Key Insights

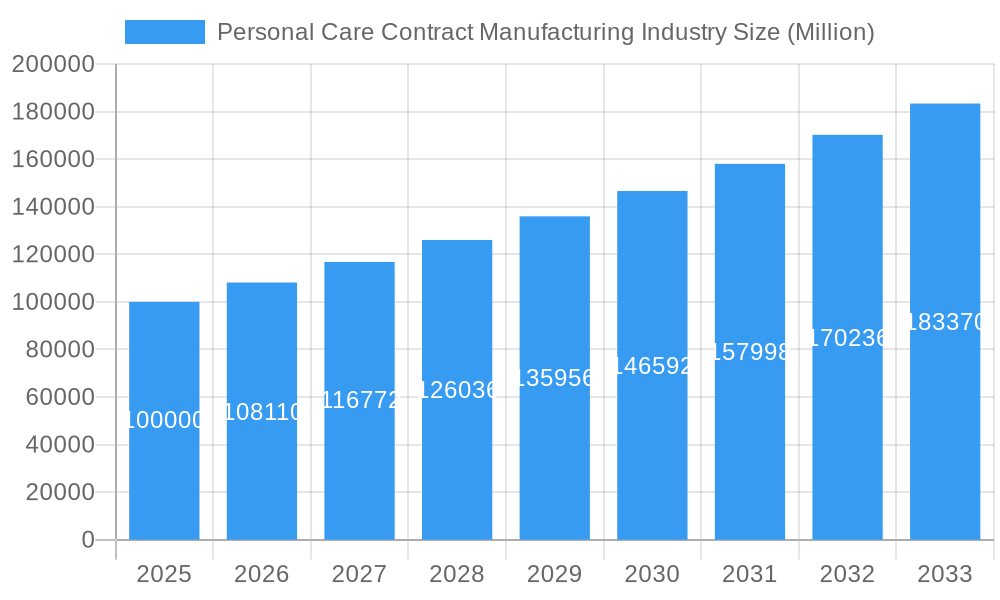

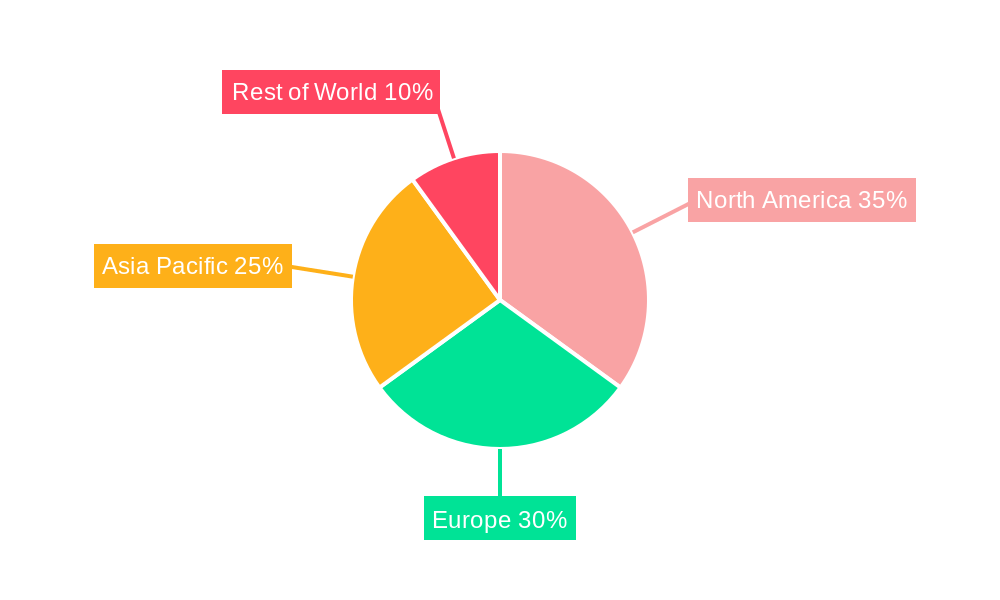

The global personal care contract manufacturing market is experiencing robust growth, driven by increasing demand for customized and innovative personal care products. The market's value, estimated at $XX billion in 2025, is projected to expand at a compound annual growth rate (CAGR) of 8.11% from 2025 to 2033, reaching an estimated $YY billion by 2033. This expansion is fueled by several key factors. Firstly, the rising preference for personalized beauty and skincare solutions is pushing brands to outsource manufacturing to specialized contract manufacturers who offer flexibility and agility in product development and production. Secondly, the increasing adoption of sustainable and ethically sourced ingredients is driving demand for contract manufacturers with robust supply chain management capabilities and commitment to environmental responsibility. Furthermore, the growth of e-commerce and direct-to-consumer brands is creating opportunities for smaller companies to leverage contract manufacturing services, allowing them to focus on marketing and brand building without the overhead of in-house production. The market is segmented by service type (R&D and formulation, manufacturing, packaging & allied services) and product type (skincare, hair care, make-up & cosmetics, other product types). North America and Europe currently hold significant market share, but the Asia-Pacific region is exhibiting the fastest growth potential, driven by rising disposable incomes and increasing consumer awareness of personal care products in emerging markets.

Personal Care Contract Manufacturing Industry Market Size (In Billion)

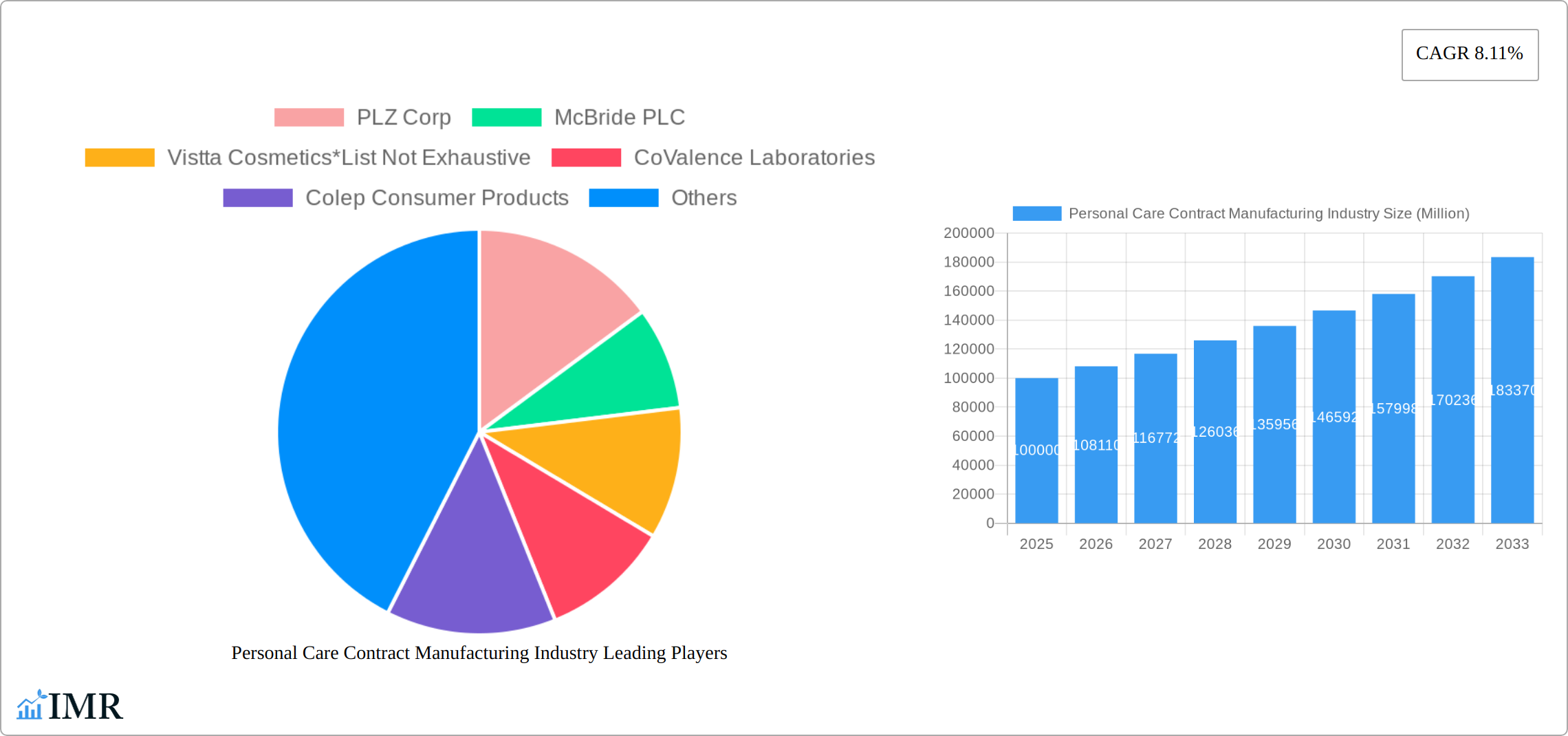

Despite the promising outlook, the market faces certain challenges. Competition from established players and the emergence of new entrants can put pressure on pricing and margins. Furthermore, stringent regulatory requirements regarding product safety and labeling necessitate significant investment in compliance measures for contract manufacturers. Maintaining consistent quality and managing supply chain complexities, especially given potential global disruptions, are also key considerations. The industry's success hinges on continuous innovation, the adoption of advanced manufacturing technologies, and a strategic focus on sustainability to meet the evolving demands of the personal care market. The leading players in this dynamic market include PLZ Corp, McBride PLC, Vistta Cosmetics, CoValence Laboratories, Colep Consumer Products, ALBEA SA, Fareva Group, Powerpack Cosmetics, Intercos SPA, Voyant Beauty, Hair Styling Applications SpA, FORMULA CORP, Clarion Cosmetics, and HCT Group, among others. Their success is largely dependent on their ability to adapt to changing consumer preferences, technological advancements, and regulatory environments.

Personal Care Contract Manufacturing Industry Company Market Share

Personal Care Contract Manufacturing Industry: A Comprehensive Market Report (2019-2033)

This comprehensive report delivers an in-depth analysis of the Personal Care Contract Manufacturing industry, encompassing market dynamics, growth trends, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report provides crucial insights for industry professionals, investors, and strategists. The report segments the market by service type (R&D and Formulation, Manufacturing, Packaging & Allied Services) and product type (Skin care, Hair care, Make-up & Cosmetics, Other Product Types), providing granular data for informed decision-making. The total market size is projected to reach xx Million units by 2033.

Personal Care Contract Manufacturing Industry Market Dynamics & Structure

The personal care contract manufacturing market is characterized by moderate concentration, with several large players and numerous smaller niche operators. Technological innovation, particularly in sustainable and eco-friendly manufacturing processes, is a key driver. Stringent regulatory frameworks regarding ingredients and safety standards significantly influence operations. Competitive pressures from private label brands and increasing consumer demand for natural and organic products necessitate continuous innovation. Mergers and acquisitions (M&A) activity is relatively high, indicating consolidation and expansion within the industry.

- Market Concentration: Moderately concentrated, with top 10 players holding approximately xx% market share in 2024.

- Technological Innovation: Focus on sustainable packaging, automation, and AI-driven formulation optimization.

- Regulatory Framework: Stringent regulations on ingredient safety and labeling, varying by region.

- Competitive Substitutes: Private label brands, direct-to-consumer brands leveraging agile manufacturing.

- End-User Demographics: Growing demand from millennials and Gen Z for personalized and ethically sourced products.

- M&A Trends: Significant M&A activity in recent years, driven by expansion into new markets and product categories (xx deals in 2024).

Personal Care Contract Manufacturing Industry Growth Trends & Insights

The personal care contract manufacturing market is experiencing a period of dynamic expansion, propelled by an escalating consumer desire for bespoke, specialized, and ethically produced beauty and wellness products. This robust growth trajectory saw a Compound Annual Growth Rate (CAGR) of approximately [Insert specific CAGR, e.g., 7.5%] during the historical period (2019-2024) and is forecasted to sustain a CAGR of around [Insert specific CAGR, e.g., 8.2%] through the forecast period (2025-2033). A significant catalyst for this surge is the increasing reliance on contract manufacturing services by emerging and smaller brands, who benefit from cost-efficiencies and adaptable scalability. Furthermore, technological innovations, including advanced automation, AI-driven formulation development, and sophisticated manufacturing techniques, are actively accelerating market development. The evolving consumer ethos, prioritizing natural, organic, cruelty-free, and sustainable product choices, presents both significant opportunities for differentiation and challenges requiring agile adaptation in manufacturing processes and product portfolios. Market penetration of contract manufacturing services is projected to climb from an estimated [Insert specific percentage, e.g., 45%] in 2024 to over [Insert specific percentage, e.g., 60%] by 2033, largely attributed to the burgeoning e-commerce landscape and the continued rise of niche and direct-to-consumer brands.

Dominant Regions, Countries, or Segments in Personal Care Contract Manufacturing Industry

Currently, North America and Europe stand as the leading continents in the personal care contract manufacturing market. This dominance is underpinned by substantial consumer spending, sophisticated industrial infrastructure, and a well-established network of prominent contract manufacturers. However, the Asia-Pacific region is rapidly emerging as a key growth engine, driven by burgeoning disposable incomes, a growing middle class, and the increasing global adoption of Western beauty and wellness standards. Within the service segmentation, the 'Manufacturing' segment commands the largest market share, closely followed by 'Packaging & Allied Services'. In terms of product categories, 'Skincare' and 'Makeup & Cosmetics' continue to be the dominant segments, reflecting persistent high consumer demand.

- North America: Characterized by a stringent regulatory framework, high per capita consumer expenditure on beauty and personal care, and a highly developed manufacturing infrastructure.

- Europe: A mature market with a strong emphasis on premium ingredients, ethical sourcing, stringent sustainability mandates, and innovative product development.

- Asia-Pacific: The fastest-growing region globally, propelled by significant increases in disposable income, a rapidly expanding consumer base, and an increasing appetite for diverse personal care products.

- By Service Type: The 'Manufacturing' segment is the largest, offering end-to-end production capabilities, with 'Packaging & Allied Services' as a critical supporting segment.

- By Product Type: 'Skincare' and 'Makeup & Cosmetics' are leading segments due to their consistent high demand and rapid innovation cycles.

Personal Care Contract Manufacturing Industry Product Landscape

The personal care contract manufacturing industry encompasses an expansive and ever-evolving product portfolio, meticulously designed to address a wide spectrum of skin, hair, and body care needs. Innovation is heavily concentrated on developing formulations that are increasingly natural, organic, and ethically sourced, alongside the creation of highly personalized and customized product offerings. Sustainable packaging solutions are also a paramount focus. Cutting-edge technologies such as micro-encapsulation, advanced nanotechnology, and bio-fermentation are being leveraged to significantly enhance product efficacy, sensory experience, and performance. Key unique selling propositions that resonate with today's discerning consumers include verifiable eco-friendly certifications, deeply personalized formulation options tailored to individual needs, and complete transparency and traceability of all raw ingredients, appealing to a growing cohort of environmentally and socially conscious buyers.

Key Drivers, Barriers & Challenges in Personal Care Contract Manufacturing Industry

Key Drivers:

- A sustained and growing consumer demand for personalized, customizable, and highly effective beauty and personal care products.

- The exponential growth of e-commerce platforms and the direct-to-consumer (DTC) brand model, creating new avenues for product launch and distribution.

- The increasing global imperative for and adoption of sustainable, eco-friendly, and ethical manufacturing and sourcing practices.

- Rapid advancements and widespread integration of new technologies in product formulation, R&D, manufacturing, and innovative packaging solutions.

Key Challenges:

- Intense market competition and significant price pressures arising from both established large-scale manufacturers and agile, smaller niche players.

- Navigating complex and often diverging regulatory compliance requirements across different international markets, alongside the challenges of ethical and consistent ingredient sourcing.

- Susceptibility to supply chain disruptions and inherent volatility in raw material costs, which can significantly impact profit margins, estimated to have affected margins by approximately [Insert specific percentage, e.g., 10%] in 2024.

- The critical and ongoing challenge of maintaining stringent quality control and ensuring absolute consistency across a broad and diverse range of product lines and formulations.

Emerging Opportunities in Personal Care Contract Manufacturing Industry

- Growth of the clean beauty and sustainable beauty segments.

- Increasing demand for personalized products tailored to individual needs.

- Expansion into untapped markets, particularly in developing economies.

- Development of innovative packaging solutions for sustainability and convenience.

- Leveraging AI and machine learning for formulation optimization and process improvement.

Growth Accelerators in the Personal Care Contract Manufacturing Industry

Significant growth in the personal care contract manufacturing sector is being propelled by several key factors. Technological advancements in formulation science and manufacturing processes are enabling greater efficiency and product innovation. Strategic partnerships and collaborations are proving vital for expanding market reach and gaining access to novel technologies and intellectual property. Furthermore, a focused expansion into high-growth segments such as 'clean beauty,' 'vegan formulations,' and 'personalized wellness' is capturing significant market attention. The emphasis on sustainable and ethical sourcing practices is no longer just a trend but a fundamental requirement for attracting environmentally and socially conscious consumers, thereby enhancing the overall market appeal and long-term viability of contract manufacturing services.

Key Players Shaping the Personal Care Contract Manufacturing Market

- PLZ Corp

- McBride PLC

- Vistta Cosmetics

- CoValence Laboratories

- Colep Consumer Products

- ALBEA SA

- Fareva Group

- Powerpack Cosmetics

- Intercos SPA

- Voyant Beauty

- Hair Styling Applications SpA

- FORMULA CORP

- Clarion Cosmetics

- HCT Group

Notable Milestones in Personal Care Contract Manufacturing Industry Sector

- April 2023: TruArcPartners invests in Trademark Cosmetics (TCI), signaling increased M&A activity and focus on organic growth in the sector.

- February 2023: BASF highlights its commitment to sustainable and healthy beauty solutions at PCHi, showcasing innovations like Postbiolift and Phytocine.

In-Depth Personal Care Contract Manufacturing Industry Market Outlook

The future of the personal care contract manufacturing industry looks bright, with sustained growth driven by the aforementioned factors. Strategic partnerships, technological innovation, and a focus on sustainability will be crucial for success. The market's potential is vast, particularly in emerging economies and specialized niche segments. Companies that can adapt to evolving consumer preferences and regulatory landscapes will thrive in this dynamic market.

Personal Care Contract Manufacturing Industry Segmentation

-

1. Service Type

- 1.1. R&D & Formulation

- 1.2. Manufacturing

- 1.3. Packaging & Allied Services

-

2. Product Type

- 2.1. Skin Care

- 2.2. Hair Care

- 2.3. Make-up & Cosmetics

- 2.4. Other Product Types

Personal Care Contract Manufacturing Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. United Kingdom

- 2.2. France

- 2.3. Italy

-

3. Asia

- 3.1. China

- 3.2. India

- 3.3. Japan

- 3.4. South Korea

- 4. Australia and New Zealand

- 5. Rest of the World

Personal Care Contract Manufacturing Industry Regional Market Share

Geographic Coverage of Personal Care Contract Manufacturing Industry

Personal Care Contract Manufacturing Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.11% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Evolution of Service Offerings has Enabled Organizations to Increasingly Rely on Contract Manufacturers for their Production Needs While they Focus on R&D and Promotion; Localization of Contract Manufacturing in Personal Care Helps in Gaining Lead Time & Cost Advantages

- 3.3. Market Restrains

- 3.3.1. Stringent Government Rules and Regulations

- 3.4. Market Trends

- 3.4.1. Skin Care Segment to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 5.1.1. R&D & Formulation

- 5.1.2. Manufacturing

- 5.1.3. Packaging & Allied Services

- 5.2. Market Analysis, Insights and Forecast - by Product Type

- 5.2.1. Skin Care

- 5.2.2. Hair Care

- 5.2.3. Make-up & Cosmetics

- 5.2.4. Other Product Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Service Type

- 6. North America Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 6.1.1. R&D & Formulation

- 6.1.2. Manufacturing

- 6.1.3. Packaging & Allied Services

- 6.2. Market Analysis, Insights and Forecast - by Product Type

- 6.2.1. Skin Care

- 6.2.2. Hair Care

- 6.2.3. Make-up & Cosmetics

- 6.2.4. Other Product Types

- 6.1. Market Analysis, Insights and Forecast - by Service Type

- 7. Europe Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 7.1.1. R&D & Formulation

- 7.1.2. Manufacturing

- 7.1.3. Packaging & Allied Services

- 7.2. Market Analysis, Insights and Forecast - by Product Type

- 7.2.1. Skin Care

- 7.2.2. Hair Care

- 7.2.3. Make-up & Cosmetics

- 7.2.4. Other Product Types

- 7.1. Market Analysis, Insights and Forecast - by Service Type

- 8. Asia Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 8.1.1. R&D & Formulation

- 8.1.2. Manufacturing

- 8.1.3. Packaging & Allied Services

- 8.2. Market Analysis, Insights and Forecast - by Product Type

- 8.2.1. Skin Care

- 8.2.2. Hair Care

- 8.2.3. Make-up & Cosmetics

- 8.2.4. Other Product Types

- 8.1. Market Analysis, Insights and Forecast - by Service Type

- 9. Australia and New Zealand Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 9.1.1. R&D & Formulation

- 9.1.2. Manufacturing

- 9.1.3. Packaging & Allied Services

- 9.2. Market Analysis, Insights and Forecast - by Product Type

- 9.2.1. Skin Care

- 9.2.2. Hair Care

- 9.2.3. Make-up & Cosmetics

- 9.2.4. Other Product Types

- 9.1. Market Analysis, Insights and Forecast - by Service Type

- 10. Rest of the World Personal Care Contract Manufacturing Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 10.1.1. R&D & Formulation

- 10.1.2. Manufacturing

- 10.1.3. Packaging & Allied Services

- 10.2. Market Analysis, Insights and Forecast - by Product Type

- 10.2.1. Skin Care

- 10.2.2. Hair Care

- 10.2.3. Make-up & Cosmetics

- 10.2.4. Other Product Types

- 10.1. Market Analysis, Insights and Forecast - by Service Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 PLZ Corp

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 McBride PLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vistta Cosmetics*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 CoValence Laboratories

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Colep Consumer Products

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 ALBEA SA

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Fareva Group

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Powerpack Cosmetics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Intercos SPA

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Voyant Beauty

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Hair Styling Applications SpA

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 FORMULA CORP

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Clarion Cosmetics

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 HCT Group

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 PLZ Corp

List of Figures

- Figure 1: Global Personal Care Contract Manufacturing Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 3: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 4: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 5: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 9: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 10: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 11: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 15: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 16: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 17: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: Asia Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 21: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 22: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 23: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Service Type 2025 & 2033

- Figure 27: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Service Type 2025 & 2033

- Figure 28: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Product Type 2025 & 2033

- Figure 29: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Rest of the World Personal Care Contract Manufacturing Industry Revenue (Million), by Country 2025 & 2033

- Figure 31: Rest of the World Personal Care Contract Manufacturing Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 2: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 3: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 5: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 6: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 10: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 11: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: United Kingdom Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: France Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Italy Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 16: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 17: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 18: China Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: India Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Japan Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: South Korea Personal Care Contract Manufacturing Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 23: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 24: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 26: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 27: Global Personal Care Contract Manufacturing Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Personal Care Contract Manufacturing Industry?

The projected CAGR is approximately 8.11%.

2. Which companies are prominent players in the Personal Care Contract Manufacturing Industry?

Key companies in the market include PLZ Corp, McBride PLC, Vistta Cosmetics*List Not Exhaustive, CoValence Laboratories, Colep Consumer Products, ALBEA SA, Fareva Group, Powerpack Cosmetics, Intercos SPA, Voyant Beauty, Hair Styling Applications SpA, FORMULA CORP, Clarion Cosmetics, HCT Group.

3. What are the main segments of the Personal Care Contract Manufacturing Industry?

The market segments include Service Type, Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX Million as of 2022.

5. What are some drivers contributing to market growth?

Evolution of Service Offerings has Enabled Organizations to Increasingly Rely on Contract Manufacturers for their Production Needs While they Focus on R&D and Promotion; Localization of Contract Manufacturing in Personal Care Helps in Gaining Lead Time & Cost Advantages.

6. What are the notable trends driving market growth?

Skin Care Segment to Dominate the Market.

7. Are there any restraints impacting market growth?

Stringent Government Rules and Regulations.

8. Can you provide examples of recent developments in the market?

April 2023: TruArcPartners, a private equity fund, invested in Trademark Cosmetics (TCI) to pursue continuous expansion and support brand partner success through organic initiatives and strategic mergers and acquisitions (M&A). TCI's formulation and production capabilities and strong customer-service focus proved important in its growth and will be the primary driver for future progress and expansion.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Personal Care Contract Manufacturing Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Personal Care Contract Manufacturing Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Personal Care Contract Manufacturing Industry?

To stay informed about further developments, trends, and reports in the Personal Care Contract Manufacturing Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence