Key Insights

The European security screening market is poised for substantial expansion, driven by escalating security imperatives across diverse industries. Valued at $9.76 billion in 2024, the market is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.2% through 2033. This growth is propelled by stringent security protocols at transportation hubs and borders, coupled with escalating demand for advanced security solutions in critical infrastructure, defense, and other key sectors. The integration of sophisticated technologies such as advanced imaging, millimeter-wave scanners, and explosive trace detection systems is a significant market contributor. Government-led initiatives and increased investment in security infrastructure across Europe further bolster market dynamics. Key markets include Germany, France, the United Kingdom, and Italy, all benefiting from substantial security modernization efforts.

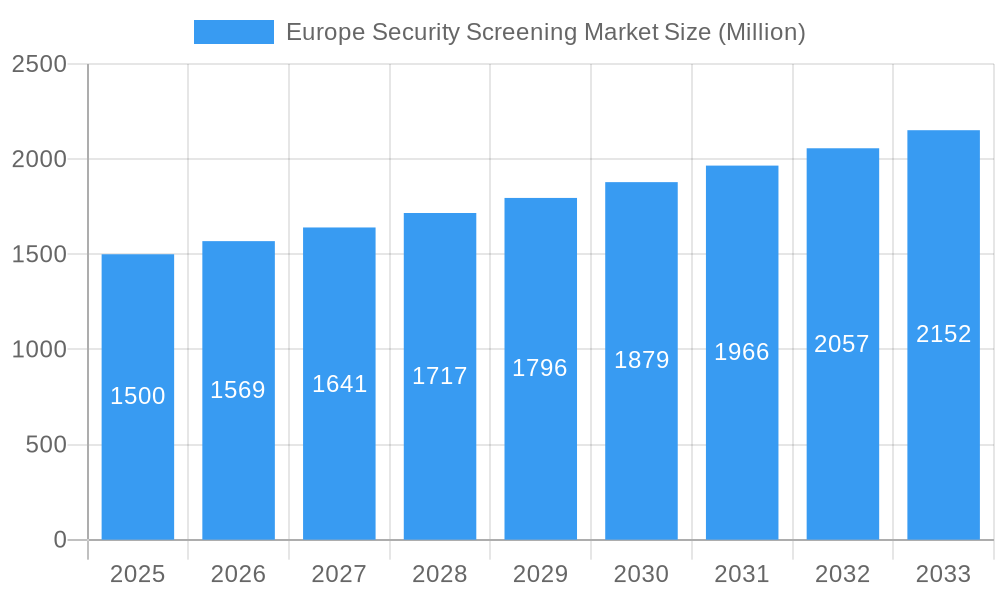

Europe Security Screening Market Market Size (In Billion)

Conversely, high initial capital expenditure for advanced security screening technologies may present an adoption barrier for smaller organizations. The requirement for continuous training and skilled personnel to operate complex systems also poses a challenge. Nevertheless, the market outlook remains robust, underscored by the persistent necessity for enhanced security measures. Segmentation by application (people, cargo) and end-user (airports, seaports, border control, defense) offers critical insights into sector-specific demands and technological trends. Leading entities such as CEIA SpA, Astrophysics Inc., and Smiths Detection are actively shaping this growth through innovation and the provision of tailored advanced security solutions.

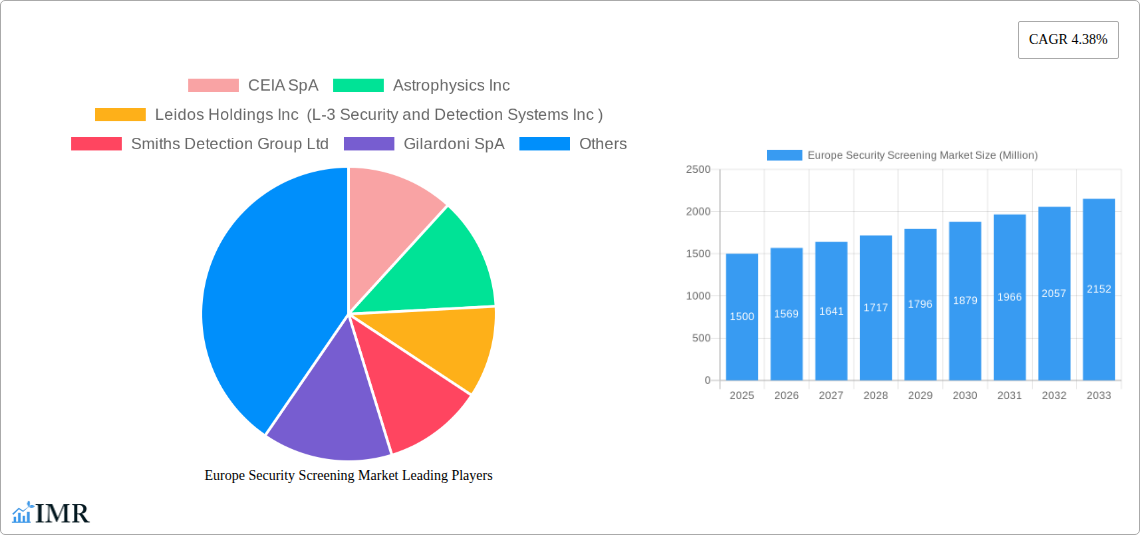

Europe Security Screening Market Company Market Share

Europe Security Screening Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Security Screening Market, encompassing its current state, future trajectory, and key players. With a focus on market segmentation by application (People, Product), end-user (Airports, Ports and Borders, Defense, Critical Infrastructure, Other End Users), and country (United Kingdom, Germany, France, Italy, Rest of Europe), this report offers invaluable insights for industry professionals, investors, and strategic decision-makers. The study period spans 2019-2033, with 2025 serving as the base and estimated year, and the forecast period covering 2025-2033. The historical period analyzed is 2019-2024. The market size is presented in Million units.

Europe Security Screening Market Market Dynamics & Structure

The Europe security screening market is characterized by moderate concentration, with a few major players holding significant market share. The market's growth is driven by technological innovations like advanced imaging technologies (AIT), improved threat detection capabilities, and increasing automation. Stringent regulatory frameworks, particularly post-9/11, mandate enhanced security measures across various sectors, fueling demand. Competitive substitutes exist, primarily in the form of alternative security technologies, but the overall demand remains robust. End-user demographics significantly influence market dynamics, with airports and border security representing the largest segments. Mergers and acquisitions (M&A) activity is moderate, with larger companies seeking to expand their product portfolios and geographic reach.

- Market Concentration: Moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2025.

- Technological Innovation: Significant advancements in AIT, millimeter-wave technology, and explosives detection systems are driving market growth.

- Regulatory Landscape: Stringent regulations in Europe, especially concerning aviation security, are key market drivers.

- Competitive Substitutes: Alternative screening methods exist, but their effectiveness and widespread adoption remain limited.

- M&A Activity: Moderate M&A activity observed in the past 5 years, with approximately xx deals recorded.

- Innovation Barriers: High R&D costs and stringent regulatory approvals pose challenges to innovation.

Europe Security Screening Market Growth Trends & Insights

The Europe security screening market experienced robust growth during the historical period (2019-2024), with a CAGR of xx%. This growth is attributed to heightened security concerns, increased passenger traffic at airports and seaports, and the expanding adoption of advanced security technologies across various sectors. The market is projected to maintain a healthy growth trajectory during the forecast period (2025-2033), driven by factors such as increasing investments in infrastructure security, rising adoption of AI-powered screening systems, and ongoing technological advancements. The market size is estimated to reach xx Million units in 2025 and is projected to surpass xx Million units by 2033. Market penetration rates in critical infrastructure sectors are expected to increase significantly. Consumer behavior shifts towards prioritizing safety and security contribute to this growth.

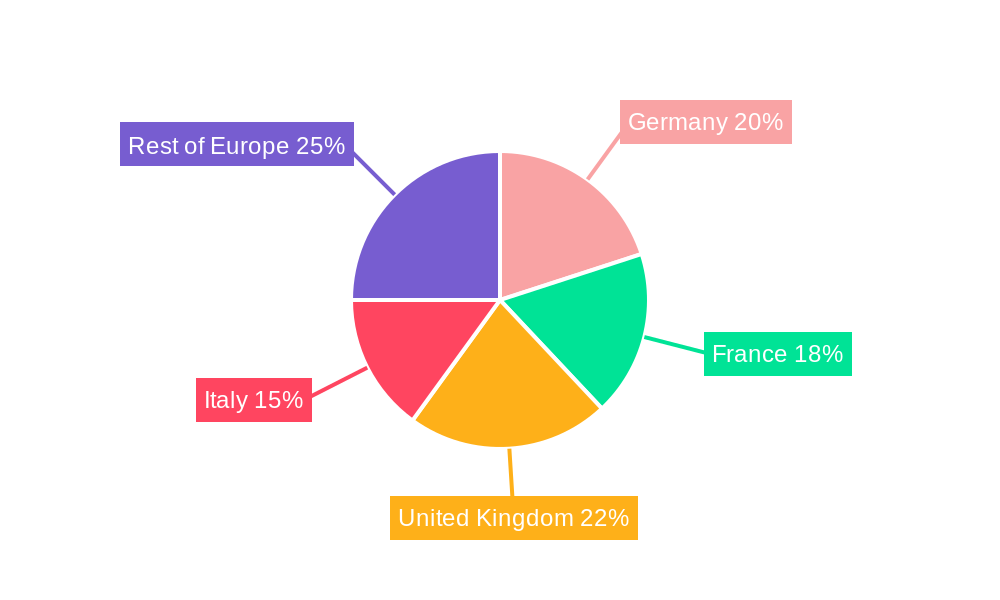

Dominant Regions, Countries, or Segments in Europe Security Screening Market

The United Kingdom holds the largest market share in the Europe security screening market, followed by Germany and France. This dominance is primarily attributed to robust air travel, significant port activities, and a higher concentration of critical infrastructure compared to other European countries. The airports segment leads in terms of market share, driven by the mandatory installation of advanced screening technologies across major airports.

- United Kingdom: High air passenger traffic, stringent security regulations, and substantial investment in airport infrastructure contribute to its market leadership.

- Germany: Large industrial base and significant presence of critical infrastructure contribute to strong demand.

- France: Similar to the UK, strong tourism and air travel contribute to high demand for security screening solutions.

- By Application: The "People" segment currently holds a larger market share than the "Product" segment due to increased passenger screening requirements.

- By End User: Airports and Ports and Borders segments dominate due to mandatory security protocols and high traffic volumes.

Europe Security Screening Market Product Landscape

The market offers a diverse range of products, including X-ray machines, metal detectors, explosive trace detectors, millimeter-wave scanners, and advanced imaging technologies. Recent innovations focus on enhancing speed, accuracy, and throughput, with features like automated threat detection and improved image processing capabilities. Unique selling propositions often center on ease of use, reduced operational costs, and improved threat detection sensitivity. Technological advancements continuously drive innovation in this field.

Key Drivers, Barriers & Challenges in Europe Security Screening Market

Key Drivers: Increased terrorist threats, rising security concerns, stringent government regulations, and advancements in technology are the primary drivers. For example, the post-9/11 security enhancements fueled massive growth.

Key Challenges: High initial investment costs for advanced technologies, the need for skilled personnel to operate the equipment, and integrating new technologies into existing infrastructure pose significant challenges. Supply chain disruptions and regulatory complexities further add to the difficulties. Competition among established players can also be intense, potentially leading to price wars.

Emerging Opportunities in Europe Security Screening Market

The increasing adoption of AI and machine learning in security screening offers substantial opportunities. The integration of biometric technologies and the development of more efficient, user-friendly screening systems are other growth areas. Untapped markets exist in smaller airports, seaports, and critical infrastructure sites.

Growth Accelerators in the Europe Security Screening Market Industry

Strategic partnerships between technology providers and security integrators are likely to accelerate market growth. Investments in R&D to develop next-generation screening technologies, and government initiatives promoting infrastructure security upgrades, represent significant catalysts. Expanding into new geographic markets and addressing evolving security threats through innovative solutions will fuel long-term growth.

Key Players Shaping the Europe Security Screening Market Market

- CEIA SpA

- Astrophysics Inc

- Leidos Holdings Inc (L-3 Security and Detection Systems Inc)

- Smiths Detection Group Ltd

- Gilardoni SpA

- OSI Systems Inc

- 3DX-RAY Ltd

- Teledyne ICM SA

- Nuctech Company Limited

Notable Milestones in Europe Security Screening Market Sector

- 2021: Smiths Detection launched a new generation of X-ray scanners with improved threat detection capabilities.

- 2022: Increased investment in AI-powered security screening solutions by several major players.

- 2023: New EU regulations introduced stricter standards for security screening at airports and borders.

- 2024: Significant merger activity between smaller security companies creating larger conglomerates.

In-Depth Europe Security Screening Market Market Outlook

The Europe security screening market exhibits a promising future, driven by sustained investments in security infrastructure, ongoing technological advancements, and the growing need to enhance security across various sectors. Strategic partnerships, expansion into new applications, and leveraging AI and machine learning will be key drivers of long-term growth, presenting substantial opportunities for market players. The market is expected to maintain a strong growth trajectory well into the next decade.

Europe Security Screening Market Segmentation

-

1. Application

- 1.1. People

-

1.2. Product

- 1.2.1. Mail and Parcel

- 1.2.2. Baggage

- 1.2.3. Cargo and Vehicle Inspection

- 1.2.4. Trace Detection

- 1.2.5. Other Applications

-

2. End User

- 2.1. Airports

- 2.2. Ports and Borders

- 2.3. Defense

- 2.4. Critical Infrastructure

- 2.5. Other End Users

Europe Security Screening Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Security Screening Market Regional Market Share

Geographic Coverage of Europe Security Screening Market

Europe Security Screening Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Terror Activities Happening Across the Region; Automation of Screening Processes

- 3.3. Market Restrains

- 3.3.1. ; Multiple apprehensions regarding X-ray radiation on health limiting the growth

- 3.4. Market Trends

- 3.4.1. Airports are Expected to Hold Major Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Security Screening Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. People

- 5.1.2. Product

- 5.1.2.1. Mail and Parcel

- 5.1.2.2. Baggage

- 5.1.2.3. Cargo and Vehicle Inspection

- 5.1.2.4. Trace Detection

- 5.1.2.5. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Airports

- 5.2.2. Ports and Borders

- 5.2.3. Defense

- 5.2.4. Critical Infrastructure

- 5.2.5. Other End Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 CEIA SpA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Astrophysics Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Leidos Holdings Inc (L-3 Security and Detection Systems Inc )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Smiths Detection Group Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Gilardoni SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 OSI Systems Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 3DX-RAY Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Teledyne ICM SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Nuctech Company Limited

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 CEIA SpA

List of Figures

- Figure 1: Europe Security Screening Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Security Screening Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Security Screening Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Europe Security Screening Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Europe Security Screening Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Security Screening Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Europe Security Screening Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Europe Security Screening Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Security Screening Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Security Screening Market?

The projected CAGR is approximately 7.2%.

2. Which companies are prominent players in the Europe Security Screening Market?

Key companies in the market include CEIA SpA, Astrophysics Inc, Leidos Holdings Inc (L-3 Security and Detection Systems Inc ), Smiths Detection Group Ltd, Gilardoni SpA, OSI Systems Inc, 3DX-RAY Ltd, Teledyne ICM SA, Nuctech Company Limited.

3. What are the main segments of the Europe Security Screening Market?

The market segments include Application, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.76 billion as of 2022.

5. What are some drivers contributing to market growth?

; Terror Activities Happening Across the Region; Automation of Screening Processes.

6. What are the notable trends driving market growth?

Airports are Expected to Hold Major Share.

7. Are there any restraints impacting market growth?

; Multiple apprehensions regarding X-ray radiation on health limiting the growth.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Security Screening Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Security Screening Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Security Screening Market?

To stay informed about further developments, trends, and reports in the Europe Security Screening Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence