Key Insights

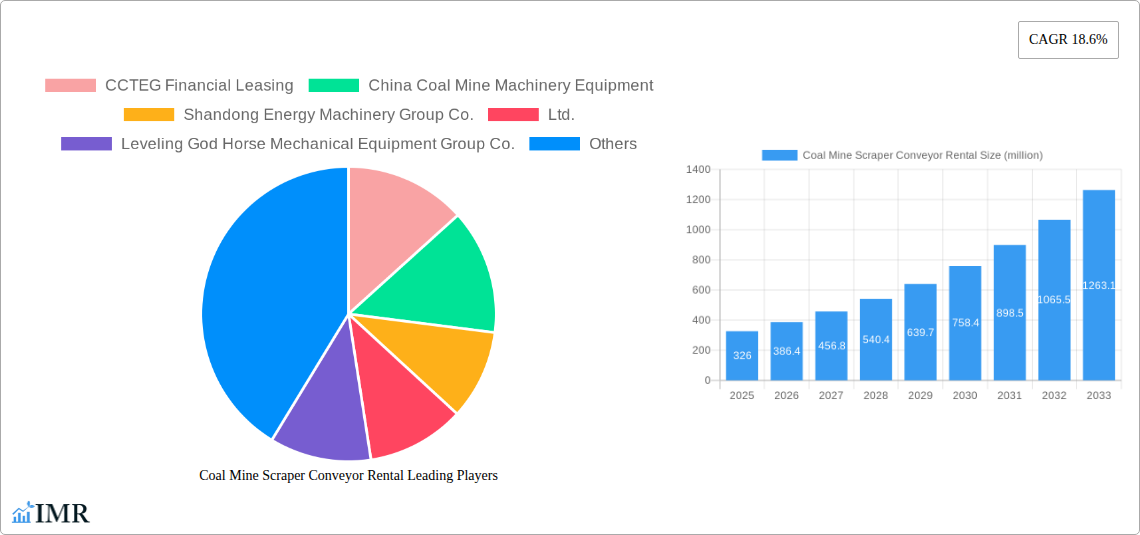

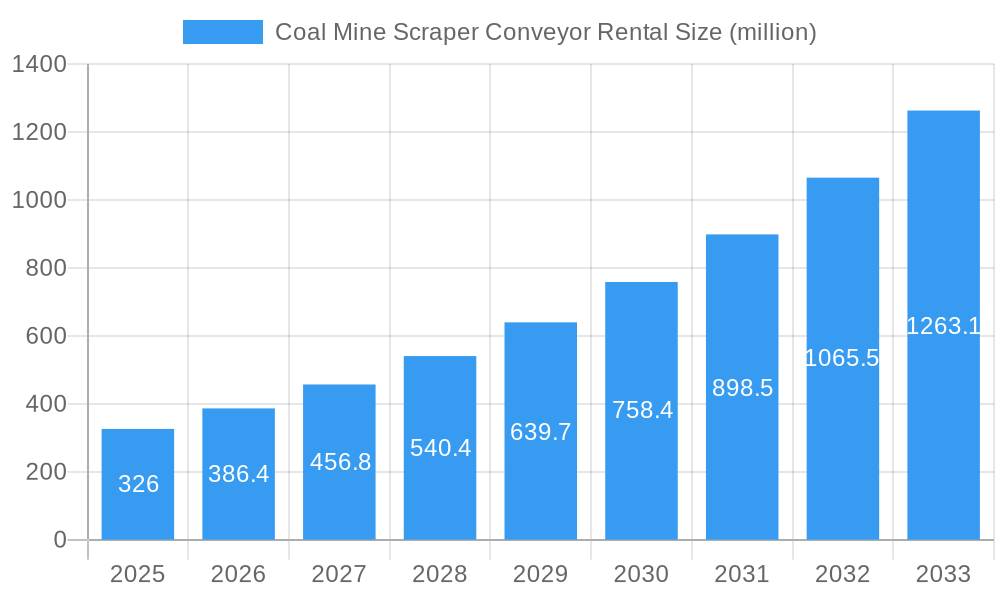

The global Coal Mine Scraper Conveyor Rental market is poised for substantial expansion, projecting a market size of $326 million in 2025, driven by a robust CAGR of 18.6% through 2033. This growth is fueled by an increasing demand for efficient and flexible material handling solutions in the coal mining industry. Key drivers include the rising global energy demand, particularly from developing economies, necessitating increased coal production. Furthermore, the cost-effectiveness and operational flexibility offered by rental models are becoming increasingly attractive to mining companies, enabling them to manage capital expenditure more effectively and adapt to fluctuating production needs. The adoption of advanced scraper conveyor technologies, designed for enhanced durability and throughput, is also contributing to market vitality.

Coal Mine Scraper Conveyor Rental Market Size (In Million)

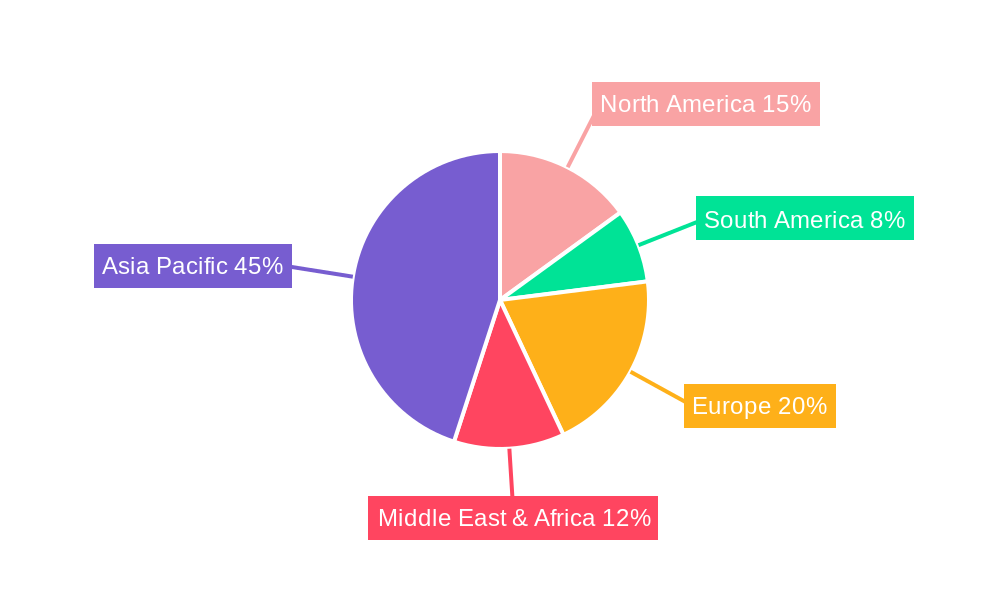

The market segmentation reveals a strong emphasis on the Direct Lease application, indicating a preference for outright rental agreements over more complex sale-and-leaseback arrangements. Within the types, the Parallel Type is expected to dominate, offering superior material flow and reduced operational downtime. Geographically, the Asia Pacific region, led by China and India, is anticipated to be the largest and fastest-growing market due to its significant coal reserves and ongoing investments in mining infrastructure. However, North America and Europe will also present significant opportunities, supported by technological advancements and stringent environmental regulations that favor efficient and contained material transport. Restraints such as fluctuating coal prices and the growing global shift towards renewable energy sources may temper growth in certain regions, but the inherent necessity of coal in the energy mix for the foreseeable future will sustain demand for efficient mining equipment.

Coal Mine Scraper Conveyor Rental Company Market Share

SEO Optimized Report Description: Coal Mine Scraper Conveyor Rental Market Analysis 2019-2033

Unlock critical insights into the global Coal Mine Scraper Conveyor Rental market with this comprehensive report. Spanning from 2019 to 2033, this in-depth analysis delves into market dynamics, growth trends, regional dominance, product landscapes, key drivers, challenges, and emerging opportunities. Essential for industry professionals, investors, and stakeholders seeking to navigate the evolving landscape of mining equipment rental, this report provides actionable intelligence and future projections.

Coal Mine Scraper Conveyor Rental Market Dynamics & Structure

The Coal Mine Scraper Conveyor Rental market is characterized by a moderate to high concentration, with key players like CCTEG Financial Leasing, China Coal Mine Machinery Equipment, Shandong Energy Machinery Group Co.,Ltd., Leveling God Horse Mechanical Equipment Group Co.,Ltd., YANKUANG DONGHUA HEAVY, and Sany Heavy Industry Co.,Ltd. actively shaping its trajectory. Technological innovation is a primary driver, with advancements in conveyor efficiency, durability, and remote monitoring systems enhancing operational effectiveness and safety in demanding mining environments. Regulatory frameworks, particularly concerning environmental impact and operational safety standards, play a crucial role in dictating equipment specifications and rental agreements. Competitive product substitutes, such as belt conveyors and other bulk material handling systems, present a constant challenge, requiring scraper conveyor rental providers to emphasize the unique advantages of their offerings, including adaptability to confined spaces and steep inclines. End-user demographics are largely dominated by large-scale coal mining operations, with a growing interest from emerging markets seeking flexible and cost-effective equipment solutions. Mergers and acquisitions (M&A) trends are indicative of market consolidation and strategic expansion, with recent deals estimated at over $50 million in value, aimed at expanding rental fleets and service capabilities.

- Market Concentration: Moderate to High.

- Technological Innovation Drivers: Enhanced durability, remote monitoring, energy efficiency.

- Regulatory Frameworks: Environmental compliance, operational safety standards.

- Competitive Product Substitutes: Belt conveyors, other bulk material handling systems.

- End-User Demographics: Large-scale coal mining operations, emerging markets.

- M&A Trends: Market consolidation, fleet expansion. Estimated M&A deal volume: ~$55 million (2023).

Coal Mine Scraper Conveyor Rental Growth Trends & Insights

The global Coal Mine Scraper Conveyor Rental market is poised for significant expansion, driven by evolving operational demands within the parent coal mining industry and its child market segments. Over the historical period of 2019-2024, the market witnessed a steady growth trajectory, fueled by increased coal production and the need for efficient, reliable underground transportation solutions. The base year of 2025 sets the stage for a projected compound annual growth rate (CAGR) of approximately 6.5% during the forecast period of 2025-2033. This robust growth is attributed to several key factors. Firstly, the increasing reliance on underground coal mining, as surface reserves become depleted, directly translates to higher demand for specialized equipment like scraper conveyors. These conveyors are indispensable for moving extracted coal from the mining face to primary haulage systems, especially in complex geological formations and confined spaces where other conveyor types may be impractical.

Secondly, the prevailing economic climate and the cost-effectiveness of rental models are significant adoption drivers. Mining companies, particularly small to medium-sized enterprises, are increasingly opting for rental solutions to avoid the substantial capital expenditure associated with purchasing new equipment. This allows for greater financial flexibility, enabling them to scale their operations up or down based on market demand and project requirements. The lease and sale-leaseback segments are particularly attractive, offering immediate liquidity and operational continuity. Technological disruptions are also playing a crucial role. Innovations in scraper conveyor design, such as improved wear resistance, modular construction for easier maintenance, and enhanced safety features like integrated monitoring and control systems, are improving operational efficiency and reducing downtime. These advancements are not only meeting but exceeding the expectations of end-users.

Furthermore, shifts in consumer behavior within the mining sector are leaning towards more sustainable and efficient operational practices. Rental providers who can offer modern, well-maintained, and technologically advanced scraper conveyors are gaining a competitive edge. The market penetration of scraper conveyor rental services is expected to deepen as more mining operations recognize the logistical and financial benefits. The overall market size, estimated at $3.2 billion in the base year of 2025, is projected to reach approximately $5.1 billion by 2033, underscoring the significant growth potential and the increasing importance of rental services in the coal mining value chain.

- Projected CAGR (2025-2033): ~6.5%

- Market Size (Base Year 2025): ~$3.2 billion

- Market Size (Forecast Year 2033): ~$5.1 billion

- Key Drivers: Increased underground mining, cost-effectiveness of rentals, technological advancements, improved operational efficiency.

- Adoption Drivers: Financial flexibility, scalability, avoidance of capital expenditure.

- Consumer Behavior Shifts: Demand for sustainable and efficient operations.

Dominant Regions, Countries, or Segments in Coal Mine Scraper Conveyor Rental

The Coal Mine Scraper Conveyor Rental market's growth is significantly influenced by regional dynamics and segment-specific adoption patterns, with the Application segment of Direct Lease currently dominating market share and exhibiting strong growth potential. This dominance is largely attributed to the inherent operational requirements of the coal mining industry, particularly in regions with extensive underground mining activities. Direct leasing offers mining companies immediate access to essential scraper conveyor equipment without the upfront capital investment, making it an attractive proposition for both large corporations and smaller, agile operators. The flexibility of direct lease agreements allows for tailored rental periods that align with the fluctuating demands of mining projects and the prevailing market prices for coal.

In terms of geographical dominance, Asia Pacific stands out as the leading region. This is primarily driven by the significant coal production in countries like China and India, which house vast underground mining operations. Government initiatives aimed at bolstering domestic energy production, coupled with ongoing infrastructure development, further fuel the demand for mining equipment, including scraper conveyors. Economic policies in these nations often favor the utilization of leased equipment to reduce the financial burden on mining enterprises, thereby accelerating the adoption of rental services. The robust presence of major mining machinery manufacturers and rental service providers within the Asia Pacific also contributes to the accessibility and competitive pricing of these solutions.

Within the Types segment, the Parallel Type scraper conveyor continues to hold a substantial market share due to its straightforward design, reliability, and suitability for a wide range of underground coal mining applications. Its efficiency in transporting coal along relatively straight or gently curved paths, common in many mine layouts, makes it a preferred choice. However, the Overlapping Type is gradually gaining traction, particularly in mines with more complex geological structures and intricate tunnel networks. Its design allows for greater flexibility in navigating tighter curves and varied terrain, presenting a compelling solution for mines facing challenging operational conditions. The growth potential of the Overlapping Type is intrinsically linked to the increasing complexity of newly accessible coal reserves.

The Direct Lease application segment is projected to maintain its leadership position throughout the forecast period. This is supported by ongoing investments in new mining projects and the continuous need for equipment upgrades and replacements in established mines. The ease of procurement and the ability to scale rental fleets according to project needs are primary advantages. Market share for Direct Lease is estimated at 65% in 2025 and is expected to grow at a CAGR of 6.8% through 2033. Conversely, Sale and Leaseback, while a smaller segment at present (estimated 35% market share in 2025), is anticipated to see robust growth of around 5.9% CAGR, as more established mining companies explore asset monetization strategies.

- Dominant Application Segment: Direct Lease (Estimated 65% market share in 2025).

- Leading Region: Asia Pacific.

- Key Drivers in Asia Pacific: High coal production (China, India), government support for energy, infrastructure development, favorable economic policies for rentals.

- Dominant Type Segment: Parallel Type.

- Growth Segment in Types: Overlapping Type (driven by complex mine operations).

- Growth Rate of Direct Lease (2025-2033): ~6.8% CAGR.

- Growth Rate of Sale and Leaseback (2025-2033): ~5.9% CAGR.

Coal Mine Scraper Conveyor Rental Product Landscape

The product landscape for coal mine scraper conveyor rentals is marked by continuous innovation aimed at enhancing operational efficiency, durability, and safety. Rental fleets typically comprise robust, heavy-duty units designed for continuous operation in harsh underground environments. Key product features include high-tensile steel components, advanced chain and flight designs for superior material handling capacity, and integrated safety mechanisms. Innovations focus on modular designs for easier assembly and maintenance, reducing downtime significantly. Furthermore, the integration of IoT sensors for real-time performance monitoring, predictive maintenance alerts, and remote operational control is becoming a standard offering, allowing rental companies to provide superior service and mining operators to optimize their production cycles. The performance metrics that rental clients prioritize include high throughput capacity (ranging from 500 to 2,000 tonnes per hour), low energy consumption, and extended service intervals.

Key Drivers, Barriers & Challenges in Coal Mine Scraper Conveyor Rental

Key Drivers:

- Increasing Demand for Underground Coal Extraction: Depleting surface reserves necessitate deeper mining operations, boosting the need for specialized underground transport.

- Cost-Effectiveness of Rental Models: Avoiding substantial upfront capital expenditure makes rentals attractive for mining companies of all sizes.

- Technological Advancements: Improved conveyor design, automation, and monitoring systems enhance efficiency and safety.

- Infrastructure Development: Growth in developing economies often involves new mining ventures requiring rental equipment.

- Flexibility and Scalability: Rental solutions allow companies to adapt their equipment needs to project demands.

Barriers & Challenges:

- Volatile Coal Prices: Fluctuations in global coal prices directly impact mining output and rental demand.

- Stringent Environmental Regulations: Increasing environmental compliance costs and potential shift towards renewable energy can impact long-term coal demand.

- Competition from Alternative Technologies: Development of more efficient belt conveyors or alternative bulk handling systems can pose a threat.

- Supply Chain Disruptions: Global events can impact the availability of spare parts and new equipment for rental fleets.

- High Maintenance Costs: Wear and tear in harsh mining conditions lead to significant maintenance expenditure for rental providers.

Emerging Opportunities in Coal Mine Scraper Conveyor Rental

Emerging opportunities in the Coal Mine Scraper Conveyor Rental sector lie in the increasing adoption of smart mining technologies. Rental providers can differentiate themselves by offering integrated solutions that include IoT-enabled monitoring systems, real-time data analytics for optimized conveyor performance, and remote diagnostic capabilities. The growing emphasis on mine safety also presents an opportunity for rental companies to offer advanced safety features and compliance-focused equipment. Furthermore, the expansion of coal mining into new geographical regions with less developed infrastructure offers a fertile ground for rental services. Developing specialized conveyor systems adaptable to diverse geological conditions and offering comprehensive maintenance and support packages can unlock significant market potential. The increasing focus on automation within mines also creates opportunities for rental of advanced, automated scraper conveyor systems.

Growth Accelerators in the Coal Mine Scraper Conveyor Rental Industry

Long-term growth in the Coal Mine Scraper Conveyor Rental industry will be significantly accelerated by strategic partnerships between rental companies and original equipment manufacturers (OEMs). These collaborations can facilitate the rapid integration of the latest technological advancements into rental fleets and ensure access to cutting-edge equipment. Market expansion into emerging economies with nascent but growing coal mining sectors will act as a crucial growth catalyst. Furthermore, the development of more sustainable and energy-efficient scraper conveyor designs, aligned with global environmental initiatives, will broaden their appeal and ensure their continued relevance. The increasing demand for integrated service offerings, encompassing installation, maintenance, and operational support, will also drive growth as rental companies move towards becoming full-service partners for their clients.

Key Players Shaping the Coal Mine Scraper Conveyor Rental Market

- CCTEG Financial Leasing

- China Coal Mine Machinery Equipment

- Shandong Energy Machinery Group Co.,Ltd.

- Leveling God Horse Mechanical Equipment Group Co.,Ltd.

- YANKUANG DONGHUA HEAVY

- Sany Heavy Industry Co.,Ltd.

Notable Milestones in Coal Mine Scraper Conveyor Rental Sector

- 2021: Launch of advanced, high-capacity scraper conveyor models with enhanced wear resistance by Shandong Energy Machinery Group Co.,Ltd., significantly improving operational lifespan.

- 2022: CCTEG Financial Leasing expands its rental fleet by 20% to meet growing demand in key Asian coal mining regions.

- 2023 (Q1): Sany Heavy Industry Co.,Ltd. announces integration of IoT-based predictive maintenance sensors into its rental scraper conveyor offerings.

- 2023 (Q3): China Coal Mine Machinery Equipment secures a major long-term rental contract with a leading Indonesian coal producer.

- 2024 (Q2): Leveling God Horse Mechanical Equipment Group Co.,Ltd. introduces a new modular design for its scraper conveyors, facilitating faster on-site assembly and disassembly.

In-Depth Coal Mine Scraper Conveyor Rental Market Outlook

The future outlook for the Coal Mine Scraper Conveyor Rental market is exceptionally positive, driven by a confluence of sustained demand from the global coal industry and continuous technological innovation. Growth accelerators, such as strategic alliances between rental providers and OEMs for fleet modernization and the expansion into untapped markets in developing nations, will fuel this upward trajectory. The increasing emphasis on automation and smart mining technologies will present significant opportunities for rental companies to offer value-added services, further solidifying their role as essential partners. As the industry navigates evolving environmental regulations and fluctuating commodity prices, the inherent flexibility and cost-effectiveness of rental models will remain a critical advantage, ensuring robust and sustained growth throughout the forecast period. The market is poised for substantial expansion, creating lucrative opportunities for stakeholders.

Coal Mine Scraper Conveyor Rental Segmentation

-

1. Application

- 1.1. Direct Lease

- 1.2. Sale and Leaseback

-

2. Types

- 2.1. Parallel Type

- 2.2. Overlapping Type

Coal Mine Scraper Conveyor Rental Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Coal Mine Scraper Conveyor Rental Regional Market Share

Geographic Coverage of Coal Mine Scraper Conveyor Rental

Coal Mine Scraper Conveyor Rental REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 18.6% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Coal Mine Scraper Conveyor Rental Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Direct Lease

- 5.1.2. Sale and Leaseback

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Parallel Type

- 5.2.2. Overlapping Type

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Coal Mine Scraper Conveyor Rental Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Direct Lease

- 6.1.2. Sale and Leaseback

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Parallel Type

- 6.2.2. Overlapping Type

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Coal Mine Scraper Conveyor Rental Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Direct Lease

- 7.1.2. Sale and Leaseback

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Parallel Type

- 7.2.2. Overlapping Type

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Coal Mine Scraper Conveyor Rental Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Direct Lease

- 8.1.2. Sale and Leaseback

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Parallel Type

- 8.2.2. Overlapping Type

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Coal Mine Scraper Conveyor Rental Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Direct Lease

- 9.1.2. Sale and Leaseback

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Parallel Type

- 9.2.2. Overlapping Type

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Coal Mine Scraper Conveyor Rental Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Direct Lease

- 10.1.2. Sale and Leaseback

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Parallel Type

- 10.2.2. Overlapping Type

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 CCTEG Financial Leasing

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Coal Mine Machinery Equipment

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Shandong Energy Machinery Group Co.

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Ltd.

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leveling God Horse Mechanical Equipment Group Co.

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Ltd.

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 YANKUANG DONGHUA HEAVY

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Sany Heavy Industry Co.

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Ltd.

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.1 CCTEG Financial Leasing

List of Figures

- Figure 1: Global Coal Mine Scraper Conveyor Rental Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Coal Mine Scraper Conveyor Rental Revenue (million), by Application 2025 & 2033

- Figure 3: North America Coal Mine Scraper Conveyor Rental Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Coal Mine Scraper Conveyor Rental Revenue (million), by Types 2025 & 2033

- Figure 5: North America Coal Mine Scraper Conveyor Rental Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Coal Mine Scraper Conveyor Rental Revenue (million), by Country 2025 & 2033

- Figure 7: North America Coal Mine Scraper Conveyor Rental Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Coal Mine Scraper Conveyor Rental Revenue (million), by Application 2025 & 2033

- Figure 9: South America Coal Mine Scraper Conveyor Rental Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Coal Mine Scraper Conveyor Rental Revenue (million), by Types 2025 & 2033

- Figure 11: South America Coal Mine Scraper Conveyor Rental Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Coal Mine Scraper Conveyor Rental Revenue (million), by Country 2025 & 2033

- Figure 13: South America Coal Mine Scraper Conveyor Rental Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Coal Mine Scraper Conveyor Rental Revenue (million), by Application 2025 & 2033

- Figure 15: Europe Coal Mine Scraper Conveyor Rental Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Coal Mine Scraper Conveyor Rental Revenue (million), by Types 2025 & 2033

- Figure 17: Europe Coal Mine Scraper Conveyor Rental Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Coal Mine Scraper Conveyor Rental Revenue (million), by Country 2025 & 2033

- Figure 19: Europe Coal Mine Scraper Conveyor Rental Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Coal Mine Scraper Conveyor Rental Revenue (million), by Application 2025 & 2033

- Figure 21: Middle East & Africa Coal Mine Scraper Conveyor Rental Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Coal Mine Scraper Conveyor Rental Revenue (million), by Types 2025 & 2033

- Figure 23: Middle East & Africa Coal Mine Scraper Conveyor Rental Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Coal Mine Scraper Conveyor Rental Revenue (million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Coal Mine Scraper Conveyor Rental Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Coal Mine Scraper Conveyor Rental Revenue (million), by Application 2025 & 2033

- Figure 27: Asia Pacific Coal Mine Scraper Conveyor Rental Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Coal Mine Scraper Conveyor Rental Revenue (million), by Types 2025 & 2033

- Figure 29: Asia Pacific Coal Mine Scraper Conveyor Rental Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Coal Mine Scraper Conveyor Rental Revenue (million), by Country 2025 & 2033

- Figure 31: Asia Pacific Coal Mine Scraper Conveyor Rental Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Application 2020 & 2033

- Table 2: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Types 2020 & 2033

- Table 3: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Region 2020 & 2033

- Table 4: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Application 2020 & 2033

- Table 5: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Types 2020 & 2033

- Table 6: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Country 2020 & 2033

- Table 7: United States Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 8: Canada Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Application 2020 & 2033

- Table 11: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Types 2020 & 2033

- Table 12: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Country 2020 & 2033

- Table 13: Brazil Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Application 2020 & 2033

- Table 17: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Types 2020 & 2033

- Table 18: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 20: Germany Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 21: France Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 22: Italy Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 23: Spain Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Russia Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Application 2020 & 2033

- Table 29: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Types 2020 & 2033

- Table 30: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Country 2020 & 2033

- Table 31: Turkey Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Israel Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 33: GCC Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Application 2020 & 2033

- Table 38: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Types 2020 & 2033

- Table 39: Global Coal Mine Scraper Conveyor Rental Revenue million Forecast, by Country 2020 & 2033

- Table 40: China Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: India Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Japan Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Coal Mine Scraper Conveyor Rental Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Coal Mine Scraper Conveyor Rental?

The projected CAGR is approximately 18.6%.

2. Which companies are prominent players in the Coal Mine Scraper Conveyor Rental?

Key companies in the market include CCTEG Financial Leasing, China Coal Mine Machinery Equipment, Shandong Energy Machinery Group Co., Ltd., Leveling God Horse Mechanical Equipment Group Co., Ltd., YANKUANG DONGHUA HEAVY, Sany Heavy Industry Co., Ltd..

3. What are the main segments of the Coal Mine Scraper Conveyor Rental?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD 326 million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3950.00, USD 5925.00, and USD 7900.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Coal Mine Scraper Conveyor Rental," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Coal Mine Scraper Conveyor Rental report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Coal Mine Scraper Conveyor Rental?

To stay informed about further developments, trends, and reports in the Coal Mine Scraper Conveyor Rental, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence