Key Insights

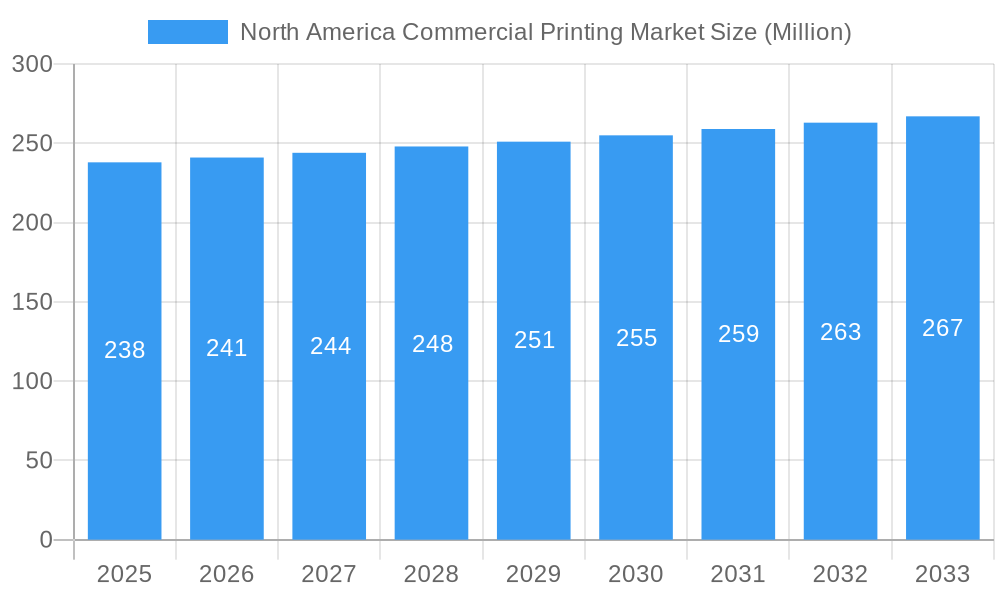

The North American commercial printing market, valued at approximately $238 million in 2025, is projected to experience moderate growth, driven primarily by the ongoing demand for high-quality packaging solutions and specialized printing services. While a CAGR of 1.27% indicates a relatively stable market, several factors are shaping its trajectory. The increasing adoption of sustainable printing practices, including the use of recycled materials and eco-friendly inks, is a significant trend, responding to growing environmental concerns among consumers and businesses. Furthermore, the rise of personalized marketing and customized packaging is fueling demand for short-run, high-quality printing jobs, benefiting smaller, specialized printing companies. However, the market faces challenges from the continued digitalization of marketing and communication, impacting the demand for traditional print media. The competitive landscape is characterized by a mix of large multinational corporations like Amcor Group and Graphic Packaging International, along with numerous smaller, regional players specializing in niche areas. This fragmentation presents both opportunities and challenges, requiring companies to differentiate through specialized services, innovative technologies, and strong customer relationships. The projected growth will likely be uneven across segments, with packaging printing and specialized applications experiencing higher growth rates than traditional print media.

North America Commercial Printing Market Market Size (In Million)

Looking ahead to 2033, the market is expected to show gradual expansion, with sustained demand in packaging and specialized printing offsetting the decline in traditional print segments. Key players are likely to focus on strategic acquisitions to expand their market share and product offerings, while smaller players will continue to compete through specialization and agility. Technological advancements, such as advancements in digital printing technology and improved software for design and production, will continue to impact market dynamics, driving efficiency and cost reduction. Sustained investment in research and development will be crucial for companies seeking to innovate and maintain a competitive edge in a constantly evolving market. This requires a focus on meeting evolving customer needs and adapting to changing market conditions.

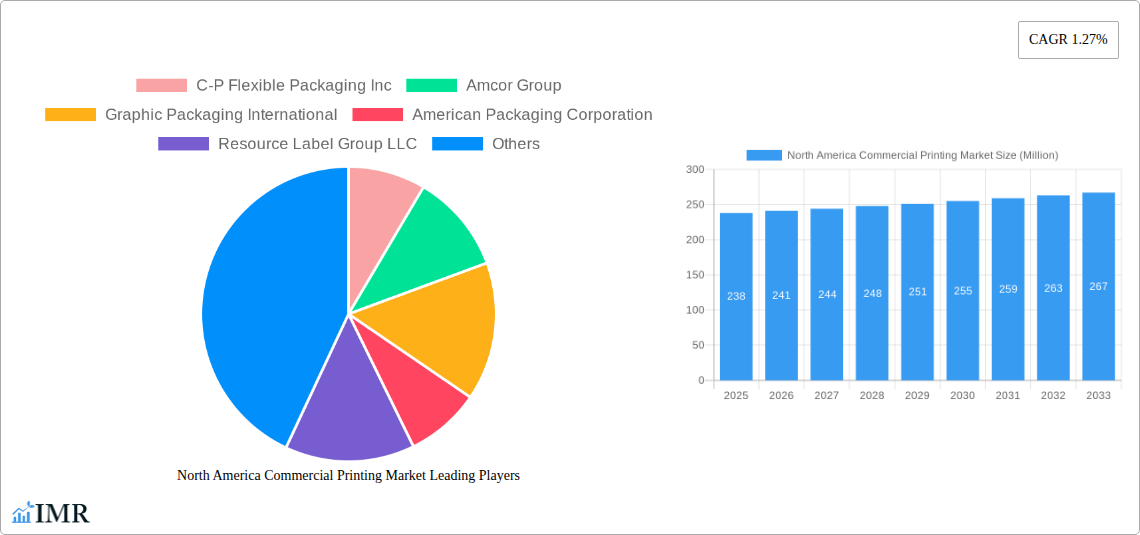

North America Commercial Printing Market Company Market Share

North America Commercial Printing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the North America commercial printing market, encompassing market dynamics, growth trends, regional segmentation, product landscape, and key players. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. This report is invaluable for industry professionals, investors, and strategic decision-makers seeking to navigate the evolving landscape of the North American commercial printing sector. The report also delves into the parent market of Packaging and the child market of Digital Printing to offer a holistic perspective. Market values are presented in million units.

North America Commercial Printing Market Dynamics & Structure

This section analyzes the North American commercial printing market's structure, identifying key drivers and challenges. We examine market concentration, revealing the competitive landscape and the market share held by major players. Technological innovation, regulatory changes, and the emergence of competitive substitutes are also assessed. Furthermore, the report explores end-user demographics and the impact of mergers and acquisitions (M&A) activities.

- Market Concentration: The market is moderately concentrated, with the top 5 players holding approximately xx% of the market share in 2024. This is expected to shift slightly by 2033, with increased consolidation predicted.

- Technological Innovation: The adoption of digital printing technologies, automation, and sustainable materials are key drivers. However, the high initial investment costs present a barrier to entry for smaller players.

- Regulatory Framework: Environmental regulations concerning waste reduction and sustainable practices are shaping the industry, driving demand for eco-friendly printing solutions.

- Competitive Substitutes: Digital marketing and electronic communication present significant competition, impacting traditional print media.

- End-User Demographics: The report analyzes the distribution of print demands across various sectors, including publishing, packaging, marketing and advertising.

- M&A Trends: A moderate number of M&A deals (xx in the past 5 years) have been observed, indicating a trend towards consolidation within the market.

North America Commercial Printing Market Growth Trends & Insights

This section offers a detailed examination of market size evolution, adoption rates, and technological disruptions impacting the North American commercial printing market. We analyze consumer behavior shifts and present key metrics like Compound Annual Growth Rate (CAGR) and market penetration rates to provide comprehensive insights into the market's trajectory. The market is experiencing a transition from traditional printing methods to digital solutions, leading to a shift in consumer preferences towards speed, personalization, and shorter print runs.

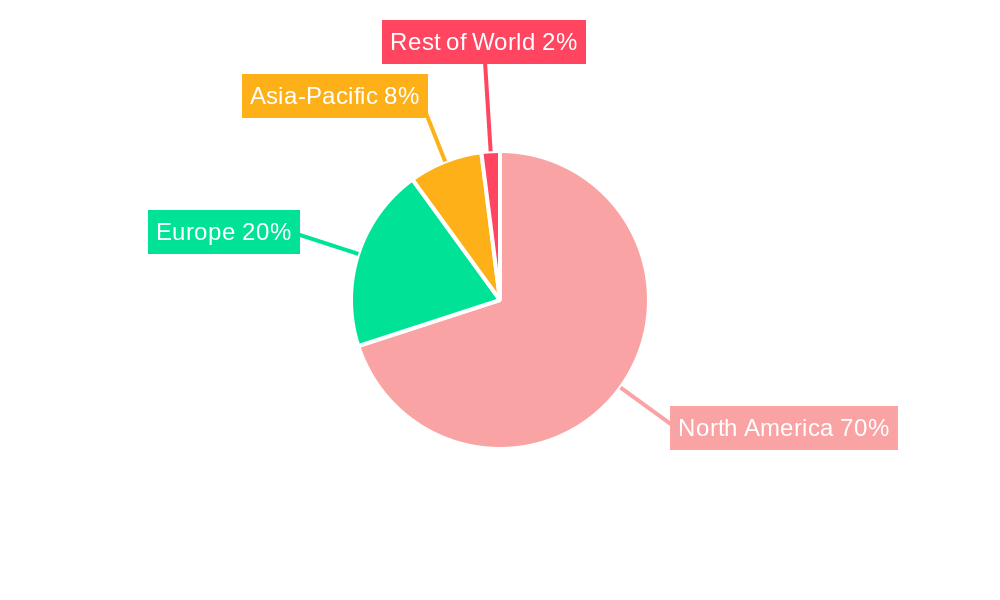

Dominant Regions, Countries, or Segments in North America Commercial Printing Market

This section pinpoints the leading regions and segments driving market growth within North America. We analyze the factors contributing to their dominance, including economic policies, infrastructure, and market share. Key drivers for specific regions are highlighted.

- United States: Remains the dominant market due to its robust economy and advanced infrastructure.

- Canada: Demonstrates steady growth, driven by increasing investments in digital printing and packaging solutions.

- Mexico: Shows potential for significant expansion, boosted by its growing manufacturing sector and proximity to the US market.

- Key Segments: The packaging segment is experiencing the highest growth rate, driven by increasing demand for customized packaging solutions and e-commerce growth.

North America Commercial Printing Market Product Landscape

This section details the current product offerings in the North American commercial printing market, highlighting innovations, applications, and performance metrics. It emphasizes unique selling propositions and technological advancements, including the increasing use of sustainable materials and eco-friendly printing methods. The market is witnessing a rise in digital printing technologies, personalized printing solutions, and on-demand printing services.

Key Drivers, Barriers & Challenges in North America Commercial Printing Market

This section identifies the primary drivers and challenges impacting the North American commercial printing market.

Key Drivers:

- Growing demand for customized packaging in e-commerce

- Increasing adoption of digital printing technologies

- Rise in personalized marketing campaigns

Key Challenges:

- Intense competition from digital marketing platforms

- Rising raw material costs and supply chain disruptions (estimated xx% increase in 2024)

- Environmental regulations and sustainability concerns

Emerging Opportunities in North America Commercial Printing Market

This section explores emerging opportunities, such as untapped niche markets, the rise of sustainable printing practices, and the growing demand for personalized and on-demand printing solutions. The increasing adoption of augmented reality (AR) and virtual reality (VR) technologies in printed materials also presents potential growth avenues.

Growth Accelerators in the North America Commercial Printing Market Industry

Technological advancements, particularly in digital printing and automation, are driving long-term growth. Strategic partnerships and mergers & acquisitions are also contributing to market expansion and increased efficiency. The focus on sustainability and eco-friendly practices is also acting as a key growth accelerator.

Key Players Shaping the North America Commercial Printing Market Market

- C-P Flexible Packaging Inc

- Amcor Group

- Graphic Packaging International

- American Packaging Corporation

- Resource Label Group LLC

- Weber Packaging Solution

- Advanced Labelworx Inc

- Multi-colour Corporation

- OMNI Systems Inc

- Quad (formerly known as Quad/Graphics)

- Vistaprint (Cimpress PLC)

- R R Donnelley & Sons Company

- Deluxe Corporation

- Taylor Corporation

- LSC Communications LLC

- 4over LLC

- JPS Books + Logistics

- Cober Solutions

- CJ Graphics Inc

- Hemlock Printers Ltd

- *List Not Exhaustive

Notable Milestones in North America Commercial Printing Market Sector

- May 2024: American Packaging Corporation expands operations with a new digital printing unit in Wisconsin, enhancing its flexible packaging capabilities.

- February 2024: Resource Label Group LLC launches RLG Healthcare, focusing on pharmaceutical and healthcare packaging solutions.

In-Depth North America Commercial Printing Market Market Outlook

The North American commercial printing market is poised for continued growth, driven by technological advancements, increasing demand for personalized packaging and print solutions, and the ongoing transition towards sustainable practices. Strategic investments in digital printing technologies and automation will further enhance efficiency and cater to the evolving needs of the market, opening avenues for significant market expansion and increased profitability in the coming years.

North America Commercial Printing Market Segmentation

-

1. Technology

- 1.1. Offset Lithography

- 1.2. Inkjet

- 1.3. Flexographic

- 1.4. Screen

- 1.5. Gravure

- 1.6. Others (Electrophotography and Letterpress)

-

2. Application

- 2.1. Direct Mail

- 2.2. Books & Stationery

- 2.3. Business Forms & Cards

- 2.4. Tickets (Lottery, others)

- 2.5. Advertis

- 2.6. Transactional Print

- 2.7. Security

- 2.8. Labels

- 2.9. Packaging (Paper & Other Packaging)

- 2.10. Other Applications

-

3. North America Commercial Printing Growth Analysis

- 3.1. Factors Responsible for Growth Projections

- 3.2. Key Segm

- 3.3. Labels I

-

4. Printing Industry Supply Landscape

- 4.1. Printing

- 4.2. Inks & Toners

- 4.3. Printing Equipment

- 4.4. Print Components - Printheads, etc.

- 4.5. Printing Services in North America

North America Commercial Printing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Commercial Printing Market Regional Market Share

Geographic Coverage of North America Commercial Printing Market

North America Commercial Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.27% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth

- 3.3. Market Restrains

- 3.3.1. Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth

- 3.4. Market Trends

- 3.4.1. Packaging Application Segment is Expected to Hold Significant Market Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Commercial Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Offset Lithography

- 5.1.2. Inkjet

- 5.1.3. Flexographic

- 5.1.4. Screen

- 5.1.5. Gravure

- 5.1.6. Others (Electrophotography and Letterpress)

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Direct Mail

- 5.2.2. Books & Stationery

- 5.2.3. Business Forms & Cards

- 5.2.4. Tickets (Lottery, others)

- 5.2.5. Advertis

- 5.2.6. Transactional Print

- 5.2.7. Security

- 5.2.8. Labels

- 5.2.9. Packaging (Paper & Other Packaging)

- 5.2.10. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by North America Commercial Printing Growth Analysis

- 5.3.1. Factors Responsible for Growth Projections

- 5.3.2. Key Segm

- 5.3.3. Labels I

- 5.4. Market Analysis, Insights and Forecast - by Printing Industry Supply Landscape

- 5.4.1. Printing

- 5.4.2. Inks & Toners

- 5.4.3. Printing Equipment

- 5.4.4. Print Components - Printheads, etc.

- 5.4.5. Printing Services in North America

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 C-P Flexible Packaging Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Amcor Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Graphic Packaging International

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 American Packaging Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Resource Label Group LLC

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Weber Packaging Solution

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Advanced Labelworx Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Multi-colour Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 OMNI Systems Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Quad (formerly known as Quad/Graphics)

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vistaprint (Cimpress PLC)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 R R Donnelley & Sons Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Deluxe Corporation

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Taylor Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 LSC Communications LLC

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 4over LLC

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 JPS Books + Logistics

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.18 Cober Solutions

- 6.2.18.1. Overview

- 6.2.18.2. Products

- 6.2.18.3. SWOT Analysis

- 6.2.18.4. Recent Developments

- 6.2.18.5. Financials (Based on Availability)

- 6.2.19 CJ Graphics Inc

- 6.2.19.1. Overview

- 6.2.19.2. Products

- 6.2.19.3. SWOT Analysis

- 6.2.19.4. Recent Developments

- 6.2.19.5. Financials (Based on Availability)

- 6.2.20 Hemlock Printers Ltd*List Not Exhaustive 7 2 Sustainability Trends in the North American Printing Industr

- 6.2.20.1. Overview

- 6.2.20.2. Products

- 6.2.20.3. SWOT Analysis

- 6.2.20.4. Recent Developments

- 6.2.20.5. Financials (Based on Availability)

- 6.2.1 C-P Flexible Packaging Inc

List of Figures

- Figure 1: North America Commercial Printing Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Commercial Printing Market Share (%) by Company 2025

List of Tables

- Table 1: North America Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: North America Commercial Printing Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 3: North America Commercial Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: North America Commercial Printing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 5: North America Commercial Printing Market Revenue Million Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 6: North America Commercial Printing Market Volume Billion Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 7: North America Commercial Printing Market Revenue Million Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 8: North America Commercial Printing Market Volume Billion Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 9: North America Commercial Printing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 10: North America Commercial Printing Market Volume Billion Forecast, by Region 2020 & 2033

- Table 11: North America Commercial Printing Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 12: North America Commercial Printing Market Volume Billion Forecast, by Technology 2020 & 2033

- Table 13: North America Commercial Printing Market Revenue Million Forecast, by Application 2020 & 2033

- Table 14: North America Commercial Printing Market Volume Billion Forecast, by Application 2020 & 2033

- Table 15: North America Commercial Printing Market Revenue Million Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 16: North America Commercial Printing Market Volume Billion Forecast, by North America Commercial Printing Growth Analysis 2020 & 2033

- Table 17: North America Commercial Printing Market Revenue Million Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 18: North America Commercial Printing Market Volume Billion Forecast, by Printing Industry Supply Landscape 2020 & 2033

- Table 19: North America Commercial Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 20: North America Commercial Printing Market Volume Billion Forecast, by Country 2020 & 2033

- Table 21: United States North America Commercial Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: United States North America Commercial Printing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 23: Canada North America Commercial Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Canada North America Commercial Printing Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 25: Mexico North America Commercial Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Mexico North America Commercial Printing Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Commercial Printing Market?

The projected CAGR is approximately 1.27%.

2. Which companies are prominent players in the North America Commercial Printing Market?

Key companies in the market include C-P Flexible Packaging Inc, Amcor Group, Graphic Packaging International, American Packaging Corporation, Resource Label Group LLC, Weber Packaging Solution, Advanced Labelworx Inc, Multi-colour Corporation, OMNI Systems Inc, Quad (formerly known as Quad/Graphics), Vistaprint (Cimpress PLC), R R Donnelley & Sons Company, Deluxe Corporation, Taylor Corporation, LSC Communications LLC, 4over LLC, JPS Books + Logistics, Cober Solutions, CJ Graphics Inc, Hemlock Printers Ltd*List Not Exhaustive 7 2 Sustainability Trends in the North American Printing Industr.

3. What are the main segments of the North America Commercial Printing Market?

The market segments include Technology, Application, North America Commercial Printing Growth Analysis, Printing Industry Supply Landscape.

4. Can you provide details about the market size?

The market size is estimated to be USD 238 Million as of 2022.

5. What are some drivers contributing to market growth?

Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth.

6. What are the notable trends driving market growth?

Packaging Application Segment is Expected to Hold Significant Market Share.

7. Are there any restraints impacting market growth?

Economic Growth & Industrialization; Rising Demand for Flexible and E-commerce Packaging; Advertising Printing & Branding Growth.

8. Can you provide examples of recent developments in the market?

May 2024: The American Packaging Corporation expanded its operations by opening a second production unit for digitally printed flexible packaging at its Wisconsin Center of Excellence. The company invested in this new unit's packaging equipment and service capabilities, including digital printing, laminating, registered coating, and pouch-making machinery. APC established a rapid response library of stocked packaging materials designed to fulfill orders within 15 days or less.February 2024: Resource Label Group LLC (RLG) announced the formation of a specialty pharmaceutical and healthcare packaging division named RLG Healthcare. The formation of RLG Healthcare is expected to help the company offer packaging solutions such as labels, inserts, cartons, and others for the pharmaceutical and healthcare sector in the region.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Commercial Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Commercial Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Commercial Printing Market?

To stay informed about further developments, trends, and reports in the North America Commercial Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence