Key Insights

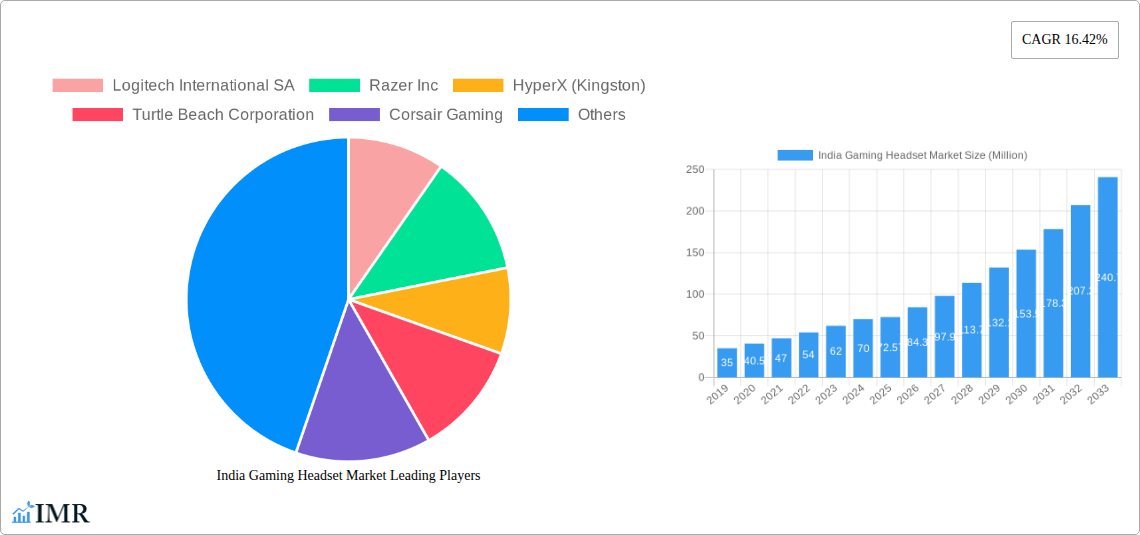

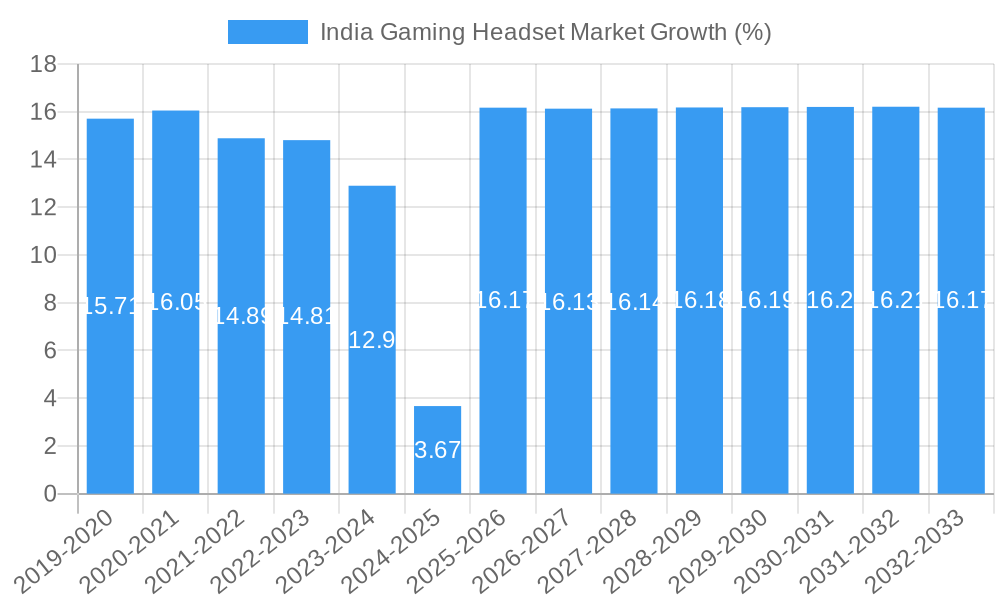

The Indian gaming headset market is poised for substantial expansion, driven by an estimated market size of USD 72.57 million in 2025, projecting a robust CAGR of 16.42% through to 2033. This impressive growth trajectory is fueled by a confluence of factors, prominently including the increasing penetration of high-speed internet and mobile devices, which has democratized access to online gaming for a wider demographic. The burgeoning esports scene in India, with its growing prize pools and dedicated fan base, also acts as a significant catalyst, encouraging more gamers to invest in high-quality audio peripherals for an immersive competitive experience. Furthermore, the rising disposable incomes and a growing youth population with a strong affinity for gaming are creating a fertile ground for market expansion. The continuous innovation by leading companies, introducing features like advanced noise cancellation, virtual surround sound, and ergonomic designs, further stimulates consumer demand. The shift towards wireless connectivity is a key trend, offering enhanced freedom of movement and convenience, while console and PC headsets are expected to dominate, catering to both dedicated gaming consoles and the ever-popular PC gaming segment.

The market is expected to experience sustained demand across both retail and online sales channels, with e-commerce platforms playing a pivotal role in reaching a wider consumer base across diverse geographical locations within India. While the market benefits from strong drivers, potential restraints include price sensitivity among a segment of the Indian consumer base and the need for ongoing consumer education regarding the benefits of premium gaming headsets beyond basic audio output. However, the overwhelming positive market sentiment, coupled with the increasing adoption of gaming as a mainstream entertainment form, suggests that these challenges will be navigated successfully. The competitive landscape features established global players like Logitech, Razer, and HyperX, alongside growing local interest and technological advancements, all contributing to a dynamic and evolving market. The Indian gaming headset market is not just a segment of the broader electronics industry; it's a critical component of the rapidly expanding digital entertainment ecosystem in the nation, set to witness remarkable growth in the coming years.

India Gaming Headset Market Report: Unleashing Immersion and Driving Growth (2024-2033)

Unlock comprehensive insights into India's burgeoning gaming headset market. This in-depth report analyzes the competitive landscape, key growth drivers, and emerging opportunities within the Indian gaming headset industry. Covering the period 2019–2033, with a base year of 2025, the report offers a detailed forecast (2025–2033) and historical analysis (2019–2024) of a market projected for significant expansion. Explore market dynamics, regional dominance, product innovation, and the strategies of leading players. Understand the impact of parent and child market segments on the overall industry. All values are presented in million units, ensuring precise data for strategic decision-making.

India Gaming Headset Market Market Dynamics & Structure

The Indian gaming headset market exhibits a dynamic interplay of technological advancement, evolving consumer preferences, and a growing competitive landscape. Market concentration is moderately fragmented, with global giants vying for dominance alongside emerging domestic players. Technological innovation remains a paramount driver, fueled by the demand for immersive audio experiences, low latency wireless connectivity, and enhanced comfort for extended gaming sessions. Regulatory frameworks, while still developing in the gaming accessory space, are increasingly influencing product safety and import policies. Competitive product substitutes, ranging from high-fidelity consumer headphones to basic audio devices, present a constant challenge, necessitating continuous product differentiation. End-user demographics are shifting, with a burgeoning youth population, increasing disposable incomes, and a rising interest in esports contributing to market expansion. Mergers and acquisitions (M&A) activity is anticipated to play a role in consolidating market share and expanding product portfolios, though detailed deal volumes are still nascent.

- Market Concentration: Moderately fragmented, with key global players holding significant market share.

- Technological Innovation Drivers: Demand for immersive audio, low-latency wireless, superior comfort, and advanced features like active noise cancellation.

- Regulatory Frameworks: Evolving standards impacting product safety, import duties, and e-commerce regulations.

- Competitive Product Substitutes: High-fidelity consumer headphones, basic audio devices, and built-in audio solutions.

- End-User Demographics: Predominantly young, tech-savvy population with growing disposable incomes and a strong interest in PC and mobile gaming, and esports.

- M&A Trends: Potential for consolidation and strategic acquisitions to expand market reach and product offerings.

India Gaming Headset Market Growth Trends & Insights

The Indian gaming headset market is poised for remarkable growth, propelled by a confluence of factors that are reshaping the nation's entertainment and technology landscape. The overall market size is projected to experience a robust Compound Annual Growth Rate (CAGR) over the forecast period, driven by increasing adoption rates of gaming as a primary form of entertainment. Technological disruptions, such as the rapid advancements in audio technology and wireless connectivity, are creating new product categories and enhancing user experiences. Consumers are increasingly prioritizing high-quality audio immersion to gain a competitive edge in multiplayer games and to fully appreciate the rich soundscapes of modern titles. This shift in consumer behavior is evident in the rising demand for specialized gaming headsets that offer superior sound clarity, positional audio, and effective communication features. The proliferation of affordable smartphones and the expansion of internet infrastructure are also bringing more individuals into the gaming ecosystem, thereby broadening the potential customer base for gaming headsets. Furthermore, the burgeoning esports scene in India, with its growing number of professional players, tournaments, and enthusiastic spectators, acts as a significant catalyst, driving the demand for professional-grade gaming peripherals. The trend towards hybrid work and study models also contributes to increased at-home entertainment consumption, including gaming, further boosting the market. As disposable incomes rise and the perception of gaming shifts from a niche hobby to a mainstream activity, the market penetration of gaming headsets is expected to deepen significantly, indicating a strong and sustained growth trajectory.

Dominant Regions, Countries, or Segments in India Gaming Headset Market

The Indian gaming headset market's dominance is currently concentrated within the PC Headset segment, driven by a burgeoning PC gaming culture and the increasing popularity of esports, which heavily relies on PC platforms. This segment captures a substantial market share, fueled by a growing number of PC gamers who invest in specialized peripherals to enhance their gaming experience. The Online sales channel also plays a pivotal role in driving market growth, offering accessibility and convenience to consumers across diverse geographical locations. This channel allows brands to reach a wider audience and cater to the preferences of a digitally native population.

- Dominant Compatibility Type: PC Headset:

- Growing PC Gaming Ecosystem: Increasing accessibility of gaming PCs and the popularity of competitive PC titles.

- Esports Growth: Professional esports tournaments and leagues predominantly use PC platforms, driving demand for high-performance PC headsets.

- Content Creation: Rise of streamers and content creators who require high-quality audio for their broadcasts.

- Technological Superiority: PC headsets often offer advanced features and customization options catering to discerning gamers.

- Dominant Sales Channel: Online:

- Wider Reach and Accessibility: Online platforms connect brands with consumers across Tier 1, Tier 2, and Tier 3 cities, overcoming geographical limitations.

- Competitive Pricing and Deals: E-commerce sites frequently offer discounts and promotions, attracting price-sensitive consumers.

- Convenience and Ease of Purchase: Consumers can easily compare products, read reviews, and make purchases from the comfort of their homes.

- Direct-to-Consumer (DTC) Models: Brands leverage online channels to establish direct relationships with customers and gain valuable market insights.

- Significant Growth in Wireless Connectivity:

- Convenience and Freedom of Movement: Wireless headsets offer an untethered gaming experience, appealing to a broad consumer base.

- Technological Advancements: Improved battery life, reduced latency, and enhanced signal stability in modern wireless technology.

- Premiumization Trend: Consumers are increasingly willing to pay a premium for the convenience and advanced features of wireless gaming headsets.

India Gaming Headset Market Product Landscape

The Indian gaming headset market is characterized by a rapid evolution of product offerings, with manufacturers continuously innovating to deliver superior audio fidelity and immersive gameplay experiences. Key product innovations include advancements in driver technology for richer sound, the integration of virtual surround sound for enhanced spatial awareness, and the development of low-latency wireless solutions that rival wired performance. Features such as active noise cancellation (ANC) are becoming more prevalent, allowing gamers to block out external distractions and focus on in-game audio cues. Ergonomic designs, lightweight materials, and breathable earcups are also prioritized to ensure comfort during extended gaming sessions. The inclusion of high-quality microphones with noise-filtering capabilities ensures clear in-game communication, a critical aspect for multiplayer gaming. Products are increasingly tailored to specific gaming platforms, with dedicated console headsets and versatile PC headsets catering to different user needs. The focus on aesthetics, with customizable RGB lighting and sleek designs, also contributes to the appeal of gaming headsets as a statement accessory for many gamers.

Key Drivers, Barriers & Challenges in India Gaming Headset Market

Key Drivers:

- Explosion of Esports and Competitive Gaming: The rapid growth of esports leagues, tournaments, and a professional gaming ecosystem in India directly fuels the demand for high-performance gaming headsets.

- Increasing Smartphone Penetration and Mobile Gaming: The widespread availability of affordable smartphones and the popularity of mobile gaming are expanding the addressable market for gaming accessories, including headsets.

- Rising Disposable Incomes and Urbanization: A growing middle class with increased disposable income is willing to invest in premium gaming peripherals to enhance their entertainment experience.

- Technological Advancements: Continuous innovation in audio technology, wireless connectivity, and comfort features are creating new product appeal and driving upgrades.

- Influence of Content Creators and Streamers: Popular streamers and esports personalities often endorse and use high-end gaming headsets, influencing consumer purchasing decisions.

Barriers & Challenges:

- Price Sensitivity of a Large Consumer Base: While disposable incomes are rising, a significant portion of the Indian market remains price-sensitive, making premium headsets a luxury for many.

- Counterfeit Products and Grey Market: The prevalence of counterfeit and unofficial gaming accessories can erode consumer trust and impact sales of genuine products.

- Limited Awareness of Specialized Features: In some segments of the market, consumers may not be fully aware of the benefits and unique features offered by dedicated gaming headsets compared to standard audio devices.

- Supply Chain and Distribution Challenges: Ensuring consistent availability and efficient distribution of products across a vast and diverse country like India can be a logistical hurdle.

- Intense Competition: The market is characterized by a high degree of competition from both global and emerging players, leading to pricing pressures.

Emerging Opportunities in India Gaming Headset Market

Emerging opportunities in the India gaming headset market lie in catering to the burgeoning mobile gaming segment with specialized, cost-effective wireless headsets. The growing interest in Virtual Reality (VR) and Augmented Reality (AR) gaming presents a significant avenue for innovation in audio solutions for immersive experiences. Furthermore, there's an untapped potential in developing gaming headsets optimized for specific regional languages and cultural preferences, enhancing user engagement. Partnerships with gaming cafes and educational institutions to promote esports and provide gaming headset solutions can also unlock new market segments. The increasing adoption of cloud gaming services in India opens doors for lightweight, high-fidelity wireless headsets that can seamlessly transition between devices.

Growth Accelerators in the India Gaming Headset Market Industry

Several catalysts are accelerating the growth of the India gaming headset market. The rapid expansion of the esports infrastructure, including dedicated arenas and online tournament platforms, is creating a sustained demand for professional-grade equipment. Strategic partnerships between gaming hardware manufacturers and popular game developers, offering bundled deals or exclusive in-game content with headset purchases, can significantly boost sales. The increasing integration of advanced audio technologies, such as spatial audio and AI-powered noise cancellation, within mid-range and budget headsets makes premium features accessible to a wider audience, driving market penetration. Government initiatives promoting digital India and incentivizing technology adoption also contribute to a more favorable market environment for gaming accessories.

Key Players Shaping the India Gaming Headset Market Market

- Logitech International SA

- Razer Inc

- HyperX (Kingston)

- Turtle Beach Corporation

- Corsair Gaming

- SteelSeries

- Audio-Technica Ltd

- Sony Interactive Entertainment

- Creative Technology

- Skullcandy

- Sennheiser Electronic GmbH & Co KG

- ROCCA

Notable Milestones in India Gaming Headset Market Sector

- April 2024: DPVR announced the launch of the new E4 Arc VR headset with hand-tracking support, integrating Ultraleap's Leap Motion Controller 2 for an enhanced VR experience. This development highlights the growing convergence of gaming headsets and advanced immersive technologies.

- April 2024: Pimax unveiled the Crystal Super and Crystal Light VR headsets, featuring revolutionary changeable optical engines and high-resolution displays. The introduction of the 60G Airlink module signifies advancements in high-fidelity wireless PCVR, directly impacting the future of gaming audio connectivity.

In-Depth India Gaming Headset Market Market Outlook

The India gaming headset market is set to witness substantial growth, fueled by a dynamic blend of technological innovation and evolving consumer behaviors. The increasing penetration of high-speed internet and smartphones, coupled with the rapidly expanding esports ecosystem, creates a fertile ground for gaming peripheral adoption. Emerging trends such as the demand for wireless convenience, the integration of advanced audio technologies for immersive experiences, and the growing influence of content creators will continue to shape product development and market strategies. Opportunities in the mobile gaming and VR/AR segments offer significant avenues for expansion, while strategic collaborations and government support for digital technologies will act as crucial growth accelerators, positioning India as a key market for gaming headsets globally.

India Gaming Headset Market Segmentation

-

1. Compatibility Type

- 1.1. Console Headset

- 1.2. PC Headset

-

2. Connectivity Type

- 2.1. Wired

- 2.2. Wireless

-

3. Sales Channel

- 3.1. Retail

- 3.2. Online

India Gaming Headset Market Segmentation By Geography

- 1. India

India Gaming Headset Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 16.42% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms such as E-sports Betting and Fantasy Sites

- 3.3. Market Restrains

- 3.3.1. Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms such as E-sports Betting and Fantasy Sites

- 3.4. Market Trends

- 3.4.1. Rising Internet Penetration and Emergence of Cloud Gaming Platforms

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Gaming Headset Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 5.1.1. Console Headset

- 5.1.2. PC Headset

- 5.2. Market Analysis, Insights and Forecast - by Connectivity Type

- 5.2.1. Wired

- 5.2.2. Wireless

- 5.3. Market Analysis, Insights and Forecast - by Sales Channel

- 5.3.1. Retail

- 5.3.2. Online

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Compatibility Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Logitech International SA

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Razer Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HyperX (Kingston)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Turtle Beach Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Corsair Gaming

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 SteelSeries

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Audio-Technica Ltd

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sony Interactive Entertainment

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Creative Technology

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Skullcandy

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Sennheiser Electronic GmbH & Co KG

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 ROCCA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Logitech International SA

List of Figures

- Figure 1: India Gaming Headset Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India Gaming Headset Market Share (%) by Company 2024

List of Tables

- Table 1: India Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 3: India Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 4: India Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 5: India Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 6: India Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 7: India Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 8: India Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 9: India Gaming Headset Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: India Gaming Headset Market Volume Million Forecast, by Region 2019 & 2032

- Table 11: India Gaming Headset Market Revenue Million Forecast, by Compatibility Type 2019 & 2032

- Table 12: India Gaming Headset Market Volume Million Forecast, by Compatibility Type 2019 & 2032

- Table 13: India Gaming Headset Market Revenue Million Forecast, by Connectivity Type 2019 & 2032

- Table 14: India Gaming Headset Market Volume Million Forecast, by Connectivity Type 2019 & 2032

- Table 15: India Gaming Headset Market Revenue Million Forecast, by Sales Channel 2019 & 2032

- Table 16: India Gaming Headset Market Volume Million Forecast, by Sales Channel 2019 & 2032

- Table 17: India Gaming Headset Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: India Gaming Headset Market Volume Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Gaming Headset Market?

The projected CAGR is approximately 16.42%.

2. Which companies are prominent players in the India Gaming Headset Market?

Key companies in the market include Logitech International SA, Razer Inc, HyperX (Kingston), Turtle Beach Corporation, Corsair Gaming, SteelSeries, Audio-Technica Ltd, Sony Interactive Entertainment, Creative Technology, Skullcandy, Sennheiser Electronic GmbH & Co KG, ROCCA.

3. What are the main segments of the India Gaming Headset Market?

The market segments include Compatibility Type, Connectivity Type, Sales Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.57 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms such as E-sports Betting and Fantasy Sites.

6. What are the notable trends driving market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms.

7. Are there any restraints impacting market growth?

Rising Internet Penetration and Emergence of Cloud Gaming Platforms; Adoption of Gaming Platforms such as E-sports Betting and Fantasy Sites.

8. Can you provide examples of recent developments in the market?

April 2024: DPVR announced the launch of the new E4 Arc VR headset with hand-tracking support. This variant of the DPVR E4 PC VR headset is equipped with the Leap Motion Controller 2 hand-tracking camera from Ultraleap. Ultraleap's Leap Motion 2 provides a tracking range of between 10 and 110 cm and a maximum field of view of 160° x 160°. The E4 Arc is also equipped with a "turbo cooling system," which features an improved fan model, optimized vapor chamber, and optimized fan operating logic. The headset also features easily replaceable cables for easier maintenance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Gaming Headset Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Gaming Headset Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Gaming Headset Market?

To stay informed about further developments, trends, and reports in the India Gaming Headset Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence