Key Insights

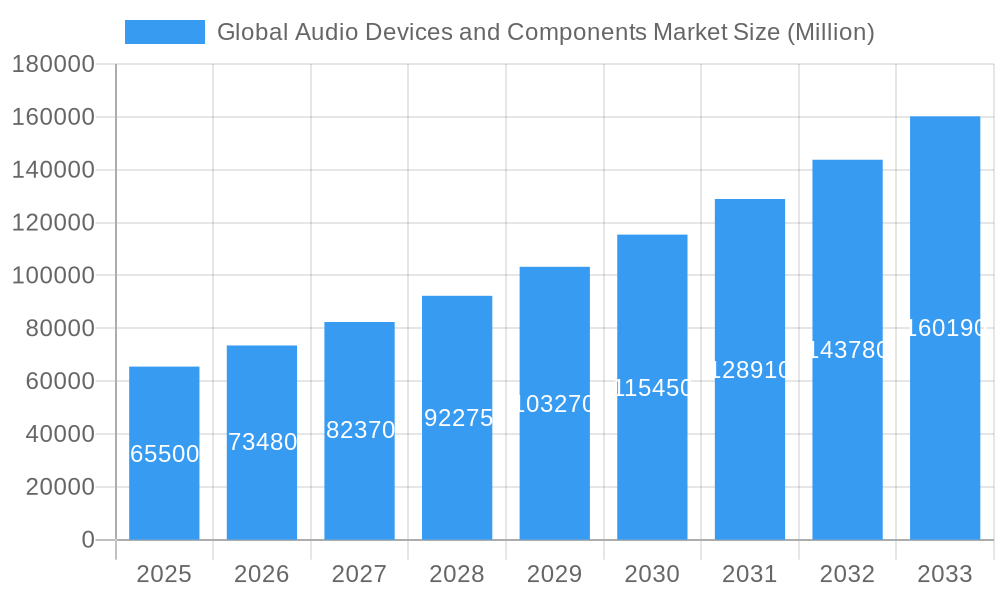

The Global Audio Devices and Components Market is poised for robust expansion, projected to surpass USD 90 billion by 2033, driven by a Compound Annual Growth Rate (CAGR) exceeding 11.80%. This significant growth trajectory is fueled by a confluence of escalating consumer demand for immersive audio experiences, rapid technological advancements, and the increasing integration of audio into smart home ecosystems and wearable devices. The market is segmented into Home Audio, Professional Audio, and Audio Device Components, each contributing to the overall market dynamism. Home audio, encompassing A/V receivers, hi-fi systems, soundbars, and wireless speakers, is witnessing substantial traction due to the growing popularity of home entertainment setups and the rise of sophisticated sound delivery technologies. Similarly, the professional audio segment, including power amplifiers, mixing consoles, and microphones, benefits from the expanding entertainment and broadcast industries. The burgeoning demand for miniaturized, high-performance audio components, such as MEMS microphones and audio codecs, underpins the growth of the components segment, enabling the development of more compact and advanced audio products.

Global Audio Devices and Components Market Market Size (In Billion)

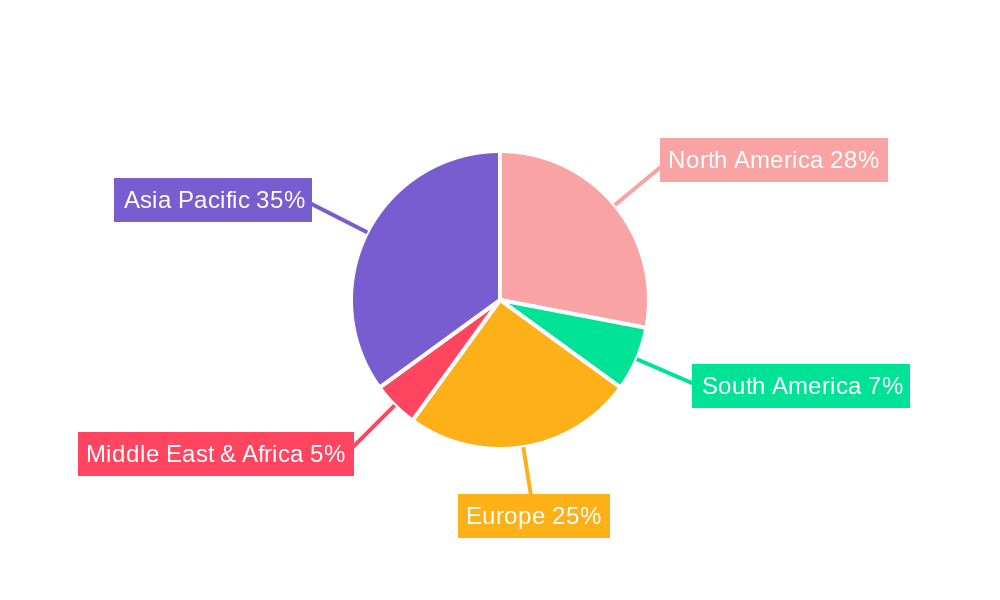

Key market drivers include the pervasive adoption of wireless audio technologies, the increasing affordability of premium audio solutions, and the continuous innovation in audio processing and playback technologies. The proliferation of smart devices, from smartphones and smart TVs to smart speakers and voice assistants, has created a pervasive ecosystem for audio integration, further stimulating market growth. Emerging trends such as spatial audio, AI-powered sound personalization, and the integration of audio into augmented and virtual reality experiences are set to redefine the market landscape. However, challenges such as the high cost of premium components in certain segments and the intense competition among established and emerging players necessitate strategic pricing and product differentiation. Geographically, the Asia Pacific region, led by China and India, is expected to emerge as a dominant force, owing to a burgeoning middle class, increasing disposable incomes, and a strong appetite for consumer electronics. North America and Europe also represent significant markets, driven by technological adoption and established consumer preferences for high-fidelity audio.

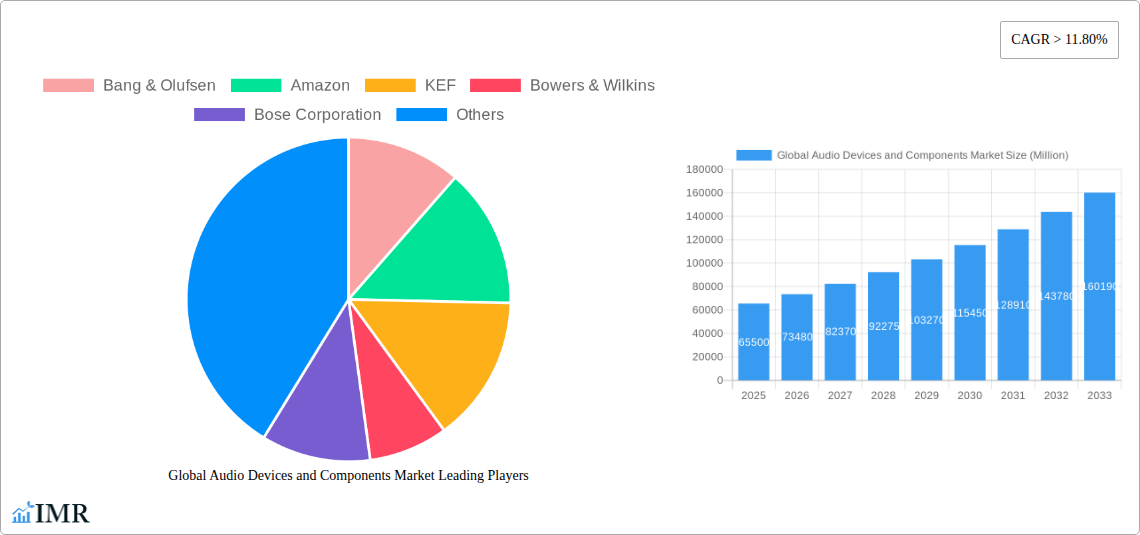

Global Audio Devices and Components Market Company Market Share

Global Audio Devices and Components Market: Comprehensive Industry Report (2019-2033)

This in-depth report provides a strategic analysis of the global audio devices and components market, projecting a significant growth trajectory. Covering the period from 2019 to 2033, with a base year of 2025, this research delves into market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, and emerging opportunities. Industry professionals will gain critical insights into market segmentation, technological advancements, competitive strategies, and the future outlook for this dynamic sector. The report meticulously details the performance of Home Audio and Professional Audio segments, along with the crucial Audio Device Components. All market values are presented in Million Units.

Global Audio Devices and Components Market Market Dynamics & Structure

The global audio devices and components market is characterized by a moderate to high concentration of key players, driven by substantial capital investment requirements and the need for advanced research and development. Technological innovation remains a primary driver, with a relentless pursuit of superior sound quality, enhanced connectivity, and immersive audio experiences. Regulatory frameworks, particularly those concerning electromagnetic compatibility (EMC) and safety standards, play a significant role in shaping product development and market entry. The presence of competitive product substitutes is notable, ranging from basic audio playback devices to sophisticated audiophile-grade equipment, forcing manufacturers to differentiate through innovation and branding. End-user demographics are diversifying, with a growing demand from both tech-savvy millennials and older generations seeking premium audio solutions. Mergers and acquisitions (M&A) activity has been a consistent trend, as larger companies aim to expand their product portfolios, acquire cutting-edge technologies, and gain market share. For instance, Samsung's acquisition of Harman International significantly bolstered its presence in the automotive and professional audio sectors.

- Market Concentration: Dominated by a few leading global manufacturers, alongside a vibrant ecosystem of niche and emerging players.

- Technological Innovation Drivers: Focus on low-latency audio, high-resolution audio playback, AI integration, and miniaturization of components.

- Regulatory Frameworks: Compliance with global standards like CE, FCC, and RoHS is crucial for market access.

- Competitive Product Substitutes: Intense competition from integrated smart home devices, portable speakers, and professional-grade studio equipment.

- End-User Demographics: Growing demand from home entertainment enthusiasts, content creators, professional musicians, and the automotive sector.

- M&A Trends: Strategic acquisitions aimed at technology integration, market expansion, and portfolio diversification.

- Innovation Barriers: High R&D costs, rapid technological obsolescence, and the need for consistent intellectual property protection.

Global Audio Devices and Components Market Growth Trends & Insights

The global audio devices and components market is poised for robust expansion, fueled by several converging trends. The estimated market size for 2025 is projected to be substantial, with sustained Compound Annual Growth Rate (CAGR) expected throughout the forecast period of 2025–2033. This growth is intrinsically linked to the increasing adoption rates of smart home devices, where integrated audio solutions are becoming standard. Technological disruptions, such as the widespread adoption of Bluetooth 5.0 and the development of lossless audio streaming technologies, are enhancing the consumer experience and driving demand for higher-fidelity audio products. Consumer behavior shifts are also playing a pivotal role; there's a discernible move towards personalized audio experiences, with consumers willing to invest in premium sound systems for both home entertainment and personal listening. The proliferation of streaming services and the growing popularity of podcasts and audiobooks further bolster the demand for quality audio playback devices.

The rise of immersive audio formats like Dolby Atmos and DTS:X is revolutionizing the home theater experience, leading to increased sales of soundbars and A/V receivers. In the professional audio sector, advancements in digital signal processing (DSP) and the increasing demand for high-quality content creation are driving the market for mixing consoles, microphones, and audio interfaces. The miniaturization and improved efficiency of Audio Device Components such as MEMS microphones and consumer audio ICs are enabling the development of smaller, more powerful, and feature-rich audio devices. The automotive industry's growing emphasis on in-car audio experiences, driven by premium sound systems from brands like Harman (JBL), is another significant growth accelerator. The report will quantify these trends, providing specific market penetration figures for wireless speakers, soundbars, and professional audio equipment, alongside detailed projections for the component market. The evolving landscape of digital content consumption, coupled with advancements in audio reproduction technologies, ensures a dynamic and expanding market for audio devices and components globally.

Dominant Regions, Countries, or Segments in Global Audio Devices and Components Market

The Home Audio segment is currently a dominant force within the global audio devices and components market, driven by escalating consumer disposable incomes and a growing appetite for enhanced in-home entertainment. Within this segment, Wireless Speakers have emerged as a significant growth driver, largely due to their portability, ease of use, and seamless integration with smart home ecosystems. Countries like the United States, China, and Germany are at the forefront of this expansion, propelled by strong economies, high consumer spending power, and early adoption of new technologies. The robust infrastructure for e-commerce in these regions also facilitates wider product availability and accessibility, further fueling market penetration.

In terms of specific product categories, Soundbars are experiencing remarkable growth as consumers seek to upgrade their television audio experience without the complexity of traditional home theater setups. The increasing adoption of high-definition and 4K televisions directly correlates with the demand for immersive sound solutions that soundbars provide. The Professional Audio segment, while smaller in volume than Home Audio, represents a critical and growing market. Advancements in music production, podcasting, and live event sound reinforcement are driving demand for Microphones, Mixing Consoles, and Power Amplifiers. Asia Pacific, particularly China and South Korea, is emerging as a key manufacturing hub for audio device components, leveraging cost-effective production and a skilled workforce. The Audio Device Components segment, encompassing MEMS Microphones, Consumer Audio ICs (Audio Codec), APUs, and SoC and DSPs, serves as the foundational layer for innovation across all audio devices. The increasing complexity and functionality of modern audio devices necessitate a continuous evolution and demand for these advanced components.

- Dominant Segment: Home Audio, particularly Wireless Speakers and Soundbars.

- Key Drivers in Home Audio: Increasing disposable incomes, smart home adoption, demand for immersive entertainment, and streaming service proliferation.

- Leading Countries: United States, China, Germany, Japan.

- Dominant Region: North America and Asia Pacific.

- Key Drivers in Professional Audio: Growth in content creation (music, podcasts), live events, and broadcast industries.

- Emerging Component Hubs: Asia Pacific (China, South Korea) for manufacturing.

- Growth Potential in Components: Driven by the need for miniaturization, higher processing power, and energy efficiency in all audio devices.

Global Audio Devices and Components Market Product Landscape

The product landscape of the global audio devices and components market is characterized by continuous innovation, focusing on delivering superior audio fidelity, enhanced user experience, and seamless connectivity. Key product developments include the integration of advanced digital signal processing (DSP) for personalized sound profiles and active noise cancellation (ANC) in headphones and portable speakers. The evolution of wireless audio technologies, such as the adoption of higher bandwidth codecs, ensures lossless audio transmission, catering to audiophiles' demands. Soundbars are increasingly incorporating Dolby Atmos and DTS:X support, offering a more immersive cinematic experience. In the realm of audio components, MEMS microphones are becoming smaller and more sensitive, enabling sophisticated voice control and multi-microphone arrays for beamforming and noise reduction. Consumer audio ICs are evolving to handle higher resolution audio streams and support complex audio processing tasks with greater power efficiency. The integration of Artificial Intelligence (AI) in audio devices is enabling features like intelligent sound optimization, voice assistants, and adaptive audio environments.

Key Drivers, Barriers & Challenges in Global Audio Devices and Components Market

Key Drivers:

The global audio devices and components market is propelled by several significant forces. The increasing disposable income and rising consumer spending on premium entertainment experiences are fundamental drivers. The pervasive adoption of smartphones and smart home devices creates a sustained demand for complementary audio solutions, such as wireless speakers and high-quality headphones. Technological advancements, particularly in wireless connectivity (e.g., Wi-Fi 6, Bluetooth 5.3), audio compression codecs, and digital signal processing (DSP), are continuously enhancing product performance and offering new functionalities. The growing popularity of streaming services for music and video content directly fuels the demand for devices capable of delivering high-fidelity audio. Furthermore, the burgeoning content creation industry, including podcasting and home studio setups, necessitates professional-grade audio equipment like microphones and audio interfaces.

Barriers & Challenges:

Despite the positive growth trajectory, the market faces considerable challenges. Intense price competition, especially in the consumer electronics segment, can compress profit margins for manufacturers. Rapid technological obsolescence requires continuous investment in R&D and product lifecycle management, posing a significant financial burden. Supply chain disruptions, as witnessed in recent years due to geopolitical events and component shortages, can significantly impact production volumes and lead times. Regulatory hurdles, particularly concerning safety standards, energy efficiency, and material sourcing, can add to compliance costs and product development timelines. The market is also susceptible to economic downturns, which can dampen consumer spending on discretionary items like premium audio equipment. Furthermore, the cybersecurity of connected audio devices is an increasing concern, requiring robust security measures to protect user data and prevent unauthorized access.

Emerging Opportunities in Global Audio Devices and Components Market

The global audio devices and components market is ripe with emerging opportunities. The expanding automotive sector presents a significant avenue for growth, with increasing demand for sophisticated in-car audio systems, including premium sound installations and noise-cancellation technologies. The metaverse and virtual reality (VR)/augmented reality (AR) ecosystems offer a nascent but promising market for immersive spatial audio devices, such as advanced headphones and haptic audio solutions. The professional audio sector is seeing a surge in demand for compact, portable, and high-performance recording equipment, catering to the rise of independent content creators and remote work setups. Furthermore, the growing awareness of hearing health and the development of advanced assistive listening devices present another niche but important opportunity. The integration of AI into audio devices for personalized sound experiences, voice control, and predictive audio adjustments also represents a significant area for future innovation and market penetration.

Growth Accelerators in the Global Audio Devices and Components Market Industry

Several key factors are accelerating the long-term growth of the global audio devices and components market. The ongoing technological breakthroughs in miniaturization and power efficiency of audio components are enabling the development of more compact, versatile, and feature-rich devices. Strategic partnerships between audio manufacturers and technology giants (e.g., chipset providers, AI developers) are fostering innovation and expanding the capabilities of audio products. The increasing penetration of high-speed internet and 5G networks is crucial for the seamless delivery of high-resolution streaming audio and the reliable performance of connected audio devices. Furthermore, the global expansion of the entertainment industry, coupled with the continued growth of digital content consumption, provides a consistently expanding market base. The development of new applications for audio technology, beyond traditional listening, such as in healthcare and industrial monitoring, also represents a significant growth accelerator.

Key Players Shaping the Global Audio Devices and Components Market Market

- Bang & Olufsen

- Amazon

- KEF

- Bowers & Wilkins

- Bose Corporation

- Dynaudio

- Boston Acoustics

- Sonos Inc

- Samsung (including Harman and JBL)

- Apple

- Klipsch Audio Technologies

- Sony Corporation

Notable Milestones in Global Audio Devices and Components Market Sector

- December 2021: Latency technology house RealTime Audio partnered with audio manufacturer iCON Pro Audio to supply the latter's next line of audio interfaces with RealTime Audio technology. These iCONs 'ultra-low latency boxes' would be available as a standalone box for any audio interface and all-in-one audio interface complete with embedded RealTime Audio technology, significantly impacting professional audio workflows by reducing latency.

- October 2021: Bose launched its new SoundLink Flex wireless Bluetooth speaker. The wireless speaker has a portable, lightweight design meant for the outdoors, with its IP67 build allowing for considerable exposure to dirt and water. It also features a long battery life per charge and can be paired with other Bose speakers, highlighting innovation in portable and durable consumer audio.

- August 2021: KEF announced that three leading KEF loudspeaker models had been declared the best in their categories in this year's prestigious EISA Awards. Both models in the LS50 Collection had earned the best-in-class accolade, with KEF LS50 Wireless II being named Best Product, Wireless Standmount Loudspeakers 2021-22 and KEF LS50 Meta selected as Best Product, Standmount Loudspeakers 2021-2022, underscoring advancements in high-fidelity home audio systems.

In-Depth Global Audio Devices and Components Market Market Outlook

The future outlook for the global audio devices and components market is exceptionally promising, driven by sustained demand for enhanced audio experiences across diverse applications. The convergence of AI, advanced connectivity, and sophisticated component technology will continue to fuel product innovation, leading to more intelligent, personalized, and immersive audio solutions. Emerging markets, particularly in Asia Pacific and Latin America, are expected to represent significant growth opportunities as consumer spending power rises and access to advanced audio technology increases. The ongoing evolution of the metaverse and immersive technologies will create new frontiers for spatial audio, demanding specialized hardware and software. Strategic investments in R&D, coupled with a keen understanding of evolving consumer preferences for convenience, quality, and connectivity, will be crucial for market players to capitalize on these future opportunities and maintain a competitive edge.

Global Audio Devices and Components Market Segmentation

-

1. Home Audio

- 1.1. A/V Receivers

- 1.2. Hi-Fi Systems

- 1.3. Soundbars

- 1.4. Wireless Speakers

- 1.5. Dedicated Docks

-

2. Professional Audio

- 2.1. Power Amplifiers

- 2.2. Mixing Consoles

- 2.3. Microphones

- 2.4. Headphones

-

3. Audio Device Components

- 3.1. MEMS Microphones

- 3.2. Microspeakers

- 3.3. Consumer Audio IC (Audio Codec)

- 3.4. APU, SoC and DSP

- 3.5. Audio Amplifiers

Global Audio Devices and Components Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Global Audio Devices and Components Market Regional Market Share

Geographic Coverage of Global Audio Devices and Components Market

Global Audio Devices and Components Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.49% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Penetration of Mobile Devices; Decreasing Cost of E-books

- 3.3. Market Restrains

- 3.3.1. Privacy and Copyright Issues among E-sellers and Book Writers

- 3.4. Market Trends

- 3.4.1. The Home Audio Segment is Expected to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Home Audio

- 5.1.1. A/V Receivers

- 5.1.2. Hi-Fi Systems

- 5.1.3. Soundbars

- 5.1.4. Wireless Speakers

- 5.1.5. Dedicated Docks

- 5.2. Market Analysis, Insights and Forecast - by Professional Audio

- 5.2.1. Power Amplifiers

- 5.2.2. Mixing Consoles

- 5.2.3. Microphones

- 5.2.4. Headphones

- 5.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 5.3.1. MEMS Microphones

- 5.3.2. Microspeakers

- 5.3.3. Consumer Audio IC (Audio Codec)

- 5.3.4. APU, SoC and DSP

- 5.3.5. Audio Amplifiers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Home Audio

- 6. North America Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Home Audio

- 6.1.1. A/V Receivers

- 6.1.2. Hi-Fi Systems

- 6.1.3. Soundbars

- 6.1.4. Wireless Speakers

- 6.1.5. Dedicated Docks

- 6.2. Market Analysis, Insights and Forecast - by Professional Audio

- 6.2.1. Power Amplifiers

- 6.2.2. Mixing Consoles

- 6.2.3. Microphones

- 6.2.4. Headphones

- 6.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 6.3.1. MEMS Microphones

- 6.3.2. Microspeakers

- 6.3.3. Consumer Audio IC (Audio Codec)

- 6.3.4. APU, SoC and DSP

- 6.3.5. Audio Amplifiers

- 6.1. Market Analysis, Insights and Forecast - by Home Audio

- 7. South America Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Home Audio

- 7.1.1. A/V Receivers

- 7.1.2. Hi-Fi Systems

- 7.1.3. Soundbars

- 7.1.4. Wireless Speakers

- 7.1.5. Dedicated Docks

- 7.2. Market Analysis, Insights and Forecast - by Professional Audio

- 7.2.1. Power Amplifiers

- 7.2.2. Mixing Consoles

- 7.2.3. Microphones

- 7.2.4. Headphones

- 7.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 7.3.1. MEMS Microphones

- 7.3.2. Microspeakers

- 7.3.3. Consumer Audio IC (Audio Codec)

- 7.3.4. APU, SoC and DSP

- 7.3.5. Audio Amplifiers

- 7.1. Market Analysis, Insights and Forecast - by Home Audio

- 8. Europe Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Home Audio

- 8.1.1. A/V Receivers

- 8.1.2. Hi-Fi Systems

- 8.1.3. Soundbars

- 8.1.4. Wireless Speakers

- 8.1.5. Dedicated Docks

- 8.2. Market Analysis, Insights and Forecast - by Professional Audio

- 8.2.1. Power Amplifiers

- 8.2.2. Mixing Consoles

- 8.2.3. Microphones

- 8.2.4. Headphones

- 8.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 8.3.1. MEMS Microphones

- 8.3.2. Microspeakers

- 8.3.3. Consumer Audio IC (Audio Codec)

- 8.3.4. APU, SoC and DSP

- 8.3.5. Audio Amplifiers

- 8.1. Market Analysis, Insights and Forecast - by Home Audio

- 9. Middle East & Africa Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Home Audio

- 9.1.1. A/V Receivers

- 9.1.2. Hi-Fi Systems

- 9.1.3. Soundbars

- 9.1.4. Wireless Speakers

- 9.1.5. Dedicated Docks

- 9.2. Market Analysis, Insights and Forecast - by Professional Audio

- 9.2.1. Power Amplifiers

- 9.2.2. Mixing Consoles

- 9.2.3. Microphones

- 9.2.4. Headphones

- 9.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 9.3.1. MEMS Microphones

- 9.3.2. Microspeakers

- 9.3.3. Consumer Audio IC (Audio Codec)

- 9.3.4. APU, SoC and DSP

- 9.3.5. Audio Amplifiers

- 9.1. Market Analysis, Insights and Forecast - by Home Audio

- 10. Asia Pacific Global Audio Devices and Components Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Home Audio

- 10.1.1. A/V Receivers

- 10.1.2. Hi-Fi Systems

- 10.1.3. Soundbars

- 10.1.4. Wireless Speakers

- 10.1.5. Dedicated Docks

- 10.2. Market Analysis, Insights and Forecast - by Professional Audio

- 10.2.1. Power Amplifiers

- 10.2.2. Mixing Consoles

- 10.2.3. Microphones

- 10.2.4. Headphones

- 10.3. Market Analysis, Insights and Forecast - by Audio Device Components

- 10.3.1. MEMS Microphones

- 10.3.2. Microspeakers

- 10.3.3. Consumer Audio IC (Audio Codec)

- 10.3.4. APU, SoC and DSP

- 10.3.5. Audio Amplifiers

- 10.1. Market Analysis, Insights and Forecast - by Home Audio

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Bang & Olufsen

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Amazon

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 KEF

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Bowers & Wilkins

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bose Corporation

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Dynaudio

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Boston Acoustics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sonos Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Google

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Samsung (including Harman and JBL)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Apple

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Klipsch Audio Technologies

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Sony Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Bang & Olufsen

List of Figures

- Figure 1: Global Global Audio Devices and Components Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Global Audio Devices and Components Market Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 4: North America Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 5: North America Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 6: North America Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 7: North America Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 8: North America Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 9: North America Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 10: North America Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 11: North America Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 12: North America Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 13: North America Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 14: North America Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 15: North America Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 16: North America Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 17: North America Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: North America Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

- Figure 19: South America Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 20: South America Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 21: South America Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 22: South America Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 23: South America Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 24: South America Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 25: South America Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 26: South America Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 27: South America Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 28: South America Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 29: South America Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 30: South America Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 31: South America Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 32: South America Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 33: South America Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: South America Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

- Figure 35: Europe Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 36: Europe Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 37: Europe Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 38: Europe Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 39: Europe Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 40: Europe Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 41: Europe Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 42: Europe Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 43: Europe Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 44: Europe Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 45: Europe Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 46: Europe Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 47: Europe Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 48: Europe Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 49: Europe Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Europe Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East & Africa Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 52: Middle East & Africa Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 53: Middle East & Africa Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 54: Middle East & Africa Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 55: Middle East & Africa Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 56: Middle East & Africa Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 57: Middle East & Africa Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 58: Middle East & Africa Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 59: Middle East & Africa Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 60: Middle East & Africa Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 61: Middle East & Africa Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 62: Middle East & Africa Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 63: Middle East & Africa Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 64: Middle East & Africa Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 65: Middle East & Africa Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 66: Middle East & Africa Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

- Figure 67: Asia Pacific Global Audio Devices and Components Market Revenue (undefined), by Home Audio 2025 & 2033

- Figure 68: Asia Pacific Global Audio Devices and Components Market Volume (K Unit), by Home Audio 2025 & 2033

- Figure 69: Asia Pacific Global Audio Devices and Components Market Revenue Share (%), by Home Audio 2025 & 2033

- Figure 70: Asia Pacific Global Audio Devices and Components Market Volume Share (%), by Home Audio 2025 & 2033

- Figure 71: Asia Pacific Global Audio Devices and Components Market Revenue (undefined), by Professional Audio 2025 & 2033

- Figure 72: Asia Pacific Global Audio Devices and Components Market Volume (K Unit), by Professional Audio 2025 & 2033

- Figure 73: Asia Pacific Global Audio Devices and Components Market Revenue Share (%), by Professional Audio 2025 & 2033

- Figure 74: Asia Pacific Global Audio Devices and Components Market Volume Share (%), by Professional Audio 2025 & 2033

- Figure 75: Asia Pacific Global Audio Devices and Components Market Revenue (undefined), by Audio Device Components 2025 & 2033

- Figure 76: Asia Pacific Global Audio Devices and Components Market Volume (K Unit), by Audio Device Components 2025 & 2033

- Figure 77: Asia Pacific Global Audio Devices and Components Market Revenue Share (%), by Audio Device Components 2025 & 2033

- Figure 78: Asia Pacific Global Audio Devices and Components Market Volume Share (%), by Audio Device Components 2025 & 2033

- Figure 79: Asia Pacific Global Audio Devices and Components Market Revenue (undefined), by Country 2025 & 2033

- Figure 80: Asia Pacific Global Audio Devices and Components Market Volume (K Unit), by Country 2025 & 2033

- Figure 81: Asia Pacific Global Audio Devices and Components Market Revenue Share (%), by Country 2025 & 2033

- Figure 82: Asia Pacific Global Audio Devices and Components Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 2: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 3: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 4: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 5: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 6: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 7: Global Audio Devices and Components Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 8: Global Audio Devices and Components Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 10: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 11: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 12: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 13: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 14: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 15: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 16: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 17: United States Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: United States Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Canada Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Canada Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 21: Mexico Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Mexico Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 23: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 24: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 25: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 26: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 27: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 28: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 29: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: Brazil Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Brazil Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Argentina Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Argentina Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of South America Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 38: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 39: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 40: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 41: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 42: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 43: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 44: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 45: United Kingdom Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: United Kingdom Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: Germany Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: Germany Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: France Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: France Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: Italy Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Italy Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Spain Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Spain Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Russia Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 56: Russia Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 57: Benelux Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 58: Benelux Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 59: Nordics Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Nordics Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 61: Rest of Europe Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: Rest of Europe Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 64: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 65: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 66: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 67: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 68: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 69: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 70: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 71: Turkey Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 72: Turkey Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 73: Israel Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Israel Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: GCC Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: GCC Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: North Africa Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: North Africa Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 79: South Africa Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 80: South Africa Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 81: Rest of Middle East & Africa Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 82: Rest of Middle East & Africa Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 83: Global Audio Devices and Components Market Revenue undefined Forecast, by Home Audio 2020 & 2033

- Table 84: Global Audio Devices and Components Market Volume K Unit Forecast, by Home Audio 2020 & 2033

- Table 85: Global Audio Devices and Components Market Revenue undefined Forecast, by Professional Audio 2020 & 2033

- Table 86: Global Audio Devices and Components Market Volume K Unit Forecast, by Professional Audio 2020 & 2033

- Table 87: Global Audio Devices and Components Market Revenue undefined Forecast, by Audio Device Components 2020 & 2033

- Table 88: Global Audio Devices and Components Market Volume K Unit Forecast, by Audio Device Components 2020 & 2033

- Table 89: Global Audio Devices and Components Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 90: Global Audio Devices and Components Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 91: China Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 92: China Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 93: India Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 94: India Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 95: Japan Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 96: Japan Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 97: South Korea Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 98: South Korea Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 99: ASEAN Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 100: ASEAN Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 101: Oceania Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 102: Oceania Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 103: Rest of Asia Pacific Global Audio Devices and Components Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 104: Rest of Asia Pacific Global Audio Devices and Components Market Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Global Audio Devices and Components Market?

The projected CAGR is approximately 3.49%.

2. Which companies are prominent players in the Global Audio Devices and Components Market?

Key companies in the market include Bang & Olufsen, Amazon, KEF, Bowers & Wilkins, Bose Corporation, Dynaudio, Boston Acoustics, Sonos Inc, Google, Samsung (including Harman and JBL), Apple, Klipsch Audio Technologies, Sony Corporation.

3. What are the main segments of the Global Audio Devices and Components Market?

The market segments include Home Audio, Professional Audio, Audio Device Components.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Penetration of Mobile Devices; Decreasing Cost of E-books.

6. What are the notable trends driving market growth?

The Home Audio Segment is Expected to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Privacy and Copyright Issues among E-sellers and Book Writers.

8. Can you provide examples of recent developments in the market?

December 2021 - Latency technology house RealTime Audio partnered with audio manufacturer iCON Pro Audio to supply the latter's next line of audio interfaces with RealTime Audio technology. These iCONs 'ultra-low latency boxes' would be available as a standalone box for any audio interface and all-in-one audio interface complete with embedded RealTime Audio technology.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Global Audio Devices and Components Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Global Audio Devices and Components Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Global Audio Devices and Components Market?

To stay informed about further developments, trends, and reports in the Global Audio Devices and Components Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence