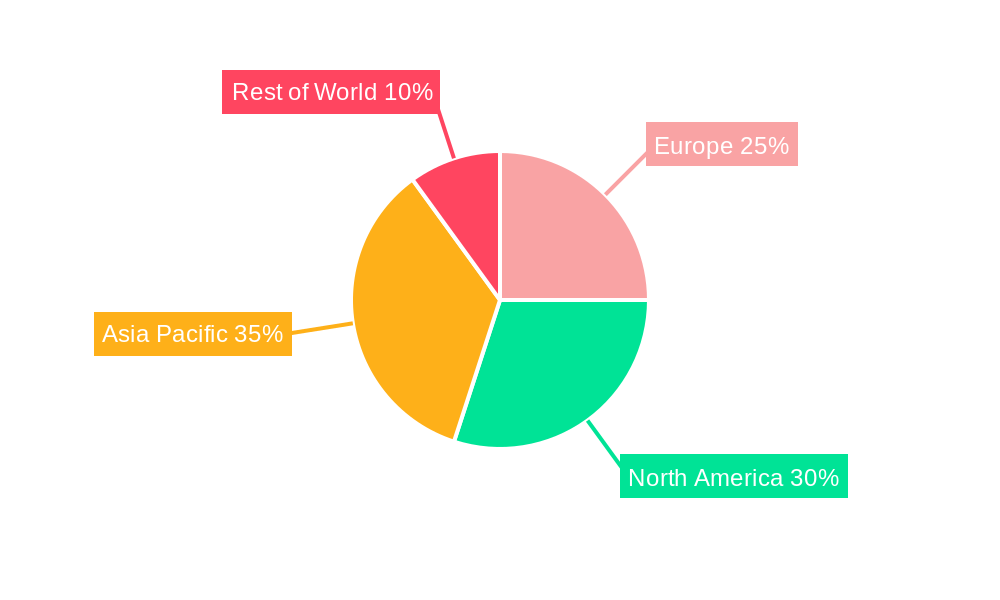

Dominant Regions, Countries, or Segments in Europe Image Sensors Industry

Within the Europe Image Sensors Industry, the Automotive and Transportation segment emerges as a dominant growth engine, closely followed by Consumer Electronics and Industrial applications. Germany, as a leading automotive hub in Europe, spearheads the demand for advanced image sensors essential for autonomous driving technologies, ADAS, and in-car safety features. The country’s robust automotive manufacturing base and significant investments in R&D for self-driving vehicles position it as a critical market. France and the UK also contribute substantially, driven by their respective automotive and industrial sectors.

In the Consumer Electronics realm, countries with high disposable incomes and a strong appetite for the latest gadgets, such as Germany, the UK, and France, exhibit significant demand for high-resolution and feature-rich image sensors used in smartphones, digital cameras, and emerging AR/VR devices. The Industrial segment's growth is propelled by digitalization trends and the adoption of Industry 4.0 initiatives across the continent. Countries with strong manufacturing capabilities, like Germany and Italy, are key drivers, implementing machine vision solutions for quality control, automation, and robotics.

- Dominant Segment - Automotive and Transportation:

- Key Drivers: Mandates for ADAS, increasing adoption of electric and autonomous vehicles, focus on in-cabin monitoring and driver safety.

- Market Share Potential: Expected to capture over XX% of the European image sensor market by 2033.

- Growth Potential: Fueled by stringent safety regulations and consumer demand for advanced automotive features.

- Leading Country - Germany:

- Economic Policies: Strong government support for automotive innovation and R&D funding.

- Infrastructure: Well-developed automotive manufacturing ecosystem and testing facilities.

- Market Share: Accounts for an estimated XX% of the European image sensor market.

- Emerging Segment - Healthcare:

- Key Drivers: Advancements in medical imaging, minimally invasive surgical equipment, and wearable health monitoring devices.

- Growth Potential: Driven by an aging population and the increasing demand for advanced diagnostic tools.

Europe Image Sensors Industry Product Landscape

The Europe image sensors industry is characterized by a vibrant product landscape driven by innovation and a focus on delivering superior imaging performance. Leading companies are continuously introducing advanced CMOS and, to a lesser extent, CCD sensors with enhanced features such as higher resolution (e.g., 50MP, 100MP, and beyond), improved dynamic range for better detail in extreme lighting conditions, and faster frame rates for capturing rapid motion. Innovations in pixel architecture, like back-illuminated sensors and stacked CMOS technology, are becoming standard, leading to enhanced light sensitivity and reduced noise. The development of specialized sensors for niche applications, such as thermal imaging sensors for industrial inspection or hyperspectral sensors for agricultural and environmental monitoring, is also gaining traction. Unique selling propositions often revolve around miniaturization, power efficiency, and the integration of on-chip processing capabilities for tasks like AI inference, enabling smarter and more autonomous imaging systems.

Key Drivers, Barriers & Challenges in Europe Image Sensors Industry

Key Drivers:

- Technological Advancements: The relentless pursuit of higher resolution, improved low-light performance, and increased frame rates in image sensors is a primary growth driver. Innovations in CMOS technology, such as stacked sensors and advanced pixel designs, continue to push performance boundaries.

- Automotive Electrification & Autonomy: The rapidly growing demand for advanced driver-assistance systems (ADAS), autonomous driving, and in-car monitoring systems is a significant catalyst for image sensor adoption in vehicles.

- Industrial Automation (Industry 4.0): The proliferation of robotics, automated quality control, and smart manufacturing processes necessitates sophisticated machine vision, driving demand for industrial-grade image sensors.

- Consumer Electronics Innovation: The continuous evolution of smartphones, drones, AR/VR headsets, and other consumer devices fuels demand for smaller, more powerful, and energy-efficient image sensors.

Barriers & Challenges:

- Supply Chain Disruptions: Geopolitical factors, raw material shortages, and complex global logistics can impact the availability and cost of essential components, leading to production delays.

- High R&D Costs & Long Development Cycles: Developing cutting-edge image sensor technology requires substantial investment in research and development, with long lead times before market introduction.

- Intense Global Competition: The market is highly competitive, with established players and emerging companies vying for market share, putting pressure on pricing and profit margins.

- Regulatory Compliance: Meeting stringent safety, privacy, and environmental regulations in various end-user industries, particularly automotive and healthcare, adds complexity and cost to product development.

- Talent Shortage: A lack of skilled engineers and technicians with expertise in semiconductor design and advanced imaging technologies can pose a challenge for companies seeking to scale operations and innovate.

Emerging Opportunities in Europe Image Sensors Industry

Emerging opportunities within the Europe Image Sensors Industry are vast and multifaceted. The escalating demand for AI-powered edge computing within image sensors presents a significant avenue for growth, enabling on-device intelligent processing for applications like real-time object detection and facial recognition without relying on cloud connectivity. The expanding field of augmented reality (AR) and virtual reality (VR) is creating a substantial need for high-resolution, low-latency image sensors that can accurately capture and render the real world, paving the way for immersive experiences in gaming, training, and remote collaboration. Furthermore, the healthcare sector's drive towards remote patient monitoring and advanced diagnostics offers substantial potential for specialized image sensors in medical devices and wearable health trackers. The increasing focus on sustainability and environmental monitoring also opens doors for hyperspectral and multispectral imaging sensors used in precision agriculture, resource management, and pollution detection.

Growth Accelerators in the Europe Image Sensors Industry Industry

Several key factors are accelerating the long-term growth of the Europe Image Sensors Industry. The ongoing advancement in artificial intelligence (AI) and machine learning algorithms is creating a synergistic effect, driving the demand for more sophisticated image sensors capable of capturing the rich data required for these intelligent systems. Strategic partnerships between sensor manufacturers and AI solution providers are crucial for developing integrated imaging systems that offer enhanced functionalities. Furthermore, the increasing adoption of Industry 4.0 principles and smart manufacturing across Europe is creating a sustained demand for machine vision solutions powered by advanced image sensors. The expansion of 5G infrastructure is also a significant growth accelerator, enabling faster data transfer and real-time processing for image-intensive applications, particularly in the automotive and industrial sectors. Finally, government initiatives promoting digital transformation and innovation across various European nations provide a supportive ecosystem for the growth of the image sensor market.

Key Players Shaping the Europe Image Sensors Industry Market

- BAE Systems

- Samsung Electronics Co Ltd

- SK Hynix

- STMicroelectronics

- Nikon

- On Semiconductor

- Omnivision

- Toshiba

- Panasonic Corporation

- Sony Corporation

Notable Milestones in Europe Image Sensors Industry Sector

- January 2022: SK Hynix initiated mass production of 0.7µm image sensors, intensifying competition with Sony and Samsung Electronics in the global market. The company's 0.7µm 50-million-pixel image sensors are now at par with Sony's offerings.

- September 2021: Samsung Electronics launched a 0.64µm 200-million-pixel image sensor, showcasing advancements in miniaturization and resolution.

- June 2021: Samsung Electronics introduced a 0.64µm 50-million-pixel image sensor, recognized as one of the industry's smallest at the time.

- January 2022 (CES 2022): Omnivision unveiled a 0.62µm pixel image sensor, further pushing the boundaries of miniaturization in image sensor technology.

- December 2021: Canon developed a new image sensor utilizing a single-photon avalanche diode (SPAD) for capturing high-quality color images in extremely low-light conditions, offering significant advantages over traditional CMOS sensors by amplifying single photons for detailed imaging with minimal brightness.

In-Depth Europe Image Sensors Industry Market Outlook

The future outlook for the Europe Image Sensors Industry is exceptionally promising, driven by a confluence of technological advancements and expanding application frontiers. Growth accelerators such as the integration of AI into edge devices, the burgeoning AR/VR market, and the continuous demand for enhanced safety and performance in the automotive sector will significantly shape market expansion. Strategic partnerships and increasing government support for digital transformation initiatives are poised to further fuel innovation and market penetration. The industry's ability to adapt to evolving end-user needs, coupled with a relentless focus on performance improvements and cost-effectiveness, will be crucial in capitalizing on the immense future market potential. Opportunities in emerging sectors like advanced healthcare imaging and environmental monitoring present untapped avenues for significant growth and diversification.

Europe Image Sensors Industry Segmentation

-

1. Type

- 1.1. CMOS

- 1.2. CCD

-

2. End-User Industry

- 2.1. Consumer Electronics

- 2.2. Healthcare

- 2.3. Industrial

- 2.4. Security and Surveillance

- 2.5. Automotive and Transportation

- 2.6. Aerospace and Defense

- 2.7. Other End-user Industries

Europe Image Sensors Industry Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Image Sensors Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 8.60% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Incorporation of high-resolution cameras with image sensors in mobile devices; Improving medical imaging solutions; Increasing expenditure on security and surveillance in public places

- 3.3. Market Restrains

- 3.3.1. High Manufacturing costs

- 3.4. Market Trends

- 3.4.1. The Automotive Segment is Expected to Drive the Market's Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. CMOS

- 5.1.2. CCD

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Consumer Electronics

- 5.2.2. Healthcare

- 5.2.3. Industrial

- 5.2.4. Security and Surveillance

- 5.2.5. Automotive and Transportation

- 5.2.6. Aerospace and Defense

- 5.2.7. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Germany Europe Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 7. France Europe Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 8. Italy Europe Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 9. United Kingdom Europe Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 10. Netherlands Europe Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 11. Sweden Europe Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 12. Rest of Europe Europe Image Sensors Industry Analysis, Insights and Forecast, 2019-2031

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 BAE Systems

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Samsung Electronics Co Ltd

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 SK Hynix

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 STMicroelectronics

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nikon

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 On Semiconductor

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Omnivision*List Not Exhaustive

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Toshiba

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Panasonic Corporation

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Sony Corporation

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 BAE Systems

List of Figures

- Figure 1: Europe Image Sensors Industry Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Europe Image Sensors Industry Share (%) by Company 2024

List of Tables

- Table 1: Europe Image Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Europe Image Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Europe Image Sensors Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: Europe Image Sensors Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Europe Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Germany Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: France Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Italy Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United Kingdom Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: Netherlands Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Sweden Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Rest of Europe Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Europe Image Sensors Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 14: Europe Image Sensors Industry Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 15: Europe Image Sensors Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United Kingdom Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Germany Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: France Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Italy Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: Spain Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Netherlands Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Belgium Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 23: Sweden Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Norway Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Poland Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Denmark Europe Image Sensors Industry Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Image Sensors Industry?

The projected CAGR is approximately 8.60%.

2. Which companies are prominent players in the Europe Image Sensors Industry?

Key companies in the market include BAE Systems, Samsung Electronics Co Ltd, SK Hynix, STMicroelectronics, Nikon, On Semiconductor, Omnivision*List Not Exhaustive, Toshiba, Panasonic Corporation, Sony Corporation.

3. What are the main segments of the Europe Image Sensors Industry?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Incorporation of high-resolution cameras with image sensors in mobile devices; Improving medical imaging solutions; Increasing expenditure on security and surveillance in public places.

6. What are the notable trends driving market growth?

The Automotive Segment is Expected to Drive the Market's Growth.

7. Are there any restraints impacting market growth?

High Manufacturing costs.

8. Can you provide examples of recent developments in the market?

January 2022 - SK Hynix started to mass-produce 0.7 image sensors, getting into competition with Sony and Samsung Electronics in the global image sensor market. The company recently began volume production of 0.7 50-million-pixel image sensors, which are at the same level as Sony products. Samsung Electronics launched a 0.64 50-million-pixel image sensor, one of the industry's smallest, in June 2021 and introduced a 0.64 200-million-pixel sensor in September 2021. Recently, Omnivision of China also took the wraps off a 0.62-pixel image sensor at CES 2022.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Image Sensors Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Image Sensors Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Image Sensors Industry?

To stay informed about further developments, trends, and reports in the Europe Image Sensors Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence