Key Insights

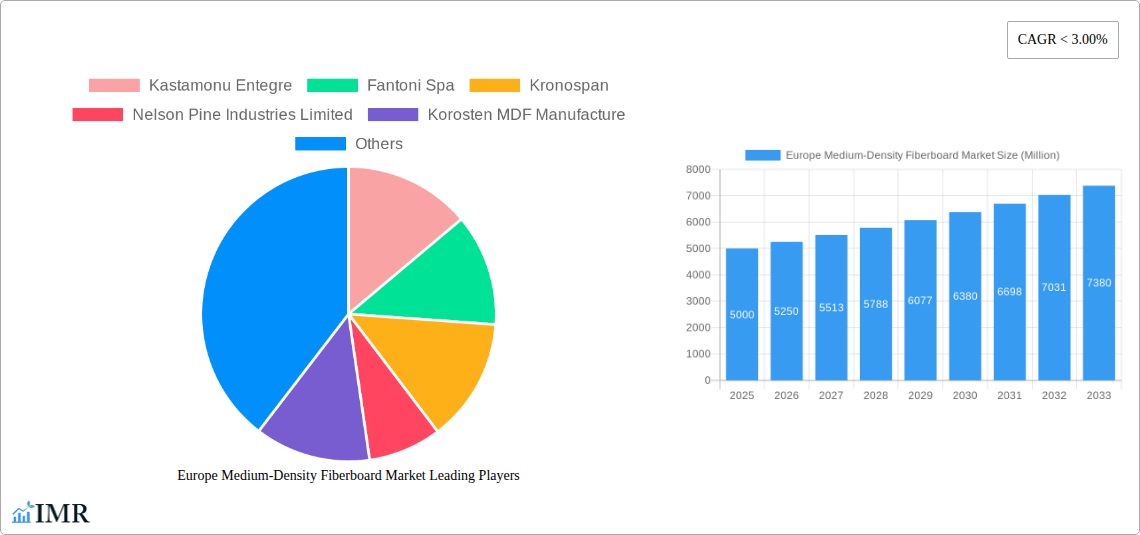

The European Medium-Density Fiberboard (MDF) market is poised for sustained expansion from 2025 through 2033. Driven by robust growth in the construction and furniture manufacturing sectors, the market size was an estimated 13.58 billion in 2024. Key growth catalysts include rising disposable incomes, urbanization, and a strong preference for cost-effective, aesthetically pleasing materials in interior design. Technological advancements in MDF production, yielding improved quality and sustainability, along with innovative products offering enhanced moisture resistance and dimensional stability, further bolster market appeal.

Europe Medium-Density Fiberboard Market Market Size (In Billion)

The Compound Annual Growth Rate (CAGR) for the period 2019-2033 is projected at a healthy 9.03%, indicating consistent year-on-year market value increase. Future growth will be supported by continued infrastructure development, residential construction booms across key European regions, and expanded MDF applications in flooring and interior paneling. Market participants should address potential challenges, including raw material price volatility and formaldehyde emission regulations, to ensure sustainable growth. The European MDF market presents a positive outlook with significant opportunities for both established and emerging companies.

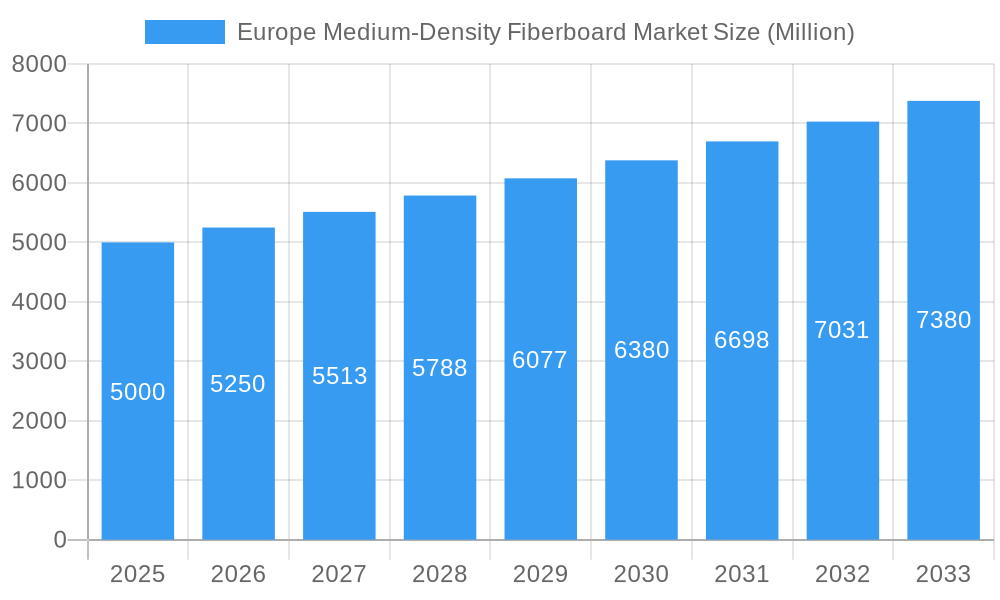

Europe Medium-Density Fiberboard Market Company Market Share

Europe Medium-Density Fiberboard (MDF) Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Europe Medium-Density Fiberboard (MDF) market, encompassing market dynamics, growth trends, regional performance, product landscape, and key players. The report covers the period from 2019 to 2033, with 2025 as the base year and a forecast period of 2025-2033. The study analyzes the parent market of wood panels and the child market of MDF, offering valuable insights for industry professionals, investors, and stakeholders. The market size is presented in million units.

Europe Medium-Density Fiberboard Market Dynamics & Structure

The European MDF market exhibits a moderately concentrated structure, with key players such as Kastamonu Entegre, Kronospan, and Egger Group holding significant market share. Technological innovation, driven by sustainability concerns and evolving end-user demands, is a key driver. Stringent environmental regulations are shaping production processes and material sourcing. Competitive pressures from substitute materials like particleboard and engineered wood products are present. The market is influenced by fluctuating wood prices and macroeconomic conditions. M&A activity has been moderate, with a focus on consolidation and expansion into new geographical markets. Recent deals involved xx transactions totaling an estimated xx million units in the last five years.

- Market Concentration: Moderately concentrated, with top players holding xx% market share (2024).

- Technological Innovation: Focus on sustainable production, improved performance characteristics, and cost optimization.

- Regulatory Framework: Stringent environmental regulations impacting production and raw material sourcing.

- Substitute Products: Competition from particleboard, plywood, and other engineered wood products.

- End-User Demographics: Shifting preferences towards sustainable and high-performance MDF products.

- M&A Trends: Moderate activity, driven by consolidation and geographic expansion.

Europe Medium-Density Fiberboard Market Growth Trends & Insights

The European MDF market experienced steady growth during the historical period (2019-2024), driven by robust demand from the construction and furniture industries. The market size reached xx million units in 2024. The CAGR from 2019 to 2024 was xx%. Growth is projected to continue during the forecast period (2025-2033), albeit at a slightly moderated pace, with factors like increasing construction activity and rising disposable incomes positively influencing demand. However, economic uncertainties and potential supply chain disruptions pose challenges. Technological advancements in MDF production, focusing on sustainability and enhanced performance characteristics, are expected to stimulate further market growth. Changes in consumer preferences towards eco-friendly materials will also influence demand. The market penetration rate in key applications like furniture and cabinetry is expected to increase during the forecast period, reaching xx% by 2033.

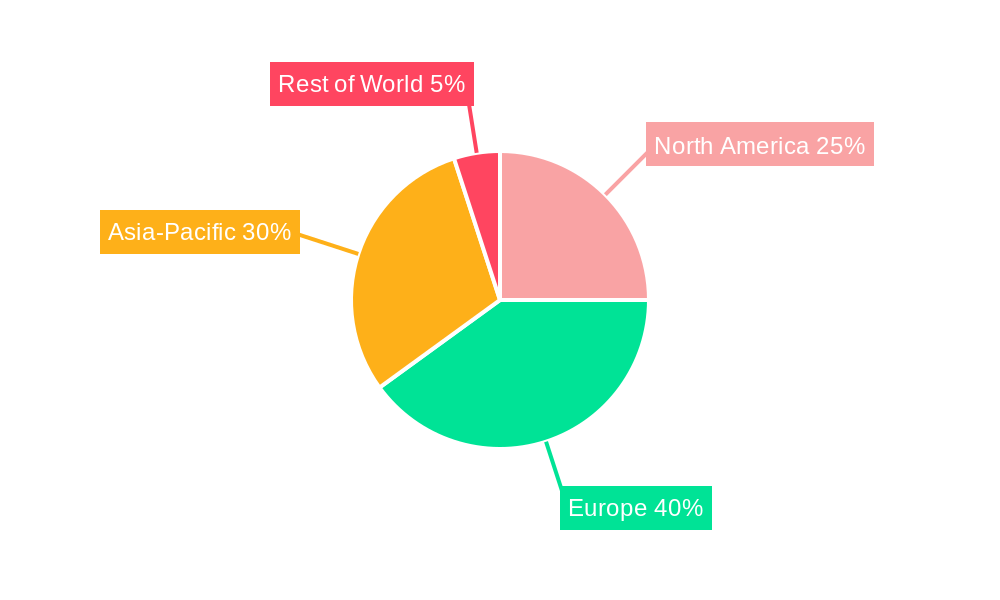

Dominant Regions, Countries, or Segments in Europe Medium-Density Fiberboard Market

Germany, the United Kingdom, and Italy represent the largest national markets for MDF in Europe, driven by strong construction sectors and a significant furniture manufacturing base. The residential segment remains the dominant end-user, followed by the commercial and institutional sectors. Furniture and cabinetry are the leading application segments. Growth in these countries is fueled by factors like:

- Germany: Strong construction activity, robust manufacturing sector, and a well-established furniture industry.

- United Kingdom: Growing housing demand and renovation projects, coupled with a healthy furniture market.

- Italy: Significant presence of furniture manufacturers, and a focus on high-quality interior design.

- France: Similar drivers as Germany and UK, with a particular strength in the luxury furniture sector.

The Rest of Europe region shows promising growth potential, driven by rising infrastructure development and increasing disposable incomes in certain countries. Market share distribution by country in 2024 is estimated as follows: Germany (xx%), UK (xx%), Italy (xx%), France (xx%), Rest of Europe (xx%).

Europe Medium-Density Fiberboard Market Product Landscape

The MDF product landscape is characterized by a range of products tailored to specific applications, differing in density, thickness, and surface finishes. Innovations focus on improving dimensional stability, water resistance, and aesthetic appeal. The use of recycled wood fibers and sustainable manufacturing processes is becoming increasingly prominent, driven by environmental concerns. Manufacturers offer various surface treatments, including melamine, veneer, and paint finishes to enhance durability and visual appeal. Unique selling propositions include improved strength-to-weight ratios and enhanced design flexibility.

Key Drivers, Barriers & Challenges in Europe Medium-Density Fiberboard Market

Key Drivers:

- Increasing construction and infrastructure investments.

- Growing demand for furniture and interior design products.

- Technological advancements leading to improved product quality and performance.

- Favorable government policies promoting sustainable building materials.

Key Challenges:

- Fluctuations in raw material prices (wood).

- Rising transportation costs and supply chain disruptions.

- Stringent environmental regulations increasing production costs.

- Competition from alternative materials (particleboard, plywood). These have an estimated impact of reducing market growth by xx% annually.

Emerging Opportunities in Europe Medium-Density Fiberboard Market

Emerging opportunities include the growing demand for sustainable and eco-friendly MDF products, the development of innovative applications in the construction and automotive industries (xx million units projected demand in 2033), and the expansion into untapped markets within the Rest of Europe region. Specific opportunities relate to the development of high-performance MDF for specialized applications and personalized surface treatments.

Growth Accelerators in the Europe Medium-Density Fiberboard Market Industry

Technological advancements in manufacturing processes, strategic partnerships among industry players to improve supply chain efficiency, and expansion into new geographical markets and application areas will accelerate long-term growth. These innovations combined with a focus on sustainable production will attract investment and drive market expansion.

Key Players Shaping the Europe Medium-Density Fiberboard Market Market

- Kastamonu Entegre

- Fantoni Spa

- Kronospan

- Nelson Pine Industries Limited

- Korosten MDF Manufacture

- Daiken Corporation

- Duratex SA

- ARAUCO

- Egger Group

- Roseburg

- Siempelkamp Group

- Eucatex SA

- Norbord Inc

- Daiken Group

- Dieffenbacher

Notable Milestones in Europe Medium-Density Fiberboard Market Sector

- October 2022: Dieffenbacher and 19 organizations launched the EcoReFibre initiative, aiming to improve the sustainability of fiberboard production through wood fiber recycling. This initiative received USD 12 million in funding.

- February 2022: West Fraser Timber Co. Ltd. committed to science-based targets for GHG reductions across its European operations, emphasizing the growing importance of sustainability in the industry.

In-Depth Europe Medium-Density Fiberboard Market Market Outlook

The Europe MDF market is poised for continued growth, driven by the factors discussed above. Strategic opportunities exist for companies focusing on sustainable production, innovative product development, and effective supply chain management. The focus on sustainability and innovation will be key to capturing market share and achieving long-term success. The market is expected to reach xx million units by 2033.

Europe Medium-Density Fiberboard Market Segmentation

-

1. Application

- 1.1. Cabinet

- 1.2. Flooring

- 1.3. Furniture

- 1.4. Molding, Door, and Millwork

- 1.5. Packaging System

- 1.6. Other Applications

-

2. End-user Sector

- 2.1. Residential

- 2.2. Commercial

- 2.3. Institutional

Europe Medium-Density Fiberboard Market Segmentation By Geography

-

1. Europe

- 1.1. United Kingdom

- 1.2. Germany

- 1.3. France

- 1.4. Italy

- 1.5. Spain

- 1.6. Netherlands

- 1.7. Belgium

- 1.8. Sweden

- 1.9. Norway

- 1.10. Poland

- 1.11. Denmark

Europe Medium-Density Fiberboard Market Regional Market Share

Geographic Coverage of Europe Medium-Density Fiberboard Market

Europe Medium-Density Fiberboard Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.03% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for MDF for Furniture; Easy Availability of Raw Materials

- 3.3. Market Restrains

- 3.3.1. Strict Government Regulations; Impact of Hot-Pressing Temperature on MDF

- 3.4. Market Trends

- 3.4.1. The Residential Segment is Anticipated to Hold a Significant Share

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Europe Medium-Density Fiberboard Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Cabinet

- 5.1.2. Flooring

- 5.1.3. Furniture

- 5.1.4. Molding, Door, and Millwork

- 5.1.5. Packaging System

- 5.1.6. Other Applications

- 5.2. Market Analysis, Insights and Forecast - by End-user Sector

- 5.2.1. Residential

- 5.2.2. Commercial

- 5.2.3. Institutional

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Europe

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Kastamonu Entegre

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Fantoni Spa

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kronospan

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Nelson Pine Industries Limited

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Korosten MDF Manufacture

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Daiken Corporation

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Duratex SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ARAUCO

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Egger Group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Roseburg

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Siempelkamp Grou

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Eucatex SA

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Norbord Inc

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.14 Daiken Group

- 6.2.14.1. Overview

- 6.2.14.2. Products

- 6.2.14.3. SWOT Analysis

- 6.2.14.4. Recent Developments

- 6.2.14.5. Financials (Based on Availability)

- 6.2.15 Dieffenbacher

- 6.2.15.1. Overview

- 6.2.15.2. Products

- 6.2.15.3. SWOT Analysis

- 6.2.15.4. Recent Developments

- 6.2.15.5. Financials (Based on Availability)

- 6.2.1 Kastamonu Entegre

List of Figures

- Figure 1: Europe Medium-Density Fiberboard Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Europe Medium-Density Fiberboard Market Share (%) by Company 2025

List of Tables

- Table 1: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by Application 2020 & 2033

- Table 2: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by End-user Sector 2020 & 2033

- Table 3: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by Application 2020 & 2033

- Table 5: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by End-user Sector 2020 & 2033

- Table 6: Europe Medium-Density Fiberboard Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United Kingdom Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Germany Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: France Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Italy Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Spain Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 12: Netherlands Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 13: Belgium Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 14: Sweden Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Norway Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Poland Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Denmark Europe Medium-Density Fiberboard Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Europe Medium-Density Fiberboard Market?

The projected CAGR is approximately 9.03%.

2. Which companies are prominent players in the Europe Medium-Density Fiberboard Market?

Key companies in the market include Kastamonu Entegre, Fantoni Spa, Kronospan, Nelson Pine Industries Limited, Korosten MDF Manufacture, Daiken Corporation, Duratex SA, ARAUCO, Egger Group, Roseburg, Siempelkamp Grou, Eucatex SA, Norbord Inc, Daiken Group, Dieffenbacher.

3. What are the main segments of the Europe Medium-Density Fiberboard Market?

The market segments include Application, End-user Sector.

4. Can you provide details about the market size?

The market size is estimated to be USD 13.58 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for MDF for Furniture; Easy Availability of Raw Materials.

6. What are the notable trends driving market growth?

The Residential Segment is Anticipated to Hold a Significant Share.

7. Are there any restraints impacting market growth?

Strict Government Regulations; Impact of Hot-Pressing Temperature on MDF.

8. Can you provide examples of recent developments in the market?

October 2022: Dieffenbacher and 19 organizations from seven countries collaborated on the EcoReFibre (Ecological methods for secondary material recovery from post-consumer fiberboards) research initiative to make fiberboard (MDF & HDF) production more sustainable. The project aims to recycle wood fibers at the end of their life cycle and utilize them to create new fiberboard. Currently, fresh wood is nearly entirely used to manufacture wood fiberboard. Europe funded the four-year initiative, which began in May, with USD 12 million under its Horizon Europe research and innovation financing program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Europe Medium-Density Fiberboard Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Europe Medium-Density Fiberboard Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Europe Medium-Density Fiberboard Market?

To stay informed about further developments, trends, and reports in the Europe Medium-Density Fiberboard Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence