Key Insights

The Middle East and Africa (MEA) paper packaging market is poised for substantial expansion, driven by increasing consumer expenditure, a thriving e-commerce landscape, and escalating demand across a multitude of end-use industries. With a projected compound annual growth rate (CAGR) of 5.1%, the market size is estimated to reach 30,539.4 million by 2025. The market is strategically segmented by product type (folding cartons, corrugated boxes, etc.), end-user industry (food & beverage, personal care, electrical goods, etc.), and geography, with key markets including Saudi Arabia, the UAE, Egypt, and South Africa demonstrating significant growth potential. The market's expansion is further propelled by the widespread adoption of sustainable packaging solutions and a growing consumer preference for convenient, ready-to-consume products, particularly within the food and beverage sector. The burgeoning population and expanding middle class across many MEA nations are contributing to heightened demand for packaged goods, thereby reinforcing market growth. Despite existing challenges such as fluctuating raw material costs and regional economic volatility, the long-term outlook for the MEA paper packaging market remains exceptionally positive, with continued growth anticipated through 2033. Prominent industry leaders, including Amcor, Metsa Group, Rengo, and Smurfit Kappa, are actively investing in cutting-edge packaging technologies and expanding their regional footprints to leverage emerging opportunities. Shifts in the dominance of specific product types and end-user industries are anticipated during the forecast period, influenced by evolving consumer preferences and technological advancements.

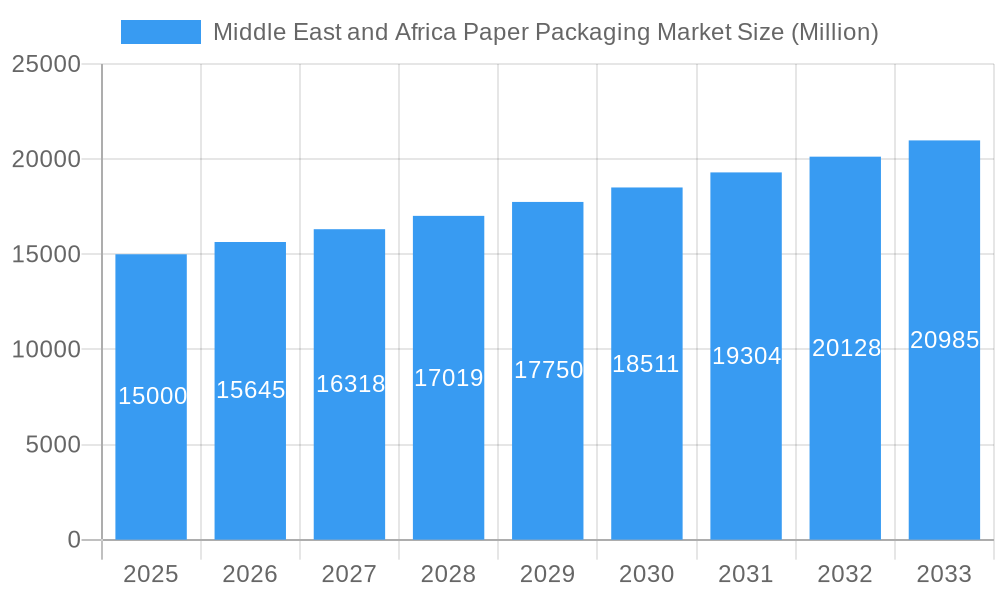

Middle East and Africa Paper Packaging Market Market Size (In Billion)

Governmental initiatives aimed at promoting sustainable practices are significantly contributing to the robust growth observed in the MEA region. Heightened environmental awareness is directly fueling demand for eco-friendly packaging alternatives, such as recycled and biodegradable materials. This strong emphasis on sustainability is creating lucrative avenues for companies offering innovative and environmentally responsible packaging solutions. Furthermore, advancements in printing and packaging technologies are enhancing the visual appeal and functional performance of paper packaging, aligning with brand owners' objectives to elevate product presentation and on-shelf visibility. This technological evolution, coupled with the region's growing population and increasing urbanization, is laying the groundwork for sustained market expansion in the upcoming years. However, variations in economic growth and infrastructural development across the region will influence the pace of expansion in different MEA countries.

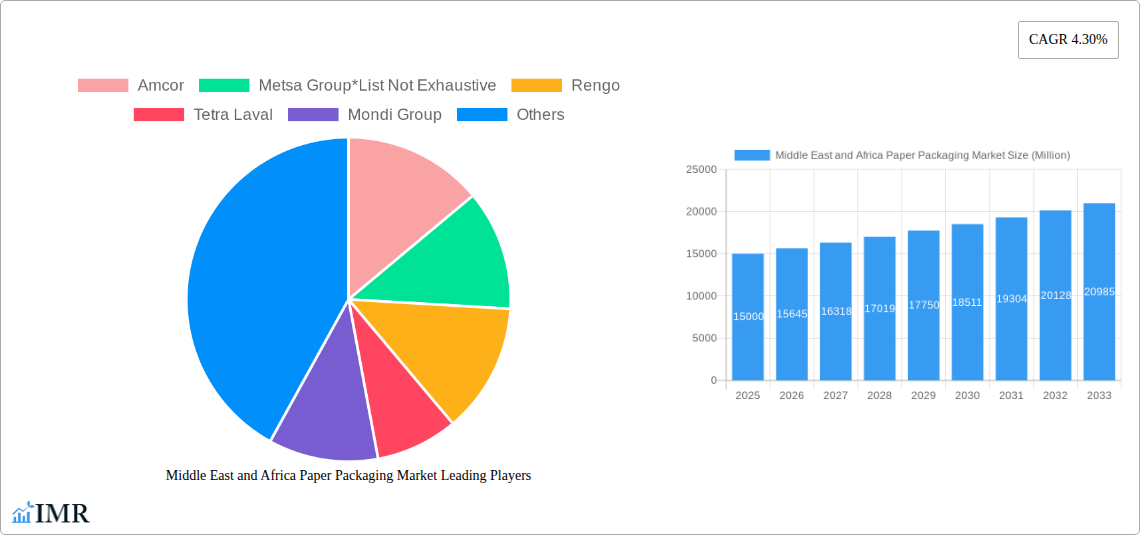

Middle East and Africa Paper Packaging Market Company Market Share

This comprehensive report offers an in-depth analysis of the Middle East and Africa paper packaging market, encompassing market dynamics, growth trajectories, key stakeholders, and future projections. The study period covers 2019 to 2033, with 2025 identified as the base year. This report is an essential resource for industry professionals, investors, and strategic decision-makers seeking to understand and capitalize on the opportunities within this dynamic market. The market is segmented by product type (Folding Cartons, Corrugated Boxes, Slotted Containers, Die Cut Containers, Five Panel Folder Boxes, Setup Boxes, Other Product Types), end-user industry (Food, Beverage, Personal Care and Home Care, Electrical Goods, Other End-user Industries), and key countries (Saudi Arabia, Israel, United Arab Emirates, Egypt, South Africa, Others).

Middle East and Africa Paper Packaging Market Market Dynamics & Structure

The Middle East and Africa paper packaging market is characterized by a moderately consolidated structure, with a few major players holding significant market share. Technological innovation, particularly in sustainable packaging solutions, is a key driver. Stringent regulatory frameworks concerning environmental sustainability are shaping industry practices. The market also faces competition from alternative packaging materials like plastics and other sustainable alternatives. End-user demographics, particularly growth in the food and beverage sectors and rising disposable incomes in certain regions, influence demand. M&A activity has been moderate, with xx deals recorded in the past five years, driven by consolidation and expansion strategies.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on sustainable and recyclable materials, automation, and improved printing techniques.

- Regulatory Framework: Increasing emphasis on environmental regulations and waste management impacting material choices and production processes.

- Competitive Substitutes: Growing competition from plastic and other sustainable packaging materials.

- End-User Demographics: Rising population and disposable incomes driving demand, particularly in food and beverage.

- M&A Trends: Moderate activity driven by consolidation and expansion, with an estimated xx deals recorded between 2019-2024.

Middle East and Africa Paper Packaging Market Growth Trends & Insights

The Middle East and Africa paper packaging market is projected to experience significant growth over the forecast period (2025-2033). Driven by factors such as increasing urbanization, rising consumer spending, and growth in the food and beverage and e-commerce sectors, the market size is anticipated to reach xx million units by 2033, exhibiting a CAGR of xx% from 2025 to 2033. The adoption of sustainable packaging is also gaining traction, with brands increasingly focusing on eco-friendly options to cater to environmentally conscious consumers. Technological disruptions like automation and smart packaging are further enhancing efficiency and consumer experience. Consumer behaviour is shifting towards convenience and sustainability, influencing packaging design and material selection. The historical period (2019-2024) witnessed a CAGR of xx%, laying a strong foundation for future expansion.

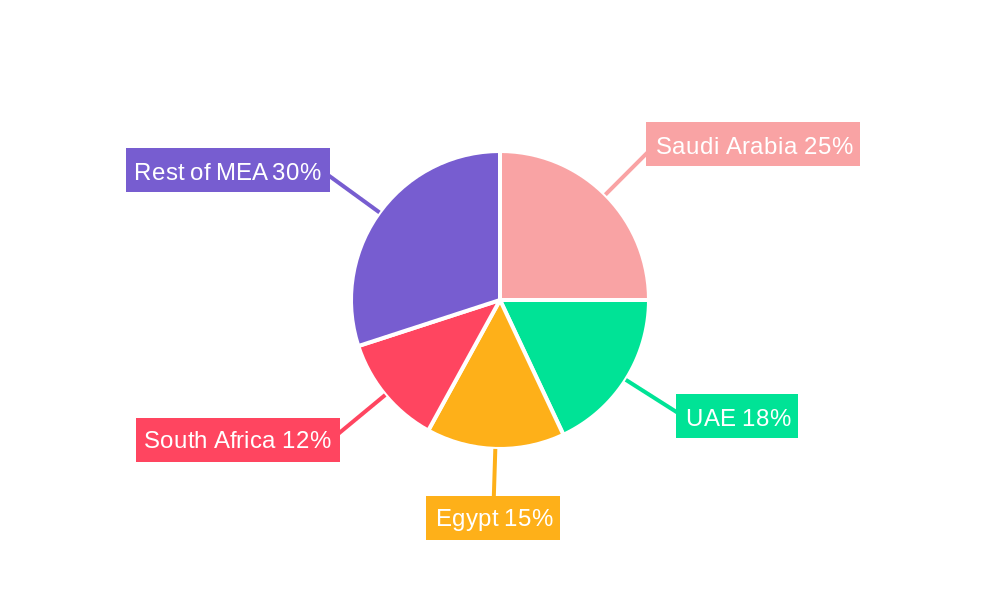

Dominant Regions, Countries, or Segments in Middle East and Africa Paper Packaging Market

Saudi Arabia, the UAE, and South Africa are the leading countries in the MEA paper packaging market, accounting for approximately xx% of the total market share in 2025. The corrugated boxes segment dominates the product landscape, driven by its versatility and cost-effectiveness for a variety of applications. The food and beverage industry is the largest end-user segment, owing to the significant demand for packaging solutions across the food supply chain. Growth is propelled by:

- Saudi Arabia: Robust economic growth, expansion of the food and beverage sector, and government initiatives promoting industrial development.

- UAE: Growing e-commerce sector, burgeoning tourism industry, and increasing demand for premium packaging solutions.

- South Africa: Expanding consumer base, diversified industrial sector, and relatively developed packaging infrastructure.

- Corrugated Boxes: Versatility, cost-effectiveness, and suitability for various products driving segment dominance.

- Food & Beverage: Largest end-user segment, fueled by the high demand for packaged food and beverages.

Middle East and Africa Paper Packaging Market Product Landscape

The paper packaging market offers a diverse range of products, including folding cartons, corrugated boxes, and specialized packaging solutions. Innovations focus on enhanced barrier properties, improved printability, and sustainable materials. Companies are adopting lightweighting techniques to reduce material usage and transportation costs, while incorporating features for enhanced product protection and consumer appeal. Unique selling propositions include customization, eco-friendly designs, and advanced functionalities such as tamper evidence and smart packaging features.

Key Drivers, Barriers & Challenges in Middle East and Africa Paper Packaging Market

Key Drivers: Increased urbanization and consumer spending, growth in the food and beverage sector, government investments in infrastructure, and the rise of e-commerce are boosting market demand. Technological advancements in packaging materials and printing technologies are improving product quality and efficiency. Stringent environmental regulations are also driving the adoption of eco-friendly paper packaging.

Challenges: Fluctuations in raw material prices, intense competition from alternative packaging materials, and supply chain disruptions pose significant challenges. Regulatory compliance and sustainability concerns require companies to adapt their practices and invest in sustainable solutions. The market faces challenges from plastic packaging, and its dominance in certain applications.

Emerging Opportunities in Middle East and Africa Paper Packaging Market

The growing demand for sustainable packaging, especially in the food and beverage sector, presents significant opportunities. E-commerce expansion is driving the need for innovative packaging solutions to ensure product protection during transit. Untapped markets in rural areas and the increasing demand for customized packaging options create opportunities for growth.

Growth Accelerators in the Middle East and Africa Paper Packaging Market Industry

Technological advancements, particularly in sustainable packaging materials and printing techniques, are key growth catalysts. Strategic partnerships between packaging companies and brand owners are promoting innovation and market expansion. Government initiatives supporting sustainable packaging practices are also driving market growth.

Key Players Shaping the Middle East and Africa Paper Packaging Market Market

Notable Milestones in Middle East and Africa Paper Packaging Market Sector

- 2022 Q3: Smurfit Kappa announces expansion of its manufacturing facility in Egypt.

- 2021 Q4: Amcor launches a new range of sustainable paper-based packaging solutions.

- 2020 Q1: Increased focus on sustainable packaging solutions by many companies due to heightened consumer demand. (Further milestones would be added here based on available data)

In-Depth Middle East and Africa Paper Packaging Market Market Outlook

The Middle East and Africa paper packaging market is poised for continued growth, driven by technological innovation, increasing consumer demand, and supportive government policies. The focus on sustainable solutions and the expanding e-commerce sector present significant opportunities for companies to invest in and develop innovative products and services. Strategic partnerships, market diversification, and technological advancements will be crucial factors in shaping the future of the market.

Middle East and Africa Paper Packaging Market Segmentation

-

1. Product

- 1.1. Folding Cartons

- 1.2. Corrugated Boxes

- 1.3. Slotted Containers

- 1.4. Die Cut Container

- 1.5. Five Panel Folder Boxes

- 1.6. Setup Boxes

- 1.7. Other Product Types

-

2. End-User Industry

- 2.1. Food

- 2.2. Beverage

- 2.3. Personal Care and Home Care

- 2.4. Electrical Goods

- 2.5. Other End-user Industries

Middle East and Africa Paper Packaging Market Segmentation By Geography

-

1. Middle East

- 1.1. Saudi Arabia

- 1.2. United Arab Emirates

- 1.3. Israel

- 1.4. Qatar

- 1.5. Kuwait

- 1.6. Oman

- 1.7. Bahrain

- 1.8. Jordan

- 1.9. Lebanon

Middle East and Africa Paper Packaging Market Regional Market Share

Geographic Coverage of Middle East and Africa Paper Packaging Market

Middle East and Africa Paper Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Strong Demand from the Food and Beverage Sector

- 3.3. Market Restrains

- 3.3.1. ; Fluctuating Raw Material Prices

- 3.4. Market Trends

- 3.4.1. Food and Beverage Industry is one of the Significant Factor for Growth of Paper Packaging

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Middle East and Africa Paper Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Folding Cartons

- 5.1.2. Corrugated Boxes

- 5.1.3. Slotted Containers

- 5.1.4. Die Cut Container

- 5.1.5. Five Panel Folder Boxes

- 5.1.6. Setup Boxes

- 5.1.7. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Personal Care and Home Care

- 5.2.4. Electrical Goods

- 5.2.5. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Metsa Group*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Rengo

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Tetra Laval

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mondi Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 International Paper Company

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Sappi Limited

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Oji Paper

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Graphic Packaging International Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Smurfit Kappa

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 DS Smith

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Amcor

List of Figures

- Figure 1: Middle East and Africa Paper Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Middle East and Africa Paper Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 2: Middle East and Africa Paper Packaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 3: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Product 2020 & 2033

- Table 5: Middle East and Africa Paper Packaging Market Revenue million Forecast, by End-User Industry 2020 & 2033

- Table 6: Middle East and Africa Paper Packaging Market Revenue million Forecast, by Country 2020 & 2033

- Table 7: Saudi Arabia Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: United Arab Emirates Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Israel Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Qatar Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Kuwait Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Oman Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 13: Bahrain Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Jordan Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Lebanon Middle East and Africa Paper Packaging Market Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Middle East and Africa Paper Packaging Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Middle East and Africa Paper Packaging Market?

Key companies in the market include Amcor, Metsa Group*List Not Exhaustive, Rengo, Tetra Laval, Mondi Group, International Paper Company, Sappi Limited, Oji Paper, Graphic Packaging International Corporation, Smurfit Kappa, DS Smith.

3. What are the main segments of the Middle East and Africa Paper Packaging Market?

The market segments include Product, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 30539.4 million as of 2022.

5. What are some drivers contributing to market growth?

; Strong Demand from the Food and Beverage Sector.

6. What are the notable trends driving market growth?

Food and Beverage Industry is one of the Significant Factor for Growth of Paper Packaging.

7. Are there any restraints impacting market growth?

; Fluctuating Raw Material Prices.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Middle East and Africa Paper Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Middle East and Africa Paper Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Middle East and Africa Paper Packaging Market?

To stay informed about further developments, trends, and reports in the Middle East and Africa Paper Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence