Key Insights

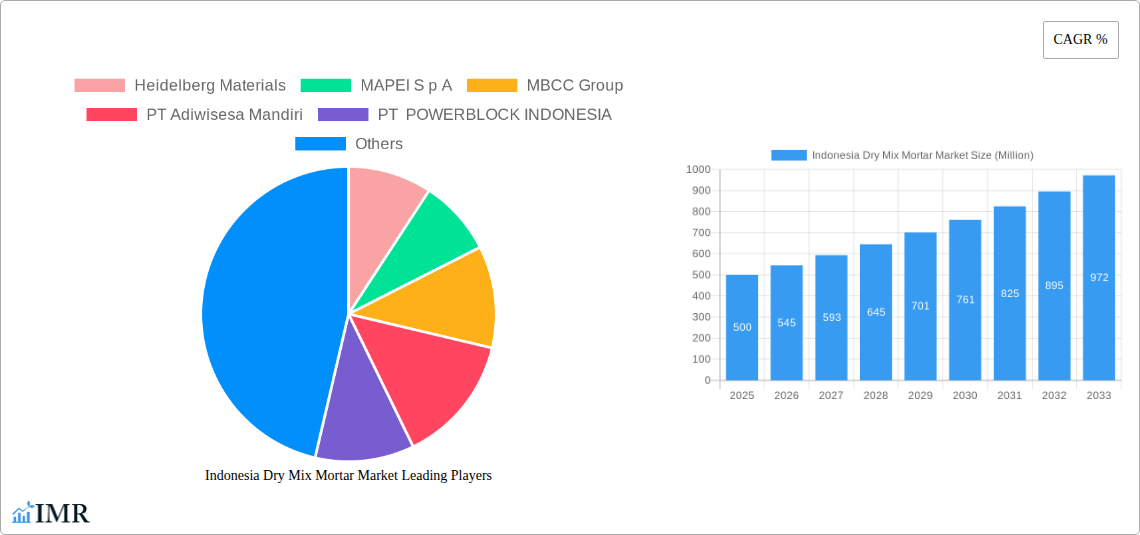

The Indonesian Dry Mix Mortar market is projected for significant expansion, driven by a robust CAGR of 6.5%. The market size was valued at $5 million in the base year 2024 and is anticipated to grow substantially. This growth is fueled by extensive infrastructure development, a flourishing residential construction sector, and the increasing adoption of advanced building materials across commercial, industrial, and institutional segments. Key applications including concrete protection, renovation, plaster, tile adhesives, and waterproofing slurries are experiencing heightened demand. Builders and developers are increasingly choosing dry mix mortars for their convenience, consistency, and superior performance compared to traditional site-mixed alternatives. The inherent benefits of reduced waste, enhanced durability, and faster application further bolster this market's trajectory, contributing to a projected market size of over $10 million by 2033.

Indonesia Dry Mix Mortar Market Market Size (In Million)

Indonesia's construction industry is prioritizing quality, efficiency, and sustainability, aligning perfectly with the advantages offered by dry mix mortars. Government initiatives in infrastructure, combined with a growing urban population and rising disposable incomes, are stimulating residential and commercial construction, creating consistent demand for these essential building materials. While strong demand drivers are evident, potential restraints include fluctuations in raw material prices (cement, aggregates) impacting profitability. The initial cost of specialized dry mix mortars may also present a challenge in price-sensitive segments, although long-term benefits often justify the upfront investment. Nevertheless, the overall trend towards construction modernization, supported by prominent global and local players, ensures a dynamic and promising future for the Indonesian dry mix mortar market.

Indonesia Dry Mix Mortar Market Company Market Share

This report provides an in-depth analysis of the Indonesian dry mix mortar market, covering its structure, growth trajectory, and future potential. The study spans a comprehensive period, offering critical insights for stakeholders. The base year is 2024, with estimated figures for 2024 and a detailed forecast period, complemented by historical data. Our analysis covers key segments including End Use Sector: Commercial, Industrial and Institutional, Infrastructure, Residential, and Application: Concrete Protection and Renovation, Grouts, Insulation and Finishing Systems, Plaster, Render, Tile Adhesive, Water Proofing Slurries, Other Applications.

Indonesia Dry Mix Mortar Market Market Dynamics & Structure

The Indonesia dry mix mortar market exhibits a moderate to high concentration, driven by a growing construction industry and increasing demand for specialized building materials. Technological innovation plays a pivotal role, with manufacturers continuously developing advanced formulations to meet performance requirements and environmental regulations. Key innovation drivers include the development of faster-setting mortars, improved adhesion properties, and eco-friendly compositions. Regulatory frameworks, while evolving, generally support the adoption of quality-controlled construction materials, influencing product standards and safety.

Competitive product substitutes, primarily traditional site-mixed mortars, are gradually being displaced by the convenience, consistency, and performance advantages of dry mix solutions. End-user demographics are shifting towards those who value efficiency, reduced waste, and predictable outcomes in construction projects. Mergers and acquisitions (M&A) trends are notable, indicating a consolidation phase as larger players seek to expand their market share and technological capabilities. For instance, the divestment of MBCC Group's construction systems business to Sika AG in May 2023 exemplifies this trend, signaling a significant shift in market landscape. The market share of leading players, estimated at xx% combined, underscores the competitive environment. Innovation barriers include the initial investment in research and development, stringent quality control processes, and the need for extensive marketing to educate end-users on the benefits of dry mix mortars over traditional methods.

- Market Concentration: Moderate to high, with key players investing in production capacity and R&D.

- Technological Innovation: Focus on rapid setting, enhanced durability, and sustainability.

- Regulatory Frameworks: Growing emphasis on building codes and material certifications.

- Competitive Substitutes: Traditional site-mixed mortar, facing increasing competition.

- End-User Demographics: Shift towards construction professionals seeking efficiency and quality.

- M&A Trends: Consolidation for market expansion and technological integration.

Indonesia Dry Mix Mortar Market Growth Trends & Insights

The Indonesia dry mix mortar market is projected for robust growth, fueled by accelerating urbanization, a burgeoning middle class, and substantial government investments in infrastructure development. The overall market size is expected to witness a significant upward trend, driven by increasing adoption rates across residential, commercial, and industrial sectors. Technological disruptions, such as advancements in additive technologies and automated manufacturing processes, are enhancing the performance and cost-effectiveness of dry mix mortars, further stimulating market penetration. Consumer behavior is shifting towards a preference for high-quality, reliable, and easy-to-use construction materials that contribute to faster project completion and reduced on-site labor costs.

The projected Compound Annual Growth Rate (CAGR) for the Indonesia dry mix mortar market is estimated at xx% over the forecast period. Market penetration is steadily increasing as awareness of the benefits of dry mix solutions grows among architects, builders, and contractors. The increasing demand for specialized applications like tile adhesives, waterproofing slurries, and insulation and finishing systems is a key growth driver. Furthermore, the government's focus on sustainable construction practices is creating a favorable environment for the adoption of dry mix mortars, which often contribute to reduced waste and a smaller environmental footprint compared to site-mixed alternatives. Economic factors, including rising disposable incomes and an expansion of the construction finance sector, also play a crucial role in supporting overall market expansion. The digitalization of the construction industry and the increasing use of Building Information Modeling (BIM) are expected to further streamline the specification and application of dry mix mortars, leading to greater efficiency and wider adoption. The market's evolution is also influenced by a growing emphasis on pre-packaged solutions that offer convenience and consistent quality, thereby reducing the complexities associated with traditional mortar mixing on construction sites.

Dominant Regions, Countries, or Segments in Indonesia Dry Mix Mortar Market

Within the Indonesia dry mix mortar market, the Residential end-use sector is emerging as a dominant force, propelled by a significant housing deficit and government initiatives to increase home ownership. This segment benefits from the increasing preference for faster and more reliable construction methods in the rapidly expanding urban and suburban areas. The Tile Adhesive application segment also commands substantial market share, driven by the widespread use of tiles in both residential and commercial projects, and the growing demand for high-performance adhesives that ensure durability and aesthetic appeal.

- Dominant End-Use Sector: Residential - This segment is experiencing unprecedented growth due to population expansion and government housing programs. The need for quick and consistent construction solutions in residential projects directly translates to higher demand for dry mix mortars.

- Dominant Application: Tile Adhesive - The widespread use of ceramic and porcelain tiles in kitchens, bathrooms, and flooring across all construction types makes this a perpetually strong segment. Modern tile adhesives offer superior bonding strength, flexibility, and ease of application, aligning perfectly with the advantages of dry mix technology.

- Key Drivers for Residential Dominance:

- Urbanization and population growth.

- Government housing schemes and affordable housing projects.

- Rising disposable incomes and demand for modern housing.

- Increased awareness of construction quality and aesthetics.

- Key Drivers for Tile Adhesive Dominance:

- High volume of tile installations in all construction types.

- Technological advancements in tile adhesive formulations for better performance.

- Demand for durable and aesthetically pleasing finishes.

- Ease of application and reduced labor costs compared to cementitious mortars.

- Market Share & Growth Potential: The residential segment and tile adhesive application are anticipated to account for over xx% and xx% respectively of the total Indonesia dry mix mortar market by 2033. Their growth potential is further amplified by ongoing infrastructure projects that indirectly stimulate residential construction and by the evolving design trends favoring extensive tile usage. The Infrastructure end-use sector, though significant, often involves larger-scale projects where site-mixed concrete might still be prevalent for structural elements, making residential and tile applications more immediate drivers for dry mix mortar growth. However, as infrastructure projects increasingly adopt pre-fabricated components and specialized finishing, the demand for dry mix mortars in this segment is also expected to rise. The Commercial, Industrial and Institutional sectors also present substantial opportunities, particularly for specialized products like grouts and waterproofing slurries.

Indonesia Dry Mix Mortar Market Product Landscape

The Indonesia dry mix mortar market is characterized by continuous product innovation, focusing on enhanced performance and application-specific solutions. Manufacturers are actively developing advanced formulations for tile adhesives offering improved workability, extended open time, and superior bond strength for various tile types. Plaster and render products are being engineered for faster application, better crack resistance, and enhanced thermal and acoustic insulation properties. Grouts are formulated for precision filling, non-shrinkage, and high compressive strength, crucial for industrial applications and machinery installation. Waterproofing slurries are gaining prominence with improved flexibility and adhesion to various substrates, crucial for protecting structures from moisture damage. Insulation and finishing systems are evolving to offer energy-efficient solutions with ease of application. The overall trend is towards pre-packaged, high-performance mortars that simplify construction processes and deliver consistent, reliable results.

Key Drivers, Barriers & Challenges in Indonesia Dry Mix Mortar Market

Key Drivers: The Indonesia dry mix mortar market is propelled by several key factors. Significant government investment in infrastructure projects, coupled with a growing demand for residential housing, forms a primary growth engine. The increasing adoption of modern construction techniques that prioritize efficiency, speed, and quality further boosts demand. Technological advancements leading to improved product performance, durability, and ease of application are also critical drivers. Moreover, the rising awareness among construction professionals and end-users about the benefits of dry mix mortars, such as reduced waste and consistent quality, contributes to market expansion.

Barriers & Challenges: Despite strong growth prospects, the market faces certain barriers and challenges. The initial cost of dry mix mortars can be higher compared to traditional site-mixed alternatives, posing a price sensitivity challenge, especially in smaller projects. Insufficient awareness and education about the long-term benefits and proper application of dry mix mortars among a segment of the construction workforce can hinder adoption. Supply chain disruptions and logistical complexities in a vast archipelago like Indonesia can impact product availability and costs. Stringent regulatory requirements and the need for product certifications can also present hurdles for new entrants. Furthermore, intense competition from established players and the threat of counterfeit products require continuous focus on quality and brand building.

Emerging Opportunities in Indonesia Dry Mix Mortar Market

Emerging opportunities in the Indonesia dry mix mortar market lie in the development of specialized, high-performance products tailored to the unique environmental conditions and construction needs of the region. There is a significant untapped market for advanced waterproofing slurries and concrete protection and renovation solutions, driven by the need to preserve existing infrastructure and combat the effects of humidity and tropical climates. The growing trend towards green building and sustainable construction practices presents an avenue for eco-friendly dry mix mortars with reduced VOC emissions and recycled content. Furthermore, the increasing use of pre-fabricated construction elements will create demand for specialized dry mix mortars designed for jointing and assembly. The expansion of e-commerce platforms for construction materials also offers an opportunity to reach a wider customer base, particularly in remote areas.

Growth Accelerators in the Indonesia Dry Mix Mortar Market Industry

Several growth accelerators are poised to significantly boost the Indonesia dry mix mortar market in the long term. Technological breakthroughs in material science, leading to the development of mortars with self-healing properties, enhanced fire resistance, and superior thermal insulation, will drive demand for premium products. Strategic partnerships between dry mix mortar manufacturers and large-scale developers, construction companies, and government agencies will solidify market presence and ensure consistent demand. Market expansion strategies, including investing in localized production facilities to reduce logistics costs and improve product availability, will be crucial. The ongoing digitalization of the construction industry, with the integration of BIM and smart construction technologies, will further streamline the specification and use of dry mix mortars, making them an indispensable part of modern construction practices.

Key Players Shaping the Indonesia Dry Mix Mortar Market Market

- Heidelberg Materials

- MAPEI S p A

- MBCC Group

- PT Adiwisesa Mandiri

- PT POWERBLOCK INDONESIA

- PT RAPI Hijau Perkasa

- Saint-Gobain

- SIG

- Sika AG

- Triputra Group

Notable Milestones in Indonesia Dry Mix Mortar Market Sector

- May 2023: PCI, an affiliate of MBCC Group, formulated a ready-mixed flowable screed mortar, PCI Novoment Flow, offering multiple benefits like quick setting and curing, enhancing construction efficiency.

- May 2023: MBCC Group divested its construction systems business, including its subsidiaries, product portfolio, and advanced technologies, to Sika AG, significantly reshaping the competitive landscape and consolidating market power.

- April 2023: PCI, an affiliate of MBCC Group, developed a new leveling mortar, PCI Polycret 50, a low-emission and high-performance mortar used by machine and fast setting, providing rapid construction progress and improved worker safety.

In-Depth Indonesia Dry Mix Mortar Market Market Outlook

The Indonesia dry mix mortar market is set for a period of sustained and accelerated growth. The confluence of strong demographic drivers, rapid urbanization, and proactive government policies supporting infrastructure development creates a highly favorable environment. The market will likely witness further technological advancements, with a focus on sustainability, enhanced performance, and smart material integration. Opportunities for expansion in niche applications and the increasing adoption of pre-fabricated construction will also contribute to market buoyancy. Key players are expected to focus on innovation, strategic collaborations, and expanding their distribution networks to capture the growing demand. The shift towards digital construction further solidifies the long-term positive outlook for the Indonesia dry mix mortar market.

Indonesia Dry Mix Mortar Market Segmentation

-

1. End Use Sector

- 1.1. Commercial

- 1.2. Industrial and Institutional

- 1.3. Infrastructure

- 1.4. Residential

-

2. Application

- 2.1. Concrete Protection and Renovation

- 2.2. Grouts

- 2.3. Insulation and Finishing Systems

- 2.4. Plaster

- 2.5. Render

- 2.6. Tile Adhesive

- 2.7. Water Proofing Slurries

- 2.8. Other Applications

Indonesia Dry Mix Mortar Market Segmentation By Geography

- 1. Indonesia

Indonesia Dry Mix Mortar Market Regional Market Share

Geographic Coverage of Indonesia Dry Mix Mortar Market

Indonesia Dry Mix Mortar Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Indonesia Dry Mix Mortar Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 5.1.1. Commercial

- 5.1.2. Industrial and Institutional

- 5.1.3. Infrastructure

- 5.1.4. Residential

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Concrete Protection and Renovation

- 5.2.2. Grouts

- 5.2.3. Insulation and Finishing Systems

- 5.2.4. Plaster

- 5.2.5. Render

- 5.2.6. Tile Adhesive

- 5.2.7. Water Proofing Slurries

- 5.2.8. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Indonesia

- 5.1. Market Analysis, Insights and Forecast - by End Use Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Heidelberg Materials

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 MAPEI S p A

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 MBCC Group

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 PT Adiwisesa Mandiri

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 PT POWERBLOCK INDONESIA

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 PT RAPI Hijau Perkasa

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Saint-Gobain

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 SIG

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Sika AG

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Triputra Grou

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Heidelberg Materials

List of Figures

- Figure 1: Indonesia Dry Mix Mortar Market Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Indonesia Dry Mix Mortar Market Share (%) by Company 2025

List of Tables

- Table 1: Indonesia Dry Mix Mortar Market Revenue million Forecast, by End Use Sector 2020 & 2033

- Table 2: Indonesia Dry Mix Mortar Market Revenue million Forecast, by Application 2020 & 2033

- Table 3: Indonesia Dry Mix Mortar Market Revenue million Forecast, by Region 2020 & 2033

- Table 4: Indonesia Dry Mix Mortar Market Revenue million Forecast, by End Use Sector 2020 & 2033

- Table 5: Indonesia Dry Mix Mortar Market Revenue million Forecast, by Application 2020 & 2033

- Table 6: Indonesia Dry Mix Mortar Market Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Indonesia Dry Mix Mortar Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the Indonesia Dry Mix Mortar Market?

Key companies in the market include Heidelberg Materials, MAPEI S p A, MBCC Group, PT Adiwisesa Mandiri, PT POWERBLOCK INDONESIA, PT RAPI Hijau Perkasa, Saint-Gobain, SIG, Sika AG, Triputra Grou.

3. What are the main segments of the Indonesia Dry Mix Mortar Market?

The market segments include End Use Sector, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 5 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

May 2023: PCI, an affiliate of MBCC Group, formulated a ready-mixed flowable screed mortar, PCI Novoment Flow, offering multiple benefits like quick setting and curing.May 2023: MBCC group divested its construction systems business, including its subsidiaries, product portfolio, and advanced technologies, to Sika AG.April 2023: PCI, an affiliate of MBCC Group, developed a new leveling mortar, PCI Polycret 50, a low-emission and high-performance mortar used by machine and fast setting provides rapid construction progress.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Indonesia Dry Mix Mortar Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Indonesia Dry Mix Mortar Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Indonesia Dry Mix Mortar Market?

To stay informed about further developments, trends, and reports in the Indonesia Dry Mix Mortar Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence