Key Insights

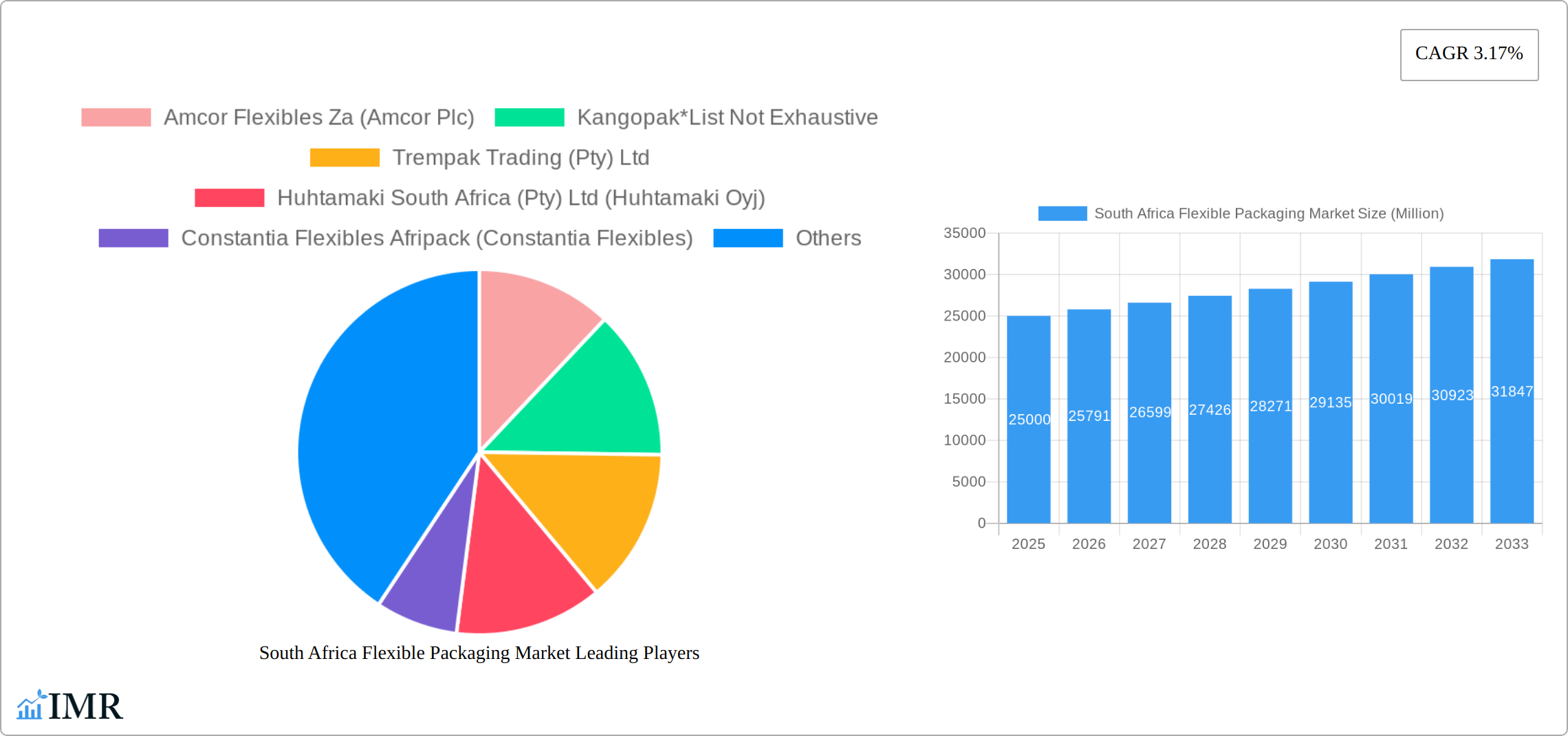

The South Africa flexible packaging market, valued at approximately ZAR 25 billion in 2025, is projected to experience steady growth, exhibiting a Compound Annual Growth Rate (CAGR) of 3.17% from 2025 to 2033. This growth is fueled by several key factors. The burgeoning food and beverage sector, driven by increasing consumer demand and a rising middle class, is a significant driver. The healthcare and pharmaceutical industries also contribute substantially, with a growing need for safe and efficient packaging solutions for medications and medical devices. Furthermore, the increasing adoption of flexible packaging for its cost-effectiveness, lightweight nature, and enhanced product preservation capabilities across various sectors contributes to market expansion. Technological advancements, including the introduction of sustainable and recyclable materials, are also shaping the market landscape, fostering environmentally conscious packaging choices.

South Africa Flexible Packaging Market Market Size (In Billion)

However, challenges remain. Fluctuations in raw material prices, particularly for polymers, pose a significant constraint. Furthermore, stringent regulatory requirements regarding food safety and environmental impact necessitates ongoing compliance investments for manufacturers. Competition from established international players coupled with a need to cater to evolving consumer preferences for sustainable and innovative packaging solutions presents ongoing hurdles for market participants. Segmentation reveals bags and pouches as the dominant product type, while food and beverage end-users represent the largest consumer segment. Key players such as Amcor Flexibles ZA, Huhtamaki South Africa, and Constantia Flexibles Afripack are actively engaged in shaping the market dynamics through product innovation and strategic partnerships. The market's future growth trajectory depends on effectively navigating these challenges and capitalizing on the prevailing growth opportunities.

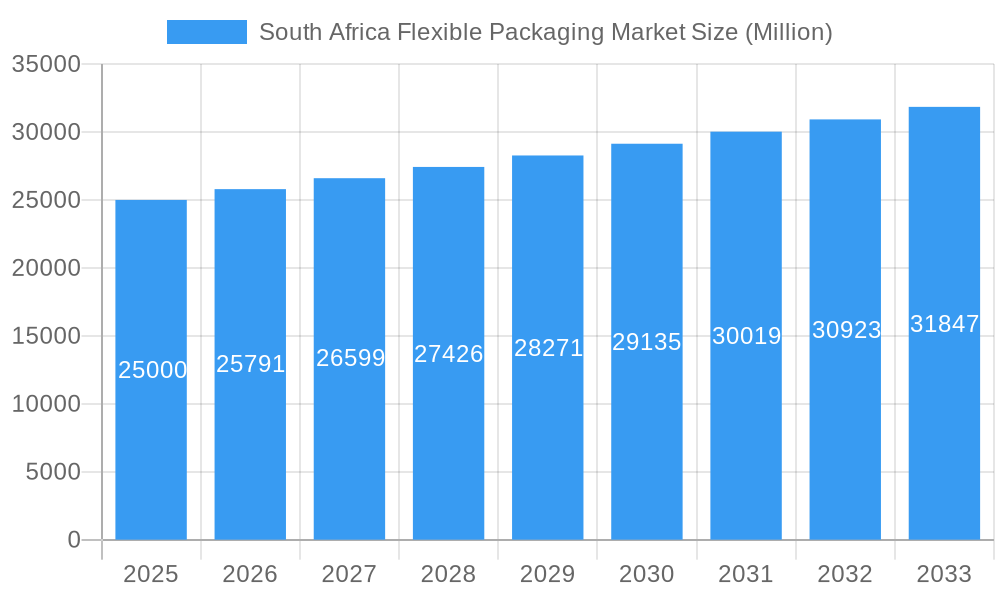

South Africa Flexible Packaging Market Company Market Share

South Africa Flexible Packaging Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the South Africa flexible packaging market, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base year and a forecast period of 2025-2033. The report delves into the parent market of packaging and the child market of flexible packaging, offering granular insights for industry professionals. Market values are presented in Million units.

South Africa Flexible Packaging Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends influencing the South Africa flexible packaging market. The market is moderately concentrated, with key players holding significant market share, but also exhibiting a degree of fragmentation amongst smaller players.

- Market Concentration: xx% market share held by top 5 players. Remaining share distributed amongst numerous smaller companies.

- Technological Innovation: Focus on sustainable and recyclable materials, improved barrier properties, and advanced printing technologies are driving innovation. However, high initial investment costs can be a barrier for smaller players.

- Regulatory Framework: Government regulations regarding food safety, material recyclability, and waste management are impacting product development and material selection.

- Competitive Product Substitutes: Rigid packaging remains a key competitor, though flexible packaging offers advantages in cost, lightweighting, and convenience.

- End-User Demographics: Growing urban population and changing consumer preferences towards convenience and sustainability are shaping market demand.

- M&A Trends: Consolidation is expected to continue, driven by the need for economies of scale and access to new technologies. The number of M&A deals in the period 2019-2024 was xx.

South Africa Flexible Packaging Market Growth Trends & Insights

The South Africa flexible packaging market is experiencing substantial and sustained growth, propelled by a confluence of dynamic market forces. The burgeoning demand from the food and beverage sectors remains a primary growth driver, fueled by an expanding urban population and evolving consumer lifestyles. Concurrently, a significant and intensifying focus on sustainable packaging solutions is reshaping market dynamics, as both consumers and regulators push for environmentally responsible alternatives. The rise of a growing middle class, characterized by increased disposable income and a propensity for convenience, further amplifies the demand for flexible packaging formats. The market demonstrated a Compound Annual Growth Rate (CAGR) of approximately XX% during the historical period spanning 2019-2024. Looking ahead, the market is projected to sustain this positive momentum, exhibiting an estimated CAGR of XX% during the forecast period from 2025 to 2033. The penetration of flexible packaging is on a consistent upward trajectory across various end-use industries, with the food and beverage segments leading this expansion.

The industry's commitment to sustainability is a critical factor, with a marked surge in the adoption of eco-friendly flexible packaging solutions. This trend is a direct response to heightened environmental consciousness among consumers and the implementation of more stringent regulatory frameworks promoting responsible waste management and material use. Technological advancements are also playing a pivotal role in market expansion. The introduction of cutting-edge advanced barrier materials that enhance product shelf-life and preserve freshness, coupled with innovations in high-definition printing technologies that improve visual appeal and brand storytelling, are significant enablers of growth. Furthermore, evolving consumer preferences that lean towards convenience and on-the-go consumption patterns directly translate into a higher demand for the lightweight, versatile, and user-friendly nature of flexible packaging.

Dominant Regions, Countries, or Segments in South Africa Flexible Packaging Market

The South African flexible packaging landscape is characterized by its geographical diversity, with significant growth concentrated in its major urban centers, which act as hubs for consumption and manufacturing. The Food segment stands out as the largest end-user of flexible packaging solutions, closely followed by the dynamic Beverage sector. Within the product categories, Bags and Pouches consistently command the largest market share, owing to their inherent versatility and widespread application across a multitude of end-use segments.

-

By Product Type:

- Bags and Pouches: This category dominates the market due to its exceptional versatility and broad applicability across various end-use segments, from snacks and confectionery to dry goods and ready-to-eat meals.

- Films and Wraps: Holding a substantial market share, films and wraps are integral to applications focused on food preservation, including fresh produce, dairy products, and baked goods, as well as for industrial wrapping needs.

- Others: This segment, while representing a smaller portion of the market, is experiencing healthy growth and encompasses specialized flexible packaging solutions tailored for niche applications and advanced packaging requirements.

-

By End-users:

- Food: The undisputed largest segment, driven by the escalating demand for convenient, safe, and visually appealing packaged food products that cater to busy lifestyles and a growing population.

- Beverage: This segment exhibits strong growth potential, propelled by the increasing consumption of packaged beverages, including water, soft drinks, juices, and alcoholic beverages, where flexible packaging offers lightweight and cost-effective solutions.

- Healthcare and Pharmaceutical: A significant and growing segment due to the stringent packaging requirements for safety, sterility, and product integrity, coupled with a strong emphasis on hygiene standards and regulatory compliance.

- Other End-users: This broad category includes a range of industries such as personal care, cosmetics, detergents, and industrial goods, all of which increasingly leverage flexible packaging for its functional and aesthetic benefits.

South Africa Flexible Packaging Market Product Landscape

The market offers a diverse range of flexible packaging solutions, tailored to specific end-use applications. Innovations focus on enhanced barrier properties for improved product protection, sustainable and recyclable materials to meet environmental concerns, and advanced printing technologies for enhanced brand appeal. These advancements are constantly improving product performance metrics, including shelf life extension and improved oxygen and moisture barriers. Unique selling propositions often include customized designs, ease of use, and superior product protection.

Key Drivers, Barriers & Challenges in South Africa Flexible Packaging Market

Key Drivers: Increased demand from the food and beverage industries, rising disposable incomes, and a growing preference for convenient packaging are key market drivers. Technological advancements in materials and printing processes also contribute to growth. Government initiatives promoting sustainable packaging contribute positively.

Key Barriers and Challenges: Fluctuations in raw material prices, stringent environmental regulations, and competitive pressures from alternative packaging types pose challenges. Supply chain disruptions and the high cost of implementing sustainable packaging solutions further impede market growth.

Emerging Opportunities in South Africa Flexible Packaging Market

Untapped markets in rural areas, increasing demand for specialized packaging solutions for niche products, and the growing popularity of e-commerce are significant opportunities. Innovations in biodegradable and compostable flexible packaging offer substantial growth potential, aligning with sustainable consumer trends.

Growth Accelerators in the South Africa Flexible Packaging Market Industry

The South African flexible packaging industry is poised for continued expansion, driven by several key accelerators. Technological breakthroughs, particularly in the development of advanced barrier materials that extend product shelf-life and reduce spoilage, and the ongoing innovation in sustainable and biodegradable packaging solutions, are paramount in driving market growth. The increasing emphasis on circular economy principles is also fostering the adoption of recyclable and compostable flexible packaging options. Strategic partnerships and collaborations between leading packaging manufacturers and prominent brand owners are crucial for co-developing customized, innovative, and market-responsive packaging solutions that meet specific product needs and consumer expectations. Furthermore, supportive government initiatives and policies aimed at promoting sustainable manufacturing practices, reducing plastic waste, and encouraging the adoption of eco-friendly packaging will significantly accelerate the industry's growth trajectory.

Key Players Shaping the South Africa Flexible Packaging Market Market

- Amcor Flexibles Za (Amcor Plc)

- Kangopak

- Trempak Trading (Pty) Ltd

- Huhtamaki South Africa (Pty) Ltd (Huhtamaki Oyj)

- Constantia Flexibles Afripack (Constantia Flexibles)

- Flexible Packages Convertors (Pty) Ltd

- Packaging World SA

- Foster International Packaging (Pty) Ltd

- Richflex (Pty) Ltd

- CTP Flexibles Packaging

- ITB Flexible Packaging Solutions (Novus Holdings Ltd)

Notable Milestones in South Africa Flexible Packaging Market Sector

- October 2022: ALPLA Group's strategic expansion with a new, state-of-the-art production site in Lanseria, near Johannesburg. This facility boasts an impressive annual capacity of nearly 3.5 billion pieces, significantly bolstering plastic packaging production capabilities within the South African market. This move is expected to enhance market competitiveness, optimize supply chain efficiencies, and potentially lead to greater product availability and variety.

- August 2022: The International Finance Corporation (IFC) provided Averda with a substantial USD 30 million loan. This funding is specifically earmarked to support the advancement of sustainable waste management practices across Africa, with a significant portion dedicated to the establishment of a new plastics recycling plant in South Africa. This initiative is instrumental in strengthening the circular economy for plastics and fostering more sustainable operational practices within the flexible packaging value chain.

In-Depth South Africa Flexible Packaging Market Outlook

The South Africa flexible packaging market is poised for sustained growth, driven by rising consumer demand, technological innovation, and a growing focus on sustainability. Strategic investments in advanced manufacturing capabilities and the development of eco-friendly packaging solutions will unlock significant growth opportunities for market players. Companies focusing on customized solutions and strategic partnerships will be best positioned to capitalize on future market potential.

South Africa Flexible Packaging Market Segmentation

-

1. Product Type

- 1.1. Bags and Pouches

- 1.2. Films and Wraps

- 1.3. Others

-

2. End-users

- 2.1. Food

- 2.2. Beverage

- 2.3. Healthcare and Pharmaceutical

- 2.4. Other End-users

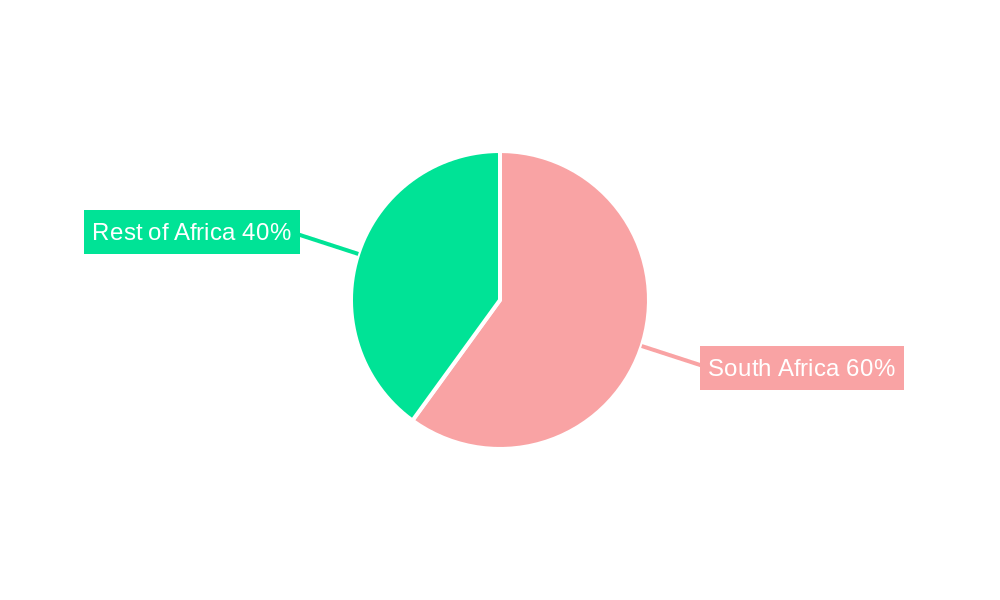

South Africa Flexible Packaging Market Segmentation By Geography

- 1. South Africa

South Africa Flexible Packaging Market Regional Market Share

Geographic Coverage of South Africa Flexible Packaging Market

South Africa Flexible Packaging Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing E-commerce Industry and Demand for Convenient Packaging; Increasing Demand for Cosmetics Products

- 3.3. Market Restrains

- 3.3.1. Concerns Regarding Environment and Recycling

- 3.4. Market Trends

- 3.4.1. Increasing Demand for Cosmetics Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Flexible Packaging Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bags and Pouches

- 5.1.2. Films and Wraps

- 5.1.3. Others

- 5.2. Market Analysis, Insights and Forecast - by End-users

- 5.2.1. Food

- 5.2.2. Beverage

- 5.2.3. Healthcare and Pharmaceutical

- 5.2.4. Other End-users

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Amcor Flexibles Za (Amcor Plc)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Kangopak*List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Trempak Trading (Pty) Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Huhtamaki South Africa (Pty) Ltd (Huhtamaki Oyj)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Constantia Flexibles Afripack (Constantia Flexibles)

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Flexible Packages Convertors (Pty) Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Packaging World SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Foster International Packaging (Pty) Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Richflex (Pty) Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 CTP Flexibles Packaging

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 ITB Flexible Packaging Solutions (Novus Holdings Ltd)

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Amcor Flexibles Za (Amcor Plc)

List of Figures

- Figure 1: South Africa Flexible Packaging Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Africa Flexible Packaging Market Share (%) by Company 2025

List of Tables

- Table 1: South Africa Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: South Africa Flexible Packaging Market Revenue Million Forecast, by End-users 2020 & 2033

- Table 3: South Africa Flexible Packaging Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: South Africa Flexible Packaging Market Revenue Million Forecast, by Product Type 2020 & 2033

- Table 5: South Africa Flexible Packaging Market Revenue Million Forecast, by End-users 2020 & 2033

- Table 6: South Africa Flexible Packaging Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Flexible Packaging Market?

The projected CAGR is approximately 3.17%.

2. Which companies are prominent players in the South Africa Flexible Packaging Market?

Key companies in the market include Amcor Flexibles Za (Amcor Plc), Kangopak*List Not Exhaustive, Trempak Trading (Pty) Ltd, Huhtamaki South Africa (Pty) Ltd (Huhtamaki Oyj), Constantia Flexibles Afripack (Constantia Flexibles), Flexible Packages Convertors (Pty) Ltd, Packaging World SA, Foster International Packaging (Pty) Ltd, Richflex (Pty) Ltd, CTP Flexibles Packaging, ITB Flexible Packaging Solutions (Novus Holdings Ltd).

3. What are the main segments of the South Africa Flexible Packaging Market?

The market segments include Product Type, End-users.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing E-commerce Industry and Demand for Convenient Packaging; Increasing Demand for Cosmetics Products.

6. What are the notable trends driving market growth?

Increasing Demand for Cosmetics Products.

7. Are there any restraints impacting market growth?

Concerns Regarding Environment and Recycling.

8. Can you provide examples of recent developments in the market?

October 2022 - The ALPLA Group, a plastic packaging, and recycling company opened its new production site, in Lanseria, near Johannesburg (South Africa). The new plant has been set up to manufacture plastic packaging for various markets, including personal and home care, food, chemical, cleaning agents, and pharmaceuticals, producing nearly 3.5 billion pieces per year.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Flexible Packaging Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Flexible Packaging Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Flexible Packaging Market?

To stay informed about further developments, trends, and reports in the South Africa Flexible Packaging Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence