Key Insights

The Myanmar packaging market, valued at $725 million in 2023, is projected to expand at a Compound Annual Growth Rate (CAGR) of 8% from 2023 to 2033. This growth is propelled by a rising middle class and increasing consumer spending, driving demand in the food and beverage sector. The expanding pharmaceutical and healthcare industries also necessitate advanced packaging solutions. Furthermore, the surge in e-commerce fuels the need for robust and convenient transit packaging. The market is segmented by material (plastic, paper & paperboard, metal, glass), product type (bottles, pouches, cans), and end-user industry. While plastic packaging leads due to its cost-effectiveness, environmental consciousness is fostering a shift towards sustainable alternatives. Potential challenges include fluctuating raw material prices and infrastructure limitations, yet the market outlook remains strong. Leading players such as Double Packaging Myanmar Co Limited, Jackway Convertor Industries Pte Ltd, and Ball Corporation are instrumental in market development through innovation and expansion.

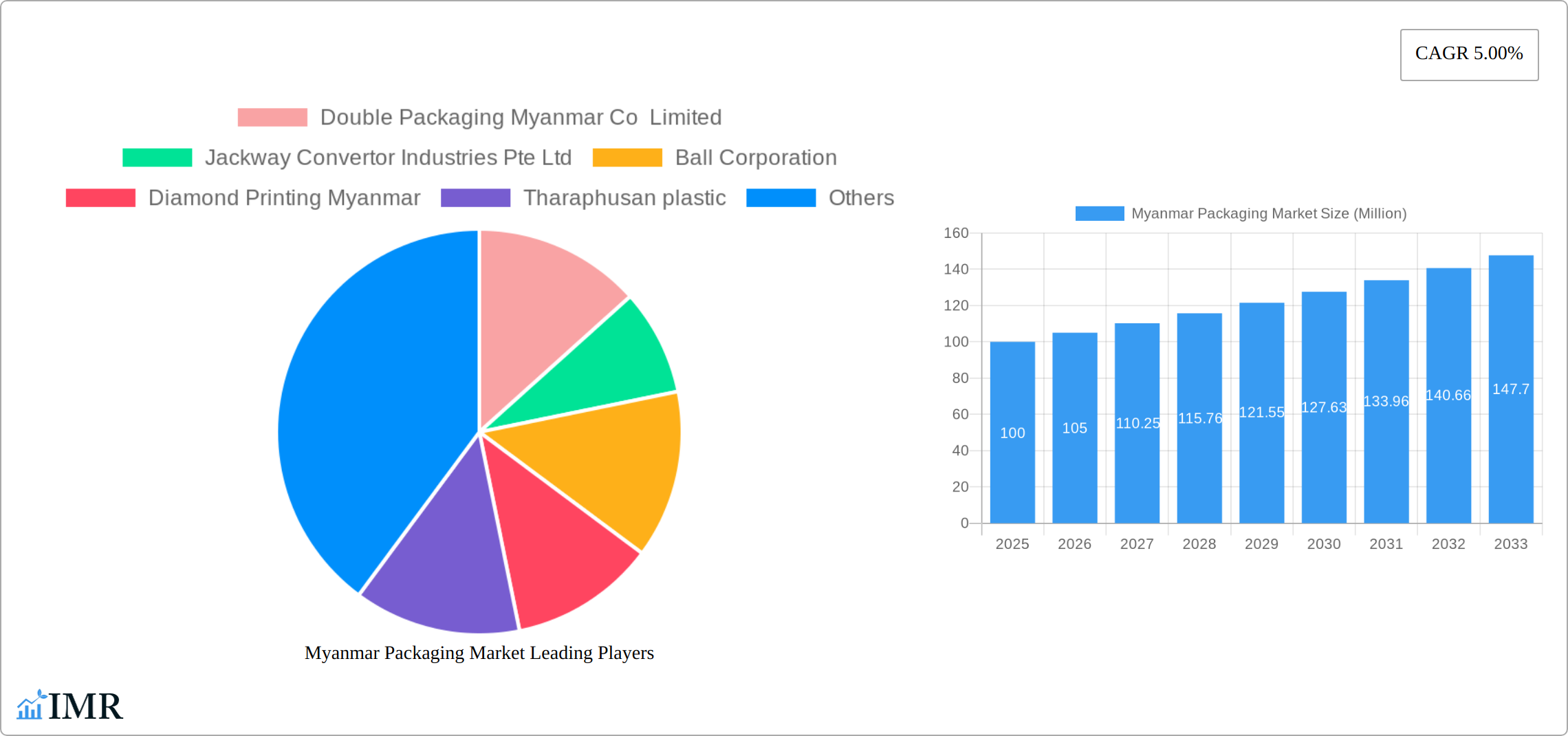

Myanmar Packaging Market Market Size (In Million)

The forecast period (2023-2033) indicates continued expansion, supported by investments in manufacturing and capacity enhancement by both established and new market participants. Government initiatives promoting infrastructure development and foreign direct investment are anticipated to significantly boost market growth. The competitive environment features domestic and international firms prioritizing product differentiation, sustainability, and cost-effectiveness. This interplay of growth drivers, emerging trends, and market challenges points to a positive long-term trajectory for the Myanmar packaging market, presenting substantial opportunities for innovation and development across all segments. Evolving consumer preferences for eco-friendly packaging will continue to shape market dynamics.

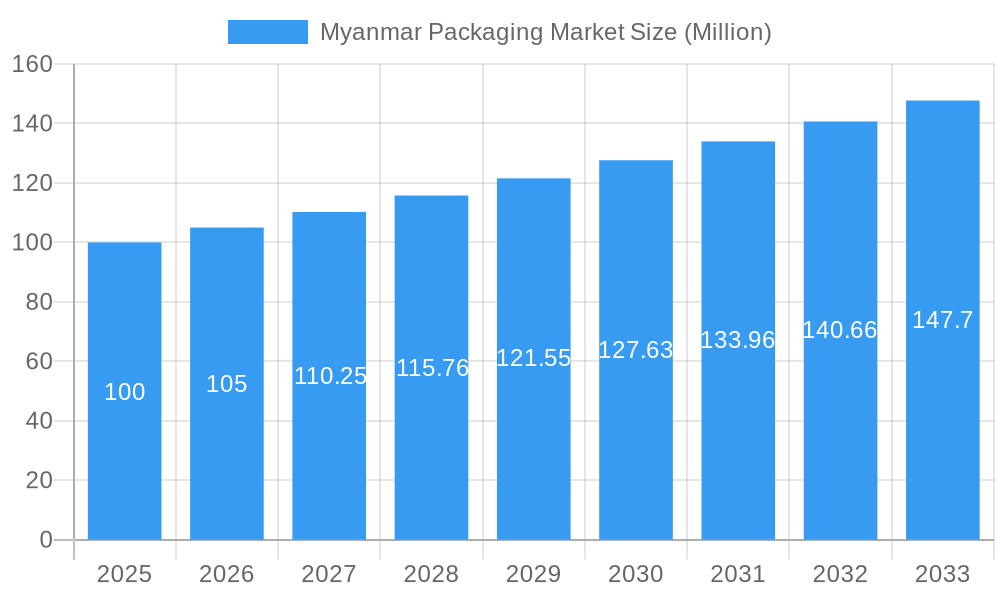

Myanmar Packaging Market Company Market Share

Myanmar Packaging Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Myanmar packaging market, encompassing market dynamics, growth trends, key players, and future outlook. It segments the market by material (plastic, paper & paperboard, metal, glass), product type (plastic bottles & containers, pouches & bags, metal cans, glass bottles & containers, other product types), and end-user industry (beverage, food, pharmaceutical and healthcare, cosmetics and toiletries, household chemicals, other end-user industries). The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The market size is presented in million units.

Myanmar Packaging Market Dynamics & Structure

The Myanmar packaging market exhibits a moderately fragmented structure, with several large players and numerous smaller companies competing across diverse segments. Market concentration is relatively low, with no single entity holding a dominant market share exceeding xx%. Technological innovation, particularly in sustainable packaging solutions, is a key driver, while regulatory changes related to environmental protection and food safety are significant shaping factors. The market faces competition from substitute materials like biodegradable plastics and compostable packaging, creating both challenges and opportunities. End-user demographics, particularly the rising middle class, influence packaging preferences towards convenience and premium features. M&A activity within the sector has been moderate during the historical period (2019-2024), with an estimated xx M&A deals recorded, primarily focused on consolidating smaller players and expanding market reach.

- Market Concentration: Low, with no single dominant player.

- Technological Innovation: Driven by sustainability and convenience demands.

- Regulatory Framework: Increasing emphasis on environmental regulations and food safety standards.

- Competitive Substitutes: Growing adoption of biodegradable and compostable packaging alternatives.

- M&A Trends: Moderate activity, with a focus on consolidation and expansion.

- Innovation Barriers: Limited access to advanced technologies and skilled workforce.

Myanmar Packaging Market Growth Trends & Insights

The Myanmar packaging market has witnessed substantial growth during the historical period (2019-2024), driven by increasing consumer spending, economic expansion, and rising demand across various end-user industries. The market size reached xx million units in 2024, exhibiting a CAGR of xx% during this period. The forecast period (2025-2033) projects continued growth, with a projected CAGR of xx%, driven by factors such as increasing urbanization, rising disposable incomes, and expanding e-commerce. Technological disruptions, like the adoption of smart packaging and personalized solutions, are expected to further boost market growth. Consumer behavior shifts towards convenience, sustainability, and premiumization will significantly impact packaging choices. Market penetration of sustainable packaging solutions is expected to increase from xx% in 2024 to xx% by 2033.

Dominant Regions, Countries, or Segments in Myanmar Packaging Market

The Yangon region stands as the undisputed leader in Myanmar's packaging market, capturing a significant share of the total market value in 2024, driven by its robust industrial concentration, extensive population base, and well-established infrastructure. Within the materials landscape, plastic packaging continues to hold the largest market share, owing to its cost-effectiveness and versatility. Following closely are paper and paperboard packaging. The food and beverage industry remains the primary engine of demand, with a particular emphasis on flexible packaging solutions such as pouches and bags, alongside rigid formats like bottles and cans. The sustained growth in sectors such as pharmaceuticals and cosmetics further contributes to the overall expansion of the packaging market.

- Key Dominant Factors (Yangon Region): High concentration of manufacturing and commercial enterprises, substantial urban population, and superior logistical and industrial infrastructure.

- Key Dominant Factors (Plastic Packaging): Economical production costs, exceptional adaptability across a wide array of product types, and enhanced durability.

- Key Dominant Factors (Food & Beverage): High consumer spending on food items, escalating demand for convenient and processed food products, and a growing appetite for diverse food options.

Myanmar Packaging Market Product Landscape

The Myanmar packaging market is characterized by a rich and evolving product assortment designed to meet the diverse requirements of an array of end-user industries. Significant advancements are being witnessed, particularly in the realm of flexible packaging, with the integration of advanced multilayer films and sophisticated barrier coatings engineered to significantly extend product shelf life and enhance preservation efficacy. In the beverage sector, metal cans continue to maintain their stronghold, prized for their inherent robustness and their suitability for high-temperature sterilization processes. Current innovation efforts are predominantly focused on lightweighting packaging to minimize environmental impact and on improving the recyclability of all packaging materials. Differentiating factors and unique selling propositions within the market include the integration of tamper-evident seals for enhanced product security, the availability of bespoke and customized design options, and the growing adoption of sustainably sourced and eco-friendly materials.

Key Drivers, Barriers & Challenges in Myanmar Packaging Market

Key Drivers: Rising disposable incomes, expanding FMCG sector, increasing urbanization, government initiatives promoting manufacturing.

Key Challenges: Limited access to advanced technologies, reliance on imports of raw materials, infrastructural constraints, fluctuating raw material prices, competition from cheaper imports. This results in an estimated xx% increase in production costs annually.

Emerging Opportunities in Myanmar Packaging Market

The burgeoning e-commerce sector presents a compelling landscape of emerging opportunities, necessitating the development of innovative packaging solutions that prioritize both product protection during transit and user convenience. The escalating global and local emphasis on sustainability is creating a substantial opening for companies offering biodegradable and compostable packaging alternatives. Furthermore, the increasing consumer preference for premium and personalized packaging experiences is paving the way for the introduction of higher-value products and the potential for enhanced profit margins across various packaging segments.

Growth Accelerators in the Myanmar Packaging Market Industry

Sustained long-term growth is anticipated to be propelled by ongoing technological advancements, particularly in the field of sustainable packaging solutions. Strategic collaborations and partnerships forged between packaging manufacturers and key end-user industries will play a crucial role in driving innovation and market penetration. Moreover, the expansion of packaging services into currently underserved regions within Myanmar is expected to unlock new growth avenues. Supportive government initiatives aimed at fostering domestic manufacturing capabilities and investing in critical infrastructure development are poised to further accelerate the overall trajectory of the packaging market.

Key Players Shaping the Myanmar Packaging Market Market

- Double Packaging Myanmar Co Limited

- Jackway Convertor Industries Pte Ltd

- Ball Corporation

- Diamond Printing Myanmar

- Tharaphusan plastic

- Can-One Berhad

- Daibochi Myanmar

- May Kha San Family Co Ltd

- Oji Myanmar Packaging Co Ltd

(List Not Exhaustive)

Notable Milestones in Myanmar Packaging Market Sector

- 2021: The implementation of new environmental regulations significantly influenced the types of packaging materials permitted and encouraged a shift towards more sustainable options.

- 2022: A substantial investment was made by a prominent international packaging corporation to establish a state-of-the-art manufacturing facility, indicating growing foreign confidence and capacity expansion.

- 2023: Several domestic packaging companies successfully launched innovative and environmentally conscious sustainable packaging solutions, reflecting a growing commitment to eco-friendly practices within the local industry.

In-Depth Myanmar Packaging Market Market Outlook

The Myanmar packaging market is poised for continued robust growth in the coming years, driven by favorable macroeconomic conditions and evolving consumer preferences. Strategic investments in advanced technologies, sustainable solutions, and expansion into new market segments will be crucial for companies to capitalize on future opportunities. The market is projected to reach xx million units by 2033, offering substantial potential for both domestic and international players.

Myanmar Packaging Market Segmentation

-

1. Material

- 1.1. Plastic

- 1.2. Paper & Paperboard

- 1.3. Metal

- 1.4. Glass

-

2. Product Type

- 2.1. Plastic Bottles & Containers

- 2.2. Pouches & Bags

- 2.3. Metal Cans

- 2.4. Glass Bottles & Containers

- 2.5. Other Product Types

-

3. End-user Industry

- 3.1. Beverage

- 3.2. Food

- 3.3. Pharmaceutical and Healthcare

- 3.4. Cosmetics and Toiletries

- 3.5. Household Chemicals

- 3.6. Other End-user Industries

Myanmar Packaging Market Segmentation By Geography

- 1. Myanmar

Myanmar Packaging Market Regional Market Share

Geographic Coverage of Myanmar Packaging Market

Myanmar Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Growth in Demand of End user Industries; Low Import and Export Duty

- 3.3. Market Restrains

- 3.3.1. Stringent Government Rules and Regulations

- 3.4. Market Trends

- 3.4.1. Growing Demand in Food and Beverage Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Myanmar Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Plastic

- 5.1.2. Paper & Paperboard

- 5.1.3. Metal

- 5.1.4. Glass

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Plastic Bottles & Containers

- 5.2.2. Pouches & Bags

- 5.2.3. Metal Cans

- 5.2.4. Glass Bottles & Containers

- 5.2.5. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Beverage

- 5.3.2. Food

- 5.3.3. Pharmaceutical and Healthcare

- 5.3.4. Cosmetics and Toiletries

- 5.3.5. Household Chemicals

- 5.3.6. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Myanmar

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Double Packaging Myanmar Co Limited

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Jackway Convertor Industries Pte Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Ball Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Diamond Printing Myanmar

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Tharaphusan plastic

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Can-One Berhad**List Not Exhaustive

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Daibochi Myanmar

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 May Kha San Family Co Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Oji Myanmar Packaging Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Double Packaging Myanmar Co Limited

List of Figures

- Figure 1: Myanmar Packaging Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Myanmar Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: Myanmar Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 2: Myanmar Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 3: Myanmar Packaging Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 4: Myanmar Packaging Market Revenue million Forecast, by Region 2020 & 2033

- Table 5: Myanmar Packaging Market Revenue million Forecast, by Material 2020 & 2033

- Table 6: Myanmar Packaging Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 7: Myanmar Packaging Market Revenue million Forecast, by End-user Industry 2020 & 2033

- Table 8: Myanmar Packaging Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Myanmar Packaging Market?

The projected CAGR is approximately 8%.

2. Which companies are prominent players in the Myanmar Packaging Market?

Key companies in the market include Double Packaging Myanmar Co Limited, Jackway Convertor Industries Pte Ltd, Ball Corporation, Diamond Printing Myanmar, Tharaphusan plastic, Can-One Berhad**List Not Exhaustive, Daibochi Myanmar, May Kha San Family Co Ltd, Oji Myanmar Packaging Co Ltd.

3. What are the main segments of the Myanmar Packaging Market?

The market segments include Material, Product Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 725 million as of 2022.

5. What are some drivers contributing to market growth?

; Growth in Demand of End user Industries; Low Import and Export Duty.

6. What are the notable trends driving market growth?

Growing Demand in Food and Beverage Industry.

7. Are there any restraints impacting market growth?

Stringent Government Rules and Regulations.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Myanmar Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Myanmar Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Myanmar Packaging Market?

To stay informed about further developments, trends, and reports in the Myanmar Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence