Key Insights

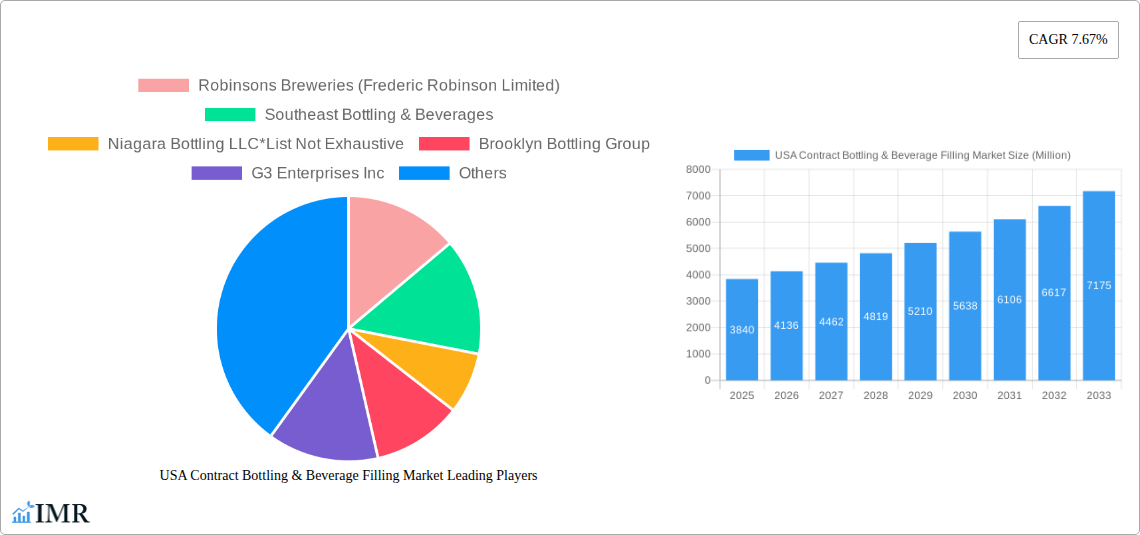

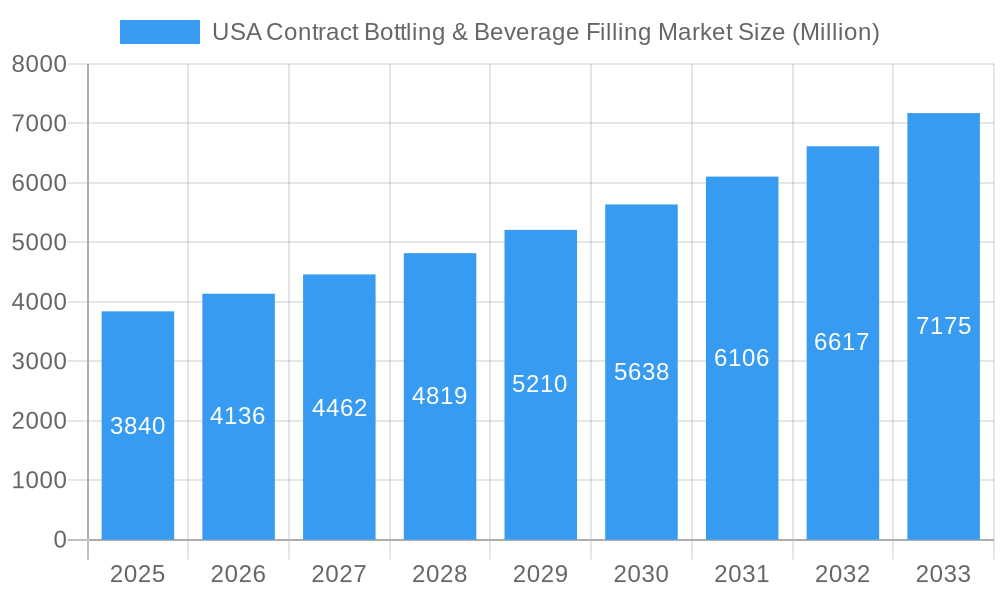

The US contract bottling and beverage filling market, valued at $3.84 billion in 2025, is projected to experience robust growth, driven by increasing demand for packaged beverages and the outsourcing trend among beverage companies. This thriving market is segmented by beverage type, encompassing beer, carbonated drinks and fruit-based beverages, bottled water, and others (including sports drinks). The market's expansion is fueled by several factors, including the rising popularity of ready-to-drink beverages, the convenience they offer consumers, and the cost-effectiveness of contract bottling for smaller and mid-sized beverage brands. Furthermore, technological advancements in filling and packaging technologies contribute to increased efficiency and reduced production costs, further bolstering market growth. While challenges such as fluctuating raw material prices and stringent regulatory compliance exist, the overall outlook remains positive. The projected Compound Annual Growth Rate (CAGR) of 7.67% from 2025 to 2033 indicates substantial market expansion, with significant opportunities for contract bottlers and beverage filling companies across all regions of the United States, particularly in areas with high population density and established beverage production infrastructure. Companies like Robinsons Breweries, Southeast Bottling & Beverages, and Niagara Bottling are key players in this competitive landscape, continually adapting to meet evolving consumer preferences and industry demands.

USA Contract Bottling & Beverage Filling Market Market Size (In Billion)

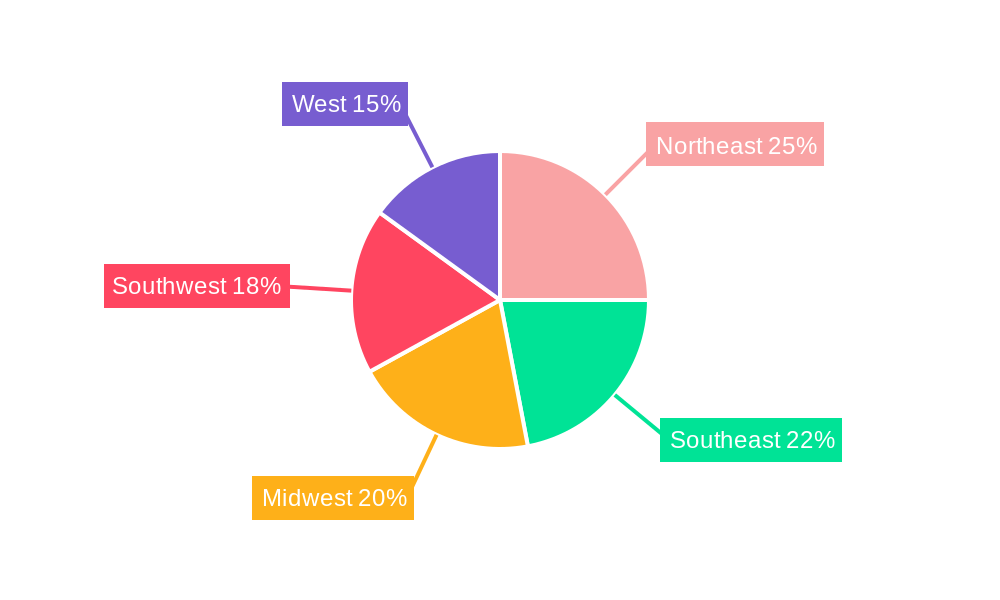

The regional distribution of the US contract bottling and beverage filling market reflects the country's diverse demographics and consumption patterns. The Northeast, Southeast, Midwest, Southwest, and West regions all contribute significantly to the overall market size, with variations driven by factors such as population density, local beverage preferences, and the presence of major beverage companies. The market's evolution will be shaped by continued innovation in packaging materials, sustainable practices within the industry, and the increasing consumer focus on health and wellness. This will influence the demand for various beverage types and drive further growth in specific segments, such as bottled water and functional beverages. The forecast period (2025-2033) presents significant opportunities for market expansion, attracting further investment and technological advancement within the US contract bottling and beverage filling sector.

USA Contract Bottling & Beverage Filling Market Company Market Share

USA Contract Bottling & Beverage Filling Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the USA Contract Bottling & Beverage Filling Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. With a study period spanning 2019-2033, a base year of 2025, and a forecast period of 2025-2033, this report is an essential resource for industry professionals, investors, and strategic decision-makers. The report analyzes the parent market of contract manufacturing and the child market of beverage filling, providing a granular understanding of this dynamic sector. The total market value in 2025 is estimated at XX Million, with projections for significant growth throughout the forecast period.

USA Contract Bottling & Beverage Filling Market Dynamics & Structure

The USA contract bottling and beverage filling market is characterized by a moderately concentrated structure with several large players and numerous smaller niche operators. Technological advancements, particularly in automation and sustainable packaging, are key drivers. Stringent regulatory frameworks concerning food safety and labeling influence operational practices. Competition from private label brands and the increasing popularity of alternative beverage formats present challenges. Mergers and acquisitions (M&A) activity reflects consolidation trends and expansion strategies within the market.

- Market Concentration: The top 5 players hold an estimated xx% market share in 2025.

- Technological Innovation: Automation in filling lines, high-speed bottling technologies, and sustainable packaging solutions are driving efficiency and reducing costs.

- Regulatory Landscape: FDA regulations and state-specific labeling requirements heavily influence operations.

- Competitive Substitutes: Private label brands and ready-to-drink (RTD) beverages pose competitive threats.

- End-User Demographics: The market caters to diverse beverage types, ranging from alcoholic and non-alcoholic beverages to bottled water.

- M&A Activity: The number of M&A deals in the sector averaged xx per year during the historical period (2019-2024).

USA Contract Bottling & Beverage Filling Market Growth Trends & Insights

The USA contract bottling and beverage filling market experienced steady growth during the historical period (2019-2024), primarily driven by increasing demand for packaged beverages, expansion of the food and beverage industry, and advancements in contract manufacturing capabilities. The market is projected to register a CAGR of xx% during the forecast period (2025-2033), reaching an estimated value of XX Million by 2033. This growth is fueled by several factors, including rising consumer preference for convenience, increasing health consciousness driving demand for bottled water and functional beverages, and the growing popularity of craft breweries and specialty beverage companies relying on contract filling services. Technological disruptions, particularly in automation and sustainable packaging, are enhancing efficiency and creating new market opportunities. Consumer behavior shifts towards premiumization and personalized beverages further contribute to market growth.

Dominant Regions, Countries, or Segments in USA Contract Bottling & Beverage Filling Market

The Northeast and West Coast regions of the USA are currently the dominant markets for contract bottling and beverage filling, driven by higher population density, established beverage manufacturing clusters, and robust consumer demand. Within beverage types, bottled water and carbonated drinks & fruit-based beverages constitute the largest segments.

- Key Drivers:

- Strong consumer demand for packaged beverages.

- Presence of major beverage manufacturers and distributors.

- Well-developed infrastructure and logistics networks.

- Dominance Factors:

- Higher per capita consumption of packaged beverages.

- Significant investments in manufacturing and distribution facilities.

- Favorable regulatory environment.

The bottled water segment displays the highest growth potential due to increasing health concerns and consumer preference for healthier hydration options. The carbonated drinks & fruit-based beverage segment is expected to maintain substantial growth driven by ongoing innovation in flavors and formulations.

USA Contract Bottling & Beverage Filling Market Product Landscape

The market offers a diverse range of services, including filling, labeling, packaging, and warehousing. Innovation is focused on enhancing efficiency through automation, implementing sustainable packaging solutions, and offering flexible contract options to cater to diverse client needs. Advanced filling technologies, such as aseptic filling for extended shelf life, are gaining traction. Unique selling propositions center around speed, flexibility, scalability, and adherence to stringent quality standards.

Key Drivers, Barriers & Challenges in USA Contract Bottling & Beverage Filling Market

Key Drivers:

- Increasing demand for packaged beverages.

- Growth of the craft beverage industry.

- Advancements in packaging technology.

- Consolidation and expansion of contract manufacturing companies.

Key Challenges:

- Fluctuations in raw material costs (e.g., aluminum, plastic).

- Supply chain disruptions and labor shortages.

- Stringent regulatory compliance requirements.

- Intense competition among contract manufacturers. The impact of these challenges is estimated to reduce annual market growth by approximately xx% in the next 5 years.

Emerging Opportunities in USA Contract Bottling & Beverage Filling Market

- Growing demand for sustainable and eco-friendly packaging.

- Rise of functional and health-focused beverages.

- Expansion into niche markets like craft beverages and personalized drinks.

- Opportunities in emerging technologies such as AI-powered automation.

Growth Accelerators in the USA Contract Bottling & Beverage Filling Market Industry

Long-term growth will be accelerated by continued technological advancements in automation, sustainable packaging, and flexible filling solutions. Strategic partnerships between contract bottlers and beverage brands will also drive market expansion. Furthermore, expansion into untapped markets, such as emerging beverage categories and geographic regions, presents significant opportunities for growth.

Key Players Shaping the USA Contract Bottling & Beverage Filling Market Market

- Robinsons Breweries (Frederic Robinson Limited)

- Southeast Bottling & Beverages

- Niagara Bottling LLC

- Brooklyn Bottling Group

- G3 Enterprises Inc

- CSD Co-Packers Inc

- Western Innovations Inc

Notable Milestones in USA Contract Bottling & Beverage Filling Market Sector

- October 2021: MSI Express acquires Power Packaging, expanding its capabilities in aseptic beverage filling and other packaging services. This significantly impacted the market by adding capacity and expertise in diverse beverage types.

- January 2022: Encore Consumer Capital acquires Lion Beverages, injecting capital and expertise into a craft brewery and contract manufacturer. This acquisition signifies a consolidation trend and signals increased investment in the sector.

- April 2022: G3 Enterprises launches a dedicated aluminum can supply, alleviating supply chain issues for craft brewers and other beverage companies. This move directly addressed a significant market challenge impacting the availability and cost of cans.

In-Depth USA Contract Bottling & Beverage Filling Market Market Outlook

The USA contract bottling and beverage filling market presents substantial growth potential, driven by a combination of factors including increasing beverage consumption, innovation in packaging and technology, and strategic expansions by key players. The market's future growth will be shaped by the ability of contract manufacturers to adapt to evolving consumer preferences, embrace sustainable practices, and leverage technological advancements to enhance efficiency and offer innovative solutions. Strategic partnerships and investments in automation will play crucial roles in capturing market share and driving long-term success.

USA Contract Bottling & Beverage Filling Market Segmentation

-

1. Beverage Type

- 1.1. Beer

- 1.2. Carbonated Drinks and Fruit-based Beverages

- 1.3. Bottled Water

- 1.4. Other Beverage Types (Sport Drinks)

USA Contract Bottling & Beverage Filling Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Contract Bottling & Beverage Filling Market Regional Market Share

Geographic Coverage of USA Contract Bottling & Beverage Filling Market

USA Contract Bottling & Beverage Filling Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.67% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement

- 3.3. Market Restrains

- 3.3.1. Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending

- 3.4. Market Trends

- 3.4.1. Beer is Expected to Hold Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 5.1.1. Beer

- 5.1.2. Carbonated Drinks and Fruit-based Beverages

- 5.1.3. Bottled Water

- 5.1.4. Other Beverage Types (Sport Drinks)

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. South America

- 5.2.3. Europe

- 5.2.4. Middle East & Africa

- 5.2.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6. North America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 6.1.1. Beer

- 6.1.2. Carbonated Drinks and Fruit-based Beverages

- 6.1.3. Bottled Water

- 6.1.4. Other Beverage Types (Sport Drinks)

- 6.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7. South America USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 7.1.1. Beer

- 7.1.2. Carbonated Drinks and Fruit-based Beverages

- 7.1.3. Bottled Water

- 7.1.4. Other Beverage Types (Sport Drinks)

- 7.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8. Europe USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 8.1.1. Beer

- 8.1.2. Carbonated Drinks and Fruit-based Beverages

- 8.1.3. Bottled Water

- 8.1.4. Other Beverage Types (Sport Drinks)

- 8.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9. Middle East & Africa USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 9.1.1. Beer

- 9.1.2. Carbonated Drinks and Fruit-based Beverages

- 9.1.3. Bottled Water

- 9.1.4. Other Beverage Types (Sport Drinks)

- 9.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10. Asia Pacific USA Contract Bottling & Beverage Filling Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 10.1.1. Beer

- 10.1.2. Carbonated Drinks and Fruit-based Beverages

- 10.1.3. Bottled Water

- 10.1.4. Other Beverage Types (Sport Drinks)

- 10.1. Market Analysis, Insights and Forecast - by Beverage Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Southeast Bottling & Beverages

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Niagara Bottling LLC*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Brooklyn Bottling Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 G3 Enterprises Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 CSD Co-Packers Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Western Innovations Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.1 Robinsons Breweries (Frederic Robinson Limited)

List of Figures

- Figure 1: Global USA Contract Bottling & Beverage Filling Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 3: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 4: North America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 5: North America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 7: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 8: South America USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 9: South America USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 11: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 12: Europe USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 13: Europe USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 15: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 16: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 17: Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Beverage Type 2025 & 2033

- Figure 19: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Beverage Type 2025 & 2033

- Figure 20: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million), by Country 2025 & 2033

- Figure 21: Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 2: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 4: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: United States USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Canada USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: Mexico USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 9: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 10: Brazil USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Argentina USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of South America USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 14: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 15: United Kingdom USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Germany USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: France USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Italy USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Spain USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Russia USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Benelux USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Nordics USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Rest of Europe USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 25: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Turkey USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Israel USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: GCC USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 29: North Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: South Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East & Africa USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Beverage Type 2020 & 2033

- Table 33: Global USA Contract Bottling & Beverage Filling Market Revenue Million Forecast, by Country 2020 & 2033

- Table 34: China USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: India USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Japan USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: South Korea USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: ASEAN USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Oceania USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Asia Pacific USA Contract Bottling & Beverage Filling Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Contract Bottling & Beverage Filling Market?

The projected CAGR is approximately 7.67%.

2. Which companies are prominent players in the USA Contract Bottling & Beverage Filling Market?

Key companies in the market include Robinsons Breweries (Frederic Robinson Limited), Southeast Bottling & Beverages, Niagara Bottling LLC*List Not Exhaustive, Brooklyn Bottling Group, G3 Enterprises Inc, CSD Co-Packers Inc, Western Innovations Inc.

3. What are the main segments of the USA Contract Bottling & Beverage Filling Market?

The market segments include Beverage Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.84 Million as of 2022.

5. What are some drivers contributing to market growth?

CapEx Benefits offered by contract bottlers for small-scale beverage manufacturers; Rise in demand from new-age drinks and craft beer segment; Gradual change in the business model of Contact packagers towards a consultative approach involving design & placement.

6. What are the notable trends driving market growth?

Beer is Expected to Hold Significant Share.

7. Are there any restraints impacting market growth?

Strong Competition from the Paints Segment; Recent Changes in Macro-environment Expected to Impact Customer Spending.

8. Can you provide examples of recent developments in the market?

April 2022 - G3 Enterprises introduces a new; dedicated aluminum can supply to craft brewers, RTD cocktail producers, and beverage companies. The recent aluminum can shortage has questioned this pastime, particularly for small beer companies, forced to pay more for aluminum cans if they can find them.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Contract Bottling & Beverage Filling Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Contract Bottling & Beverage Filling Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Contract Bottling & Beverage Filling Market?

To stay informed about further developments, trends, and reports in the USA Contract Bottling & Beverage Filling Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence