Key Insights

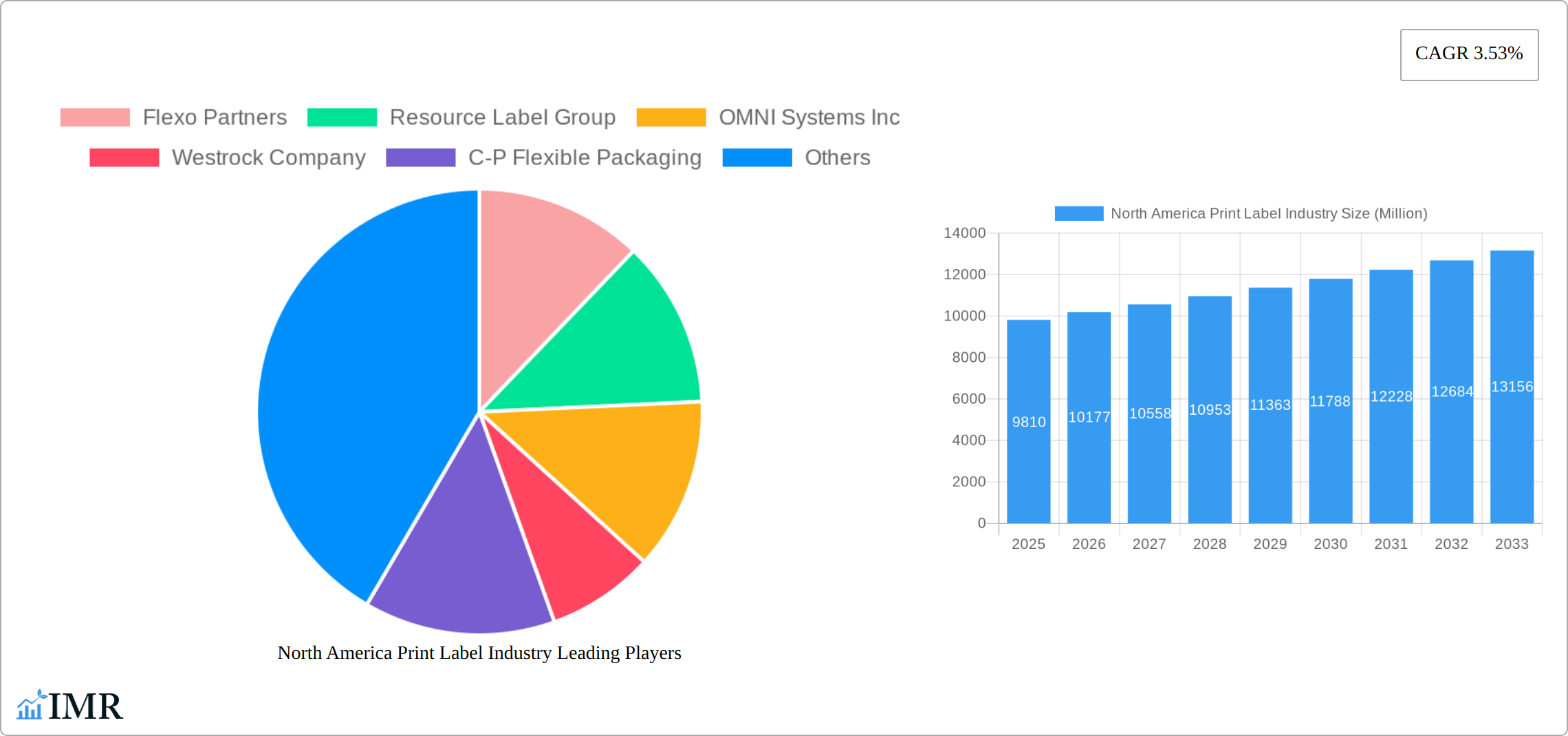

The North American print label industry, valued at $9.81 billion in 2025, is projected to experience steady growth, driven by robust demand across diverse end-user sectors. A compound annual growth rate (CAGR) of 3.53% from 2025 to 2033 indicates a healthy market trajectory. Key growth drivers include the increasing adoption of sophisticated packaging solutions to enhance brand visibility and product appeal, particularly within the food and beverage, healthcare, and cosmetics sectors. The rising e-commerce landscape fuels demand for efficient and informative labels, further contributing to market expansion. The preference for customized and digitally printed labels is shaping industry trends, along with the growing adoption of sustainable and eco-friendly label materials made from recycled content and biodegradable materials. While competition among established players and smaller niche label printers remains intense, innovation in printing technologies such as inkjet and flexography, offering high-speed and cost-effective solutions, is further stimulating growth. However, fluctuating raw material prices and evolving regulatory requirements regarding label composition and disposal present potential restraints. Segment-wise, pressure-sensitive labels and wet-glue labels continue to dominate the market due to their versatility and cost-effectiveness; however, linerless labels and in-mold labels are gaining traction for their sustainable and efficient nature. The North American market is geographically concentrated, with the United States holding a significant market share, followed by Canada and Mexico.

North America Print Label Industry Market Size (In Billion)

The forecast for the North American print label market through 2033 points to continued expansion. The estimated CAGR reflects a balanced market dynamic influenced by evolving consumer preferences for sustainable packaging and the continuous advancement of printing technologies. Major players are focusing on expanding their product portfolios, embracing digital printing capabilities, and adopting sustainable practices to maintain market competitiveness. The ongoing integration of smart packaging solutions featuring augmented reality (AR) and QR codes further enhances label functionalities and drives demand. Regional variations in growth may occur based on specific economic factors, regulatory landscapes, and the varied adoption rates of innovative labeling solutions. However, overall, the North American print label market's outlook remains positive, propelled by sustained demand across diverse industry sectors and technological innovation.

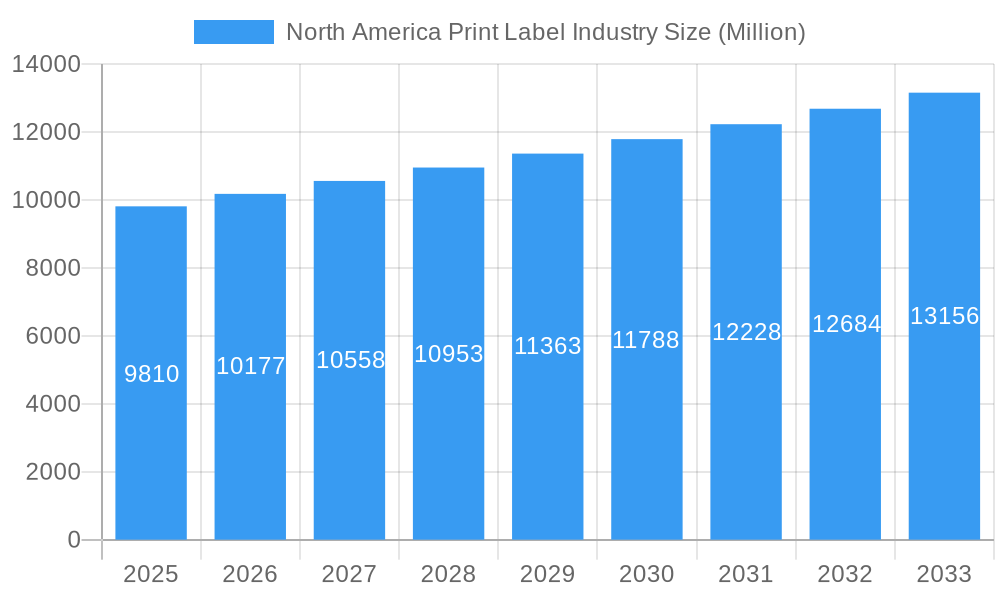

North America Print Label Industry Company Market Share

North America Print Label Industry Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the North American print label industry, covering market dynamics, growth trends, key players, and future outlook. The report uses 2025 as its base year and offers forecasts spanning 2025-2033, utilizing data from the historical period of 2019-2024. The market is segmented by label type, end-user industry, and printing technology, providing granular insights for informed strategic decision-making. The report is invaluable for industry professionals, investors, and anyone seeking a deep understanding of this dynamic sector. Market values are presented in million units.

North America Print Label Industry Market Dynamics & Structure

The North American print label market is a highly fragmented yet consolidating landscape, characterized by intense competition and continuous technological advancements. Market concentration is moderate, with a few large players holding significant shares, alongside numerous smaller regional players. Technological innovation, driven by demands for enhanced performance and sustainability, is a key driver. Stringent regulatory frameworks, particularly concerning material safety and environmental impact, also shape industry practices. Pressure-sensitive labels dominate the market, facing competition from emerging alternatives like linerless labels. End-user demographics and consumption patterns influence label demand across various sectors. Mergers and acquisitions (M&A) activity is frequent, reflecting consolidation trends and expansion strategies of major players.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share (2024).

- Technological Innovation: Focus on sustainable materials, digital printing, and smart labels.

- Regulatory Landscape: Compliance with FDA, EPA, and other relevant regulations crucial.

- Competitive Substitutes: Digital printing technologies, alternative packaging solutions.

- M&A Activity: High volume of acquisitions in recent years, reflecting consolidation trends. (e.g., Resource Label Group's acquisition of QSX Labels).

North America Print Label Industry Growth Trends & Insights

The North American print label market exhibits robust growth, driven by factors like increasing product diversification, rising e-commerce, and expanding end-user industries. The market size experienced a CAGR of xx% during the historical period (2019-2024) and is projected to maintain a healthy CAGR of xx% throughout the forecast period (2025-2033), reaching xx million units by 2033. This growth is fueled by technological advancements like digital printing and the adoption of sustainable materials. Shifting consumer preferences towards convenient and aesthetically pleasing packaging also contribute significantly. Adoption rates of specialized label types, such as linerless and smart labels, are increasing rapidly, indicating a significant market shift.

Dominant Regions, Countries, or Segments in North America Print Label Industry

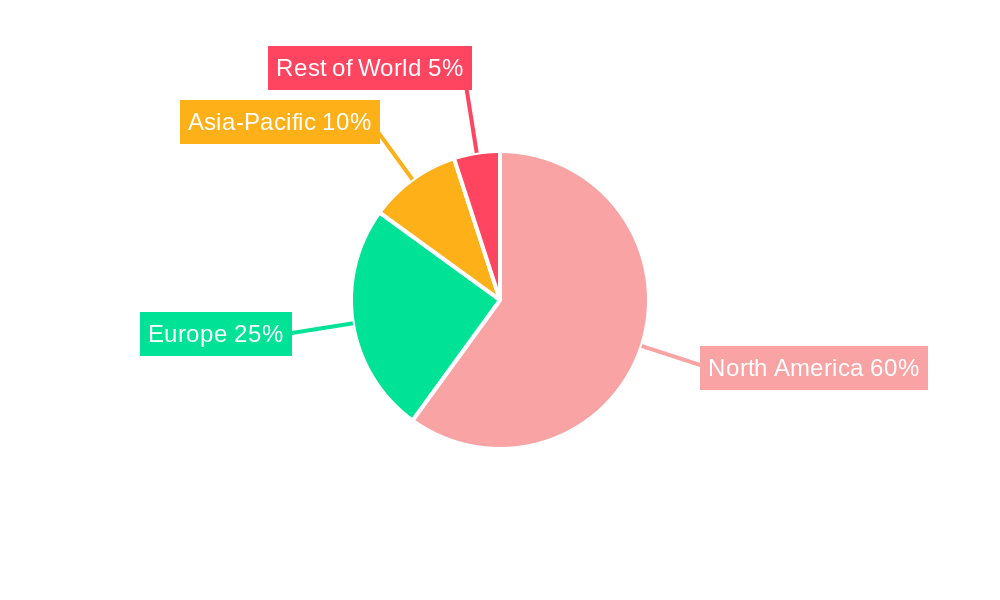

The North American print label market is geographically diverse, with significant variations in growth rates and market share across regions. The largest segments are pressure-sensitive labels, driven by its wide applicability across end-user industries. The food and beverage sector is the largest end-user, followed by healthcare and cosmetics. Flexography remains the dominant printing technology. However, digital printing is rapidly gaining traction, especially for shorter print runs and personalized labeling.

- By Label Type: Pressure-sensitive labels constitute the largest segment (xx million units in 2024), followed by wet-glue labels (xx million units).

- By End-user Industry: Food and beverage accounts for the largest share (xx million units) followed by healthcare (xx million units).

- By Printing Technology: Flexography holds the largest market share (xx million units), with digital printing experiencing significant growth.

- Dominant Regions: The US remains the largest market, followed by Canada and Mexico.

North America Print Label Industry Product Landscape

The North American print label market is a dynamic and diverse sector, offering an extensive array of products designed to meet the evolving needs of a multitude of industries. Innovations are continuously shaping the landscape, with a significant rise in the adoption of linerless labels, which not only streamline application processes but also offer substantial environmental advantages by minimizing waste. Furthermore, the integration of advanced technologies has given rise to smart labels, incorporating features like RFID and NFC capabilities. These smart labels are revolutionizing product tracking, enabling enhanced supply chain visibility, facilitating seamless consumer engagement through interactive brand experiences, and opening new avenues for data collection and analysis.

Key performance indicators for print labels encompass critical attributes such as superior adhesion across various substrates, exceptional durability to withstand diverse environmental conditions, optimal printability for vibrant and clear graphics, and robust recyclability to align with sustainability goals. Unique selling propositions in this competitive market often revolve around specialized functionalities like tamper-evidence or security features, the utilization of innovative, eco-friendly materials such as compostable or recycled content, and delivering cost-effective solutions without compromising on quality or performance.

Key Drivers, Barriers & Challenges in North America Print Label Industry

Key Drivers:

- The relentless growth of the e-commerce sector, coupled with increasing consumer spending, is fueling a sustained demand for high-quality, functional, and aesthetically pleasing labels.

- Continuous technological advancements in printing methods, such as digital printing and high-speed flexography, alongside breakthroughs in material science, are enabling the creation of more sophisticated and specialized label solutions.

- A pronounced and growing industry-wide focus on sustainable and eco-friendly packaging solutions is a major catalyst, pushing for the development and adoption of recyclable, biodegradable, and reduced-waste labeling options.

Challenges and Restraints:

- Significant fluctuations in the prices of raw materials, such as paper, films, and adhesives, alongside persistent supply chain disruptions, continue to pose challenges to cost management and production stability.

- The evolving landscape of stringent environmental regulations, coupled with the associated compliance costs, necessitates ongoing investment in sustainable practices and product development.

- Intense market competition, both domestically and internationally, often leads to significant price pressures, requiring manufacturers to optimize efficiency and differentiate their offerings.

Emerging Opportunities in North America Print Label Industry

- Growing demand for customized and personalized labels.

- Expansion into niche markets like pharmaceutical and medical devices.

- Development of smart labels with advanced functionalities like track and trace.

Growth Accelerators in the North America Print Label Industry Industry

The North American print label industry is experiencing robust growth, significantly propelled by strategic partnerships and collaborations. These alliances, formed between label manufacturers, innovative material suppliers, and cutting-edge technology providers, are fostering innovation, expanding market reach, and accelerating the development of next-generation labeling solutions. The widespread adoption of Industry 4.0 technologies, including advanced automation, sophisticated robotics, and data analytics, is dramatically enhancing operational efficiency, optimizing production workflows, and improving overall productivity across the value chain. Furthermore, strategic expansion into emerging markets and the continuous pursuit of product diversification, by offering a broader range of specialized labels and services, are proving to be critical catalysts for sustained industry growth.

Key Players Shaping the North America Print Label Industry Market

- Flexo Partners

- Resource Label Group

- OMNI Systems Inc

- Westrock Company

- C-P Flexible Packaging

- Cenveo Corporation

- IMS Inc

- Mondi Group

- Blue Label Packaging Company

- Avery Dennison Corporation

- Derksen Co

- Multi-Color Corporation

- Traco Packaging

- Brady Corporation

- Ahlstrom-munksjo Oyj

- Brandmark Inc

- Inovar

Notable Milestones in North America Print Label Industry Sector

- January 2022: Resource Label Group LLC strategically acquired QSX Labels, significantly bolstering its presence and capabilities within the New England region.

- March 2022: Avery Dennison Corporation, a global leader in labeling and packaging materials, advanced its commitment to sustainable solutions by acquiring linerless label technology from Catchpoint Ltd., further enhancing its portfolio of waste-reducing label options.

In-Depth North America Print Label Industry Market Outlook

The North American print label market is firmly on a trajectory for sustained and significant growth. This expansion is primarily fueled by continuous technological innovations that are redefining label capabilities, the ever-increasing demand from a diverse spectrum of end-user industries, and a powerful, growing emphasis on sustainable and environmentally responsible packaging solutions. Companies that proactively invest in state-of-the-art printing technologies, particularly in digital printing for customization and shorter runs, and embrace the development and use of eco-friendly materials, are exceptionally well-positioned to capture substantial market share. Furthermore, a strategic focus on developing and offering advanced smart label solutions, enabling enhanced functionality and consumer interaction, will be a key differentiator and a significant driver of success in the coming years.

North America Print Label Industry Segmentation

-

1. Printing Technology

- 1.1. Offset Lithography

- 1.2. Gravure

- 1.3. Flexography

- 1.4. Screen

- 1.5. Letterpress

- 1.6. Electrophotography

- 1.7. Inkjet

-

2. Label Type

- 2.1. Wet-glue Labels

- 2.2. Pressure-sensitive Labels

- 2.3. Linerless Labels

- 2.4. Multi-part Tracking Labels

- 2.5. In-mold Labels

- 2.6. Shrink and Stretch Sleeves

-

3. End-user Industry

- 3.1. Food

- 3.2. Beverage

- 3.3. Healthcare

- 3.4. Cosmetics

- 3.5. Household

- 3.6. Industri

- 3.7. Logistics

- 3.8. Other End-user Industries

North America Print Label Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Print Label Industry Regional Market Share

Geographic Coverage of North America Print Label Industry

North America Print Label Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.53% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetics Segment

- 3.3. Market Restrains

- 3.3.1. Lack of Products with Ability to Withstand Harsh Climatic Conditions

- 3.4. Market Trends

- 3.4.1. Food and Allied Products Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Print Label Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Technology

- 5.1.1. Offset Lithography

- 5.1.2. Gravure

- 5.1.3. Flexography

- 5.1.4. Screen

- 5.1.5. Letterpress

- 5.1.6. Electrophotography

- 5.1.7. Inkjet

- 5.2. Market Analysis, Insights and Forecast - by Label Type

- 5.2.1. Wet-glue Labels

- 5.2.2. Pressure-sensitive Labels

- 5.2.3. Linerless Labels

- 5.2.4. Multi-part Tracking Labels

- 5.2.5. In-mold Labels

- 5.2.6. Shrink and Stretch Sleeves

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Food

- 5.3.2. Beverage

- 5.3.3. Healthcare

- 5.3.4. Cosmetics

- 5.3.5. Household

- 5.3.6. Industri

- 5.3.7. Logistics

- 5.3.8. Other End-user Industries

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Printing Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Flexo Partners

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Resource Label Group

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OMNI Systems Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Westrock Company

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 C-P Flexible Packaging

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cenveo Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IMS Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Mondi Group

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Blue Label Packaging Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Avery Dennison Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Derksen Co

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Multi-Color Corporation*List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Traco Packaging

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Brady Corporation

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Ahlstrom-munksjo Oyj

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.16 Brandmark Inc

- 6.2.16.1. Overview

- 6.2.16.2. Products

- 6.2.16.3. SWOT Analysis

- 6.2.16.4. Recent Developments

- 6.2.16.5. Financials (Based on Availability)

- 6.2.17 Inovar

- 6.2.17.1. Overview

- 6.2.17.2. Products

- 6.2.17.3. SWOT Analysis

- 6.2.17.4. Recent Developments

- 6.2.17.5. Financials (Based on Availability)

- 6.2.1 Flexo Partners

List of Figures

- Figure 1: North America Print Label Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Print Label Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Print Label Industry Revenue Million Forecast, by Printing Technology 2020 & 2033

- Table 2: North America Print Label Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 3: North America Print Label Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 4: North America Print Label Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: North America Print Label Industry Revenue Million Forecast, by Printing Technology 2020 & 2033

- Table 6: North America Print Label Industry Revenue Million Forecast, by Label Type 2020 & 2033

- Table 7: North America Print Label Industry Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 8: North America Print Label Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 9: United States North America Print Label Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Canada North America Print Label Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Mexico North America Print Label Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Print Label Industry?

The projected CAGR is approximately 3.53%.

2. Which companies are prominent players in the North America Print Label Industry?

Key companies in the market include Flexo Partners, Resource Label Group, OMNI Systems Inc, Westrock Company, C-P Flexible Packaging, Cenveo Corporation, IMS Inc, Mondi Group, Blue Label Packaging Company, Avery Dennison Corporation, Derksen Co, Multi-Color Corporation*List Not Exhaustive, Traco Packaging, Brady Corporation, Ahlstrom-munksjo Oyj, Brandmark Inc, Inovar.

3. What are the main segments of the North America Print Label Industry?

The market segments include Printing Technology, Label Type, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 9.81 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Demand for Labels Manufactured with Digital Print Technologies; High Adoption from the Healthcare and Cosmetics Segment.

6. What are the notable trends driving market growth?

Food and Allied Products Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Lack of Products with Ability to Withstand Harsh Climatic Conditions.

8. Can you provide examples of recent developments in the market?

March 2022 - Avery Dennison Corporation, a global materials science company specializing in the design and manufacture of a wide variety of labeling and functional materials, acquired the linerless label technology developed by Catchpoint Ltd, a UK company based in Yorkshire, England.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Print Label Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Print Label Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Print Label Industry?

To stay informed about further developments, trends, and reports in the North America Print Label Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence