Key Insights

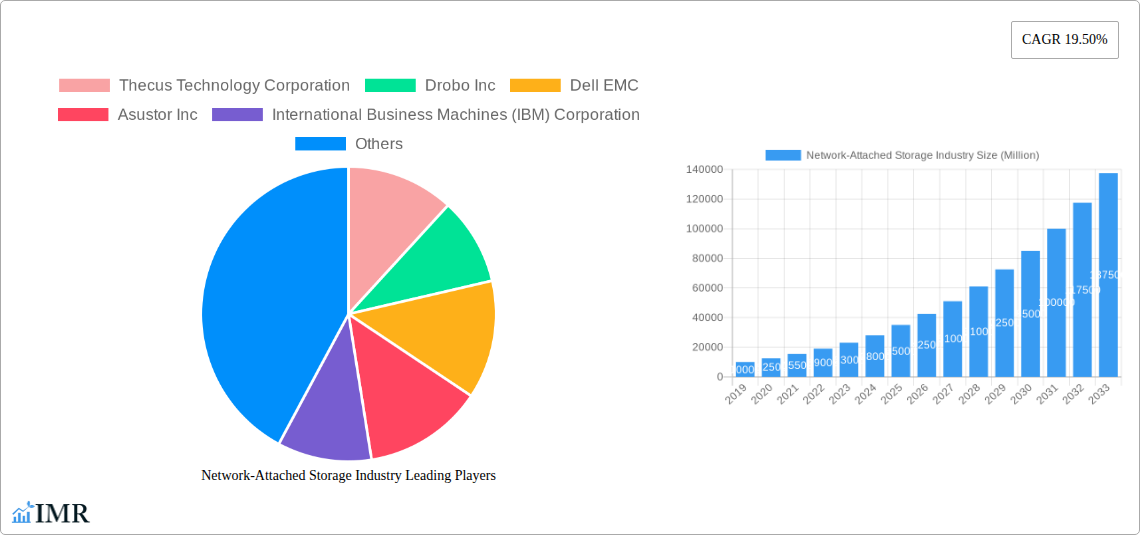

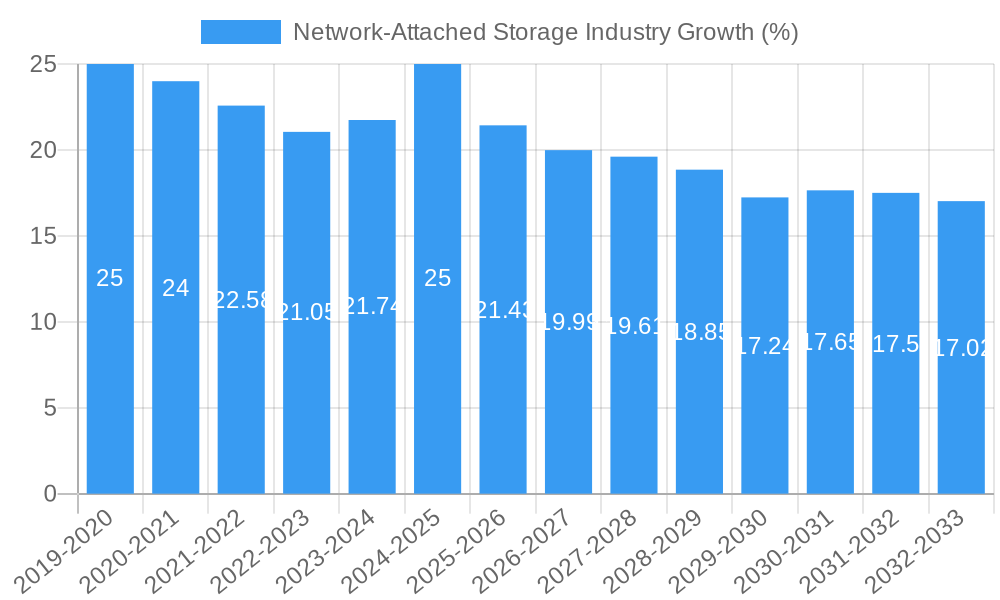

The global Network-Attached Storage (NAS) market is experiencing robust expansion, projected to reach a substantial market size of approximately $35,000 million by 2025, fueled by a remarkable Compound Annual Growth Rate (CAGR) of 19.50%. This significant growth trajectory is primarily driven by the escalating demand for scalable and cost-effective data storage solutions across a diverse range of industries. The proliferation of digital data, coupled with the increasing adoption of cloud computing and the Internet of Things (IoT), necessitates advanced storage capabilities that NAS solutions are uniquely positioned to provide. Key market drivers include the burgeoning need for centralized data management, enhanced data security, and simplified data accessibility for remote workforces and distributed operations. Furthermore, the continuous evolution of NAS technology, incorporating faster processors, increased storage capacities, and advanced features like virtualization and data deduplication, is further propelling market adoption.

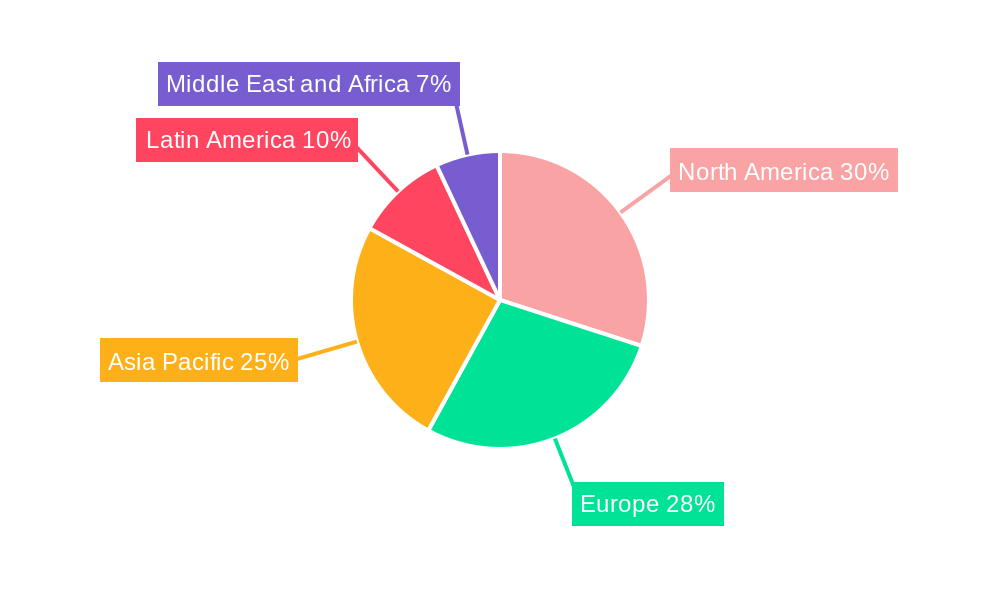

The NAS market is segmented into two primary types: Scale-up and Scale-out, catering to different organizational needs for storage expansion. End-user industries are demonstrating substantial adoption, with the BFSI, IT and Telecom, and Healthcare sectors leading the charge due to their stringent data management and security requirements. The Retail and Media & Entertainment industries are also significant contributors, driven by the growth of e-commerce and digital content creation. Geographically, North America and Europe are expected to maintain a strong market presence due to advanced technological infrastructure and high enterprise spending. However, the Asia Pacific region is poised for the most rapid growth, driven by increasing digital transformation initiatives, a burgeoning SMB sector, and government investments in digital infrastructure. While the market benefits from strong growth drivers, potential restraints include the initial cost of high-end NAS solutions and the growing competition from cloud storage providers, necessitating continuous innovation and competitive pricing strategies from NAS vendors.

Network-Attached Storage (NAS) Industry Report: Unlocking Data Growth & Scalability (2019-2033)

This comprehensive report provides an in-depth analysis of the global Network-Attached Storage (NAS) market, forecasting its trajectory from 2019 to 2033. With a base year of 2025, the study meticulously examines market dynamics, growth trends, regional dominance, product landscapes, and key players shaping the industry. Dive into crucial insights on scale-up vs. scale-out architectures, and understand the impact of NAS solutions across BFSI, IT and Telecom, Healthcare, Retail, Media and Entertainment, and other critical end-user industries. Explore technological innovations, competitive landscapes, and emerging opportunities that will redefine data storage and management. All market values are presented in Million Units.

Network-Attached Storage Industry Market Dynamics & Structure

The Network-Attached Storage (NAS) market is characterized by a dynamic blend of established players and emerging innovators, contributing to a moderately concentrated industry. Technological innovation remains a paramount driver, with vendors continuously enhancing performance, scalability, and data management capabilities through advanced hardware and software solutions. Regulatory frameworks, while not overly restrictive, focus on data privacy and security, influencing product development and deployment strategies. Competitive product substitutes, such as direct-attached storage (DAS) and Storage Area Networks (SAN), offer alternative solutions, but NAS differentiates itself through ease of use, centralized access, and cost-effectiveness for a wide range of applications. End-user demographics are increasingly diverse, spanning large enterprises, small and medium-sized businesses (SMBs), and even prosumers, each with unique storage requirements. Mergers and acquisitions (M&A) trends, while moderate, indicate strategic consolidation aimed at expanding product portfolios and market reach.

- Market Concentration: A mix of large, established vendors and specialized niche players defines the market.

- Technological Innovation Drivers: Focus on cloud integration, hyper-converged infrastructure, AI-driven data management, and enhanced cybersecurity features.

- Regulatory Frameworks: Emphasis on data sovereignty, GDPR compliance, and industry-specific data protection mandates.

- Competitive Product Substitutes: DAS for direct connectivity, SAN for high-performance block storage, and cloud storage solutions for off-site data access.

- End-User Demographics: Growing adoption in SMBs for cost-effective data consolidation and in enterprises for departmental file sharing and collaboration.

- M&A Trends: Strategic acquisitions to broaden cloud integration capabilities and expand into adjacent storage markets.

Network-Attached Storage Industry Growth Trends & Insights

The Network-Attached Storage (NAS) market is poised for significant expansion, driven by the exponential growth of data across all sectors and the increasing demand for centralized, accessible, and scalable storage solutions. The study period from 2019 to 2033, with a base year of 2025, will witness a robust compound annual growth rate (CAGR) of xx%, indicating a substantial market size evolution. This growth is fueled by a rising adoption rate of NAS devices, particularly among Small and Medium-sized Businesses (SMBs) seeking cost-effective data management and disaster recovery capabilities. Technological disruptions are continuously reshaping the landscape, with the integration of flash storage, higher network speeds, and advanced software features like data deduplication, compression, and automated tiering significantly boosting performance and efficiency.

Consumer behavior shifts also play a pivotal role. The proliferation of remote work and the increasing reliance on digital collaboration platforms have amplified the need for seamless file sharing and centralized data repositories, making NAS an indispensable tool for organizations of all sizes. Furthermore, the burgeoning demand for multimedia content creation and storage, alongside the rapid advancements in the Internet of Things (IoT), which generates massive volumes of data, are strong contributors to market penetration. The evolution from traditional on-premises deployments to hybrid cloud strategies, where NAS acts as a crucial on-premises gateway to cloud services, is another significant trend enhancing market accessibility and adoption. The increasing emphasis on data security and compliance further drives the adoption of NAS solutions with robust encryption and access control features. The market is also seeing a rise in specialized NAS solutions tailored for specific industries, such as video surveillance in retail or high-performance computing in media and entertainment. The overall trend points towards a market where NAS is not just a storage device, but an integral part of an organization's data infrastructure, supporting business continuity, operational efficiency, and digital transformation initiatives.

Dominant Regions, Countries, or Segments in Network-Attached Storage Industry

The Network-Attached Storage (NAS) market's dominance is currently observed across several key regions and segments, driven by a confluence of economic, technological, and infrastructural factors. North America, particularly the United States, consistently leads in market share due to its robust IT infrastructure, high adoption rates of advanced technologies, and the presence of major technology corporations. The strong presence of BFSI and IT and Telecom sectors, which generate vast amounts of data and require secure, scalable storage, further bolsters this dominance. Economic policies fostering innovation and digital transformation, coupled with significant investments in research and development, are key drivers.

The IT and Telecom end-user industry segment stands out as a primary growth engine. This sector's continuous need for high-performance, scalable, and reliable storage solutions for data centers, cloud services, and network infrastructure management makes it a prime consumer of NAS technology. Coupled with the BFSI sector, which demands stringent data security, compliance, and high availability for financial transactions and customer data, these two segments represent a substantial portion of the global NAS market.

- North America: Leads in market share due to advanced IT infrastructure, strong economic growth, and early adoption of technology.

- Key Drivers: High concentration of enterprises in BFSI and IT & Telecom, government initiatives supporting digital transformation, and significant R&D investments.

- Asia Pacific: Emerging as a significant growth region, driven by rapid digitalization, increasing adoption of cloud computing, and a growing SMB population.

- Key Drivers: Favorable government policies for technology adoption, increasing investments in smart city initiatives, and the burgeoning e-commerce sector.

- Europe: A mature market with steady growth, driven by stringent data protection regulations (e.g., GDPR) and a strong emphasis on cybersecurity.

- Key Drivers: Demand for compliance-driven storage solutions, growing adoption of IoT in manufacturing and healthcare.

Scale-out NAS architectures are gaining significant traction over scale-up solutions. The ability of scale-out NAS to offer linear scalability, high availability, and improved performance as data volumes grow makes it increasingly attractive for demanding enterprise workloads, especially in cloud environments and big data analytics. This trend is particularly pronounced in the IT and Telecom, and Media and Entertainment sectors where data volumes are immense and performance requirements are high.

Network-Attached Storage Industry Product Landscape

The Network-Attached Storage (NAS) product landscape is characterized by continuous innovation aimed at enhancing performance, capacity, and data management capabilities. Vendors are focusing on high-performance solutions leveraging NVMe SSDs and multi-gigabit Ethernet connectivity to meet the demands of data-intensive applications. Features such as advanced data protection, including snapshots, replication, and built-in backup utilities, are standard offerings. Cloud integration is a significant trend, with NAS devices seamlessly connecting to public, private, and hybrid cloud environments for data backup, archiving, and disaster recovery. Furthermore, specialized NAS solutions cater to specific use cases, such as video surveillance storage with advanced recording and analytics capabilities, or high-performance computing (HPC) clusters requiring parallel access to massive datasets. User-friendly interfaces and intuitive management software are also key differentiators, simplifying deployment and administration for businesses of all sizes.

Key Drivers, Barriers & Challenges in Network-Attached Storage Industry

The Network-Attached Storage (NAS) industry is propelled by several key drivers. The exponential growth of data generated by businesses and consumers necessitates efficient and scalable storage solutions. The increasing adoption of cloud computing, hybrid cloud strategies, and the rise of remote work further amplify the need for centralized data access and management, where NAS plays a crucial role. Technological advancements, including faster network interfaces, higher storage densities, and integrated AI for data analytics, are also significant catalysts.

However, the industry faces notable barriers and challenges. The complexity of integrating NAS into existing heterogeneous IT environments can be a hurdle. Supply chain issues, particularly concerning semiconductor availability, can impact production and lead times. Regulatory hurdles, such as data sovereignty laws and evolving privacy regulations, require continuous adaptation from vendors. Competitive pressures from hyperscale cloud providers and alternative storage solutions like object storage also pose a challenge. The high initial cost of enterprise-grade NAS solutions can be a barrier for smaller businesses, and cybersecurity threats remain a constant concern, demanding robust data protection and access control mechanisms.

Emerging Opportunities in Network-Attached Storage Industry

Emerging opportunities in the Network-Attached Storage (NAS) industry are centered around niche applications and evolving market demands. The proliferation of edge computing presents a significant opportunity, with a growing need for localized, intelligent NAS solutions to process and store data closer to its source. The burgeoning Internet of Things (IoT) ecosystem, generating massive data streams from connected devices, requires specialized NAS for efficient data aggregation and analysis. Furthermore, the demand for NAS solutions tailored for specific industries, such as AI-powered video analytics in retail or advanced imaging storage in healthcare, offers significant growth potential. The increasing trend of ransomware attacks also creates an opportunity for NAS vendors to offer enhanced data protection and recovery features, emphasizing immutable backups and robust disaster recovery capabilities.

Growth Accelerators in the Network-Attached Storage Industry Industry

Several catalysts are accelerating the growth of the Network-Attached Storage (NAS) industry. The relentless digital transformation across all sectors is a primary driver, pushing organizations to adopt more sophisticated data management solutions. Strategic partnerships between NAS vendors and cloud providers are facilitating seamless hybrid cloud integration, expanding market reach and user adoption. The increasing focus on data analytics and Artificial Intelligence (AI) necessitates powerful and scalable storage, making NAS indispensable for these workloads. Market expansion into emerging economies, driven by increasing digitalization and the growth of SMBs, is another significant accelerator. Furthermore, continuous innovation in NAS hardware and software, including improvements in performance, capacity, and energy efficiency, fuels market growth by meeting evolving customer demands.

Key Players Shaping the Network-Attached Storage Industry Market

- Thecus Technology Corporation

- Drobo Inc

- Dell EMC

- Asustor Inc

- International Business Machines (IBM) Corporation

- Hewlett-Packard Development Company

- Netgear Inc

- NetApp Inc

- Hitachi Data Systems Corporation

- QNAP Systems Inc

- Synology Inc

- ZyXEL Communications Corporation

- Buffalo Technology Inc

- Seagate Technology PLC

Notable Milestones in Network-Attached Storage Industry Sector

- June 2021: Dell EMC's Unity XT hybrid storage systems demonstrated enhanced raw performance, ensuring controllers are not a limiting factor for scaling IOPS, latency, and capacity growth, designed for 5-9's availability. Unity XT hybrid array IO was accelerated with FAST Cache or SSD Read Cache, delivering flash performance with lower-priced MLC flash drives.

- xx xx xxxx: xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx.

- xx xx xxxx: xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx.

- xx xx xxxx: xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx xx xxxxxx xx xxxx.

In-Depth Network-Attached Storage Industry Market Outlook

The Network-Attached Storage (NAS) industry is set for robust long-term growth, driven by the pervasive digital transformation and the ever-increasing volume of data. The integration of AI and edge computing capabilities within NAS solutions presents significant future market potential, enabling localized data processing and intelligent decision-making. Strategic partnerships and the expansion of NAS functionalities beyond simple file storage, incorporating advanced data analytics and robust cybersecurity, will further enhance its value proposition. Emerging economies, with their rapidly expanding IT infrastructure and growing SMB sectors, offer substantial untapped markets. The ongoing evolution towards hybrid and multi-cloud strategies positions NAS as a critical component for seamless data management and accessibility across diverse environments, ensuring continued market relevance and strategic opportunities for growth.

Network-Attached Storage Industry Segmentation

-

1. Type

- 1.1. Scale-up

- 1.2. Scale-out

-

2. End-user Industry

- 2.1. BFSI

- 2.2. IT and Telecom

- 2.3. Healthcare

- 2.4. Retail

- 2.5. Media and Entertainment

- 2.6. Other End-user Industries

Network-Attached Storage Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Latin America

- 5. Middle East and Africa

Network-Attached Storage Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 19.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Explosion of Unstructured Data; Increase in the Footprint of Scale-out in Enterprise IT; Focus on Data Center Virtualization and Software Defined NAS

- 3.3. Market Restrains

- 3.3.1. Increasing Adoption of Cloud; Cost Ineffectiveness with High Data Growth

- 3.4. Market Trends

- 3.4.1. Increasing Adoption of Cloud Hindering the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Scale-up

- 5.1.2. Scale-out

- 5.2. Market Analysis, Insights and Forecast - by End-user Industry

- 5.2.1. BFSI

- 5.2.2. IT and Telecom

- 5.2.3. Healthcare

- 5.2.4. Retail

- 5.2.5. Media and Entertainment

- 5.2.6. Other End-user Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Latin America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Scale-up

- 6.1.2. Scale-out

- 6.2. Market Analysis, Insights and Forecast - by End-user Industry

- 6.2.1. BFSI

- 6.2.2. IT and Telecom

- 6.2.3. Healthcare

- 6.2.4. Retail

- 6.2.5. Media and Entertainment

- 6.2.6. Other End-user Industries

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Scale-up

- 7.1.2. Scale-out

- 7.2. Market Analysis, Insights and Forecast - by End-user Industry

- 7.2.1. BFSI

- 7.2.2. IT and Telecom

- 7.2.3. Healthcare

- 7.2.4. Retail

- 7.2.5. Media and Entertainment

- 7.2.6. Other End-user Industries

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Scale-up

- 8.1.2. Scale-out

- 8.2. Market Analysis, Insights and Forecast - by End-user Industry

- 8.2.1. BFSI

- 8.2.2. IT and Telecom

- 8.2.3. Healthcare

- 8.2.4. Retail

- 8.2.5. Media and Entertainment

- 8.2.6. Other End-user Industries

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Latin America Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Scale-up

- 9.1.2. Scale-out

- 9.2. Market Analysis, Insights and Forecast - by End-user Industry

- 9.2.1. BFSI

- 9.2.2. IT and Telecom

- 9.2.3. Healthcare

- 9.2.4. Retail

- 9.2.5. Media and Entertainment

- 9.2.6. Other End-user Industries

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East and Africa Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Scale-up

- 10.1.2. Scale-out

- 10.2. Market Analysis, Insights and Forecast - by End-user Industry

- 10.2.1. BFSI

- 10.2.2. IT and Telecom

- 10.2.3. Healthcare

- 10.2.4. Retail

- 10.2.5. Media and Entertainment

- 10.2.6. Other End-user Industries

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Europe Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Asia Pacific Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1.

- 14. Latin America Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1.

- 15. Middle East and Africa Network-Attached Storage Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1.

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Thecus Technology Corporation

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Drobo Inc

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Dell EMC

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Asustor Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 International Business Machines (IBM) Corporation

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Hewlett-Packard Development Company

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Netgear Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 NetApp Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Hitachi Data Systems Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 QNAP Systems Inc *List Not Exhaustive

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Synology Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 ZyXEL Communications Corporation

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Buffalo Technology Inc

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.14 Seagate Technology PLC

- 16.2.14.1. Overview

- 16.2.14.2. Products

- 16.2.14.3. SWOT Analysis

- 16.2.14.4. Recent Developments

- 16.2.14.5. Financials (Based on Availability)

- 16.2.1 Thecus Technology Corporation

List of Figures

- Figure 1: Global Network-Attached Storage Industry Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Latin America Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 9: Latin America Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: Middle East and Africa Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 11: Middle East and Africa Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Network-Attached Storage Industry Revenue (Million), by Type 2024 & 2032

- Figure 13: North America Network-Attached Storage Industry Revenue Share (%), by Type 2024 & 2032

- Figure 14: North America Network-Attached Storage Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 15: North America Network-Attached Storage Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 16: North America Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 17: North America Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Network-Attached Storage Industry Revenue (Million), by Type 2024 & 2032

- Figure 19: Europe Network-Attached Storage Industry Revenue Share (%), by Type 2024 & 2032

- Figure 20: Europe Network-Attached Storage Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 21: Europe Network-Attached Storage Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 22: Europe Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 23: Europe Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Network-Attached Storage Industry Revenue (Million), by Type 2024 & 2032

- Figure 25: Asia Pacific Network-Attached Storage Industry Revenue Share (%), by Type 2024 & 2032

- Figure 26: Asia Pacific Network-Attached Storage Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 27: Asia Pacific Network-Attached Storage Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 28: Asia Pacific Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 29: Asia Pacific Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Latin America Network-Attached Storage Industry Revenue (Million), by Type 2024 & 2032

- Figure 31: Latin America Network-Attached Storage Industry Revenue Share (%), by Type 2024 & 2032

- Figure 32: Latin America Network-Attached Storage Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 33: Latin America Network-Attached Storage Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 34: Latin America Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 35: Latin America Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: Middle East and Africa Network-Attached Storage Industry Revenue (Million), by Type 2024 & 2032

- Figure 37: Middle East and Africa Network-Attached Storage Industry Revenue Share (%), by Type 2024 & 2032

- Figure 38: Middle East and Africa Network-Attached Storage Industry Revenue (Million), by End-user Industry 2024 & 2032

- Figure 39: Middle East and Africa Network-Attached Storage Industry Revenue Share (%), by End-user Industry 2024 & 2032

- Figure 40: Middle East and Africa Network-Attached Storage Industry Revenue (Million), by Country 2024 & 2032

- Figure 41: Middle East and Africa Network-Attached Storage Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Network-Attached Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Network-Attached Storage Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 3: Global Network-Attached Storage Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 4: Global Network-Attached Storage Industry Revenue Million Forecast, by Region 2019 & 2032

- Table 5: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 6: Network-Attached Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Network-Attached Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 10: Network-Attached Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Network-Attached Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Network-Attached Storage Industry Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Network-Attached Storage Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 16: Global Network-Attached Storage Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 17: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Network-Attached Storage Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 19: Global Network-Attached Storage Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 20: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 21: Global Network-Attached Storage Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Network-Attached Storage Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 23: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 24: Global Network-Attached Storage Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 25: Global Network-Attached Storage Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 26: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Global Network-Attached Storage Industry Revenue Million Forecast, by Type 2019 & 2032

- Table 28: Global Network-Attached Storage Industry Revenue Million Forecast, by End-user Industry 2019 & 2032

- Table 29: Global Network-Attached Storage Industry Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Network-Attached Storage Industry?

The projected CAGR is approximately 19.50%.

2. Which companies are prominent players in the Network-Attached Storage Industry?

Key companies in the market include Thecus Technology Corporation, Drobo Inc, Dell EMC, Asustor Inc, International Business Machines (IBM) Corporation, Hewlett-Packard Development Company, Netgear Inc, NetApp Inc, Hitachi Data Systems Corporation, QNAP Systems Inc *List Not Exhaustive, Synology Inc, ZyXEL Communications Corporation, Buffalo Technology Inc, Seagate Technology PLC.

3. What are the main segments of the Network-Attached Storage Industry?

The market segments include Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Explosion of Unstructured Data; Increase in the Footprint of Scale-out in Enterprise IT; Focus on Data Center Virtualization and Software Defined NAS.

6. What are the notable trends driving market growth?

Increasing Adoption of Cloud Hindering the Growth of the Market.

7. Are there any restraints impacting market growth?

Increasing Adoption of Cloud; Cost Ineffectiveness with High Data Growth.

8. Can you provide examples of recent developments in the market?

June 2021 - Dell EMC's Unity XT hybrid storage systems have the raw performance to ensure that controllers don't become the limiting factor, enabling users to scale as needed to keep pace with application IOPS, latency, and capacity growth and are designed for 5-9's availability. Unity XT hybrid array IO is accelerated with FAST Cache or SSD Read Cache to deliver the performance of flash with lower-priced MLC flash drives.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Network-Attached Storage Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Network-Attached Storage Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Network-Attached Storage Industry?

To stay informed about further developments, trends, and reports in the Network-Attached Storage Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence