Key Insights

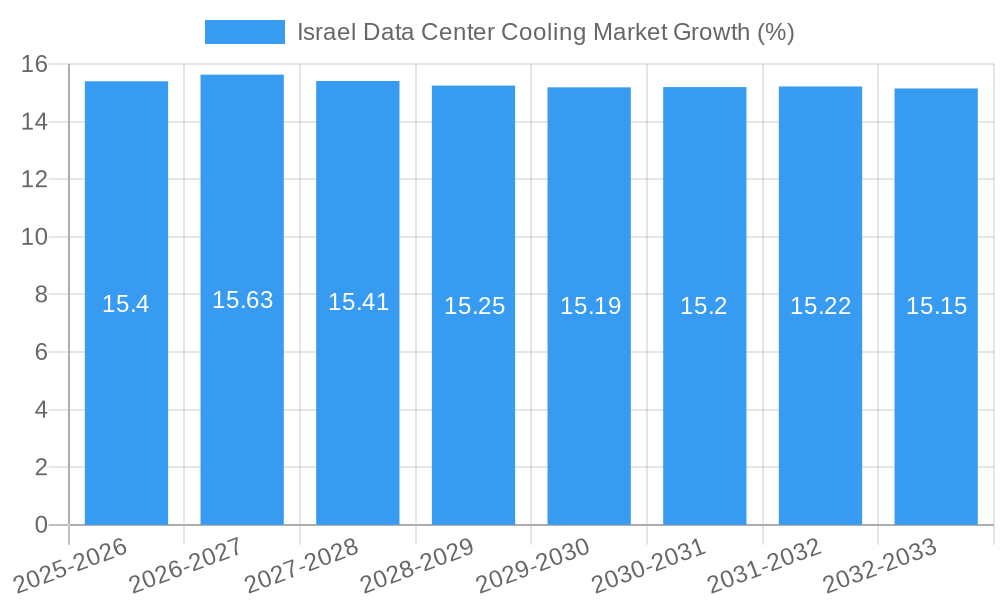

The Israel data center cooling market is poised for substantial growth, projected to reach an estimated USD 15.80 million in 2025, with a robust Compound Annual Growth Rate (CAGR) of 15.40% through 2033. This dynamic expansion is fueled by an increasing demand for advanced data processing and storage solutions within Israel's burgeoning technology sector. Key drivers include the rapid digitalization across various industries, a significant surge in cloud adoption by enterprises and hyperscalers alike, and the continuous development of AI and machine learning capabilities, all of which necessitate more powerful and efficient data center infrastructures. The market is witnessing a pronounced shift towards liquid-based cooling technologies, such as immersion cooling and direct-to-chip cooling, driven by their superior thermal management capabilities compared to traditional air-based systems, especially for high-density computing environments. Furthermore, the escalating need for energy efficiency and sustainability in data center operations is pushing for innovative cooling solutions that minimize power consumption and environmental impact.

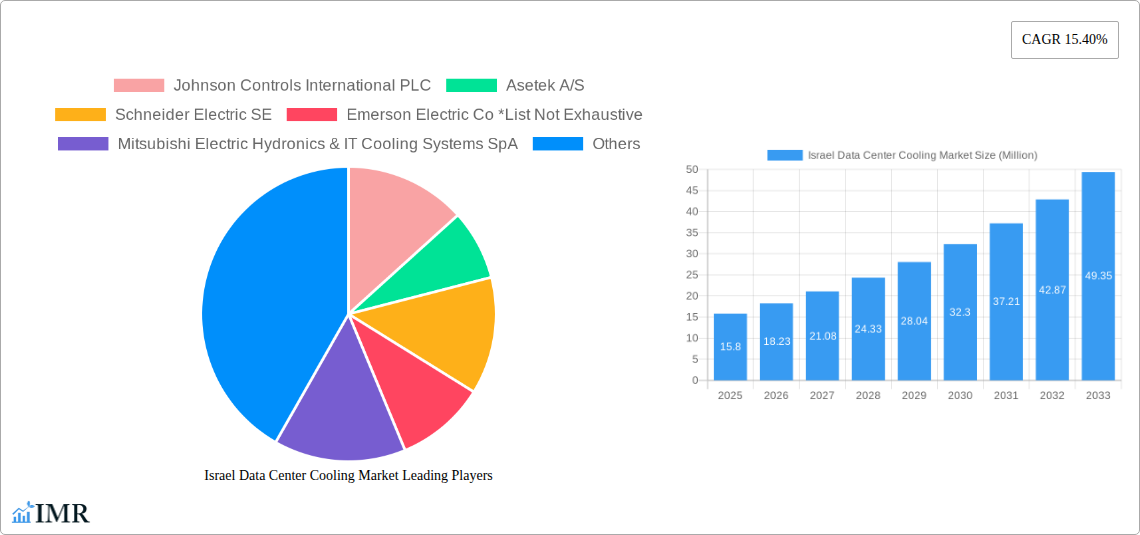

The competitive landscape in Israel's data center cooling market is characterized by the presence of established global players and emerging local specialists. Companies like Johnson Controls International PLC, Schneider Electric SE, and Vertiv Group Corp are actively involved, offering a comprehensive suite of cooling technologies. The market segmentation reveals a strong presence in the IT & Telecom sector, with significant contributions from Healthcare and Media & Entertainment verticals as they increasingly rely on data-intensive operations. Hyperscale data centers, both owned and leased, represent a significant segment, alongside enterprise on-premise deployments and colocation facilities. Challenges to growth, though present, are being actively addressed; these may include the initial capital investment for advanced cooling systems and the availability of skilled personnel for installation and maintenance. However, the overwhelming trend towards higher computational demands and the drive for operational efficiency are expected to outweigh these restraints, ensuring sustained and significant market expansion in the coming years.

This in-depth report provides a detailed analysis of the Israel Data Center Cooling Market, covering its dynamic structure, growth trends, dominant segments, product landscape, key drivers, emerging opportunities, and competitive landscape. Designed to be SEO-optimized with high-traffic keywords, this report is an essential resource for industry professionals, investors, and stakeholders seeking to understand the current state and future trajectory of data center cooling solutions in Israel. The study spans from 2019 to 2033, with a base year of 2025 and a forecast period from 2025 to 2033, offering historical context and forward-looking insights. All values are presented in Million units.

Israel Data Center Cooling Market Market Dynamics & Structure

The Israel Data Center Cooling Market is characterized by a dynamic interplay of technological innovation, evolving regulatory frameworks, and increasing demand for efficient cooling solutions. Market concentration is moderate, with a growing number of established players and emerging innovators vying for market share. Key drivers of technological innovation stem from the relentless pursuit of higher computing densities, energy efficiency, and sustainability in data center operations. The integration of advanced cooling technologies like liquid-based solutions, including Immersion Cooling and Direct-to-Chip Cooling, is rapidly gaining traction, driven by the need to manage the heat generated by powerful processors and AI workloads. Regulatory frameworks, while still developing, are increasingly focused on energy consumption and environmental impact, pushing for greener cooling strategies. Competitive product substitutes are abundant, ranging from traditional Air-based Cooling solutions like chillers and CRAC units to more advanced liquid cooling systems. End-user demographics are diverse, with significant demand originating from the IT & Telecom sector, followed by Healthcare, Retail & Consumer Goods, and Federal & Institutional agencies. Merger and acquisition (M&A) trends, while not always publicly disclosed, are anticipated to play a crucial role in consolidating expertise and expanding market reach as companies seek to offer comprehensive data center infrastructure solutions. Innovation barriers include high initial investment costs for advanced cooling systems and the need for specialized expertise in installation and maintenance.

- Market Concentration: Moderate, with a mix of global leaders and local providers.

- Technological Innovation Drivers: Increased computing power, AI workloads, energy efficiency mandates, sustainability goals.

- Regulatory Frameworks: Growing emphasis on energy consumption standards and environmental impact reduction.

- Competitive Product Substitutes: Traditional air cooling vs. advanced liquid cooling technologies.

- End-User Demographics: Dominated by IT & Telecom, with growing influence from Healthcare and Federal sectors.

- M&A Trends: Anticipated to increase as companies seek to offer integrated solutions.

- Innovation Barriers: High capital expenditure, specialized skill requirements, existing infrastructure compatibility.

Israel Data Center Cooling Market Growth Trends & Insights

The Israel Data Center Cooling Market is poised for significant expansion, driven by a confluence of factors including rapid digitalization, the burgeoning demand for cloud services, and the exponential growth of data generated by artificial intelligence and high-performance computing. Market size evolution is projected to witness a healthy Compound Annual Growth Rate (CAGR) throughout the forecast period, as more organizations recognize the critical role of efficient cooling in ensuring data center reliability, performance, and cost-effectiveness. Adoption rates for advanced cooling technologies are on an upward trajectory, particularly for liquid cooling solutions, which are becoming indispensable for managing the thermal challenges of increasingly dense server racks. Technological disruptions are a constant theme, with ongoing advancements in heat exchanger efficiency, refrigerant technologies, and integrated cooling management systems. Consumer behavior shifts are also influencing the market, with a growing preference for vendors offering end-to-end solutions that encompass cooling, power, and IT infrastructure management. The market is transitioning from a reactive approach to cooling to a proactive, integrated strategy that prioritizes energy efficiency and sustainability. The increasing adoption of hyperscale and colocation data centers, alongside the continued need for on-premise enterprise solutions, further fuels this growth.

The Israel Data Center Cooling Market size is projected to grow from approximately $XXX Million in 2019 to an estimated $XXX Million in 2025, and is expected to reach $XXX Million by 2033, exhibiting a robust CAGR of XX.X% during the forecast period of 2025-2033. This growth is underpinned by several key trends. The increasing deployment of advanced processors and GPUs for AI and machine learning applications necessitates more sophisticated cooling solutions capable of dissipating higher heat loads. The Israeli government's focus on fostering a digital economy and attracting foreign investment in technology infrastructure is a significant catalyst. Furthermore, the ongoing expansion of cloud services and the rise of edge computing are creating new demand centers for data center capacity, each requiring optimized cooling systems.

The adoption of liquid cooling technologies, including Direct-to-Chip Cooling and Immersion Cooling, is witnessing a substantial increase. These technologies offer superior heat dissipation capabilities compared to traditional air-based methods, enabling higher rack densities and improving energy efficiency. For instance, Direct-to-Chip Cooling solutions can effectively manage heat loads of up to XX kW per rack, while Immersion Cooling systems are capable of handling even higher densities, crucial for high-performance computing (HPC) environments. The market is also seeing a growing interest in free cooling technologies, such as Economizers, which leverage ambient air to reduce reliance on mechanical cooling, thereby lowering operational costs and environmental impact.

The Type segment of the market is experiencing diverse growth patterns. Hyperscalers (owned & Leased) are major drivers due to their massive infrastructure investments and demand for scalable, efficient cooling. Colocation providers are also expanding rapidly, offering flexible solutions that benefit from advanced cooling to attract a wider range of clients. While Enterprise (On-premise) deployments might see a slower growth in terms of new build-outs, there is a significant opportunity in upgrading existing facilities with more efficient cooling technologies.

The End-user Vertical analysis reveals the IT & Telecom sector as the dominant consumer of data center cooling solutions. However, sectors like Healthcare, driven by increasing adoption of digital health records and medical imaging, and Federal & Institutional agencies, investing in secure and resilient data infrastructure, are showing substantial growth potential. The Retail & Consumer Goods sector, with its increasing reliance on e-commerce and data analytics, also contributes to market demand.

Overall, the Israel Data Center Cooling Market is characterized by a forward-looking approach, driven by innovation and the continuous need for more efficient, sustainable, and high-performance data center operations. The forecast period is expected to witness significant advancements and widespread adoption of next-generation cooling technologies.

Dominant Regions, Countries, or Segments in Israel Data Center Cooling Market

The Israel Data Center Cooling Market exhibits distinct patterns of dominance across its various segments, driven by technological adoption, infrastructure development, and end-user demand. While Israel itself is a unified market, regional concentrations of data center development and specific segments are key to understanding growth dynamics. The IT & Telecom sector stands as the most dominant end-user vertical, consistently driving the demand for advanced cooling solutions due to the high-density computing requirements and continuous data processing needs. This sector's insatiable appetite for processing power, fueled by cloud computing, big data analytics, and the proliferation of mobile and internet services, makes it the primary consumer of both air-based and liquid-based cooling technologies.

Within the Cooling Technology segment, Air-based Cooling, particularly Chiller and Economizer systems, continues to hold a significant market share due to their established reliability and familiarity. However, the growth trajectory is increasingly shifting towards Liquid-based Cooling. Direct-to-Chip Cooling is emerging as a key growth driver within this category, catering to the specific needs of high-performance computing and AI applications where localized heat dissipation is paramount. The Rear-Door Heat Exchanger is also gaining traction as a supplementary solution for managing rack-level heat loads.

The Type of data center infrastructure also plays a crucial role in segment dominance. Hyperscalers (owned & Leased) represent a substantial portion of the market due to their enormous scale and continuous investment in state-of-the-art facilities. Their demand for highly efficient and scalable cooling solutions directly influences the market's technological direction. Colocation data centers are another significant segment, benefiting from the increasing trend of businesses outsourcing their IT infrastructure. The need for flexible, cost-effective, and high-density colocation offerings propels the adoption of advanced cooling technologies.

The dominance of specific segments is further amplified by key drivers:

IT & Telecom Sector Dominance:

- High Computing Densities: Driven by AI, ML, and big data analytics.

- Continuous Data Processing: Essential for cloud services and network operations.

- Infrastructure Expansion: Ongoing investment in new data centers and upgrades.

- Market Share: Estimated to account for over XX% of the total data center cooling market demand.

- Growth Potential: Strong, with continued technological advancements and evolving service demands.

Liquid-based Cooling Growth (Direct-to-Chip Cooling):

- Thermal Management for HPC: Essential for supercomputers and AI accelerators.

- Energy Efficiency Gains: Reduced power consumption compared to traditional cooling.

- Increased Rack Density: Enabling more computing power in smaller footprints.

- Partnerships: Collaboration between technology providers, like the Kelvion and Rosseau partnership for HPC immersion cooling solutions, is accelerating adoption.

Hyperscalers and Colocation Dominance:

- Economies of Scale: Large-scale deployments drive demand for efficient and cost-effective cooling.

- Technological Innovation Adoption: Hyperscalers are early adopters of cutting-edge cooling technologies.

- Market Share: Hyperscalers and colocation combined are estimated to represent XX% of the data center capacity in Israel.

- Infrastructure Investment: Significant capital expenditure in building and expanding data center facilities.

Emerging Dominance Factors:

- Government Initiatives: Support for digital infrastructure development and technological innovation.

- Foreign Investment: Attraction of global cloud providers and tech companies establishing local operations.

- Sustainability Mandates: Increasing pressure to reduce the environmental footprint of data centers, favoring energy-efficient cooling.

The analysis of dominant segments within the Israel Data Center Cooling Market highlights a clear trend towards higher-density computing and more energy-efficient cooling solutions. The synergy between the IT & Telecom sector, the adoption of Liquid-based Cooling, and the growth of Hyperscaler and Colocation data centers is shaping the market's trajectory, indicating significant opportunities for innovation and market penetration.

Israel Data Center Cooling Market Product Landscape

The product landscape of the Israel Data Center Cooling Market is characterized by a rapid evolution towards higher efficiency, greater density management, and integrated solutions. Manufacturers are continuously innovating to offer cooling technologies that can effectively dissipate the increasing heat loads generated by modern IT equipment, particularly for AI and high-performance computing applications. Key product innovations include advancements in Direct-to-Chip Cooling systems that deliver coolant directly to critical components like CPUs and GPUs, thereby maximizing thermal transfer efficiency. Immersion Cooling solutions are also gaining prominence, offering superior heat dissipation for extreme high-density racks. Beyond liquid cooling, advancements in Air-based Cooling include more efficient Chillers and intelligent Economizer systems that leverage ambient conditions to reduce energy consumption. The market also sees a rise in integrated cooling management platforms that provide real-time monitoring, predictive maintenance, and optimized performance adjustments, enhancing overall data center operational efficiency and reliability. These innovations aim to address the growing challenges of power consumption and environmental impact associated with data center growth.

Key Drivers, Barriers & Challenges in Israel Data Center Cooling Market

Key Drivers:

The Israel Data Center Cooling Market is propelled by several significant drivers. The escalating demand for digital services, cloud computing, and big data analytics necessitates the expansion of data center infrastructure, directly increasing the need for cooling solutions. The rapid adoption of Artificial Intelligence (AI) and Machine Learning (ML) technologies is a paramount driver, as these applications generate immense heat loads that traditional cooling methods struggle to manage. Government initiatives promoting digital transformation and the establishment of technology hubs further stimulate data center development. Furthermore, the growing emphasis on energy efficiency and sustainability mandates are pushing organizations to adopt advanced cooling technologies that reduce power consumption and operational costs.

Barriers & Challenges:

Despite the robust growth, the market faces several barriers and challenges. The substantial initial capital investment required for advanced liquid cooling infrastructure can be a deterrent for some organizations. Supply chain disruptions, as witnessed globally, can impact the availability of critical components and delay project timelines. Regulatory hurdles, although generally supportive, can sometimes involve complex compliance requirements for new technologies. Integration with existing infrastructure can also pose a significant challenge, requiring specialized expertise and potentially costly retrofits. Competition is intense, with a wide array of global and local vendors offering diverse solutions, making it challenging for businesses to select the most appropriate and cost-effective options. The lack of skilled personnel for the installation, operation, and maintenance of advanced cooling systems is another critical restraint impacting market expansion.

Emerging Opportunities in Israel Data Center Cooling Market

Emerging opportunities in the Israel Data Center Cooling Market are abundant, driven by evolving technological landscapes and market demands. The burgeoning AI and HPC sectors present a significant opportunity for Liquid-based Cooling solutions, particularly Immersion Cooling and Direct-to-Chip Cooling, which are essential for managing extremely high heat densities. The increasing focus on sustainability and energy efficiency creates a demand for innovative Economizer systems and solutions that reduce PUE (Power Usage Effectiveness). The growth of edge computing and the expansion of IoT devices will necessitate smaller, more distributed cooling solutions, opening avenues for modular and highly efficient cooling units. Furthermore, the demand for advanced monitoring and management software that provides predictive analytics and optimizes cooling performance presents lucrative opportunities for technology providers. The increasing adoption of Colocation and Hyperscale data centers will continue to drive large-scale deployments of efficient cooling infrastructure.

Growth Accelerators in the Israel Data Center Cooling Market Industry

Several catalysts are accelerating the growth of the Israel Data Center Cooling Market. Technological breakthroughs in materials science and fluid dynamics are leading to the development of more efficient and cost-effective cooling systems. Strategic partnerships between hardware manufacturers, software providers, and data center operators are fostering innovation and enabling the delivery of comprehensive solutions. The Israeli government's commitment to developing a robust digital economy, coupled with incentives for technology infrastructure investment, acts as a significant market expansion strategy. The increasing global awareness of the environmental impact of data centers is driving demand for greener cooling solutions, which in turn fuels innovation and adoption. Furthermore, the continuous rise in data generation and processing demands, particularly from emerging technologies like 5G and the metaverse, will necessitate a proportional increase in data center capacity and, consequently, cooling solutions.

Key Players Shaping the Israel Data Center Cooling Market Market

- Johnson Controls International PLC

- Asetek A/S

- Schneider Electric SE

- Emerson Electric Co

- Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- Fujitsu General Limited

- Stulz GmbH

- Airedale International Air Conditioning

- Vertiv Group Corp

- Rittal GMBH & Co KG

Notable Milestones in Israel Data Center Cooling Market Sector

- March 2024: German heat exchanger manufacturer Kelvion and US immersion cooling company Rosseau announced a partnership to deliver enhanced immersion cooling solutions for the high-performance computing (HPC) market.

- January 2024: Data center firm Aligned launched a new liquid cooling system called DeltaFlow. The liquid cooling technology is designed to support high-density computing requirements and supercomputers. It can cool densities up to 300 kW per rack. The new DeltaFlow system works simultaneously with Aligned’s air-cooled Delta technology, enabling no change in power delivery or existing data hall temperatures.

In-Depth Israel Data Center Cooling Market Market Outlook

- March 2024: German heat exchanger manufacturer Kelvion and US immersion cooling company Rosseau announced a partnership to deliver enhanced immersion cooling solutions for the high-performance computing (HPC) market.

- January 2024: Data center firm Aligned launched a new liquid cooling system called DeltaFlow. The liquid cooling technology is designed to support high-density computing requirements and supercomputers. It can cool densities up to 300 kW per rack. The new DeltaFlow system works simultaneously with Aligned’s air-cooled Delta technology, enabling no change in power delivery or existing data hall temperatures.

In-Depth Israel Data Center Cooling Market Market Outlook

The Israel Data Center Cooling Market outlook is exceptionally promising, driven by a powerful combination of technological innovation and expanding market needs. Growth accelerators such as the relentless advancement in AI and HPC are creating an urgent demand for sophisticated thermal management solutions. Strategic partnerships and collaborations between key industry players are fostering an environment of continuous improvement and accelerated market penetration. The government's proactive stance in supporting digital infrastructure development provides a fertile ground for investment and expansion. As the world increasingly relies on digital services, the exponential growth in data generation and processing will continue to fuel the need for more data center capacity, directly translating into a sustained demand for advanced and efficient cooling technologies. The market is set to witness a significant shift towards liquid-based cooling and highly intelligent, energy-efficient solutions, presenting substantial opportunities for vendors who can deliver on these critical requirements.

Israel Data Center Cooling Market Segmentation

-

1. Cooling Technology

-

1.1. Air-based Cooling

- 1.1.1. Chiller and Economizer

- 1.1.2. CRAH

- 1.1.3. Cooling

- 1.1.4. Others

-

1.2. Liquid-based Cooling

- 1.2.1. Immersion Cooling

- 1.2.2. Direct-to-Chip Cooling

- 1.2.3. Rear-Door Heat Exchanger

-

1.1. Air-based Cooling

-

2. Type

- 2.1. Hyperscalers (owned & Leased)

- 2.2. Enterprise (On-premise)

- 2.3. Colocation

-

3. End user Vertical

- 3.1. IT & Telecom

- 3.2. Retail & Consumer Goods

- 3.3. Healthcare

- 3.4. Media & Entertainment

- 3.5. Federal & Institutional agencies

- 3.6. Other end-users

Israel Data Center Cooling Market Segmentation By Geography

- 1. Israel

Israel Data Center Cooling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 15.40% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Trend of High-performance Computing Across Europe; Growing Rack Power Density

- 3.3. Market Restrains

- 3.3.1. High Initial Investments

- 3.4. Market Trends

- 3.4.1. IT and Telecom to Have Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Israel Data Center Cooling Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 5.1.1. Air-based Cooling

- 5.1.1.1. Chiller and Economizer

- 5.1.1.2. CRAH

- 5.1.1.3. Cooling

- 5.1.1.4. Others

- 5.1.2. Liquid-based Cooling

- 5.1.2.1. Immersion Cooling

- 5.1.2.2. Direct-to-Chip Cooling

- 5.1.2.3. Rear-Door Heat Exchanger

- 5.1.1. Air-based Cooling

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Hyperscalers (owned & Leased)

- 5.2.2. Enterprise (On-premise)

- 5.2.3. Colocation

- 5.3. Market Analysis, Insights and Forecast - by End user Vertical

- 5.3.1. IT & Telecom

- 5.3.2. Retail & Consumer Goods

- 5.3.3. Healthcare

- 5.3.4. Media & Entertainment

- 5.3.5. Federal & Institutional agencies

- 5.3.6. Other end-users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Israel

- 5.1. Market Analysis, Insights and Forecast - by Cooling Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Johnson Controls International PLC

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Asetek A/S

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Schneider Electric SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Emerson Electric Co *List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Hydronics & IT Cooling Systems SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Fujitsu General Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Stulz GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Airedale International Air Conditioning

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Vertiv Group Corp

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Rittal GMBH & Co KG

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Johnson Controls International PLC

List of Figures

- Figure 1: Israel Data Center Cooling Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Israel Data Center Cooling Market Share (%) by Company 2024

List of Tables

- Table 1: Israel Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Israel Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 3: Israel Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Israel Data Center Cooling Market Revenue Million Forecast, by End user Vertical 2019 & 2032

- Table 5: Israel Data Center Cooling Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: Israel Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

- Table 7: Israel Data Center Cooling Market Revenue Million Forecast, by Cooling Technology 2019 & 2032

- Table 8: Israel Data Center Cooling Market Revenue Million Forecast, by Type 2019 & 2032

- Table 9: Israel Data Center Cooling Market Revenue Million Forecast, by End user Vertical 2019 & 2032

- Table 10: Israel Data Center Cooling Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Israel Data Center Cooling Market?

The projected CAGR is approximately 15.40%.

2. Which companies are prominent players in the Israel Data Center Cooling Market?

Key companies in the market include Johnson Controls International PLC, Asetek A/S, Schneider Electric SE, Emerson Electric Co *List Not Exhaustive, Mitsubishi Electric Hydronics & IT Cooling Systems SpA, Fujitsu General Limited, Stulz GmbH, Airedale International Air Conditioning, Vertiv Group Corp, Rittal GMBH & Co KG.

3. What are the main segments of the Israel Data Center Cooling Market?

The market segments include Cooling Technology, Type, End user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 15.80 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Trend of High-performance Computing Across Europe; Growing Rack Power Density.

6. What are the notable trends driving market growth?

IT and Telecom to Have Significant Market Share.

7. Are there any restraints impacting market growth?

High Initial Investments.

8. Can you provide examples of recent developments in the market?

March 2024: German heat exchanger manufacturer Kelvion and US immersion cooling company Rosseau announced a partnership to deliver enhanced immersion cooling solutions for the high-performance computing (HPC) market.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Israel Data Center Cooling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Israel Data Center Cooling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Israel Data Center Cooling Market?

To stay informed about further developments, trends, and reports in the Israel Data Center Cooling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence