Key Insights

The Middle East and Africa (MEA) Aerosol Disinfectants Market is poised for robust expansion, driven by heightened health awareness, the increasing incidence of infectious diseases, and augmented demand from healthcare and residential sectors. The market is projected to achieve a Compound Annual Growth Rate (CAGR) of 7.4%, with an estimated market size of 377.3 million by the base year 2025. Key growth catalysts include supportive government hygiene and sanitation initiatives, amplified by post-pandemic public health focus, and rising disposable incomes facilitating greater expenditure on personal care and hygiene products across the region. Major market contributors include the UAE, Saudi Arabia, and Egypt, owing to their substantial populations and developed healthcare infrastructure. Aluminum cans dominate material preference, valued for their lightweight, durable, and dispensing-friendly properties, followed by steel-tinplate. The cosmetic and personal care sector, encompassing deodorants and hairsprays, alongside household and pharmaceutical/veterinary applications, represents significant end-user segments. While stringent regulatory compliance for chemical compositions and environmental considerations surrounding propellants present challenges, the overall market outlook remains highly positive. The competitive arena features prominent international entities such as Crown Holdings Inc. and Ball Corporation, alongside agile regional players adapting to local consumer preferences. Future market growth will be further propelled by innovations in aerosol formulations, emphasizing efficiency and environmental sustainability.

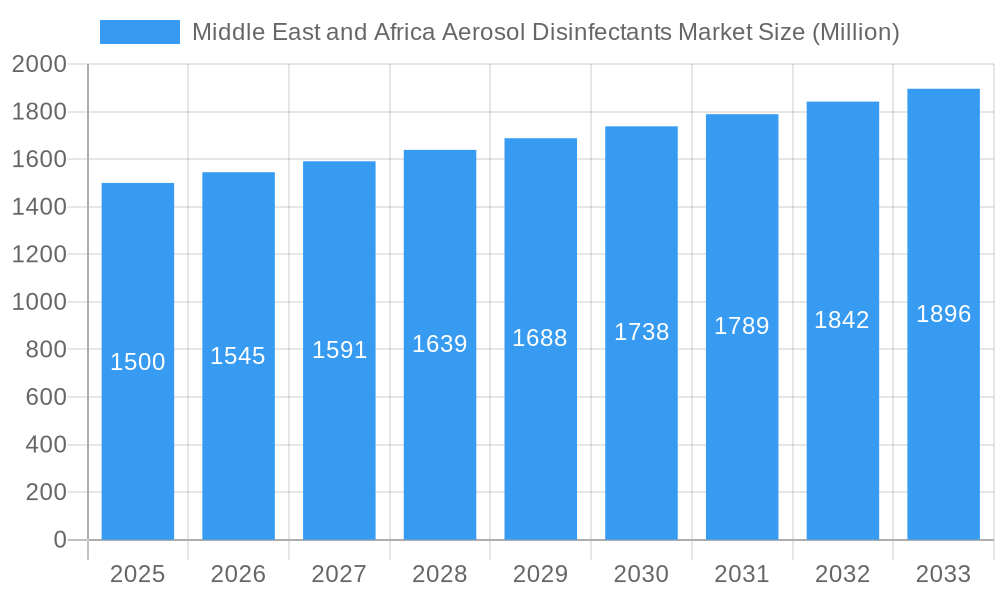

Middle East and Africa Aerosol Disinfectants Market Market Size (In Million)

The projected market size for 2025 stands at an estimated 377.3 million, reflecting a positive growth trajectory supported by the market's CAGR of 7.4%. This forecast is underpinned by a thorough analysis of historical data, current market dynamics, and strategic segmentation by country and industry. Continuous monitoring of regulatory landscapes, evolving consumer behaviors, and technological advancements is crucial for precise future market forecasting. Strategic decisions made by key industry stakeholders will significantly influence upcoming market trends and overall regional dynamics.

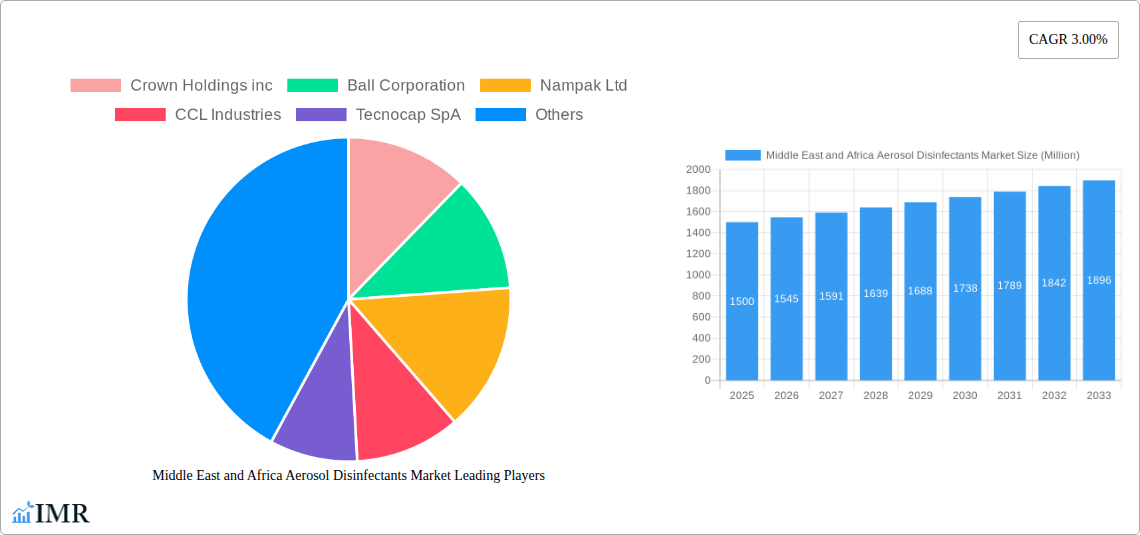

Middle East and Africa Aerosol Disinfectants Market Company Market Share

Middle East & Africa Aerosol Disinfectants Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Middle East and Africa Aerosol Disinfectants Market, offering invaluable insights for industry professionals, investors, and strategic decision-makers. Covering the period 2019-2033, with a focus on 2025, this report segments the market by country (UAE, Saudi Arabia, Egypt, South Africa, Qatar, Kuwait, Morocco, Rest of MEA), material (Aluminum, Steel-tinplate, Other Materials), and end-user industry (Cosmetic & Personal Care, Household, Pharmaceutical/Veterinary, Paints & Varnishes, Automotive/Industrial, Others). The report's analysis incorporates market sizing in million units, CAGR calculations, and detailed competitive landscapes, making it an indispensable resource for understanding this dynamic market.

Middle East and Africa Aerosol Disinfectants Market Dynamics & Structure

This section analyzes the market's competitive landscape, technological advancements, regulatory environment, and key market trends. The report delves into market concentration, identifying major players and their market share percentages. We examine the influence of technological innovations on product development and adoption rates, alongside regulatory frameworks impacting market growth. The analysis also covers the presence of competitive substitutes, end-user demographics, and the impact of mergers and acquisitions (M&A) activity within the industry. Quantitative data on M&A deal volumes (xx deals in the historical period) is included, along with qualitative assessments of innovation barriers (e.g., high R&D costs, stringent regulations).

- Market Concentration: The MEA aerosol disinfectants market exhibits a moderately concentrated structure with xx% market share held by the top 5 players.

- Technological Innovation: Key drivers include advancements in formulation (e.g., eco-friendly propellants) and packaging (e.g., lighter weight materials). Innovation barriers include high R&D costs and stringent regulatory approvals.

- Regulatory Framework: Stringent regulations regarding chemical composition and environmental impact are shaping market dynamics. Compliance costs represent a significant challenge for smaller players (xx% of total operational costs).

- Competitive Substitutes: The market faces competition from liquid disinfectants and other cleaning solutions, influencing market penetration rates.

- End-User Demographics: Growing urbanization and rising health consciousness in the region are driving demand. Population growth (xx% CAGR 2019-2024) is a significant factor impacting market expansion.

- M&A Trends: The market has witnessed xx M&A deals in the historical period (2019-2024), primarily driven by strategies for market expansion and technological access.

Middle East and Africa Aerosol Disinfectants Market Growth Trends & Insights

This section utilizes various data sources (XXX) to provide a comprehensive analysis of market size evolution, adoption rates, technological disruptions, and consumer behavior shifts. We examine historical data (2019-2024) and project future growth (2025-2033) using robust forecasting methodologies. The analysis includes a detailed examination of CAGR, market penetration rates across different segments, and regional variations in growth trajectories. Specifically, the report examines the adoption of eco-friendly aerosols and the influence of changing consumer preferences (e.g., preference for natural ingredients) on market dynamics. The impact of technological disruptions, such as the introduction of new propellant technologies, is also addressed in detail.

(This section would contain 600 words of detailed analysis based on the data source XXX. Market size values in million units would be included for each year in the study period.)

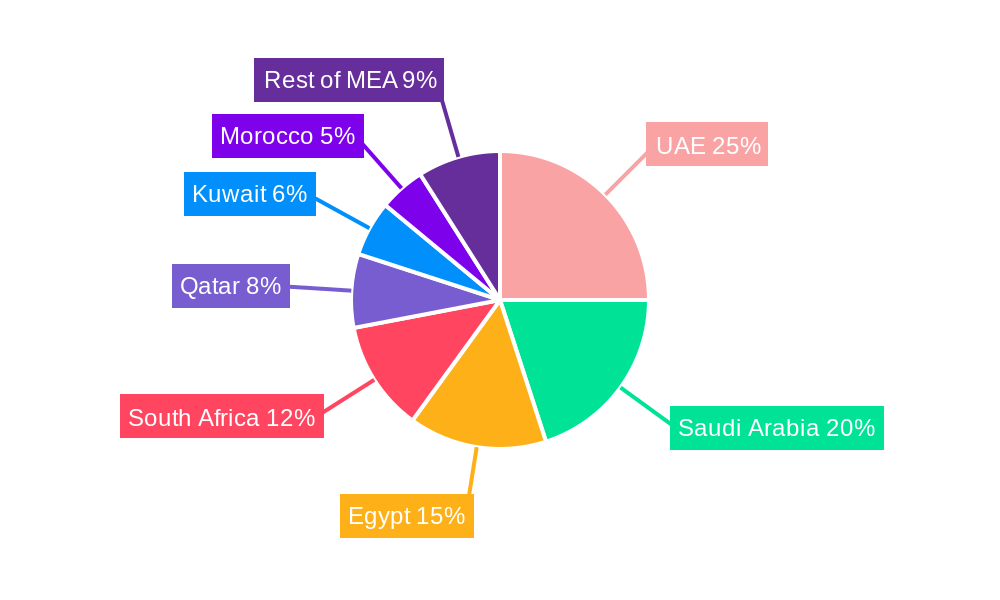

Dominant Regions, Countries, or Segments in Middle East and Africa Aerosol Disinfectants Market

This section pinpoints the leading regions, countries, and segments within the MEA aerosol disinfectants market. Detailed analysis is provided to explain the dominance of each region and segment. The analysis incorporates factors such as economic growth, infrastructure development, and consumer preferences. Market share data and growth potential projections for each segment are provided.

- Leading Countries: The UAE and Saudi Arabia are projected to dominate the market due to higher per capita income, well-developed infrastructure, and substantial demand across multiple end-user segments.

- Dominant Material: Aluminum is expected to maintain its leading position due to its lightweight nature, durability, and recyclability.

- Leading End-User Industry: Cosmetic and personal care, specifically deodorants and hairsprays, are projected to represent the largest end-user segment, driven by increasing disposable incomes and changing lifestyles. (This section would contain 600 words of detailed analysis, including quantitative data, such as market share percentages and growth forecasts for each segment and country.)

Middle East and Africa Aerosol Disinfectants Market Product Landscape

The MEA aerosol disinfectants market showcases a diverse range of products with varying formulations and applications. Innovations focus on enhanced efficacy, eco-friendly propellants, and improved packaging designs. Many products emphasize ease of use and unique selling propositions such as natural ingredients or targeted functionalities. Technological advancements include the development of more sustainable packaging options and propellant systems to reduce environmental impact.

Key Drivers, Barriers & Challenges in Middle East and Africa Aerosol Disinfectants Market

Key Drivers: The market is driven by factors like rising health awareness, increased disposable incomes, and growing urbanization in the region. Government initiatives promoting hygiene standards further stimulate market growth. The expanding cosmetic and personal care industry, along with the increasing demand for household and pharmaceutical disinfectants, also contribute significantly.

Key Barriers and Challenges: Supply chain disruptions, fluctuating raw material prices, and stringent regulatory approvals pose challenges to market expansion. Intense competition among established players and the entry of new participants can impact profit margins. Sustainability concerns and the increasing focus on eco-friendly solutions necessitate significant investments in R&D for innovative, environmentally conscious products.

Emerging Opportunities in Middle East and Africa Aerosol Disinfectants Market

Untapped markets exist in rural areas and less developed countries within the region. Opportunities lie in developing specialized disinfectants targeting niche applications (e.g., veterinary products, industrial cleaning). Furthermore, consumer preference for natural and organic formulations presents a significant avenue for innovation and market expansion.

Growth Accelerators in the Middle East and Africa Aerosol Disinfectants Market Industry

Long-term growth is fueled by technological advancements in propellant systems and packaging technologies. Strategic partnerships among manufacturers, distributors, and retailers can further enhance market penetration. Expansion into untapped markets and a focus on product diversification based on emerging consumer preferences will be key drivers of sustained growth.

Key Players Shaping the Middle East and Africa Aerosol Disinfectants Market Market

- Crown Holdings inc

- Ball Corporation

- Nampak Ltd

- CCL Industries

- Tecnocap SpA

- Saudi Can Co Ltd

- Saudi Arabian Packaging Industry WLL (SAPIN)

- Can-Pack SA

- Mauser Packaging Solutions

Notable Milestones in Middle East and Africa Aerosol Disinfectants Market Sector

- June 2021: Ball Corporation announces 2030 sustainability goals, including a vision for a fully circular aluminum aerosol packaging system in the MEA region. This initiative is expected to significantly impact market dynamics by driving the adoption of sustainable packaging solutions.

In-Depth Middle East and Africa Aerosol Disinfectants Market Market Outlook

The MEA aerosol disinfectants market is poised for significant growth over the forecast period (2025-2033), driven by the factors mentioned earlier. Companies focusing on sustainable practices, technological innovation, and strategic market expansion will be well-positioned to capitalize on this growth potential. The market offers significant opportunities for both established players and new entrants to achieve substantial market share through product diversification and targeted marketing strategies. The report provides a detailed market outlook, forecasting market size and key trends with high accuracy, offering a valuable resource for future decision-making.

Middle East and Africa Aerosol Disinfectants Market Segmentation

-

1. Material

- 1.1. Aluminum

- 1.2. Steel-tinplate

- 1.3. Other Materials

-

2. End-User Industry

- 2.1. Cosmetic

- 2.2. Household

- 2.3. Pharmaceutical/Veterinary

- 2.4. Paints and Varnishes

- 2.5. Automotive/Industrial

- 2.6. Other End-user Industries

Middle East and Africa Aerosol Disinfectants Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Aerosol Disinfectants Market Regional Market Share

Geographic Coverage of Middle East and Africa Aerosol Disinfectants Market

Middle East and Africa Aerosol Disinfectants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.4% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand from the Cosmetic Industry; Recyclability of aerosol cans

- 3.3. Market Restrains

- 3.3.1. Changing Consumer Preferences

- 3.4. Market Trends

- 3.4.1. Pharmaceutical Sector Accounts for the Largest Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Aerosol Disinfectants Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Aluminum

- 5.1.2. Steel-tinplate

- 5.1.3. Other Materials

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Cosmetic

- 5.2.2. Household

- 5.2.3. Pharmaceutical/Veterinary

- 5.2.4. Paints and Varnishes

- 5.2.5. Automotive/Industrial

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Crown Holdings inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Ball Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nampak Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 CCL Industries

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tecnocap SpA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Saudi Can Co Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saudi Arabian Packaging Industry WLL (SAPIN)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Can-Pack SA

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Mauser Packaging Solutions

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Crown Holdings inc

List of Figures

- Figure 1: Middle East and Africa Aerosol Disinfectants Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Aerosol Disinfectants Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Aerosol Disinfectants Market Revenue million Forecast, by Material 2020 & 2033

- Table 2: Middle East and Africa Aerosol Disinfectants Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: Middle East and Africa Aerosol Disinfectants Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Aerosol Disinfectants Market Revenue million Forecast, by Material 2020 & 2033

- Table 5: Middle East and Africa Aerosol Disinfectants Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: Middle East and Africa Aerosol Disinfectants Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Aerosol Disinfectants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Aerosol Disinfectants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Aerosol Disinfectants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Aerosol Disinfectants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Aerosol Disinfectants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Aerosol Disinfectants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Aerosol Disinfectants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Aerosol Disinfectants Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Aerosol Disinfectants Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Aerosol Disinfectants Market?

The projected CAGR is approximately 7.4%.

2. Which companies are prominent players in the Middle East and Africa Aerosol Disinfectants Market?

Key companies in the market include Crown Holdings inc, Ball Corporation, Nampak Ltd, CCL Industries, Tecnocap SpA, Saudi Can Co Ltd, Saudi Arabian Packaging Industry WLL (SAPIN)*List Not Exhaustive, Can-Pack SA, Mauser Packaging Solutions.

3. What are the main segments of the Middle East and Africa Aerosol Disinfectants Market?

The market segments include Material, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 377.3 million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand from the Cosmetic Industry; Recyclability of aerosol cans.

6. What are the notable trends driving market growth?

Pharmaceutical Sector Accounts for the Largest Market Share.

7. Are there any restraints impacting market growth?

Changing Consumer Preferences.

8. Can you provide examples of recent developments in the market?

June 2021 - Ball Corporation has announced 2030 sustainability goals focused on enhancing product stewardship and social impact to create value for stakeholders, together with a vision for how industry partners can collaborate to achieve a fully circular aluminum aerosol packaging system in the studied region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Aerosol Disinfectants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Aerosol Disinfectants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Aerosol Disinfectants Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Aerosol Disinfectants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence