Key Insights

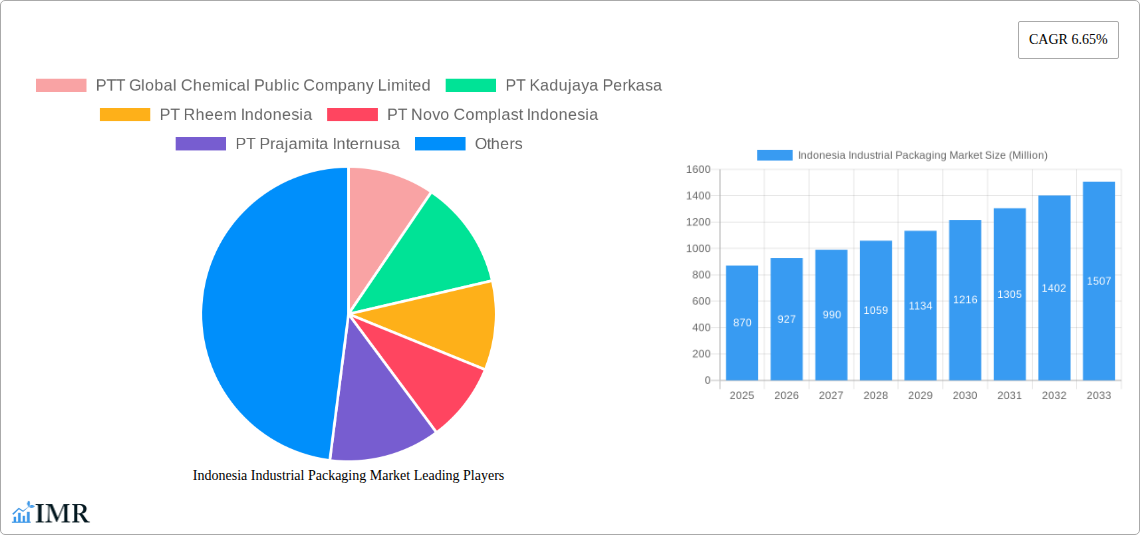

The Indonesia Industrial Packaging Market, valued at $870 million in 2025, is projected to experience robust growth, driven by a burgeoning manufacturing sector, increasing e-commerce activities, and rising demand for packaged goods across various industries. A Compound Annual Growth Rate (CAGR) of 6.65% from 2025 to 2033 indicates significant market expansion. Key drivers include the growth of food and beverage processing, pharmaceuticals, and consumer goods, all requiring efficient and protective packaging solutions. Furthermore, a rising focus on sustainability and the adoption of eco-friendly packaging materials, like recycled plastics and biodegradable alternatives, are shaping market trends. Challenges include fluctuating raw material prices and increasing competition, particularly from emerging players seeking to establish a market presence. The market is segmented by packaging type (e.g., corrugated boxes, plastic containers, flexible packaging), material (e.g., paperboard, plastic, metal), and end-use industry (e.g., food and beverage, chemicals, consumer goods). Established players like PTT Global Chemical and PT Kadujaya Perkasa maintain significant market share, while emerging companies are innovating to capture growing segments. Regional variations within Indonesia reflect varying industrial concentrations and consumer demand patterns. The forecast period (2025-2033) anticipates continued market expansion, with growth further propelled by government initiatives supporting industrial development and infrastructure improvements.

Indonesia Industrial Packaging Market Market Size (In Million)

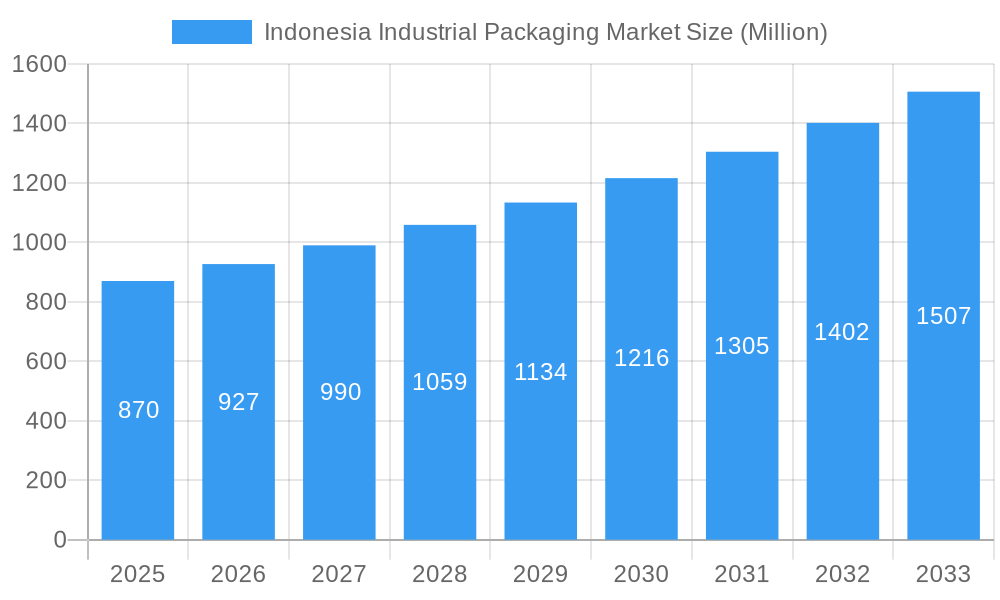

The competitive landscape involves both established multinational corporations and smaller domestic players. Established companies leverage their extensive distribution networks and brand recognition to maintain their market dominance. Emerging players are focusing on product differentiation, cost-effectiveness, and niche market segments to carve out their share. The market is expected to see strategic alliances, mergers and acquisitions, and technological innovations in packaging materials and manufacturing processes during the forecast period. A deeper understanding of consumer preferences, sustainability concerns, and evolving regulatory landscape will be crucial for businesses seeking sustained success within the dynamic Indonesia Industrial Packaging Market.

Indonesia Industrial Packaging Market Company Market Share

Indonesia Industrial Packaging Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Indonesia Industrial Packaging Market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for industry professionals, investors, and stakeholders seeking to understand and capitalize on opportunities within this dynamic market. The report analyzes both the parent market (Industrial Packaging) and child markets (e.g., plastic pallets, corrugated boxes, etc.) to provide a holistic view. Market values are presented in million units.

Indonesia Industrial Packaging Market Dynamics & Structure

The Indonesian industrial packaging market is characterized by moderate concentration, with several key players holding significant market share. Technological innovation, particularly in sustainable and efficient packaging solutions, is a major driver. Government regulations concerning waste management and environmental sustainability are shaping industry practices. The market faces competition from alternative packaging materials and methods. End-user demographics, heavily influenced by the manufacturing and FMCG sectors, significantly impact demand. Mergers and acquisitions (M&A) activity, while not exceptionally high, remains a strategic tool for market expansion.

- Market Concentration: Moderately concentrated, with the top 5 players holding an estimated xx% market share in 2024.

- Technological Innovation: Focus on sustainable materials (recycled plastics, biodegradable options), automation in production, and improved logistics.

- Regulatory Framework: Increasingly stringent environmental regulations driving demand for eco-friendly packaging.

- Competitive Substitutes: Alternative packaging materials (e.g., reusable containers) pose a moderate threat.

- End-User Demographics: Dominated by the food & beverage, manufacturing, and consumer goods industries.

- M&A Trends: A moderate number of M&A deals (xx in the last 5 years) aimed at expanding capacity and market reach.

Indonesia Industrial Packaging Market Growth Trends & Insights

The Indonesian industrial packaging market witnessed robust growth during the historical period (2019-2024), driven primarily by the expansion of manufacturing and e-commerce sectors. The market is projected to maintain a healthy Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033), reaching a market size of xx million units by 2033. Technological disruptions, particularly the adoption of automation and sustainable packaging solutions, are accelerating market growth. Shifts in consumer preference towards eco-friendly products are also influencing demand. Market penetration of sustainable packaging is expected to increase from xx% in 2025 to xx% by 2033.

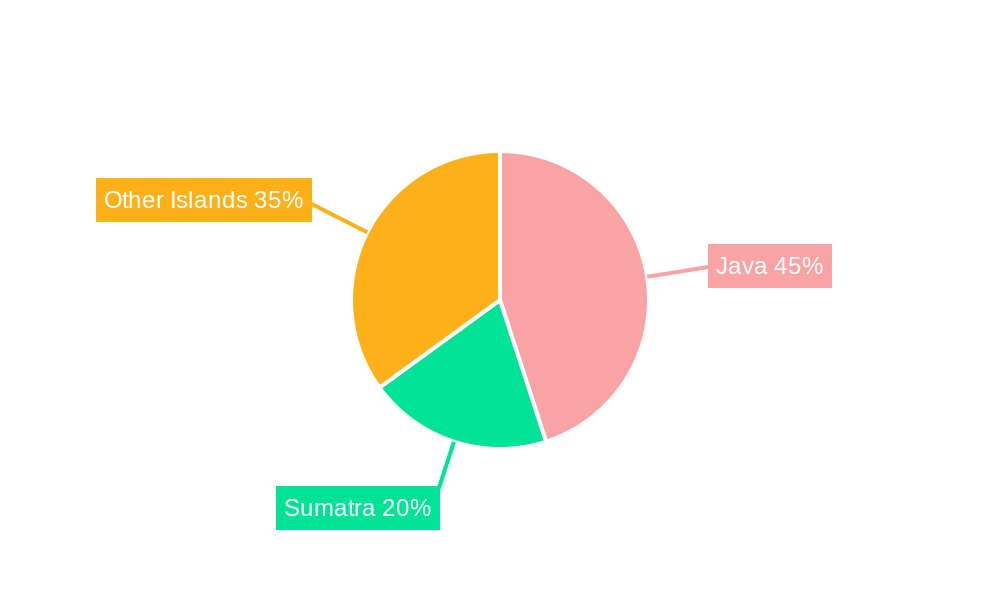

Dominant Regions, Countries, or Segments in Indonesia Industrial Packaging Market

Java remains the dominant region for industrial packaging in Indonesia, fueled by a high concentration of manufacturing facilities and a large consumer base. This dominance is attributed to robust infrastructure, established supply chains, and a concentration of key players. Other regions are exhibiting growth potential, but Java's established market share is expected to persist throughout the forecast period. The plastic pallet segment is experiencing the fastest growth, driven by increased demand from logistics and warehousing.

- Key Drivers in Java: Established industrial infrastructure, strong consumer demand, and concentration of manufacturing hubs.

- Growth Potential in Other Regions: Expanding infrastructure development and industrialization in regions outside Java are contributing to growth.

- Fastest-Growing Segment: Plastic pallets, due to rising e-commerce and logistics activities.

Indonesia Industrial Packaging Market Product Landscape

The Indonesian industrial packaging market offers a diverse range of products, including corrugated boxes, plastic containers, pallets, and flexible packaging. Recent product innovations focus on sustainable materials, improved durability, and enhanced functionalities. Unique selling propositions include lightweight yet robust designs, customization options, and eco-friendly certifications. Technological advancements involve automation in packaging processes and the use of smart packaging technologies for improved supply chain visibility.

Key Drivers, Barriers & Challenges in Indonesia Industrial Packaging Market

Key Drivers:

- Rapid industrialization and economic growth.

- Expansion of e-commerce and related logistics activities.

- Increasing demand for sustainable and eco-friendly packaging.

Challenges:

- Fluctuations in raw material prices (e.g., plastic resins).

- Supply chain disruptions and logistical challenges.

- Intense competition among players.

- Increasing regulatory scrutiny on environmental impacts.

Emerging Opportunities in Indonesia Industrial Packaging Market

- Growing demand for customized packaging solutions.

- Expansion into niche markets (e.g., pharmaceuticals, healthcare).

- Opportunities for innovative packaging materials (e.g., biodegradable plastics).

- Increased adoption of e-commerce packaging solutions.

Growth Accelerators in the Indonesia Industrial Packaging Market Industry

Technological advancements, strategic collaborations, and a growing focus on sustainability are key catalysts for long-term growth in the Indonesian industrial packaging market. Investments in automation and the development of innovative packaging materials will further drive market expansion. Strategic partnerships between packaging manufacturers and end-users are also playing a crucial role in fostering growth.

Key Players Shaping the Indonesia Industrial Packaging Market Market

- PTT Global Chemical Public Company Limited

- PT Kadujaya Perkasa

- PT Rheem Indonesia

- PT Novo Complast Indonesia

- PT Prajamita Internusa

- PT Repal Internasional Indonesia (Re-Pal)

- PT Yanasurya Bhaktipersada

- PT SCHTZ Container Systems Indonesia

- PT Dinito Jaya Sakti

- PT Indragraha Nusaplasindo

- PT Java Taiko

- PT Pelangi Indah Anindo Tbk

Notable Milestones in Indonesia Industrial Packaging Market Sector

- May 2024: PT Mowilex Indonesia launched its Mowilex Recycled paint line, reducing the carbon footprint of paint containers by up to 60%.

- January 2024: Mah Sing Group Bhd partnered with PT Gaya Sukses Mandiri Kaseindo to manufacture plastic pallets in Indonesia.

In-Depth Indonesia Industrial Packaging Market Market Outlook

The Indonesian industrial packaging market is poised for continued growth, driven by a robust economy, increasing industrialization, and a rising consumer base. Strategic investments in sustainable packaging solutions and technological advancements will further enhance market potential. Companies focusing on innovation, sustainability, and efficient supply chains are well-positioned to capture significant market share in the years to come.

Indonesia Industrial Packaging Market Segmentation

-

1. Packaging Type

- 1.1. Jerry Cans

- 1.2. Rigid IBCs

- 1.3. Drums & Barrels

- 1.4. Crates & Pallets

- 1.5. Insulated Shipping Containers

- 1.6. FIBC

- 1.7. Other Pa

-

2. End-use Industries

- 2.1. Automotive

- 2.2. Food & Beverage

- 2.3. Chemicals & Petrochemicals

- 2.4. Pharmaceuticals

- 2.5. Paints & Coatings

- 2.6. Building & Construction

- 2.7. Other End-use Industries (Agriculture, Logistics)

Indonesia Industrial Packaging Market Segmentation By Geography

- 1. Indonesia

Indonesia Industrial Packaging Market Regional Market Share

Geographic Coverage of Indonesia Industrial Packaging Market

Indonesia Industrial Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.65% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers

- 3.2.2 etc.

- 3.3. Market Restrains

- 3.3.1 Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers

- 3.3.2 etc.

- 3.4. Market Trends

- 3.4.1. Jerry Cans Witness Major Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Industrial Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 5.1.1. Jerry Cans

- 5.1.2. Rigid IBCs

- 5.1.3. Drums & Barrels

- 5.1.4. Crates & Pallets

- 5.1.5. Insulated Shipping Containers

- 5.1.6. FIBC

- 5.1.7. Other Pa

- 5.2. Market Analysis, Insights and Forecast - by End-use Industries

- 5.2.1. Automotive

- 5.2.2. Food & Beverage

- 5.2.3. Chemicals & Petrochemicals

- 5.2.4. Pharmaceuticals

- 5.2.5. Paints & Coatings

- 5.2.6. Building & Construction

- 5.2.7. Other End-use Industries (Agriculture, Logistics)

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by Packaging Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 PTT Global Chemical Public Company Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PT Kadujaya Perkasa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 PT Rheem Indonesia

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Novo Complast Indonesia

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT Prajamita Internusa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT Repal Internasional Indonesia (Re-Pal)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 PT Yanasurya Bhaktipersada

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 PT SCHTZ Container Systems Indonesia

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PT Dinito Jaya Sakti

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 PT Indragraha Nusaplasindo

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 PT Java Taiko

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 PT Pelangi Indah Anindo Tbk7 2 Heat Map Analysis by Key Players7 3 Company Market Share/Ranking Analysis 20247 4 Company Categorization Established vs Emerging Player

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 PTT Global Chemical Public Company Limited

List of Figures

- Figure 1: Indonesia Industrial Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Indonesia Industrial Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Industrial Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 2: Indonesia Industrial Packaging Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 3: Indonesia Industrial Packaging Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 4: Indonesia Industrial Packaging Market Volume Billion Forecast, by End-use Industries 2020 & 2033

- Table 5: Indonesia Industrial Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Indonesia Industrial Packaging Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Indonesia Industrial Packaging Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 8: Indonesia Industrial Packaging Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 9: Indonesia Industrial Packaging Market Revenue Million Forecast, by End-use Industries 2020 & 2033

- Table 10: Indonesia Industrial Packaging Market Volume Billion Forecast, by End-use Industries 2020 & 2033

- Table 11: Indonesia Industrial Packaging Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Indonesia Industrial Packaging Market Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Industrial Packaging Market?

The projected CAGR is approximately 6.65%.

2. Which companies are prominent players in the Indonesia Industrial Packaging Market?

Key companies in the market include PTT Global Chemical Public Company Limited, PT Kadujaya Perkasa, PT Rheem Indonesia, PT Novo Complast Indonesia, PT Prajamita Internusa, PT Repal Internasional Indonesia (Re-Pal), PT Yanasurya Bhaktipersada, PT SCHTZ Container Systems Indonesia, PT Dinito Jaya Sakti, PT Indragraha Nusaplasindo, PT Java Taiko, PT Pelangi Indah Anindo Tbk7 2 Heat Map Analysis by Key Players7 3 Company Market Share/Ranking Analysis 20247 4 Company Categorization Established vs Emerging Player.

3. What are the main segments of the Indonesia Industrial Packaging Market?

The market segments include Packaging Type, End-use Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.87 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers. etc..

6. What are the notable trends driving market growth?

Jerry Cans Witness Major Growth.

7. Are there any restraints impacting market growth?

Increasing Demand for Plastics & Paper Packaging Owing to their Favorable Material Properties and Increasing Utilization of Shipping Containers. etc..

8. Can you provide examples of recent developments in the market?

May 2024 - PT Mowilex Indonesia (Mowilex) launched its new Mowilex Recycled paint line, which reduces water consumption, energy usage, and the carbon footprint of each 2.5-litre paint container by up to 60%. The company incorporates up to 40% premium Mowilex paint in each Mowilex Recycled container, thereby decreasing potential waste while maintaining product quality.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Industrial Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Industrial Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Industrial Packaging Market?

To stay informed about further developments, trends, and reports in the Indonesia Industrial Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence