Key Insights

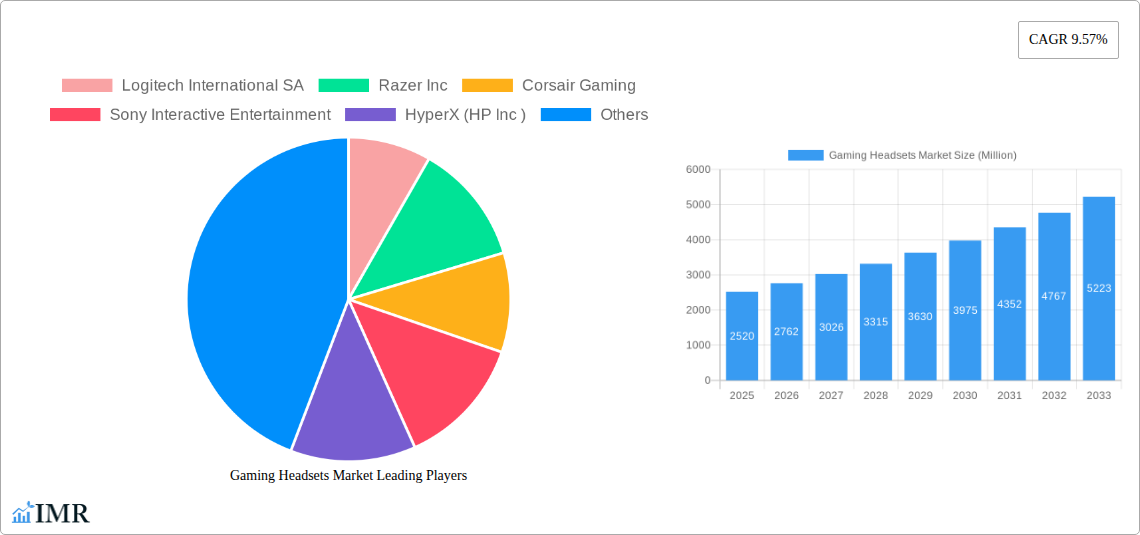

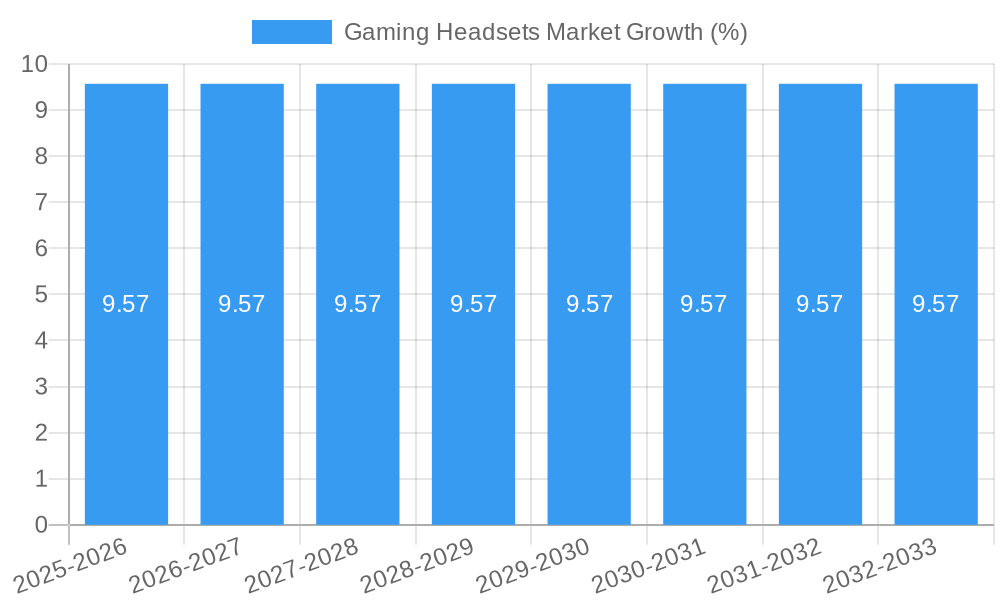

The global Gaming Headsets Market is poised for significant expansion, projected to reach an estimated USD 2.52 billion by 2025. This robust growth is fueled by a compound annual growth rate (CAGR) of 9.57% throughout the forecast period of 2025-2033. The increasing popularity of esports, coupled with the continuous innovation in audio technology and virtual reality, are primary drivers for this market surge. Gamers are increasingly seeking immersive experiences, and high-quality gaming headsets are instrumental in delivering superior soundscapes, clear communication, and enhanced competitive performance. The shift towards wireless connectivity is also a prominent trend, offering greater freedom of movement and convenience, which is highly valued by a growing segment of the gaming population. Furthermore, the expanding gaming ecosystem, encompassing console, PC, and mobile gaming, provides a broad and diverse consumer base for gaming headsets.

The market is characterized by strong competition among established players like Logitech International SA, Razer Inc, and Sony Interactive Entertainment, alongside emerging brands. This competitive landscape drives innovation in product features, such as advanced noise cancellation, customizable audio profiles, and ergonomic designs. The retail sales channel remains significant, but the online segment is experiencing accelerated growth, driven by e-commerce convenience and direct-to-consumer strategies employed by manufacturers. While the market exhibits strong growth potential, certain restraints, such as the high cost of premium gaming headsets and the increasing prevalence of integrated audio solutions in some devices, could temper overall expansion. However, the relentless demand for enhanced gaming peripherals and the ongoing evolution of gaming hardware are expected to outweigh these challenges, ensuring a dynamic and expanding market for gaming headsets in the coming years.

Here is a compelling, SEO-optimized report description for the Gaming Headsets Market, designed for maximum visibility and engagement with industry professionals.

Report Title: Global Gaming Headsets Market Analysis 2019-2033: Evolution, Trends, and Future Outlook

Report Description: Gain unparalleled insights into the dynamic Global Gaming Headsets Market, a critical segment within the broader gaming peripherals industry. This comprehensive report provides an in-depth analysis of market dynamics, growth trends, and future outlooks for the period 2019–2033, with a base year of 2025. Explore the intricate parent and child market structures, from foundational PC Headsets and Console Headsets to the evolving landscape of Wired and Wireless connectivity, and the crucial Sales Channels of Retail and Online.

This report is essential for stakeholders seeking to understand market concentration, technological innovation drivers, competitive product substitutes, and M&A trends. Delve into detailed market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. Identify dominant regions, countries, and segments, and explore the product landscape with a focus on innovations and performance metrics. Uncover key drivers, barriers, challenges, and emerging opportunities that will shape the future of the gaming headsets industry. Analyze the strategic moves of key players like Logitech International SA, Razer Inc., Corsair Gaming, and Sony Interactive Entertainment, and review notable industry milestones, including recent product launches and strategic collaborations. With a forecast period extending to 2033, this report offers a strategic roadmap for navigating the evolving gaming headsets market.

Gaming Headsets Market Market Dynamics & Structure

The gaming headsets market is characterized by a moderately concentrated landscape, with a few dominant players holding significant market share while a growing number of niche and emerging companies vie for consumer attention. Technological innovation serves as a primary driver, fueled by the relentless pursuit of superior audio quality, immersive surround sound capabilities, and enhanced comfort for extended gaming sessions. The integration of features like active noise cancellation, low-latency wireless technology, and personalized audio profiles are becoming industry standards. Regulatory frameworks, while generally permissive, focus on product safety standards and digital content rights, indirectly influencing headset features and compatibility. Competitive product substitutes include high-fidelity audio systems and advancements in spatial audio rendering within games themselves, pushing headset manufacturers to continuously innovate. End-user demographics are expanding beyond the core young adult male demographic to include a growing female gamer base and a significant increase in casual mobile gamers, demanding diverse product offerings. Mergers and acquisitions (M&A) activity is on the rise as larger tech companies seek to consolidate their presence in the lucrative gaming accessory market, acquiring innovative startups to expand their portfolios.

- Market Concentration: Top 5 players hold approximately 55-60% of the market share.

- Technological Innovation Drivers: Demand for spatial audio, low-latency wireless, advanced microphone technology.

- Regulatory Frameworks: Focus on product safety (e.g., FCC, CE certifications) and data privacy for companion apps.

- Competitive Product Substitutes: High-fidelity speakers, integration of audio into consoles/PCs.

- End-User Demographics: Expansion to include female gamers, mobile gamers, and e-sports professionals.

- M&A Trends: Strategic acquisitions of audio technology firms and accessory brands.

Gaming Headsets Market Growth Trends & Insights

The global gaming headsets market is experiencing robust and sustained growth, driven by an ever-expanding gaming ecosystem and evolving consumer preferences for immersive audio experiences. The market size for gaming headsets has seen consistent expansion, moving from an estimated 125 million units in the historical period of 2019-2024 to a projected 210 million units in the base year 2025, and is anticipated to reach over 300 million units by 2033. This growth is underpinned by increasing adoption rates of gaming as a primary entertainment medium across all age groups and platforms. Technological disruptions, such as the widespread adoption of wireless connectivity, advancements in surround sound technologies like DTS Headphone:X and Dolby Atmos, and the integration of AI-powered audio processing, are significantly enhancing the gaming experience and driving demand for premium headsets.

Consumer behavior shifts are also playing a pivotal role. Gamers are increasingly prioritizing audio fidelity, comfort, and connectivity options, leading to a higher propensity to invest in dedicated gaming headsets rather than relying on generic audio devices. The rise of e-sports, with its professional leagues and massive viewership, has created a segment of highly discerning users who demand top-tier performance, further fueling market growth. Furthermore, the proliferation of cloud gaming services and cross-platform compatibility needs are creating new avenues for market penetration. The increasing accessibility of gaming across various devices, from dedicated consoles and PCs to smartphones and tablets, necessitates a versatile range of headset solutions. The market penetration of gaming headsets is expected to climb steadily as more individuals engage with interactive entertainment. The forecast period of 2025–2033 is projected to witness a Compound Annual Growth Rate (CAGR) of approximately 8-10%, reflecting the sustained demand and innovation within this sector. Understanding these trends is crucial for manufacturers, retailers, and investors to capitalize on the opportunities presented by this dynamic market.

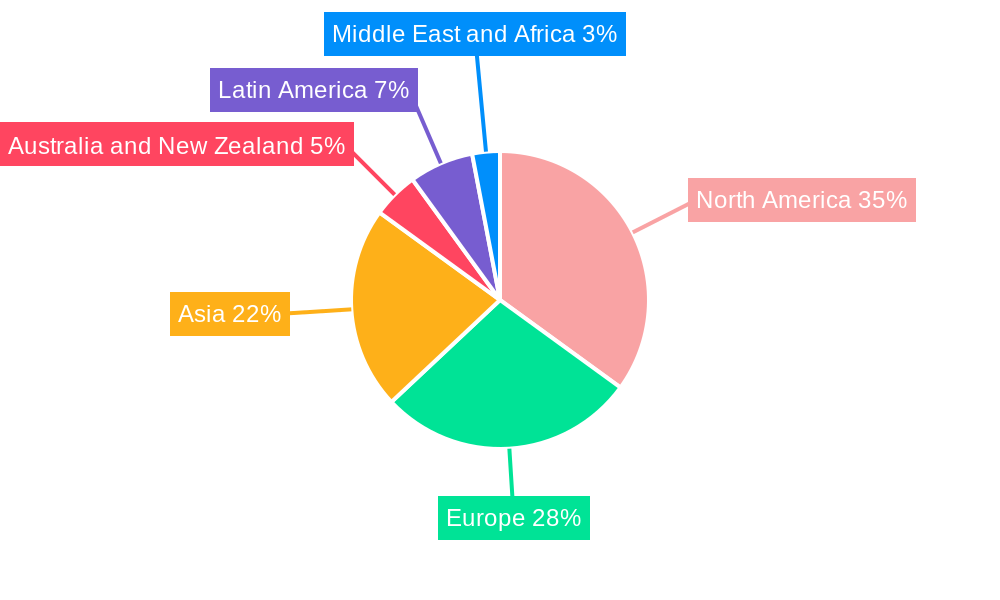

Dominant Regions, Countries, or Segments in Gaming Headsets Market

The global gaming headsets market is experiencing significant growth, with North America currently leading in terms of market size and adoption rates, driven by a highly engaged gaming community and robust economic conditions that support higher discretionary spending on gaming peripherals. The United States, in particular, represents a substantial portion of this dominance, fueled by a mature gaming culture, a strong presence of e-sports, and a high concentration of dedicated gamers across PC, console, and mobile platforms. Economic policies that foster technological innovation and consumer spending, coupled with well-established retail and online distribution networks, further solidify North America's leadership.

Within the Compatibility Type segment, PC Headsets historically held the largest share due to the PC gaming community's early adoption and its enduring popularity, particularly among competitive gamers who value precision and customization. However, Console Headsets are rapidly gaining ground, driven by the massive install bases of current-generation consoles like PlayStation and Xbox, and the increasing sophistication of console gaming experiences that benefit greatly from immersive audio. The appeal of plug-and-play simplicity and console-specific features contributes to this growth.

In terms of Connectivity Type, the Wireless segment is exhibiting the most dynamic growth. While Wired headsets continue to offer a reliable and cost-effective solution, the demand for freedom of movement, reduced cable clutter, and enhanced convenience is pushing wireless technology to the forefront. Advancements in low-latency wireless protocols have largely mitigated the perceived drawbacks of wireless audio for gaming, making it the preferred choice for a growing number of consumers.

The Sales Channel landscape is increasingly dominated by Online sales. E-commerce platforms offer unparalleled convenience, wider product selection, competitive pricing, and direct-to-consumer engagement. This channel is particularly effective for reaching a global audience and for brands to build direct relationships with their customers. While Retail still plays a significant role, especially for brick-and-mortar experiences and impulse purchases, the trend clearly favors online purchasing for gaming accessories.

- Dominant Region: North America (particularly the United States)

- Key Drivers: High disposable income, strong e-sports culture, early technology adoption, established distribution channels.

- Leading Compatibility Type: PC Headsets (historically), Console Headsets (rapidly growing)

- Drivers for PC: Competitive gaming, customization, vast software library.

- Drivers for Console: Large install base, ease of use, console-specific features.

- Dominant Connectivity Type: Wireless

- Drivers: Convenience, freedom of movement, reduced clutter, advancements in low-latency technology.

- Leading Sales Channel: Online

- Drivers: Convenience, wider selection, competitive pricing, direct-to-consumer engagement.

Gaming Headsets Market Product Landscape

The gaming headsets market is characterized by a vibrant product landscape where innovation is paramount. Manufacturers are continuously pushing the boundaries of audio technology, focusing on delivering superior sound fidelity, immersive spatial audio experiences, and crystal-clear microphone communication. Key product innovations include the integration of advanced drivers for richer bass and sharper highs, the implementation of advanced noise-cancellation technologies for both earcups and microphones, and the development of ergonomic designs for enhanced comfort during prolonged gaming sessions. Many headsets now feature customizable RGB lighting, allowing gamers to personalize their setup and express their individual style. Software integration is also a critical aspect, with companion apps enabling users to fine-tune audio profiles, adjust EQ settings, and manage microphone features, creating a more personalized and immersive gaming audio experience. The application scope ranges from competitive e-sports and immersive single-player adventures to casual mobile gaming and virtual reality experiences, with each application demanding specific features and performance metrics.

Key Drivers, Barriers & Challenges in Gaming Headsets Market

The gaming headsets market is propelled by several key drivers that fuel its continuous expansion. The ever-growing global gaming community, spurred by the accessibility of gaming across multiple platforms and the rise of e-sports, is a primary growth accelerator. Technological advancements, particularly in wireless audio, surround sound, and microphone clarity, enhance the player experience, leading to increased demand for premium headsets. The increasing disposable income in emerging economies also contributes to market growth as more consumers can afford dedicated gaming peripherals. Furthermore, strategic partnerships between headset manufacturers and game developers, or console makers, help in creating tailored audio solutions.

However, the market faces notable barriers and challenges. Supply chain disruptions, exacerbated by geopolitical factors and component shortages, can impact production volumes and lead times, affecting product availability and pricing. The high cost of advanced technologies and premium materials can create a barrier to entry for budget-conscious consumers, limiting market penetration in certain segments. Intense competition among established players and new entrants leads to price wars and necessitates significant R&D investment to stay competitive. Evolving consumer preferences and the rapid pace of technological obsolescence require continuous product innovation and a flexible manufacturing approach. Regulatory hurdles related to wireless spectrum usage and product certifications can also pose challenges.

Emerging Opportunities in Gaming Headsets Market

Emerging opportunities within the gaming headsets market are ripe for exploration, driven by evolving consumer preferences and technological advancements. The growing popularity of VR and AR gaming presents a significant opportunity for specialized VR headsets with integrated spatial audio and advanced haptics. The increasing penetration of mobile gaming, especially among casual and mid-core players, opens avenues for more affordable, feature-rich wireless headsets with seamless smartphone connectivity. Furthermore, the integration of AI-powered features, such as real-time voice translation for global multiplayer games or personalized audio adjustments based on game genre, could create unique selling propositions. The demand for sustainable and eco-friendly gaming peripherals is also on the rise, presenting an opportunity for manufacturers to develop headsets using recycled materials and energy-efficient designs.

Growth Accelerators in the Gaming Headsets Market Industry

Several catalysts are accelerating long-term growth in the gaming headsets industry. The continued professionalization of e-sports, with increasing prize pools and mainstream media coverage, drives demand for high-performance, professional-grade headsets. Strategic partnerships between gaming headset brands and popular game developers or streamers can significantly boost brand visibility and product adoption. The expansion of cloud gaming services, offering console-quality experiences on a wider range of devices, necessitates versatile and high-quality audio solutions that can cater to diverse user needs. Furthermore, innovation in material science and battery technology is enabling the development of lighter, more comfortable, and longer-lasting wireless headsets, enhancing the overall user experience and encouraging upgrades.

Key Players Shaping the Gaming Headsets Market Market

- Logitech International SA

- Razer Inc.

- Corsair Gaming

- Sony Interactive Entertainment

- HyperX (HP Inc.)

- ASUSTeK Computer Inc.

- Harman International Industries Incorporated

- SteelSeries

- Turtle Beach Corporation

Notable Milestones in Gaming Headsets Market Sector

- May 2024: SteelSeries broadened its Arctis Nova lineup by introducing the Arctis Nova 5 series headsets, accompanied by the innovative Nova 5 Companion App. This expansion aims to enhance the gaming audio experience for Xbox and PlayStation players by improving audio quality, offering a premium yet affordable wireless gaming headset, and enabling longer gaming sessions.

- July 2024: Beats by Dre unveiled a significant collaboration, partnering with Minecraft to introduce a special edition of Beats Solo 4 headphones. Drawing inspiration from the game's iconic Creepers, the headphones sport a striking design in neon green and black, featuring a block motif.

In-Depth Gaming Headsets Market Market Outlook

The future outlook for the gaming headsets market remains exceptionally bright, fueled by sustained innovation and expanding market reach. Growth accelerators such as the burgeoning e-sports industry, strategic collaborations with gaming influencers and developers, and the increasing adoption of cloud gaming are poised to drive significant market expansion. The continued evolution of wireless audio technology and the integration of advanced AI features will further enhance the immersive gaming experience, creating opportunities for premium product differentiation. As gaming continues its trajectory as a dominant form of entertainment, the demand for high-quality audio peripherals like gaming headsets is set to witness sustained growth, making this a dynamic and promising market for investment and development.

Gaming Headsets Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

Gaming Headsets Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East and Africa

Gaming Headsets Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.57% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Popularity of Virtual Reality; Rise in e-sports gaming to fuel the demand for gaming accessory equipment

- 3.3. Market Restrains

- 3.3.1. Growing Popularity of Virtual Reality; Rise in e-sports gaming to fuel the demand for gaming accessory equipment

- 3.4. Market Trends

- 3.4.1. Console Headset Gaming Type Segment Holds Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia

- 5.4.4. Australia and New Zealand

- 5.4.5. Latin America

- 5.4.6. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. North America Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6.1.1. Console Headset

- 6.1.2. PC Headset

- 6.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 6.2.1. Wired

- 6.2.2. Wireless

- 6.3. Market Analysis, Insights and Forecast - by Sales Channel

- 6.3.1. Retail

- 6.3.2. Online

- 6.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 7. Europe Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 7.1.1. Console Headset

- 7.1.2. PC Headset

- 7.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 7.2.1. Wired

- 7.2.2. Wireless

- 7.3. Market Analysis, Insights and Forecast - by Sales Channel

- 7.3.1. Retail

- 7.3.2. Online

- 7.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 8. Asia Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 8.1.1. Console Headset

- 8.1.2. PC Headset

- 8.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 8.2.1. Wired

- 8.2.2. Wireless

- 8.3. Market Analysis, Insights and Forecast - by Sales Channel

- 8.3.1. Retail

- 8.3.2. Online

- 8.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 9. Australia and New Zealand Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 9.1.1. Console Headset

- 9.1.2. PC Headset

- 9.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 9.2.1. Wired

- 9.2.2. Wireless

- 9.3. Market Analysis, Insights and Forecast - by Sales Channel

- 9.3.1. Retail

- 9.3.2. Online

- 9.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 10. Latin America Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 10.1.1. Console Headset

- 10.1.2. PC Headset

- 10.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 10.2.1. Wired

- 10.2.2. Wireless

- 10.3. Market Analysis, Insights and Forecast - by Sales Channel

- 10.3.1. Retail

- 10.3.2. Online

- 10.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 11. Middle East and Africa Gaming Headsets Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 11.1.1. Console Headset

- 11.1.2. PC Headset

- 11.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 11.2.1. Wired

- 11.2.2. Wireless

- 11.3. Market Analysis, Insights and Forecast - by Sales Channel

- 11.3.1. Retail

- 11.3.2. Online

- 11.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2024

- 12.2. Company Profiles

- 12.2.1 Logitech International SA

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Razer Inc

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Corsair Gaming

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Sony Interactive Entertainment

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 HyperX (HP Inc )

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 ASUSTeK Computer Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Harman International Industries Incorporated

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 SteelSeries

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Turtle Beach Corporatio

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.1 Logitech International SA

List of Figures

- Figure 1: Global Gaming Headsets Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Gaming Headsets Market Volume Breakdown (Billion, %) by Region 2024 & 2032

- Figure 3: North America Gaming Headsets Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 4: North America Gaming Headsets Market Volume (Billion), by Compatibility Type 2024 & 2032

- Figure 5: North America Gaming Headsets Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 6: North America Gaming Headsets Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 7: North America Gaming Headsets Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 8: North America Gaming Headsets Market Volume (Billion), by Connectivity Type 2024 & 2032

- Figure 9: North America Gaming Headsets Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 10: North America Gaming Headsets Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 11: North America Gaming Headsets Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 12: North America Gaming Headsets Market Volume (Billion), by Sales Channel 2024 & 2032

- Figure 13: North America Gaming Headsets Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 14: North America Gaming Headsets Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 15: North America Gaming Headsets Market Revenue (Million), by Country 2024 & 2032

- Figure 16: North America Gaming Headsets Market Volume (Billion), by Country 2024 & 2032

- Figure 17: North America Gaming Headsets Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: North America Gaming Headsets Market Volume Share (%), by Country 2024 & 2032

- Figure 19: Europe Gaming Headsets Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 20: Europe Gaming Headsets Market Volume (Billion), by Compatibility Type 2024 & 2032

- Figure 21: Europe Gaming Headsets Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 22: Europe Gaming Headsets Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 23: Europe Gaming Headsets Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 24: Europe Gaming Headsets Market Volume (Billion), by Connectivity Type 2024 & 2032

- Figure 25: Europe Gaming Headsets Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 26: Europe Gaming Headsets Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 27: Europe Gaming Headsets Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 28: Europe Gaming Headsets Market Volume (Billion), by Sales Channel 2024 & 2032

- Figure 29: Europe Gaming Headsets Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 30: Europe Gaming Headsets Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 31: Europe Gaming Headsets Market Revenue (Million), by Country 2024 & 2032

- Figure 32: Europe Gaming Headsets Market Volume (Billion), by Country 2024 & 2032

- Figure 33: Europe Gaming Headsets Market Revenue Share (%), by Country 2024 & 2032

- Figure 34: Europe Gaming Headsets Market Volume Share (%), by Country 2024 & 2032

- Figure 35: Asia Gaming Headsets Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 36: Asia Gaming Headsets Market Volume (Billion), by Compatibility Type 2024 & 2032

- Figure 37: Asia Gaming Headsets Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 38: Asia Gaming Headsets Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 39: Asia Gaming Headsets Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 40: Asia Gaming Headsets Market Volume (Billion), by Connectivity Type 2024 & 2032

- Figure 41: Asia Gaming Headsets Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 42: Asia Gaming Headsets Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 43: Asia Gaming Headsets Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 44: Asia Gaming Headsets Market Volume (Billion), by Sales Channel 2024 & 2032

- Figure 45: Asia Gaming Headsets Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 46: Asia Gaming Headsets Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 47: Asia Gaming Headsets Market Revenue (Million), by Country 2024 & 2032

- Figure 48: Asia Gaming Headsets Market Volume (Billion), by Country 2024 & 2032

- Figure 49: Asia Gaming Headsets Market Revenue Share (%), by Country 2024 & 2032

- Figure 50: Asia Gaming Headsets Market Volume Share (%), by Country 2024 & 2032

- Figure 51: Australia and New Zealand Gaming Headsets Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 52: Australia and New Zealand Gaming Headsets Market Volume (Billion), by Compatibility Type 2024 & 2032

- Figure 53: Australia and New Zealand Gaming Headsets Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 54: Australia and New Zealand Gaming Headsets Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 55: Australia and New Zealand Gaming Headsets Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 56: Australia and New Zealand Gaming Headsets Market Volume (Billion), by Connectivity Type 2024 & 2032

- Figure 57: Australia and New Zealand Gaming Headsets Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 58: Australia and New Zealand Gaming Headsets Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 59: Australia and New Zealand Gaming Headsets Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 60: Australia and New Zealand Gaming Headsets Market Volume (Billion), by Sales Channel 2024 & 2032

- Figure 61: Australia and New Zealand Gaming Headsets Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 62: Australia and New Zealand Gaming Headsets Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 63: Australia and New Zealand Gaming Headsets Market Revenue (Million), by Country 2024 & 2032

- Figure 64: Australia and New Zealand Gaming Headsets Market Volume (Billion), by Country 2024 & 2032

- Figure 65: Australia and New Zealand Gaming Headsets Market Revenue Share (%), by Country 2024 & 2032

- Figure 66: Australia and New Zealand Gaming Headsets Market Volume Share (%), by Country 2024 & 2032

- Figure 67: Latin America Gaming Headsets Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 68: Latin America Gaming Headsets Market Volume (Billion), by Compatibility Type 2024 & 2032

- Figure 69: Latin America Gaming Headsets Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 70: Latin America Gaming Headsets Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 71: Latin America Gaming Headsets Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 72: Latin America Gaming Headsets Market Volume (Billion), by Connectivity Type 2024 & 2032

- Figure 73: Latin America Gaming Headsets Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 74: Latin America Gaming Headsets Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 75: Latin America Gaming Headsets Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 76: Latin America Gaming Headsets Market Volume (Billion), by Sales Channel 2024 & 2032

- Figure 77: Latin America Gaming Headsets Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 78: Latin America Gaming Headsets Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 79: Latin America Gaming Headsets Market Revenue (Million), by Country 2024 & 2032

- Figure 80: Latin America Gaming Headsets Market Volume (Billion), by Country 2024 & 2032

- Figure 81: Latin America Gaming Headsets Market Revenue Share (%), by Country 2024 & 2032

- Figure 82: Latin America Gaming Headsets Market Volume Share (%), by Country 2024 & 2032

- Figure 83: Middle East and Africa Gaming Headsets Market Revenue (Million), by Compatibility Type 2024 & 2032

- Figure 84: Middle East and Africa Gaming Headsets Market Volume (Billion), by Compatibility Type 2024 & 2032

- Figure 85: Middle East and Africa Gaming Headsets Market Revenue Share (%), by Compatibility Type 2024 & 2032

- Figure 86: Middle East and Africa Gaming Headsets Market Volume Share (%), by Compatibility Type 2024 & 2032

- Figure 87: Middle East and Africa Gaming Headsets Market Revenue (Million), by Connectivity Type 2024 & 2032

- Figure 88: Middle East and Africa Gaming Headsets Market Volume (Billion), by Connectivity Type 2024 & 2032

- Figure 89: Middle East and Africa Gaming Headsets Market Revenue Share (%), by Connectivity Type 2024 & 2032

- Figure 90: Middle East and Africa Gaming Headsets Market Volume Share (%), by Connectivity Type 2024 & 2032

- Figure 91: Middle East and Africa Gaming Headsets Market Revenue (Million), by Sales Channel 2024 & 2032

- Figure 92: Middle East and Africa Gaming Headsets Market Volume (Billion), by Sales Channel 2024 & 2032

- Figure 93: Middle East and Africa Gaming Headsets Market Revenue Share (%), by Sales Channel 2024 & 2032

- Figure 94: Middle East and Africa Gaming Headsets Market Volume Share (%), by Sales Channel 2024 & 2032

- Figure 95: Middle East and Africa Gaming Headsets Market Revenue (Million), by Country 2024 & 2032

- Figure 96: Middle East and Africa Gaming Headsets Market Volume (Billion), by Country 2024 & 2032

- Figure 97: Middle East and Africa Gaming Headsets Market Revenue Share (%), by Country 2024 & 2032

- Figure 98: Middle East and Africa Gaming Headsets Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Gaming Headsets Market Volume Billion Forecast, by Region 2019 & 2032

- Table 3: Global Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: Global Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 5: Global Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: Global Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 7: Global Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: Global Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 9: Global Gaming Headsets Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Gaming Headsets Market Volume Billion Forecast, by Region 2019 & 2032

- Table 11: Global Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: Global Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 13: Global Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 14: Global Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 15: Global Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: Global Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 17: Global Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

- Table 19: Global Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 20: Global Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 21: Global Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 22: Global Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 23: Global Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 24: Global Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 25: Global Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 26: Global Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

- Table 27: Global Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 28: Global Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 29: Global Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 30: Global Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 31: Global Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 32: Global Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 33: Global Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 34: Global Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

- Table 35: Global Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 36: Global Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 37: Global Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 38: Global Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 39: Global Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 40: Global Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 41: Global Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

- Table 43: Global Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 44: Global Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 45: Global Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 46: Global Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 47: Global Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 48: Global Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 49: Global Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 50: Global Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

- Table 51: Global Gaming Headsets Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 52: Global Gaming Headsets Market Volume Billion Forecast, by Compatibility Type 2019 & 2032

- Table 53: Global Gaming Headsets Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 54: Global Gaming Headsets Market Volume Billion Forecast, by Connectivity Type 2019 & 2032

- Table 55: Global Gaming Headsets Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 56: Global Gaming Headsets Market Volume Billion Forecast, by Sales Channel 2019 & 2032

- Table 57: Global Gaming Headsets Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Global Gaming Headsets Market Volume Billion Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gaming Headsets Market?

The projected CAGR is approximately 9.57%.

2. Which companies are prominent players in the Gaming Headsets Market?

Key companies in the market include Logitech International SA, Razer Inc, Corsair Gaming, Sony Interactive Entertainment, HyperX (HP Inc ), ASUSTeK Computer Inc, Harman International Industries Incorporated, SteelSeries, Turtle Beach Corporatio.

3. What are the main segments of the Gaming Headsets Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.52 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Popularity of Virtual Reality; Rise in e-sports gaming to fuel the demand for gaming accessory equipment.

6. What are the notable trends driving market growth?

Console Headset Gaming Type Segment Holds Significant Market Share.

7. Are there any restraints impacting market growth?

Growing Popularity of Virtual Reality; Rise in e-sports gaming to fuel the demand for gaming accessory equipment.

8. Can you provide examples of recent developments in the market?

May 2024: SteelSeries is broadening its Arctis Nova lineup by introducing the Arctis Nova 5 series headsets, accompanied by the innovative Nova 5 Companion App. This expansion seeks to enhance the gaming audio experience for Xbox and PlayStation players. It does so by improving audio quality, offering a premium yet affordable wireless gaming headset, and enabling longer gaming sessions.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gaming Headsets Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gaming Headsets Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gaming Headsets Market?

To stay informed about further developments, trends, and reports in the Gaming Headsets Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence