Key Insights

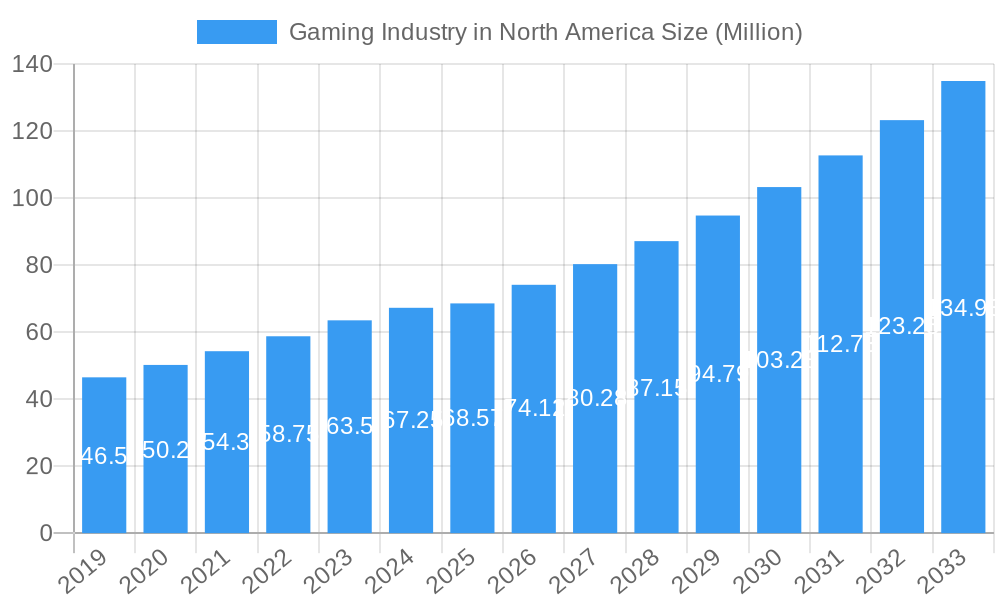

The North American gaming market is poised for substantial growth, projected to reach an estimated USD 68.57 billion in the base year 2025. This robust expansion is fueled by an impressive Compound Annual Growth Rate (CAGR) of 8.65%, indicating sustained momentum throughout the forecast period of 2025-2033. A significant driver of this growth is the increasing adoption of digital games and online microtransactions, reflecting a consumer shift towards more accessible and engaging gaming experiences. The proliferation of mobile gaming, coupled with the rising popularity of Virtual Reality (VR) and Augmented Reality (AR) games, is further contributing to market dynamism. These emerging technologies are not only attracting new players but also offering deeper immersion for existing ones, pushing the boundaries of interactive entertainment. The widespread availability of high-speed internet and the increasing affordability of gaming hardware, from consoles and PCs to mobile devices, also play a crucial role in broadening the market's reach and appeal.

Gaming Industry in North America Market Size (In Million)

This thriving market is further propelled by innovation from key industry players such as Electronic Arts Inc., Activision Blizzard Inc., and Nintendo Co. Ltd., who are consistently introducing new titles and exploring novel monetization strategies. The market's segmentation reveals a diverse landscape, with digital games, mobile games, and online/microtransactions leading the charge in revenue generation. The console and PC segments, while mature, continue to exhibit strong performance due to the release of high-fidelity AAA titles and dedicated gaming communities. North America, encompassing the United States, Canada, and Mexico, stands as a dominant region in the global gaming industry, representing a significant portion of market value and consumer engagement. The continued investment in content creation, technological advancements, and strategic partnerships by leading companies will undoubtedly shape the future trajectory of this rapidly evolving market.

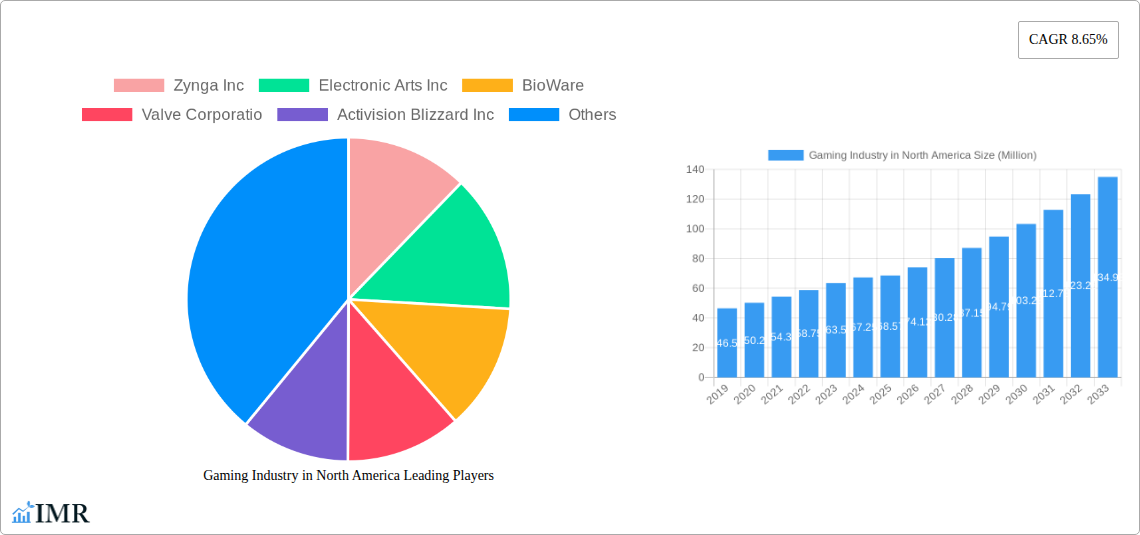

Gaming Industry in North America Company Market Share

North America Gaming Market Report: Unveiling Digital Dominance and Emerging Frontiers

This comprehensive report delivers an in-depth analysis of the North America gaming market, meticulously dissecting its dynamics, growth trajectories, and future potential. Delve into the evolving landscape of video games, mobile gaming, online/microtransactions, and the nascent yet promising VR/AR gaming sectors. We present granular insights into digital game sales, physical game sales, and the pervasive influence of in-game purchases. Discover the strategic maneuvers of industry titans such as Zynga Inc, Electronic Arts Inc, Valve Corporation, Microsoft Corporation, and Sony Corporation, alongside established players and emerging innovators. With a robust study period spanning 2019–2033, this report offers an unparalleled understanding of market segmentation, regional dominance across the United States, Canada, and Mexico, and the pivotal platforms including consoles, PCs, and mobile devices.

Gaming Industry in North America Market Dynamics & Structure

The North America gaming market is characterized by a dynamic interplay of intense competition and rapid innovation, creating a highly concentrated yet perpetually evolving ecosystem. Major players like Activision Blizzard Inc, Electronic Arts Inc, and Take-Two Interactive Software Inc exert significant influence through established franchises and expansive portfolios. Technological advancements, particularly in cloud gaming and high-fidelity graphics, are key drivers, while evolving consumer expectations for interactive and immersive experiences fuel continuous R&D. Regulatory frameworks, though generally supportive, are increasingly scrutinizing in-game monetization practices and data privacy, impacting business models. Competitive product substitutes are emerging from other entertainment industries, demanding constant differentiation. The end-user demographic is broadening beyond traditional young males, with a significant rise in casual and older gamers. Mergers and acquisitions (M&A) remain a strategic tool for consolidation and talent acquisition, with deal volumes showing a steady upward trend, though innovation barriers remain in areas like widespread VR adoption.

- Market Concentration: Dominated by a few large publishers and platform holders, with strong IP leverage.

- Technological Innovation: Driven by advancements in GPUs, AI, cloud streaming, and extended reality (XR).

- Regulatory Frameworks: Focus on player protection, loot box scrutiny, and age verification.

- Competitive Substitutes: Streaming services, social media entertainment, and other digital leisure activities.

- End-User Demographics: Diversifying to include women, older adults, and casual gamers.

- M&A Trends: Active consolidation for IP acquisition, talent, and market expansion.

Gaming Industry in North America Growth Trends & Insights

The North America gaming market is poised for sustained and robust growth, projected to expand significantly over the forecast period. The global gaming market size, of which North America is a colossal component, is witnessing an accelerated adoption rate driven by increased internet penetration, the proliferation of affordable gaming devices, and the undeniable cultural integration of gaming into mainstream entertainment. Technological disruptions, such as the advent of cloud gaming and the continued refinement of virtual reality (VR) and augmented reality (AR) technologies, are fundamentally reshaping how games are developed, distributed, and consumed. Consumer behavior shifts are evident, with an increasing preference for digital games over physical media, a surge in online/microtransactions as a primary revenue stream, and a growing appetite for live-service games offering continuous engagement. The base year of 2025 showcases a market already valued in the hundreds of billions of million units, with projections indicating a compound annual growth rate (CAGR) that will far outpace many other entertainment sectors. The market penetration of gaming across various demographics is nearing saturation in some segments, yet new avenues for growth are continuously being forged through innovative gameplay mechanics and accessibility features. The historical period from 2019 to 2024 has laid a strong foundation, marked by rapid digital transformation and the resilience of the industry even amidst global economic fluctuations. The forecast period of 2025–2033 will likely witness further evolution, with emerging technologies and evolving player preferences dictating the pace and direction of market expansion. The increasing sophistication of mobile games continues to capture a vast audience, while advancements in PC gaming and console technologies maintain their appeal for dedicated gamers. The convergence of gaming with other digital experiences, such as social media and esports, is also a significant factor driving long-term engagement and market value. The accessibility of gaming has never been higher, further solidifying its position as a dominant entertainment force.

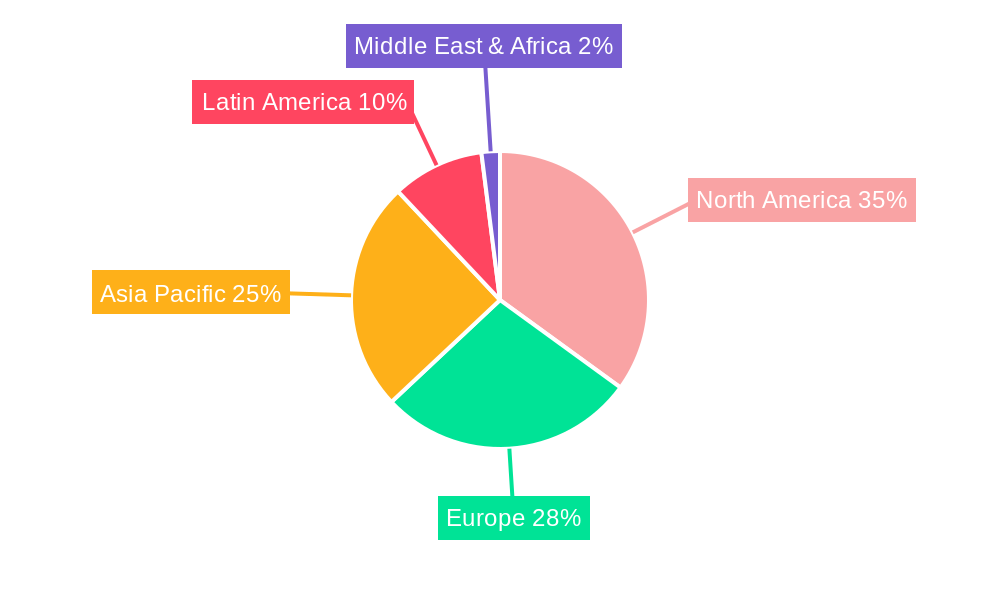

Dominant Regions, Countries, or Segments in Gaming Industry in North America

Within the expansive North America gaming market, the United States unequivocally stands as the dominant region, commanding the largest market share and serving as the epicenter for innovation and consumer spending. This dominance is underpinned by a confluence of factors including a robust economy, high disposable incomes, extensive internet infrastructure, and a deeply ingrained gaming culture. The United States leads across multiple product types, with Digital Games and Online/Microtransactions representing the lion's share of revenue.

- United States:

- Market Share: Accounts for over 70% of the North American gaming revenue.

- Key Drivers: High disposable income, advanced technological adoption, extensive digital distribution networks, and a large, engaged gamer population.

- Dominant Segments: Digital Games, Online/Microtransactions, Mobile Games.

- Platform Dominance: Strong presence across Consoles, PCs, and Mobile Devices.

Canada follows as a significant contributor, exhibiting strong growth driven by increasing internet access and a burgeoning esports scene. While its market size is smaller than the United States, its growth trajectory is impressive, fueled by a tech-savvy population and a supportive environment for game development.

- Canada:

- Market Share: Approximately 15% of the North American gaming revenue.

- Key Drivers: High internet penetration, growing esports popularity, government initiatives supporting the tech sector, and a younger demographic with high gaming engagement.

- Dominant Segments: Digital Games, Mobile Games, Online/Microtransactions.

Mexico, while currently holding a smaller market share, presents the most significant growth potential within North America. Rapid urbanization, increasing smartphone adoption, and a growing middle class are fueling a surge in gaming interest and spending. The accessibility of Mobile Games is a crucial factor in Mexico's market expansion.

- Mexico:

- Market Share: Approximately 10% of the North American gaming revenue.

- Key Drivers: Rapidly growing smartphone penetration, increasing disposable income, a young and enthusiastic population, and the affordability of mobile gaming.

- Dominant Segments: Mobile Games, Online/Microtransactions.

In terms of Product Type, Digital Games continue to dominate due to convenience and accessibility, closely followed by Online/Microtransactions, which have become an integral revenue model for many games. Mobile Games are experiencing explosive growth, driven by the ubiquity of smartphones, and are expected to surpass other segments in the coming years. While Virtual Reality (VR) and Augmented Reality (AR) Games are still nascent, their long-term potential is substantial, with ongoing technological advancements and increasing hardware affordability. On the Platform front, Mobile Devices are the most widely used, followed by Consoles and PCs, with Virtual Reality Headsets representing a growing but niche segment.

Gaming Industry in North America Product Landscape

The product landscape of the North America gaming industry is characterized by an unprecedented diversity and relentless innovation, catering to a wide spectrum of player preferences. Digital Games have become the primary mode of distribution, offering immediate access to vast libraries across genres, from AAA blockbuster titles to independent indie gems. Online/Microtransactions have evolved from optional additions to core monetization strategies, enabling ongoing revenue streams through in-game purchases, battle passes, and cosmetic items, thereby extending game longevity. The surge in Mobile Games has democratized gaming, with sophisticated titles available on smartphones, driving engagement through intuitive controls and accessible gameplay loops. The burgeoning Virtual Reality (VR) and Augmented Reality (AR) Games sector is pushing the boundaries of immersion, offering unparalleled sensory experiences and interactive environments that are redefining player engagement. Companies are constantly pushing the envelope with cutting-edge graphics, compelling narratives, and innovative gameplay mechanics that redefine player experiences and create unique selling propositions in a highly competitive market.

Key Drivers, Barriers & Challenges in Gaming Industry in North America

The North America gaming industry is propelled by powerful drivers including the ever-increasing demand for digital entertainment, the relentless pace of technological innovation in graphics and processing power, and the significant investments in esports and competitive gaming. The widespread adoption of high-speed internet and sophisticated mobile devices further democratizes access. Strategic partnerships between game developers and hardware manufacturers, alongside a strong intellectual property ecosystem, foster continued growth.

However, the industry faces significant barriers and challenges. Regulatory scrutiny over in-game monetization practices, particularly loot boxes, poses a persistent challenge. The increasing cost of AAA game development, coupled with longer development cycles, creates financial risks. Supply chain disruptions for physical media and gaming hardware, though lessening, can still impact availability. Intense competition necessitates continuous innovation, and the threat of market saturation in certain segments is ever-present.

Emerging Opportunities in Gaming Industry in North America

Emerging opportunities in the North America gaming industry are abundant, particularly within the rapidly evolving cloud gaming sector, which promises to lower hardware barriers and expand accessibility. The continued development and adoption of Virtual Reality (VR) and Augmented Reality (AR) technologies present a significant frontier for immersive gaming experiences, creating new avenues for player engagement and content creation. The burgeoning esports ecosystem, with its professional leagues, tournaments, and dedicated fan bases, offers substantial opportunities for sponsorship, media rights, and merchandise. Furthermore, the integration of gaming with other digital platforms, such as social media and the metaverse, opens doors for cross-platform experiences and new forms of interactive entertainment, tapping into evolving consumer preferences for interconnected digital lives.

Growth Accelerators in the Gaming Industry in North America Industry

Several key catalysts are accelerating long-term growth in the North America gaming industry. Technological breakthroughs in artificial intelligence and machine learning are enabling more sophisticated game design and personalized player experiences. Strategic partnerships between major tech giants and game developers are expanding the reach and capabilities of gaming platforms, exemplified by collaborations bringing gaming content to VR hardware. Market expansion strategies, including the localization of games for diverse audiences and the development of free-to-play models with robust monetization, are crucial for capturing new player segments. The continued growth of esports, driven by professional leagues and massive online viewership, further fuels engagement and commercial opportunities.

Key Players Shaping the Gaming Industry in North America Market

- Activision Blizzard Inc

- Electronic Arts Inc

- Microsoft Corporation

- Nintendo Co Ltd

- Sony Corporation

- Take-Two Interactive Software Inc

- Ubisoft Entertainment SA

- Valve Corporation

- Zynga Inc

- BioWare

Notable Milestones in Gaming Industry in North America Sector

- October 2022: Meta partnered with Microsoft Corporation to bring Teams, Windows apps, and games to Quest devices, aiming to integrate work and gaming functionalities within the metaverse.

- July 2022: Nuvei Corporation and GAN Limited announced a strategic partnership to provide gaming operators access to Nuvei's payment solutions through GAN's platform, initially supporting Ontario's regulated market and expanding to the US and Canada.

In-Depth Gaming Industry in North America Market Outlook

The North America gaming market outlook is exceptionally bright, driven by ongoing technological advancements and a sustained surge in player engagement. The convergence of cloud gaming, VR/AR, and esports presents a significant future market potential, promising more accessible, immersive, and interconnected gaming experiences. Strategic opportunities lie in further innovating mobile games, enhancing cross-platform play, and capitalizing on the growing demand for player-generated content. The continuous evolution of monetization models and the expansion into new entertainment verticals will solidify gaming's position as a dominant force in the digital entertainment landscape, ensuring robust growth and profitability for years to come.

Gaming Industry in North America Segmentation

-

1. Product Type

- 1.1. Digital Games

- 1.2. Physical Games

- 1.3. Online/Microtransactions

- 1.4. Virtual Reality (VR) and Augmented Reality (AR) Games

- 1.5. Mobile Games

-

2. Platform

- 2.1. Consoles

- 2.2. PCs

- 2.3. Mobile Devices

- 2.4. Virtual Reality Headsets

-

3. Region

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

Gaming Industry in North America Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

Gaming Industry in North America Regional Market Share

Geographic Coverage of Gaming Industry in North America

Gaming Industry in North America REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Rising Smartphone and Internet Penetration; Adoption of Gaming Platforms

- 3.2.2 such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1. Implementation and Integration Concerns Hindering the Market

- 3.4. Market Trends

- 3.4.1. Rising Smartphone adoption and Internet Penetration Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Gaming Industry in North America Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Digital Games

- 5.1.2. Physical Games

- 5.1.3. Online/Microtransactions

- 5.1.4. Virtual Reality (VR) and Augmented Reality (AR) Games

- 5.1.5. Mobile Games

- 5.2. Market Analysis, Insights and Forecast - by Platform

- 5.2.1. Consoles

- 5.2.2. PCs

- 5.2.3. Mobile Devices

- 5.2.4. Virtual Reality Headsets

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zynga Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Electronic Arts Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BioWare

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Valve Corporatio

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Activision Blizzard Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Microsoft Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ubisoft Entertainment SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Nintendo Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Take-Two Interactive Software Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sony Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Zynga Inc

List of Figures

- Figure 1: Global Gaming Industry in North America Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Gaming Industry in North America Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Gaming Industry in North America Revenue (Million), by Product Type 2025 & 2033

- Figure 4: North America Gaming Industry in North America Volume (K Unit), by Product Type 2025 & 2033

- Figure 5: North America Gaming Industry in North America Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Gaming Industry in North America Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America Gaming Industry in North America Revenue (Million), by Platform 2025 & 2033

- Figure 8: North America Gaming Industry in North America Volume (K Unit), by Platform 2025 & 2033

- Figure 9: North America Gaming Industry in North America Revenue Share (%), by Platform 2025 & 2033

- Figure 10: North America Gaming Industry in North America Volume Share (%), by Platform 2025 & 2033

- Figure 11: North America Gaming Industry in North America Revenue (Million), by Region 2025 & 2033

- Figure 12: North America Gaming Industry in North America Volume (K Unit), by Region 2025 & 2033

- Figure 13: North America Gaming Industry in North America Revenue Share (%), by Region 2025 & 2033

- Figure 14: North America Gaming Industry in North America Volume Share (%), by Region 2025 & 2033

- Figure 15: North America Gaming Industry in North America Revenue (Million), by Country 2025 & 2033

- Figure 16: North America Gaming Industry in North America Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Gaming Industry in North America Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Gaming Industry in North America Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Gaming Industry in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: Global Gaming Industry in North America Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 3: Global Gaming Industry in North America Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Global Gaming Industry in North America Volume K Unit Forecast, by Platform 2020 & 2033

- Table 5: Global Gaming Industry in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Gaming Industry in North America Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Gaming Industry in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Global Gaming Industry in North America Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Gaming Industry in North America Revenue Million Forecast, by Product Type 2020 & 2033

- Table 10: Global Gaming Industry in North America Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 11: Global Gaming Industry in North America Revenue Million Forecast, by Platform 2020 & 2033

- Table 12: Global Gaming Industry in North America Volume K Unit Forecast, by Platform 2020 & 2033

- Table 13: Global Gaming Industry in North America Revenue Million Forecast, by Region 2020 & 2033

- Table 14: Global Gaming Industry in North America Volume K Unit Forecast, by Region 2020 & 2033

- Table 15: Global Gaming Industry in North America Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Gaming Industry in North America Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Gaming Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: United States Gaming Industry in North America Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Gaming Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Canada Gaming Industry in North America Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Gaming Industry in North America Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Mexico Gaming Industry in North America Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Gaming Industry in North America?

The projected CAGR is approximately 8.65%.

2. Which companies are prominent players in the Gaming Industry in North America?

Key companies in the market include Zynga Inc, Electronic Arts Inc, BioWare, Valve Corporatio, Activision Blizzard Inc, Microsoft Corporation, Ubisoft Entertainment SA, Nintendo Co Ltd, Take-Two Interactive Software Inc, Sony Corporation.

3. What are the main segments of the Gaming Industry in North America?

The market segments include Product Type , Platform, Region.

4. Can you provide details about the market size?

The market size is estimated to be USD 68.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Smartphone and Internet Penetration; Adoption of Gaming Platforms. such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

Rising Smartphone adoption and Internet Penetration Driving the Market Growth.

7. Are there any restraints impacting market growth?

Implementation and Integration Concerns Hindering the Market.

8. Can you provide examples of recent developments in the market?

October 2022 - Meta partnered with Microsoft Corporation to bring Teams, Windows apps, and games to Quest devices. The partnership is to bring new content, including Windows apps and Teams tie-ins, to Meta's metaverse hardware efforts.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Gaming Industry in North America," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Gaming Industry in North America report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Gaming Industry in North America?

To stay informed about further developments, trends, and reports in the Gaming Industry in North America, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence