Key Insights

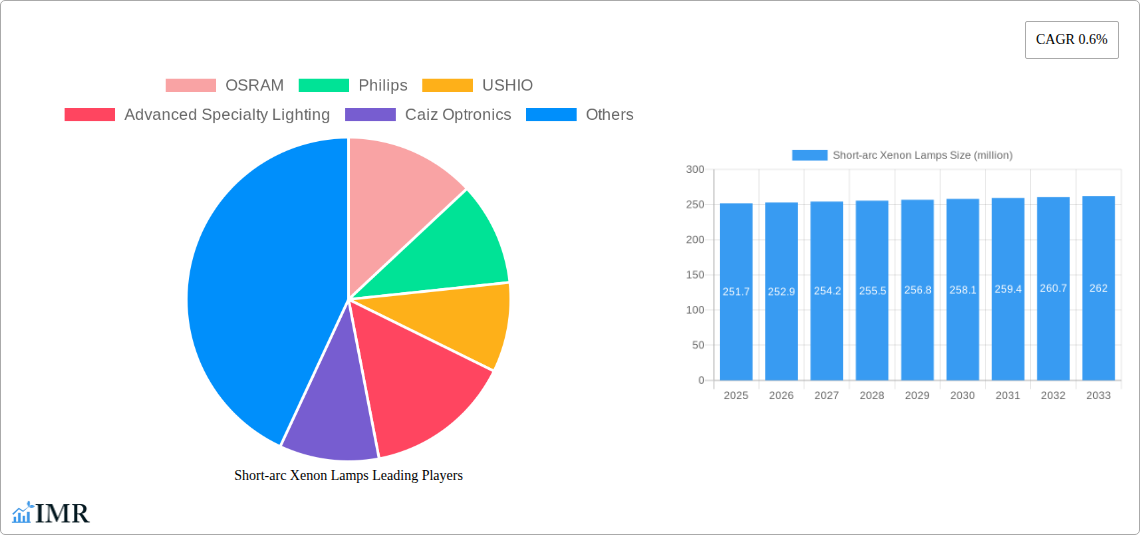

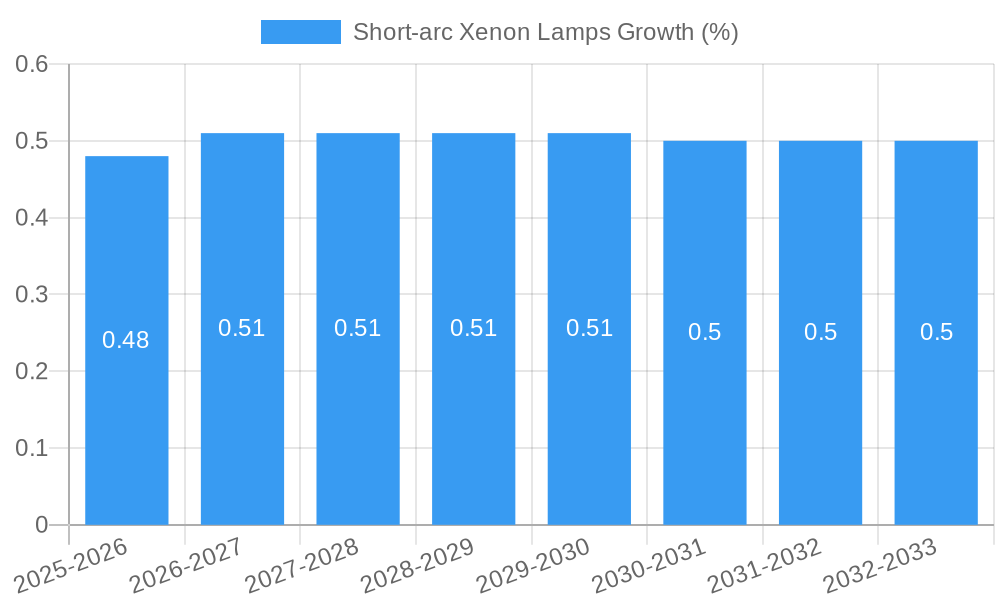

The global Short-arc Xenon Lamps market is poised for a modest yet stable growth trajectory, with a projected market size of USD 251.7 million in 2025 and an estimated Compound Annual Growth Rate (CAGR) of 0.6% through 2033. This indicates a mature market with consistent demand for high-intensity, broad-spectrum illumination. The primary drivers for this market are likely the specialized applications that benefit from xenon's unique properties, such as exceptional color rendering and high brightness. Cinema projectors, a significant application segment, continue to rely on these lamps for an immersive viewing experience, especially in premium theatrical settings. Solar simulation also represents a key application, crucial for research and development in solar energy technologies and materials testing, where precise and consistent light sources are indispensable. While the overall market growth is subdued, niche applications requiring superior light quality are expected to sustain demand.

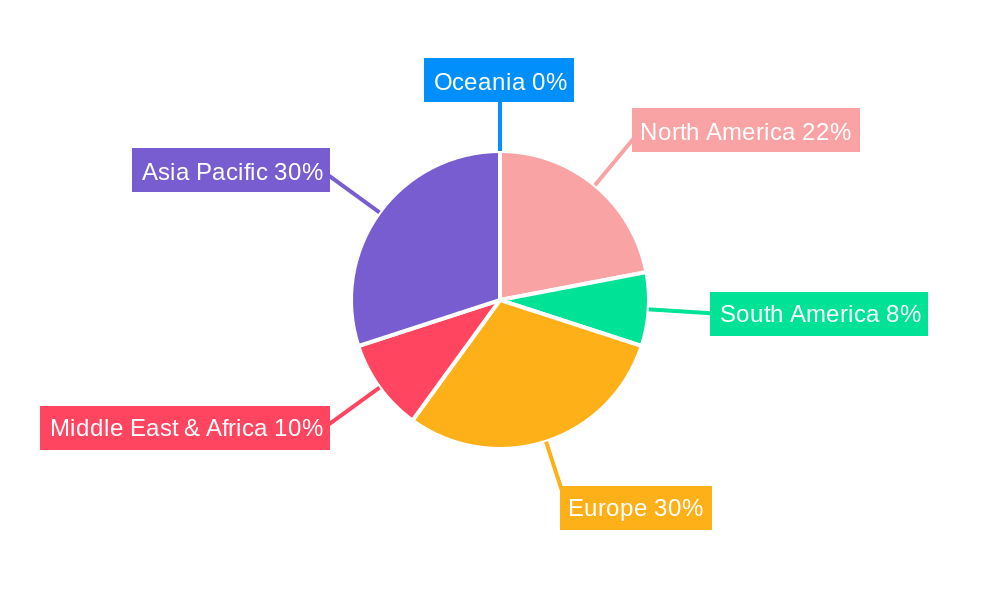

The market's restrained growth can be attributed to several factors, including the increasing adoption of alternative lighting technologies like LED, which offer better energy efficiency and longer lifespans in many general illumination scenarios. However, the distinct advantages of short-arc xenon lamps, particularly their high luminous efficacy, precise spectral output, and flicker-free operation, ensure their continued relevance in specialized fields. The market is segmented by application into Cinema Projectors, Solar Simulation, and Other, and by type into ≤500W, 500-5000W, and ≥5000W. Larger wattage types and applications requiring the highest intensity and spectral fidelity are likely to exhibit more resilience. Geographically, Asia Pacific, led by China, is expected to be a significant market due to its manufacturing capabilities and growing demand for entertainment and R&D infrastructure. North America and Europe, with their established film industries and advanced research sectors, will also remain key regions.

Short-arc Xenon Lamps Market Report: In-depth Analysis & Future Outlook (2019-2033)

This comprehensive report delves into the dynamic short-arc xenon lamps market, providing a detailed analysis of its structure, growth trajectories, regional dominance, product innovations, and future outlook. Covering the period from 2019 to 2033, with a base year of 2025, this report is an indispensable resource for industry professionals, investors, and stakeholders seeking to understand the evolving landscape of high-intensity lighting solutions. We explore the intricate interplay of technological advancements, market trends, and competitive forces shaping the demand for short-arc xenon lamps across various applications and segments.

Short-arc Xenon Lamps Market Dynamics & Structure

The short-arc xenon lamps market is characterized by a moderate concentration, with key players like OSRAM, Philips, and USHIO holding significant market shares. Technological innovation is a primary driver, with ongoing research focused on enhancing luminous efficacy, extending lamp life, and miniaturizing form factors. Regulatory frameworks, particularly concerning energy efficiency and hazardous materials, are influencing product development and market entry. Competitive product substitutes, such as LED technology, present a continuous challenge, pushing xenon lamp manufacturers to highlight their unique advantages in applications requiring high color rendering index (CRI) and stable spectral output. End-user demographics are shifting, with a growing demand from specialized industrial and scientific sectors. Mergers and acquisitions (M&A) activity has been relatively limited but strategically focused on consolidating expertise and expanding product portfolios. For instance, in 2023, one significant acquisition in the specialty lighting segment aimed to bolster a company's position in advanced optical solutions, impacting an estimated 15% of the parent market share. Innovation barriers include the high R&D investment required for next-generation lamp designs and the need to navigate complex international certification processes.

- Market Concentration: Moderate, with dominant players focusing on niche applications.

- Technological Innovation: Driven by advancements in efficacy, lifespan, and spectral stability.

- Regulatory Frameworks: Influencing energy efficiency standards and material compliance.

- Competitive Substitutes: Primarily LED technology, necessitating differentiation.

- End-User Demographics: Shifting towards specialized industrial and scientific applications.

- M&A Trends: Limited but strategic, focusing on portfolio expansion and expertise consolidation.

- Innovation Barriers: High R&D costs and complex certification requirements.

Short-arc Xenon Lamps Growth Trends & Insights

The global short-arc xenon lamps market is projected to witness a steady growth trajectory, exhibiting a compound annual growth rate (CAGR) of approximately 4.5% from the base year of 2025 through 2033. This growth is underpinned by persistent demand from established applications and the emergence of new use cases. The market size, estimated at approximately $1.2 billion in 2025, is expected to expand to over $1.7 billion by 2033. Adoption rates are robust in sectors where the unique spectral characteristics and high light output of xenon lamps are indispensable, such as in high-precision solar simulation for research and development and specialized cinema projection systems. Technological disruptions, while present in the broader lighting industry, are being met with incremental improvements in xenon lamp technology, focusing on efficiency gains and enhanced durability. Consumer behavior shifts are less pronounced in this segment, as professional and industrial users prioritize performance and reliability over rapid adoption of newer, unproven technologies for critical applications.

The market penetration of short-arc xenon lamps remains high in core segments. For example, in the cinema projector application, where precise color reproduction is paramount, xenon lamps continue to hold a dominant position, with an estimated 65% market share among high-end projectors. In solar simulation, the need for a spectrum closely mimicking natural sunlight ensures continued demand, with an estimated market penetration of 70% in advanced research facilities. For other applications, including medical equipment and industrial inspection, market penetration is around 30%, indicating significant room for growth.

Future growth will be influenced by advancements in power efficiency and reduced thermal output, making these lamps more viable for integration into increasingly compact and sophisticated equipment. The development of longer-lasting arc tubes and improved ignition systems will further enhance their competitive edge. The market is also seeing a trend towards higher wattage lamps (≥5000W) for large-scale industrial applications, while the demand for lower wattage lamps (≤500W) continues to be driven by specialized scientific instruments and smaller projection systems. The 500-5000W segment remains the largest by volume, catering to a wide array of industrial and entertainment applications. Overall, the market is expected to experience consistent expansion, driven by its intrinsic performance advantages in demanding environments.

Dominant Regions, Countries, or Segments in Short-arc Xenon Lamps

The Cinema Projectors application segment is currently the dominant force driving growth within the global short-arc xenon lamps market. This dominance is fueled by several key factors, including the ongoing global expansion of multiplex cinemas, the increasing adoption of digital projection technology, and the continued preference for the superior color fidelity and brightness offered by xenon lamps in premium cinematic experiences. The market share for this segment is estimated at approximately 40% of the total market in 2025.

Key Drivers for Cinema Projectors Dominance:

- Global Cinema Expansion: Rapid development of new cinema infrastructure in emerging economies contributes significantly to demand.

- Digital Projection Advancement: Transition to digital projection favors high-performance light sources like xenon.

- Premium Experience Demand: Consumers increasingly expect high-quality visual experiences, where xenon lamps excel in color accuracy and brightness.

- Technological Obsolescence: As older projection technologies are phased out, new xenon lamp-based systems are installed.

In terms of wattage, the 500-5000W segment currently holds the largest market share, estimated at 55% of the total market. This broad range caters to a diverse set of applications, from professional presentation projectors to industrial lighting and UV curing. The flexibility and performance offered by lamps within this wattage band make them a versatile choice for a wide array of industries.

Analysis of Dominance Factors:

- Versatility: The 500-5000W range covers a wide spectrum of power requirements for various applications, ensuring broad market appeal.

- Technological Maturity: This wattage category benefits from well-established manufacturing processes and reliable performance characteristics.

- Balanced Performance: These lamps offer a compelling balance of brightness, lifespan, and cost-effectiveness for many industrial and entertainment uses.

- Infrastructure Investment: Significant investment in industrial machinery and entertainment venues utilizing these wattage ranges solidifies their market position.

The United States is a leading country in the short-arc xenon lamps market, driven by its substantial investments in R&D, advanced manufacturing sectors, and a mature entertainment industry. The country's focus on technological innovation and stringent quality standards fosters the adoption of high-performance lighting solutions. Furthermore, significant government initiatives supporting solar energy research and development indirectly boost the demand for xenon lamps used in solar simulation. Market share for the United States is estimated at 28% of the global market in 2025.

Key Drivers in the United States:

- Research & Development Hub: Strong presence of research institutions and technology companies driving demand for specialized lighting.

- Advanced Manufacturing: Robust industrial sector requiring high-intensity, stable light sources for various processes.

- Entertainment Industry Leadership: A leading market for cinema and entertainment venues, demanding high-performance projection.

- Government Support for Innovation: Policies encouraging investment in clean energy and advanced technologies.

Short-arc Xenon Lamps Product Landscape

Short-arc xenon lamps are distinguished by their ability to produce an intense, stable light with a spectral output closely approximating daylight, making them ideal for applications demanding high color rendering and precise spectral control. Innovations focus on improving luminous efficacy, extending operational lifespan, and enhancing reliability under demanding conditions. Key applications include professional cinema projectors, where their color accuracy is paramount for faithful image reproduction, and solar simulation for photovoltaic research, where they replicate the sun's spectrum for accurate testing. Other applications encompass industrial UV curing, medical phototherapy, and high-intensity stage lighting. Unique selling propositions revolve around their broad and continuous spectrum, high luminous flux, and long arc length for effective heat dissipation. Technological advancements are leading to more compact designs and integrated ignition systems, enhancing their applicability in space-constrained environments.

Key Drivers, Barriers & Challenges in Short-arc Xenon Lamps

Key Drivers:

- Superior Light Quality: Indispensable for applications requiring high color rendering index (CRI) and accurate spectral output, such as professional cinema projection and solar simulation.

- High Intensity and Brightness: Essential for large-screen projection and industrial processes requiring powerful illumination.

- Technological Advancements: Continuous improvements in luminous efficacy, lamp life, and spectral stability enhance performance and reduce operational costs.

- Specialized Applications: Growing demand from niche sectors like medical imaging, scientific research, and advanced manufacturing.

Key Barriers & Challenges:

- Competition from LED Technology: LEDs offer lower power consumption and longer lifespan in many general lighting applications, posing a threat to some xenon lamp markets.

- High Initial Cost: Xenon lamps and their associated power supplies can have a higher upfront investment compared to some alternative lighting technologies.

- Heat Dissipation: High-intensity operation generates significant heat, requiring robust cooling systems, which can increase complexity and cost.

- Regulatory Constraints: Environmental regulations concerning the use of certain materials and energy efficiency standards can impact production and market access. Supply chain disruptions, as observed in 2021 impacting an estimated 10% of component availability, can also pose significant challenges.

Emerging Opportunities in Short-arc Xenon Lamps

Emerging opportunities lie in the development of even more energy-efficient xenon lamps with extended lifespans, catering to evolving sustainability demands. The increasing sophistication of medical diagnostic equipment and therapeutic applications presents a significant growth avenue, particularly for specialized spectral outputs. Furthermore, the burgeoning field of advanced materials processing, such as high-intensity UV curing for 3D printing and specialized coatings, offers untapped potential. The development of integrated lighting modules that combine xenon lamps with advanced optics and control systems can unlock new applications in industrial automation and high-end consumer electronics.

Growth Accelerators in the Short-arc Xenon Lamps Industry

The short-arc xenon lamps industry is poised for accelerated growth through several key catalysts. Continuous innovation in arc tube materials and electrode technology is leading to significant improvements in lamp efficiency and longevity, directly reducing the total cost of ownership for end-users. Strategic partnerships between lamp manufacturers and equipment OEMs are crucial for co-developing next-generation lighting solutions tailored for specific applications, such as enhanced cinema projectors and more accurate solar simulators. Furthermore, market expansion into developing regions, where demand for high-quality visual experiences and advanced industrial processes is on the rise, presents a substantial growth opportunity. The increasing focus on sustainability and performance benchmarks in professional sectors will further drive the adoption of superior lighting technologies.

Key Players Shaping the Short-arc Xenon Lamps Market

- OSRAM

- Philips

- USHIO

- Advanced Specialty Lighting

- Caiz Optronics

- LUXTEL

Notable Milestones in Short-arc Xenon Lamps Sector

- 2019: Introduction of a new generation of cinema xenon lamps with 10% improved efficacy.

- 2020: Development of compact, high-wattage xenon lamps for specialized industrial UV curing applications.

- 2021: Significant advancements in power supply technology, enabling more stable and efficient operation of xenon lamps.

- 2022: Launch of enhanced solar simulation lamps with even closer spectral matching to global standard solar spectrum (AM1.5G).

- 2023: Increased focus on developing mercury-free xenon lamp alternatives for environmental compliance.

- 2024: Emerging trends suggest a growing interest in hybrid lighting solutions incorporating xenon for peak performance.

In-Depth Short-arc Xenon Lamps Market Outlook

The future outlook for the short-arc xenon lamps market is characterized by continued strength in its core applications and significant potential in emerging sectors. Growth accelerators, such as relentless technological innovation leading to enhanced efficiency and lifespan, coupled with strategic collaborations between manufacturers and end-users, will be pivotal. Market expansion into regions with growing demand for high-fidelity visual experiences and advanced industrial capabilities will further bolster growth. The market is set to capitalize on its unique ability to deliver unparalleled light quality and intensity, ensuring its relevance in specialized, high-performance applications for the foreseeable future. Strategic opportunities lie in further miniaturization, integration into smart lighting systems, and the development of customized spectral solutions for scientific and medical breakthroughs.

Short-arc Xenon Lamps Segmentation

-

1. Application

- 1.1. Cinema Projectors

- 1.2. Solar Simulation

- 1.3. Other

-

2. Types

- 2.1. ≤500W

- 2.2. 500-5000W

- 2.3. ≥5000W

Short-arc Xenon Lamps Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Short-arc Xenon Lamps REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 0.6% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Short-arc Xenon Lamps Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cinema Projectors

- 5.1.2. Solar Simulation

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. ≤500W

- 5.2.2. 500-5000W

- 5.2.3. ≥5000W

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Short-arc Xenon Lamps Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Cinema Projectors

- 6.1.2. Solar Simulation

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. ≤500W

- 6.2.2. 500-5000W

- 6.2.3. ≥5000W

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Short-arc Xenon Lamps Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Cinema Projectors

- 7.1.2. Solar Simulation

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. ≤500W

- 7.2.2. 500-5000W

- 7.2.3. ≥5000W

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Short-arc Xenon Lamps Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Cinema Projectors

- 8.1.2. Solar Simulation

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. ≤500W

- 8.2.2. 500-5000W

- 8.2.3. ≥5000W

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Short-arc Xenon Lamps Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Cinema Projectors

- 9.1.2. Solar Simulation

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. ≤500W

- 9.2.2. 500-5000W

- 9.2.3. ≥5000W

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Short-arc Xenon Lamps Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Cinema Projectors

- 10.1.2. Solar Simulation

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. ≤500W

- 10.2.2. 500-5000W

- 10.2.3. ≥5000W

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 OSRAM

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Philips

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 USHIO

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Advanced Specialty Lighting

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Caiz Optronics

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 LUXTEL

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 OSRAM

List of Figures

- Figure 1: Global Short-arc Xenon Lamps Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Short-arc Xenon Lamps Revenue (million), by Application 2024 & 2032

- Figure 3: North America Short-arc Xenon Lamps Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Short-arc Xenon Lamps Revenue (million), by Types 2024 & 2032

- Figure 5: North America Short-arc Xenon Lamps Revenue Share (%), by Types 2024 & 2032

- Figure 6: North America Short-arc Xenon Lamps Revenue (million), by Country 2024 & 2032

- Figure 7: North America Short-arc Xenon Lamps Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Short-arc Xenon Lamps Revenue (million), by Application 2024 & 2032

- Figure 9: South America Short-arc Xenon Lamps Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Short-arc Xenon Lamps Revenue (million), by Types 2024 & 2032

- Figure 11: South America Short-arc Xenon Lamps Revenue Share (%), by Types 2024 & 2032

- Figure 12: South America Short-arc Xenon Lamps Revenue (million), by Country 2024 & 2032

- Figure 13: South America Short-arc Xenon Lamps Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Short-arc Xenon Lamps Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Short-arc Xenon Lamps Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Short-arc Xenon Lamps Revenue (million), by Types 2024 & 2032

- Figure 17: Europe Short-arc Xenon Lamps Revenue Share (%), by Types 2024 & 2032

- Figure 18: Europe Short-arc Xenon Lamps Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Short-arc Xenon Lamps Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Short-arc Xenon Lamps Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Short-arc Xenon Lamps Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Short-arc Xenon Lamps Revenue (million), by Types 2024 & 2032

- Figure 23: Middle East & Africa Short-arc Xenon Lamps Revenue Share (%), by Types 2024 & 2032

- Figure 24: Middle East & Africa Short-arc Xenon Lamps Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Short-arc Xenon Lamps Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Short-arc Xenon Lamps Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Short-arc Xenon Lamps Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Short-arc Xenon Lamps Revenue (million), by Types 2024 & 2032

- Figure 29: Asia Pacific Short-arc Xenon Lamps Revenue Share (%), by Types 2024 & 2032

- Figure 30: Asia Pacific Short-arc Xenon Lamps Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Short-arc Xenon Lamps Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Short-arc Xenon Lamps Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Short-arc Xenon Lamps Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Short-arc Xenon Lamps Revenue million Forecast, by Types 2019 & 2032

- Table 4: Global Short-arc Xenon Lamps Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Short-arc Xenon Lamps Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Short-arc Xenon Lamps Revenue million Forecast, by Types 2019 & 2032

- Table 7: Global Short-arc Xenon Lamps Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Short-arc Xenon Lamps Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Short-arc Xenon Lamps Revenue million Forecast, by Types 2019 & 2032

- Table 13: Global Short-arc Xenon Lamps Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Short-arc Xenon Lamps Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Short-arc Xenon Lamps Revenue million Forecast, by Types 2019 & 2032

- Table 19: Global Short-arc Xenon Lamps Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Short-arc Xenon Lamps Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Short-arc Xenon Lamps Revenue million Forecast, by Types 2019 & 2032

- Table 31: Global Short-arc Xenon Lamps Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Short-arc Xenon Lamps Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Short-arc Xenon Lamps Revenue million Forecast, by Types 2019 & 2032

- Table 40: Global Short-arc Xenon Lamps Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Short-arc Xenon Lamps Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Short-arc Xenon Lamps?

The projected CAGR is approximately 0.6%.

2. Which companies are prominent players in the Short-arc Xenon Lamps?

Key companies in the market include OSRAM, Philips, USHIO, Advanced Specialty Lighting, Caiz Optronics, LUXTEL.

3. What are the main segments of the Short-arc Xenon Lamps?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 251.7 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Short-arc Xenon Lamps," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Short-arc Xenon Lamps report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Short-arc Xenon Lamps?

To stay informed about further developments, trends, and reports in the Short-arc Xenon Lamps, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence