Key Insights

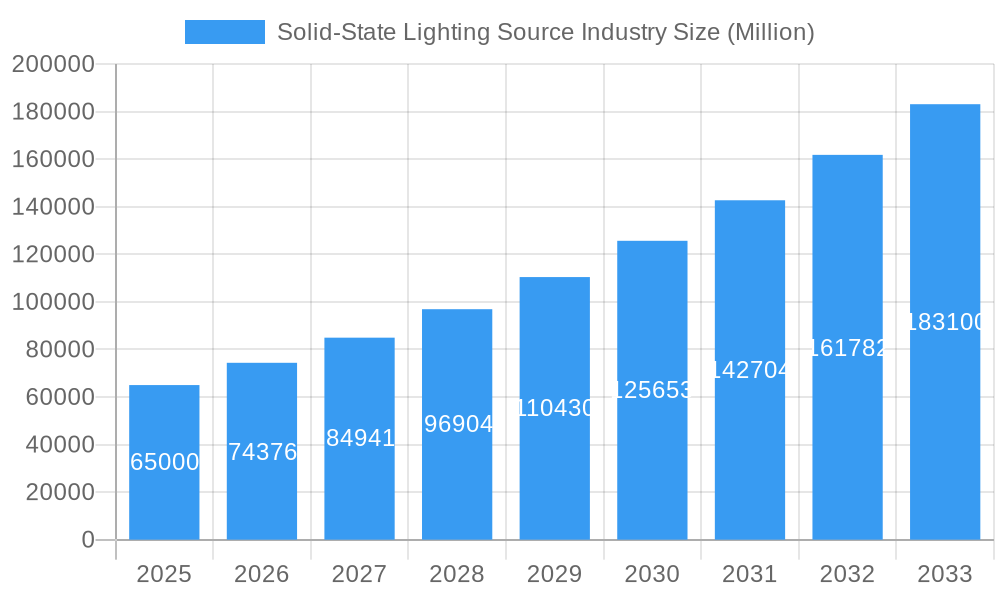

The global Solid-State Lighting (SSL) Source Industry is experiencing robust expansion, projected to reach a substantial market size of XX million by 2033. This growth is fueled by a remarkable Compound Annual Growth Rate (CAGR) of 14.40%, indicating a dynamic and rapidly evolving market. Key drivers propelling this surge include increasing energy efficiency mandates across governments worldwide, leading to a significant shift away from traditional lighting technologies towards more sustainable and cost-effective SSL solutions. The rising adoption of smart lighting systems, coupled with advancements in the performance and cost-effectiveness of LED, OLED, and PLED technologies, further cements SSL's dominant position. Consumer demand for improved lighting quality, enhanced aesthetics, and integrated functionalities in residential, commercial, and automotive sectors is also a crucial factor. The medical and consumer electronics industries are also increasingly integrating SSL for its unique properties, such as controllability and low heat emission.

Solid-State Lighting Source Industry Market Size (In Billion)

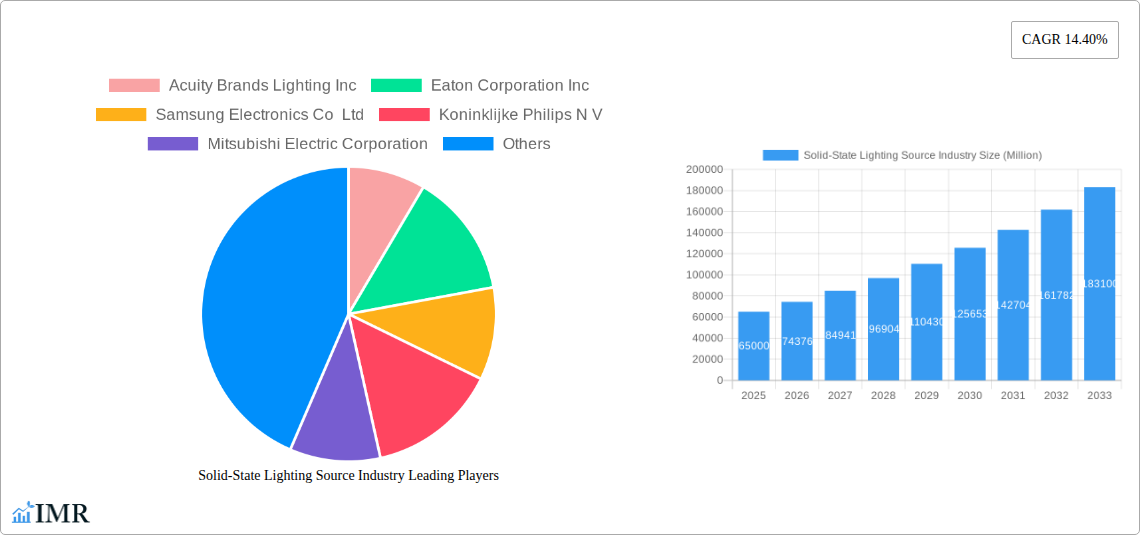

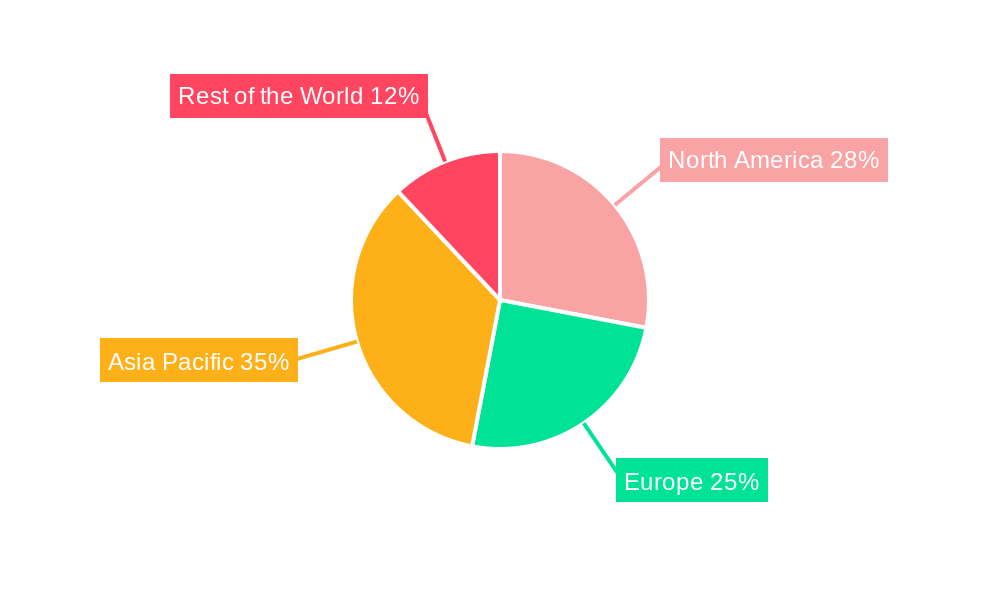

The competitive landscape is characterized by the presence of established giants like Acuity Brands Lighting Inc., Eaton Corporation Inc., Samsung Electronics Co Ltd., and Koninklijke Philips N.V., alongside innovative players like Bridglux Inc. and Nichia Corporation. These companies are actively investing in research and development to introduce next-generation SSL products, focusing on higher lumen output, improved color rendering, and extended lifespan. The market segments are diverse, with Light Emitting Diodes (LEDs) currently holding the largest share due to their widespread application and cost-effectiveness, followed closely by the burgeoning Organic Light Emitting Diodes (OLED) and Polymer Light Emitting Diodes (PLED) technologies, which are finding their niche in premium applications and flexible displays. Geographically, Asia Pacific is anticipated to lead the market owing to rapid industrialization, increasing infrastructure development, and supportive government initiatives promoting energy-efficient technologies. North America and Europe are also significant contributors, driven by stringent energy regulations and a strong consumer preference for advanced lighting solutions.

Solid-State Lighting Source Industry Company Market Share

Comprehensive Report: Solid-State Lighting Source Industry Market Dynamics, Growth, and Future Outlook (2019-2033)

This in-depth report provides a detailed analysis of the global Solid-State Lighting (SSL) Source Industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key drivers, challenges, opportunities, and a future outlook. Covering the historical period from 2019 to 2024, with a base year of 2025 and a forecast period extending to 2033, this research offers critical insights for industry professionals, investors, and stakeholders seeking to understand the evolving SSL market. The report integrates high-traffic SEO keywords, parent and child market analysis, and presents all values in Million Units for clarity and maximum search engine visibility.

Solid-State Lighting Source Industry Market Dynamics & Structure

The global Solid-State Lighting Source Industry is characterized by a moderately concentrated market structure, with a few key players holding significant market share. Technological innovation, particularly in Light Emitting Diodes (LEDs) and advancements in Organic Light Emitting Diodes (OLEDs), serves as a primary driver of market growth. Regulatory frameworks, focusing on energy efficiency and environmental sustainability, are increasingly influencing product development and adoption rates. Competitive product substitutes, such as traditional lighting technologies, while diminishing, still represent a factor. End-user demographics are shifting, with increasing demand from residential, commercial, and automotive sectors.

- Market Concentration: Dominated by established players but with increasing fragmentation due to new entrants and niche specialization.

- Technological Innovation Drivers: Miniaturization, increased lumen output, improved color rendering index (CRI), and integration of smart features.

- Regulatory Frameworks: Government mandates for energy efficiency (e.g., Energy Star, EU Ecodesign), phasing out of inefficient lighting technologies, and focus on reducing light pollution.

- Competitive Product Substitutes: Incandescent and fluorescent lighting, though their market share is rapidly declining.

- End-User Demographics: Growing demand from smart homes, urban infrastructure projects, advanced automotive lighting systems, and specialized medical applications.

- Mergers & Acquisitions (M&A) Trends: Strategic acquisitions focused on expanding technology portfolios, market reach, and acquiring intellectual property. The period saw approximately $xx Billion in M&A deals, with a predicted $xx Billion in the forecast period.

Solid-State Lighting Source Industry Growth Trends & Insights

The Solid-State Lighting Source Industry is poised for substantial growth, driven by the inherent advantages of SSL technologies, most notably their energy efficiency, longevity, and versatility. The market size evolution is projected to be robust, transitioning from an estimated $xxx Million in 2025 to $xxxx Million by 2033. This expansion is fueled by increasing adoption rates across diverse end-user segments, propelled by both economic incentives and environmental consciousness. Technological disruptions, such as the development of more efficient LED chips, advanced OLED materials, and the integration of tunable white and color-changing capabilities, are reshaping the product landscape and creating new application possibilities.

Consumer behavior shifts are also playing a pivotal role. There is a growing preference for smart lighting solutions that offer convenience, controllability, and enhanced ambiance. This trend is particularly evident in the residential and commercial sectors, where integrated smart home systems and intelligent building management are becoming standard. Furthermore, the automotive industry's demand for advanced LED lighting for safety, aesthetics, and adaptive functionalities is a significant growth engine. The CAGR for the Solid-State Lighting Source Industry is projected to be a healthy XX.X% during the forecast period. Market penetration of SSL technologies is expected to reach over XX% globally by 2033, indicating a significant displacement of older lighting technologies. The increasing demand for specialized applications, such as horticultural lighting, UV-C disinfection lighting, and high-performance displays, further underscores the dynamic growth trajectory of this industry. The market is also witnessing a rise in the adoption of Polymer Light Emitting Diodes (PLEDs) for flexible and transparent display applications, adding another dimension to the market's diversification.

Dominant Regions, Countries, or Segments in Solid-State Lighting Source Industry

The Light Emitting Diodes (LEDs) segment is overwhelmingly the dominant technology driving growth in the Solid-State Lighting Source Industry. Its widespread adoption across nearly all end-user applications, coupled with continuous improvements in efficiency and cost-effectiveness, solidifies its leading position. Within the end-user segments, the Commercial sector stands out as a major growth engine, driven by large-scale retrofitting projects in office buildings, retail spaces, and industrial facilities, all seeking to reduce operational costs and meet sustainability targets.

Dominant Technology: Light Emitting Diodes (LEDs)

- Market Share: Estimated to hold over XX% of the total SSL market in 2025.

- Key Drivers: Superior energy efficiency, extended lifespan, high lumen output, and declining manufacturing costs.

- Growth Potential: Continued innovation in specialized LEDs for niche applications, such as horticulture and UV disinfection, will further bolster its market dominance.

Dominant End-User Segment: Commercial

- Market Share: Projected to account for approximately XX% of the total SSL market by 2025.

- Key Drivers: Significant energy cost savings from LED retrofits, government incentives for energy efficiency, increasing demand for smart lighting solutions in commercial spaces for enhanced productivity and security.

- Growth Potential: Ongoing development of smart buildings and the integration of IoT in commercial lighting infrastructure will create sustained demand.

Leading Regions: Asia-Pacific, particularly China, is the dominant manufacturing hub and a significant consumer market due to its vast industrial base and rapid urbanization. North America and Europe follow closely, driven by strong regulatory support for energy efficiency and a mature market for smart home and automotive lighting.

Country-Specific Drivers:

- China: Massive domestic demand, government support for manufacturing, and extensive infrastructure development.

- United States: Strong adoption of smart home technologies, significant commercial building retrofits, and automotive industry demand.

- European Union: Stringent energy efficiency regulations, growing focus on sustainable building practices, and advancements in automotive lighting.

Solid-State Lighting Source Industry Product Landscape

The Solid-State Lighting Source Industry is characterized by rapid product innovation focused on enhancing performance, functionality, and sustainability. Light Emitting Diodes (LEDs) continue to dominate with increasingly higher lumen efficacy, improved color rendering, and miniaturization for intricate designs. Organic Light Emitting Diodes (OLEDs) are gaining traction for their thin, flexible, and emissive panel capabilities, ideal for premium display applications and unique lighting designs. Polymer Light Emitting Diodes (PLEDs) are emerging for their cost-effectiveness and flexibility in various display and lighting applications. Key advancements include the integration of sophisticated control systems for dimming, color tuning, and connectivity, enabling smart lighting solutions. Applications range from general illumination in residential and commercial spaces to specialized lighting in automotive headlights, medical devices, and consumer electronics.

Key Drivers, Barriers & Challenges in Solid-State Lighting Source Industry

The primary forces propelling the Solid-State Lighting Source Industry include the unwavering demand for energy efficiency, leading to significant cost savings for end-users and reduced environmental impact. Technological advancements continuously improve lumen output and lifespan, making SSL a superior alternative to traditional lighting. Government regulations and incentives favoring energy-efficient products also act as major catalysts. The growing integration of smart technologies, enabling connectivity and control, further expands application possibilities and consumer appeal.

However, the industry faces several challenges. High upfront costs compared to traditional lighting can be a barrier for some consumers and businesses. Supply chain disruptions, particularly for critical raw materials and components, can impact production volumes and pricing. Regulatory hurdles and the need for standardization across different regions can slow down market penetration. Furthermore, intense competitive pressures among manufacturers, leading to price wars, can squeeze profit margins. The disposal and recycling of electronic components also present an environmental challenge that requires robust solutions.

Emerging Opportunities in Solid-State Lighting Source Industry

Emerging opportunities in the Solid-State Lighting Source Industry lie in the growth of smart city initiatives, demanding intelligent street lighting and integrated urban infrastructure solutions. The increasing focus on health and well-being is driving demand for human-centric lighting, which mimics natural daylight cycles to improve productivity and sleep patterns, particularly in commercial and residential settings. The horticultural lighting market is experiencing rapid expansion, with specialized LEDs optimized for plant growth. Furthermore, the development of advanced SSL for medical applications, such as phototherapy and surgical lighting, presents a high-value niche. The increasing adoption of UV-C LED technology for disinfection and sterilization in public spaces and healthcare facilities is another significant growth avenue.

Growth Accelerators in the Solid-State Lighting Source Industry Industry

Growth accelerators in the Solid-State Lighting Source Industry are primarily driven by continuous technological breakthroughs in semiconductor materials and manufacturing processes, leading to ever-increasing energy efficiency and reduced costs. Strategic partnerships between lighting manufacturers and technology companies, particularly in the IoT and smart home sectors, are expanding market reach and enabling innovative product development. Furthermore, aggressive market expansion strategies by leading players, focusing on emerging economies and untapped application segments, are vital growth catalysts. The ongoing trend towards digitalization and the increasing demand for connected lighting solutions are creating new revenue streams and driving further investment in research and development.

Key Players Shaping the Solid-State Lighting Source Industry Market

- Acuity Brands Lighting Inc

- Eaton Corporation Inc

- Samsung Electronics Co Ltd

- Koninklijke Philips N V

- Mitsubishi Electric Corporation

- GE Lighting

- OsRam Licht AG

- Toshiba Lighting

- Bridgelux Inc

- Nichia Corporation

Notable Milestones in Solid-State Lighting Source Industry Sector

- 2019: Launch of highly efficient Blue and Green LEDs with improved quantum efficiency by Nichia Corporation.

- 2020: Samsung Electronics unveils advanced OLED display technology with enhanced color accuracy and brightness for premium devices.

- 2021: Eaton Corporation expands its smart lighting portfolio with integrated control systems for commercial applications.

- 2022: Philips Lighting (now Signify) introduces new human-centric lighting solutions for office environments aimed at improving employee well-being.

- 2023: Bridgelux Inc. announces advancements in GaN-on-Silicon LED technology, promising cost reductions and performance improvements.

- 2024 (estimated): Osram Licht AG focuses on expanding its portfolio of specialized LEDs for automotive and medical applications.

In-Depth Solid-State Lighting Source Industry Market Outlook

The future outlook for the Solid-State Lighting Source Industry is exceptionally bright, with sustained growth projected across all segments. Technological breakthroughs in material science and manufacturing will continue to drive down costs while enhancing performance metrics like lumen output and lifespan. Strategic partnerships will foster innovation and accelerate the integration of SSL into broader smart ecosystems, including smart cities and intelligent buildings. Market expansion strategies, focusing on both developed and developing economies, will ensure broad adoption. The increasing demand for sustainable and energy-efficient solutions, coupled with evolving consumer preferences for advanced lighting functionalities, will fuel significant market potential and create compelling strategic opportunities for industry players. The continued growth of niche applications like horticultural lighting and UV-C disinfection further solidifies this optimistic outlook.

Solid-State Lighting Source Industry Segmentation

-

1. Technology

- 1.1. Light Emitting Diodes (LEDs)

- 1.2. Organic Light Emitting Diodes (OLED)

- 1.3. Polymer Light Emitting Diodes (PLED)

-

2. End-User

- 2.1. Residential

- 2.2. Commercial

- 2.3. Automotive

- 2.4. Medical

- 2.5. Consumer Electronics

- 2.6. Other End-Users

Solid-State Lighting Source Industry Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Rest of the World

Solid-State Lighting Source Industry Regional Market Share

Geographic Coverage of Solid-State Lighting Source Industry

Solid-State Lighting Source Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 14.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Greater Energy Savings Compared to Other Forms of Lighting; Growing Adoption of LEDs in the Automotive Industry

- 3.3. Market Restrains

- 3.3.1. ; High Implementation and Equipment Cost

- 3.4. Market Trends

- 3.4.1. LED Technology to Occupy the Maximum Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 5.1.1. Light Emitting Diodes (LEDs)

- 5.1.2. Organic Light Emitting Diodes (OLED)

- 5.1.3. Polymer Light Emitting Diodes (PLED)

- 5.2. Market Analysis, Insights and Forecast - by End-User

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Automotive

- 5.2.4. Medical

- 5.2.5. Consumer Electronics

- 5.2.6. Other End-Users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Technology

- 6. North America Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 6.1.1. Light Emitting Diodes (LEDs)

- 6.1.2. Organic Light Emitting Diodes (OLED)

- 6.1.3. Polymer Light Emitting Diodes (PLED)

- 6.2. Market Analysis, Insights and Forecast - by End-User

- 6.2.1. Residential

- 6.2.2. Commercial

- 6.2.3. Automotive

- 6.2.4. Medical

- 6.2.5. Consumer Electronics

- 6.2.6. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Technology

- 7. Europe Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 7.1.1. Light Emitting Diodes (LEDs)

- 7.1.2. Organic Light Emitting Diodes (OLED)

- 7.1.3. Polymer Light Emitting Diodes (PLED)

- 7.2. Market Analysis, Insights and Forecast - by End-User

- 7.2.1. Residential

- 7.2.2. Commercial

- 7.2.3. Automotive

- 7.2.4. Medical

- 7.2.5. Consumer Electronics

- 7.2.6. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Technology

- 8. Asia Pacific Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 8.1.1. Light Emitting Diodes (LEDs)

- 8.1.2. Organic Light Emitting Diodes (OLED)

- 8.1.3. Polymer Light Emitting Diodes (PLED)

- 8.2. Market Analysis, Insights and Forecast - by End-User

- 8.2.1. Residential

- 8.2.2. Commercial

- 8.2.3. Automotive

- 8.2.4. Medical

- 8.2.5. Consumer Electronics

- 8.2.6. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Technology

- 9. Rest of the World Solid-State Lighting Source Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 9.1.1. Light Emitting Diodes (LEDs)

- 9.1.2. Organic Light Emitting Diodes (OLED)

- 9.1.3. Polymer Light Emitting Diodes (PLED)

- 9.2. Market Analysis, Insights and Forecast - by End-User

- 9.2.1. Residential

- 9.2.2. Commercial

- 9.2.3. Automotive

- 9.2.4. Medical

- 9.2.5. Consumer Electronics

- 9.2.6. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Technology

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Acuity Brands Lighting Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Eaton Corporation Inc

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Samsung Electronics Co Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Koninklijke Philips N V

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Mitsubishi Electric Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 GE Lighting

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 OsRam Licht AG

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Toshiba Lighting

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bridgelux Inc

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Nichia Corporation*List Not Exhaustive

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 Acuity Brands Lighting Inc

List of Figures

- Figure 1: Global Solid-State Lighting Source Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Solid-State Lighting Source Industry Revenue (Million), by Technology 2025 & 2033

- Figure 3: North America Solid-State Lighting Source Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 4: North America Solid-State Lighting Source Industry Revenue (Million), by End-User 2025 & 2033

- Figure 5: North America Solid-State Lighting Source Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 6: North America Solid-State Lighting Source Industry Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Solid-State Lighting Source Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Solid-State Lighting Source Industry Revenue (Million), by Technology 2025 & 2033

- Figure 9: Europe Solid-State Lighting Source Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 10: Europe Solid-State Lighting Source Industry Revenue (Million), by End-User 2025 & 2033

- Figure 11: Europe Solid-State Lighting Source Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 12: Europe Solid-State Lighting Source Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Solid-State Lighting Source Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Solid-State Lighting Source Industry Revenue (Million), by Technology 2025 & 2033

- Figure 15: Asia Pacific Solid-State Lighting Source Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 16: Asia Pacific Solid-State Lighting Source Industry Revenue (Million), by End-User 2025 & 2033

- Figure 17: Asia Pacific Solid-State Lighting Source Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 18: Asia Pacific Solid-State Lighting Source Industry Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Pacific Solid-State Lighting Source Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Solid-State Lighting Source Industry Revenue (Million), by Technology 2025 & 2033

- Figure 21: Rest of the World Solid-State Lighting Source Industry Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Rest of the World Solid-State Lighting Source Industry Revenue (Million), by End-User 2025 & 2033

- Figure 23: Rest of the World Solid-State Lighting Source Industry Revenue Share (%), by End-User 2025 & 2033

- Figure 24: Rest of the World Solid-State Lighting Source Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Rest of the World Solid-State Lighting Source Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 2: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 3: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 5: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 6: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 8: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 9: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 11: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 12: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Technology 2020 & 2033

- Table 14: Global Solid-State Lighting Source Industry Revenue Million Forecast, by End-User 2020 & 2033

- Table 15: Global Solid-State Lighting Source Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Solid-State Lighting Source Industry?

The projected CAGR is approximately 14.40%.

2. Which companies are prominent players in the Solid-State Lighting Source Industry?

Key companies in the market include Acuity Brands Lighting Inc, Eaton Corporation Inc, Samsung Electronics Co Ltd, Koninklijke Philips N V, Mitsubishi Electric Corporation, GE Lighting, OsRam Licht AG, Toshiba Lighting, Bridgelux Inc, Nichia Corporation*List Not Exhaustive.

3. What are the main segments of the Solid-State Lighting Source Industry?

The market segments include Technology, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

; Greater Energy Savings Compared to Other Forms of Lighting; Growing Adoption of LEDs in the Automotive Industry.

6. What are the notable trends driving market growth?

LED Technology to Occupy the Maximum Share.

7. Are there any restraints impacting market growth?

; High Implementation and Equipment Cost.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Solid-State Lighting Source Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Solid-State Lighting Source Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Solid-State Lighting Source Industry?

To stay informed about further developments, trends, and reports in the Solid-State Lighting Source Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence