Key Insights

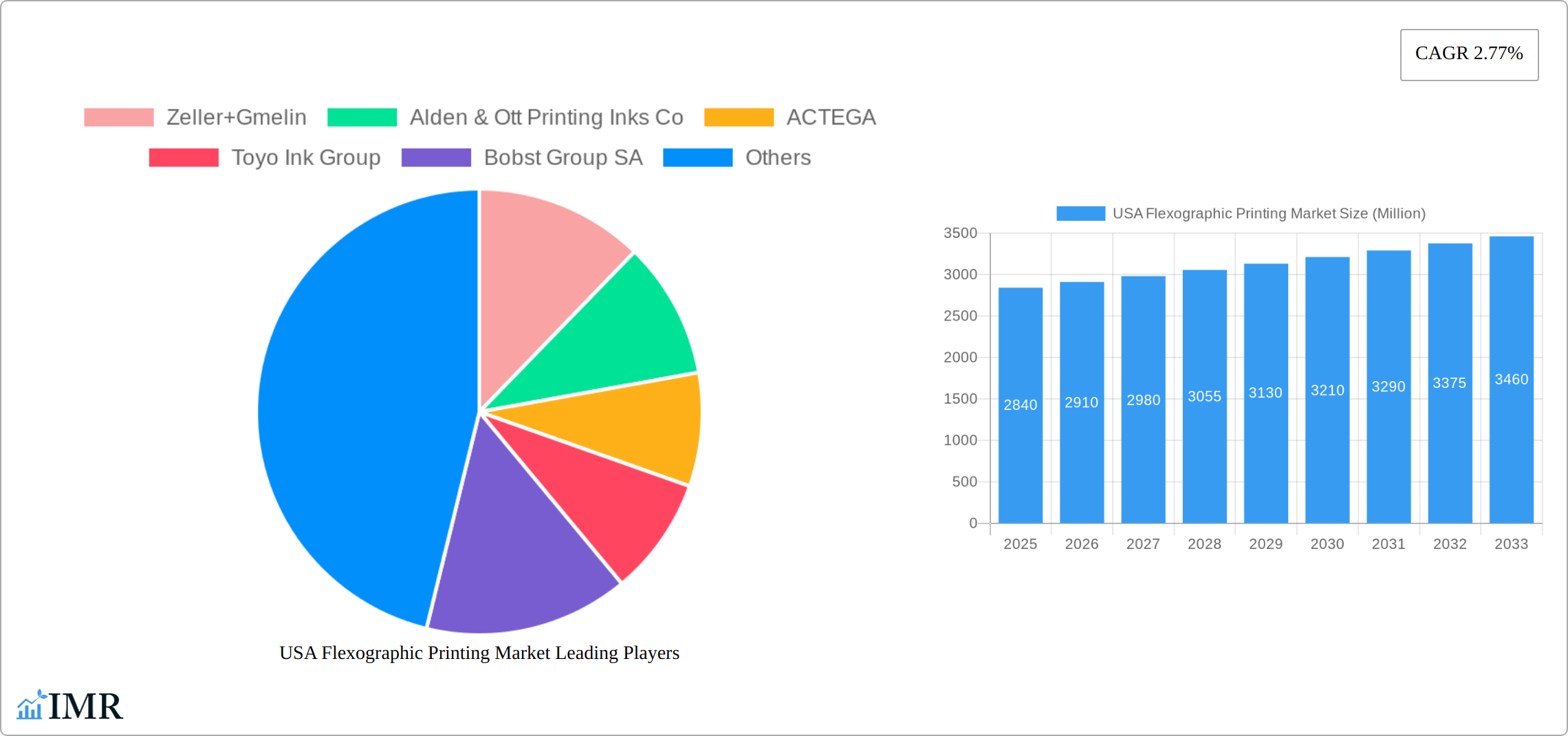

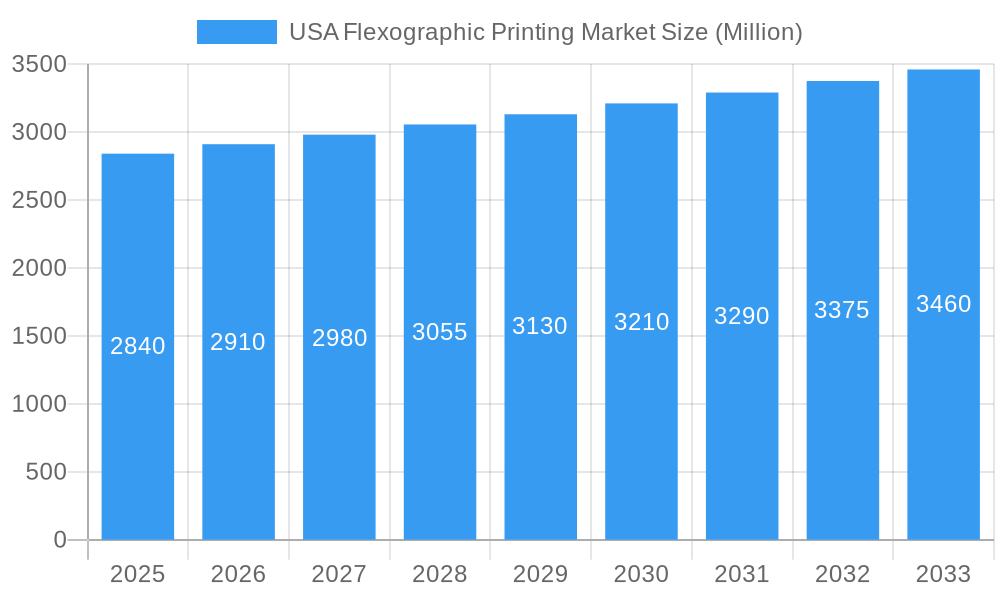

The USA flexographic printing market, valued at $2.84 billion in 2025, is projected to experience steady growth, driven by increasing demand for flexible packaging across diverse sectors like food & beverage, pharmaceuticals, and personal care. The market's Compound Annual Growth Rate (CAGR) of 2.77% from 2025 to 2033 indicates a consistent expansion, albeit moderate. Key drivers include the rising preference for sustainable and eco-friendly packaging solutions, advancements in ink technology (particularly UV-curable inks) leading to improved print quality and faster curing times, and the adoption of automation and digital printing technologies in flexographic printing processes for higher efficiency and reduced costs. The market segmentation shows a significant portion dedicated to flexible packaging, owing to its widespread use in various consumer goods. Growth within the segment will be further fueled by innovations in material science, offering improved barrier properties and recyclability. The increasing adoption of narrow-web and mid-web printing presses, as well as the rising popularity of post-print processes for enhanced product appeal and brand differentiation, further contribute to market expansion. Competition is intense, with major players like Zeller+Gmelin, ACTEGA, and Toyo Ink Group constantly innovating and expanding their product offerings. The regional breakdown shows robust growth across all US regions, mirroring the national trends.

USA Flexographic Printing Market Market Size (In Billion)

The restraints on market growth primarily stem from fluctuating raw material prices, stringent environmental regulations concerning ink composition and waste management, and the competitive pressure from other printing technologies like digital printing and gravure printing. However, the ongoing adoption of sustainable practices, coupled with technological advancements mitigating environmental impact, is likely to minimize these restraints. The forecast period (2025-2033) promises a continued albeit gradual rise in market value, influenced by factors like expanding e-commerce and the consequent surge in demand for packaging solutions. Further market segmentation by ink technology, application type (e.g., food packaging, labels), and equipment type provides granular insights for targeted investment and strategic planning within the industry. Overall, the USA flexographic printing market shows a positive trajectory, driven by technological innovation, evolving consumer preferences, and the robust growth of end-use sectors.

USA Flexographic Printing Market Company Market Share

USA Flexographic Printing Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the USA flexographic printing market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report segments the market into Printing Inks (by ink technology, including UV-curable), Packaging (flexible and rigid), Equipment (by application type and phase, including post-print), and other relevant categories. This detailed analysis will equip industry professionals with the insights needed to navigate this dynamic market and capitalize on emerging opportunities. The market value is projected to reach xx Million units by 2033.

USA Flexographic Printing Market Dynamics & Structure

The USA flexographic printing market is characterized by moderate concentration, with several large players and numerous smaller specialized firms. Technological innovation, particularly in UV-curable inks and digital printing technologies, is a key driver. Stringent regulatory frameworks concerning food safety and environmental regulations significantly impact ink formulations and equipment standards. Competition from other printing methods like digital and offset printing represents a significant challenge, although flexography maintains a strong position due to its cost-effectiveness for high-volume applications. The end-user demographic spans diverse sectors, including food and beverage, pharmaceuticals, cosmetics, and consumer goods. M&A activity has been moderate, with strategic acquisitions aiming to expand geographical reach and product portfolios.

- Market Concentration: Moderately concentrated, with a Herfindahl-Hirschman Index (HHI) estimated at xx.

- Technological Innovation: Focus on sustainable inks, faster printing speeds, and improved print quality.

- Regulatory Framework: Stringent FDA and EPA regulations drive the adoption of low-migration inks and environmentally friendly processes.

- Competitive Substitutes: Offset printing, digital printing, and other label printing technologies.

- M&A Trends: Strategic acquisitions focused on expanding product lines and market reach. xx M&A deals were recorded between 2019 and 2024.

USA Flexographic Printing Market Growth Trends & Insights

The USA flexographic printing market has demonstrated robust expansion throughout the historical period (2019-2024), largely propelled by the escalating demand for flexible packaging solutions and a growing consumer preference for sustainable packaging. Projections indicate continued healthy growth, with an anticipated Compound Annual Growth Rate (CAGR) of [Insert specific CAGR percentage here]% during the forecast period (2025-2033), aiming to achieve a market size of [Insert specific market size in Million units here] Million units by 2033. This upward trajectory is underpinned by several key catalysts, including increasing consumer desire for convenient and aesthetically pleasing product packaging, significant technological advancements that are enhancing both print quality and operational efficiency, and the burgeoning e-commerce sector, which is a significant driver of packaging demand. Despite these positive indicators, potential headwinds such as volatility in raw material pricing and broader economic downturns could influence growth rates. The market's embrace of UV-curable inks is expected to accelerate considerably, driven by their superior performance attributes and pronounced environmental advantages. Furthermore, a pronounced shift in consumer preferences towards eco-friendly and sustainable packaging alternatives will act as a substantial market growth accelerant. The integration of digital flexographic printing technologies, while still representing a nascent segment, is gradually gaining momentum.

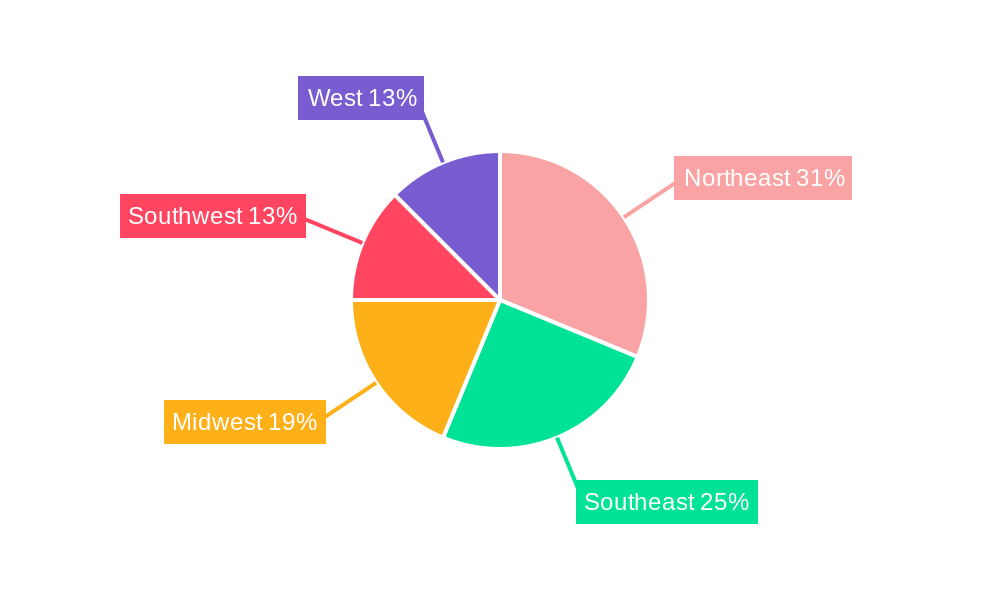

Dominant Regions, Countries, or Segments in USA Flexographic Printing Market

The Northeast and West Coast regions stand out as dominant forces within the USA flexographic printing market, largely attributable to the significant presence of leading packaging and consumer goods manufacturers in these areas. Within the market segments, UV-curable inks tailored for flexible packaging applications are exhibiting the most substantial growth potential, closely followed by advancements in high-speed printing equipment. The increasing demand for specialized printing capabilities, such as extended gamut printing and inline finishing solutions, is also a notable trend shaping segment performance.

- Leading Regions: Northeast and West Coast, characterized by a high concentration of industrial activity and innovation.

- Key Drivers: A strong ecosystem of manufacturing enterprises, robust consumer spending on packaged goods, and well-developed logistical infrastructure.

- Dominant Segment: UV-curable inks for flexible packaging, driven by their performance, sustainability, and versatility.

- Growth Potential: Significant opportunities lie in the burgeoning demand for sustainable and recyclable packaging, the customization capabilities offered by personalized packaging, and the sustained growth of the e-commerce landscape necessitating efficient and appealing shipping solutions. The adoption of advanced inline printing and converting technologies also presents a key area for expansion.

USA Flexographic Printing Market Product Landscape

The USA flexographic printing market offers a comprehensive array of inks, encompassing water-based, solvent-based, and UV-curable formulations, each engineered with distinct performance characteristics. UV-curable inks are experiencing a surge in adoption due to their exceptionally fast curing times, the high fidelity of print quality they achieve, and their diminished environmental footprint compared to traditional alternatives. Emerging innovations are intensely focused on developing low-migration inks that rigorously adhere to stringent food safety regulations, thereby broadening their applicability and market acceptance. In terms of equipment, advancements are primarily directed towards enhancing printing speeds, incorporating sophisticated automation features, and refining precision control systems. Key unique selling propositions for market players include the capability to significantly reduce material waste, boost overall production efficiency, and deliver truly sustainable printing solutions that align with modern corporate and consumer values.

Key Drivers, Barriers & Challenges in USA Flexographic Printing Market

Key Drivers:

- Growing demand for flexible packaging.

- Increasing e-commerce adoption.

- Rising consumer preference for attractive and sustainable packaging.

- Technological advancements in inks and equipment.

Challenges:

- Fluctuations in raw material prices.

- Environmental regulations and sustainability concerns.

- Intense competition from other printing technologies.

- Supply chain disruptions causing delays and increased costs. This is estimated to impact the market by xx% in 2025.

Emerging Opportunities in USA Flexographic Printing Market

- Growth of sustainable and eco-friendly packaging solutions.

- Increasing demand for personalized and customized packaging.

- Expansion into niche markets like pharmaceuticals and cosmetics.

- Development of innovative ink and equipment technologies.

Growth Accelerators in the USA Flexographic Printing Market Industry

Long-term growth will be accelerated by strategic partnerships between ink manufacturers and equipment suppliers, leading to integrated solutions that optimize the printing process. Further technological breakthroughs in digital flexography and the development of more sustainable and cost-effective printing solutions will drive market expansion. Expansion into emerging markets and diversification of applications will also contribute to growth.

Key Players Shaping the USA Flexographic Printing Market Market

- Zeller+Gmelin

- Alden & Ott Printing Inks Co

- ACTEGA

- Toyo Ink Group

- Bobst Group SA

- OMET

- HEIDELBERG USA INC

- American Inks & Technology

- Colorcon Inc

- Comexi Group Industries S A U

- SiegwerkGroup

- Windmoeller & Hoelscher

- MPS Systems BV

- Fujifilm Corporation

- Nilpeter

- INX International Ink Co

- DIC Corporation (Sun Chemical)

- WikOff Color Corporation

- Wolverine Flexographic

- Star Flex International

- Flint Group

- Kolorcure Corp

- CMS Industrial Technologies LLC

Notable Milestones in USA Flexographic Printing Market Sector

- September 2022: ACTEGA significantly bolstered its product portfolio with the introduction of its ACTExact SafeShield UV-LED low-migration ink line, a development that has since garnered multiple prestigious certifications for its suitability in demanding food contact, cosmetic, and nutraceutical packaging applications.

- April 2022: Fortis Solutions Group executed a strategic acquisition of Label Tech Inc., a move that effectively expanded its geographic footprint and enhanced its comprehensive service offerings within the labeling and packaging sector.

- [Insert New Milestone Here, e.g., Month Year]: [Briefly describe a new significant milestone, such as a new technology launch, strategic partnership, or major investment by a key player in the US flexographic printing market.]

In-Depth USA Flexographic Printing Market Outlook

The USA flexographic printing market is poised for continued growth, driven by technological advancements, increasing demand for sustainable packaging, and the expansion of e-commerce. Strategic partnerships, investments in research and development, and the adoption of innovative business models will be crucial for companies to capitalize on the market's future potential. The focus on sustainable and cost-effective solutions will be key differentiators in a competitive market.

USA Flexographic Printing Market Segmentation

-

1. Printing Inks

-

1.1. By Ink Technology

- 1.1.1. Water-based

- 1.1.2. Solvent-based

- 1.1.3. UV-curable

-

1.2. By Application Type

-

1.2.1. Packaging

- 1.2.1.1. Flexible

- 1.2.1.2. Rigid

- 1.2.2. Folding Cartons

- 1.2.3. Tags and Labels

- 1.2.4. Paper-based Printing

-

1.2.1. Packaging

-

1.1. By Ink Technology

-

2. Equipment

-

2.1. By Application Type

- 2.1.1. Narrow Web

- 2.1.2. Medium Web

- 2.1.3. Sheet Fed

- 2.1.4. Other Printing Equipment

-

2.2. By Phase

- 2.2.1. Pre-print

- 2.2.2. Post-print

-

2.3. By End-User

- 2.3.1. Folding Carton

- 2.3.2. Flexible Packaging

- 2.3.3. Labels

- 2.3.4. Print Media

- 2.3.5. Other End-Users

-

2.1. By Application Type

USA Flexographic Printing Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

USA Flexographic Printing Market Regional Market Share

Geographic Coverage of USA Flexographic Printing Market

USA Flexographic Printing Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.77% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enables Higher Production Speeds Within Reasonable Cost Overlay; Growing Demand for UV-curable Inks; Growing Packaging Industry

- 3.3. Market Restrains

- 3.3.1. Advent of New Printing Technologies and Shift to Digital Mediums

- 3.4. Market Trends

- 3.4.1. Packaging Industry to Witness Significant Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global USA Flexographic Printing Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Printing Inks

- 5.1.1. By Ink Technology

- 5.1.1.1. Water-based

- 5.1.1.2. Solvent-based

- 5.1.1.3. UV-curable

- 5.1.2. By Application Type

- 5.1.2.1. Packaging

- 5.1.2.1.1. Flexible

- 5.1.2.1.2. Rigid

- 5.1.2.2. Folding Cartons

- 5.1.2.3. Tags and Labels

- 5.1.2.4. Paper-based Printing

- 5.1.2.1. Packaging

- 5.1.1. By Ink Technology

- 5.2. Market Analysis, Insights and Forecast - by Equipment

- 5.2.1. By Application Type

- 5.2.1.1. Narrow Web

- 5.2.1.2. Medium Web

- 5.2.1.3. Sheet Fed

- 5.2.1.4. Other Printing Equipment

- 5.2.2. By Phase

- 5.2.2.1. Pre-print

- 5.2.2.2. Post-print

- 5.2.3. By End-User

- 5.2.3.1. Folding Carton

- 5.2.3.2. Flexible Packaging

- 5.2.3.3. Labels

- 5.2.3.4. Print Media

- 5.2.3.5. Other End-Users

- 5.2.1. By Application Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Printing Inks

- 6. North America USA Flexographic Printing Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Printing Inks

- 6.1.1. By Ink Technology

- 6.1.1.1. Water-based

- 6.1.1.2. Solvent-based

- 6.1.1.3. UV-curable

- 6.1.2. By Application Type

- 6.1.2.1. Packaging

- 6.1.2.1.1. Flexible

- 6.1.2.1.2. Rigid

- 6.1.2.2. Folding Cartons

- 6.1.2.3. Tags and Labels

- 6.1.2.4. Paper-based Printing

- 6.1.2.1. Packaging

- 6.1.1. By Ink Technology

- 6.2. Market Analysis, Insights and Forecast - by Equipment

- 6.2.1. By Application Type

- 6.2.1.1. Narrow Web

- 6.2.1.2. Medium Web

- 6.2.1.3. Sheet Fed

- 6.2.1.4. Other Printing Equipment

- 6.2.2. By Phase

- 6.2.2.1. Pre-print

- 6.2.2.2. Post-print

- 6.2.3. By End-User

- 6.2.3.1. Folding Carton

- 6.2.3.2. Flexible Packaging

- 6.2.3.3. Labels

- 6.2.3.4. Print Media

- 6.2.3.5. Other End-Users

- 6.2.1. By Application Type

- 6.1. Market Analysis, Insights and Forecast - by Printing Inks

- 7. South America USA Flexographic Printing Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Printing Inks

- 7.1.1. By Ink Technology

- 7.1.1.1. Water-based

- 7.1.1.2. Solvent-based

- 7.1.1.3. UV-curable

- 7.1.2. By Application Type

- 7.1.2.1. Packaging

- 7.1.2.1.1. Flexible

- 7.1.2.1.2. Rigid

- 7.1.2.2. Folding Cartons

- 7.1.2.3. Tags and Labels

- 7.1.2.4. Paper-based Printing

- 7.1.2.1. Packaging

- 7.1.1. By Ink Technology

- 7.2. Market Analysis, Insights and Forecast - by Equipment

- 7.2.1. By Application Type

- 7.2.1.1. Narrow Web

- 7.2.1.2. Medium Web

- 7.2.1.3. Sheet Fed

- 7.2.1.4. Other Printing Equipment

- 7.2.2. By Phase

- 7.2.2.1. Pre-print

- 7.2.2.2. Post-print

- 7.2.3. By End-User

- 7.2.3.1. Folding Carton

- 7.2.3.2. Flexible Packaging

- 7.2.3.3. Labels

- 7.2.3.4. Print Media

- 7.2.3.5. Other End-Users

- 7.2.1. By Application Type

- 7.1. Market Analysis, Insights and Forecast - by Printing Inks

- 8. Europe USA Flexographic Printing Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Printing Inks

- 8.1.1. By Ink Technology

- 8.1.1.1. Water-based

- 8.1.1.2. Solvent-based

- 8.1.1.3. UV-curable

- 8.1.2. By Application Type

- 8.1.2.1. Packaging

- 8.1.2.1.1. Flexible

- 8.1.2.1.2. Rigid

- 8.1.2.2. Folding Cartons

- 8.1.2.3. Tags and Labels

- 8.1.2.4. Paper-based Printing

- 8.1.2.1. Packaging

- 8.1.1. By Ink Technology

- 8.2. Market Analysis, Insights and Forecast - by Equipment

- 8.2.1. By Application Type

- 8.2.1.1. Narrow Web

- 8.2.1.2. Medium Web

- 8.2.1.3. Sheet Fed

- 8.2.1.4. Other Printing Equipment

- 8.2.2. By Phase

- 8.2.2.1. Pre-print

- 8.2.2.2. Post-print

- 8.2.3. By End-User

- 8.2.3.1. Folding Carton

- 8.2.3.2. Flexible Packaging

- 8.2.3.3. Labels

- 8.2.3.4. Print Media

- 8.2.3.5. Other End-Users

- 8.2.1. By Application Type

- 8.1. Market Analysis, Insights and Forecast - by Printing Inks

- 9. Middle East & Africa USA Flexographic Printing Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Printing Inks

- 9.1.1. By Ink Technology

- 9.1.1.1. Water-based

- 9.1.1.2. Solvent-based

- 9.1.1.3. UV-curable

- 9.1.2. By Application Type

- 9.1.2.1. Packaging

- 9.1.2.1.1. Flexible

- 9.1.2.1.2. Rigid

- 9.1.2.2. Folding Cartons

- 9.1.2.3. Tags and Labels

- 9.1.2.4. Paper-based Printing

- 9.1.2.1. Packaging

- 9.1.1. By Ink Technology

- 9.2. Market Analysis, Insights and Forecast - by Equipment

- 9.2.1. By Application Type

- 9.2.1.1. Narrow Web

- 9.2.1.2. Medium Web

- 9.2.1.3. Sheet Fed

- 9.2.1.4. Other Printing Equipment

- 9.2.2. By Phase

- 9.2.2.1. Pre-print

- 9.2.2.2. Post-print

- 9.2.3. By End-User

- 9.2.3.1. Folding Carton

- 9.2.3.2. Flexible Packaging

- 9.2.3.3. Labels

- 9.2.3.4. Print Media

- 9.2.3.5. Other End-Users

- 9.2.1. By Application Type

- 9.1. Market Analysis, Insights and Forecast - by Printing Inks

- 10. Asia Pacific USA Flexographic Printing Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Printing Inks

- 10.1.1. By Ink Technology

- 10.1.1.1. Water-based

- 10.1.1.2. Solvent-based

- 10.1.1.3. UV-curable

- 10.1.2. By Application Type

- 10.1.2.1. Packaging

- 10.1.2.1.1. Flexible

- 10.1.2.1.2. Rigid

- 10.1.2.2. Folding Cartons

- 10.1.2.3. Tags and Labels

- 10.1.2.4. Paper-based Printing

- 10.1.2.1. Packaging

- 10.1.1. By Ink Technology

- 10.2. Market Analysis, Insights and Forecast - by Equipment

- 10.2.1. By Application Type

- 10.2.1.1. Narrow Web

- 10.2.1.2. Medium Web

- 10.2.1.3. Sheet Fed

- 10.2.1.4. Other Printing Equipment

- 10.2.2. By Phase

- 10.2.2.1. Pre-print

- 10.2.2.2. Post-print

- 10.2.3. By End-User

- 10.2.3.1. Folding Carton

- 10.2.3.2. Flexible Packaging

- 10.2.3.3. Labels

- 10.2.3.4. Print Media

- 10.2.3.5. Other End-Users

- 10.2.1. By Application Type

- 10.1. Market Analysis, Insights and Forecast - by Printing Inks

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Zeller+Gmelin

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Alden & Ott Printing Inks Co

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ACTEGA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Toyo Ink Group

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bobst Group SA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 OMET

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 HEIDELBERG USA INC

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 American Inks & Technology

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Colorcon Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Comexi Group Industries S A U

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 SiegwerkGroup

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Windmoeller & Hoelscher

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 MPS Systems BV

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Fujifilm Corporation

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.15 Nilpeter*List Not Exhaustive

- 11.2.15.1. Overview

- 11.2.15.2. Products

- 11.2.15.3. SWOT Analysis

- 11.2.15.4. Recent Developments

- 11.2.15.5. Financials (Based on Availability)

- 11.2.16 INX International Ink Co

- 11.2.16.1. Overview

- 11.2.16.2. Products

- 11.2.16.3. SWOT Analysis

- 11.2.16.4. Recent Developments

- 11.2.16.5. Financials (Based on Availability)

- 11.2.17 DIC Corporation (Sun Chemical)

- 11.2.17.1. Overview

- 11.2.17.2. Products

- 11.2.17.3. SWOT Analysis

- 11.2.17.4. Recent Developments

- 11.2.17.5. Financials (Based on Availability)

- 11.2.18 WikOff Color Corporation

- 11.2.18.1. Overview

- 11.2.18.2. Products

- 11.2.18.3. SWOT Analysis

- 11.2.18.4. Recent Developments

- 11.2.18.5. Financials (Based on Availability)

- 11.2.19 Wolverine Flexographic

- 11.2.19.1. Overview

- 11.2.19.2. Products

- 11.2.19.3. SWOT Analysis

- 11.2.19.4. Recent Developments

- 11.2.19.5. Financials (Based on Availability)

- 11.2.20 Star Flex International

- 11.2.20.1. Overview

- 11.2.20.2. Products

- 11.2.20.3. SWOT Analysis

- 11.2.20.4. Recent Developments

- 11.2.20.5. Financials (Based on Availability)

- 11.2.21 Flint Group

- 11.2.21.1. Overview

- 11.2.21.2. Products

- 11.2.21.3. SWOT Analysis

- 11.2.21.4. Recent Developments

- 11.2.21.5. Financials (Based on Availability)

- 11.2.22 Kolorcure Corp

- 11.2.22.1. Overview

- 11.2.22.2. Products

- 11.2.22.3. SWOT Analysis

- 11.2.22.4. Recent Developments

- 11.2.22.5. Financials (Based on Availability)

- 11.2.23 CMS Industrial Technologies LLC

- 11.2.23.1. Overview

- 11.2.23.2. Products

- 11.2.23.3. SWOT Analysis

- 11.2.23.4. Recent Developments

- 11.2.23.5. Financials (Based on Availability)

- 11.2.1 Zeller+Gmelin

List of Figures

- Figure 1: Global USA Flexographic Printing Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America USA Flexographic Printing Market Revenue (Million), by Printing Inks 2025 & 2033

- Figure 3: North America USA Flexographic Printing Market Revenue Share (%), by Printing Inks 2025 & 2033

- Figure 4: North America USA Flexographic Printing Market Revenue (Million), by Equipment 2025 & 2033

- Figure 5: North America USA Flexographic Printing Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 6: North America USA Flexographic Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 7: North America USA Flexographic Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America USA Flexographic Printing Market Revenue (Million), by Printing Inks 2025 & 2033

- Figure 9: South America USA Flexographic Printing Market Revenue Share (%), by Printing Inks 2025 & 2033

- Figure 10: South America USA Flexographic Printing Market Revenue (Million), by Equipment 2025 & 2033

- Figure 11: South America USA Flexographic Printing Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 12: South America USA Flexographic Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 13: South America USA Flexographic Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe USA Flexographic Printing Market Revenue (Million), by Printing Inks 2025 & 2033

- Figure 15: Europe USA Flexographic Printing Market Revenue Share (%), by Printing Inks 2025 & 2033

- Figure 16: Europe USA Flexographic Printing Market Revenue (Million), by Equipment 2025 & 2033

- Figure 17: Europe USA Flexographic Printing Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 18: Europe USA Flexographic Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe USA Flexographic Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa USA Flexographic Printing Market Revenue (Million), by Printing Inks 2025 & 2033

- Figure 21: Middle East & Africa USA Flexographic Printing Market Revenue Share (%), by Printing Inks 2025 & 2033

- Figure 22: Middle East & Africa USA Flexographic Printing Market Revenue (Million), by Equipment 2025 & 2033

- Figure 23: Middle East & Africa USA Flexographic Printing Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 24: Middle East & Africa USA Flexographic Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa USA Flexographic Printing Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific USA Flexographic Printing Market Revenue (Million), by Printing Inks 2025 & 2033

- Figure 27: Asia Pacific USA Flexographic Printing Market Revenue Share (%), by Printing Inks 2025 & 2033

- Figure 28: Asia Pacific USA Flexographic Printing Market Revenue (Million), by Equipment 2025 & 2033

- Figure 29: Asia Pacific USA Flexographic Printing Market Revenue Share (%), by Equipment 2025 & 2033

- Figure 30: Asia Pacific USA Flexographic Printing Market Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific USA Flexographic Printing Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global USA Flexographic Printing Market Revenue Million Forecast, by Printing Inks 2020 & 2033

- Table 2: Global USA Flexographic Printing Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 3: Global USA Flexographic Printing Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global USA Flexographic Printing Market Revenue Million Forecast, by Printing Inks 2020 & 2033

- Table 5: Global USA Flexographic Printing Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 6: Global USA Flexographic Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global USA Flexographic Printing Market Revenue Million Forecast, by Printing Inks 2020 & 2033

- Table 11: Global USA Flexographic Printing Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 12: Global USA Flexographic Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global USA Flexographic Printing Market Revenue Million Forecast, by Printing Inks 2020 & 2033

- Table 17: Global USA Flexographic Printing Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 18: Global USA Flexographic Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global USA Flexographic Printing Market Revenue Million Forecast, by Printing Inks 2020 & 2033

- Table 29: Global USA Flexographic Printing Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 30: Global USA Flexographic Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global USA Flexographic Printing Market Revenue Million Forecast, by Printing Inks 2020 & 2033

- Table 38: Global USA Flexographic Printing Market Revenue Million Forecast, by Equipment 2020 & 2033

- Table 39: Global USA Flexographic Printing Market Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific USA Flexographic Printing Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the USA Flexographic Printing Market?

The projected CAGR is approximately 2.77%.

2. Which companies are prominent players in the USA Flexographic Printing Market?

Key companies in the market include Zeller+Gmelin, Alden & Ott Printing Inks Co, ACTEGA, Toyo Ink Group, Bobst Group SA, OMET, HEIDELBERG USA INC, American Inks & Technology, Colorcon Inc, Comexi Group Industries S A U, SiegwerkGroup, Windmoeller & Hoelscher, MPS Systems BV, Fujifilm Corporation, Nilpeter*List Not Exhaustive, INX International Ink Co, DIC Corporation (Sun Chemical), WikOff Color Corporation, Wolverine Flexographic, Star Flex International, Flint Group, Kolorcure Corp, CMS Industrial Technologies LLC.

3. What are the main segments of the USA Flexographic Printing Market?

The market segments include Printing Inks, Equipment.

4. Can you provide details about the market size?

The market size is estimated to be USD 2.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Enables Higher Production Speeds Within Reasonable Cost Overlay; Growing Demand for UV-curable Inks; Growing Packaging Industry.

6. What are the notable trends driving market growth?

Packaging Industry to Witness Significant Growth.

7. Are there any restraints impacting market growth?

Advent of New Printing Technologies and Shift to Digital Mediums.

8. Can you provide examples of recent developments in the market?

September 2022 - ACTEGA unveiled its latest product line of ACTExact SafeShield UV-LED low. The SafeShield UV-LED ink line from ACTEGA has received the most certifications. It was created for low-migration applications such as packaging for indirect food contact, cosmetics, and nutraceuticals.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "USA Flexographic Printing Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the USA Flexographic Printing Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the USA Flexographic Printing Market?

To stay informed about further developments, trends, and reports in the USA Flexographic Printing Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence