Key Insights

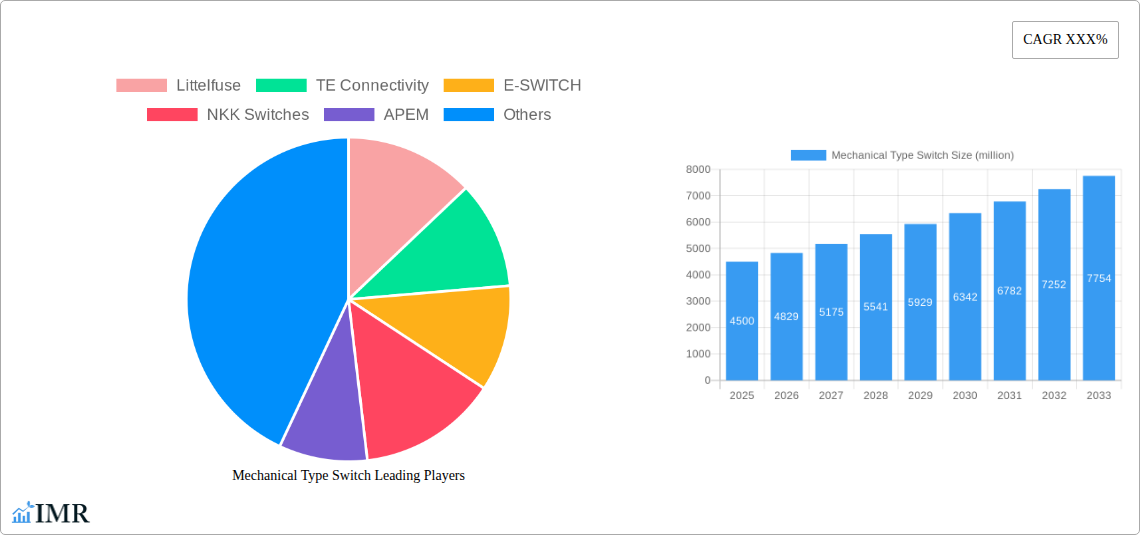

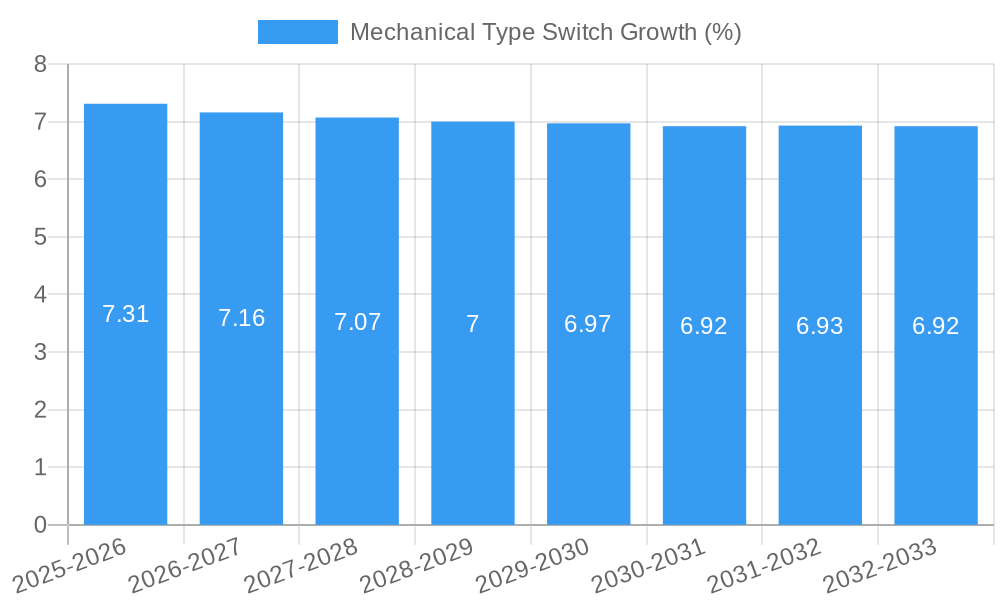

The global Mechanical Type Switch market is poised for robust growth, projected to reach an estimated USD 4,500 million by 2025, with a Compound Annual Growth Rate (CAGR) of approximately 7.2% during the forecast period of 2025-2033. This expansion is primarily fueled by the increasing demand across diverse end-use industries, including automotive, industrial automation, and medical devices, where the reliability and durability of mechanical switches remain paramount. The automotive sector, in particular, is a significant contributor, driven by the proliferation of advanced driver-assistance systems (ADAS) and the growing complexity of in-vehicle electronics that necessitate dependable switch functionalities. Similarly, the industrial sector's embrace of Industry 4.0 principles and the expansion of automated manufacturing processes are creating sustained demand for high-performance mechanical switches for control panels, machinery, and safety equipment. The medical treatment segment is also witnessing a steady uptake, owing to the stringent regulatory requirements and the need for fail-safe operation in critical medical equipment.

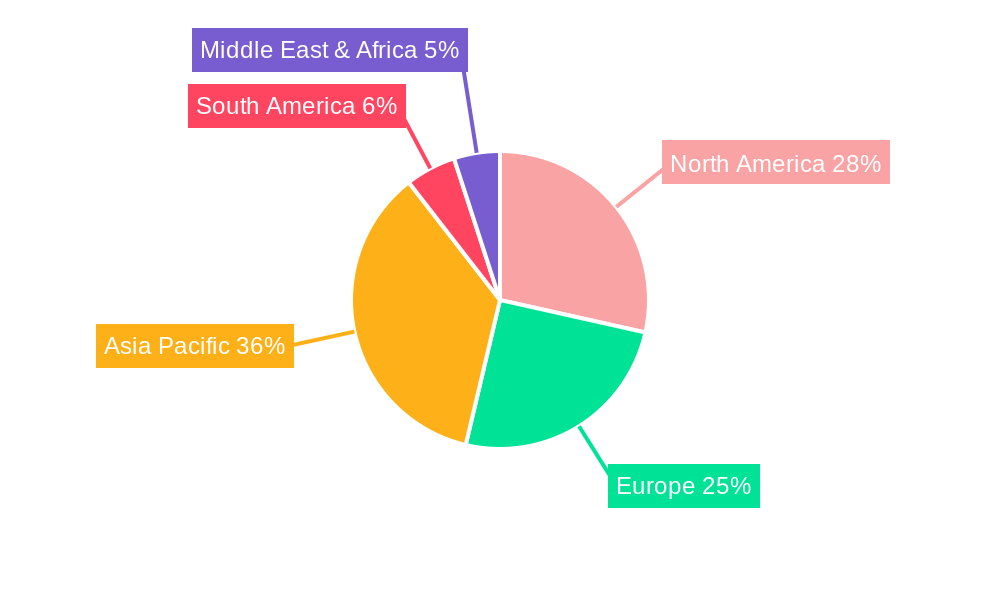

The market is segmented by type into Single Stage Switch and Multi-Stage Switch, with both categories expected to experience growth, albeit with Multi-Stage Switches likely to see a faster adoption rate due to their increasing integration into complex control systems. Geographically, the Asia Pacific region, led by China and India, is expected to emerge as the fastest-growing market, driven by rapid industrialization, expanding manufacturing capabilities, and a burgeoning automotive industry. North America and Europe will continue to hold significant market shares, supported by well-established industrial bases, advanced technological adoption, and a strong focus on automotive innovation and medical device manufacturing. Key players such as Littelfuse, TE Connectivity, and Omron are actively investing in research and development to introduce innovative switch solutions with enhanced features and miniaturization, further propelling market growth. However, the market may face challenges from the increasing adoption of solid-state switches in certain applications where extreme environments or specific electrical characteristics are not a primary concern, and potential supply chain disruptions could impact production.

Mechanical Type Switch Market Dynamics & Structure

The global mechanical type switch market is characterized by moderate concentration, with key players like Littelfuse, TE Connectivity, and NKK Switches holding significant market share. Technological innovation remains a primary driver, with continuous advancements in materials, miniaturization, and enhanced durability fueling demand across various applications. Stringent regulatory frameworks, particularly in automotive and aerospace sectors, mandate high-quality and reliable mechanical switches, further shaping market dynamics. Competitive product substitutes, such as solid-state switches, pose a challenge, but the robust performance and cost-effectiveness of mechanical switches ensure their continued relevance. End-user demographics are shifting towards increased adoption in industrial automation, medical devices, and electric vehicles, demanding higher performance and specialized switch designs. Mergers and acquisitions (M&A) are a notable trend, as larger players consolidate their market positions and acquire innovative technologies. For instance, an estimated xx M&A deals were recorded in the historical period (2019-2024), indicating strategic consolidation. Innovation barriers primarily revolve around the significant R&D investment required for developing next-generation mechanical switches with improved functionalities and compliance with evolving industry standards.

- Market Concentration: Moderate, with top players holding approximately 45% of the market share.

- Technological Innovation Drivers: Miniaturization, enhanced durability, improved sealing, and integration with smart functionalities.

- Regulatory Frameworks: Increasing emphasis on safety standards (e.g., UL, CE) and environmental compliance.

- Competitive Product Substitutes: Solid-state relays, optocouplers, and other non-mechanical switching solutions.

- End-User Demographics: Growing demand from Industrial Automation (xx% market share), Automotive (xx% market share), Medical Treatment (xx% market share), and Aerospace (xx% market share).

- M&A Trends: Strategic acquisitions to gain market share, access new technologies, and expand product portfolios.

Mechanical Type Switch Growth Trends & Insights

The global mechanical type switch market is poised for steady growth, driven by a confluence of technological advancements, evolving industry needs, and increasing adoption across diverse sectors. The market size, valued at approximately $xx billion in the base year 2025, is projected to reach $xx billion by the end of the forecast period in 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately xx% from 2025 to 2033. Historical data from 2019-2024 indicates a robust growth trajectory, with the market expanding from $xx billion to $xx billion, reflecting an average annual growth of xx%. This consistent expansion is fueled by the indispensable role of mechanical switches in providing reliable and tactile feedback, a crucial element in many industrial and consumer applications.

Adoption rates for mechanical type switches remain high, particularly in applications where physical actuation and clear operational status are paramount. For instance, in the industrial segment, the need for durable and fault-tolerant switches in control panels, machinery, and power distribution systems continues to drive demand. The automotive industry's transition towards electric vehicles (EVs) and advanced driver-assistance systems (ADAS) also presents significant growth opportunities, as these complex systems rely on a multitude of reliable mechanical switches for various functions, from interior controls to critical safety features.

Technological disruptions, while present in the form of advanced solid-state alternatives, are also fostering innovation within the mechanical switch segment. Manufacturers are focusing on developing switches with improved environmental resistance (e.g., IP ratings), enhanced lifespan, and reduced form factors to cater to space-constrained designs. Furthermore, the integration of smart capabilities, such as embedded sensors or connectivity features, is beginning to emerge, offering a hybrid approach that combines the reliability of mechanical actuation with the data-driven insights of modern electronics.

Consumer behavior shifts are also playing a role. In certain high-end applications and niche markets, there's a resurgence of appreciation for the tactile feel and audible click of mechanical switches, leading to their adoption in premium consumer electronics and specialized control interfaces. The enduring preference for a physical connection and the clear confirmation of an action are factors that continue to support the market. The broad spectrum of applications, from simple on/off switches to complex multi-stage configurations, ensures a sustained demand that is resilient to incremental technological obsolescence. The market's ability to adapt and innovate within its core strengths, while also exploring integration with emerging technologies, positions it for continued, reliable expansion throughout the forecast period.

Dominant Regions, Countries, or Segments in Mechanical Type Switch

The global mechanical type switch market's dominance is multifaceted, with distinct regions, countries, and application segments playing pivotal roles in shaping its growth trajectory. Among the application segments, the Industrial sector consistently emerges as the most dominant, commanding an estimated xx% of the total market share in 2025. This supremacy is driven by the relentless pace of industrial automation, the expansion of manufacturing facilities worldwide, and the critical need for robust, reliable, and long-lasting switching solutions in machinery, control systems, and power management equipment. The ongoing digital transformation of industries, including Industry 4.0 initiatives, further amplifies the demand for sophisticated and dependable mechanical switches that can withstand harsh operating environments and ensure uninterrupted operations.

Within the Industrial application segment, countries like China and the United States lead in terms of market size and consumption. China's position as a global manufacturing hub, coupled with its significant investments in infrastructure and industrial modernization, makes it a primary driver of demand for mechanical switches. The United States, with its advanced manufacturing capabilities and a strong emphasis on automation and technological innovation, also represents a substantial market. Other key countries contributing to the industrial segment's dominance include Germany, Japan, and South Korea, all renowned for their sophisticated industrial ecosystems and high-quality manufacturing standards.

The Automobile application segment is another significant contributor to market growth, projected to hold a xx% market share in 2025. The increasing complexity of vehicle electronics, the surge in electric vehicle (EV) production, and the integration of advanced driver-assistance systems (ADAS) necessitate a vast array of reliable mechanical switches. From basic controls like window lifters and seat adjustments to critical components in powertrain management and infotainment systems, mechanical switches are indispensable. The automotive industry's stringent safety and performance requirements further drive demand for high-quality, durable, and certified mechanical switches.

Regarding the Type of switches, the Single Stage Switch segment is currently dominant, accounting for approximately xx% of the market share in 2025. This prevalence is due to their widespread use in a myriad of basic functions across all application areas, such as simple on/off controls, momentary activations, and basic signal switching. Their simplicity, cost-effectiveness, and reliability make them the go-to choice for a vast number of applications where complex multi-state operations are not required.

However, the Multi-Stage Switch segment is exhibiting a higher growth rate and is expected to gain market share over the forecast period. This is attributed to the increasing sophistication of end-user products, particularly in industrial control panels, medical equipment, and automotive interiors, where multiple functions can be consolidated into a single switch assembly. The development of more intricate control interfaces and the drive for product miniaturization are pushing the demand for multi-stage switches that can offer greater functionality within a smaller footprint.

Geographically, Asia Pacific is the leading region for mechanical type switches, driven by its robust manufacturing base, rapid industrialization, and growing automotive production. North America and Europe follow closely, with strong demand from established industrial sectors, advanced automotive markets, and stringent regulatory environments mandating high-quality components. The dominance of these regions is further reinforced by economic policies that favor manufacturing and technological development, coupled with significant infrastructure investments that require a continuous supply of electrical components, including mechanical type switches.

Mechanical Type Switch Product Landscape

The mechanical type switch product landscape is characterized by continuous innovation focused on enhancing performance, reliability, and application versatility. Manufacturers are developing switches with improved durability, achieving millions of actuation cycles, and incorporating enhanced sealing capabilities to withstand challenging environmental conditions, including dust, moisture, and extreme temperatures. Miniaturization remains a key trend, with smaller form factors enabling their integration into increasingly compact electronic devices and control panels. Innovations include tactile feedback mechanisms that provide a distinct physical sensation, ergonomic designs for improved user experience, and materials that offer superior electrical conductivity and resistance to wear. Unique selling propositions often lie in specialized designs for specific industries, such as hermetically sealed switches for aerospace, high-temperature switches for industrial furnaces, or low-profile switches for automotive interiors. Technological advancements are also seen in the development of switches with self-cleaning contacts, reduced actuation force, and improved electrical insulation properties.

Key Drivers, Barriers & Challenges in Mechanical Type Switch

The mechanical type switch market is propelled by several key drivers.

- Technological Drivers: The persistent demand for reliable, durable, and cost-effective switching solutions in industrial automation, automotive, and consumer electronics remains paramount. Continuous innovation in materials, miniaturization, and enhanced sealing further fuels growth.

- Economic Drivers: Global industrial expansion, particularly in emerging economies, and the increasing complexity of automotive systems, including EVs and ADAS, create substantial demand.

- Policy-Driven Factors: Stringent safety regulations and industry standards in sectors like aerospace and medical treatment necessitate the use of highly reliable mechanical switches.

Conversely, the market faces significant barriers and challenges.

- Technological Barriers: The rise of advanced solid-state switching alternatives poses a competitive threat, offering faster switching speeds and integration capabilities, albeit often at a higher cost or with less tactile feedback.

- Supply Chain Issues: Global supply chain disruptions, raw material price volatility, and geopolitical factors can impact production costs and lead times.

- Regulatory Hurdles: Evolving environmental regulations and compliance requirements for materials and manufacturing processes can add complexity and cost.

- Competitive Pressures: Intense competition among numerous players, especially in the commoditized segments, can lead to price erosion and reduced profit margins.

Emerging Opportunities in Mechanical Type Switch

Emerging opportunities in the mechanical type switch sector lie in the growing demand for smart industrial controls, where mechanical switches can be integrated with sensors and microcontrollers for enhanced data collection and remote monitoring capabilities. The expansion of the electric vehicle market presents a significant avenue, with the need for a higher volume of specialized switches for battery management systems, charging infrastructure, and advanced interior controls. Furthermore, the increasing adoption of IoT devices in various sectors, from smart homes to industrial monitoring, opens up possibilities for miniaturized and robust mechanical switches that offer reliable actuation and tactile feedback. Niche applications in medical equipment requiring high reliability and sterilizability, as well as the growing demand for premium user interfaces in consumer electronics, also represent untapped markets.

Growth Accelerators in the Mechanical Type Switch Industry

The mechanical type switch industry is experiencing significant growth acceleration fueled by several catalysts. The relentless drive for industrial automation and smart manufacturing (Industry 4.0) necessitates robust and reliable mechanical switches for intricate control systems and operator interfaces. The burgeoning electric vehicle (EV) market is a major growth accelerator, with increasing vehicle electrification leading to a higher demand for specialized and high-performance switches across various automotive sub-systems. Strategic partnerships between mechanical switch manufacturers and system integrators or automotive OEMs are crucial for developing customized solutions that meet evolving vehicle architectures. Furthermore, the ongoing miniaturization trend, enabling the integration of mechanical switches into increasingly compact designs, opens up new application possibilities and expands market reach.

Key Players Shaping the Mechanical Type Switch Market

- Littelfuse

- TE Connectivity

- E-SWITCH

- NKK Switches

- APEM

- AB Elektronik

- RS PRO

- Nidec Copal

- Bulgin

- Arcolectric

- Omron

- CHINT

- C&K Components

- Carling Technologies

- CW Industries

- Everel Group

Notable Milestones in Mechanical Type Switch Sector

- 2019: Littelfuse acquires a significant stake in a specialized switch manufacturer, expanding its product portfolio for industrial automation.

- 2020: NKK Switches launches a new series of ultra-miniature tactile switches designed for portable electronic devices.

- 2021: TE Connectivity introduces a robust, high-current mechanical switch engineered for demanding automotive applications.

- 2022: APEM unveils a range of ruggedized joysticks and pushbuttons with enhanced IP ratings for harsh environments.

- 2023: E-SWITCH announces the integration of anti-microbial properties into select switch lines for medical device applications.

- 2024: Several key players report increased demand for mechanical switches driven by the acceleration of electric vehicle production and infrastructure development.

In-Depth Mechanical Type Switch Market Outlook

The mechanical type switch market is poised for continued robust growth, driven by the foundational need for reliability and tactile feedback across a diverse range of critical applications. The ongoing industrial automation revolution, coupled with the exponential growth of the electric vehicle sector, will serve as primary growth accelerators. Manufacturers are expected to focus on developing more intelligent switches that integrate sensing capabilities and enhanced connectivity, bridging the gap between traditional mechanical designs and modern digital ecosystems. Strategic collaborations and acquisitions will likely continue to shape the competitive landscape, allowing companies to expand their technological prowess and market reach. The market's resilience, coupled with its capacity for innovation within its core competencies, suggests a promising future with significant opportunities for value creation.

Mechanical Type Switch Segmentation

-

1. Application

- 1.1. Industrial

- 1.2. Aerospace

- 1.3. Medical Treatment

- 1.4. Automobile

- 1.5. Others

-

2. Type

- 2.1. Single Stage Switch

- 2.2. Multi-Stage Switch

Mechanical Type Switch Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Mechanical Type Switch REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Mechanical Type Switch Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Industrial

- 5.1.2. Aerospace

- 5.1.3. Medical Treatment

- 5.1.4. Automobile

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Single Stage Switch

- 5.2.2. Multi-Stage Switch

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Mechanical Type Switch Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Industrial

- 6.1.2. Aerospace

- 6.1.3. Medical Treatment

- 6.1.4. Automobile

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Single Stage Switch

- 6.2.2. Multi-Stage Switch

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Mechanical Type Switch Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Industrial

- 7.1.2. Aerospace

- 7.1.3. Medical Treatment

- 7.1.4. Automobile

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Single Stage Switch

- 7.2.2. Multi-Stage Switch

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Mechanical Type Switch Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Industrial

- 8.1.2. Aerospace

- 8.1.3. Medical Treatment

- 8.1.4. Automobile

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Single Stage Switch

- 8.2.2. Multi-Stage Switch

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Mechanical Type Switch Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Industrial

- 9.1.2. Aerospace

- 9.1.3. Medical Treatment

- 9.1.4. Automobile

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Single Stage Switch

- 9.2.2. Multi-Stage Switch

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Mechanical Type Switch Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Industrial

- 10.1.2. Aerospace

- 10.1.3. Medical Treatment

- 10.1.4. Automobile

- 10.1.5. Others

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Single Stage Switch

- 10.2.2. Multi-Stage Switch

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Littelfuse

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 TE Connectivity

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 E-SWITCH

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 NKK Switches

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 APEM

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 AB Elektronik

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 RS PRO

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Nidec Copal

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bulgin

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Arcolectric

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Omron

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 CHINT

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 C&K Components

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Carling Technologies

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 CW Industries

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 Everel Group

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.1 Littelfuse

List of Figures

- Figure 1: Global Mechanical Type Switch Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Mechanical Type Switch Revenue (million), by Application 2024 & 2032

- Figure 3: North America Mechanical Type Switch Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Mechanical Type Switch Revenue (million), by Type 2024 & 2032

- Figure 5: North America Mechanical Type Switch Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Mechanical Type Switch Revenue (million), by Country 2024 & 2032

- Figure 7: North America Mechanical Type Switch Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Mechanical Type Switch Revenue (million), by Application 2024 & 2032

- Figure 9: South America Mechanical Type Switch Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Mechanical Type Switch Revenue (million), by Type 2024 & 2032

- Figure 11: South America Mechanical Type Switch Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Mechanical Type Switch Revenue (million), by Country 2024 & 2032

- Figure 13: South America Mechanical Type Switch Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Mechanical Type Switch Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Mechanical Type Switch Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Mechanical Type Switch Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Mechanical Type Switch Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Mechanical Type Switch Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Mechanical Type Switch Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Mechanical Type Switch Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Mechanical Type Switch Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Mechanical Type Switch Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Mechanical Type Switch Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Mechanical Type Switch Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Mechanical Type Switch Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Mechanical Type Switch Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Mechanical Type Switch Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Mechanical Type Switch Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Mechanical Type Switch Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Mechanical Type Switch Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Mechanical Type Switch Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Mechanical Type Switch Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Mechanical Type Switch Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Mechanical Type Switch Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Mechanical Type Switch Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Mechanical Type Switch Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Mechanical Type Switch Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Mechanical Type Switch Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Mechanical Type Switch Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Mechanical Type Switch Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Mechanical Type Switch Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Mechanical Type Switch Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Mechanical Type Switch Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Mechanical Type Switch Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Mechanical Type Switch Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Mechanical Type Switch Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Mechanical Type Switch Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Mechanical Type Switch Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Mechanical Type Switch Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Mechanical Type Switch Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Mechanical Type Switch Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mechanical Type Switch?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Mechanical Type Switch?

Key companies in the market include Littelfuse, TE Connectivity, E-SWITCH, NKK Switches, APEM, AB Elektronik, RS PRO, Nidec Copal, Bulgin, Arcolectric, Omron, CHINT, C&K Components, Carling Technologies, CW Industries, Everel Group.

3. What are the main segments of the Mechanical Type Switch?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4250.00, USD 6375.00, and USD 8500.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mechanical Type Switch," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mechanical Type Switch report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mechanical Type Switch?

To stay informed about further developments, trends, and reports in the Mechanical Type Switch, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence