Key Insights

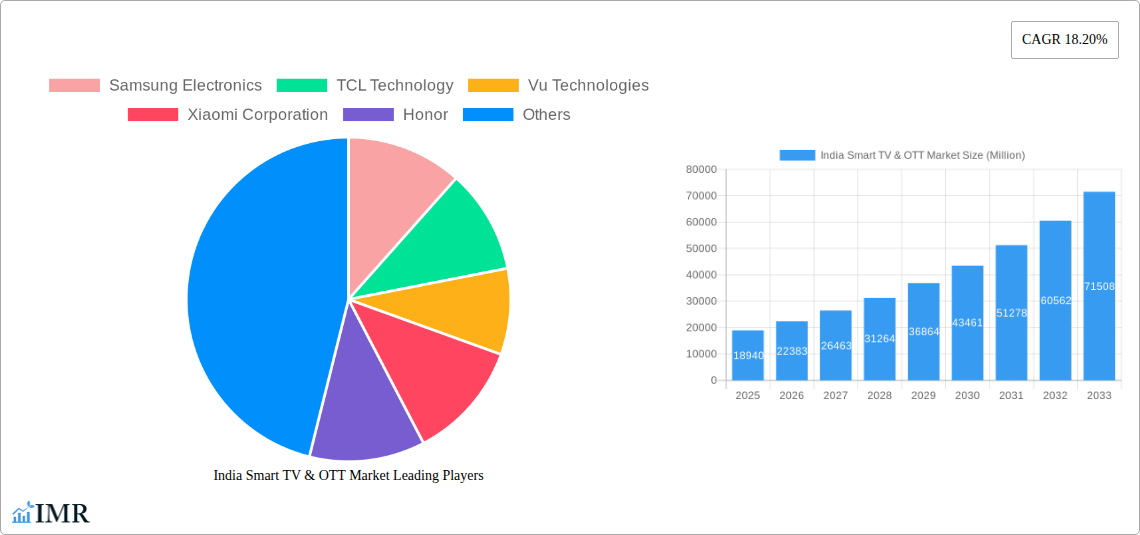

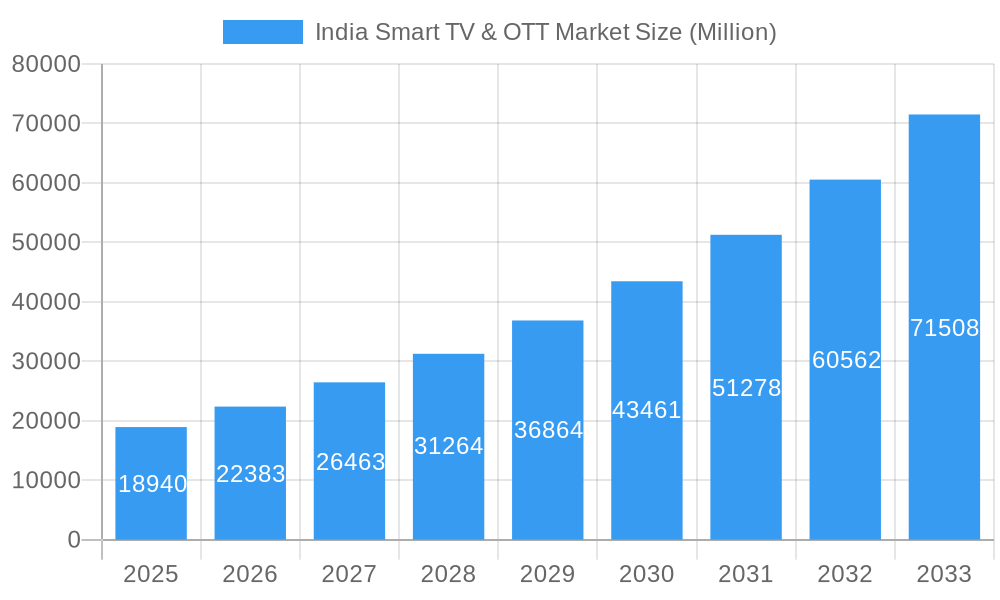

The India Smart TV and OTT market is experiencing robust growth, driven by increasing internet and smartphone penetration, affordable data plans, and a rising young population with high disposable incomes. The market, valued at $18.94 billion in 2025, is projected to witness a Compound Annual Growth Rate (CAGR) of 18.20% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the preference for larger screen sizes and advanced features like 4K resolution, HDR, and smart functionalities continues to drive Smart TV sales. Secondly, the proliferation of OTT platforms offering diverse content at competitive subscription prices significantly boosts viewership. This is particularly noticeable in the growth of streaming services targeting regional language content, catering to a broader audience. The segment breakdown shows a strong demand for larger screen sizes (above 55 inches) within the Smart TV market and a preference for subscription-based models in the OTT sector. Major players like Samsung, TCL, Xiaomi, and others are heavily investing in expanding their product portfolios and partnerships to capitalize on this growth opportunity.

India Smart TV & OTT Market Market Size (In Billion)

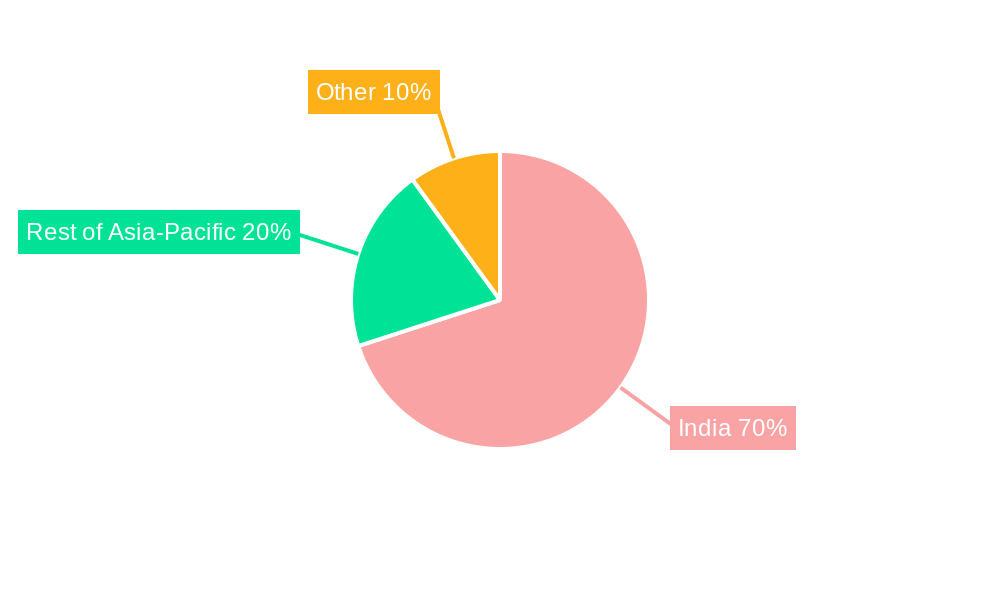

Despite the positive outlook, certain restraints exist. High initial investment costs for Smart TVs, coupled with the potential for subscription fatigue among consumers, pose challenges. The market is also susceptible to fluctuations in global economic conditions and supply chain disruptions. The competitive landscape is fiercely contested, demanding constant innovation and effective marketing strategies to maintain market share. Regional disparities in internet access and digital literacy also affect market penetration. However, initiatives to improve infrastructure and digital literacy are expected to mitigate these limitations over the forecast period. The Asia-Pacific region, specifically India, remains a key focus for global players due to its vast untapped potential.

India Smart TV & OTT Market Company Market Share

India Smart TV & OTT Market: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic India Smart TV & OTT market, covering the period 2019-2033. It offers invaluable insights for industry professionals, investors, and strategic decision-makers seeking to navigate this rapidly evolving landscape. The report delves into market size, growth trends, competitive dynamics, and future opportunities, providing a granular view of both the Smart TV and OTT segments. The base year for this analysis is 2025, with estimations for 2025 and forecasts extending to 2033, encompassing historical data from 2019-2024. This report is meticulously crafted to provide actionable intelligence and is ready for immediate use without further modification.

India Smart TV & OTT Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and consumer trends. We examine market concentration, identifying key players and their market shares, alongside analyzing the impact of mergers and acquisitions (M&A) activity. The analysis explores the influence of technological innovations, such as advancements in display technology (OLED, QLED, Mini-LED), operating systems (Android TV, Google TV, etc.), and AI-powered features.

- Market Concentration: The Indian Smart TV market is moderately concentrated, with key players like Samsung, TCL, Xiaomi, and LG holding significant market share (xx%). The OTT market exhibits a more fragmented structure with a mix of global and local players.

- Technological Innovation: The adoption of 4K, 8K resolution, HDR, and smart features is driving growth. However, challenges remain in affordability and widespread high-speed internet access.

- Regulatory Framework: Government policies promoting digitalization and initiatives like the Digital India program are fostering market expansion. However, content regulations and data privacy concerns need consideration.

- Competitive Landscape: Intense competition exists among brands in terms of pricing, features, and content offerings. The rise of local brands poses a challenge to established players.

- M&A Trends: The past five years have witnessed xx M&A deals in the Indian Smart TV and OTT sectors, primarily focused on content acquisition and market consolidation. This trend is expected to continue.

- End-User Demographics: The primary target audience is the young, tech-savvy urban population, but expansion into rural markets is gaining momentum.

India Smart TV & OTT Market Growth Trends & Insights

The India Smart TV and OTT market has witnessed exponential growth, driven by increasing disposable incomes, rising internet penetration, and a preference for streaming content. We project a compound annual growth rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration for Smart TVs is expected to reach xx% by 2033, with OTT platform subscriptions surpassing xx million units.

The shift towards online video consumption is a significant driver, with viewers increasingly opting for subscription-based OTT services. Furthermore, technological advancements in display technology and streaming capabilities have further fuelled market growth. The changing consumer behaviour, driven by the convenience and affordability of OTT, has dramatically increased demand for Smart TVs. This trend, along with declining prices of Smart TVs, will continue to fuel market expansion.

Dominant Regions, Countries, or Segments in India Smart TV & OTT Market

The urban areas of major metropolitan cities like Mumbai, Delhi, Bengaluru, and Chennai are leading the Smart TV and OTT market, driven by higher internet penetration and disposable incomes.

- Smart TVs: The high demand for larger screen sizes (55 inches and above) is a key trend, with 4K and HDR displays gaining significant traction. Android TV remains the dominant operating system.

- OTT Platforms: Subscription-based models dominate, with a preference for diverse content, including movies, web series, and regional content.

- Key Drivers:

- Increasing internet and smartphone penetration

- Rising disposable incomes

- Growing adoption of streaming services

- Government initiatives promoting digitalization

- Affordable pricing of Smart TVs and OTT subscriptions

India Smart TV & OTT Market Product Landscape

The Indian Smart TV and OTT market showcases diverse product offerings, ranging from budget-friendly Smart TVs to premium models with advanced features. Technological advancements, like AI-powered voice assistants, improved picture quality (8K resolution, HDR), and enhanced streaming capabilities are driving innovation. Unique selling propositions include localized content, affordable pricing, and integration with other smart home devices.

Key Drivers, Barriers & Challenges in India Smart TV & OTT Market

Key Drivers: The rapid expansion of the internet, government initiatives to boost digital literacy, and the increasing popularity of streaming services are driving significant growth. Technological advancements in display and streaming technology are also fueling demand.

Key Challenges: Uneven internet infrastructure in rural areas, affordability concerns in lower-income segments, and content piracy remain significant obstacles. Competition amongst a vast number of brands further complicates the market.

Emerging Opportunities in India Smart TV & OTT Market

The expanding rural market presents a significant untapped opportunity. Moreover, the growing demand for hyper-localized content, including regional languages, and integration with smart home ecosystems offer lucrative avenues for growth. Innovative business models, such as ad-supported OTT platforms and bundled offers, are also emerging.

Growth Accelerators in the India Smart TV & OTT Market Industry

Technological innovation, strategic partnerships between content providers and hardware manufacturers, and expansion into untapped markets are key catalysts for long-term growth. The rising adoption of 5G technology will further accelerate the growth of the sector, especially for high-definition streaming. Strategic alliances between OTT platforms and telecom providers will further drive market expansion.

Key Players Shaping the India Smart TV & OTT Market Market

Notable Milestones in India Smart TV & OTT Market Sector

- May 2022: Launch of CSpace, a state-owned OTT platform by the Kerala Government, signifying government initiatives in the digital space.

- February 2022: T-Series' entry into web series production for streaming platforms, indicating expansion of content creation for OTT platforms.

In-Depth India Smart TV & OTT Market Market Outlook

The Indian Smart TV and OTT market is poised for sustained growth, driven by technological advancements, increased affordability, and rising internet penetration. The focus on localized content and the integration of smart home features will be critical for future success. Strategic partnerships and innovative business models will play a vital role in shaping the market's trajectory. The forecast period suggests strong potential for continued market expansion.

India Smart TV & OTT Market Segmentation

- 1. OS Type (Tizen, WebOS, Android TV, etc.)

- 2. Price Range

India Smart TV & OTT Market Segmentation By Geography

- 1. India

India Smart TV & OTT Market Regional Market Share

Geographic Coverage of India Smart TV & OTT Market

India Smart TV & OTT Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.20% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Large Volume of the Indian Households and Relative Less Levels of Penetration; Growing Spending Power and Growth in Smartphone Adoption to boost OTT Demand; Declining Unit Prices Coupled with Entry of Several Regional Players to Drive Bargaining Leverage of Buyers

- 3.3. Market Restrains

- 3.3.1. Manufacturers Faced with Taxation Challenges and Relatively Higher Replacement Rate

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Smart Devices Across IoT Ecosystem to Drive the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Smart TV & OTT Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by OS Type (Tizen, WebOS, Android TV, etc.)

- 5.2. Market Analysis, Insights and Forecast - by Price Range

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by OS Type (Tizen, WebOS, Android TV, etc.)

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Samsung Electronics

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 TCL Technology

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Vu Technologies

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Xiaomi Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Honor

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 OnePlus

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sansui*List Not Exhaustive

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Sony Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 LG Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Samsung Electronics

List of Figures

- Figure 1: India Smart TV & OTT Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Smart TV & OTT Market Share (%) by Company 2025

List of Tables

- Table 1: India Smart TV & OTT Market Revenue Million Forecast, by OS Type (Tizen, WebOS, Android TV, etc.) 2020 & 2033

- Table 2: India Smart TV & OTT Market Revenue Million Forecast, by Price Range 2020 & 2033

- Table 3: India Smart TV & OTT Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Smart TV & OTT Market Revenue Million Forecast, by OS Type (Tizen, WebOS, Android TV, etc.) 2020 & 2033

- Table 5: India Smart TV & OTT Market Revenue Million Forecast, by Price Range 2020 & 2033

- Table 6: India Smart TV & OTT Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Smart TV & OTT Market?

The projected CAGR is approximately 18.20%.

2. Which companies are prominent players in the India Smart TV & OTT Market?

Key companies in the market include Samsung Electronics, TCL Technology, Vu Technologies, Xiaomi Corporation, Honor, Haier, OnePlus, Sansui*List Not Exhaustive, Panasonic Corporation, Sony Corporation, LG Corporation.

3. What are the main segments of the India Smart TV & OTT Market?

The market segments include OS Type (Tizen, WebOS, Android TV, etc.), Price Range.

4. Can you provide details about the market size?

The market size is estimated to be USD 18.94 Million as of 2022.

5. What are some drivers contributing to market growth?

Large Volume of the Indian Households and Relative Less Levels of Penetration; Growing Spending Power and Growth in Smartphone Adoption to boost OTT Demand; Declining Unit Prices Coupled with Entry of Several Regional Players to Drive Bargaining Leverage of Buyers.

6. What are the notable trends driving market growth?

Increasing Adoption of Smart Devices Across IoT Ecosystem to Drive the Market Growth.

7. Are there any restraints impacting market growth?

Manufacturers Faced with Taxation Challenges and Relatively Higher Replacement Rate.

8. Can you provide examples of recent developments in the market?

May 2022: Kerala Government announced to launch of a state-owned over-the-top platform offering an array of movies, short films, and documentaries. The OTT platform's name is CSpace, an initiative of the Kerala State Film Development Corporation.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Smart TV & OTT Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Smart TV & OTT Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Smart TV & OTT Market?

To stay informed about further developments, trends, and reports in the India Smart TV & OTT Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence