Key Insights

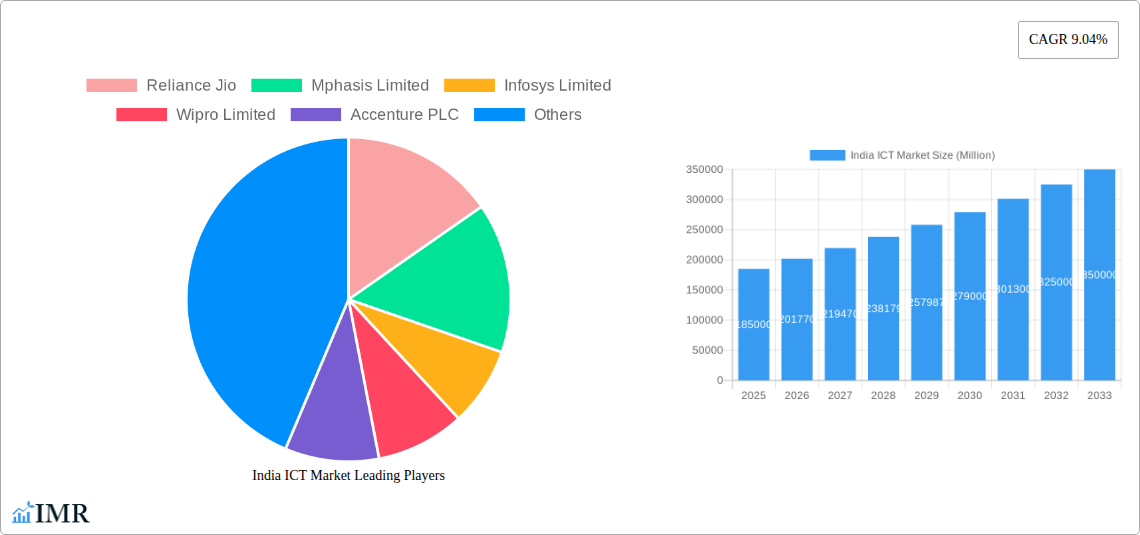

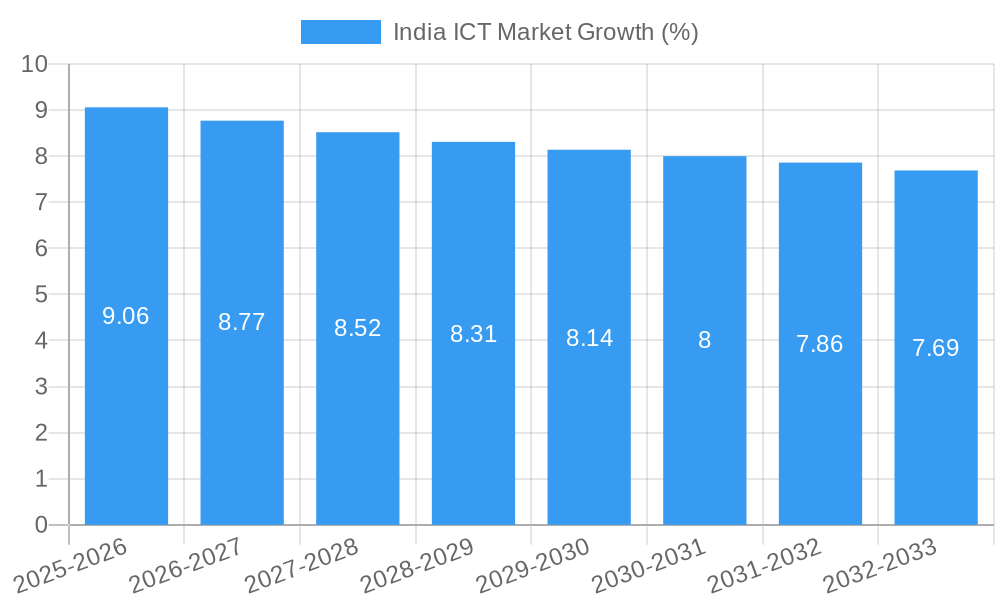

The Indian ICT market is poised for robust expansion, projected to reach a substantial market size in 2025 and maintain a healthy Compound Annual Growth Rate (CAGR) of 9.04% through 2033. This growth is fueled by several critical drivers, including the accelerating digital transformation initiatives across industries, the increasing adoption of cloud computing and big data analytics, and the government's push for a digitally empowered nation through programs like Digital India. The burgeoning startup ecosystem and the consistent demand for advanced IT services from both domestic and international clients are also significant contributors. Furthermore, the pervasive integration of technologies like Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT) is creating new avenues for growth and innovation within the sector. The telecom services segment, in particular, is experiencing a surge driven by the rollout of 5G networks and the increasing demand for high-speed data connectivity.

The market's dynamism is further shaped by emerging trends such as the rise of hybrid cloud solutions, the growing importance of cybersecurity as digital footprints expand, and the increasing reliance on Software-as-a-Service (SaaS) models. The enterprise segment, spanning micro, small, and medium enterprises (MSMEs) to large corporations, is actively investing in ICT solutions to enhance operational efficiency, customer engagement, and competitive advantage. Key industry verticals like BFSI, IT and Telecom, Government, and Retail and E-commerce are at the forefront of this adoption. However, certain restraints, such as the shortage of skilled IT professionals and potential cybersecurity threats, necessitate strategic planning and investment in talent development and robust security frameworks to sustain this growth trajectory. The competitive landscape is marked by the presence of established global players and agile domestic companies, all vying for market share through innovation and strategic partnerships.

Uncover the explosive growth and intricate dynamics of India's Information and Communication Technology (ICT) market. This definitive report delves into current trends, future projections, and key player strategies, providing invaluable insights for stakeholders navigating this rapidly evolving landscape. Our analysis covers parent and child markets, offering a holistic view of opportunities within hardware, software, IT services, and telecommunications.

India ICT Market Market Dynamics & Structure

The India ICT market is characterized by a moderately consolidated structure, with a few dominant players controlling significant market share across segments, alongside a vibrant ecosystem of agile startups and specialized service providers. Technological innovation is a primary driver, fueled by increasing R&D investments and a focus on emerging technologies such as Artificial Intelligence (AI), Machine Learning (ML), Internet of Things (IoT), and cloud computing. The Indian government's supportive regulatory framework, including initiatives like 'Digital India' and incentives for manufacturing and R&D, further propels market expansion. Competitive product substitutes are abundant, particularly in the software and IT services sectors, fostering innovation and driving down costs for end-users. The end-user demographic is diverse, ranging from digitally native millennials to a rapidly growing segment of tech-savvy enterprises seeking digital transformation. Mergers and acquisitions (M&A) are a prevalent trend, as larger entities aim to acquire innovative technologies, expand service portfolios, and consolidate market presence. For instance, numerous small and medium-sized IT service providers are being acquired by larger conglomerates to bolster their capabilities.

- Market Concentration: Moderate, with a mix of large enterprises and a growing number of agile players.

- Technological Innovation Drivers: AI, ML, IoT, Cloud Computing, 5G adoption.

- Regulatory Frameworks: Favorable government policies, 'Digital India' initiative, Production Linked Incentives (PLI) schemes.

- Competitive Product Substitutes: High competition across software, cloud services, and hardware components.

- End-User Demographics: Diverse, from individual consumers to large enterprises and government bodies.

- M&A Trends: Active consolidation, strategic acquisitions to gain market share and technological expertise.

India ICT Market Growth Trends & Insights

The India ICT market is projected for substantial growth, propelled by a confluence of factors including increasing digital penetration, burgeoning startup ecosystem, and government-led digital transformation initiatives. The market size is expected to witness a robust Compound Annual Growth Rate (CAGR) throughout the forecast period, driven by the escalating adoption of cloud-based solutions, the expansion of the e-commerce sector, and the growing demand for digital services across all industry verticals. Indian enterprises are increasingly investing in modernizing their IT infrastructure and embracing digital technologies to enhance operational efficiency, customer engagement, and competitive advantage. This is particularly evident in the BFSI, IT and Telecom, and Government sectors, where the impetus for digital transformation is highest.

The rise of the internet and mobile penetration has democratized access to digital services, leading to a significant shift in consumer behavior towards online platforms for shopping, entertainment, and communication. This trend is further amplified by the increasing availability of affordable data plans and smartphones. Technological disruptions, such as the rollout of 5G networks, are poised to unlock new use cases and drive demand for advanced ICT solutions, including edge computing and enhanced IoT applications. The IT services segment, encompassing digital transformation, cloud migration, cybersecurity, and data analytics, is expected to be a major growth engine. Software solutions, particularly enterprise resource planning (ERP), customer relationship management (CRM), and AI-powered tools, are also experiencing elevated demand as businesses seek to optimize their operations and gain data-driven insights. The hardware segment, while mature, continues to see demand from the expansion of data centers, the need for advanced computing power, and the proliferation of connected devices. The overall market penetration of digital services is steadily increasing, indicating a widespread adoption across both urban and rural demographics.

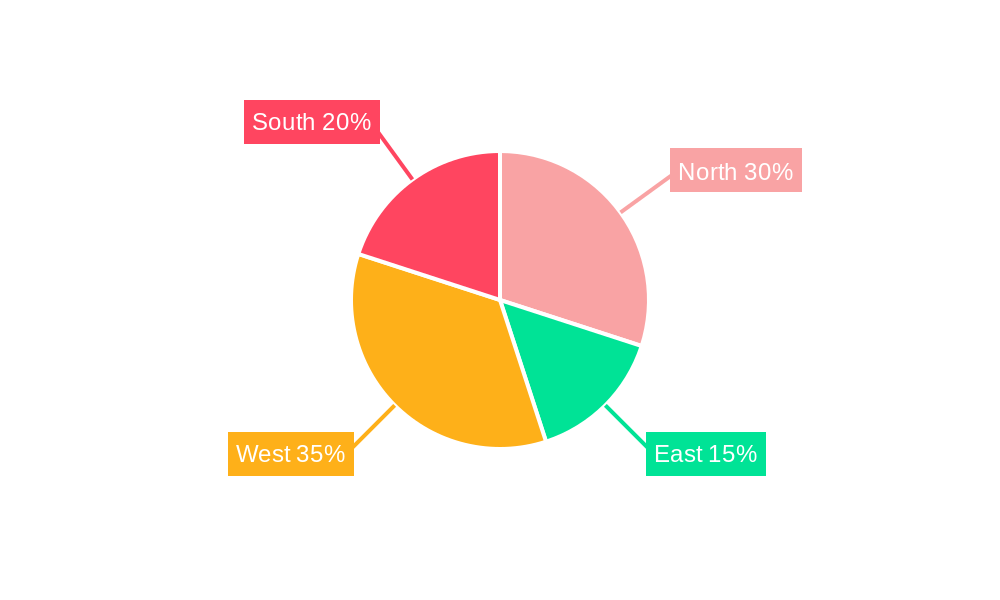

Dominant Regions, Countries, or Segments in India ICT Market

The India ICT market's dominance is significantly influenced by a combination of regional economic powerhouses, specific industry verticals, and key technology segments. Geographically, the South and West regions are leading the charge, driven by the presence of major IT hubs, a robust industrial base, and a higher concentration of large enterprises investing heavily in technology. Cities like Bengaluru, Hyderabad, Chennai, and Pune in the South, and Mumbai, Pune, and Ahmedabad in the West, serve as epicenters for innovation, IT services, and digital adoption. The IT and Telecom industry vertical is a primary growth driver, not only as a consumer of ICT solutions but also as a provider of these services globally. The extensive digital infrastructure development and the sheer volume of telecommunication services being consumed in India contribute significantly to this segment's dominance.

The Software segment is a powerhouse, fueled by India's strong software development talent pool and the global demand for custom and off-the-shelf software solutions. This includes everything from operating systems and application software to sophisticated AI and analytics platforms. Within the enterprise size segment, Large Enterprises are the most dominant consumers of ICT solutions due to their substantial IT budgets and the complexity of their operational needs, driving demand for comprehensive enterprise resource planning (ERP) systems, cloud infrastructure, and advanced cybersecurity. However, the Micro, Small, and Medium Enterprises (MSMEs) segment presents a rapidly growing opportunity, as government initiatives and the availability of affordable, scalable cloud solutions encourage digitalization. The BFSI (Banking, Financial Services, and Insurance) sector is another critical vertical, continuously adopting new technologies for enhanced security, customer service, and operational efficiency, including blockchain, AI for fraud detection, and digital payment platforms.

- Dominant Geography: South and West regions, owing to IT hubs and industrial presence.

- Key Industry Verticals: IT and Telecom, BFSI, Government, driving digital transformation and service consumption.

- Dominant Segments: Software and IT Services, fueled by development capabilities and digital adoption.

- Enterprise Size: Large Enterprises are primary consumers, with MSMEs showing significant growth potential.

- Growth Drivers: Economic policies, digital infrastructure expansion, high digital adoption rates, and demand for advanced solutions.

India ICT Market Product Landscape

The India ICT market's product landscape is vibrant and rapidly evolving, marked by a continuous influx of innovative solutions. In the Hardware segment, advancements in computing power, the miniaturization of components, and the growing demand for IoT-enabled devices are shaping product offerings. This includes high-performance servers for data centers, advanced networking equipment supporting 5G deployment, and a wide array of smart devices. The Software segment is dominated by cloud-native applications, AI-powered analytics platforms, cybersecurity suites, and business process automation tools, all designed to enhance efficiency and drive digital transformation. IT Services encompass a broad spectrum, from application development and maintenance to cloud migration, data analytics, managed IT services, and comprehensive digital transformation consulting. Telecommunication Services are witnessing a revolution with the ongoing 5G rollout, offering faster speeds and lower latency, enabling new applications in areas like enhanced mobile broadband, massive IoT, and mission-critical communications. Unique selling propositions often revolve around scalability, cost-effectiveness, advanced features, and seamless integration capabilities.

Key Drivers, Barriers & Challenges in India ICT Market

The India ICT market is propelled by several key drivers, including the government's strong push for digitalization through initiatives like 'Digital India,' a burgeoning startup ecosystem fostering innovation, and a large pool of skilled IT professionals. The increasing adoption of cloud computing and the demand for data analytics solutions by enterprises across various sectors are also significant growth accelerators. Furthermore, the expansion of 5G infrastructure promises to unlock new opportunities for connected devices and advanced applications.

However, the market faces considerable barriers and challenges. A significant challenge is the digital divide, with disparities in internet access and digital literacy across different regions and demographics. Cybersecurity threats remain a persistent concern, requiring robust and evolving security measures. Regulatory hurdles, although decreasing with supportive government policies, can still pose challenges for new market entrants. Supply chain disruptions, particularly for hardware components, can impact product availability and pricing. Intense competition, both from domestic and international players, exerts pressure on pricing and necessitates continuous innovation to maintain market share.

Emerging Opportunities in India ICT Market

Emerging opportunities within the India ICT market are manifold and span across various segments. The burgeoning Internet of Things (IoT) ecosystem presents significant potential, with applications ranging from smart cities and industrial automation to connected healthcare and agriculture. The continuous evolution of Artificial Intelligence (AI) and Machine Learning (ML) is creating demand for AI-powered solutions in customer service, predictive analytics, and process optimization across all industries. The ongoing 5G rollout is set to revolutionize telecommunications, creating new avenues for services like augmented reality (AR), virtual reality (VR), and enhanced gaming experiences. Furthermore, the growing focus on sustainability and green ICT presents opportunities for businesses offering energy-efficient hardware and eco-friendly software solutions. The increasing digitization of government services also opens up avenues for citizen-centric digital platforms and data management solutions.

Growth Accelerators in the India ICT Market Industry

Several catalysts are accelerating the long-term growth of the India ICT market. Technological breakthroughs in areas like edge computing, quantum computing, and blockchain are paving the way for disruptive innovations and new business models. Strategic partnerships between global tech giants and Indian companies, such as collaborations for cloud migration and SaaS development, are crucial for knowledge transfer and market expansion. The Indian government's continued focus on fostering a conducive business environment through policy reforms and incentives plays a pivotal role. The increasing outflow of IT services from India to global markets, coupled with the growing domestic demand for advanced digital solutions, provides a dual engine for sustained growth.

Key Players Shaping the India ICT Market Market

- Reliance Jio

- Mphasis Limited

- Infosys Limited

- Wipro Limited

- Accenture PLC

- Atria Convergence Technologies Ltd

- HCL Technologies

- Allied Digital Services Ltd

- Vodafone India

- Tata Consultancy Services Limited

- Tech Mahindra Ltd

- Bharti Airtel Limited

- IBM Global Services

- Mindtree Ltd

- BSNL

- Capgemini Technology Services India Ltd

Notable Milestones in India ICT Market Sector

- May 2023: SolarWinds and Infosys announced a collaboration to accelerate the shift of SolarWinds solutions to a new SaaS model, leveraging Infosys' engineering capabilities to enhance customer visibility in complex hybrid and multi-cloud environments. This collaboration is central to SolarWinds' strategy of delivering accessible, value-based solutions empowering customers' digital transformation.

- October 2022: HCL Technologies expanded its strategic partnership with Google Cloud, introducing new capabilities and service options to expedite cloud migration for HCL Tech clients. This fortified partnership significantly enhances HCL Tech's capacity to support digital transformation, offering professional services, critical migration, and system modernization to enterprise clients.

In-Depth India ICT Market Market Outlook

- May 2023: SolarWinds and Infosys announced a collaboration to accelerate the shift of SolarWinds solutions to a new SaaS model, leveraging Infosys' engineering capabilities to enhance customer visibility in complex hybrid and multi-cloud environments. This collaboration is central to SolarWinds' strategy of delivering accessible, value-based solutions empowering customers' digital transformation.

- October 2022: HCL Technologies expanded its strategic partnership with Google Cloud, introducing new capabilities and service options to expedite cloud migration for HCL Tech clients. This fortified partnership significantly enhances HCL Tech's capacity to support digital transformation, offering professional services, critical migration, and system modernization to enterprise clients.

In-Depth India ICT Market Market Outlook

The India ICT Market outlook is exceptionally positive, driven by the nation's digital-first agenda and its robust talent pool. The continued investment in digital infrastructure, coupled with the widespread adoption of emerging technologies like AI, IoT, and 5G, will be critical growth accelerators. Strategic alliances and collaborations will foster innovation and expand market reach. The increasing demand for cloud-based services and cybersecurity solutions, alongside the growing need for data analytics, points towards a future where ICT is intrinsically linked to business success and economic growth. The market is poised for sustained expansion, offering significant opportunities for both domestic and international stakeholders.

India ICT Market Segmentation

-

1. Type

- 1.1. Hardware

- 1.2. Software

- 1.3. IT Services

- 1.4. Telecommunication Services

-

2. Size of Enterprise

- 2.1. Micro, Small, and Medium Enterprises

- 2.2. Large Enterprises

-

3. Industry Vertical

- 3.1. BFSI

- 3.2. IT and Telecom

- 3.3. Government

- 3.4. Retail and E-commerce

- 3.5. Manufacturing

- 3.6. Energy and Utilities

- 3.7. Other Industry Verticals

-

4. Geography

- 4.1. North

- 4.2. East

- 4.3. West

- 4.4. South

India ICT Market Segmentation By Geography

- 1. North

- 2. East

- 3. West

- 4. South

India ICT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 9.04% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Need to Explore and Adopt Digital technologies and Initiatives

- 3.3. Market Restrains

- 3.3.1. Managing Regulatory and Compliance Needs Across the World

- 3.4. Market Trends

- 3.4.1 Micro

- 3.4.2 Small

- 3.4.3 and Medium Enterprises to Register Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India ICT Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. IT Services

- 5.1.4. Telecommunication Services

- 5.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 5.2.1. Micro, Small, and Medium Enterprises

- 5.2.2. Large Enterprises

- 5.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 5.3.1. BFSI

- 5.3.2. IT and Telecom

- 5.3.3. Government

- 5.3.4. Retail and E-commerce

- 5.3.5. Manufacturing

- 5.3.6. Energy and Utilities

- 5.3.7. Other Industry Verticals

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. North

- 5.4.2. East

- 5.4.3. West

- 5.4.4. South

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North

- 5.5.2. East

- 5.5.3. West

- 5.5.4. South

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North India ICT Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. IT Services

- 6.1.4. Telecommunication Services

- 6.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 6.2.1. Micro, Small, and Medium Enterprises

- 6.2.2. Large Enterprises

- 6.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 6.3.1. BFSI

- 6.3.2. IT and Telecom

- 6.3.3. Government

- 6.3.4. Retail and E-commerce

- 6.3.5. Manufacturing

- 6.3.6. Energy and Utilities

- 6.3.7. Other Industry Verticals

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. North

- 6.4.2. East

- 6.4.3. West

- 6.4.4. South

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. East India ICT Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. IT Services

- 7.1.4. Telecommunication Services

- 7.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 7.2.1. Micro, Small, and Medium Enterprises

- 7.2.2. Large Enterprises

- 7.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 7.3.1. BFSI

- 7.3.2. IT and Telecom

- 7.3.3. Government

- 7.3.4. Retail and E-commerce

- 7.3.5. Manufacturing

- 7.3.6. Energy and Utilities

- 7.3.7. Other Industry Verticals

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. North

- 7.4.2. East

- 7.4.3. West

- 7.4.4. South

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. West India ICT Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. IT Services

- 8.1.4. Telecommunication Services

- 8.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 8.2.1. Micro, Small, and Medium Enterprises

- 8.2.2. Large Enterprises

- 8.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 8.3.1. BFSI

- 8.3.2. IT and Telecom

- 8.3.3. Government

- 8.3.4. Retail and E-commerce

- 8.3.5. Manufacturing

- 8.3.6. Energy and Utilities

- 8.3.7. Other Industry Verticals

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. North

- 8.4.2. East

- 8.4.3. West

- 8.4.4. South

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South India ICT Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. IT Services

- 9.1.4. Telecommunication Services

- 9.2. Market Analysis, Insights and Forecast - by Size of Enterprise

- 9.2.1. Micro, Small, and Medium Enterprises

- 9.2.2. Large Enterprises

- 9.3. Market Analysis, Insights and Forecast - by Industry Vertical

- 9.3.1. BFSI

- 9.3.2. IT and Telecom

- 9.3.3. Government

- 9.3.4. Retail and E-commerce

- 9.3.5. Manufacturing

- 9.3.6. Energy and Utilities

- 9.3.7. Other Industry Verticals

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. North

- 9.4.2. East

- 9.4.3. West

- 9.4.4. South

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. North India India ICT Market Analysis, Insights and Forecast, 2019-2031

- 11. South India India ICT Market Analysis, Insights and Forecast, 2019-2031

- 12. East India India ICT Market Analysis, Insights and Forecast, 2019-2031

- 13. West India India ICT Market Analysis, Insights and Forecast, 2019-2031

- 14. Competitive Analysis

- 14.1. Market Share Analysis 2024

- 14.2. Company Profiles

- 14.2.1 Reliance Jio

- 14.2.1.1. Overview

- 14.2.1.2. Products

- 14.2.1.3. SWOT Analysis

- 14.2.1.4. Recent Developments

- 14.2.1.5. Financials (Based on Availability)

- 14.2.2 Mphasis Limited

- 14.2.2.1. Overview

- 14.2.2.2. Products

- 14.2.2.3. SWOT Analysis

- 14.2.2.4. Recent Developments

- 14.2.2.5. Financials (Based on Availability)

- 14.2.3 Infosys Limited

- 14.2.3.1. Overview

- 14.2.3.2. Products

- 14.2.3.3. SWOT Analysis

- 14.2.3.4. Recent Developments

- 14.2.3.5. Financials (Based on Availability)

- 14.2.4 Wipro Limited

- 14.2.4.1. Overview

- 14.2.4.2. Products

- 14.2.4.3. SWOT Analysis

- 14.2.4.4. Recent Developments

- 14.2.4.5. Financials (Based on Availability)

- 14.2.5 Accenture PLC

- 14.2.5.1. Overview

- 14.2.5.2. Products

- 14.2.5.3. SWOT Analysis

- 14.2.5.4. Recent Developments

- 14.2.5.5. Financials (Based on Availability)

- 14.2.6 Atria Convergence Technologies Ltd

- 14.2.6.1. Overview

- 14.2.6.2. Products

- 14.2.6.3. SWOT Analysis

- 14.2.6.4. Recent Developments

- 14.2.6.5. Financials (Based on Availability)

- 14.2.7 HCL Technologies

- 14.2.7.1. Overview

- 14.2.7.2. Products

- 14.2.7.3. SWOT Analysis

- 14.2.7.4. Recent Developments

- 14.2.7.5. Financials (Based on Availability)

- 14.2.8 Allied Digital Services Ltd

- 14.2.8.1. Overview

- 14.2.8.2. Products

- 14.2.8.3. SWOT Analysis

- 14.2.8.4. Recent Developments

- 14.2.8.5. Financials (Based on Availability)

- 14.2.9 Vodafone India*List Not Exhaustive

- 14.2.9.1. Overview

- 14.2.9.2. Products

- 14.2.9.3. SWOT Analysis

- 14.2.9.4. Recent Developments

- 14.2.9.5. Financials (Based on Availability)

- 14.2.10 Tata Consultancy Services Limited

- 14.2.10.1. Overview

- 14.2.10.2. Products

- 14.2.10.3. SWOT Analysis

- 14.2.10.4. Recent Developments

- 14.2.10.5. Financials (Based on Availability)

- 14.2.11 Tech Mahindra Ltd

- 14.2.11.1. Overview

- 14.2.11.2. Products

- 14.2.11.3. SWOT Analysis

- 14.2.11.4. Recent Developments

- 14.2.11.5. Financials (Based on Availability)

- 14.2.12 Bharti Airtel Limited

- 14.2.12.1. Overview

- 14.2.12.2. Products

- 14.2.12.3. SWOT Analysis

- 14.2.12.4. Recent Developments

- 14.2.12.5. Financials (Based on Availability)

- 14.2.13 IBM Global Services

- 14.2.13.1. Overview

- 14.2.13.2. Products

- 14.2.13.3. SWOT Analysis

- 14.2.13.4. Recent Developments

- 14.2.13.5. Financials (Based on Availability)

- 14.2.14 Mindtree Ltd

- 14.2.14.1. Overview

- 14.2.14.2. Products

- 14.2.14.3. SWOT Analysis

- 14.2.14.4. Recent Developments

- 14.2.14.5. Financials (Based on Availability)

- 14.2.15 BSNL

- 14.2.15.1. Overview

- 14.2.15.2. Products

- 14.2.15.3. SWOT Analysis

- 14.2.15.4. Recent Developments

- 14.2.15.5. Financials (Based on Availability)

- 14.2.16 Capgemini Technology Services India Ltd

- 14.2.16.1. Overview

- 14.2.16.2. Products

- 14.2.16.3. SWOT Analysis

- 14.2.16.4. Recent Developments

- 14.2.16.5. Financials (Based on Availability)

- 14.2.1 Reliance Jio

List of Figures

- Figure 1: India ICT Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: India ICT Market Share (%) by Company 2024

List of Tables

- Table 1: India ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: India ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: India ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 4: India ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 5: India ICT Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 6: India ICT Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: India ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: North India India ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: South India India ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: East India India ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: West India India ICT Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: India ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 13: India ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 14: India ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 15: India ICT Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 16: India ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 17: India ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 18: India ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 19: India ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 20: India ICT Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 21: India ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 22: India ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 23: India ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 24: India ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 25: India ICT Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 26: India ICT Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: India ICT Market Revenue Million Forecast, by Type 2019 & 2032

- Table 28: India ICT Market Revenue Million Forecast, by Size of Enterprise 2019 & 2032

- Table 29: India ICT Market Revenue Million Forecast, by Industry Vertical 2019 & 2032

- Table 30: India ICT Market Revenue Million Forecast, by Geography 2019 & 2032

- Table 31: India ICT Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India ICT Market?

The projected CAGR is approximately 9.04%.

2. Which companies are prominent players in the India ICT Market?

Key companies in the market include Reliance Jio, Mphasis Limited, Infosys Limited, Wipro Limited, Accenture PLC, Atria Convergence Technologies Ltd, HCL Technologies, Allied Digital Services Ltd, Vodafone India*List Not Exhaustive, Tata Consultancy Services Limited, Tech Mahindra Ltd, Bharti Airtel Limited, IBM Global Services, Mindtree Ltd, BSNL, Capgemini Technology Services India Ltd.

3. What are the main segments of the India ICT Market?

The market segments include Type, Size of Enterprise, Industry Vertical, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Need to Explore and Adopt Digital technologies and Initiatives.

6. What are the notable trends driving market growth?

Micro. Small. and Medium Enterprises to Register Significant Growth.

7. Are there any restraints impacting market growth?

Managing Regulatory and Compliance Needs Across the World.

8. Can you provide examples of recent developments in the market?

May 2023: Solarwinds and Infoysis have announced a collaboration to advance the shift of SolarWinds solutions to a new SaaS model. Through this engagement, Infosys will leverage its engineering capabilities to accelerate the SaaSification of SolarWinds products and platforms built to increase customer visibility in highly complex hybrid and multi-cloud environments. This collaboration is a key component of the SolarWinds strategy to offer accessible, highly effective, and value-based solutions built to empower its customers to accelerate their digital transformation efforts regardless of where they are on their journey to the cloud.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India ICT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India ICT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India ICT Market?

To stay informed about further developments, trends, and reports in the India ICT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence