Key Insights

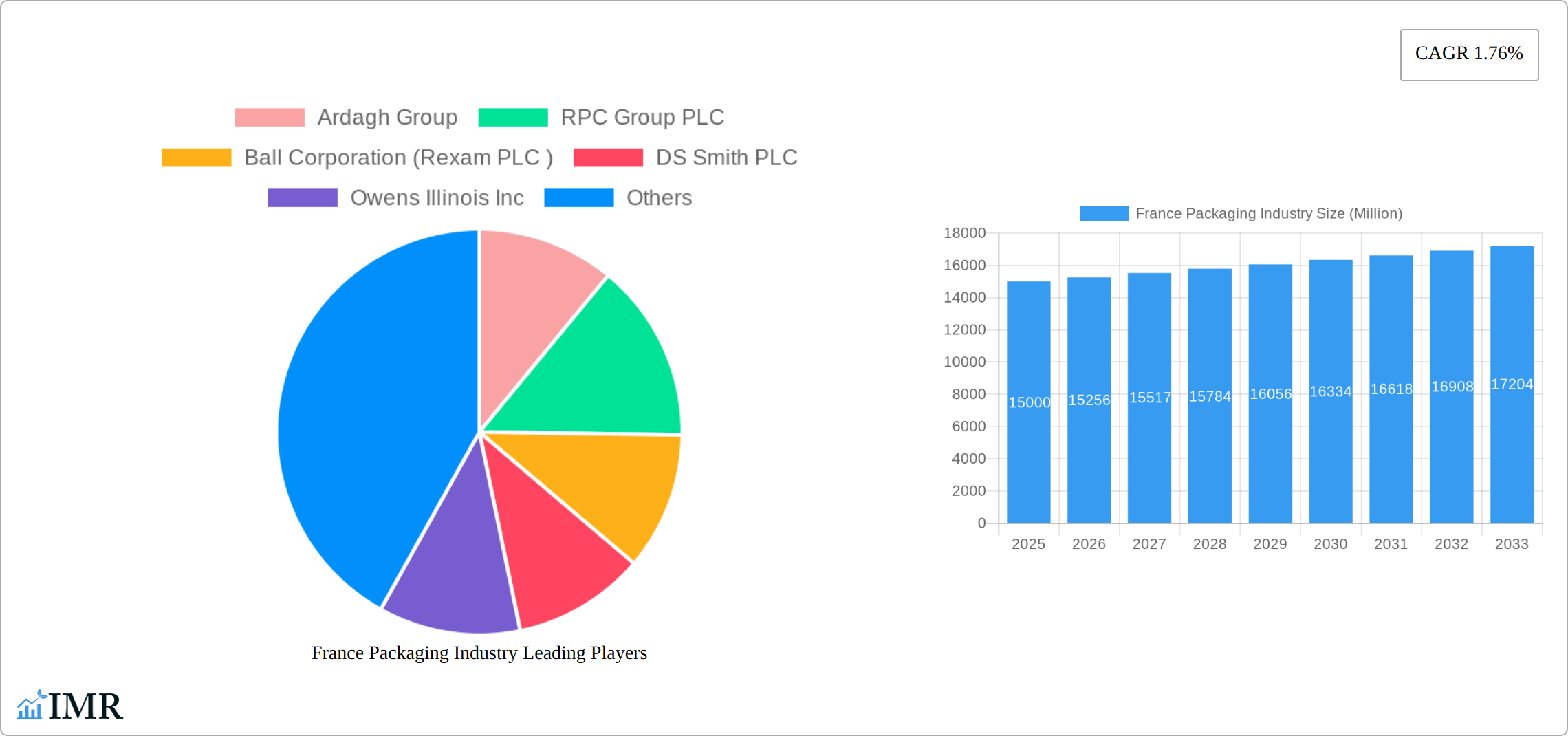

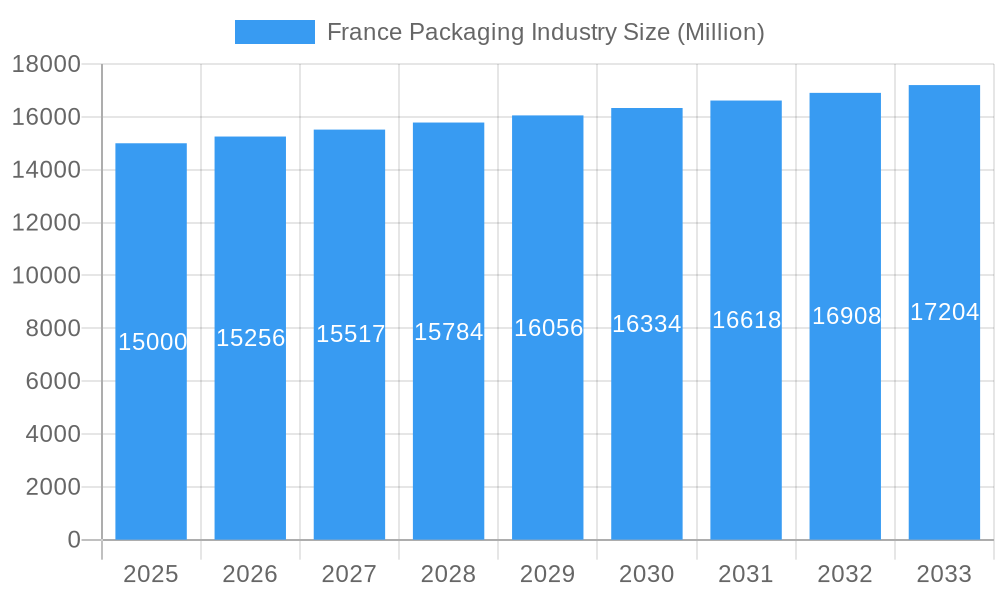

The French packaging market, valued at €15 billion in the base year 2024, is poised for robust expansion. The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.6% from 2024 to 2033, reaching an estimated market size of €31.6 billion. Key growth drivers include escalating demand for convenient and secure food and beverage packaging, particularly in flexible formats. The surge in e-commerce necessitates advanced shipping solutions, further stimulating market growth. The healthcare and pharmaceutical sectors are significant contributors, requiring specialized packaging to ensure product integrity and patient safety. While sustainability mandates drive the adoption of eco-friendly materials like recycled and biodegradable options, this presents both challenges and opportunities for innovation. Stringent food safety and material composition regulations will continue to shape material selection and design.

France Packaging Industry Market Size (In Billion)

The competitive environment features established multinational corporations and agile regional specialists. Prominent players include Ardagh Group, RPC Group PLC, and Amcor PLC, leveraging extensive manufacturing and global presence. Niche market segments are served by specialized companies offering innovative solutions. Regional variations in consumer preferences and industrial distribution within France present targeted growth opportunities. The rigid packaging segment (glass and metal) is expected to see stable growth, while the flexible packaging segment is anticipated to expand more rapidly due to its versatility and cost-effectiveness. The market will continue to evolve, driven by technological innovation, sustainability imperatives, and shifting consumer demands.

France Packaging Industry Company Market Share

France Packaging Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the France packaging industry, offering invaluable insights for industry professionals, investors, and strategic decision-makers. The study covers the period 2019-2033, with a focus on the forecast period 2025-2033 and a base year of 2025. Market values are presented in million units.

France Packaging Industry Market Dynamics & Structure

The French packaging market is characterized by a moderately consolidated structure with several major players alongside numerous smaller companies catering to niche segments. Technological innovation, driven by sustainability concerns and evolving consumer preferences, is a key driver. Stringent environmental regulations and the circular economy push are shaping industry practices. Competition from substitute materials (e.g., biodegradable alternatives) and changing consumer demographics impact market dynamics. Mergers and acquisitions (M&A) activity remains significant, contributing to market consolidation and reshaping the competitive landscape.

- Market Concentration: xx% market share held by top 5 players in 2024.

- Technological Innovation: Focus on sustainable packaging solutions (e.g., recycled content, compostable materials) is increasing.

- Regulatory Framework: Strict regulations on packaging waste and material composition are impacting industry strategies.

- M&A Activity: Significant M&A activity observed between 2019-2024, with xx deals recorded, leading to increased consolidation.

France Packaging Industry Growth Trends & Insights

The French packaging market has demonstrated remarkable resilience and expansion, particularly between 2019 and 2024. This robust growth was underpinned by several dynamic factors, including sustained increases in consumer spending, the accelerated adoption of e-commerce channels, and a discernible shift towards packaging formats that prioritize convenience and user-friendliness. Looking ahead, the market is projected to sustain a healthy Compound Annual Growth Rate (CAGR) of approximately 6.5% during the forecast period spanning 2025 to 2033. This continued expansion is expected to be fueled by ongoing technological advancements, evolving consumer preferences leaning towards sustainable and user-centric packaging solutions, and the persistent upward trajectory of the e-commerce sector. The integration and adoption rates of cutting-edge packaging innovations, such as active and intelligent packaging technologies designed to enhance product shelf life and provide real-time information, are steadily climbing. Furthermore, the penetration of environmentally conscious packaging materials is anticipated to reach around 70% by 2033, reflecting a significant industry-wide commitment to sustainability.

Dominant Regions, Countries, or Segments in France Packaging Industry

The Ile-de-France region, due to its high population density and robust industrial activity, is the dominant market segment in France. Within materials, plastic packaging holds the largest market share, followed by paper and cardboard. The food and beverage sector constitutes the largest end-user vertical.

- Key Growth Drivers: Strong consumer demand, expanding e-commerce, government initiatives promoting sustainable packaging.

- Market Share: Ile-de-France holds xx% of the national market share; Plastic packaging represents xx% of the material market share; The Food & Beverage sector accounts for xx% of total end-user demand.

- Growth Potential: High potential for growth in sustainable packaging segments, particularly in the e-commerce sector.

France Packaging Industry Product Landscape

The French packaging market offers a diverse range of products, encompassing flexible and rigid packaging options across various materials. Innovation focuses on lightweighting, improved barrier properties, enhanced recyclability, and incorporating smart features. These advancements cater to specific product requirements and consumer demands for convenience, sustainability, and brand differentiation.

Key Drivers, Barriers & Challenges in France Packaging Industry

Key Drivers: The French packaging industry's growth is propelled by a confluence of factors. Paramount among these is the escalating demand across diverse end-user sectors, including food and beverage, healthcare, and consumer goods. Complementing this is a strong and growing consumer preference for packaging that is not only convenient to use but also demonstrably sustainable. Government initiatives and increasingly stringent regulations actively promoting eco-friendly packaging solutions further act as significant catalysts, incentivizing innovation and adoption of greener alternatives.

Challenges: Despite the positive growth trajectory, the industry faces several hurdles. Volatility in raw material prices presents a constant challenge, impacting production costs and predictability. The market is characterized by intense competition, necessitating continuous innovation and cost optimization. Stringent environmental regulations, while driving sustainability, also require significant investment and adaptation. Maintaining resilient and efficient supply chains, especially in the face of global disruptions, remains a critical concern. Furthermore, the effective management and reduction of packaging waste, aligning with circular economy principles, is an ongoing and complex challenge. These combined challenges can potentially lead to an estimated 10-15% increase in production costs for certain segments.

Emerging Opportunities in France Packaging Industry

Emerging opportunities lie in the growing demand for sustainable and eco-friendly packaging solutions, the rise of e-commerce driving innovation in protective packaging, and personalized packaging solutions. Untapped markets exist in specialized packaging for niche products and expanding into sustainable materials and packaging-as-a-service models.

Growth Accelerators in the France Packaging Industry

Several key factors are actively accelerating growth within the French packaging industry. Significant advancements in material science are enabling the development of lighter, stronger, and more sustainable packaging options. Innovations in packaging design are leading to enhanced functionality, improved aesthetics, and reduced material usage. Strategic partnerships and collaborations across the value chain are proving instrumental in optimizing supply chains, ensuring timely delivery, and fostering greater efficiency. Proactive adaptation to, and even anticipation of, evolving environmental regulations is not just a compliance measure but a strategic advantage, driving innovation in eco-friendly solutions. Furthermore, the expansion of packaging solutions tailored for emerging niche markets within France, a sharpened focus on highly customized packaging addressing specific product and consumer needs, and the widespread adoption of Industry 4.0 technologies such as automation, AI, and data analytics are all poised to further fuel market growth and competitiveness.

Key Players Shaping the France Packaging Industry Market

- Ardagh Group

- RPC Group PLC

- Ball Corporation (Rexam PLC)

- DS Smith PLC

- Owens Illinois Inc

- Amcor PLC

- Mondi PLC

- Constantia Flexibles GmbH

- Ametek Inc.

- Smurfit Kappa Group PLC

- Tetra Pak International SA

- AR Packaging Group AB

- Crown Holdings Inc.

Notable Milestones in France Packaging Industry Sector

- November 2022: Verallia acquired 100% of Allied Glass, significantly impacting the glass packaging segment.

- June 2022: Carlsberg Group's Fibre Bottle trial demonstrated a commitment to sustainable packaging innovation.

In-Depth France Packaging Industry Market Outlook

The French packaging market is at an exciting juncture, presenting substantial opportunities for growth driven by a powerful combination of factors. The escalating demand for sustainable packaging solutions is a primary catalyst, compelling manufacturers to invest in recyclable, compostable, and biodegradable materials. Concurrent technological innovations in material science, smart packaging functionalities, and automated production processes are further enhancing efficiency and product appeal. The continued expansion of the e-commerce sector is creating a specific demand for robust, lightweight, and customizable packaging that can withstand the rigors of shipping while offering an appealing unboxing experience. To fully harness this potential, strategic investments in eco-friendly infrastructure and materials will be paramount. Fostering strategic partnerships across the entire supply chain will be crucial for enhancing agility, reducing lead times, and driving cost efficiencies. The widespread adoption of Industry 4.0 technologies will not only streamline operations but also enable greater traceability and customization. The market is anticipated to witness ongoing consolidation and strategic expansion initiatives, creating significant and lucrative opportunities for forward-thinking companies that can adeptly navigate evolving consumer expectations, stringent environmental mandates, and the dynamic technological landscape.

France Packaging Industry Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Glass

- 1.3. Metal

- 1.4. Other Materials

-

2. Packaging Type

- 2.1. Flexible Packaging

- 2.2. Rigid Packaging

-

3. End-user Verticals

- 3.1. Food

- 3.2. Beverages

- 3.3. Healthcare and Pharmaceuticals

- 3.4. Beauty and Personal Care

- 3.5. Other End-user Verticals

France Packaging Industry Segmentation By Geography

- 1. France

France Packaging Industry Regional Market Share

Geographic Coverage of France Packaging Industry

France Packaging Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Macroeconomic Factors

- 3.2.2 such as Demographic Changes and Changing Consumer Preferences; Increasing Tourism in the Industry

- 3.3. Market Restrains

- 3.3.1. The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation

- 3.4. Market Trends

- 3.4.1. Flexible Packaging to Have a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. France Packaging Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Glass

- 5.1.3. Metal

- 5.1.4. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Flexible Packaging

- 5.2.2. Rigid Packaging

- 5.3. Market Analysis, Insights and Forecast - by End-user Verticals

- 5.3.1. Food

- 5.3.2. Beverages

- 5.3.3. Healthcare and Pharmaceuticals

- 5.3.4. Beauty and Personal Care

- 5.3.5. Other End-user Verticals

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. France

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ardagh Group

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 RPC Group PLC

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ball Corporation (Rexam PLC )

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 DS Smith PLC

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Owens Illinois Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amcor PLC

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mondi PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Constantia Flexibles Gmb

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ametek Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Smurfit Kappa Group PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Tetra Pak International SA

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 AR Packaging Group AB

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Crown Holding Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Ardagh Group

List of Figures

- Figure 1: France Packaging Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: France Packaging Industry Share (%) by Company 2025

List of Tables

- Table 1: France Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 2: France Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 3: France Packaging Industry Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 4: France Packaging Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: France Packaging Industry Revenue billion Forecast, by Material 2020 & 2033

- Table 6: France Packaging Industry Revenue billion Forecast, by Packaging Type 2020 & 2033

- Table 7: France Packaging Industry Revenue billion Forecast, by End-user Verticals 2020 & 2033

- Table 8: France Packaging Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the France Packaging Industry?

The projected CAGR is approximately 4.6%.

2. Which companies are prominent players in the France Packaging Industry?

Key companies in the market include Ardagh Group, RPC Group PLC, Ball Corporation (Rexam PLC ), DS Smith PLC, Owens Illinois Inc, Amcor PLC, Mondi PLC, Constantia Flexibles Gmb, Ametek Inc, Smurfit Kappa Group PLC, Tetra Pak International SA, AR Packaging Group AB, Crown Holding Inc.

3. What are the main segments of the France Packaging Industry?

The market segments include Material, Packaging Type, End-user Verticals.

4. Can you provide details about the market size?

The market size is estimated to be USD 31.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Macroeconomic Factors. such as Demographic Changes and Changing Consumer Preferences; Increasing Tourism in the Industry.

6. What are the notable trends driving market growth?

Flexible Packaging to Have a Significant Share.

7. Are there any restraints impacting market growth?

The existence of stringent government restrictions and a decrease in the approval of numerous small molecules and biologics in specific regions of the nation.

8. Can you provide examples of recent developments in the market?

November 2022: Verallia acquired 100% of the capital of Allied Glass. The Group had announced the signature of a binding agreement with an affiliate of Sun European Partners LLP to acquire Allied Glass.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "France Packaging Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the France Packaging Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the France Packaging Industry?

To stay informed about further developments, trends, and reports in the France Packaging Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence