Key Insights

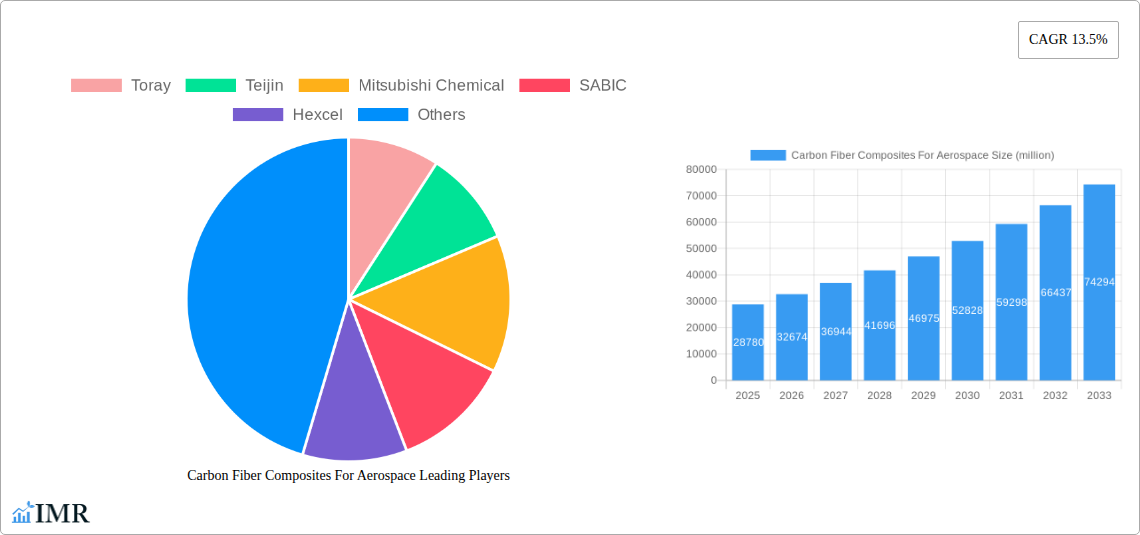

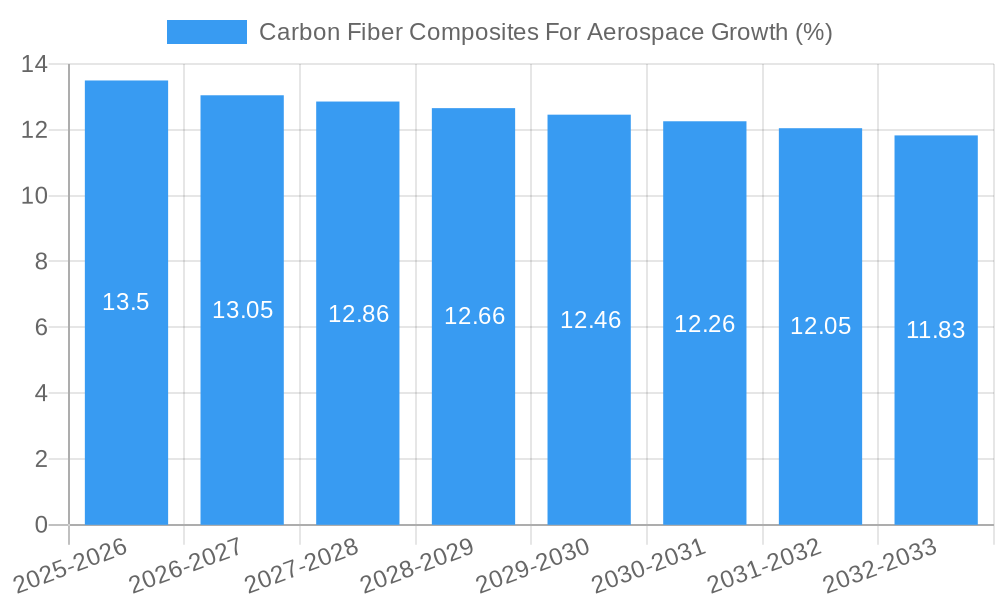

The global market for Carbon Fiber Composites in Aerospace is poised for significant expansion, with a current valuation of $28,780 million. This robust market is projected to grow at a Compound Annual Growth Rate (CAGR) of 13.5% over the forecast period of 2025-2033. This remarkable growth trajectory is primarily fueled by the increasing demand for lightweight, high-strength materials in aircraft manufacturing to enhance fuel efficiency and performance. The aerospace industry's continuous innovation in aircraft design and the growing stringency of environmental regulations mandating reduced emissions are key drivers. Furthermore, advancements in carbon fiber production technologies are making these materials more cost-effective and accessible, paving the way for broader adoption across various aerospace applications, including commercial aviation, defense, and space exploration. The trend towards increased use of composite structures in airframes, wings, and internal components is a testament to their superior properties compared to traditional metallic materials.

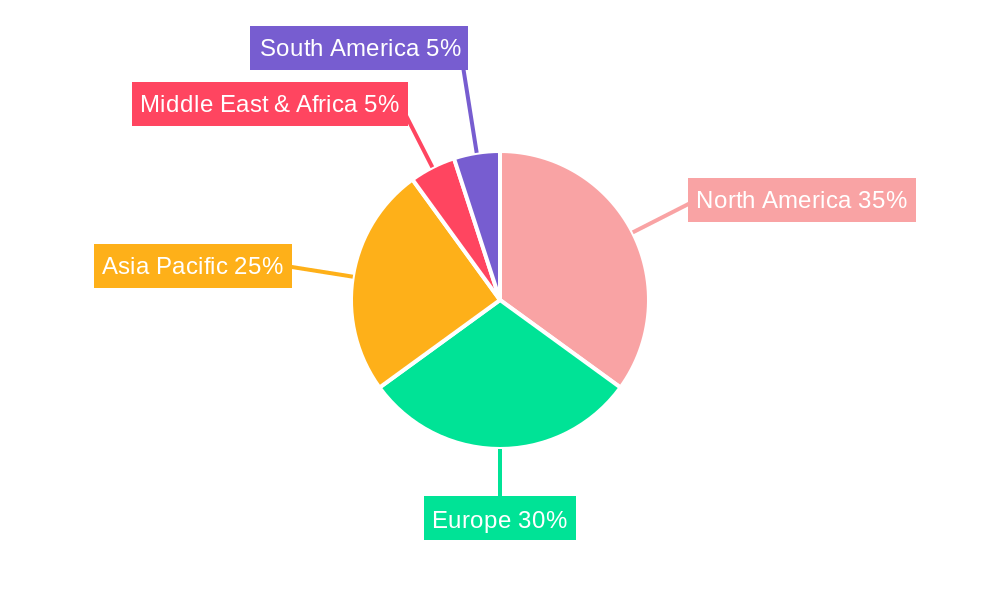

The market is segmented into distinct applications, with Military and Civilian sectors being the primary consumers. Within the composite types, Carbon Fiber-Resin Composites are anticipated to dominate, owing to their versatility and established use. However, Carbon Fiber-Metal Composites and Carbon Fiber-Ceramics Composites are also expected to see substantial growth as specialized applications demand their unique properties. Leading global players such as Toray, Teijin, Mitsubishi Chemical, SABIC, Hexcel, DowAksa, Solvay, and SGL Carbon are at the forefront of innovation and market penetration, investing heavily in research and development. Geographically, the Asia Pacific region, particularly China and India, is emerging as a significant growth hub due to expanding indigenous aerospace manufacturing capabilities and increasing defense spending. North America and Europe, with their mature aerospace industries, will continue to be major markets, driven by fleet modernization and the development of next-generation aircraft.

This in-depth report provides a definitive analysis of the Carbon Fiber Composites for Aerospace market, encompassing a detailed exploration of its dynamics, growth trajectory, and future potential. With a focus on high-traffic keywords such as "aerospace composites," "carbon fiber aircraft," "advanced materials aviation," and "lightweight aircraft structures," this report is optimized for maximum search engine visibility and engagement with industry professionals, engineers, procurement managers, and strategic decision-makers. We delve into parent and child market segments, offering granular insights into this critical sector. The study period spans from 2019–2033, with a base and estimated year of 2025, and a forecast period of 2025–2033, building upon a historical analysis from 2019–2024. All quantitative data is presented in million units.

Carbon Fiber Composites For Aerospace Market Dynamics & Structure

The global carbon fiber composites for aerospace market exhibits a moderate to high concentration, with a few key players dominating significant portions of the market share. Technological innovation is the primary driver, fueled by the relentless pursuit of lighter, stronger, and more fuel-efficient aircraft. Regulatory frameworks, particularly those focusing on safety and material certification from bodies like the FAA and EASA, play a crucial role in market entry and product development. Competitive product substitutes, such as advanced aluminum alloys and titanium, present a continuous challenge, though carbon fiber's superior strength-to-weight ratio often provides a decisive advantage. End-user demographics are shifting towards greater adoption in commercial aviation alongside the consistent demand from the military sector. Mergers and acquisitions (M&A) are a significant trend, consolidating expertise and market reach. For instance, the historical period saw xx M&A deals, with an estimated aggregate deal value of $xxx million.

- Market Concentration: Dominated by a few leading manufacturers, with the top 5 players holding an estimated 65% market share.

- Technological Innovation Drivers: Demand for reduced aircraft weight, improved fuel efficiency, enhanced structural integrity, and novel manufacturing processes.

- Regulatory Frameworks: Stringent certification processes by aviation authorities significantly influence product development timelines and costs.

- Competitive Product Substitutes: Advanced aluminum alloys and titanium remain key competitors, but their weight disadvantages are increasingly critical.

- End-User Demographics: Growing adoption in both commercial passenger jets and military platforms, with increasing interest from business aviation and drones.

- M&A Trends: Strategic acquisitions aimed at expanding product portfolios, securing raw material supply, and gaining market access.

Carbon Fiber Composites For Aerospace Growth Trends & Insights

The carbon fiber composites market for aerospace is poised for substantial growth, driven by an escalating demand for lightweight materials that directly translate to improved aircraft performance and reduced operational costs. Market size evolution is projected to witness a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033. Adoption rates in new aircraft models are accelerating, with an estimated xx% of new commercial aircraft structures now incorporating significant carbon fiber content. Technological disruptions, such as advancements in automated manufacturing and additive manufacturing for composite components, are further streamlining production and enabling more complex designs. Consumer behavior shifts, indirectly influenced by airline commitments to sustainability and cost reduction, are indirectly fueling the demand for fuel-efficient aircraft, thereby boosting the need for carbon fiber composites. The penetration of carbon fiber composites in the aerospace sector is expected to reach xx% by 2033, a significant increase from xx% in 2019.

- Market Size Evolution: The global market value is expected to grow from $xxx million in 2025 to $xxx million by 2033.

- Adoption Rates: Increasing integration in primary and secondary aircraft structures, including wings, fuselage, and empennage.

- Technological Disruptions: Advancements in prepregs, resin systems, automated fiber placement, and out-of-autoclave curing are reducing manufacturing complexities and costs.

- Consumer Behavior Shifts: Indirect influence through airline demand for fuel-efficient and environmentally friendly aircraft, leading to greater adoption of lightweight materials.

- Market Penetration: Forecasted to reach xx% in the aerospace industry by the end of the forecast period.

Dominant Regions, Countries, or Segments in Carbon Fiber Composites For Aerospace

North America currently dominates the aerospace carbon fiber composites market, driven by the established presence of major aircraft manufacturers like Boeing and Lockheed Martin, coupled with robust military spending and a proactive approach to adopting advanced materials. The United States, in particular, holds a significant market share due to its extensive aerospace ecosystem and ongoing investments in defense and commercial aviation. The Civilian application segment is a major growth engine, propelled by the constant demand for new, fuel-efficient commercial aircraft that reduce operating expenses for airlines and lower emissions. Within the Type segment, Carbon Fiber-Resin Composite remains the most dominant, accounting for an estimated xx% of the market due to its proven performance, versatility, and established manufacturing processes.

- Dominant Region: North America, led by the United States.

- Key Drivers: Presence of major OEMs, strong military procurement, advanced research and development capabilities, and supportive government initiatives.

- Market Share: Estimated xx% of the global market in 2025.

- Growth Potential: Continued demand from next-generation aircraft programs and defense modernization efforts.

- Dominant Application Segment: Civilian.

- Key Drivers: Airline demand for fuel efficiency, passenger comfort, and increased range; ongoing fleet renewal programs.

- Market Share: Expected to grow to xx% by 2033.

- Growth Potential: Significant opportunities in wide-body and narrow-body aircraft production.

- Dominant Type Segment: Carbon Fiber-Resin Composite.

- Key Drivers: Established track record, cost-effectiveness for large-scale production, and wide range of performance characteristics achievable through material design.

- Market Share: Holds a dominant xx% share, with steady growth anticipated.

- Growth Potential: Continued refinement of resin systems and manufacturing techniques to improve performance and reduce cure times.

Carbon Fiber Composites For Aerospace Product Landscape

The aerospace carbon fiber composite product landscape is characterized by continuous innovation in material science and manufacturing processes. Key product developments include advanced prepregs with enhanced thermal and mechanical properties, specialized resin systems for extreme temperature applications, and the development of complex integrated composite structures that reduce part count and assembly time. Innovations are also focused on improving damage tolerance, fire resistance, and lightning strike protection. Applications range from primary structures like wings and fuselage sections to secondary components such as control surfaces, interior cabin parts, and engine nacelles, all contributing to significant weight savings and improved aerodynamic efficiency. Performance metrics consistently being pushed include higher tensile strength, improved fatigue resistance, and reduced density, directly impacting aircraft range and payload capacity.

Key Drivers, Barriers & Challenges in Carbon Fiber Composites For Aerospace

Key Drivers:

- Weight Reduction: The primary driver for fuel efficiency, reduced emissions, and increased payload capacity in aircraft.

- High Strength-to-Weight Ratio: Superior mechanical properties compared to traditional metals.

- Corrosion Resistance: Enhanced durability and reduced maintenance requirements.

- Design Flexibility: Ability to create complex, integrated structures.

- Technological Advancements: Ongoing improvements in manufacturing processes and material science.

Barriers & Challenges:

- High Material Costs: Carbon fiber and its associated manufacturing processes can be significantly more expensive than traditional materials.

- Complex Manufacturing Processes: Requires specialized equipment and skilled labor, leading to longer production cycles.

- Repair and Maintenance: Specialized techniques and training are needed for effective repair of composite structures.

- Certification Hurdles: Rigorous testing and validation are required for regulatory approval, adding time and cost.

- Supply Chain Volatility: Potential disruptions in the supply of raw materials and precursor fibers. The global supply chain for high-grade carbon fiber for aerospace is valued at approximately $xxx million annually, and any disruptions can impact production schedules.

Emerging Opportunities in Carbon Fiber Composites For Aerospace

Emerging opportunities in the carbon fiber composites for aerospace sector lie in the burgeoning drone and Urban Air Mobility (UAM) markets, which demand lightweight, high-performance structures for eVTOL aircraft. The development of novel, bio-based or recycled carbon fibers presents a significant opportunity for enhanced sustainability. Furthermore, advancements in additive manufacturing of composite components are opening doors for faster prototyping, on-demand production, and the creation of highly optimized, complex geometries previously unattainable. The increasing focus on digitalization and smart manufacturing in the aerospace industry also presents opportunities for integrated sensor systems within composite structures for real-time performance monitoring.

Growth Accelerators in the Carbon Fiber Composites For Aerospace Industry

The carbon fiber composites for aerospace industry is experiencing accelerated growth driven by several key factors. Continued investment in research and development by leading companies like Toray and Hexcel is pushing the boundaries of material performance and manufacturing efficiency. Strategic partnerships between material suppliers, component manufacturers, and aircraft OEMs are crucial for streamlining the adoption of new composite solutions into aircraft programs. Market expansion strategies, including the development of localized production facilities in emerging aerospace hubs, are also contributing to sustained growth. The push towards next-generation aircraft designs that fully leverage the benefits of composite materials is a significant catalyst for long-term expansion.

Key Players Shaping the Carbon Fiber Composites For Aerospace Market

- Toray Industries, Inc.

- Teijin Limited

- Mitsubishi Chemical Corporation

- SABIC

- Hexcel Corporation

- DowAksa

- Solvay

- Saertex GmbH & Co. KG

- SGL Carbon SE

- ACP Composites, Inc.

- Jiangsu Hengshen Composite Material Co., Ltd.

- Zhongfu Shenying Carbon Fiber Technology Co., Ltd.

Notable Milestones in Carbon Fiber Composites For Aerospace Sector

- 2019: Launch of Boeing 777X featuring extensive use of carbon fiber composite wings.

- 2020: Airbus introduces A350 UAM concepts heavily reliant on advanced composites.

- 2021: Development of high-temperature resin systems enabling broader application in engine components.

- 2022: Significant advancements in automated fiber placement (AFP) technology reducing manufacturing costs.

- 2023: Increased investment in additive manufacturing for composite aerospace parts.

- 2024: Growing exploration of recycled carbon fiber solutions for sustainable aerospace manufacturing.

In-Depth Carbon Fiber Composites For Aerospace Market Outlook

- 2019: Launch of Boeing 777X featuring extensive use of carbon fiber composite wings.

- 2020: Airbus introduces A350 UAM concepts heavily reliant on advanced composites.

- 2021: Development of high-temperature resin systems enabling broader application in engine components.

- 2022: Significant advancements in automated fiber placement (AFP) technology reducing manufacturing costs.

- 2023: Increased investment in additive manufacturing for composite aerospace parts.

- 2024: Growing exploration of recycled carbon fiber solutions for sustainable aerospace manufacturing.

In-Depth Carbon Fiber Composites For Aerospace Market Outlook

The carbon fiber composites for aerospace market outlook remains exceptionally strong, driven by sustained demand for lighter, more fuel-efficient aircraft across both commercial and defense sectors. Growth accelerators include ongoing technological breakthroughs in material science and manufacturing, enabling cost reductions and wider applications. Strategic partnerships between key industry players are fostering collaboration and accelerating innovation. Market expansion into emerging regions and the increasing adoption of composites in new aircraft platforms, including the rapidly growing drone and UAM segments, present substantial future opportunities. The strategic imperative for airlines to reduce operational costs and emissions will continue to fuel the demand for advanced composite solutions, ensuring robust long-term growth for this critical sector. The estimated market potential, driven by these factors, is projected to reach $xxx million by 2033.

Carbon Fiber Composites For Aerospace Segmentation

-

1. Application

- 1.1. Military

- 1.2. Civilian

-

2. Type

- 2.1. Carbon Fiber-Resin Composite

- 2.2. Carbon Fiber-Metal Composite

- 2.3. Carbon Fiber-Ceramics Composite

- 2.4. Others

Carbon Fiber Composites For Aerospace Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Carbon Fiber Composites For Aerospace REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 13.5% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Carbon Fiber Composites For Aerospace Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Military

- 5.1.2. Civilian

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Carbon Fiber-Resin Composite

- 5.2.2. Carbon Fiber-Metal Composite

- 5.2.3. Carbon Fiber-Ceramics Composite

- 5.2.4. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Carbon Fiber Composites For Aerospace Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Military

- 6.1.2. Civilian

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Carbon Fiber-Resin Composite

- 6.2.2. Carbon Fiber-Metal Composite

- 6.2.3. Carbon Fiber-Ceramics Composite

- 6.2.4. Others

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Carbon Fiber Composites For Aerospace Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Military

- 7.1.2. Civilian

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Carbon Fiber-Resin Composite

- 7.2.2. Carbon Fiber-Metal Composite

- 7.2.3. Carbon Fiber-Ceramics Composite

- 7.2.4. Others

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Carbon Fiber Composites For Aerospace Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Military

- 8.1.2. Civilian

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Carbon Fiber-Resin Composite

- 8.2.2. Carbon Fiber-Metal Composite

- 8.2.3. Carbon Fiber-Ceramics Composite

- 8.2.4. Others

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Carbon Fiber Composites For Aerospace Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Military

- 9.1.2. Civilian

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Carbon Fiber-Resin Composite

- 9.2.2. Carbon Fiber-Metal Composite

- 9.2.3. Carbon Fiber-Ceramics Composite

- 9.2.4. Others

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Carbon Fiber Composites For Aerospace Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Military

- 10.1.2. Civilian

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Carbon Fiber-Resin Composite

- 10.2.2. Carbon Fiber-Metal Composite

- 10.2.3. Carbon Fiber-Ceramics Composite

- 10.2.4. Others

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Toray

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teijin

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mitsubishi Chemical

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 SABIC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hexcel

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 DowAksa

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Solvay

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Saertex

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 SGL Carbon

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 ACP Composites

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Jiangsu Hengshen

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Zhongfu Shenying

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Toray

List of Figures

- Figure 1: Global Carbon Fiber Composites For Aerospace Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Carbon Fiber Composites For Aerospace Revenue (million), by Application 2024 & 2032

- Figure 3: North America Carbon Fiber Composites For Aerospace Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Carbon Fiber Composites For Aerospace Revenue (million), by Type 2024 & 2032

- Figure 5: North America Carbon Fiber Composites For Aerospace Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Carbon Fiber Composites For Aerospace Revenue (million), by Country 2024 & 2032

- Figure 7: North America Carbon Fiber Composites For Aerospace Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Carbon Fiber Composites For Aerospace Revenue (million), by Application 2024 & 2032

- Figure 9: South America Carbon Fiber Composites For Aerospace Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Carbon Fiber Composites For Aerospace Revenue (million), by Type 2024 & 2032

- Figure 11: South America Carbon Fiber Composites For Aerospace Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Carbon Fiber Composites For Aerospace Revenue (million), by Country 2024 & 2032

- Figure 13: South America Carbon Fiber Composites For Aerospace Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Carbon Fiber Composites For Aerospace Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Carbon Fiber Composites For Aerospace Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Carbon Fiber Composites For Aerospace Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Carbon Fiber Composites For Aerospace Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Carbon Fiber Composites For Aerospace Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Carbon Fiber Composites For Aerospace Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Carbon Fiber Composites For Aerospace Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Carbon Fiber Composites For Aerospace Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Carbon Fiber Composites For Aerospace Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Carbon Fiber Composites For Aerospace Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Carbon Fiber Composites For Aerospace Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Carbon Fiber Composites For Aerospace Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Carbon Fiber Composites For Aerospace Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Carbon Fiber Composites For Aerospace Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Carbon Fiber Composites For Aerospace Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Carbon Fiber Composites For Aerospace Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Carbon Fiber Composites For Aerospace Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Carbon Fiber Composites For Aerospace Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Carbon Fiber Composites For Aerospace Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Carbon Fiber Composites For Aerospace Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Carbon Fiber Composites For Aerospace?

The projected CAGR is approximately 13.5%.

2. Which companies are prominent players in the Carbon Fiber Composites For Aerospace?

Key companies in the market include Toray, Teijin, Mitsubishi Chemical, SABIC, Hexcel, DowAksa, Solvay, Saertex, SGL Carbon, ACP Composites, Jiangsu Hengshen, Zhongfu Shenying.

3. What are the main segments of the Carbon Fiber Composites For Aerospace?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 28780 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Carbon Fiber Composites For Aerospace," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Carbon Fiber Composites For Aerospace report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Carbon Fiber Composites For Aerospace?

To stay informed about further developments, trends, and reports in the Carbon Fiber Composites For Aerospace, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence