Key Insights

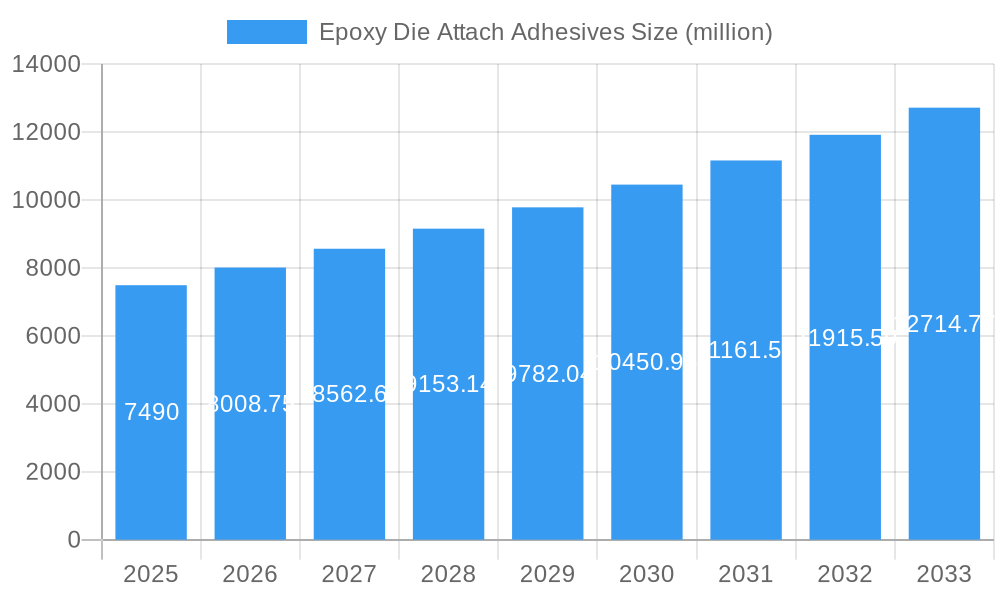

The global Epoxy Die Attach Adhesives market is poised for significant expansion, projected to reach a substantial $7.49 billion in 2025. This robust growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 6.75% throughout the forecast period of 2025-2033. A primary driver fueling this surge is the relentless demand from the consumer electronics sector, where miniaturization and enhanced performance necessitate advanced adhesive solutions for intricate component assembly. The automotive electronics segment is also exhibiting substantial growth, driven by the increasing adoption of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), both of which rely heavily on sophisticated electronic packaging and reliable die attach materials. Furthermore, the optical imaging device sector is contributing to market momentum as demand for high-resolution cameras and sensors in both consumer and professional applications continues to rise. The market is characterized by ongoing innovation, with a focus on developing electrically insulative and electrically conductive epoxy die attach adhesives that offer superior thermal management, mechanical strength, and electrical conductivity, crucial for the next generation of electronic devices.

Epoxy Die Attach Adhesives Market Size (In Billion)

The competitive landscape for Epoxy Die Attach Adhesives is dynamic, featuring a mix of established industry giants and specialized players. Key companies such as Master Bond, LG Chem, Permabond, DELO, Advanced Packaging, Epoxy Technology, Dupont, Namics, Nagase ChemteX, Henkel, Heraeus, and Nordson are actively engaged in research and development to introduce novel formulations and expand their product portfolios. Trends indicate a growing emphasis on high-performance adhesives with enhanced reliability, faster curing times, and improved adhesion to a wider range of substrates, catering to evolving manufacturing processes. While the market benefits from strong demand drivers, potential restraints could emerge from the rising cost of raw materials and increasing regulatory scrutiny regarding environmental impact and safety standards. Nevertheless, the sustained innovation and widespread application across critical industries ensure a promising outlook for the Epoxy Die Attach Adhesives market.

Epoxy Die Attach Adhesives Company Market Share

This in-depth report provides a comprehensive analysis of the global Epoxy Die Attach Adhesives market, forecasting its trajectory from 2019 to 2033. Leveraging a data-driven approach, the report examines critical market dynamics, growth trends, regional dominance, product innovations, key drivers and barriers, emerging opportunities, and the influential players shaping this vital sector. With a focus on actionable insights and quantitative data, this report is an essential resource for stakeholders seeking to navigate and capitalize on the evolving landscape of advanced semiconductor packaging.

Epoxy Die Attach Adhesives Market Dynamics & Structure

The global Epoxy Die Attach Adhesives market exhibits a moderately concentrated structure, characterized by the presence of both large, established chemical conglomerates and specialized adhesive manufacturers. Technological innovation serves as a primary driver, with continuous advancements in formulation leading to improved thermal conductivity, mechanical strength, and processability. Regulatory frameworks, particularly those pertaining to environmental impact and material safety, are increasingly influencing product development and market entry. Competitive product substitutes, such as conductive films and solder pastes, present a dynamic competitive landscape, necessitating ongoing innovation in epoxy-based solutions. End-user demographics are shifting, with a growing demand from the burgeoning consumer electronics and automotive electronics sectors driving market expansion. Mergers and acquisitions (M&A) are a significant trend, with XX M&A deals recorded between 2019 and 2024, aimed at consolidating market share, expanding technological capabilities, and achieving economies of scale. For instance, Company A's acquisition of Company B in 2022 significantly strengthened its portfolio in electrically conductive die attach adhesives. Innovation barriers include the high cost of R&D for novel formulations and the stringent qualification processes required by major electronics manufacturers.

- Market Concentration: Moderately concentrated, with key players holding significant shares.

- Technological Innovation Drivers: Enhanced thermal management, reduced voiding, improved reliability, and specialized curing mechanisms.

- Regulatory Frameworks: RoHS, REACH, and other environmental compliance standards influencing material selection.

- Competitive Product Substitutes: Conductive films, solder pastes, and silver-based adhesives.

- End-User Demographics: Growing demand from consumer electronics, automotive, and optical industries.

- M&A Trends: XX M&A deals between 2019-2024, indicating consolidation and strategic expansion.

Epoxy Die Attach Adhesives Growth Trends & Insights

The Epoxy Die Attach Adhesives market is poised for robust growth, projected to evolve from an estimated XX billion units in 2025 to an impressive XX billion units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period. This expansion is fueled by the escalating demand for advanced semiconductor packaging solutions across a multitude of industries. The adoption rates of epoxy die attach adhesives are steadily increasing, driven by their superior performance characteristics, including excellent adhesion, mechanical stability, and versatility in handling various die sizes and materials. Technological disruptions, such as the development of low-temperature curing epoxies and nano-filled conductive adhesives, are further enhancing their appeal and enabling new application possibilities. Consumer behavior shifts towards miniaturization, increased processing power, and enhanced functionality in electronic devices are directly translating into a higher demand for sophisticated die attach materials. The market penetration of epoxy die attach adhesives is expected to deepen as manufacturers prioritize reliability and longevity in their products. Historical data from 2019-2024 indicates a consistent upward trend, laying a strong foundation for future market expansion. The transition towards electric vehicles and the proliferation of smart devices are significant contributing factors to this sustained growth trajectory.

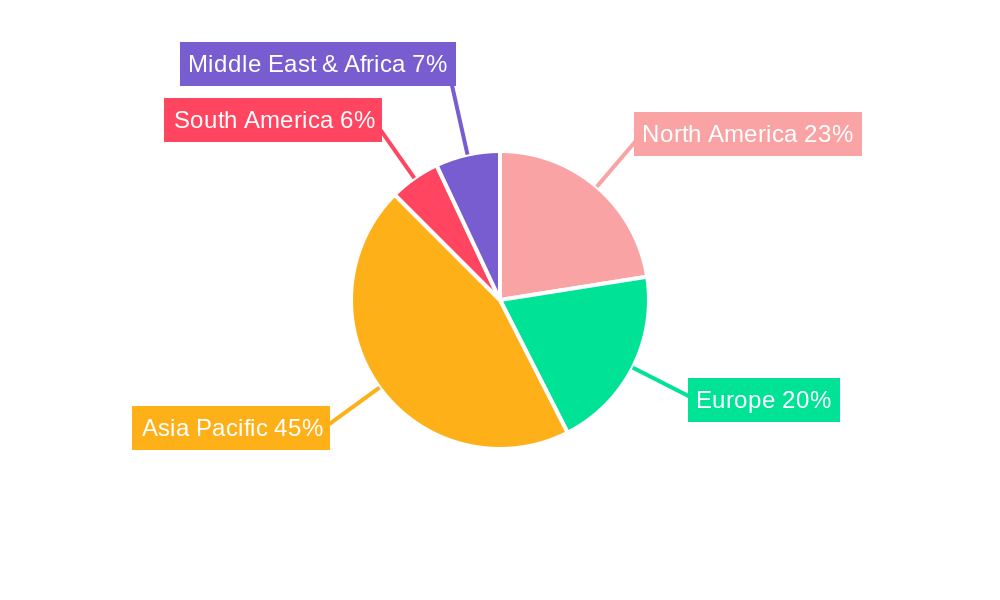

Dominant Regions, Countries, or Segments in Epoxy Die Attach Adhesives

The Consumer Electronic segment is a dominant force driving growth in the Epoxy Die Attach Adhesives market, projected to hold the largest market share throughout the forecast period. This dominance is underpinned by several key factors, including the ubiquitous nature of smartphones, tablets, wearable devices, and home entertainment systems, all of which rely heavily on advanced semiconductor packaging. The relentless pursuit of thinner, lighter, and more powerful consumer electronics necessitates the use of high-performance die attach adhesives that can ensure reliability and efficient heat dissipation. Geographically, Asia Pacific is expected to continue its reign as the leading region, driven by its massive manufacturing base for consumer electronics and its significant investments in semiconductor fabrication facilities. Countries like China, South Korea, and Taiwan are central to this regional dominance, serving as both major producers and consumers of electronic components.

- Dominant Application Segment: Consumer Electronic, driven by the high volume production of smartphones, wearables, and other personal devices.

- Leading Region: Asia Pacific, due to its extensive electronics manufacturing ecosystem and semiconductor industry presence.

- Key Country Drivers: China, South Korea, and Taiwan, with their substantial semiconductor production capabilities and consumer electronics markets.

- Growth in Automotive Electronic: A significant secondary growth driver, fueled by the increasing complexity and miniaturization of automotive electronic systems, including advanced driver-assistance systems (ADAS) and in-car infotainment.

- Emerging Potential in Optical Imaging Devices: A niche but growing segment, demanding high-performance adhesives for camera modules and other optical components.

Epoxy Die Attach Adhesives Product Landscape

The Epoxy Die Attach Adhesives product landscape is characterized by continuous innovation focused on enhancing performance metrics. Electrically conductive adhesives, often incorporating silver or other conductive fillers, are crucial for creating electrical pathways and managing heat dissipation. Electrically insulative adhesives are vital for applications requiring isolation between components. Recent advancements include the development of low-outgassing epoxies for sensitive optical and aerospace applications, as well as formulations with enhanced thermal conductivity, reaching up to XX W/mK. Unique selling propositions often lie in tailored rheology for precise dispensing, rapid cure times to increase throughput, and exceptional long-term reliability under extreme temperature and humidity conditions. Technological advancements are also addressing the trend towards larger and more complex dies, requiring adhesives with superior mechanical strength and reduced stress on the die.

Key Drivers, Barriers & Challenges in Epoxy Die Attach Adhesives

Key Drivers: The Epoxy Die Attach Adhesives market is propelled by several key factors. The escalating demand for miniaturization and higher performance in electronic devices, particularly in the consumer electronics and automotive sectors, is a primary driver. Advancements in semiconductor technology, leading to increasingly complex and powerful chips, require robust and reliable die attach solutions. The growth of the Internet of Things (IoT) and the proliferation of smart devices further fuel this demand. Furthermore, the shift towards electric vehicles (EVs) necessitates high-performance thermal management materials for power electronics, creating a significant growth opportunity for advanced epoxy adhesives.

Key Barriers & Challenges: Despite the promising growth, the market faces several challenges. The rising cost of raw materials, particularly specialized fillers and resins, can impact profit margins and product pricing. Stringent environmental regulations and the need for sustainable solutions add complexity to product development and manufacturing processes. The long qualification cycles required by major electronics manufacturers can also be a barrier to rapid market entry for new products. Supply chain disruptions, as witnessed in recent global events, can impact the availability and cost of essential raw materials. Competitive pressures from alternative bonding technologies also necessitate continuous innovation and cost optimization. The global supply chain for critical raw materials experienced significant disruptions in 2021-2022, leading to price volatility and extended lead times, impacting manufacturers' ability to meet demand.

Emerging Opportunities in Epoxy Die Attach Adhesives

Emerging opportunities in the Epoxy Die Attach Adhesives market lie in several key areas. The rapid expansion of 5G infrastructure and the increasing deployment of advanced driver-assistance systems (ADAS) in automotive applications present significant untapped markets for high-performance, thermally conductive die attach adhesives. The growing demand for advanced semiconductor packaging in industrial automation and the Internet of Medical Things (IoMT) also offers substantial growth potential. Furthermore, the development of novel nano-engineered epoxy formulations with superior electrical and thermal conductivity, as well as enhanced reliability under extreme conditions, is an area ripe for innovation. The increasing focus on sustainable manufacturing practices is also creating opportunities for eco-friendly, low-VOC epoxy formulations.

Growth Accelerators in the Epoxy Die Attach Adhesives Industry

Several catalysts are accelerating long-term growth in the Epoxy Die Attach Adhesives industry. Continuous technological breakthroughs in material science, leading to adhesives with unprecedented thermal management capabilities and enhanced reliability, are major growth accelerators. Strategic partnerships between adhesive manufacturers and semiconductor foundries or device manufacturers facilitate faster adoption of new technologies and ensure product alignment with industry needs. Market expansion into emerging economies and the growing demand for advanced electronics in these regions further fuel growth. The increasing complexity of semiconductor devices, requiring more sophisticated packaging solutions, inherently drives the demand for advanced epoxy die attach adhesives.

Key Players Shaping the Epoxy Die Attach Adhesives Market

- Master Bond

- LG Chem

- Permabond

- DELO

- Advanced Packaging

- Epoxy Technology

- Dupont

- Namics

- Nagase ChemteX

- Henkel

- Heraeus

- Nordson

Notable Milestones in Epoxy Die Attach Adhesives Sector

- 2019: Introduction of novel nano-filled conductive epoxy adhesives offering XX% improvement in thermal conductivity by Company X.

- 2020: Company Y launches a low-temperature curing epoxy die attach adhesive, significantly reducing processing time for heat-sensitive components.

- 2021: Company Z acquires a competitor, expanding its portfolio in electrically insulative die attach solutions.

- 2022: Development of a new class of high-Tg epoxy adhesives capable of withstanding extreme operating temperatures by Company A.

- 2023: Significant advancements in filler dispersion technology by Company B, leading to reduced voiding and improved bond line uniformity.

- 2024: Introduction of bio-based epoxy die attach adhesives by Company C, addressing the growing demand for sustainable materials.

In-Depth Epoxy Die Attach Adhesives Market Outlook

The future market outlook for Epoxy Die Attach Adhesives is exceptionally positive, driven by sustained demand from the rapidly evolving electronics industry. Growth accelerators, including ongoing technological innovation in material science and the expanding applications in automotive and consumer electronics, will continue to propel the market forward. Strategic partnerships and market expansion into emerging economies are expected to further capitalize on the vast potential. The increasing complexity of semiconductor devices and the need for enhanced performance and reliability will ensure a consistent demand for advanced epoxy die attach solutions, making this a dynamic and lucrative sector for investment and innovation.

Epoxy Die Attach Adhesives Segmentation

-

1. Application

- 1.1. Consumer Electronic

- 1.2. Automotive Electronic

- 1.3. Optical Imaging Device

-

2. Types

- 2.1. Electrically Insulative

- 2.2. Electrically Conductive

Epoxy Die Attach Adhesives Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Epoxy Die Attach Adhesives Regional Market Share

Geographic Coverage of Epoxy Die Attach Adhesives

Epoxy Die Attach Adhesives REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.75% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Epoxy Die Attach Adhesives Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Consumer Electronic

- 5.1.2. Automotive Electronic

- 5.1.3. Optical Imaging Device

- 5.2. Market Analysis, Insights and Forecast - by Types

- 5.2.1. Electrically Insulative

- 5.2.2. Electrically Conductive

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Epoxy Die Attach Adhesives Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Consumer Electronic

- 6.1.2. Automotive Electronic

- 6.1.3. Optical Imaging Device

- 6.2. Market Analysis, Insights and Forecast - by Types

- 6.2.1. Electrically Insulative

- 6.2.2. Electrically Conductive

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Epoxy Die Attach Adhesives Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Consumer Electronic

- 7.1.2. Automotive Electronic

- 7.1.3. Optical Imaging Device

- 7.2. Market Analysis, Insights and Forecast - by Types

- 7.2.1. Electrically Insulative

- 7.2.2. Electrically Conductive

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Epoxy Die Attach Adhesives Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Consumer Electronic

- 8.1.2. Automotive Electronic

- 8.1.3. Optical Imaging Device

- 8.2. Market Analysis, Insights and Forecast - by Types

- 8.2.1. Electrically Insulative

- 8.2.2. Electrically Conductive

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Epoxy Die Attach Adhesives Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Consumer Electronic

- 9.1.2. Automotive Electronic

- 9.1.3. Optical Imaging Device

- 9.2. Market Analysis, Insights and Forecast - by Types

- 9.2.1. Electrically Insulative

- 9.2.2. Electrically Conductive

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Epoxy Die Attach Adhesives Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Consumer Electronic

- 10.1.2. Automotive Electronic

- 10.1.3. Optical Imaging Device

- 10.2. Market Analysis, Insights and Forecast - by Types

- 10.2.1. Electrically Insulative

- 10.2.2. Electrically Conductive

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Master Bond

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 LG Chem

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Permabond

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 DELO

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Advanced Packaging

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Epoxy Technology

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Dupont

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Namics

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Nagase ChemteX

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Henkel

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Heraeus

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Nordson

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Master Bond

List of Figures

- Figure 1: Global Epoxy Die Attach Adhesives Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Epoxy Die Attach Adhesives Revenue (undefined), by Application 2025 & 2033

- Figure 3: North America Epoxy Die Attach Adhesives Revenue Share (%), by Application 2025 & 2033

- Figure 4: North America Epoxy Die Attach Adhesives Revenue (undefined), by Types 2025 & 2033

- Figure 5: North America Epoxy Die Attach Adhesives Revenue Share (%), by Types 2025 & 2033

- Figure 6: North America Epoxy Die Attach Adhesives Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Epoxy Die Attach Adhesives Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Epoxy Die Attach Adhesives Revenue (undefined), by Application 2025 & 2033

- Figure 9: South America Epoxy Die Attach Adhesives Revenue Share (%), by Application 2025 & 2033

- Figure 10: South America Epoxy Die Attach Adhesives Revenue (undefined), by Types 2025 & 2033

- Figure 11: South America Epoxy Die Attach Adhesives Revenue Share (%), by Types 2025 & 2033

- Figure 12: South America Epoxy Die Attach Adhesives Revenue (undefined), by Country 2025 & 2033

- Figure 13: South America Epoxy Die Attach Adhesives Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Epoxy Die Attach Adhesives Revenue (undefined), by Application 2025 & 2033

- Figure 15: Europe Epoxy Die Attach Adhesives Revenue Share (%), by Application 2025 & 2033

- Figure 16: Europe Epoxy Die Attach Adhesives Revenue (undefined), by Types 2025 & 2033

- Figure 17: Europe Epoxy Die Attach Adhesives Revenue Share (%), by Types 2025 & 2033

- Figure 18: Europe Epoxy Die Attach Adhesives Revenue (undefined), by Country 2025 & 2033

- Figure 19: Europe Epoxy Die Attach Adhesives Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Epoxy Die Attach Adhesives Revenue (undefined), by Application 2025 & 2033

- Figure 21: Middle East & Africa Epoxy Die Attach Adhesives Revenue Share (%), by Application 2025 & 2033

- Figure 22: Middle East & Africa Epoxy Die Attach Adhesives Revenue (undefined), by Types 2025 & 2033

- Figure 23: Middle East & Africa Epoxy Die Attach Adhesives Revenue Share (%), by Types 2025 & 2033

- Figure 24: Middle East & Africa Epoxy Die Attach Adhesives Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East & Africa Epoxy Die Attach Adhesives Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Epoxy Die Attach Adhesives Revenue (undefined), by Application 2025 & 2033

- Figure 27: Asia Pacific Epoxy Die Attach Adhesives Revenue Share (%), by Application 2025 & 2033

- Figure 28: Asia Pacific Epoxy Die Attach Adhesives Revenue (undefined), by Types 2025 & 2033

- Figure 29: Asia Pacific Epoxy Die Attach Adhesives Revenue Share (%), by Types 2025 & 2033

- Figure 30: Asia Pacific Epoxy Die Attach Adhesives Revenue (undefined), by Country 2025 & 2033

- Figure 31: Asia Pacific Epoxy Die Attach Adhesives Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Types 2020 & 2033

- Table 3: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Application 2020 & 2033

- Table 5: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Types 2020 & 2033

- Table 6: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Types 2020 & 2033

- Table 12: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Brazil Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Argentina Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Application 2020 & 2033

- Table 17: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Types 2020 & 2033

- Table 18: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Germany Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: France Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Italy Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Spain Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Russia Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Benelux Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Nordics Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Application 2020 & 2033

- Table 29: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Types 2020 & 2033

- Table 30: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: Turkey Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Israel Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: GCC Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: North Africa Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: South Africa Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Application 2020 & 2033

- Table 38: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Types 2020 & 2033

- Table 39: Global Epoxy Die Attach Adhesives Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: China Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: India Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Japan Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 43: South Korea Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 45: Oceania Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Epoxy Die Attach Adhesives Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Epoxy Die Attach Adhesives?

The projected CAGR is approximately 6.75%.

2. Which companies are prominent players in the Epoxy Die Attach Adhesives?

Key companies in the market include Master Bond, LG Chem, Permabond, DELO, Advanced Packaging, Epoxy Technology, Dupont, Namics, Nagase ChemteX, Henkel, Heraeus, Nordson.

3. What are the main segments of the Epoxy Die Attach Adhesives?

The market segments include Application, Types.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Epoxy Die Attach Adhesives," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Epoxy Die Attach Adhesives report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Epoxy Die Attach Adhesives?

To stay informed about further developments, trends, and reports in the Epoxy Die Attach Adhesives, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence