Key Insights

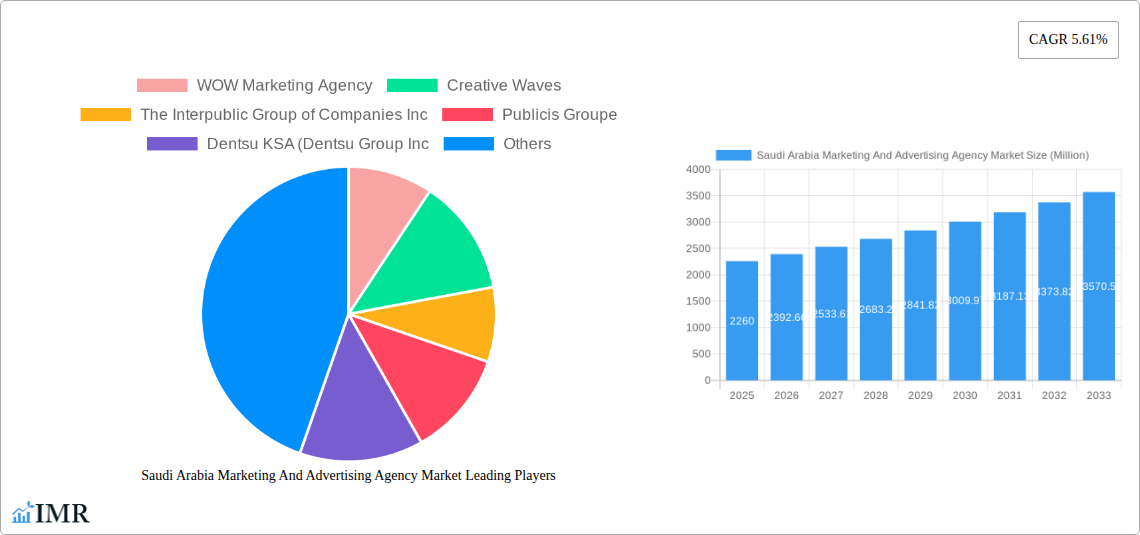

The Saudi Arabia marketing and advertising agency market is experiencing robust growth, projected to reach \$2.26 billion in 2025 and maintain a Compound Annual Growth Rate (CAGR) of 5.61% from 2025 to 2033. This expansion is driven by several key factors. The burgeoning digital landscape in Saudi Arabia, fueled by increasing internet and smartphone penetration, is creating significant opportunities for marketing agencies specializing in digital marketing, social media management, and search engine optimization (SEO). Furthermore, the Kingdom's Vision 2030 initiative, focusing on economic diversification and technological advancement, is stimulating considerable investment in marketing and advertising across various sectors. The growth is further bolstered by the rising adoption of data-driven marketing strategies and the increasing demand for sophisticated marketing solutions from large enterprises and SMEs alike across diverse sectors, including technology, healthcare, and the booming e-commerce industry. Increased government spending on promoting tourism and cultural events also contributes to market expansion. Competition is fierce, with both global giants like Publicis Groupe and Omnicom Group, and local agencies like WOW Marketing Agency vying for market share. The market segmentation across organization size, service coverage, and end-user industries reflects this dynamic environment, showcasing specific needs and opportunities across each segment.

Saudi Arabia Marketing And Advertising Agency Market Market Size (In Billion)

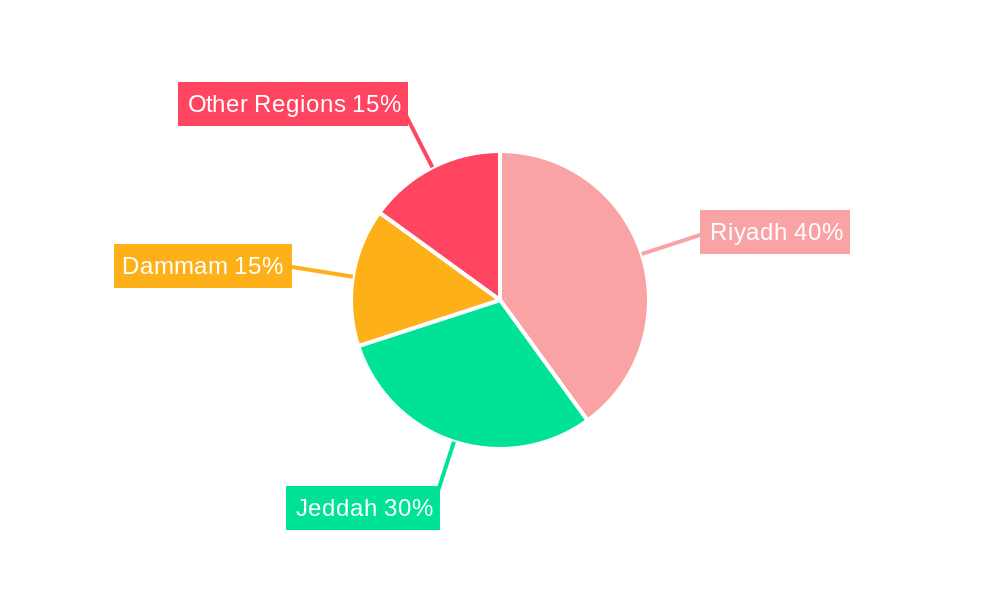

While significant growth is predicted, challenges remain. The market's sensitivity to global economic fluctuations poses a potential restraint, alongside the increasing competition among agencies. Further, effectively navigating the regulatory environment and understanding cultural nuances are crucial for successful operations within the Saudi Arabian market. However, the overall market outlook remains optimistic, indicating sustained growth driven by ongoing digital transformation and government initiatives. Specific regional variations within Saudi Arabia (Riyadh, Jeddah, Dammam, etc.) will influence the market penetration and strategy of different agencies. The continued rise of specialized agencies focusing on niche sectors like healthcare or finance will further segment the market and allow for more targeted service offerings, resulting in enhanced outcomes for clients.

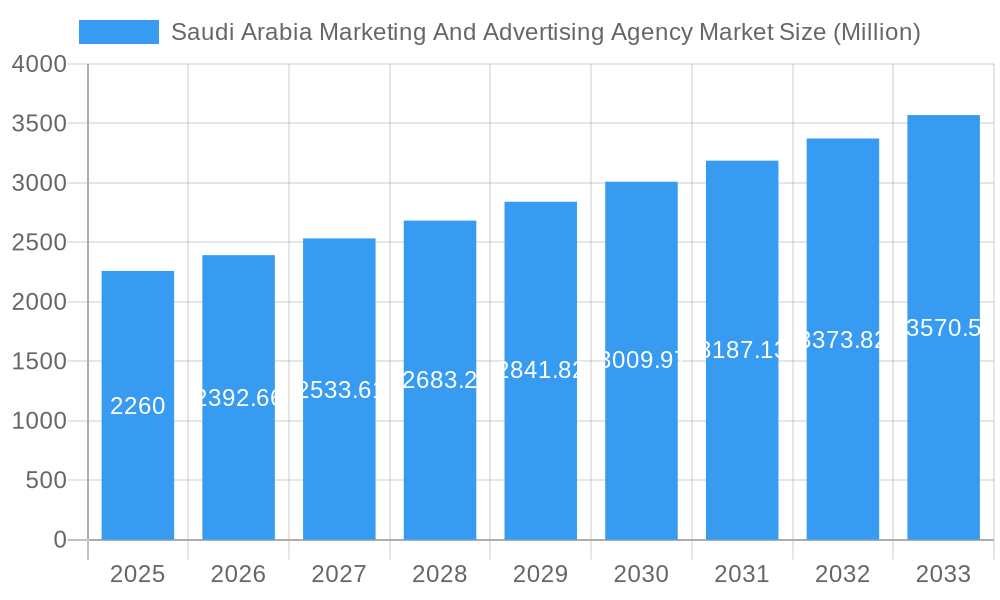

Saudi Arabia Marketing And Advertising Agency Market Company Market Share

This comprehensive report provides an in-depth analysis of the Saudi Arabia Marketing and Advertising Agency market, covering market dynamics, growth trends, dominant segments, and key players. The study period spans from 2019 to 2033, with 2025 as the base and estimated year. The report offers valuable insights for industry professionals, investors, and businesses seeking to understand and capitalize on the opportunities within this rapidly evolving market. The market is segmented by organization size (Small and Medium-sized Enterprises (SMEs), Large Enterprises), coverage (Full-service, Specialized Capabilities), region (Riyadh, Jeddah, Dammam), and end-user industry (Technology and Telecom, Healthcare, Consumer goods, Financial services, Education, Retail and e-commerce, Manufacturing, Media and Entertainment, Government, Automotive, Travel, Others).

Saudi Arabia Marketing and Advertising Agency Market Dynamics & Structure

The Saudi Arabian marketing and advertising agency market is experiencing significant transformation driven by technological advancements, evolving consumer behavior, and government initiatives. Market concentration is relatively moderate, with a mix of large multinational agencies and smaller local firms. Technological innovation, particularly in digital marketing and data analytics, is a key driver, while the regulatory framework plays a crucial role in shaping market practices. The emergence of new digital channels and technologies creates competitive substitutes for traditional advertising methods. The market's demographic shifts, notably the rise of a young and digitally savvy population, influence advertising strategies. Mergers and acquisitions (M&A) activity is moderate, with larger agencies consolidating their market share through strategic acquisitions.

- Market Concentration: Moderate, with a blend of global and local players. Large enterprises hold a larger market share (xx%) compared to SMEs (xx%).

- Technological Innovation: Digital marketing, AI, programmatic advertising, and influencer marketing are significant drivers. Barriers to innovation include access to skilled talent and technological infrastructure.

- Regulatory Framework: Government regulations impact advertising standards and data privacy, influencing market operations.

- Competitive Product Substitutes: Digital marketing channels, content marketing, and social media engagement pose competition to traditional advertising.

- End-User Demographics: The growing young and tech-savvy population fuels demand for digital marketing services.

- M&A Trends: Moderate M&A activity, driven by large agencies seeking expansion and market consolidation. The number of deals in the past five years is estimated at xx.

Saudi Arabia Marketing and Advertising Agency Market Growth Trends & Insights

The Saudi Arabia marketing and advertising agency market demonstrates robust growth, driven by increasing digital adoption, rising disposable incomes, and government investments in infrastructure and digital transformation. The market size is estimated at xx million in 2025 and is projected to reach xx million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx%. This growth is fueled by the increasing penetration of digital channels and the adoption of innovative marketing technologies. Changes in consumer behavior, including the shift towards online shopping and social media engagement, further contribute to market expansion.

- Market Size Evolution: Significant growth observed, reflecting increased advertising spending across various sectors.

- Adoption Rates: High adoption rates of digital marketing technologies are propelling market growth.

- Technological Disruptions: AI, big data analytics, and programmatic advertising are disrupting traditional marketing practices.

- Consumer Behavior Shifts: Increased reliance on digital channels for information and purchasing influences marketing strategies.

Dominant Regions, Countries, or Segments in Saudi Arabia Marketing and Advertising Agency Market

Riyadh holds the dominant position in the Saudi Arabian marketing and advertising agency market, driven by its status as the capital and the concentration of major businesses and government entities. Large enterprises represent a significant share of the market due to their higher advertising budgets and sophisticated marketing needs. The full-service segment also holds substantial market share, catering to the diverse marketing needs of various clients. Within end-user industries, Technology and Telecom, Consumer goods, and Financial Services are leading segments owing to their significant marketing investments.

- By Region: Riyadh dominates, followed by Jeddah and Dammam. Riyadh's larger market share is attributed to its concentration of businesses and government agencies (xx% market share).

- By Organization Size: Large Enterprises (xx% market share) represent a bigger share than SMEs, attributed to their higher budgets.

- By Coverage: Full-service agencies (xx% market share) cater to wider needs, dominating the Specialized Capabilities segment.

- By End-user Industry: Technology and Telecom, Consumer goods, and Financial Services sectors drive market growth due to increased advertising spends.

Saudi Arabia Marketing and Advertising Agency Market Product Landscape

The Saudi Arabian marketing and advertising agency market offers a diverse range of products and services, encompassing traditional advertising, digital marketing, content creation, public relations, and media planning. Product innovation is focused on enhancing data-driven strategies, leveraging AI and machine learning, and creating personalized customer experiences. Key performance metrics include reach, engagement, conversion rates, and return on investment (ROI). Unique selling propositions (USPs) center on specialized industry expertise, data-driven insights, creative content development, and integrated marketing solutions.

Key Drivers, Barriers & Challenges in Saudi Arabia Marketing And Advertising Agency Market

Key Drivers: The market is propelled by factors such as rising digital adoption, increasing advertising expenditure, government initiatives promoting economic diversification (Vision 2030), and the expansion of the e-commerce sector. The growth of the Saudi Arabian population and the rising middle class also contribute to this growth.

Key Challenges: Challenges include intense competition, regulatory changes, dependence on oil prices (affecting overall economic health), and the need for skilled professionals. Talent acquisition and retention are key challenges, alongside navigating a complex regulatory landscape. The digital marketing skill gap represents a challenge to market growth.

Emerging Opportunities in Saudi Arabia Marketing And Advertising Agency Market

Opportunities exist in leveraging emerging technologies such as AI, VR/AR, and the metaverse for innovative marketing campaigns. There's scope for specializing in niche markets, catering to the needs of growing sectors like e-commerce and the burgeoning Saudi entertainment industry. Developing data-driven strategies and enhancing customer experience through personalization offer substantial growth potential.

Growth Accelerators in the Saudi Arabia Marketing and Advertising Agency Market Industry

Long-term growth will be propelled by strategic partnerships between agencies and technology providers, further investments in digital infrastructure, and government support for digital transformation initiatives. The expansion of the Saudi Arabian economy and the continuous adoption of digital marketing strategies across diverse sectors will also accelerate market growth.

Key Players Shaping the Saudi Arabia Marketing and Advertising Agency Market Market

- WOW Marketing Agency

- Creative Waves

- The Interpublic Group of Companies Inc.

- Publicis Groupe

- Dentsu KSA (Dentsu Group Inc.)

- Accenture Song (Accenture PLC)

- Omnicom Group Inc.

- Havas Saudi Arabia (Vivendi)

- Extend The Ad Network

- WPP PLC

- Advertising Ways Company

Notable Milestones in Saudi Arabia Marketing and Advertising Agency Market Sector

- November 2023: iCubesWire expands into Saudi Arabia, establishing a new office in Riyadh, signaling increased investment in the region's digital advertising sector.

- October 2023: AlArabia Outdoor Advertising wins a significant project in Riyadh, showcasing the growing importance of out-of-home advertising and digital transformation in the city's infrastructure.

In-Depth Saudi Arabia Marketing and Advertising Agency Market Market Outlook

The Saudi Arabian marketing and advertising agency market is poised for sustained growth, driven by technological advancements, increasing digital adoption, and government initiatives. Strategic partnerships, focusing on data-driven solutions and customer experience enhancement, will be crucial for success. Agencies that adapt to evolving consumer behavior and effectively leverage emerging technologies will capture the significant opportunities within this dynamic market. The market’s long-term outlook is positive, with significant potential for expansion and innovation.

Saudi Arabia Marketing And Advertising Agency Market Segmentation

-

1. Organization Size

- 1.1. Small and Medium-sized Enterprises

- 1.2. Large Enterprises

-

2. Coverage

- 2.1. Full-service

- 2.2. Specialized Capabilities

-

3. End-user Industry

- 3.1. Technology and Telecom

- 3.2. Healthcare

- 3.3. Consumer goods

- 3.4. Financial services

- 3.5. Education

- 3.6. Retail and e-commerce

- 3.7. Manufacturing

- 3.8. Media and Entertainment

- 3.9. Government

- 3.10. Automotive

- 3.11. Travel

- 3.12. Others

Saudi Arabia Marketing And Advertising Agency Market Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabia Marketing And Advertising Agency Market Regional Market Share

Geographic Coverage of Saudi Arabia Marketing And Advertising Agency Market

Saudi Arabia Marketing And Advertising Agency Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.61% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increased Advertisement Spending of Organizations Leading to Outsourcing to Advertising Agency; Increased Integration of Marketing Strategies as Part of Growth Strategies

- 3.3. Market Restrains

- 3.3.1. Diminishing Profit Margins and Ongoing Changes in Macro-environment

- 3.4. Market Trends

- 3.4.1. Consumer Goods to be the Largest End-user Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabia Marketing And Advertising Agency Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 5.1.1. Small and Medium-sized Enterprises

- 5.1.2. Large Enterprises

- 5.2. Market Analysis, Insights and Forecast - by Coverage

- 5.2.1. Full-service

- 5.2.2. Specialized Capabilities

- 5.3. Market Analysis, Insights and Forecast - by End-user Industry

- 5.3.1. Technology and Telecom

- 5.3.2. Healthcare

- 5.3.3. Consumer goods

- 5.3.4. Financial services

- 5.3.5. Education

- 5.3.6. Retail and e-commerce

- 5.3.7. Manufacturing

- 5.3.8. Media and Entertainment

- 5.3.9. Government

- 5.3.10. Automotive

- 5.3.11. Travel

- 5.3.12. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Organization Size

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 WOW Marketing Agency

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Creative Waves

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 The Interpublic Group of Companies Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Publicis Groupe

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dentsu KSA (Dentsu Group Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Accenture Song (Accenture PLC)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Omnicom Group Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Havas Saudi Arabia (Vivendi)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Extend The Ad Network

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 WPP PLC

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Advertising Ways Company

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 WOW Marketing Agency

List of Figures

- Figure 1: Saudi Arabia Marketing And Advertising Agency Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabia Marketing And Advertising Agency Market Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabia Marketing And Advertising Agency Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 2: Saudi Arabia Marketing And Advertising Agency Market Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 3: Saudi Arabia Marketing And Advertising Agency Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 4: Saudi Arabia Marketing And Advertising Agency Market Volume K Unit Forecast, by Coverage 2020 & 2033

- Table 5: Saudi Arabia Marketing And Advertising Agency Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 6: Saudi Arabia Marketing And Advertising Agency Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 7: Saudi Arabia Marketing And Advertising Agency Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Saudi Arabia Marketing And Advertising Agency Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Saudi Arabia Marketing And Advertising Agency Market Revenue Million Forecast, by Organization Size 2020 & 2033

- Table 10: Saudi Arabia Marketing And Advertising Agency Market Volume K Unit Forecast, by Organization Size 2020 & 2033

- Table 11: Saudi Arabia Marketing And Advertising Agency Market Revenue Million Forecast, by Coverage 2020 & 2033

- Table 12: Saudi Arabia Marketing And Advertising Agency Market Volume K Unit Forecast, by Coverage 2020 & 2033

- Table 13: Saudi Arabia Marketing And Advertising Agency Market Revenue Million Forecast, by End-user Industry 2020 & 2033

- Table 14: Saudi Arabia Marketing And Advertising Agency Market Volume K Unit Forecast, by End-user Industry 2020 & 2033

- Table 15: Saudi Arabia Marketing And Advertising Agency Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Saudi Arabia Marketing And Advertising Agency Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabia Marketing And Advertising Agency Market?

The projected CAGR is approximately 5.61%.

2. Which companies are prominent players in the Saudi Arabia Marketing And Advertising Agency Market?

Key companies in the market include WOW Marketing Agency, Creative Waves, The Interpublic Group of Companies Inc, Publicis Groupe, Dentsu KSA (Dentsu Group Inc, Accenture Song (Accenture PLC), Omnicom Group Inc, Havas Saudi Arabia (Vivendi), Extend The Ad Network, WPP PLC, Advertising Ways Company.

3. What are the main segments of the Saudi Arabia Marketing And Advertising Agency Market?

The market segments include Organization Size, Coverage, End-user Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.26 Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Advertisement Spending of Organizations Leading to Outsourcing to Advertising Agency; Increased Integration of Marketing Strategies as Part of Growth Strategies.

6. What are the notable trends driving market growth?

Consumer Goods to be the Largest End-user Industry.

7. Are there any restraints impacting market growth?

Diminishing Profit Margins and Ongoing Changes in Macro-environment.

8. Can you provide examples of recent developments in the market?

November 2023 - iCubesWire, a leading global Ad Tech audience platform with content production studio and influencer marketing capabilities, expanded its footprint into Saudi Arabia by setting up its new office in Riyadh. The company is strategically expanding its global presence across diverse markets. iCubesWire has showcased its commitment to creating a solid foothold within the MENA region’s thriving digital advertising sector and is heavily investing in local talent. The new Riyadh office will be a hub for the company’s dynamic digital strategies, shaping influential partnerships and delivering exceptional customer experiences.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabia Marketing And Advertising Agency Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabia Marketing And Advertising Agency Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabia Marketing And Advertising Agency Market?

To stay informed about further developments, trends, and reports in the Saudi Arabia Marketing And Advertising Agency Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence