Key Insights

The Polish Point-of-Sale (POS) terminal market is projected for significant growth, driven by economic expansion and increasing demand for efficient transaction processing. With a projected market size of $210.15 billion and a Compound Annual Growth Rate (CAGR) of 12.5% from 2025 (base year) to 2033, the market is set for substantial expansion. This growth is primarily fueled by the modernization of retail and hospitality sectors, adopting advanced POS systems for operational efficiency, enhanced customer experiences, and effective inventory management. The healthcare sector's adoption of digital payment solutions also contributes to this positive trend. The increasing adoption of mobile and portable POS systems offers flexibility, allowing businesses to accept payments anywhere, benefiting small and medium-sized enterprises (SMEs) in a digital economy.

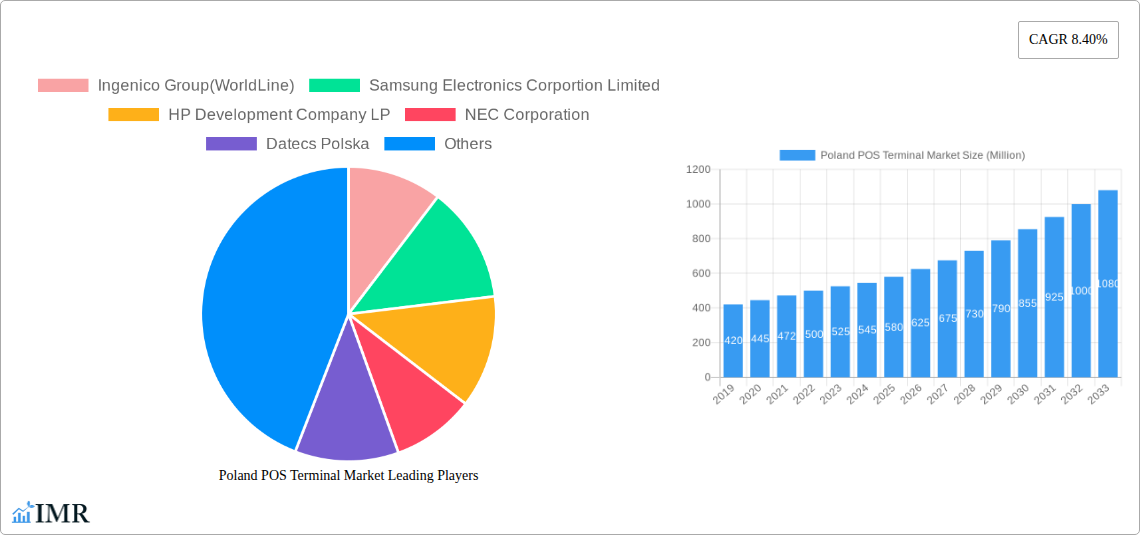

Poland POS Terminal Market Market Size (In Billion)

Potential challenges include the initial investment cost of advanced POS systems and the ongoing need for robust cybersecurity measures. However, continuous innovation in POS technology, including cloud-based solutions and enhanced security features, is expected to address these concerns. Leading companies are investing in research and development to introduce sophisticated and user-friendly POS terminals tailored to the Polish market's needs. While fixed POS systems currently dominate, mobile solutions are gaining traction, indicating a dynamic market evolution. The Polish market is anticipated to perform strongly, mirroring broader European trends in digital payment adoption.

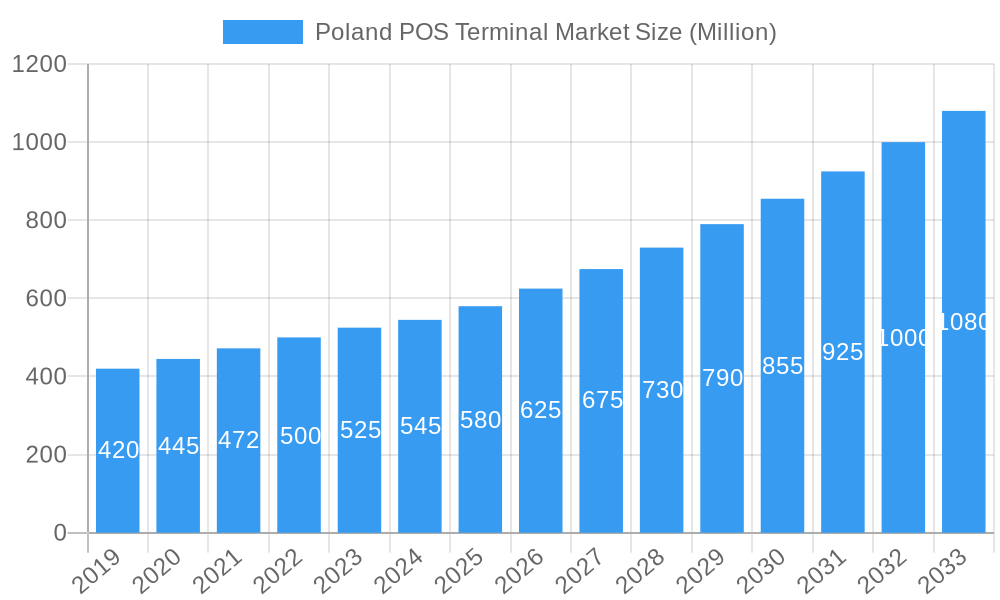

Poland POS Terminal Market Company Market Share

Poland POS Terminal Market: Comprehensive Growth & Technology Outlook (2019-2033)

This in-depth report provides a definitive analysis of the Poland Point-of-Sale (POS) Terminal Market, meticulously examining its evolution, current landscape, and future trajectory from 2019 to 2033. With a base year of 2025 and a forecast period spanning 2025-2033, this report leverages extensive data to deliver actionable insights for stakeholders seeking to capitalize on the dynamic Polish payments ecosystem. We delve into market concentration, technological innovations, regulatory influences, and the competitive dynamics shaping the future of POS solutions in Poland. This report covers parent and child market segments, offering a holistic view of market penetration, adoption rates, and technological disruptions, all presented with values in Million units for clarity.

Poland POS Terminal Market Market Dynamics & Structure

The Poland POS Terminal Market is characterized by a moderate level of market concentration, with a few key players holding significant market share, yet with a growing presence of specialized and emerging vendors. Technological innovation is a primary driver, fueled by the increasing demand for seamless, secure, and mobile payment solutions. Regulatory frameworks, particularly those aligned with EU directives on payment security and data privacy, play a crucial role in dictating product development and market entry strategies. Competitive product substitutes, such as QR code payment systems and payment links, are increasingly influencing the demand for traditional POS terminals, pushing vendors to innovate in areas like contactless payments and integrated software solutions. End-user demographics are shifting towards a younger, digitally-savvy population that expects ubiquitous payment acceptance. Mergers and acquisitions (M&A) trends are present, albeit at a moderate pace, as larger entities seek to consolidate their market position or acquire innovative technologies.

- Market Concentration: Leading players account for approximately 60-70% of the market share, with the remaining percentage distributed among smaller, regional, and niche providers.

- Technological Innovation Drivers: Increasing adoption of contactless payments, the rise of SoftPOS solutions, and the demand for integrated inventory and CRM functionalities within POS systems.

- Regulatory Frameworks: Adherence to PCI DSS standards, PSD2 compliance, and evolving data protection regulations.

- Competitive Product Substitutes: Growing adoption of mobile payment apps, e-wallets, and QR code-based payment solutions, impacting the traditional hardware-centric POS model.

- End-User Demographics: Younger consumers exhibit a preference for faster, contactless transactions, driving demand for advanced POS features.

- M&A Trends: Limited major M&A activity reported in the historical period, indicating a focus on organic growth and strategic partnerships.

Poland POS Terminal Market Growth Trends & Insights

The Poland POS Terminal Market is poised for robust growth, driven by accelerating digital transformation and evolving consumer payment preferences. From its historical period (2019-2024), the market has witnessed steady adoption of both fixed and mobile POS systems, a trend projected to continue and intensify throughout the forecast period (2025-2033). The market size evolution is marked by a consistent upward trajectory, reflecting increasing business investment in modern payment infrastructure and a growing consumer base accustomed to diverse payment methods. Key to this growth is the increasing adoption rate of EMV-compliant and contactless payment terminals, moving away from older magnetic stripe technology. Technological disruptions, such as the proliferation of SoftPOS solutions that enable payment acceptance directly on smartphones, are redefining the market landscape. Consumer behavior shifts are paramount, with an escalating preference for convenience, speed, and security in transactions, pushing merchants to adopt POS systems that facilitate these expectations. The penetration of POS terminals across various business sizes, from small SMEs to large enterprises, is expanding, signifying a maturing market.

The market size for POS terminals in Poland, estimated at approximately 1.5 Million units in 2025, is projected to experience a Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period. This expansion is fueled by a diverse range of factors, including government initiatives promoting cashless economies, the influx of new businesses, and the continuous replacement cycle of older, less sophisticated POS devices. The adoption of mobile POS systems, in particular, is set to outpace fixed systems due to their flexibility and lower initial investment, especially appealing to a growing number of micro and small businesses. The increasing use of tablets and smartphones as payment acceptance devices, facilitated by SoftPOS technology, represents a significant disruptive force. This trend is not only reducing hardware costs for merchants but also enhancing customer experience through faster checkout processes. Furthermore, the integration of POS systems with business management software, loyalty programs, and e-commerce platforms is becoming a standard expectation, driving demand for more advanced and feature-rich solutions. The "Others" end-user segment, encompassing sectors like transportation and service providers, is also showing promising growth as they increasingly adopt digital payment solutions to cater to customer convenience. The retail and hospitality sectors, traditional stalwarts of POS terminal usage, will continue to be significant contributors to market growth, driven by ongoing modernization efforts and the expansion of online and omnichannel retail models. The healthcare sector's adoption, while historically slower, is also accelerating, particularly with the rise of telemedicine and direct patient payment options. The strategic implementation of cloud-based POS solutions is further accelerating market growth by offering scalability, accessibility, and advanced analytics to businesses of all sizes.

Dominant Regions, Countries, or Segments in Poland POS Terminal Market

The Retail end-user industry segment stands as the dominant force driving growth within the Poland POS Terminal Market. This dominance is underpinned by several factors, including the sheer volume of transactions, the continuous expansion of both brick-and-mortar stores and e-commerce operations, and the inherent need for efficient checkout processes. The retail sector encompasses a vast array of businesses, from large hypermarkets and department stores to independent boutiques and specialized shops, all requiring reliable POS solutions to manage sales, inventory, and customer data. The Polish retail landscape is characterized by increasing consumer spending and a growing demand for modern shopping experiences, which directly translates into a higher demand for advanced POS hardware and software.

- Retail Segment Dominance:

- Market Share: Retail accounts for an estimated 45-50% of the total POS terminal market in Poland.

- Key Drivers: High transaction volume, extensive network of physical stores, growth of e-commerce and omnichannel retail strategies, and increasing consumer expectation for seamless payment experiences.

- Sub-segments: Supermarkets, hypermarkets, convenience stores, fashion apparel, electronics stores, and specialty retailers all contribute significantly.

- Technological Adoption: Early adopters of contactless payments, mobile POS, and integrated loyalty programs.

The Hospitality sector represents another significant segment, characterized by its high transaction frequency and the need for mobile payment solutions, particularly in restaurants, cafes, and hotels. The ongoing recovery and growth in tourism and entertainment industries are further bolstering demand for POS systems that can handle table-side ordering, split billing, and contactless payments.

- Hospitality Segment Contribution:

- Market Share: Approximately 25-30% of the market.

- Key Drivers: High volume of small-value transactions, demand for speed and convenience, increasing adoption of tablets for order taking, and the need for integrated kitchen display systems.

- Sub-segments: Restaurants, cafes, bars, hotels, and catering services.

Fixed Point-of-sale Systems continue to hold a substantial share due to their robustness and comprehensive features, particularly in larger retail and hospitality establishments. However, Mobile/Portable Point-of-sale Systems are experiencing more rapid growth due to their flexibility, lower cost of entry, and suitability for smaller businesses, mobile vendors, and businesses with dispersed operations. This growth is directly linked to the rise of SoftPOS and the increasing use of smartphones and tablets as payment terminals.

- Type Segment Dynamics:

- Fixed POS Systems: Remain strong in established retail and large hospitality venues, offering stability and advanced functionalities. Estimated market share of 55-60%.

- Mobile/Portable POS Systems: Exhibit higher growth rates due to cost-effectiveness, flexibility, and the surge in micro-businesses and on-the-go payment needs. Estimated market share of 40-45% and growing.

The Healthcare sector, while smaller in terms of current market share (estimated at 5-10%), is demonstrating significant growth potential. The increasing adoption of digital health services, patient portals, and the need for efficient payment processing for medical services and prescriptions are driving this trend. The "Others" segment, encompassing transportation, government services, and utilities, is also contributing to market diversification and growth as these sectors embrace digital payment solutions.

Poland POS Terminal Market Product Landscape

The Poland POS Terminal Market product landscape is characterized by a rapid evolution towards integrated, intelligent, and user-friendly solutions. Innovations are primarily focused on enhancing transaction security, speeding up payment processes, and providing valuable business insights. Key product developments include advanced EMV chip readers, robust contactless payment capabilities, and the increasing integration of software functionalities such as inventory management, customer relationship management (CRM), and sales analytics directly within the POS terminal. The rise of SoftPOS technology, enabling payment acceptance on standard smartphones and tablets, is a significant innovation, lowering barriers to entry for small businesses. Furthermore, vendors are emphasizing aesthetically pleasing designs and compact form factors for mobile POS devices, catering to the aesthetic demands of modern businesses. Performance metrics are increasingly being evaluated based on transaction speed, uptime reliability, security certifications, and the ease of software updates and integration with third-party applications.

Key Drivers, Barriers & Challenges in Poland POS Terminal Market

The Poland POS Terminal Market is propelled by several key drivers: the increasing adoption of cashless payments, fueled by consumer preference and government initiatives; the continuous need for merchants to upgrade to more secure and feature-rich EMV and contactless-enabled terminals; the rapid growth of e-commerce and omnichannel retail strategies necessitating integrated payment solutions; and the expanding presence of small and medium-sized enterprises (SMEs) seeking affordable and flexible POS options. Technological advancements, particularly in mobile payments and SoftPOS, are also significant growth catalysts.

Key barriers and challenges include the initial investment cost for some advanced POS systems, particularly for micro and very small businesses; the complexity of integrating new POS systems with existing legacy IT infrastructure; evolving data security and privacy regulations requiring continuous compliance updates; and the competitive pressure from alternative payment methods like mobile wallets and QR codes, which can sometimes be perceived as simpler or cheaper by certain merchant segments. Supply chain disruptions can also pose challenges in ensuring timely delivery of hardware.

Emerging Opportunities in Poland POS Terminal Market

Emerging opportunities in the Poland POS Terminal Market lie in the continued expansion of SoftPOS solutions, catering to an even broader range of SMEs and mobile service providers. The burgeoning e-health sector presents a significant opportunity for specialized POS terminals capable of handling patient payments and integrating with healthcare management systems. Furthermore, the growing demand for unified commerce solutions, where online and offline sales channels are seamlessly integrated, opens doors for POS systems that offer robust inventory synchronization, order management, and customer data aggregation. Untapped markets within the transportation and logistics sectors, and the increasing adoption of digital payments in public services, also represent promising avenues for growth.

Growth Accelerators in the Poland POS Terminal Market Industry

Several catalysts are accelerating long-term growth in the Poland POS Terminal Market. The ongoing push towards a cashless society, supported by financial institutions and government policies, is a primary accelerator. Strategic partnerships between POS hardware manufacturers, software developers, and payment processors are crucial for developing comprehensive and innovative solutions. Market expansion strategies by key players, focusing on underserved segments and regions within Poland, are also driving growth. The continuous innovation in payment technologies, such as tokenization and biometrics, will further enhance security and user experience, encouraging wider adoption. The increasing demand for data analytics and business intelligence derived from POS transactions is also a significant growth accelerator, as businesses seek to leverage this data for more informed decision-making.

Key Players Shaping the Poland POS Terminal Market Market

- Ingenico Group (WorldLine)

- Samsung Electronics Corportion Limited

- HP Development Company LP

- NEC Corporation

- Datecs Polska

- Spire Corp

- Newland Europe BV

- Verifone Payments BV

- PAX Technology

- Panasonic Corporation

Notable Milestones in Poland POS Terminal Market Sector

- April 2022 - Glory announced the opening of a direct sales office in Warsaw as part of its ongoing growth. Glory Global Solutions (Poland) LLC will benefit from market expansion in Poland, particularly in the retail industry. Glory's tried-and-true point of sale and back office hardware and software solutions help merchants run more efficiently while enhancing the shopping experience for Polish customers in all retail segments.

- April 2022 - Credit Agricole in Poland has adopted the advanced SoftPos contactless payment acceptance system. The Polish fintech business SoftPos.EU and Elavon, a player in the payments industry, are responsible for the solution. Customers of Credit Agricole have access to a mobile application for taking payments. Customers can make contactless payments for services without using extra equipment like a payment terminal or PIN pad by installing the Elavon SoftPos application on Android 8.0 or later.

In-Depth Poland POS Terminal Market Market Outlook

The Poland POS Terminal Market is set for sustained and robust growth, driven by a confluence of technological advancements, evolving consumer habits, and supportive economic policies. The ongoing digital transformation across all business sectors, from retail and hospitality to healthcare and beyond, will continue to fuel the demand for modern POS solutions. The increasing penetration of mobile POS and SoftPOS technologies offers significant opportunities for market expansion, particularly among SMEs. Strategic investments in cloud-based POS systems, enhanced security features, and integrated business management functionalities will be pivotal for market players. The outlook suggests a market that will increasingly favor flexible, scalable, and data-rich POS solutions, enabling businesses to optimize operations, enhance customer experiences, and thrive in a progressively digitalized economy.

Poland POS Terminal Market Segmentation

-

1. Type

- 1.1. Fixed Point-of-sale Systems

- 1.2. Mobile/Portable Point-of-sale Systems

-

2. End-user Industries

- 2.1. Retail

- 2.2. Hospitality

- 2.3. Healthcare

- 2.4. Others

Poland POS Terminal Market Segmentation By Geography

- 1. Poland

Poland POS Terminal Market Regional Market Share

Geographic Coverage of Poland POS Terminal Market

Poland POS Terminal Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals

- 3.3. Market Restrains

- 3.3.1. Constant Fluctuations in Raw Material Supply

- 3.4. Market Trends

- 3.4.1. Strong adoption of Mobile Point-of-Sale System is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland POS Terminal Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Fixed Point-of-sale Systems

- 5.1.2. Mobile/Portable Point-of-sale Systems

- 5.2. Market Analysis, Insights and Forecast - by End-user Industries

- 5.2.1. Retail

- 5.2.2. Hospitality

- 5.2.3. Healthcare

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Ingenico Group(WorldLine)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Samsung Electronics Corportion Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 HP Development Company LP

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 NEC Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Datecs Polska

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Spire Corp

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Newland Europe BV*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Verifone Payments BV

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 PAX Technology

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Panasonic Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ingenico Group(WorldLine)

List of Figures

- Figure 1: Poland POS Terminal Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Poland POS Terminal Market Share (%) by Company 2025

List of Tables

- Table 1: Poland POS Terminal Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Poland POS Terminal Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 3: Poland POS Terminal Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Poland POS Terminal Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Poland POS Terminal Market Revenue billion Forecast, by End-user Industries 2020 & 2033

- Table 6: Poland POS Terminal Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland POS Terminal Market?

The projected CAGR is approximately 12.5%.

2. Which companies are prominent players in the Poland POS Terminal Market?

Key companies in the market include Ingenico Group(WorldLine), Samsung Electronics Corportion Limited, HP Development Company LP, NEC Corporation, Datecs Polska, Spire Corp, Newland Europe BV*List Not Exhaustive, Verifone Payments BV, PAX Technology, Panasonic Corporation.

3. What are the main segments of the Poland POS Terminal Market?

The market segments include Type, End-user Industries.

4. Can you provide details about the market size?

The market size is estimated to be USD 210.15 billion as of 2022.

5. What are some drivers contributing to market growth?

Low Total Cost of Ownership Compared to Other Channels of Payments; Significant Rise in the Demand for Contactless and Mobile POS Terminals.

6. What are the notable trends driving market growth?

Strong adoption of Mobile Point-of-Sale System is Driving the Market Growth.

7. Are there any restraints impacting market growth?

Constant Fluctuations in Raw Material Supply.

8. Can you provide examples of recent developments in the market?

April 2022 - Glory announced the opening of a direct sales office in Warsaw as part of its ongoing growth. Glory Global Solutions (Poland) LLC will benefit from market expansion in Poland, particularly in the retail industry. Glory's tried-and-true point of sale and back office hardware and software solutions help merchants run more efficiently while enhancing the shopping experience for Polish customers in all retail segments.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland POS Terminal Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland POS Terminal Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland POS Terminal Market?

To stay informed about further developments, trends, and reports in the Poland POS Terminal Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence