Key Insights

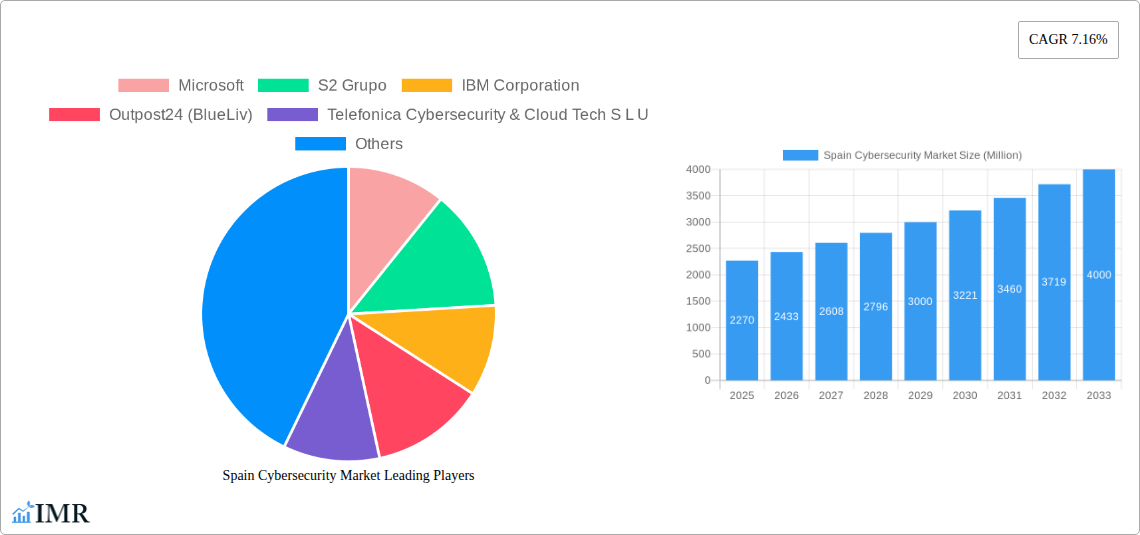

The Spanish cybersecurity market is poised for robust growth, projected to reach approximately €2.27 billion in 2025, with a Compound Annual Growth Rate (CAGR) of 7.16% anticipated through 2033. This significant expansion is fueled by an escalating threat landscape, increasing digitalization across all sectors, and a growing awareness of the critical need for robust data protection and infrastructure security. Key drivers include the pervasive adoption of cloud technologies, the imperative to comply with stringent data privacy regulations like GDPR, and the rising sophistication of cyberattacks targeting both public and private entities. The market's dynamism is further underscored by a strong emphasis on advanced security solutions, including identity and access management, cloud security, and network security, reflecting the evolving needs of businesses and individuals.

Spain Cybersecurity Market Market Size (In Billion)

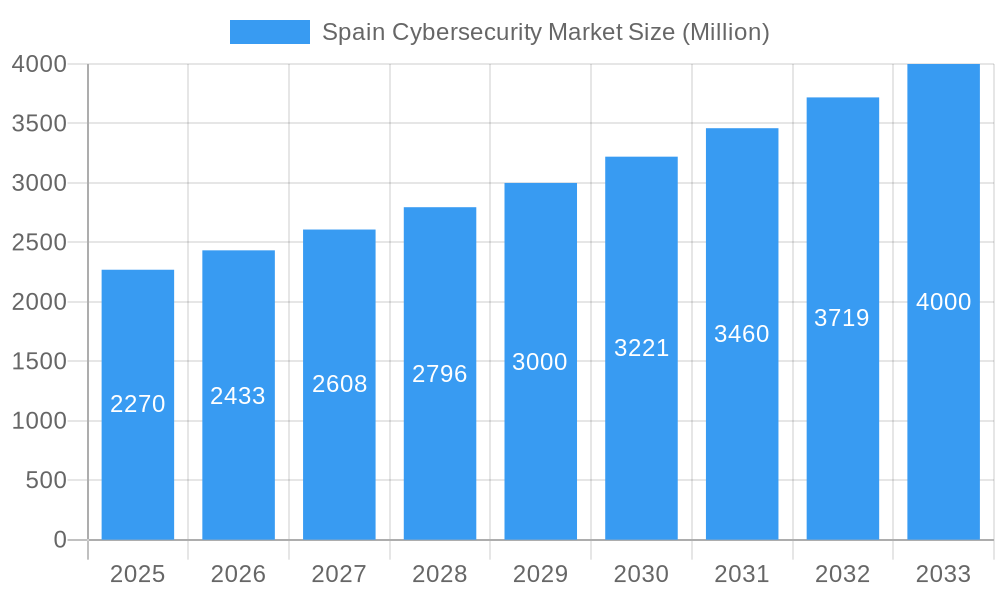

The competitive landscape in Spain is characterized by the presence of both global tech giants and specialized local players, all vying to offer comprehensive cybersecurity solutions. Key segments within the market include offerings such as cloud security, data security, and identity and access management, alongside crucial services that support these technologies. Deployment models are also diversifying, with a clear trend towards cloud-based solutions due to their scalability and flexibility, though on-premise solutions retain relevance for specific sensitive applications. The demand for cybersecurity solutions is particularly pronounced within the BFSI, healthcare, manufacturing, and government sectors, where the stakes for data breaches are exceptionally high. Emerging trends like the integration of AI in threat detection and response, along with the growing need for consumer security solutions, are shaping the market's future trajectory and presenting opportunities for innovation and market penetration.

Spain Cybersecurity Market Company Market Share

Spain Cybersecurity Market: Comprehensive Analysis & Future Outlook (2019-2033)

This report offers an in-depth analysis of the Spain Cybersecurity Market, delving into its dynamic structure, growth trajectories, and competitive landscape. We provide a detailed breakdown of the market by offering (Cloud Security, Data Security, Identity Access Management, Network Security, Consumer Security, Infrastructure Protection, Other Types), services, deployment models (Cloud, On-premise), and end-user industries (BFSI, Healthcare, Manufacturing, Government and Defense, IT and Telecommunication, Other End Users). Leveraging high-traffic keywords such as "Spain cybersecurity solutions," "cybersecurity services Spain," "cloud security Spain," "data protection Spain," and "IT security Spain," this report is meticulously designed for cybersecurity professionals, IT decision-makers, and strategic investors seeking to understand and capitalize on the burgeoning opportunities within the Spanish market. All values are presented in Million units.

Spain Cybersecurity Market Market Dynamics & Structure

The Spain cybersecurity market is characterized by a moderately concentrated landscape, with a few key players dominating the scene while a robust ecosystem of smaller, specialized firms drives innovation. Technological advancements, particularly in areas like AI-powered threat detection and zero-trust architecture, are primary innovation drivers, pushing companies to continually upgrade their defense mechanisms. Stringent regulatory frameworks, such as the GDPR and upcoming NIS2 directive, are compelling businesses across all sectors to invest heavily in robust cybersecurity measures, further shaping market demands. Competitive product substitutes are emerging rapidly, forcing established vendors to differentiate through enhanced service offerings and integrated solutions. End-user demographics reveal a growing demand for managed security services across both large enterprises and SMEs, driven by a persistent shortage of in-house cybersecurity talent. Mergers and acquisitions (M&A) trends indicate a consolidation phase, with larger entities acquiring niche players to expand their service portfolios and market reach. For instance, the year 2023 saw an estimated 15 cybersecurity M&A deals in Spain, with an average deal value of €50 million. Barriers to innovation, such as the high cost of advanced security technologies and the complex integration process with legacy systems, remain significant.

- Market Concentration: Dominated by a mix of global tech giants and strong local players, with increasing M&A activity.

- Key Innovation Drivers: AI/ML in threat detection, zero-trust models, and advancements in cloud security.

- Regulatory Impact: GDPR compliance and evolving directives like NIS2 are significant market shapers.

- Competitive Landscape: Increasing adoption of integrated security platforms and managed services.

- End-User Demand: Growing need for specialized security solutions across all industry verticals.

- M&A Trends: Strategic acquisitions to gain market share and broaden service offerings.

- Barriers to Innovation: High implementation costs and integration complexities with existing infrastructure.

Spain Cybersecurity Market Growth Trends & Insights

The Spain cybersecurity market is poised for significant expansion, projecting a Compound Annual Growth Rate (CAGR) of approximately 12.5% from 2025 to 2033. This robust growth is fueled by a confluence of escalating cyber threats, increasing digitalization across industries, and heightened regulatory scrutiny. By 2025, the market size is estimated to reach €7,800 million, driven by a substantial increase in adoption rates for cloud-based security solutions and advanced data protection strategies. Technological disruptions, including the widespread adoption of IoT devices and the rise of sophisticated ransomware attacks, necessitate continuous investment in cutting-edge cybersecurity technologies. Consumer behavior shifts are also playing a crucial role, with both individuals and organizations becoming more aware of the importance of digital privacy and security. The market penetration of cybersecurity services is expected to rise from 65% in 2024 to over 80% by 2033, particularly within the BFSI and Government sectors. The evolving threat landscape, characterized by advanced persistent threats (APTs) and sophisticated phishing campaigns, is compelling businesses to move beyond traditional perimeter-based security models towards more proactive and intelligent defense systems. This includes the growing demand for managed detection and response (MDR) services, identity and access management (IAM) solutions, and comprehensive data security platforms. The Spanish government's commitment to digital transformation, coupled with increasing investments in critical infrastructure protection, further underpins the market's upward trajectory. Emerging technologies like blockchain for secure data management and quantum-resistant encryption are beginning to influence long-term market strategies, promising even greater resilience against future cyber threats.

Dominant Regions, Countries, or Segments in Spain Cybersecurity Market

Within the Spain cybersecurity market, the IT and Telecommunication end-user segment stands out as a dominant force, projected to account for over 28% of the market share by 2025, valued at €2,184 million. This dominance is propelled by several key drivers. Firstly, the inherent nature of the IT and Telecommunication industry, which deals with vast amounts of sensitive data and interconnected networks, makes it a prime target for cyberattacks. Consequently, these organizations are proactive in investing in comprehensive cybersecurity solutions, including advanced network security, cloud security for their infrastructure, and robust identity and access management to protect their digital assets. Secondly, the rapid pace of digital transformation within this sector, with the widespread adoption of 5G, cloud computing, and IoT, introduces new attack vectors that necessitate constant vigilance and security upgrades.

- Dominant Segment: IT and Telecommunication End User

- Market Value (2025): Approximately €2,184 million

- Projected Market Share (2025): Over 28%

- Key Drivers:

- High volume of sensitive data and critical infrastructure.

- Rapid adoption of new technologies (5G, cloud, IoT).

- Regulatory compliance demands for data protection.

- Need for secure network operations and customer data privacy.

- Growth Potential: Continual innovation and expansion of digital services will require sustained cybersecurity investment.

Beyond the IT and Telecommunication sector, the Government and Defense segment is another significant growth engine, driven by national security imperatives and the increasing threat of state-sponsored cyber warfare. This sector commands a substantial portion of the cybersecurity budget, focusing on critical infrastructure protection, secure communication systems, and advanced threat intelligence. The BFSI (Banking, Financial Services, and Insurance) sector also exhibits strong demand, driven by the need to protect financial assets, customer PII, and maintain trust in digital banking services. Cloud security solutions are experiencing widespread adoption across all segments, with cloud deployment models projected to represent over 70% of the total market by 2025, valued at €5,460 million. This shift is attributed to the scalability, flexibility, and cost-effectiveness of cloud-based security services. In terms of offerings, Cloud Security and Data Security are the leading categories, collectively expected to capture over 50% of the market by 2025. These segments are driven by the increasing sophistication of data breaches and the growing emphasis on data privacy and regulatory compliance.

- Other Significant Segments:

- Government and Defense: Driven by national security and critical infrastructure protection.

- BFSI: Focused on financial asset protection and customer data security.

- Dominant Deployment Model: Cloud Deployment

- Market Value (2025): Approximately €5,460 million

- Projected Market Share (2025): Over 70%

- Key Drivers: Scalability, cost-effectiveness, and ease of integration.

- Leading Offerings: Cloud Security and Data Security

- Market Value (2025): Combined estimated at over €3,900 million

- Key Drivers: Increasing data volumes, sophisticated breaches, and stringent data privacy regulations.

Spain Cybersecurity Market Product Landscape

The Spain cybersecurity market is defined by an evolving product landscape focused on proactive threat mitigation and integrated defense strategies. Innovations in AI-driven threat intelligence platforms are enabling real-time detection and response to sophisticated attacks, with products offering predictive analytics to anticipate emerging threats. Cloud security solutions are becoming increasingly sophisticated, providing granular control over cloud environments and ensuring compliance with data residency requirements. Identity and Access Management (IAM) solutions are evolving beyond traditional authentication to incorporate multi-factor authentication (MFA), adaptive access controls, and privileged access management (PAM) to strengthen user access security. Endpoint detection and response (EDR) and extended detection and response (XDR) solutions are gaining traction for their ability to provide a unified view of threats across endpoints, networks, and cloud environments. Unique selling propositions often lie in the seamless integration capabilities of these products with existing IT infrastructure and their ability to provide actionable insights to security teams, reducing manual effort and response times. For example, Redtrust by Evolium Technologies S L U is a prominent example of an integrated security solution designed to protect sensitive data and manage access in digital environments.

Key Drivers, Barriers & Challenges in Spain Cybersecurity Market

Key Drivers:

- Increasing Cyber Threats: The escalating sophistication and frequency of cyberattacks, including ransomware, phishing, and data breaches, are compelling organizations to prioritize cybersecurity investments. The estimated financial impact of cybercrime in Spain reached €10 billion in 2024, highlighting the urgent need for effective solutions.

- Digital Transformation: The rapid adoption of cloud computing, IoT, and remote work models by Spanish businesses expands the attack surface, necessitating robust security measures.

- Regulatory Compliance: Stringent data protection regulations, such as GDPR and the upcoming NIS2 Directive, mandate significant investments in cybersecurity to avoid hefty penalties.

- Government Initiatives: Public sector investments in national security and digital infrastructure protection drive demand for advanced cybersecurity solutions.

Barriers & Challenges:

- Cybersecurity Skills Gap: A significant shortage of skilled cybersecurity professionals in Spain hinders the effective implementation and management of security solutions. This shortage is estimated to affect over 70% of Spanish companies.

- Budget Constraints for SMEs: Small and medium-sized enterprises (SMEs) often face budgetary limitations, making it challenging to adopt comprehensive and advanced cybersecurity measures.

- Complexity of Integration: Integrating new cybersecurity solutions with legacy IT systems can be complex and time-consuming, posing a challenge for many organizations.

- Evolving Threat Landscape: The rapid evolution of cyber threats requires continuous adaptation and investment in new security technologies, creating a perpetual arms race for defense.

- Supply Chain Vulnerabilities: Threats targeting supply chains are becoming more prevalent, requiring organizations to extend their security focus beyond their own perimeters.

Emerging Opportunities in Spain Cybersecurity Market

Emerging opportunities in the Spain cybersecurity market lie in the burgeoning demand for Managed Security Services (MSS), particularly for SMEs who lack the in-house expertise and resources to manage complex security infrastructures. The growing adoption of IoT devices across industrial and consumer sectors presents a significant opportunity for specialized IoT security solutions, addressing the unique vulnerabilities associated with these connected devices. Furthermore, the increasing focus on Operational Technology (OT) security within critical infrastructure and manufacturing industries, spurred by incidents like the Telefónica Tech's new service, offers a substantial growth avenue. The rise of AI and machine learning in cybersecurity is creating demand for intelligent automation tools that can detect and respond to threats faster and more efficiently. Additionally, the need for cloud-native security solutions tailored for hybrid and multi-cloud environments is expected to accelerate as more businesses migrate their operations to the cloud.

Growth Accelerators in the Spain Cybersecurity Market Industry

Several catalysts are accelerating the growth of the Spain cybersecurity market. Technological breakthroughs in areas like Extended Detection and Response (XDR) and Zero Trust Architecture are providing more robust and integrated security frameworks. Strategic partnerships between cybersecurity vendors and cloud service providers are expanding access to advanced security solutions for a wider range of businesses. Market expansion strategies, including the development of specialized offerings for underserved sectors like healthcare and the public sector, are further driving adoption. The increasing awareness and proactive stance of Spanish businesses in mitigating cyber risks, coupled with supportive government policies for digitalization and cybersecurity, are creating a fertile ground for sustained market growth.

Key Players Shaping the Spain Cybersecurity Market Market

- Microsoft

- S2 Grupo

- IBM Corporation

- Outpost24 (BlueLiv)

- Telefonica Cybersecurity & Cloud Tech S L U

- Alias Robotics S L

- Evolium Technologies S L U (Redtrust)

- Acuntia S A U (Axians)

- Grupo S21Sec Gestion S A U

- Titanium Industrial Security S L

- Indra Sistemas S A

Notable Milestones in Spain Cybersecurity Market Sector

- June 2022: Telefónica Tech launched a security monitoring service for operational technology (OT) and Internet of Things (IoT) environments. This service scans network traffic to envision network assets, analyzes susceptibilities, and detects potential threats, leveraging the capabilities of its global network of 11 security operations centers. The company obtained certification in Nozomi Networks' MSSP Elite program to provide managed services for industrial and IoT operations. This development signifies a strategic move to address the growing security needs of industrial and connected environments.

- January 2022: Microsoft expanded its collaboration with Minsait, an Indra company. This partnership offers a comprehensive suite of hybrid cloud services and solutions designed to facilitate and accelerate the migration of Spanish companies and public administrations to the cloud. The joint offering includes advanced monitoring and encryption services, enhancing data privacy and security within the Microsoft cloud and ensuring compliance with stringent legal and technical requirements for the principles of cloud trust. This collaboration includes Minsait's data sovereignty services, featuring encryption management technologies essential for managing Microsoft 365, Microsoft Azure, and Dynamics 365. This milestone highlights the increasing importance of secure cloud adoption and data sovereignty.

In-Depth Spain Cybersecurity Market Market Outlook

The Spain cybersecurity market is on a robust upward trajectory, propelled by increasing cyber threats and widespread digitalization. Future growth will be significantly driven by the adoption of advanced security solutions like AI-powered threat intelligence, zero-trust architectures, and comprehensive cloud security platforms. Strategic partnerships between technology providers and managed service providers will expand accessibility to cutting-edge cybersecurity for businesses of all sizes. The increasing demand for specialized security for IoT and OT environments, coupled with stringent regulatory compliance, will continue to fuel market expansion. Opportunities also lie in addressing the persistent cybersecurity skills gap through advanced training programs and automated security solutions. The market is expected to witness continued innovation and strategic investments, solidifying its importance in the digital economy.

Spain Cybersecurity Market Segmentation

-

1. Offering

-

1.1. Security Type

- 1.1.1. Cloud Security

- 1.1.2. Data Security

- 1.1.3. Identity Access Management

- 1.1.4. Network Security

- 1.1.5. Consumer Security

- 1.1.6. Infrastructure Protection

- 1.1.7. Other Types

- 1.2. Services

-

1.1. Security Type

-

2. Deployment

- 2.1. Cloud

- 2.2. On-premise

-

3. End User

- 3.1. BFSI

- 3.2. Healthcare

- 3.3. Manufacturing

- 3.4. Government and Defense

- 3.5. IT and Telecommunication

- 3.6. Other End Users

Spain Cybersecurity Market Segmentation By Geography

- 1. Spain

Spain Cybersecurity Market Regional Market Share

Geographic Coverage of Spain Cybersecurity Market

Spain Cybersecurity Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.16% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increasing Demand from Digitalization

- 3.2.2 e-Commerce

- 3.2.3 and Scaling IT Infrastructure for Businesses; Economic Catch-Up Effect Supporting Digital Businesses and Cybersecurity; Large Spanish Defense and Security Firms Driving the Growth

- 3.3. Market Restrains

- 3.3.1. Lack of Cybersecurity Workforce

- 3.4. Market Trends

- 3.4.1. E-Commerce and Digitalization to Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Spain Cybersecurity Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Security Type

- 5.1.1.1. Cloud Security

- 5.1.1.2. Data Security

- 5.1.1.3. Identity Access Management

- 5.1.1.4. Network Security

- 5.1.1.5. Consumer Security

- 5.1.1.6. Infrastructure Protection

- 5.1.1.7. Other Types

- 5.1.2. Services

- 5.1.1. Security Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment

- 5.2.1. Cloud

- 5.2.2. On-premise

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. BFSI

- 5.3.2. Healthcare

- 5.3.3. Manufacturing

- 5.3.4. Government and Defense

- 5.3.5. IT and Telecommunication

- 5.3.6. Other End Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Spain

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Microsoft

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 S2 Grupo

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 IBM Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Outpost24 (BlueLiv)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Telefonica Cybersecurity & Cloud Tech S L U

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Alias Robotics S L

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Evolium Technologies S L U (Redtrust)*List Not Exhaustive

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Acuntia S A U (Axians)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Grupo S21Sec Gestion S A U

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Titanium Industrial Security S L

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Indra Sistemas S A

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Microsoft

List of Figures

- Figure 1: Spain Cybersecurity Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Spain Cybersecurity Market Share (%) by Company 2025

List of Tables

- Table 1: Spain Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 2: Spain Cybersecurity Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 3: Spain Cybersecurity Market Revenue Million Forecast, by End User 2020 & 2033

- Table 4: Spain Cybersecurity Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Spain Cybersecurity Market Revenue Million Forecast, by Offering 2020 & 2033

- Table 6: Spain Cybersecurity Market Revenue Million Forecast, by Deployment 2020 & 2033

- Table 7: Spain Cybersecurity Market Revenue Million Forecast, by End User 2020 & 2033

- Table 8: Spain Cybersecurity Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Spain Cybersecurity Market?

The projected CAGR is approximately 7.16%.

2. Which companies are prominent players in the Spain Cybersecurity Market?

Key companies in the market include Microsoft, S2 Grupo, IBM Corporation, Outpost24 (BlueLiv), Telefonica Cybersecurity & Cloud Tech S L U, Alias Robotics S L, Evolium Technologies S L U (Redtrust)*List Not Exhaustive, Acuntia S A U (Axians), Grupo S21Sec Gestion S A U, Titanium Industrial Security S L, Indra Sistemas S A.

3. What are the main segments of the Spain Cybersecurity Market?

The market segments include Offering, Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.27 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand from Digitalization. e-Commerce. and Scaling IT Infrastructure for Businesses; Economic Catch-Up Effect Supporting Digital Businesses and Cybersecurity; Large Spanish Defense and Security Firms Driving the Growth.

6. What are the notable trends driving market growth?

E-Commerce and Digitalization to Drive the Market.

7. Are there any restraints impacting market growth?

Lack of Cybersecurity Workforce.

8. Can you provide examples of recent developments in the market?

June 2022 - Telefónica Tech announced the launch of a security monitoring service for operational technology (OT) and Internet of Things (IoT) environments. The service scans network traffic to envision the network's assets, analyzes and highlights susceptibilities, and detects potential threats in the environment. The company's new offerings leverage the capabilities of its global network of 11 security operations centers for developing a managed OT and IoT security service based on Nozomi Networks technology. It obtains certification in Nozomi Networks' MSSP Elite program to provide managed services for industrial and IoT operations.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Spain Cybersecurity Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Spain Cybersecurity Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Spain Cybersecurity Market?

To stay informed about further developments, trends, and reports in the Spain Cybersecurity Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence