Key Insights

The Latin American active and intelligent packaging market is poised for significant expansion, driven by escalating demand for enhanced food safety and extended product shelf life, particularly within the food and beverage industries. A growing middle class and rising disposable incomes are fostering a preference for convenient, high-quality packaged goods, creating a fertile environment for advanced packaging solutions. Technological advancements, including sensor integration and RFID technology, are further boosting market appeal. Brazil and Mexico lead national markets due to their substantial food processing sectors and established supply chains. Consumer awareness regarding food quality and safety is also fueling growth in other Latin American nations. Despite challenges such as high initial investment costs and infrastructure limitations, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.4%. This growth is further supported by the increasing adoption of active packaging in healthcare and personal care, benefiting from extended shelf life and improved product integrity.

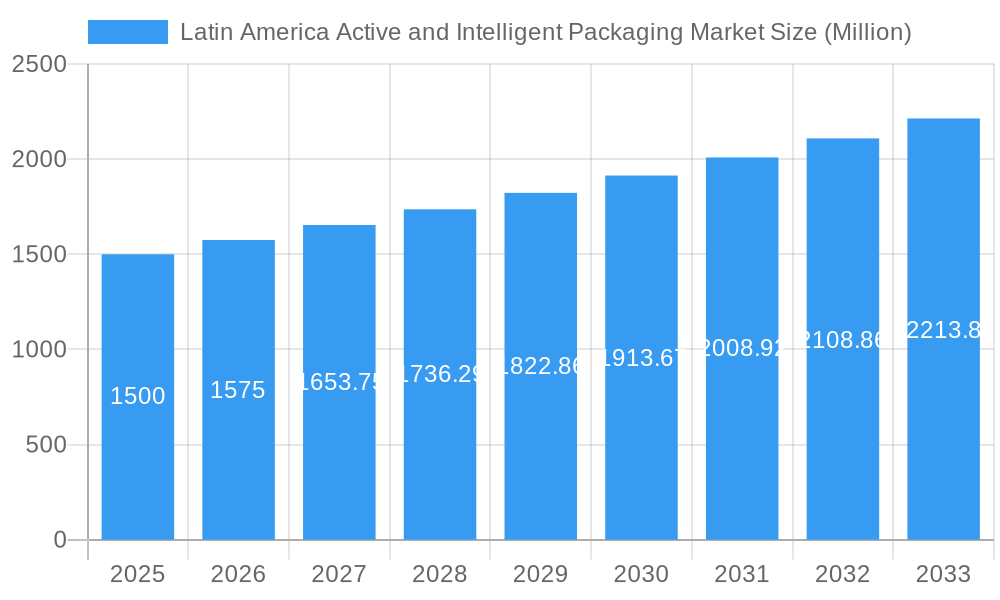

Latin America Active and Intelligent Packaging Market Market Size (In Billion)

Market segmentation presents diverse opportunities for industry players. The "Other Active Packaging Technologies" segment, encompassing intelligent packaging, is anticipated to experience substantial growth due to its capability to deliver real-time product information and bolster traceability. While the food and beverage sector remains dominant, healthcare and personal care segments are exhibiting rapid expansion, driven by the need for secure, tamper-evident packaging. The competitive landscape is moderately intense, featuring a mix of multinational corporations and local enterprises. Opportunities exist for companies prioritizing innovation and offering customized solutions tailored to the specific requirements of industries and regions within Latin America. Strategic partnerships and collaborations are vital for successful market entry and penetration.

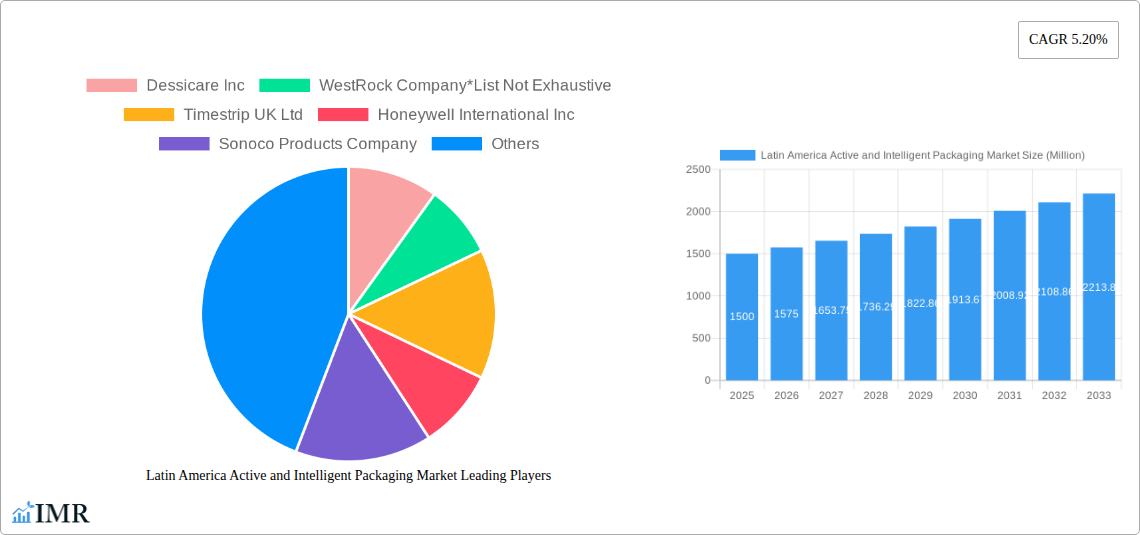

Latin America Active and Intelligent Packaging Market Company Market Share

The Latin American active and intelligent packaging market was valued at 29 billion in 2025 and is expected to reach significant growth by 2033.

Latin America Active and Intelligent Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Latin America active and intelligent packaging market, encompassing market dynamics, growth trends, dominant segments, and key players. The study covers the period 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. The report is crucial for businesses seeking to understand and capitalize on opportunities within this rapidly evolving market. It analyzes the parent market (Packaging Market) and delves into the child market segments of Active and Intelligent Packaging, providing invaluable insights for strategic decision-making. Market values are presented in million units.

Latin America Active and Intelligent Packaging Market Market Dynamics & Structure

The Latin American active and intelligent packaging market exhibits a moderately fragmented landscape, with several established players and emerging companies vying for market share. Technological innovation, driven by increasing consumer demand for extended shelf life and enhanced product traceability, is a key driver. Stringent regulatory frameworks regarding food safety and product labeling influence market dynamics, creating both opportunities and challenges. Competitive product substitutes, such as traditional packaging materials, continue to pose a challenge, while the rise of e-commerce is boosting demand for intelligent packaging solutions that ensure product integrity during transit. The market is witnessing significant M&A activity, with larger players consolidating their market positions and expanding their product portfolios.

- Market Concentration: Moderately fragmented, with a Herfindahl-Hirschman Index (HHI) of xx.

- Technological Innovation: Driven by RFID, sensors, and smart labels.

- Regulatory Framework: Stringent food safety and labeling regulations.

- Competitive Substitutes: Traditional packaging materials.

- End-User Demographics: Growing middle class and increasing urbanization.

- M&A Activity: xx deals in the last 5 years, with an average deal value of xx million units. xx% of deals involved international acquisitions.

Latin America Active and Intelligent Packaging Market Growth Trends & Insights

The Latin American active and intelligent packaging market is experiencing robust growth, fueled by rising consumer awareness, increasing demand for convenience, and technological advancements. The market size is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period. Adoption rates are particularly high in the food and beverage sectors, driven by the need to reduce food waste and enhance product safety. Technological disruptions, including the integration of IoT and AI, are further enhancing the functionality and appeal of active and intelligent packaging. Consumer behavior shifts, such as increasing preference for convenient and sustainable packaging solutions, are also driving growth.

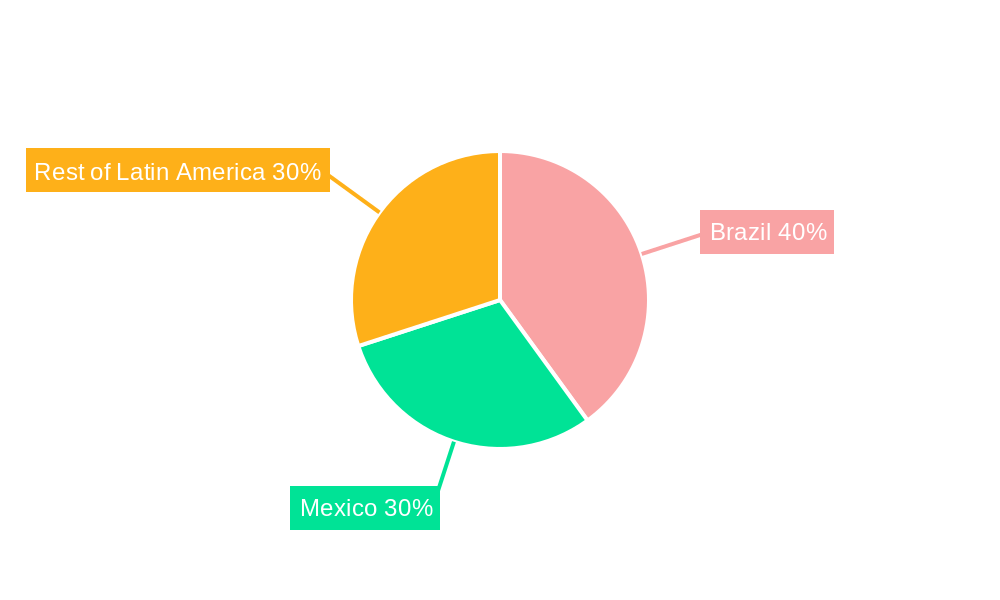

Dominant Regions, Countries, or Segments in Latin America Active and Intelligent Packaging Market

Brazil and Mexico are the dominant markets in Latin America for active and intelligent packaging, accounting for xx% and xx% of the regional market share, respectively, in 2025. The Food and Beverage segment is the largest end-user vertical, contributing xx% to the overall market revenue in 2025. The growth of these segments is fueled by several factors:

- Brazil: Strong economic growth, burgeoning food and beverage industry, and expanding e-commerce sector.

- Mexico: High population density, increasing consumer disposable income, and growing demand for imported goods.

- Food & Beverage Segment: Rising demand for extended shelf life, improved food safety, and brand protection.

The Intelligent Packaging segment is expected to experience faster growth than Active Packaging due to the increasing adoption of sophisticated technologies, such as RFID and smart labels.

Latin America Active and Intelligent Packaging Market Product Landscape

The active and intelligent packaging market showcases a wide range of innovative products, including modified atmosphere packaging (MAP), active packaging incorporating oxygen absorbers or antimicrobial agents, and intelligent packaging with integrated sensors and RFID tags. These products offer unique selling propositions such as extended shelf life, improved product safety and enhanced traceability for various goods. Technological advancements such as the miniaturization of sensors and the development of biodegradable and compostable packaging materials are reshaping the product landscape.

Key Drivers, Barriers & Challenges in Latin America Active and Intelligent Packaging Market

Key Drivers:

- Rising consumer demand for convenience and product safety.

- Growing awareness of food waste and its environmental impact.

- Stringent regulatory requirements regarding food safety and labeling.

- Technological advancements in sensors, RFID, and smart packaging.

Key Challenges:

- High initial investment costs associated with implementing new technologies.

- Lack of awareness among consumers and businesses about the benefits of active and intelligent packaging.

- Supply chain complexities and logistical challenges in transporting and storing sensitive products.

- Limited availability of skilled labor to design and manage active and intelligent packaging systems.

- xx% of companies cite regulatory hurdles as a major barrier to market entry.

Emerging Opportunities in Latin America Active and Intelligent Packaging Market

- Untapped markets in smaller Latin American countries.

- Growing demand for sustainable and eco-friendly packaging solutions.

- Opportunities in the healthcare sector for temperature-sensitive drug delivery.

- Innovative applications in the personal care sector, integrating smart packaging with personalized experiences.

- Increased adoption of e-commerce and the need for tamper-evident and secure packaging solutions.

Growth Accelerators in the Latin America Active and Intelligent Packaging Market Industry

Long-term growth in the Latin American active and intelligent packaging market will be propelled by technological breakthroughs in sensor technology, the development of more sustainable packaging materials, and strategic partnerships between packaging manufacturers and brand owners. Market expansion into previously underserved regions and a greater emphasis on consumer education will further accelerate market growth.

Key Players Shaping the Latin America Active and Intelligent Packaging Market Market

- Dessicare Inc

- WestRock Company

- Timestrip UK Ltd

- Honeywell International Inc

- Sonoco Products Company

- Landec Corporation

- Ball Corporation

- Crown Holdings Inc

- Bemis Company Inc

- BASF SE

- Graphic Packaging International LLC

- Sealed Air Corporation

- Amcor Ltd

Notable Milestones in Latin America Active and Intelligent Packaging Market Sector

- September 2021: Announcement of a USD 150 million investment to expand RFID production capacity in Brazil for food, healthcare, and personal care products. This signals a strong commitment to the Latin American market and indicates a significant increase in demand for advanced packaging solutions.

- End of 2022 (Projected): Commencement of operations for the expanded RFID production facility in Brazil, with a 30% increase in production capacity. This milestone demonstrates the growing importance of advanced packaging technologies in the region.

In-Depth Latin America Active and Intelligent Packaging Market Market Outlook

The future of the Latin American active and intelligent packaging market is bright, driven by a confluence of factors including increasing consumer demand, technological advancements, and supportive government policies. Strategic partnerships between key players and innovative start-ups will further shape the market landscape, fostering rapid innovation and expansion. The market is poised for significant growth, presenting attractive opportunities for businesses to capitalize on the rising demand for advanced packaging solutions.

Latin America Active and Intelligent Packaging Market Segmentation

-

1. Type

-

1.1. Active Packaging

- 1.1.1. Gas Scavengers/Emitters

- 1.1.2. Moisture Scavenger

- 1.1.3. Microwave Susceptors

- 1.1.4. Other Active Packaging Technologies

-

1.2. Intelligent Packaging

- 1.2.1. Coding and Markings

- 1.2.2. Antenna (RFID and NFC)

- 1.2.3. Sensors and Output Devices

- 1.2.4. Other Intelligent Packaging Technologies

-

1.1. Active Packaging

-

2. End-user Vertical

- 2.1. Food

- 2.2. Beverage

- 2.3. Healthcare

- 2.4. Personal Care

- 2.5. Other End-user Verticals

Latin America Active and Intelligent Packaging Market Segmentation By Geography

-

1. Latin America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Mexico

- 1.6. Peru

- 1.7. Venezuela

- 1.8. Ecuador

- 1.9. Bolivia

- 1.10. Paraguay

Latin America Active and Intelligent Packaging Market Regional Market Share

Geographic Coverage of Latin America Active and Intelligent Packaging Market

Latin America Active and Intelligent Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Longer Shelf Life and Changing Consumer Lifestyle; Growing Demand for Fresh and Quality Food Products

- 3.3. Market Restrains

- 3.3.1. ; High Initial Cost for Research Activities

- 3.4. Market Trends

- 3.4.1. Longer Shelf Life and Changing Consumer Lifestyle is expected to drive the market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Latin America Active and Intelligent Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Active Packaging

- 5.1.1.1. Gas Scavengers/Emitters

- 5.1.1.2. Moisture Scavenger

- 5.1.1.3. Microwave Susceptors

- 5.1.1.4. Other Active Packaging Technologies

- 5.1.2. Intelligent Packaging

- 5.1.2.1. Coding and Markings

- 5.1.2.2. Antenna (RFID and NFC)

- 5.1.2.3. Sensors and Output Devices

- 5.1.2.4. Other Intelligent Packaging Technologies

- 5.1.1. Active Packaging

- 5.2. Market Analysis, Insights and Forecast - by End-user Vertical

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Healthcare

- 5.2.4. Personal Care

- 5.2.5. Other End-user Verticals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Dessicare Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 WestRock Company*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Timestrip UK Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Honeywell International Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sonoco Products Company

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Landec Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Ball Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Crown Holdings Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Bemis Company Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 BASF SE

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Graphic Packaging International LLC

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Sealed Air Corporation

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Amcor Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 Dessicare Inc

List of Figures

- Figure 1: Latin America Active and Intelligent Packaging Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Latin America Active and Intelligent Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 3: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by End-user Vertical 2020 & 2033

- Table 6: Latin America Active and Intelligent Packaging Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Brazil Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Argentina Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Chile Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Colombia Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Mexico Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Peru Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Venezuela Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Ecuador Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Bolivia Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Paraguay Latin America Active and Intelligent Packaging Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Latin America Active and Intelligent Packaging Market?

The projected CAGR is approximately 9.4%.

2. Which companies are prominent players in the Latin America Active and Intelligent Packaging Market?

Key companies in the market include Dessicare Inc, WestRock Company*List Not Exhaustive, Timestrip UK Ltd, Honeywell International Inc, Sonoco Products Company, Landec Corporation, Ball Corporation, Crown Holdings Inc, Bemis Company Inc, BASF SE, Graphic Packaging International LLC, Sealed Air Corporation, Amcor Ltd.

3. What are the main segments of the Latin America Active and Intelligent Packaging Market?

The market segments include Type, End-user Vertical.

4. Can you provide details about the market size?

The market size is estimated to be USD 29 billion as of 2022.

5. What are some drivers contributing to market growth?

Longer Shelf Life and Changing Consumer Lifestyle; Growing Demand for Fresh and Quality Food Products.

6. What are the notable trends driving market growth?

Longer Shelf Life and Changing Consumer Lifestyle is expected to drive the market.

7. Are there any restraints impacting market growth?

; High Initial Cost for Research Activities.

8. Can you provide examples of recent developments in the market?

September 2021 - The company has long announced the investment of USD 150 million to expand the radio-frequency identification (RFID) production capacity in Brazil for food, healthcare, and personal care products amid the increased demand. However, in 2021 the company announced that it would start operations by the end of 2022 with additional investments in technology to increase the production capacity by 30%.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Latin America Active and Intelligent Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Latin America Active and Intelligent Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Latin America Active and Intelligent Packaging Market?

To stay informed about further developments, trends, and reports in the Latin America Active and Intelligent Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence