Key Insights

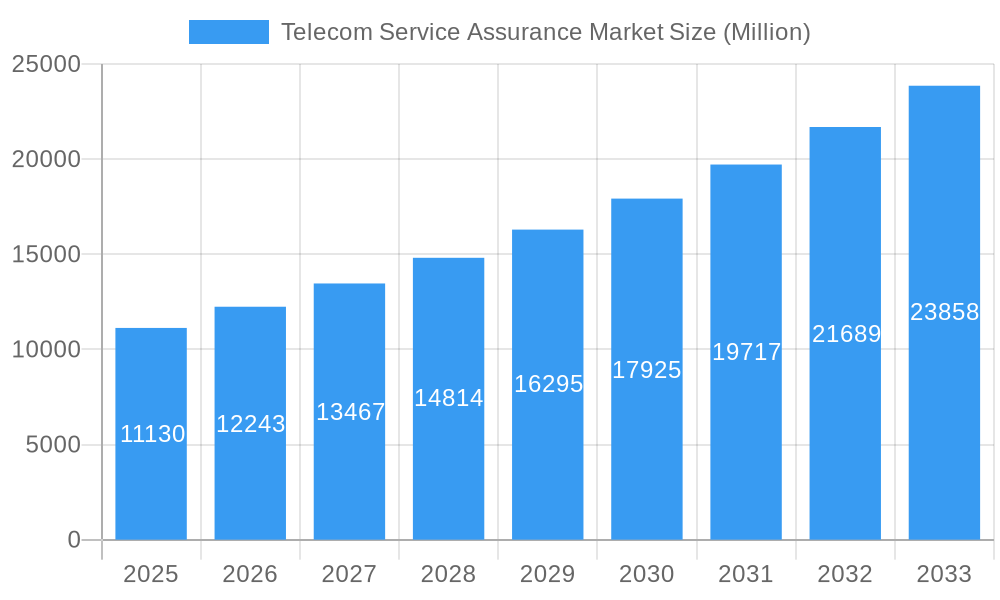

The Telecom Service Assurance Market is poised for substantial growth, projected to reach a market size of USD 11.13 billion in 2025, with a robust Compound Annual Growth Rate (CAGR) of 10.04% extending through 2033. This expansion is primarily fueled by the escalating complexity of telecommunication networks, the burgeoning demand for enhanced customer experience, and the critical need for operators to proactively identify and resolve service disruptions. Key drivers include the widespread adoption of 5G technologies, the increasing integration of Artificial Intelligence (AI) and Machine Learning (ML) for automated network monitoring and fault prediction, and the growing pressure on service providers to maintain stringent Service Level Agreements (SLAs) in an increasingly competitive landscape. The market is segmented across various component types, with Network Management, Fault Management, and Quality Monitoring systems taking center stage due to their direct impact on operational efficiency and customer satisfaction. Furthermore, the increasing reliance on professional and managed services signifies a strategic shift towards outsourcing core assurance functions to specialized vendors, allowing telecom companies to focus on innovation and core business operations.

Telecom Service Assurance Market Market Size (In Billion)

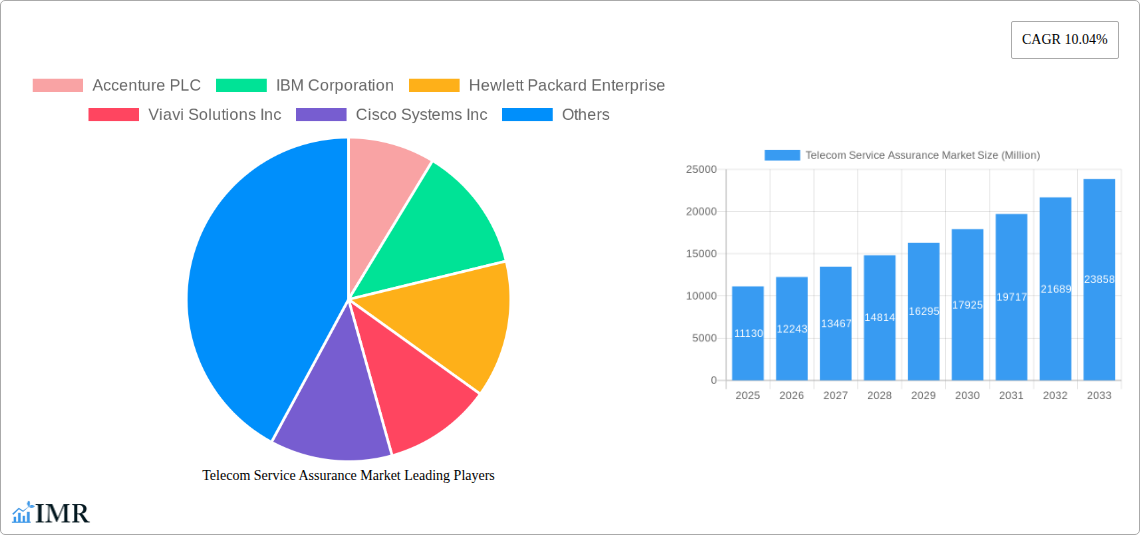

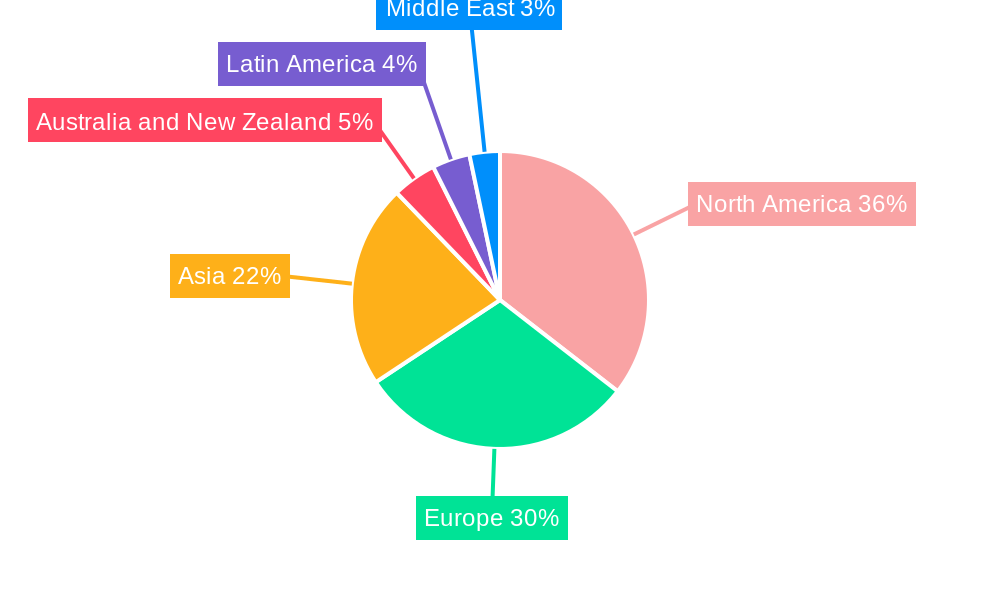

The growth trajectory of the Telecom Service Assurance Market is further shaped by evolving deployment models, with a discernible shift towards hosted solutions offering greater scalability and cost-efficiency compared to traditional on-premise deployments. While the market demonstrates strong positive momentum, certain restraints, such as the high initial investment required for advanced assurance solutions and the ongoing challenge of skilled workforce availability in specialized areas, need to be addressed. Geographically, North America and Europe are expected to lead in market adoption due to their mature telecommunications infrastructure and early embrace of advanced technologies. However, the Asia-Pacific region presents a significant growth opportunity, driven by rapid digital transformation initiatives, increasing smartphone penetration, and substantial investments in 5G network rollouts. Companies like Accenture, IBM, Hewlett Packard Enterprise, and Cisco are at the forefront of this market, offering comprehensive solutions and actively shaping its future through continuous innovation and strategic partnerships.

Telecom Service Assurance Market Company Market Share

Unleashing the Future of Connectivity: Telecom Service Assurance Market Report (2019–2033)

This comprehensive Telecom Service Assurance Market report delves deep into the evolving landscape of network performance and customer experience management. Designed for telecom operators, service providers, technology vendors, and strategic investors, this study offers critical insights into market dynamics, growth trends, regional dominance, product innovations, and key challenges. With a study period spanning from 2019 to 2033, a base year of 2025, and a forecast period of 2025–2033, this report provides an invaluable outlook on the future of telco service assurance, network assurance, service quality monitoring, and performance management solutions.

Understand the intricate ecosystem of Telecom Service Assurance, encompassing both parent and child markets. Our analysis covers the core Telecom Service Assurance Market and its vital sub-segments, providing a holistic view of market opportunities and competitive strategies. The report quantifies market sizes in Million units, offering precise financial projections.

High-traffic keywords integrated: Telecom Service Assurance Market, Telco Service Assurance, Network Assurance, Service Quality Monitoring, Performance Management, Telecom Cloud Assurance, 5G Service Assurance, NFV Assurance, SDN Assurance, AI in Telecom Assurance, Automation in Telecom, Customer Experience Management (CEM), Network Management Systems, Fault Management, Quality Monitoring, Probe Systems, Workforce Management, Professional Services, Managed Services, On-Premise Deployment, Hosted Deployment, Telecom Industry, Digital Transformation, IT Operations Management (ITOM), IT Service Management (ITSM).

Telecom Service Assurance Market Market Dynamics & Structure

The Telecom Service Assurance Market is characterized by a dynamic interplay of technological innovation, evolving regulatory landscapes, and fierce competition. Market concentration is moderately fragmented, with key players investing heavily in research and development to gain a competitive edge. Technological innovation drivers are predominantly fueled by the rapid advancements in 5G deployment, the expansion of NFV (Network Functions Virtualization) and SDN (Software-Defined Networking), and the increasing adoption of AI and automation in network operations. These technologies necessitate sophisticated assurance solutions to ensure optimal performance and reliability.

Regulatory frameworks, while varied across regions, increasingly emphasize service quality, customer experience, and data privacy, pushing operators to adopt robust assurance tools. Competitive product substitutes, ranging from basic monitoring tools to comprehensive AI-driven platforms, present a constant challenge, compelling vendors to differentiate through advanced features and integrated solutions. End-user demographics are shifting towards a more demanding consumer base expecting seamless, high-quality connectivity across all services, driving the need for proactive and predictive assurance. Mergers and acquisitions (M&A) trends are significant, with larger entities acquiring innovative startups to expand their service portfolios and market reach. For instance, the acquisition of smaller specialized assurance providers by established technology giants is a recurring theme, aiming to consolidate market share and offer end-to-end solutions.

- Market Concentration: Moderately fragmented with prominent players and emerging innovators.

- Technological Drivers: 5G rollout, NFV, SDN, AI/ML for predictive analytics, cloud-native assurance.

- Regulatory Impact: Growing emphasis on QoS, QoE, and data security mandates.

- Competitive Landscape: Intense competition from established vendors and disruptive new entrants offering specialized solutions.

- End-User Expectations: Demand for uninterrupted connectivity, low latency, and superior digital experiences.

- M&A Activity: Strategic acquisitions to enhance portfolios and expand global presence.

Telecom Service Assurance Market Growth Trends & Insights

The Telecom Service Assurance Market is poised for substantial growth, driven by the relentless digital transformation across industries and the exponential rise in data consumption. Market size evolution is directly correlated with the increasing complexity of telecommunications networks, particularly with the widespread adoption of 5G networks, IoT devices, and advanced cloud services. These technologies, while offering new revenue streams, also introduce new challenges in terms of performance monitoring, fault detection, and service continuity. The adoption rates of advanced assurance solutions are accelerating as telecom operators recognize the critical need for proactive problem-solving and enhanced customer experience management (CEM) to retain subscribers and reduce churn.

Technological disruptions, such as the integration of Artificial Intelligence (AI) and Machine Learning (ML) into assurance platforms, are transforming the market. These technologies enable predictive analytics, automated root cause analysis, and intelligent resource allocation, moving beyond traditional reactive monitoring to proactive and preventative assurance. Consumer behavior shifts towards higher expectations for real-time, high-bandwidth services, including video streaming, online gaming, and augmented/virtual reality, further intensify the demand for flawless network performance. This necessitates sophisticated network assurance and service quality monitoring solutions that can identify and resolve issues before they impact end-users.

The market penetration of sophisticated Telecom Cloud Assurance and IT Operations Management (ITOM) solutions is steadily increasing as operators migrate their infrastructure to cloud environments, seeking greater agility and scalability. This shift also brings new assurance challenges related to virtualized network functions and distributed infrastructure, requiring specialized tools. The focus is no longer solely on network uptime but on the end-to-end service quality experienced by the customer. Metrics such as Customer Experience Score (CES) and Net Promoter Score (NPS) are becoming key performance indicators that directly influence investment in advanced assurance capabilities. The projected Compound Annual Growth Rate (CAGR) for the Telecom Service Assurance Market is robust, reflecting the critical role of these solutions in the future of telecommunications. For instance, the market is projected to grow at a CAGR of approximately 12.5% from 2025 to 2033, reaching an estimated market size of $22,500 Million by 2033. This significant expansion is fueled by the ongoing investment in network upgrades and the continuous demand for superior service delivery.

Dominant Regions, Countries, or Segments in Telecom Service Assurance Market

North America currently holds a dominant position in the Telecom Service Assurance Market, driven by its early adoption of advanced technologies, significant investments in 5G infrastructure, and a highly developed telecommunications sector. The presence of major telecom operators and technology giants in the region fuels innovation and the demand for cutting-edge network assurance and service quality monitoring solutions. Stringent regulatory requirements and a strong focus on customer experience management (CEM) further bolster the adoption of comprehensive assurance platforms.

Within North America, the United States leads the market due to its extensive fiber optic deployments, rapid 5G rollout, and a high concentration of enterprises demanding reliable connectivity for digital operations. The country's mature market for IT Operations Management (ITOM) and IT Service Management (ITSM) solutions also translates into a strong demand for integrated assurance capabilities. Economic policies that encourage technological advancement and infrastructure development, coupled with a competitive market, compel service providers to invest heavily in ensuring service quality and customer satisfaction.

Analyzing by Component Type, the Network Management segment is a key driver of market growth. This encompasses a broad range of functionalities essential for monitoring, controlling, and optimizing network performance, including Fault Management, Quality Monitoring, and Probe Systems. As networks become more complex with the proliferation of virtualized functions and distributed architectures, robust network management tools are indispensable for maintaining operational efficiency and service delivery.

- North America's Dominance: Fueled by early 5G adoption, extensive R&D, and a strong CEM focus.

- United States Leadership: Driven by advanced infrastructure, rapid 5G expansion, and enterprise demand.

- Key Segment: Network Management: Essential for overseeing complex, evolving telco networks.

- Fault Management: Crucial for rapid issue detection and resolution, minimizing downtime.

- Quality Monitoring: Ensures adherence to Service Level Agreements (SLAs) and optimal user experience.

- Probe Systems: Provide granular data for performance analysis and troubleshooting.

- Services Type Impact: Managed Services are gaining traction as operators seek to offload complex assurance operations to specialized providers, allowing them to focus on core competencies.

- Deployment Type Trends: While On-Premise solutions remain significant for critical infrastructure, the shift towards Hosted and cloud-native assurance platforms is accelerating due to their scalability, flexibility, and cost-effectiveness.

Telecom Service Assurance Market Product Landscape

The Telecom Service Assurance Market product landscape is characterized by a rapid evolution towards AI-driven, automated, and integrated solutions. Vendors are focusing on developing platforms that offer end-to-end visibility across complex hybrid networks, from physical infrastructure to virtualized functions and cloud-native applications. Unique selling propositions often revolve around predictive analytics for proactive fault detection, real-time root cause analysis, and intelligent automation of remediation processes. Technological advancements include the integration of AI/ML for anomaly detection, machine learning-driven capacity planning, and sophisticated visualization tools for intuitive performance monitoring. The performance metrics being emphasized include Mean Time To Detect (MTTD), Mean Time To Resolve (MTTR), service availability, and customer experience scores. The market is witnessing a surge in cloud-native assurance solutions designed to seamlessly integrate with cloud orchestration platforms and provide assurance for dynamic, ephemeral workloads.

Key Drivers, Barriers & Challenges in Telecom Service Assurance Market

Key Drivers:

- 5G Network Expansion: The rollout of 5G necessitates advanced assurance to manage increased data traffic, lower latency, and new use cases.

- Digital Transformation: Enterprises across all sectors rely on robust connectivity, driving demand for reliable telecom services and thus, robust assurance.

- AI and Automation Adoption: The growing need for intelligent, proactive, and automated network operations.

- Enhanced Customer Experience: Rising consumer expectations for seamless, high-quality connectivity.

- IoT Growth: The proliferation of IoT devices generates massive amounts of data, requiring sophisticated monitoring and assurance.

Barriers & Challenges:

- Network Complexity: Managing highly virtualized, distributed, and multi-vendor networks presents significant assurance challenges.

- Data Overload: The sheer volume of data generated by modern networks can overwhelm traditional monitoring systems.

- Skill Gap: A shortage of skilled professionals capable of implementing and managing advanced assurance solutions.

- Integration Issues: Ensuring seamless integration of diverse assurance tools with existing IT infrastructure.

- Cost of Implementation: High initial investment required for advanced assurance platforms can be a deterrent for some operators.

- Regulatory Compliance: Navigating diverse and evolving regulatory landscapes across different geographies.

Emerging Opportunities in Telecom Service Assurance Market

Emerging opportunities in the Telecom Service Assurance Market are centered around the growing demand for AI-powered predictive analytics, end-to-end service orchestration, and assured experiences for emerging technologies like private 5G and edge computing. The increasing adoption of cloud-native architectures presents a fertile ground for specialized Telecom Cloud Assurance solutions that can provide visibility and control over dynamic virtualized environments. Furthermore, the development of assurance solutions tailored for specific industry verticals, such as healthcare, manufacturing, and automotive, offering guaranteed service levels for critical applications, represents a significant untapped market. The evolution of Customer Experience Management (CEM) platforms, moving beyond reactive monitoring to proactive experience assurance, also opens avenues for innovative product development and service offerings.

Growth Accelerators in the Telecom Service Assurance Market Industry

Growth in the Telecom Service Assurance Market is significantly accelerated by several key factors. The relentless pace of technological innovation, particularly in 5G service assurance and the integration of AI/ML for predictive maintenance and automated fault resolution, is a primary catalyst. Strategic partnerships between telecom operators, technology providers, and cloud vendors are fostering the development and deployment of integrated assurance solutions. Market expansion strategies, including a focus on emerging economies and the development of specialized assurance offerings for new use cases like enterprise IoT and autonomous systems, are further propelling growth. The increasing recognition of service assurance as a critical differentiator for customer retention and revenue generation is driving sustained investment in advanced capabilities, thereby accelerating the market's upward trajectory.

Key Players Shaping the Telecom Service Assurance Market Market

- Accenture PLC

- IBM Corporation

- Hewlett Packard Enterprise

- Viavi Solutions Inc

- Cisco Systems Inc

- Tata Consultancy Services Limited

- Telefonaktiebolaget LM Ericsson

- NEC Corporation

- Nokia Corporation

- Broadcom Inc (CA Technologies Inc)

Notable Milestones in Telecom Service Assurance Market Sector

- March 2024: ServiceNow deepened its collaboration with NVIDIA, focusing on delivering industry-specific GenAI for telcos. Their initial offering, called Now Assist for Telecommunications Service Management (TSM), harnesses NVIDIA AI on the Now Platform, streamlining AI-driven and automated processes, especially in critical telco use cases like network management assurance.

- February 2024: MYCOM OSI unveiled enhanced features for its Experience Assurance and Analytics (EAA) Service Assurance suite. These upgrades aim to expedite identifying, diagnosing, and resolving network issues on mobile and fixed lines.

In-Depth Telecom Service Assurance Market Market Outlook

The future outlook for the Telecom Service Assurance Market is exceptionally promising, driven by the sustained investment in advanced network technologies and the increasing imperative for flawless service delivery. Growth accelerators such as the pervasive integration of AI/ML for intelligent automation, the expansion of 5G use cases, and the continuous evolution of cloud-native assurance will shape market dynamics. Strategic opportunities lie in developing granular assurance solutions for emerging areas like edge computing and private networks, alongside enhancing customer experience management (CEM) capabilities to meet hyper-personalized demands. The market is on a trajectory of significant expansion, moving towards proactive, predictive, and outcome-based assurance models that are essential for the success of future telecommunications networks.

Telecom Service Assurance Market Segmentation

-

1. Component Type

-

1.1. System Type

- 1.1.1. Probe System

- 1.1.2. Network Management

- 1.1.3. Workforce Management

- 1.1.4. Fault Management

- 1.1.5. Quality Monitoring

- 1.1.6. Other System Types

-

1.2. Services Type

- 1.2.1. Professional Services

- 1.2.2. Managed Services

-

1.1. System Type

-

2. Deployment Type

- 2.1. On-Premise

- 2.2. Hosted

Telecom Service Assurance Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia

- 4. Australia and New Zealand

- 5. Latin America

- 6. Middle East

Telecom Service Assurance Market Regional Market Share

Geographic Coverage of Telecom Service Assurance Market

Telecom Service Assurance Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Service Quality; Significant Increase in the Number of Cellular Subscribers; Rising Need for High Optimization and Increased Saving Costs

- 3.3. Market Restrains

- 3.3.1. Data Privacy Concerns; Lack of Infrastructure in Emerging Economies

- 3.4. Market Trends

- 3.4.1. Network Management System Expected to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Telecom Service Assurance Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 5.1.1. System Type

- 5.1.1.1. Probe System

- 5.1.1.2. Network Management

- 5.1.1.3. Workforce Management

- 5.1.1.4. Fault Management

- 5.1.1.5. Quality Monitoring

- 5.1.1.6. Other System Types

- 5.1.2. Services Type

- 5.1.2.1. Professional Services

- 5.1.2.2. Managed Services

- 5.1.1. System Type

- 5.2. Market Analysis, Insights and Forecast - by Deployment Type

- 5.2.1. On-Premise

- 5.2.2. Hosted

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia

- 5.3.4. Australia and New Zealand

- 5.3.5. Latin America

- 5.3.6. Middle East

- 5.1. Market Analysis, Insights and Forecast - by Component Type

- 6. North America Telecom Service Assurance Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 6.1.1. System Type

- 6.1.1.1. Probe System

- 6.1.1.2. Network Management

- 6.1.1.3. Workforce Management

- 6.1.1.4. Fault Management

- 6.1.1.5. Quality Monitoring

- 6.1.1.6. Other System Types

- 6.1.2. Services Type

- 6.1.2.1. Professional Services

- 6.1.2.2. Managed Services

- 6.1.1. System Type

- 6.2. Market Analysis, Insights and Forecast - by Deployment Type

- 6.2.1. On-Premise

- 6.2.2. Hosted

- 6.1. Market Analysis, Insights and Forecast - by Component Type

- 7. Europe Telecom Service Assurance Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 7.1.1. System Type

- 7.1.1.1. Probe System

- 7.1.1.2. Network Management

- 7.1.1.3. Workforce Management

- 7.1.1.4. Fault Management

- 7.1.1.5. Quality Monitoring

- 7.1.1.6. Other System Types

- 7.1.2. Services Type

- 7.1.2.1. Professional Services

- 7.1.2.2. Managed Services

- 7.1.1. System Type

- 7.2. Market Analysis, Insights and Forecast - by Deployment Type

- 7.2.1. On-Premise

- 7.2.2. Hosted

- 7.1. Market Analysis, Insights and Forecast - by Component Type

- 8. Asia Telecom Service Assurance Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 8.1.1. System Type

- 8.1.1.1. Probe System

- 8.1.1.2. Network Management

- 8.1.1.3. Workforce Management

- 8.1.1.4. Fault Management

- 8.1.1.5. Quality Monitoring

- 8.1.1.6. Other System Types

- 8.1.2. Services Type

- 8.1.2.1. Professional Services

- 8.1.2.2. Managed Services

- 8.1.1. System Type

- 8.2. Market Analysis, Insights and Forecast - by Deployment Type

- 8.2.1. On-Premise

- 8.2.2. Hosted

- 8.1. Market Analysis, Insights and Forecast - by Component Type

- 9. Australia and New Zealand Telecom Service Assurance Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 9.1.1. System Type

- 9.1.1.1. Probe System

- 9.1.1.2. Network Management

- 9.1.1.3. Workforce Management

- 9.1.1.4. Fault Management

- 9.1.1.5. Quality Monitoring

- 9.1.1.6. Other System Types

- 9.1.2. Services Type

- 9.1.2.1. Professional Services

- 9.1.2.2. Managed Services

- 9.1.1. System Type

- 9.2. Market Analysis, Insights and Forecast - by Deployment Type

- 9.2.1. On-Premise

- 9.2.2. Hosted

- 9.1. Market Analysis, Insights and Forecast - by Component Type

- 10. Latin America Telecom Service Assurance Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Component Type

- 10.1.1. System Type

- 10.1.1.1. Probe System

- 10.1.1.2. Network Management

- 10.1.1.3. Workforce Management

- 10.1.1.4. Fault Management

- 10.1.1.5. Quality Monitoring

- 10.1.1.6. Other System Types

- 10.1.2. Services Type

- 10.1.2.1. Professional Services

- 10.1.2.2. Managed Services

- 10.1.1. System Type

- 10.2. Market Analysis, Insights and Forecast - by Deployment Type

- 10.2.1. On-Premise

- 10.2.2. Hosted

- 10.1. Market Analysis, Insights and Forecast - by Component Type

- 11. Middle East Telecom Service Assurance Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Component Type

- 11.1.1. System Type

- 11.1.1.1. Probe System

- 11.1.1.2. Network Management

- 11.1.1.3. Workforce Management

- 11.1.1.4. Fault Management

- 11.1.1.5. Quality Monitoring

- 11.1.1.6. Other System Types

- 11.1.2. Services Type

- 11.1.2.1. Professional Services

- 11.1.2.2. Managed Services

- 11.1.1. System Type

- 11.2. Market Analysis, Insights and Forecast - by Deployment Type

- 11.2.1. On-Premise

- 11.2.2. Hosted

- 11.1. Market Analysis, Insights and Forecast - by Component Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Accenture PLC

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 IBM Corporation

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Hewlett Packard Enterprise

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Viavi Solutions Inc

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Cisco Systems Inc

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 Tata Consultancy Services Limited

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 Telefonaktiebolaget LM Ericsso

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 NEC Corporation

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Nokia Corporation

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Broadcom Inc (CA Technologies Inc )

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Accenture PLC

List of Figures

- Figure 1: Global Telecom Service Assurance Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Telecom Service Assurance Market Revenue (Million), by Component Type 2025 & 2033

- Figure 3: North America Telecom Service Assurance Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 4: North America Telecom Service Assurance Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 5: North America Telecom Service Assurance Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 6: North America Telecom Service Assurance Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Telecom Service Assurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Telecom Service Assurance Market Revenue (Million), by Component Type 2025 & 2033

- Figure 9: Europe Telecom Service Assurance Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 10: Europe Telecom Service Assurance Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 11: Europe Telecom Service Assurance Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 12: Europe Telecom Service Assurance Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe Telecom Service Assurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Telecom Service Assurance Market Revenue (Million), by Component Type 2025 & 2033

- Figure 15: Asia Telecom Service Assurance Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 16: Asia Telecom Service Assurance Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 17: Asia Telecom Service Assurance Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 18: Asia Telecom Service Assurance Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Asia Telecom Service Assurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Australia and New Zealand Telecom Service Assurance Market Revenue (Million), by Component Type 2025 & 2033

- Figure 21: Australia and New Zealand Telecom Service Assurance Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 22: Australia and New Zealand Telecom Service Assurance Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 23: Australia and New Zealand Telecom Service Assurance Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 24: Australia and New Zealand Telecom Service Assurance Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Australia and New Zealand Telecom Service Assurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Telecom Service Assurance Market Revenue (Million), by Component Type 2025 & 2033

- Figure 27: Latin America Telecom Service Assurance Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 28: Latin America Telecom Service Assurance Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 29: Latin America Telecom Service Assurance Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 30: Latin America Telecom Service Assurance Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Latin America Telecom Service Assurance Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Middle East Telecom Service Assurance Market Revenue (Million), by Component Type 2025 & 2033

- Figure 33: Middle East Telecom Service Assurance Market Revenue Share (%), by Component Type 2025 & 2033

- Figure 34: Middle East Telecom Service Assurance Market Revenue (Million), by Deployment Type 2025 & 2033

- Figure 35: Middle East Telecom Service Assurance Market Revenue Share (%), by Deployment Type 2025 & 2033

- Figure 36: Middle East Telecom Service Assurance Market Revenue (Million), by Country 2025 & 2033

- Figure 37: Middle East Telecom Service Assurance Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Telecom Service Assurance Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 2: Global Telecom Service Assurance Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 3: Global Telecom Service Assurance Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Telecom Service Assurance Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 5: Global Telecom Service Assurance Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 6: Global Telecom Service Assurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: Global Telecom Service Assurance Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 8: Global Telecom Service Assurance Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 9: Global Telecom Service Assurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Global Telecom Service Assurance Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 11: Global Telecom Service Assurance Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 12: Global Telecom Service Assurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Global Telecom Service Assurance Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 14: Global Telecom Service Assurance Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 15: Global Telecom Service Assurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Global Telecom Service Assurance Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 17: Global Telecom Service Assurance Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 18: Global Telecom Service Assurance Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Global Telecom Service Assurance Market Revenue Million Forecast, by Component Type 2020 & 2033

- Table 20: Global Telecom Service Assurance Market Revenue Million Forecast, by Deployment Type 2020 & 2033

- Table 21: Global Telecom Service Assurance Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Telecom Service Assurance Market?

The projected CAGR is approximately 10.04%.

2. Which companies are prominent players in the Telecom Service Assurance Market?

Key companies in the market include Accenture PLC, IBM Corporation, Hewlett Packard Enterprise, Viavi Solutions Inc, Cisco Systems Inc, Tata Consultancy Services Limited, Telefonaktiebolaget LM Ericsso, NEC Corporation, Nokia Corporation, Broadcom Inc (CA Technologies Inc ).

3. What are the main segments of the Telecom Service Assurance Market?

The market segments include Component Type, Deployment Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.13 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Service Quality; Significant Increase in the Number of Cellular Subscribers; Rising Need for High Optimization and Increased Saving Costs.

6. What are the notable trends driving market growth?

Network Management System Expected to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Data Privacy Concerns; Lack of Infrastructure in Emerging Economies.

8. Can you provide examples of recent developments in the market?

March 2024: ServiceNow deepened its collaboration with NVIDIA, focusing on delivering industry-specific GenAI for telcos. Their initial offering, called Now Assist for Telecommunications Service Management (TSM), harnesses NVIDIA AI on the Now Platform, streamlining AI-driven and automated processes, especially in critical telco use cases like network management assurance.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Telecom Service Assurance Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Telecom Service Assurance Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Telecom Service Assurance Market?

To stay informed about further developments, trends, and reports in the Telecom Service Assurance Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence