Key Insights

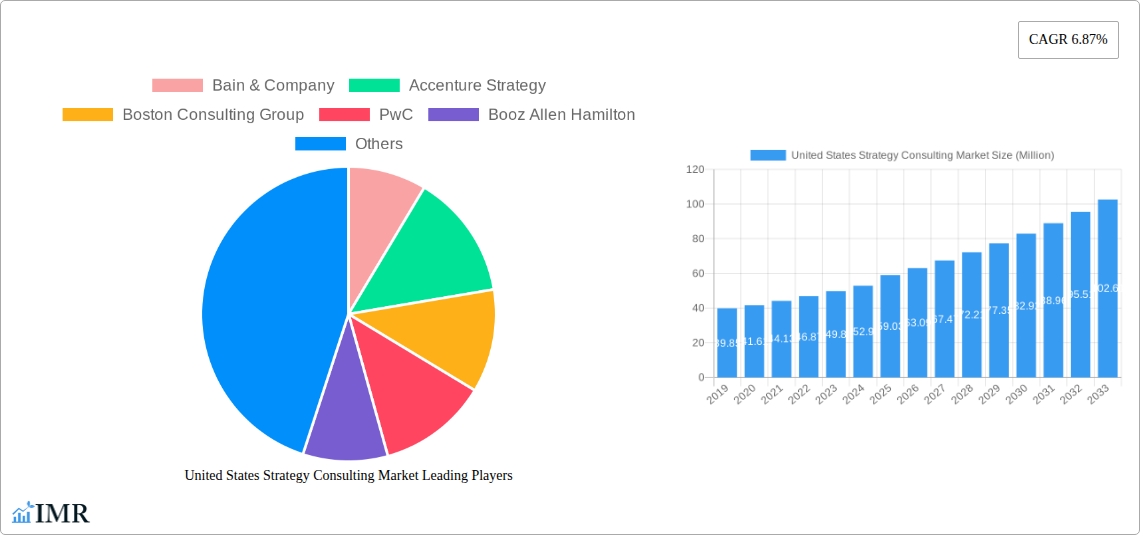

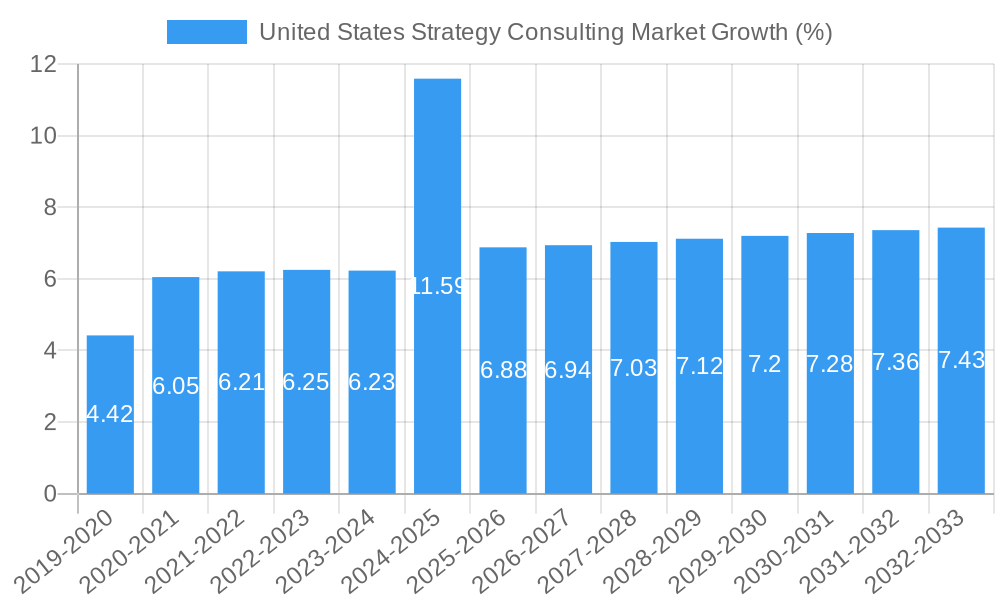

The United States strategy consulting market is poised for robust expansion, projected to reach a substantial $59.03 million by 2025, exhibiting a compelling Compound Annual Growth Rate (CAGR) of 6.87%. This growth trajectory is fueled by an increasing demand for specialized expertise across a multitude of industries. The IT & Telecommunication sector, a perennial driver of innovation and digital transformation, is a significant contributor, as are the dynamic Manufacturing and burgeoning Energy sectors, all of which require strategic guidance to navigate evolving landscapes and capitalize on new opportunities. Healthcare organizations are increasingly seeking strategic partners to address complex challenges related to patient care, operational efficiency, and regulatory compliance, further bolstering market demand. The Public Sector also presents a notable segment, as government entities increasingly leverage external expertise for policy development, program optimization, and digital modernization initiatives.

The strategic imperative for businesses to adapt to rapidly changing market dynamics, technological advancements, and competitive pressures underpins the sustained growth of the strategy consulting market in the United States. Key drivers include the need for digital transformation, supply chain optimization, sustainability initiatives, and market entry strategies. While the market is characterized by strong growth, certain restraints such as the high cost of consulting services and the availability of in-house expertise within larger corporations may present challenges. However, the sheer complexity of modern business problems, coupled with the specialized knowledge and objective perspective offered by leading consulting firms like McKinsey, Boston Consulting Group, and Bain & Company, ensures continued relevance and demand. The market is segmented into core areas of expertise, including HR Consulting, Strategy Consulting itself, and Operations Consulting, each catering to distinct organizational needs and contributing to the overall market vitality.

Unlock Strategic Advantage: The Definitive United States Strategy Consulting Market Report (2019-2033)

This comprehensive report delivers an in-depth analysis of the United States strategy consulting market, providing critical insights for industry leaders, investors, and strategic planners. Explore market dynamics, growth trajectories, and competitive landscapes within the US consulting services industry. We cover strategy consulting, HR consulting, and operations consulting, analyzing their interplay and impact across key end-user sectors including IT & Telecommunication, Manufacturing, Energy, Healthcare, Public Sector, and Retail. This report utilizes parent and child market analysis to reveal nuanced growth drivers and interdependencies. All values are presented in millions.

United States Strategy Consulting Market Market Dynamics & Structure

The United States strategy consulting market is characterized by a dynamic interplay of factors shaping its competitive landscape. Market concentration is high, with major global players such as McKinsey & Company, Boston Consulting Group (BCG), Bain & Company, Accenture Strategy, Deloitte, PwC, EY, KPMG, A.T. Kearney, and Booz Allen Hamilton dominating a significant share. These firms leverage their extensive expertise, broad service portfolios, and established client relationships to maintain their leadership positions. Technological innovation is a primary driver, with advancements in AI, machine learning, big data analytics, and cloud computing increasingly integrated into consulting methodologies to offer more sophisticated solutions. Regulatory frameworks, particularly those impacting data privacy and industry-specific compliance, also influence consulting strategies, often creating demand for specialized advisory services. Competitive product substitutes are emerging from boutique firms specializing in niche areas and in-house corporate strategy teams, though they generally lack the breadth and depth of the established players. End-user demographics are shifting, with an increasing demand for digital transformation, sustainability, and resilience strategies across all sectors. Mergers and acquisitions (M&A) are a notable trend, with larger firms acquiring specialized consultancies to expand their capabilities and market reach, thereby consolidating market share.

- Market Concentration: Dominated by a few large global consulting firms.

- Technological Innovation Drivers: AI, machine learning, big data analytics, cloud computing.

- Regulatory Frameworks: Data privacy (e.g., CCPA), industry-specific compliance.

- Competitive Product Substitutes: Niche consultancies, internal strategy departments.

- End-User Demographics: Growing demand for digital transformation, ESG strategies, supply chain resilience.

- M&A Trends: Consolidation through acquisition of specialized firms.

United States Strategy Consulting Market Growth Trends & Insights

The United States strategy consulting market has demonstrated robust growth, propelled by an insatiable demand for strategic guidance across diverse industries. From 2019 to 2024, the market experienced a steady upward trajectory, a trend expected to accelerate through 2033. The base year of 2025 sets the benchmark for future projections, with an estimated market size of approximately $58,425 million, and a projected Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. This sustained expansion is driven by businesses grappling with unprecedented complexity, including evolving market dynamics, rapid technological advancements, and shifting consumer behaviors. Adoption rates for strategic advisory services are at an all-time high, as organizations recognize the imperative of proactive planning and agile adaptation. Technological disruptions, such as the pervasive influence of AI and digital transformation initiatives, are not only creating new consulting opportunities but also fundamentally altering how businesses operate, necessitating expert guidance. Consumer behavior shifts, including a greater emphasis on sustainability, personalization, and digital-first experiences, are compelling companies to rethink their core strategies and operational models. This environment fosters continuous innovation within the consulting sector, with firms investing heavily in data analytics, AI-powered insights, and specialized expertise to meet client needs. The increasing complexity of global supply chains and geopolitical uncertainties further underscore the need for sophisticated strategic consulting to navigate risks and capitalize on opportunities.

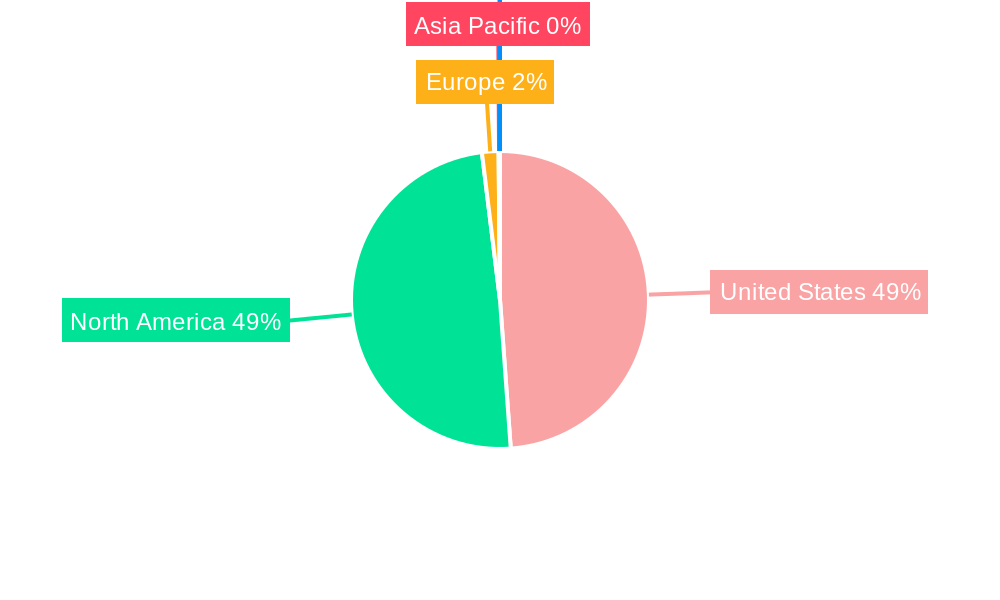

Dominant Regions, Countries, or Segments in United States Strategy Consulting Market

Within the United States strategy consulting market, the IT & Telecommunication end-user industry segment stands out as a dominant growth driver. This sector's inherent dynamism, characterized by rapid technological evolution, intense competition, and constant innovation, creates an ongoing need for strategic advisory services. The market size for consulting services within IT & Telecommunication is projected to reach approximately $13,926 million by 2025, reflecting its substantial contribution to the overall market. Key drivers for this dominance include the relentless pursuit of digital transformation by businesses across all sectors, with IT and telecommunication firms at the forefront of providing and enabling these solutions. The increasing adoption of cloud computing, cybersecurity, artificial intelligence, and 5G technology necessitates continuous strategic realignment and investment for these companies. Furthermore, the convergence of these technologies with traditional industries creates new strategic imperatives and opportunities, driving demand for specialized consulting expertise.

- IT & Telecommunication: This segment consistently leads in demand for strategy consulting due to rapid technological advancements and digital transformation initiatives.

- Key Drivers for Dominance:

- Pervasive digital transformation across all industries.

- Rapid advancements in AI, cloud computing, cybersecurity, and 5G.

- Intense competition and the need for continuous innovation.

- Strategic imperatives arising from technology convergence.

- Growth Potential: Significant future growth is anticipated as these technologies mature and become more integrated into global business operations.

The Strategy Consulting parent market segment itself remains the largest and most influential child segment within the broader consulting landscape. Its estimated market size in 2025 is projected to be around $28,567 million, underscoring its foundational role in shaping business direction. This dominance is attributed to the fundamental need for overarching strategic planning, market entry strategies, competitive analysis, and long-term vision development that businesses of all sizes require.

United States Strategy Consulting Market Product Landscape

The United States strategy consulting market's product landscape is defined by its evolution towards data-driven, technology-enabled solutions. Consulting firms are increasingly offering proprietary analytical tools, AI-powered diagnostics, and customized digital transformation frameworks. These "products" are not simply reports, but rather integrated service offerings designed to deliver tangible business outcomes. Innovations focus on predictive analytics for market forecasting, personalized customer engagement strategies, and optimized operational efficiencies through smart technologies. Performance metrics are shifting from hours billed to measurable impact, such as revenue growth, cost reduction, and market share increase. Unique selling propositions often lie in the depth of industry-specific expertise combined with cutting-edge technological capabilities, enabling firms to address complex, multi-faceted business challenges with precision and foresight.

Key Drivers, Barriers & Challenges in United States Strategy Consulting Market

Key Drivers: The United States strategy consulting market is propelled by the imperative for digital transformation, as companies across all sectors seek to modernize their operations and enhance customer experiences. Globalization and geopolitical shifts necessitate strategic navigation of complex international markets and supply chains. The increasing focus on Environmental, Social, and Governance (ESG) initiatives drives demand for sustainability strategy consulting. Advancements in Artificial Intelligence (AI) and Big Data Analytics offer new avenues for strategic decision-making and operational efficiency, creating a strong demand for expertise in these areas.

Key Barriers & Challenges: A significant barrier is the cost of consulting services, which can be prohibitive for smaller businesses. Talent acquisition and retention within consulting firms is a persistent challenge, as demand for skilled professionals often outstrips supply. Client resistance to change and the difficulty in fully embedding new strategies within an organization can hinder successful implementation. Economic downturns and budget cuts by corporations can lead to reduced spending on discretionary consulting services. Furthermore, fierce competition among a large number of consulting firms creates pricing pressures and necessitates continuous differentiation.

Emerging Opportunities in United States Strategy Consulting Market

Emerging opportunities in the United States strategy consulting market lie in the burgeoning demand for AI ethics and governance consulting, as businesses increasingly deploy AI technologies and require guidance on responsible implementation. The growing emphasis on supply chain resilience and diversification presents a significant opportunity for consultants to help companies build more robust and adaptable supply networks. Advancements in biotechnology and personalized medicine are creating a specialized consulting niche within the healthcare sector. Furthermore, the circular economy and sustainability transitions offer fertile ground for strategy consultants to guide businesses in adopting eco-friendly practices and achieving carbon neutrality goals.

Growth Accelerators in the United States Strategy Consulting Market Industry

Several catalysts are accelerating the growth of the United States strategy consulting market. The relentless pace of technological breakthroughs, particularly in AI, automation, and data analytics, continuously creates new strategic challenges and opportunities for businesses. Strategic partnerships and collaborations between consulting firms and technology providers are expanding service offerings and market reach. The ongoing need for market expansion strategies, both domestically and internationally, fuels demand for expert guidance. Moreover, increasing regulatory complexity and compliance requirements across industries necessitate specialized advisory services, acting as a significant growth accelerator.

Key Players Shaping the United States Strategy Consulting Market Market

- Bain & Company

- Accenture Strategy

- Boston Consulting Group

- PwC

- Booz Allen Hamilton

- McKinsey

- KPMG

- A T Kearney

- EY

- Deloitte

Notable Milestones in United States Strategy Consulting Market Sector

- September 2023: XIX International, a Dubai-based trade management consulting firm, announced its expansion of services to the US market. This move aims to assist US-based trading corporations in managing overseas trade contracts, enhancing assurance, and improving supply chain management for imported goods.

- April 2023: Credera, a US commercial and technology consulting firm, marked its entry into the European mainland by establishing a presence in Germany. This venture is a joint effort with Smart Digital, a German tech consulting company based in Berlin, and is part of Credera's parent company, Omnicom Group.

In-Depth United States Strategy Consulting Market Market Outlook

The United States strategy consulting market is poised for substantial future growth, driven by an evolving business landscape and an increasing reliance on expert guidance. The ongoing digital transformation, coupled with the imperative for supply chain resilience and sustainability, will continue to be major growth accelerators. Strategic partnerships between consulting firms and technology developers will foster innovation and expand service capabilities. Furthermore, the proactive pursuit of market expansion strategies by businesses, both domestically and internationally, will fuel demand for strategic advisory. The increasing complexity of the global economic and regulatory environment also necessitates sophisticated strategic planning, ensuring a robust outlook for the sector. The market's ability to adapt and offer data-driven, technology-enabled solutions will be paramount to capitalizing on emerging opportunities and maintaining a competitive edge.

United States Strategy Consulting Market Segmentation

-

1. Type

- 1.1. HR Consulting

- 1.2. Strategy Consulting

- 1.3. Operations Consulting

-

2. End-User Industry

- 2.1. IT & Telecommunication

- 2.2. Manufacturing

- 2.3. Energy

- 2.4. Healthcare

- 2.5. Public Sector

- 2.6. Retail

- 2.7. Other End-User Industries

United States Strategy Consulting Market Segmentation By Geography

- 1. United States

United States Strategy Consulting Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.87% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption Of Advanced Data Management Strategies; Growing Investment In Analytical Solutions is Surging Companies Growth

- 3.3. Market Restrains

- 3.3.1. Project Complexities and Shift In Consulting Marketplace

- 3.4. Market Trends

- 3.4.1. Strategy Consulting Segment is Expected to Drive the Market Demand

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. HR Consulting

- 5.1.2. Strategy Consulting

- 5.1.3. Operations Consulting

- 5.2. Market Analysis, Insights and Forecast - by End-User Industry

- 5.2.1. IT & Telecommunication

- 5.2.2. Manufacturing

- 5.2.3. Energy

- 5.2.4. Healthcare

- 5.2.5. Public Sector

- 5.2.6. Retail

- 5.2.7. Other End-User Industries

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. United States

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. DACH Region United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 6.1.1.

- 7. United Kingdom and Ireland United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 7.1.1.

- 8. France United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 8.1.1.

- 9. Benelux United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 9.1.1.

- 10. Eastern Europe United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 10.1.1.

- 11. Scandinavia United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1.

- 12. Rest of Europe United States Strategy Consulting Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1.

- 13. Competitive Analysis

- 13.1. Market Share Analysis 2024

- 13.2. Company Profiles

- 13.2.1 Bain & Company

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Accenture Strategy

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Boston Consulting Group

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 PwC

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Booz Allen Hamilton

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 McKinsey

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 KPMG

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 A T Kearney

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 EY

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Deloitte

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Bain & Company

List of Figures

- Figure 1: United States Strategy Consulting Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: United States Strategy Consulting Market Share (%) by Company 2024

List of Tables

- Table 1: United States Strategy Consulting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: United States Strategy Consulting Market Revenue Million Forecast, by Type 2019 & 2032

- Table 3: United States Strategy Consulting Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 4: United States Strategy Consulting Market Revenue Million Forecast, by Region 2019 & 2032

- Table 5: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 6: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 9: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 10: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: United States Strategy Consulting Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: United States Strategy Consulting Market Revenue Million Forecast, by Type 2019 & 2032

- Table 20: United States Strategy Consulting Market Revenue Million Forecast, by End-User Industry 2019 & 2032

- Table 21: United States Strategy Consulting Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United States Strategy Consulting Market?

The projected CAGR is approximately 6.87%.

2. Which companies are prominent players in the United States Strategy Consulting Market?

Key companies in the market include Bain & Company, Accenture Strategy, Boston Consulting Group, PwC, Booz Allen Hamilton, McKinsey, KPMG, A T Kearney, EY, Deloitte.

3. What are the main segments of the United States Strategy Consulting Market?

The market segments include Type, End-User Industry.

4. Can you provide details about the market size?

The market size is estimated to be USD 59.03 Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption Of Advanced Data Management Strategies; Growing Investment In Analytical Solutions is Surging Companies Growth.

6. What are the notable trends driving market growth?

Strategy Consulting Segment is Expected to Drive the Market Demand.

7. Are there any restraints impacting market growth?

Project Complexities and Shift In Consulting Marketplace.

8. Can you provide examples of recent developments in the market?

In September 2023, XIX International, a consulting firm dealing with trade management, located in Dubai, announced its plans to provide services to its clients in the US for assisting customers in managing overseas trade contracts. XIX International's purpose is is to aid US-based trading corporations that import foreign goods into the US to progress excellent assurance and supply chain management.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United States Strategy Consulting Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United States Strategy Consulting Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United States Strategy Consulting Market?

To stay informed about further developments, trends, and reports in the United States Strategy Consulting Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence